Capturing Trades

This document describes all strategy properties based on their category (filter category in Profile Configuration ), and how to capture trades using these properties.

Some properties are common to all types of strategies, they are described below.

Some properties depend on the type of strategy:

See Capturing CRD Trades for details on CRD properties.

See Capturing CRD Trades for details on CRD properties.

See Capturing CMD Trades for details on CMD properties.

See Capturing CMD Trades for details on CMD properties.

See Capturing EQD Trades for details on EQD properties.

See Capturing EQD Trades for details on EQD properties.

See Capturing ETF Trades for details on ETF properties.

See Capturing ETF Trades for details on ETF properties.

See Capturing Fixed Income Trades for details on Fixed Income properties.

See Capturing Fixed Income Trades for details on Fixed Income properties.

See Capturing FX Trades for details on FX properties.

See Capturing FX Trades for details on FX properties.

See Capturing FX Option Trades for details on FX Option properties.

See Capturing FX Option Trades for details on FX Option properties.

See Capturing IRD Trades for details on IRD properties.

See Capturing IRD Trades for details on IRD properties.

See Capturing Listed Derivatives Trades for details on Listed Derivatives properties.

See Capturing Listed Derivatives Trades for details on Listed Derivatives properties.

Contents

- Manipulating Strategy Templates

- Product: Settlement Properties

- Product: Commodity Properties

1. "Trade" Properties

"Trade" properties apply to all types of strategies. They allow the trades to be saved in the system with the minimum required information.

They can be made visible under "Common" if you want to display them for all strategies.

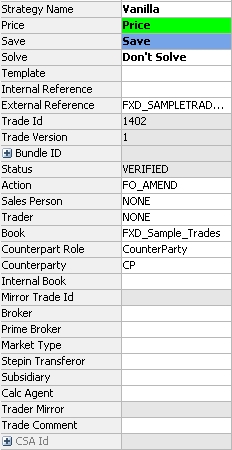

Sample Trade properties

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Strategy Name |

This property is always displayed. Select an out-of-the-box strategy or a custom strategy to capture the corresponding trade. |

|||||||||

| Price |

This property is common to all trades and set to Price by default. The settings are as follows:

|

|||||||||

| Save |

This property is common to all trades. Its default behavior can be configured on the Defaults tab in Configuration > User Preferences with the "Default behavior for Save field on executed trades" option. The settings on the pricing sheet are as follows:

|

|||||||||

| Solve |

This property is always displayed, and is not set by default. To activate the solving capability, set it to Solve. It can only be set to Solve on Active trades. |

|||||||||

| Reserve |

This property is always displayed, and it is set to Don't Reserve by default. The property provides support for trade reservation in the case of a single trade or multiple trades.

The trade keyword "LimitReserved" is utilized with this feature so that the Limits engines can determine whether or not to process a trade. |

|||||||||

| Template |

Select a strategy template as needed to populate default values into the strategy. You can only select templates created for this type of strategy. You can create strategy templates using Configuration > Manage Strategy Template.

Ⓘ [NOTE: The selected template is not stored with the trade, it is only selected to populate default values] |

|||||||||

| Internal Reference |

Enter a user-defined trade identifier as needed, for tracking purposes. |

|||||||||

| External Reference |

Enter a user-defined trade identifier as needed, for tracking purposes. |

|||||||||

|

Trade Id |

Displays the unique ID given by the system upon saving. |

|||||||||

| Trade Version |

Displays the trade version given by the system upon saving, "0" is the first version of the trade. The trade version is incremented when data are amended on the trade provided the Audit mode is enabled.

|

|||||||||

| Bundle ID |

Displays the bundle ID created upon saving if any. You can also display the following properties:

|

|||||||||

| Status | Displays the workflow status of the trade. | |||||||||

| Action |

Displays the action currently performed on the trade based on the workflow configuration. You can select a different action as needed, it will be applied to the trade upon saving. Note that actions related to trade lifecycle processes are prevented by default. The actions Allocate, Terminate, Exercise, and Trigger can be applied from the Processing menu. Other trade lifecycle actions have to be applied from their dedicated windows and processes. |

|||||||||

|

Sales Person |

Select a sales representative. Sales representatives are created in the "salesPerson" domain. It defaults to the sales representative selected in the User Defaults. This is mandatory for capturing sales fees. |

|||||||||

|

Trader |

Select a trader - Traders are created in the "trader" domain. It defaults to the trader selected in the User Defaults. |

|||||||||

|

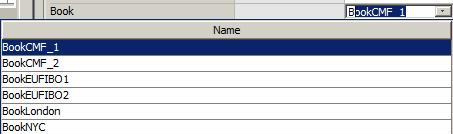

Book |

The default trading book can be set in the User Defaults attribute "Pricing Sheet Default Book". You can select another book as needed. Type in a few letters, and all books that start with those letters will appear. You can select a book from the list.

The Search can be configured from the Calypso Navigator using Configuration > User Access Control > User Settings under Preferences > Trade Capture > Book Search:

For reference, favorite books are set from the Calypso Navigator under Configuration > Favorites > Books. |

|||||||||

| Counterpart Role | The counterparty role defaults to CounterParty but you can double-click to select another role as needed. For External trades, the role set will be the role set in the for the Premium in Trade Details > Trade Fess. | |||||||||

| Counterparty |

Type in a few letters, and all counterparties that start with those letters will appear. You can select a counterparty from the list.

The Search can be configured from the Calypso Navigator using Configuration > User Access Control > User Settings under Preferences > Trade Capture > Counterparty Search. |

|||||||||

| Internal Book |

Type in a few letters, and all books that start with those letters will appear. You can select an internal book from the list to capture an internal mirror trade.

The Search can be configured from the Calypso Navigator using Configuration > User Access Control > User Settings under Preferences > Trade Capture > Book Search:

For Internal Trades (trades with an internal book), the trade counterparty is set to the processing org of the internal book for the role CounterParty. Therefore, the processing org must have the role CounterParty. For reference, favorite books are set from the Calypso Navigator using Configuration > Favorites > Internal Books. |

|||||||||

| Mirror Trade ID | Displays the mirror trade ID. | |||||||||

| Broker |

Select a broker as needed. A broker is a legal entity of role Broker. Only favorite brokers can be selected. Favorite brokers are selected from the Calypso Navigator using Configuration > Favorites > Brokers. |

|||||||||

| Prime Broker |

Select a prime broker as needed. A prime broker is a legal entity of role PrimeBroker. Only prime brokers associated with the selected counterparty in the legal entity attribute PrimeBrokerList can be selected. You can define multiple prime brokers in the legal entity PrimeBrokerList separated by ";" (semicolons). |

|||||||||

| Market Type | Select a Market Type as needed: None, Primary, Re-Issue, Secondary, When-Issued. | |||||||||

| Stepin Transferor |

Type in a few letters, and legal entities that start with those letters will appear. You can select a legal entity of role step-in transferor from the list. The step-in transferor is a transferor from a Step-In Novation done through DTCC. |

