Capturing Equity Derivatives Trades

To capture Equity Derivatives trades in the Pricing Sheet, you first need t o define Equity products.

See Equity Derivatives Trading for details.

See Equity Derivatives Trading for details.

Then select an Equity-related strategy and set the properties as needed.

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Properties specific to Equity trades are described below.

- Equity

1. Equity Reset Properties

You can select an equity reset from the Equity Reset property for equity and equity index underlyings. The fixing quote should be set for the quote name in the form "EquityReset.<equity name>.<reset name>". If you do not select an Equity Reset, CLOSE is selected by default. The fixing quote is the spot quote in that case.

For basket underlyings, and / or to enter manual resets, you need to bring up the Supplemental panel to enter Equity Reset information.

Equity resets are defined in the Equity Definition or Equity Index Definition.

Supplemental Panel

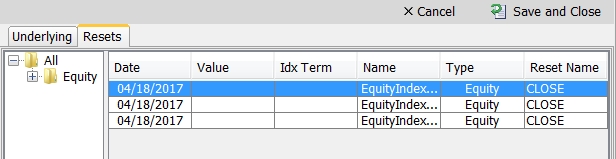

You can select the Resets panel to display Resets details for the various legs.

You can select an equity reset from the Reset Name field. The fixing quote should be set for the quote name in the form "EquityReset.<equity name>.<reset name>". If you do not select an equity reset, CLOSE is selected by default. The fixing quote is the spot quote in that case.

You can also select "Specific Reset" and enter a manual fixing quote in the Value field.

2. Equity

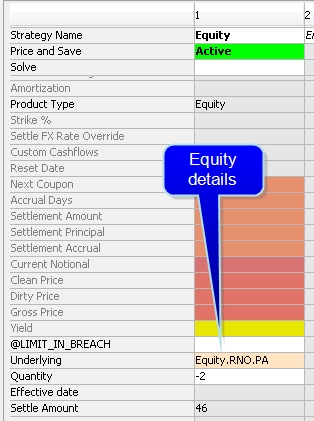

To capture equity trades, you must define an equity product in the system before it can be loaded to the Pricing Sheet.

Key Properties

Trade Direction - Underlying - Quantity - Strike - Trade Dates - Price

| Property | Description |

|---|---|

| Buy/Sell | Enter Buy or Sell. |

| Classification |

Enter the classification for the trade from a dropdown. This classification is for information purposes only. It is stored in the trade keyword "TradeClassification", and available values can be set in domain "keyword.TradeClassification". It can be used in filters to filter trades for various processes, and can be viewed in reports throughout the system. |

| Underlying |

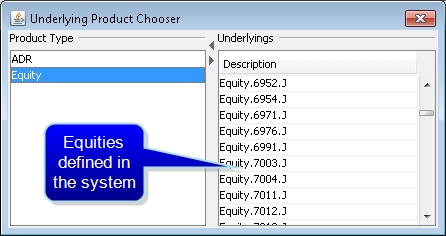

Enter the Equity product for the strategy. To enter a product, define one in the system and click in the cell to bring up the Underlying Product Chooser window.

A user can search Equity products or ADRs.

|

| Quantity |

Enter the equity product quantity to trade. |

| Strike | Enter the strike. |

| Strike Ccy | Enter the strike currency. |

| Settlement Date | Enter the settlement date. Defaults to the trade date. |

| Cash Date | Enter the cash date. |

| Negotiated Price Type | Enter the type of negotiated price. |

|

Quanto Factor |

Enter the rate between the underlying currency and the settlement currency. The trade keyword "EquityFXRate" will be populated accordingly. |

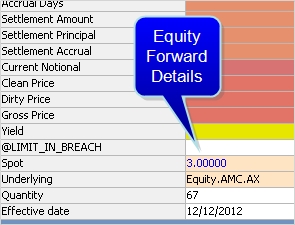

3. Equity Forward

An Equity Forward can be settled in cash or physical. The cash settlement requires the user to specify a “fixing” to determine the settlement amount. The fixing is observed on the forward date.