|||||||||

| Subsidiary |

Type in a few letters, and legal entities that start with those letters will appear. You can select a legal entity of role subsidiary from the list. |

|||||||||

| Calc Agent |

Type in a few letters, and legal entities that start with those letters will appear. You can select a legal entity of role calculation agent from the list. The calculation agent is the party who acts as the referee in the event of a disagreement about a deal's rate reset or other payment detail. The calculation agent will be designated in a legal agreement such as an ISDA agreement. |

|||||||||

| Trader Mirror | Displays the name of the trader associated with the mirror trade book. | |||||||||

| Trade Comment | Enter a comment as applicable. | |||||||||

| Reset Swap |

For details on Reset Swap properties, see "Reset Swap" Properties. |

|||||||||

| Fwd Start Notional Adjustment |

For details on Fwd Start Notional Adjustment properties, see "Fwd Start Notional Adjustment" Properties. |

|||||||||

| CSA Id |

Displays the ID of the collateral agreement associated with the selected counterparty and book's processing org, if any. Collateral agreements are created from the Calypso Navigator using Configuration > Fees, Haircuts, & Margin Calls > Margin Call. You can also display the following properties:

Discount curves can be associated with trades based on the collateral currency.

|

|||||||||

| Manual Reset | Used for equity resets. Provides a field for manually entering a value for the initial fixing. | |||||||||

| Initial Reset | Used for equity resets. Allows you to choose an observation source for the initial fixing. | |||||||||

| Equity Reset | Used for equity resets. Allows you to choose an observation source for the final fixing. For the equity ScriptableOTCProduct, this property alone is used for choosing the observation source for the multiple resets that are used. | |||||||||

| CCP/Clearing Broker Combos | Enter a list of clearing brokers, separated by commas. | |||||||||

| CCP/Clearing Broker | Enter the clearing broker. | |||||||||

| Product Code |

You can enter product code values for OTC trades, provided you have defined “OTC” product codes, like MiFID codes for example. “OTC” product codes are created using Configuration > Product > Code (menu action Note that this property does not display non OTC product codes. Non OTC product codes are defined and displayed at the product level (Bond products for example). |

|||||||||

| Negotiated Price | Negotiated Price is a sub-property under the expandable Notional property. Used for Swap trades that use ZC for the payment frequency. To enable this property so that the user can enter a negotiated price, the payment frequency for the swap must be ZC, and the parameter "Discount" in Default configurations (Configuration > User Preferences > Defaults > Swap) must be set to True. See "Defaults Panel" in Setting User Preferences documentaiton. | |||||||||

| Fixed Amount | Used with Fixed Payment Swap to indicate a payment amount for the fixed leg that will be paid at the end of the period. | |||||||||

| Reset Date Rule | Reset Date Rule | |||||||||

| Rate Factor Rounding/Rate Factor Decimals |

Both properties are sub-properties of Rate. They can be used on both fixed and float legs of a Swap. The Rate Factor Rounding property provides standard rounding methods found in Calypso: NONE, NEAREST, UP, DOWN. The Rate Factor Decimals property allows for specifying decimal precision for the first setting.

When Calc Method is NONE, rounding = fixed rate*daycount fraction, then taken to the number of decimal places specified.

Rounding = (1+spread)^daycount fraction, then taken to the number of decimal places specified. |

|||||||||

|

Reset Date Rule Payment Date Rule Coupon Date Rule |

These properties allow for using date rules to determine a period.

These properties correspond to those found on the Date Rules tab of the product details window accessed from the trade window. |

|||||||||

| Average Price |

Supported for Future and Future Option trades. Select the Average Price checkbox to preserve the trade price without rounding, regardless of the Quote Type or Quote Decimals specified on the given Future Option contract. Any trade price based calculations, including Nominal and relevant pricer measures, will use the full decimals of the trade price. |

|||||||||

| Standard Fixed Coupon |

Used in CDS Index Tranche trades. When selected, the associated "Spread" property becomes a drop-down listing standard SNAC coupon values. These values can be defined using the domain CreditDefaultSwapCoupon.SNAC.

When the checkbox is cleared, the "Spread" property becomes a text field that allows the user to enter any value for the spread. |

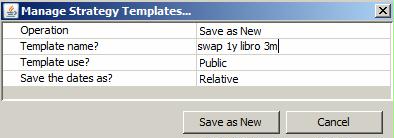

2. Manipulating Strategy Templates

To create a strategy template, select a strategy in the Pricing Sheet and set the properties as needed.

Then choose Configuration > Manage Strategy Template.

Sample Strategy Template

| » | Enter a template name and select whether the template is private or public. |

Other users will not be able to use your private templates.

| » | Select whether the dates should be saved as absolute dates or relative dates (they are relative to the valuation date). |

| » | Then click Save as New to save the template. |

The property values will be used as default values when the template is selected in the Pricing Sheet.

To store trade keywords with the template, add the keyword names to the domain "tradeTmplKeywords".

Example:

![]()

You can select the template from the Template field for the same type of strategy used to create the template.

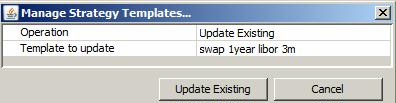

To modify an existing template, select a template in the pricing sheet, and modify the values of the properties as needed.

Then choose Configuration > Manage Strategy Template.

Sample template modification

| » | Select "Update Existing" from the Operation field and click Update Existing. |

To delete an existing template, choose Configuration > Manage Strategy Template.

| » | Select "Delete" from the Operation field and select a template. |

| » | Then click Delete. |

Only the user who created a template (whether it is public or private) can delete it.

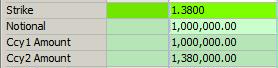

3. "Product: Amount" Properties

"Product: Amount" properties apply to all types of strategies.

They can be made visible under "Common" if you want to display them for all strategies.

Sample Product Amount properties

| Properties | Description |

|---|---|

| Notional |

Enter the notional amount. |

| Ccy1 Amount |

Enter / displays the notional in primary currency if applicable. |

| Ccy2 Amount |

Displays / enter the notional in quoting currency if applicable. |

| Settle Amount | Displays the trade settlement amount computed by the system. |

4. "Product: Style" Properties

"Product: Style" properties apply to all types of strategies.

| Properties | Description | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trade Type | The trade type: "On Market" or "Off Market".