Key Properties

Trade Direction - Product Type - Settlement Date - Fixing - FX Source

| Property | Description |

|---|---|

| Buy/Sell | Enter buy or sell. |

| Quantity | Enter the equity product quantity to trade. |

| Strike | Enter the strike. This is the forward price. |

| Effective Date | Enter the effective date. |

| Expiry Date | Enter the trade end date. |

| Underlying |

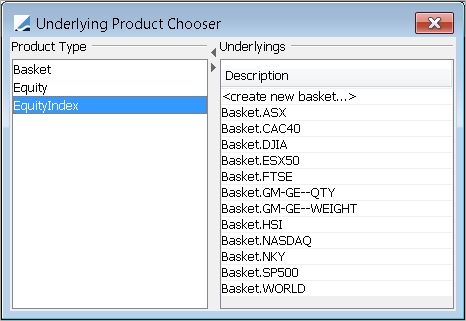

Enter the Equity product for the strategy. To enter a product, define one in the system and click in the cell to bring up the Underlying Product Chooser window.

You can select a basket, and equity or an equity index. If you choose Basket > <create new basket...>, the Basket window will appear. You can define a basket to use. Transient baskets will appear in italics. If |

| Product Type | Displays the product type. |

| Notional Ccy | Select the currency of the notional. |

| Spot | Enter the spot. |

| Settle Type | Enter the settle type. Choose CASH, PHYSICAL, FLEXO or QUANTO from a drop down. |

| Settle Ccy | Defaults to the underlying's currency if cash or physical. If QUANTO or FLEXO, choose currency pair. |

| Settlement Lag | Enter the date lag. |

| Flexo FX Source | If FLEXO is chosen in the Settle Type, displays the FX Reset. |

| Quanto Factor | If QUANTO is chosen in the Settle Type, displays the FX Reset. |

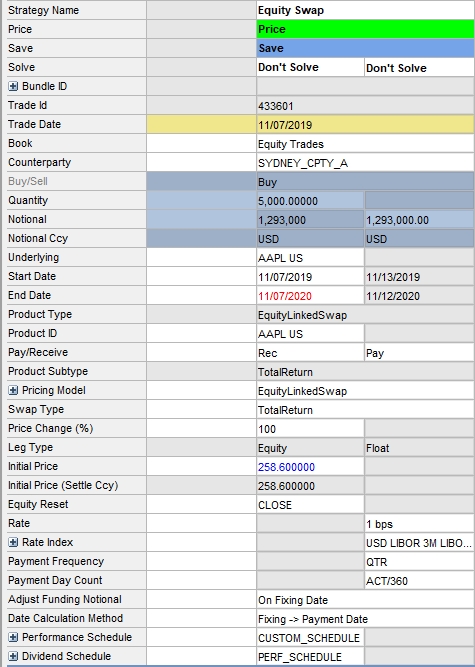

4. Equity Swap

The Equity Swap strategy in the Pricing Sheet defines the performance leg with an equity or equity index and the funding leg with a floating rate index or a fixed rate.

Key Properties

Underlying - Quantity - Initial Price - Start/End Date - Rate/Rate Index

Sample Equity Swap trade

Equities and equity indexes selected for the performance leg of the swap are defined in the equity and equity index product windows.

For equities, see Equity Product Definition.

For equities, see Equity Product Definition.

For equity indexes, see Equity Index Product Definition.