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Product Type | Displays the product type based on the selected strategy. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Product Subtype | The product subtype is set by the system based on the type of trade being captured. You can however define product subtypes as needed in the domain “<product type>.subtype”. You can set pricers and market data by product subtype. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Constants | Displays any value used in solving that is entered manually like Strike, etc. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ccy Pair |

Displays the currency pair when each leg is in a different currency. The default currency pair is set in Configuration > User Preferences. You can select another currency pair as needed. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Notional Ccy | Select the currency of the notional. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Strike Ccy | Enter the strike currency. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Quanto Ccy Pair |

Only applies to "Self Quanto" or "Quanto" set as a Settle Type. Displays the currency pair used in the Quanto. This is Settlement Ccy/Secondary Ccy in the defined currency pair. The currency pair is defined from the Calypso Navigator in Configuration > Definitions > Currency Definitions. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Buy/Sell | Select the direction of the trade: Buy or Sell. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Put/Call | Displays /select the option direction for the primary currency. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ccy2 Put/Call | Displays / select the option direction for the quoting currency. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Compound Put/Call | Select the direction of the compound option for the primary currency. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Pay/Receive | Select the direction of the trade leg from the book's perspective. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Notional Exchange | Select Initial, Final, Amortization or any combination of the three to indicate that the notional amount will be exchanged, otherwise there is no exchange of notional. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization |

The amortization of the notional defaults to Bullet. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Option Type | Select the option type: Cap, Floor, Collar, Corridor. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Exercise Type | Select the exercise type. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Settle Type |

Select the settlement type at exercise. The application may automatically select it based on the product type.

You can also set the following properties:

Examples: 3D Business, 2M Calendar, 1Y Business, etc.

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Leg Type | Select the leg type: Fixed or Float. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Swap Tenor |

Enter the fixed tenor of the swap for Fixed Tenor Swaptions. The swap starts on the option’s delivery date and ends on the option’s delivery date + fixed tenor. The system currently only supports the pricing of European Fixed Tenor Swaptions. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Select the location for commodities. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Allocated | Displays "Allocated" if the trade has been allocated using the Allocation process, or "Unallocated" otherwise. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Observation Type |

For Accrual and Accumulator options, the choices are:

Where:

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Strike Type |

Select the strike type: Fixed, Forward Start, Average or Lookback. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Rate Type | Select the rate type: Market, Average or Lookback. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Range Style |

Select Single for single range, or Multiple for multiple ranges.

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Known 1st Range |

Select Yes if the first range is known for a resetting range, or No otherwise. If Yes, you can specify the first range in Trigger and Trigger2. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Flexo FX Source |

Only applies to the "Flexo" Settle Type. Choose the FX rate source for Flexo type trades. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Initial FX Spot | Enter the FX spot trade between the two currencies. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Adjustment |

If there is notional exchange, you can also specify notional adjustments at every coupon period based on FX rates. Select None, Pay (adjustments on the Pay leg), or Rec (adjustments on the rec leg). You can also set the following properties:

If "FX Reset Use Index Reset Date" is not checked, you can set the FX Reset Lag and FX Reset Holidays as needed. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Call Type |

Select "Cancellable" for a cancellable swap, or select "None". For a Cancellable swap, you can set the following properties:

|

||||||||||||||||||||||||||||||||||||||||||||||||

| Custom Cashflows | Displays "true" if the cashflows have been customized, or "false" otherwise. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Exchange | Select the Exchange where the contract is quoted. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contract Size | Displays he contract size. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Quantity | Enter the traded quantity. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contract | Select the contract. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contract Underlying | Select the expiration date of the underlying future contract. | ||||||||||||||||||||||||||||||||||||||||||||||||

| Contract Date |

Select the expiration date. |

||||||||||||||||||||||||||||||||||||||||||||||||

| Payout | Displays the Pricing Script payout selected in the strategy. |

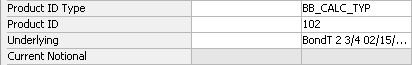

5. "Product: Info" Properties

"Product: Info" properties apply to all types of strategies.

Sample Product Info properties

| Properties | Description |

|---|---|

| Product ID Type |

Select the product ID type to choose from when entering values in the Product ID field. A default search type can be configured in Configuration > User Preferences under the Defaults tab. Select the default search type form the Default Bond Product ID type drop down. Setting this in the trade leg specifically will override the value set in the defaults. |

| Product ID | Enter the bond product identifier. |

| Underlying | Displays the Bond Product details for the selected bond product. To select a bond product double-click in this field to bring up the Search Bonds window. |

| Current Notional |

Displays the current nominal. |

6. "Product: Rate" Properties

"Product: Rate" properties apply to all types of strategies.

| Properties | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quanto Factor |

Only applies to "Self Quanto" or "Quanto" set as a Settle Type. Not available with Digital and Digital with Barrier strategies. Enter the rate between the quoting currency and the primary currency if the settlement currency is the primary currency. You can enter "k" to populate it with the strike rate, "s" for spot rate, or enter a fixed rate. The trade keyword "QuantoSource" will be populated accordingly. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strike |

Enter the strike. The following FX Delta shortcuts are also available. Add the shortcut to the Strike property field and press Enter.

Rounding Any system generated strike (solver, shortcut entry) will respect the currency pair rounding settings. If the user manually enters a strike, it will only be rounded based on the constraints of the currency rounding of the amounts that the strike generates. Example: Ccy1 amount is 10,000.00 and a strike is entered as 1.234567.

The shortcut used will not be persisted if the trade is saved. EX: Entering "atms" in this field will calculate the at-the-money-strike and will appear as "<strike value> [atms] when pricing. If the trade is saved, the value is saved, but the shortcut used will not be saved. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strike % |

Displays the percentage of strike with respect to "in-the-money" forward: [(FX Fwd - Strike)/ FX Fwd]*100. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strike Inverse |

Displays 1/Strike for an inverted trade. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compound Strike | Enter/displays the price of the underlying option as a percentage of the underlying primary amount. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compound Strike Amount |

Compound Strike Amount = Compound Strike * Ccy 1 Amount / 100. You can also enter a compound strike amount and the Compound Strike will be updated accordingly. When exercising the compound option, the compound strike amount will be passed to the created plain vanilla as PREMIUM fee. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Formula Strike | Displays the formula captured in the Strike property. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vega |

Displays what the Vega would be in a Vanilla option from the trade date to the number of days calculated from the difference of the Expiry Date and the Fixing Date of the Volatility Forward option. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VF Vol at Trade Expiry |

Displays the volatility at trade expiration (from the market data). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VF Vol at Straddle Expiry |

Displays the volatility at underlying expiration (from the market data). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VF Implied Forward Vol |

Displays the implied forward volatility. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agreed Forward Volatility |

Enter the forward volatility agreed to on the trade date. The price that is agreed upon to buy the ATM straddle. It defaults to the calculated implied forward volatility. However, you can modify the value. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rate |

Enter the fixed rate for fixed rates, or the spread over the rate value for floating rates as needed. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed Coupon Rate | For a fixed trade, enter the fixed rate. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Settlement Source |

Only applies if Settle Type is Physical NDF, Self Quanto, Quanto, or Flexo. Select an FX Rate Definition to fix the FX rates. FX Rate Definitions are configured from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Settlement Source Time |

Displays the fixing time of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Settlement Source Quote Side |

Displays the quote side of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Settlement Source Fixing Rate |

Displays the fixing rate of the selected fixing source, if any on the fixing date and if there is only one fixing date. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Observation Source |

Select an FX Rate Definition to fix the FX rates. FX Rate Definitions are configured from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. Then right-click the FX Rate Definition and choose "Supplemental" to define the accrual details. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Observation Source Time |

Displays the fixing time of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Observation Source Quote Side |

Displays the quote side of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Observation Fixing Rate |

Displays the fixing rate of the selected fixing source, if any on the fixing date and if there is only one fixing date. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Source |

Select "Not resetting" for non-resetting ranges, or select the FX Rate Definition that will be used to fix the rates. FX Rate Definitions are configured from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. Then right-click the FX Rate Definition and choose "Supplemental" to define the fixing schedule. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Source Time |

Displays the fixing time of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Source Quote Side |

Displays the quote side of the selected fixing source. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Fixing Rate |

Displays the fixing rate of the selected fixing source, if any on the fixing date and if there is only one fixing date. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rate Index Factor | Enter the index factor as needed for floating rates to multiply the rate value. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rate Index |

Select the rate index for floating rates. You can set additional properties:

The Reset Lag will persist is terms of days. Entering "30D" and saving will be displayed as "1M" on retrieval. Entering "d" for days, "w" for weeks, "m" for months and "y" for years as a tenor (EX: 1m b = -1M Business) will be saved as days. If not tenor is entered, the system will use days by default.

When NONE is selected (default), the system uses the normal reset process for fixings. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Frequency |

Select the reset frequency to sample resets at a frequency different from the payment frequency. Otherwise, the resets are sampled at the payment frequency. When the sampling frequency is more frequent that the payment frequency, you can define the weight of the resets, and the duration of the sampling period.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reset Date |

Only applies to Physical NDF settle type. Displays "Delivery Date - Number of lag days defined in the FX Rate Definition". It is based on the FX Rate Definition selected in Settlement Source. It can be modified as needed. |

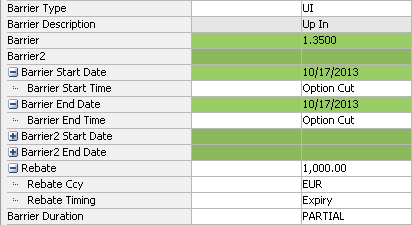

7. "Product: Barrier" Properties

"Product: Barrier" properties apply to all types of strategies.

Sample Product Barrier properties

| Properties | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Barrier Duration |

Select the duration type:

|

||||||||||||||||||||||||

| Barrier Description | Displays the description of the barrier type. | ||||||||||||||||||||||||

| Barrier Type |

Select the type of barrier:

|

||||||||||||||||||||||||

| Barrier | Strike rate for the single barrier, or upper barrier for a double barrier. | ||||||||||||||||||||||||

| Barrier Start Date |

For a partial barrier: the start date of the barrier observation. You can also set the Barrier Start Time. |

||||||||||||||||||||||||

| Barrier End Date |

For a partial barrier: the end date of the barrier observation. You can also set the Barrier End Time. |

||||||||||||||||||||||||

| Barrier2 | Strike rate for the lower barrier. | ||||||||||||||||||||||||

| Barrier2 Start Date |

For a partial double barrier: the start date of the second barrier observation. You can also enter the Barrier2 Start Date. |

||||||||||||||||||||||||

| Barrier2 End Date |

For a partial double barrier: the end date of the second barrier observation. You can also set the Barrier2 End Time. |

||||||||||||||||||||||||

| Rebate |

Enter a rebate amount, if applicable. You can also set the following properties:

|

||||||||||||||||||||||||

| Barrier Monitoring | Enter the barrier monitoring type, CONTINUOUS or CLOSING. |

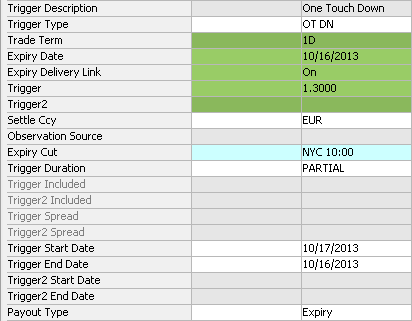

8. "Product: Trigger" Properties

"Product: Trigger" properties apply to all types of strategies.

Sample Product Trigger properties

| Properties | Description | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trigger Duration |

Select the duration type:

|

||||||||||||||||||||||||||||||||||||

| Trigger Description |

Displays the description of the trigger type. |

||||||||||||||||||||||||||||||||||||

| Trigger Type |

Select the trigger type. For Digital options, the choices are:

For Digital With Barrier options, the choices are ABOVE or BELOW. For Accrual options and Accumulator options, the choices are:

|

||||||||||||||||||||||||||||||||||||

| Payout Type | Select Instant (payout when the trigger is hit) or Expiry (payout at expiration). | ||||||||||||||||||||||||||||||||||||

|

Trigger |

Digital and European Binary options: Enter the strike rate for the single trigger, or upper trigger for a double digital. Accrual and Accumulator options: Enter the trigger for ABOVE and LOW options, or low trigger for a range. |

||||||||||||||||||||||||||||||||||||

|

Trigger Start Date |

Enter the start date of observation for a partial digital. |

||||||||||||||||||||||||||||||||||||

|

Trigger End Date |

Enter the end date of observation for a partial digital. |

||||||||||||||||||||||||||||||||||||

| Trigger Spread |

In case of resetting range, enter the upper spread for single range. |

||||||||||||||||||||||||||||||||||||

| Trigger Included |

Accrual options: For ABOVE and BELOW accruals, select Yes to monitor the trigger, or No otherwise. Range Accruals: Select Yes to monitor the upper value of the range, or No otherwise. |

||||||||||||||||||||||||||||||||||||

|

Trigger2 |

Digital and European Binary options: Enter the strike rate for the lower trigger. Accrual options and Accumulator options: Enter the high trigger for a range. |

||||||||||||||||||||||||||||||||||||

|

Trigger2 Start Date |

Enter the start date of second trigger observation for a double partial digital. |

||||||||||||||||||||||||||||||||||||

|

Trigger2 End Date |

Enter the end date of second trigger observation for a double partial digital. |

||||||||||||||||||||||||||||||||||||

| Trigger2 Spread |

In case of resetting range, enter the lower spread for single range. |

||||||||||||||||||||||||||||||||||||

| Trigger2 Included |

Range Accruals: Select Yes to monitor the lower value of the range, or No otherwise. |

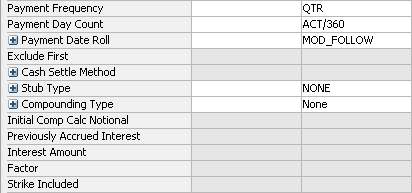

9. "Product: Payment" Properties

"Product: Payment" properties apply to all types of strategies.