For equity indexes, see Equity Index Product Definition.

|

Basic Steps for Capturing an Equity Swap Trade

|

Properties Description

| Property | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Book |

Enter the trading book to which the trade belongs, owned by the processing organization, and which identifies the initiator's side of the trade. Books can be selected only after they have been added to Favorites in the Favorite Books Configuration window. From Calypso Navigator, choose Configuration > Favorites > Books. |

|||||||||

| Counterparty |

Enter the legal entity that represents the opposite side of the trade. Counterparties can be selected only after they have been added to Favorites in the Configure Favorite Cptys window. From Calypso Navigator, choose Configuration > Favorites > Counterparties. |

|||||||||

| Trade Date | Date on which the trade is booked. The date initially defaults to the current date. | |||||||||

|

Start Date |

Effective date of the trade. |

|||||||||

|

End Date |

End date of the trade. |

|||||||||

| Buy/Sell | Defaults to Buy. | |||||||||

| Pay/Receive | Direction for each leg. Selecting one option for a leg sets the option to its opposite for the other leg. | |||||||||

| Underlying |

Double-click the Underlying field and click the down arrow to open the Underlying Product Chooser, where you can select either an underlying equity or equity index. |

|||||||||

|

Quantity |

Enter the number of shares. |

|||||||||

|

Initial Price |

Enter the initial price. This price will be used to calculate the first payoff. See Notional below. |

|||||||||

| Notional |

The funding notional of the trade. The value is "read only" in the Pricing Sheet.

The underlying equity's currency equals the settlement currency, or The underlying equity's currency is different from the contract's settlement currency, but the FX Conversion Method is Flexo.

|

|||||||||

| Rate | When the Leg Type is Fixed, enter a fixed rate. When the Leg Type is Float, you can enter an index factor in basis points. | |||||||||

| Rate Index |

When Leg Type is Float, select the reference index and make settings for associated secondary properties under the Rate Index property.

|

|||||||||

| Settle Type / Settle Ccy |

When the settlement currency is different from the underlying currency, you can select the FX Conversion Method in the Settle Type property. The choices are Local, Quanto, and Compo. |

|||||||||

| Price Change % | Enter the percentage of performance that the equity leg receives or pays. | |||||||||

| Swap Type | Currently, the only option available for the Pricing Sheet is TotalReturn. | |||||||||

| Leg Type | Either Fixed or Float. When Fixed, the Rate Index property is disabled. When Float, associated Rate Index properties are enabled. | |||||||||

| Performance Schedule | The performance payoff schedule. CUSTOM_SCHEDULE is the only option available in the Pricing Sheet. Expand the property to make selections for Frequency, Roll On Day, Performance Stub Type, and Period Rule. | |||||||||

| Dividend Schedule |

Select the payment schedule associated with the equity:

Dividend Ownership Second Period is currently the only option. Second Period relies on the dividend's ex-div date and refers to each period from one fixing date to the next fixing date, excluding the first date and including the last. The initial dividend period, however, will commence on but exclude the trade date, and the final dividend period will end on and include the final fixing date. |

|||||||||

|

Adjust Funding Notional |

Select the notional adjustment method: • On Pay Date – The Notional of the funding leg equals the Fixing of the Prior Leg * Initial Quantity. The Notional will adjust on the payment date. • On Fixing Date – The Notional of the funding leg equals the Fixing of the Prior Leg * Initial Quantity. The Notional will adjust on the fixing date. |

|||||||||

| Date Calculation Method |

Select the Date Calculation Method:

|

5. Portfolio Swap

A Portfolio Swap is an agreement between counterparties to swap cash flows on fixed dates in the future over a certain period of time, where one flow is based on the performance of a dynamic basket of equity assets and the other on a fixed or floating set interest rate whose amount is calculated using a predetermined notional value. The Portfolio Swap helps standardize the handling of equity swaps.

The underlying specifics of the agreement are defined by the Portfolio Swap Contract. For details on setting up a Portfolio Swap Contract, see Calypso Portfolio Swap Definition documentation.