Sample Product Payment properties

| Properties | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Payment Frequency | Select the payment frequency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Day Count | Select the payment daycount. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Date Roll |

Select the payment date roll, when the payment date falls on a non business day. You can also set the following properties:

The Payment Lag will persist is terms of days. Entering "30D" and saving will be displayed as "1M" on retrieval. Entering "d" for days, "w" for weeks, "m" for months and "y" for years as a tenor (EX: 1m b = -1M Business) will be saved as days.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exclude First | Check to exclude the first caplet from the cashflows. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash Settle Method |

Only applies to cash settlement. Select the settlement method to compute the settlement amount. [NOTE: If you have defined cash settlement defaults (CSD), it will pick up the settlement method from the CSD defined for the agreement specified in domain "CashSettleDefaultsAgreements" / rate index / currency - It is ANY by default. For example, ANY is defined in domain "CashSettleDefaultsAgreements", and you have a CSD defined for ANY / LIBOR / USD. If the trade is LIBOR / USD and settles in Cash, then the settlement method from the CSD will be set on the trade by default] You can set additional properties:

If you select none, you have to select a set of reference banks in Rek Bank 1, Ref Bank 2, Ref Bank 3, Ref Bank 4, Ref Bank 5 - Legal entities of role ReferenceBank. If you select OTHER_SOURCE, you need to select a rate index in Cash Settle Rate Index.

In the Option Exercise Window, there is a Settlement Rate field. You can get the value from the pricing environment by clicking Price, or you can enter a value. If you enter a rate, it will be displayed here.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stub Type |

Select the stub period, if applicable, or none. You can also set the following properties:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compounding Type |

Select the compounding type, if applicable, or none. You can also set the following properties:

When you select a DLY compounding frequency for a rate index that is not setup for daily compounding, the DailyCompound calculator is used.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Initial Comp Calc Notional |

Compounding trades only. When doing a partial termination, the PRINCIPAL transfer takes into account the part of interest that is not capitalized. On the new trade, you can adjust the initial compounding notional as needed. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Previously Accrued Interest |

Compounding trades only. Displays the amount of interest that is not capitalized on the new trade resulting from a partial termination. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Amount | Displays the interest amount of a zero coupon Fixed Rate upon pricing. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Factor |

Bond futures only. Displays the cheapest to deliver factor. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strike Included |

You can set the following properties: Physical Delivery Holidays - Select the calendar(s) the application uses to determine the business days. Physical Delivery Lag - Specify lag days from the end date of the payment period (in business or calendar days) for the actual payment to take place. By default, business days are used to calculate the payment date. To specify calendar days, double-click the Bus label to toggle to Cal. Physical Delivery Day - Number of delivery days. |

10. "Product: Settlement" Properties

"Product: Settlement" properties apply to many types of strategies. Only relevant settlement fields will be editable for each property.

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Settle Ccy | Displays the settlement currency. | ||||||||||||

| Calculation Ccy |

Select the intermediate currency to convert notional currency to settle currency. Enter:

|

||||||||||||

| Next Coupon | Displays the date for the next coupon payment. | ||||||||||||

| Settlement Amount | Displays the settlement amount in the settlement currency. | ||||||||||||

| Settlement Principal | Displays the settlement principal. | ||||||||||||

| Settlement Accrual | Displays the settlement accrual. | ||||||||||||

| Accrual Days | Accrual Days displays the number of days accrued in a bond's current coupon period (Settlement Date - current coupon Start Date). This property is used with strategies that include an underlying bond. |

11. "Date" Properties

"Date" properties apply to all types of strategies. Only relevant date properties will be available for applicable strategies.

| Properties | Description | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trade FX Date |

Displays the trade date adjusted by the 5pm rule if set. |

||||||||||||||||||||||||||||||||||||||||||

| Trade Date |

Displays the valuation date set in the Pricing window of the pricing sheet by default. You can modify as needed.

|

||||||||||||||||||||||||||||||||||||||||||

| Trade Time |

Displays the valuation time set in the Pricing window of the pricing sheet. You can modify as needed.

|

||||||||||||||||||||||||||||||||||||||||||

| Settlement Date |

Select the settlement date. |

||||||||||||||||||||||||||||||||||||||||||

| Start Date | Enter the start date. | ||||||||||||||||||||||||||||||||||||||||||

| End Date | Enter the end date. | ||||||||||||||||||||||||||||||||||||||||||

| Expiry Date |

Enter the expiration date. |

||||||||||||||||||||||||||||||||||||||||||

| Expiry | Displays expiration date details. | ||||||||||||||||||||||||||||||||||||||||||

| Expiry Cut | Displays the default expiry timezone. The default expiry timezone is set in the Defaults panel under Configuration > User Preferences. | ||||||||||||||||||||||||||||||||||||||||||

| Expiry Delivery Link |

Select one of four options in the list:

|

||||||||||||||||||||||||||||||||||||||||||

| Compound Expiry Date | Enter the expiry date of the compound option. | ||||||||||||||||||||||||||||||||||||||||||

| Compound Expiry | Displays details about the "Compound Expiry Date". | ||||||||||||||||||||||||||||||||||||||||||

| Compound Expiry Cut | Displays the default expiry timezone for the compound option. The default expiry timezone is set in the Defaults panel under Configuration > User Preferences. | ||||||||||||||||||||||||||||||||||||||||||

| Compound Term | Displays the "Compound Expiry Date" as a tenor. | ||||||||||||||||||||||||||||||||||||||||||

| Compound Delivery Date | Enter the delivery date of the compound option. | ||||||||||||||||||||||||||||||||||||||||||

| Compound Delivery | Displays details about the "Compound Delivery Date". | ||||||||||||||||||||||||||||||||||||||||||

| Delivery Date | The delivery date of the option. You can modify as needed. | ||||||||||||||||||||||||||||||||||||||||||

| Delivery | Displays details on the delivery date. | ||||||||||||||||||||||||||||||||||||||||||

| Alternate Delivery Date |

Used for FX, FX Forward, and FX Swap strategies. The Alternate Delivery Date allows you to settle the secondary currency in an FX trade on a different date from the Trade Date. When a date is entered in this field, the secondary currency will be settled on the entered date and the primary currency is settled on the Trade Date. For a swap trade, the near leg Alternate Delivery Date should not be before the Trade Date, and the far leg Alternate Delivery Date shouldn't be before the near leg Delivery Date.

|

||||||||||||||||||||||||||||||||||||||||||

| Trade Term | Displays the expiry date as a tenor. | ||||||||||||||||||||||||||||||||||||||||||

| First Exercise Date | Enter the first date the option can be exercised for American options. | ||||||||||||||||||||||||||||||||||||||||||

| Reset Effective Date | Enter the date at which the strike will be known. | ||||||||||||||||||||||||||||||||||||||||||

| VF Straddle Expiry Date | Enter the expiration date of the underlying option (straddle). | ||||||||||||||||||||||||||||||||||||||||||

| VF Straddle Term | Displays the "VF Straddle Expiry Date" as a tenor. | ||||||||||||||||||||||||||||||||||||||||||

| VF Straddle Cut | Select the expiry timezone for the expiration date of the underlying option (straddle). Expiry timezones are created from the Calypso Navigator using Configuration > Definitions > Expiry Time Zone. | ||||||||||||||||||||||||||||||||||||||||||

| Fixings |

Displays the number of fixings for averaging the rate or strike. You can also view the following properties:

Displays the first underlying futures contracts that will be used as fixing references.

Displays the last underlying futures contracts that will be used as fixing references.

|

||||||||||||||||||||||||||||||||||||||||||

| Cash Date | Enter the cash date. | ||||||||||||||||||||||||||||||||||||||||||

| Effective Date | Enter the effective date. |

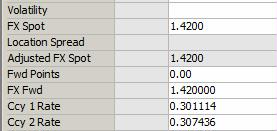

12. "Market Data" Properties

"Market Data" properties apply to all types of strategies. Only relevant market data field will be editable for each property.

Sample Market Data properties

| Properties | Description | |||

|---|---|---|---|---|

| Credit Spread (5Y) |

Enter a credit spread value for a 5 year tenor.

|

|||

| Volatility |

Displays the volatility based on the market data associated with the selected pricing environment. You can modify this value. |

|||

| FX Spot |

Displays the spot rate from the quote set associated with the selected pricing environment. You can modify this value. |

|||

|

Location Spread |

Displays the commodities location spread. | |||

| Adjusted FX Spot | Displays the spot adjusted of location spread. | |||

| Fwd Points |

Displays the forward points based on the market data associated with the selected pricing environment. You can modify this value. You can compute forward points on-the-fly based on "Ccy 1 Rate" or "Ccy 2 Rate". You can also compute "Ccy 1 Rate" based on forward points - Choose Configuration > Rate Triangulation > Adjust Ccy 1 Rate. It will keep "Ccy 2 Rate" constant. Or you can compute "Ccy 2 Rate" based on forward points - Choose Configuration > Rate Triangulation > Adjust Ccy 2 Rate. It will keep "Ccy 1 Rate" constant. |

|||

| FX Fwd |

Displays the forward rate based on FX Spot and Fwd Points. |

|||

| Ccy 1 Rate |

Displays the interest rate of the primary currency based on the market data associated with the selected pricing environment. You can modify this value. |

|||

| Ccy 2 Rate |

Displays the interest rate of the quoting currency based on the market data associated with the selected pricing environment. You can modify this value. |

|||

| Spot | Fixing price. Displays the closing rate of the underlying. | |||

| Spot Reference | Displays the fixing price. Spot Rate as effective date. |

13. "Price" Properties

Price properties apply to all types of strategies. Only relevant price properties will be available for applicable strategies.

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exercise Fee Type | For Swaptions, select a premium fee type: Amount or %. | ||||||||||||

| Exercise Fee | For Swaptions, enter the premium fee amount or %. | ||||||||||||

| Premium Date | Displays the premium payment date. The system uses the spot date by default. You can change this to a forward date. If you use a forward date, the application adjusts the premium amount using the discount curve from the selected pricing environment. | ||||||||||||

| Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

|

||||||||||||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

||||||||||||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

||||||||||||

| Price Format |

Select the currency and unit amount of the prices. The unit amount defaults to the price format specified under Configuration > User Preferences. |

||||||||||||

| Model Premium | Displays the theoretical premium computed by the pricer. | ||||||||||||

| Model Price |

Displays the unit amount of model premium based on the selected Price Format. You can also view the following properties:

If the Rate Side is Bid/Ask, you will see Bid/Ask prices displayed instead of the mid price. |

||||||||||||

| Trader Premium | Displays the theoretical premium computed by the pricer. You can modify its value. | ||||||||||||

| Trader Price |

Displays the unit amount of trader premium based on the selected Price Format. You can also view the following properties:

If the Rate Side is Bid/Ask, you will see Bid/Ask prices displayed instead of the mid price. |

||||||||||||

| Customer Premium |

Displays the premium amount such that Customer Premium = Sales Premium + Trader Premium. Displays the customer premium such that:

The customer premium is the actual fee that will be paid/received.

Sub-properties for FX Options The Customer Premium property for FX Options includes two sub-properties for specifying a third-party legal entity, or beneficiary, as the recipient. This allows for successful generation of new transfers to the beneficiary from the Pricing Sheet strategy. Premium Legal Entity - Select a legal entity as the recipient for the premium. Legal entities are those defined in the Legal Entity window. Premium Legal Entity Role - Select a role for the legal entity. Legal entity roles are the same options provided in the "Role(s)" field of the Legal Entity window. |

||||||||||||

| Customer Price |

Displays the unit amount of customer premium based on the selected Price Format. You can also view the following properties:

If the Rate Side is Bid/Ask, you will see Bid/Ask prices displayed instead of the mid price. |

||||||||||||

| Customer Fee Ccy | Select the currency of the customer premium. It can be different from the primary and quoting currencies. | ||||||||||||

| Customer Fee |

Displays the customer premium in customer fee ccy. You can also display:

|

||||||||||||

| Sales Price |

Displays the unit amount of sales premium based on the selected Price Format. |

||||||||||||

| Sales Premium |

Displays the Sales Fee in premium currency. |

||||||||||||

| Sales Fee |

This property is only enabled if a Sales Person is selected. Enter the sales fee amount. Upon saving, a fee is created. The fee type depends on the product types: FXOPT_MARGIN for FX options, SPOT_MARGIN and FAR_MARGIN for FX, and CA_SALES_MARGIN for all other product types.

You can also display:

The MarginFXRate trade keyword stores the rate used in the conversion. |

||||||||||||

| Sales Location |

You can select the location of the sales representative. The sales location is a legal entity of role SalesLocation. The sales fee is paid to that legal entity if selected. If the sales location is not selected, the sales fee is paid to the counterparty of the trade if the domain "DefaultSalesMarginFeeLE" contains the value "UseTradeCptyAsDefault". Otherwise, it is paid to the "NONE" counterparty. |

||||||||||||

| Modified Strike | Displays the strike. | ||||||||||||

| Negotiated Price Type | Displays the negotiated price type. | ||||||||||||

| Clean Price | Enter the clean price (value of bond - accrued interest). | ||||||||||||

| Dirty Price | Enter the dirty price (value of bond + accrued interest). | ||||||||||||

| Gross Price | Displays inflation adjusted price. This value is for Inflation Bonds only. | ||||||||||||

| Yield | Enter the yield to maturity based on bond inputs. |

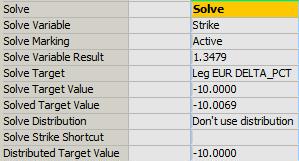

14. "Solver" Properties

"Solver" properties apply to all types of strategies. They are only populated when solving is applied, and are not editable.

Sample Solver properties

| Properties | Description |

|---|---|

| Solve Variable |

Displays the property to solve for. |

| Solve Marking |

Displays "Solve" for custom solving.

|

| Solve Variable Result | Displays the value of the solved property. |

| Solve Target | Displays the target property. |

| Solve Target Value | Displays the target value that you want to obtain. |

| Solved Target Value | Displays the computed target value. |

| Solve Distribution | Displays the distribution method selected when solving for multiple trade. |

| Solve Strike Shortcut |

Displays the solving shortcut applied to the Strike if any. |

| Solve Rate Shortcut | Displays the solving shortcut applied to the Rate if any. |

| Distributed Target Value |

Displays the distributed target value when solving for multiple trades. |

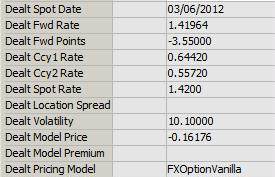

15. "Dealt Data" Properties

"Dealt Data" properties apply to all types of strategies. They are only populated on saved trades, and are not editable.

Sample Dealt Data properties

| Properties | Description |

|---|---|

|

Deal Spot Date |

Displays the spot date saved with the trade. |

|

Dealt Fwd Rate |

Displays the forward rate saved with the trade. |

|

Dealt Fwd Points |

Displays the forward points saved with the trade. |

|

Dealt Ccy1 Rate |

Displays the interest rate of the primary currency saved with the trade. |

|

Dealt Ccy2 Rate |

Displays the interest rate of the quoting currency saved with the trade. |

|

Dealt Spot Rate |

Displays the spot rate saved with the trade. |

| Dealt Location Spread | Displays the commodities location spread. |

|

Dealt Volatility |

Displays the volatility saved with the trade. |

|

Dealt Model Price |

Displays the model price saved with the trade. |

|

Dealt Model Premium |

Displays the model premium saved with the trade. |

|

Dealt Pricing Model |

Displays the pricing model saved with the trade. |

16. "Keyword" Properties

"Keyword" properties apply to all types of strategies.

| Properties | Description |

|---|---|

| @<trade keywords> |

These properties refer to trade keywords. The list of available keywords depends on which keywords are defined in your system. Enter values for trade keywords as needed. When you add a trade keyword to domain “PricingSheetKeyword.Boolean”, it will appear as a checkbox in the pricing sheet. When you add a trade keyword to domain “PricingSheetKeyword.Date”, it will allow selecting a date from a calendar.

|

17. "Pricer" Properties

"Pricer" properties apply to FX Option strategies.

| Properties | Description |

|---|---|

| Pricer.<property> | These properties display values computed by the pricers. |

| Pricer.Spot | Spot rate used for pricing the option. |

| Pricer.Pts | FX forward points for the Delivery Date from discount curves/FX curve. Is based on FX_POINTS=true/false. |

| Pricer.Fwd | FX forward rate for the Delivery Date. |

| Pricer.SpotDf1 | Ccy1 df (Spot Date, Valuation Date). |

| Pricer.SpotDf2 | Ccy2 df (Spot Date, Valuation Date). |

| Pricer.Df1 | Ccy1 df (Delivery Date, Valuation Date). |

| Pricer.Df2 | Ccy2 df (Delivery Date, Valuation Date). |

| Pricer.SpotDate | Spot Date based on the currency pair, pricing environment, time zone, Day Change Rule, and system date/time. |

| Pricer.PrimDepoRt | Ccy1 forward rate (Spot Date to Delivery Date) with DCF as per currency default with no compounding up to one year - beyond one year, compounded annually. |

| Pricer.SecDepoRt | Ccy2 forward rate (Spot Date to Delivery Date) with DCF as per currency default with no compounding up to one year - beyond one year, compounded annually. |

| Pricer.ATMVol | ATM vol interpolated from the FX vol surface that respects the market conventions as defined in the surface. This is computed for display only and is not used in the pricer calculations. |

| Pricer.RRVol | The volatility of the 25 delta call minus the volatility of the 25 delta put of a RR: Vrr = Vcall – Vput. |

| Pricer.BFVol | The average of the volatility of the 25 delta call and the volatility of the 25 delta put minus the ATM vol: Vbf = 0.5*(Vcall + Vput) - Vatm. |

| Pricer.STVol | The average of the volatility of the 25 delta call and the volatility of the 25 delta put: Vst = 0.5*(Vcall + Vput). |

| Pricer.TimeToExp | (Expiry Date – Spot Date) |

| Pricer.FXDate | Valuation Date for the currency pair, taking into consideration the Valuation Date/Time and the Day Change Rule specified in the pricing environment. |

| Pricer.ValDatetime | The Valuation Date/Time based on the Time Zone specified in the pricing environment. |

18. "Product: Cliquet" Properties

"Product: Cliquet" properties apply to all types of strategies.

| Properties | Description |

|---|---|

| Participation | Enter the percentage of the return to return to the user. |

| Initial Coupon | Enter the Initial Coupon. It is used as a base coupon that period returns are added to. |

| Global Cap | The maximum return for the payoff. |

| Global Floor | The minimum return for the payoff. |

| Local Cap | The maximum return for any given reset period. |

| Local Floor | The minimum return for any given reset period. |

19. "Product: Chooser" Properties

"Product: Chooser" properties apply to all types of strategies.

| Properties | Description |

|---|---|

|

Compound Settlement Type |

Enter Cash or Physical. |

20. "Product: Commodity" Properties

"Product: Commodity" properties apply to all types of strategies.

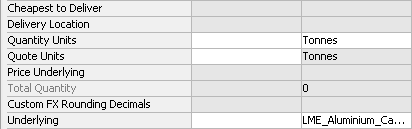

Sample Product Commodity properties

| Properties | Description |

|---|---|

|

Averaging Method |

Select a method for averaging the rates used in fixing.

|

| Averaging Rounding Method | Select the rounding method. |

| Cheapest to Deliver | Enter the cheapest to deliver amount. |

| Delivery Location | This is the delivery location for storage based commodities. It is populated from the CommodityLocation domain value. The pricer recognizes the delivery location and prices the forward according to the relevant location differentials. |

| Quantity Units |

Unit of measure that the quantity represents. You can use a different unit type than the unit in the product definition. The quantity unit defaults to the unit defined in the commodity definition. If a unit other than the default unit is chosen, the application requires a conversion definition to correctly convert the units for the cashflows. Commodity positions are always kept in the default unit in the Position Keeper. Define the conversion definition in the Calypso Navigator using Configuration > Commodites > Commodity Conversion. |

| Quote Units | The commodity unit in which the reference price is quoted, i.e. USD/Barrel. |

| Price Underlying | Price of the underlying product. |

| Total Quantity | Displays the total quantity units over the life of the trade. |

| Custom FX Rounding Decimals | When populated, FX rates will be rounded to a custom number of decimal points; otherwise, default rounding from the currency pair definition will be applied. |

| Custom Price Rounding | Enter the number of decimals to use when calculating the settlement price. Using this property at the trade level overrides the setting at the commodity level. |

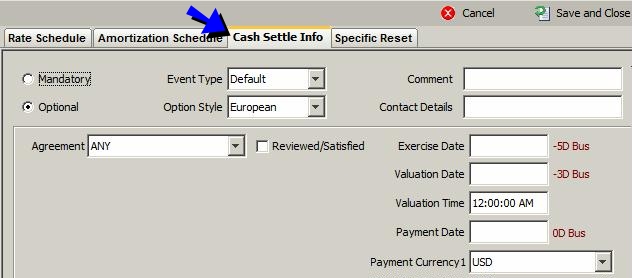

21. Cash Settle Info

Cash Settle Info allows defining a termination schedule (or break clauses) for a trade.

You can specify default cash settlement values by agreement / rate index / currency from the Calypso Navigator using Configuration > Interest Rates > Cash Settlement Defaults.

Right-click a trade and choose "Supplemental" to determine cash settle info.

If cash settlement defaults have been created for the selected agreement / rate index / currency, the "Early Termination" section will be used as default values for Cash Settlement details.

| » | Enter the fields described below as needed then click Save and Close. You can define multiple settlement details for different dates. |

Note that terminations are not enforced based on cash settlement details. The termination dates are for information purposes. However, if you terminate a trade at a specified date, the cash settlement details will be used to compute the settlement amount.

|

Fields |

Description |

||||||||||||

|

Mandatory / Optional |

Click the Mandatory or Optional radio button as needed. |

||||||||||||

|

Event Type |

Select the event type that triggers the cash settlement. The event type is populated for SwapsWire trades. Custom default values can be populated based on the event type. Refer to the Calypso Developer’s Guide for details. You can register new event types in the domain "cashSettleEvent". |

||||||||||||

|

Comment |

Enter a free form comment related to the event. |

||||||||||||

|

Option Style |

Only applies to optional cash settlements. Select the option style: European, American, or Bermudan.

European

|

||||||||||||

|

American

|

|||||||||||||

|

Bermudan

Note that the values for the dates default from the trade’s start and end dates. If you enter a date shortcut (for example, 2y) in the To field, the application calculates the date from the value entered in the From field. See also legal agreement attribute "BermudanTradeDate" for defaults. The frequency and holiday calendars default to the payment details of the trade. The holiday calendars for the Exercise Date and Valuation Date also default to the payment details. |

|||||||||||||

|

OptionCalcDialog

Days lag “D” can be business days or calendar days. Double-click the Bus label to switch to Cal as needed. For months lag “M” and years lag “Y”, the system uses calendar days only. The “No Tenor” checkbox only applies to days lag, when you enter more than 31 days. If you check the “No Tenor” checkbox, the offset will be not be converted to a tenor. Otherwise it will be converted to a tenor. Note that the conversion is for display only. The system always stores 35D.

For American and Bermudan options, you can enter the exercise fee in the Ex Schedule panel. For Bermudan options, select the frequency of the exercise dates. |

|||||||||||||

|

Contact Details |

Enter free form contact information as needed. |

||||||||||||

|

Agreement |

You can select an agreement type, or ANY. It defaults to the agreement type defined in domain "CashSettleDefaultsAgreements". If cash settlement defaults exist for the selected agreement, rate index and currency, they will be loaded. If a legal agreement of specified type is defined between the counterparty and the processing organization for the specified currency and product type, it can also drive default values on the settlement details. Ⓘ [NOTE: The legal agreement CANNOT be defined as "Master"] Attribute TERMINATION_APPENDIX_MID The attribute TERMINATION_APPENDIX_MID drives the following default values:

If TERMINATION_APPENDIX_MID = Yes or not set, it is set to MID. If TERMINATION_APPENDIX_MID = No, it is set to BID/ASK.

If TERMINATION_APPENDIX_MID = Yes or not set, it is set to False (unchecked). If TERMINATION_APPENDIX_MID = No, it is set to True (checked). Attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL The attributes CASH_SETTLE_MANDATORY_DATEROLL (mandatory agreement) and CASH_SETTLE_OPTIONAL_DATEROLL (optional agreement) drive the default value of the Date Roll conventions (Ex Date and Pay Date). You can create domains “laAdditionalField.CASH_SETTLE_MANDATORY_DATEROLL” and “laAdditionalField.CASH_SETTLE_OPTIONAL_DATEROLL” to hold the possible values. Attribute BermudanTradeDate The attribute "BermudanTradeDate" controls the Bermudan “From Date”. If true, the From Date is the Trade Date, otherwise, it is the start date of the swap. |

||||||||||||

|

Reviewed / Satisfied |

This checkbox appears checked when the trade has been reviewed from the Calypso Navigator in Trade Lifecycle > Termination > Cash Settlement (menu action For the Bermudan option style, the Reviewed/Satisfied checkbox can be set for each date. |

||||||||||||

|

Ex Date Convention |

Select the date roll convention to be applied when the termination date falls on a non-business day. Date roll conventions are described in the Calypso Navigator under Help > Date Roll Conventions. See legal agreement attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL for defaults. |

||||||||||||

|

Pay Date Convention |

Select the date roll convention to be applied when the payment date falls on a non-business day. Date roll conventions are described in the Calypso Navigator under Help > Date Roll Conventions. See legal agreement attributes CASH_SETTLE_MANDATORY_DATEROLL and CASH_SETTLE_OPTIONAL_DATEROLL for defaults. |

||||||||||||

|

Earliest Exercise Time |

Enter the earliest time on termination date when the option can be exercised. Defaults to Cash Settlement Defaults if any. |

||||||||||||

|

Expiration Time |

Enter the time at which the trade is terminated. Defaults to Cash Settlement Defaults if any. |

||||||||||||

|

Cash Settle Method |

Select a cash settlement method to compute the settlement amount. Defaults to Cash Settlement Defaults if any. |

||||||||||||

|

Rate Source |

You can select a rate source or none (empty). You can add rate sources to the "RateSource" domain. If you select none, you have to select a set of reference banks.

If you select OTHER_SOURCE, you need to select a rate index from the Rate Index field. |

||||||||||||

|

Quotation Rate |

Select the instance of the quotation rate that you want to use: MID, BID, or ASK. See legal agreement attribute TERMINATION_APPENDIX_MID for defaults. |

||||||||||||

|

Exercise Party Pays |

Check to indicate that the exercising party pays the settlement amount, otherwise the exercising party receives the settlement amount. See legal agreement attribute TERMINATION_APPENDIX_MID for defaults. |

||||||||||||

|

Location |

Select a location. Defaults to Cash Settlement Defaults if any, or to the currency’s location otherwise. |

22. Trade Drilldown

Most types of trades that can be captured in the Pricing Sheet can also be captured in native trade windows. When drilling down to such a trade from a report, the native trade window will usually be invoked by default.

To invoke the Pricing Sheet by default instead, you need to define a Trade Window Configuration using Configuration > User Access Control > Trade Window Configuration (menu action refdata.TradeWinConfigWindow) from the Calypso Navigator.

You can modify an existing configuration or create a new configuration.

| » | Select the product type, the product subtype, and enter the class name pricingSheet.PricingSheetWindow to invoke the Pricing Sheet by default. |

| » | Then associate the configuration with your Calypso user name under Configuration > User Access Control > User Defaults in the Trade Window Config field. |

You need to restart the Calypso Navigator in order for the change to take effect.

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Solving Functions |