Key Properties

Book - Counterparty - Trade Date - Start Date - Contract - Buy/Sell - Underlying - Quantity - Gross Price

Sample Portfolio Swap trade

|

Basic Steps for Capturing a Portfolio Swap Trade

|

Properties Description

| Property | Description | ||||||

|---|---|---|---|---|---|---|---|

| Book |

Enter the trading book to which the trade belongs, owned by the processing organization, and which identifies the initiator's side of the trade. Books can be selected only after they have been added to Favorites in the Favorite Books Configuration window. From Calypso Navigator, choose Configuration > Favorites > Books. |

||||||

| Counterparty |

Enter the legal entity that represents the opposite side of the trade. Counterparties can be selected only after they have been added to Favorites in the Configure Favorite Cptys window. From Calypso Navigator, choose Configuration > Favorites > Counterparties. |

||||||

| Trade Date | Date on which the trade is booked. The date initially defaults to the current date. | ||||||

|

Start Date |

Effective date of the underlying contract. |

||||||

| Contract |

Double-click the Contract property field to select a contract. The Portfolio Swap Contracts window allows you to search for the target contract. Once the Contract is entered for the trade it can be opened quickly from the Pricing Sheet by highlighting the contract in the strategy leg, opening the Leg Details tool (click

Ⓘ [NOTE: The processing organization's Book and the Counterparty selected in the Pricing Sheet must match the corresponding information in the contract before the contract is made available in the Portfolio Swap Contracts search window. Additionally, the Trade Date should be the same as or follow after the contract's Start Date and come before the End Date. When these requirements are met, a list of available contracts (if more than one exists) is displayed in the search window.] |

||||||

|

End Date |

End date of the underlying Portfolio Swap Contract. The date is defined in the contract and "read only" in the Pricing Sheet. |

||||||

| Buy/Sell | Direction of the trade from the processing organization's perspective. | ||||||

| Underlying |

Enter the underlying equity. Double-click the Underlying field and click the down arrow to open the Underlying Product Chooser. |

||||||

|

Quantity |

Enter the number of shares. |

||||||

| Gross Price | Enter the gross initial trade price of the equity. | ||||||

|

Initial Price |

Initial price is a net price calculated by the system and "read only" in the Pricing Sheet. When the contract specifies Commission Pay Method as either Upfront or Upfront Quantity, the Initial Price equals the Gross Price. When the Commission Pay Method is Embedded, The Initial Price is dependent on the direction of the trade.

|

||||||

| Initial Price (Settle Ccy) | This field is "read only" on the Pricing Sheet. A value is provided only when the settlement currency is different from the contract currency and the FX Conversion Method is Compo. It is defined as the initial price converted into settlement currency using the Initial FX Reset of the trade. | ||||||

|

Commission (bps) |

The commission fee rate in bps. The value is automatically populated from information on the Country Grid tab of the contract. When the direction of the trade is Buy, the commission rate is taken from the Long Commission (bps) field. In the case of a Sell trade, this value comes from the Short Commission (bps) field. However, this value can be overridden at the trade level and entered manually in the Pricing Sheet. When the contract specifies the Commission Pay Method as Embedded, Commission (bps) is used to calculate the Initial Price. When the Commission Pay Method is either Upfront or Upfront Quantity, Commission (bps) is used to calculate the commission at the trade level. |

||||||

| Notional |

The funding notional of the trade. The value is "read only" in the Pricing Sheet.

The underlying equity's currency equals the contract's settlement currency, or The underlying equity's currency is different from the contract's settlement currency, but the FX Conversion Method is Flexo.

|

||||||

| Leg Type | Either Fixed or Float. Defined in the Portfolio Swap Contract and "read only" in the Pricing Sheet. | ||||||

|

FX |

The FX conversion method used when the underlying currency is different from the settlement currency. The method is chosen in the contract, and this is a "read only" field in the Pricing Sheet.

|

6. Equity Structured Options

Equity Structured Option is a general term that describes an agreement between two parties to exchange one or more cash flows based on a payout. The payout formula typically refers to underlyings. The strategies listed in this section are specific instances of the equity structured option, although Calypso also provides a general Equity Option strategy, which provides the flexibility to configure any one of a variety of equity option strategies. However, Calypso recommends utilizing a specific strategy whenever possible.

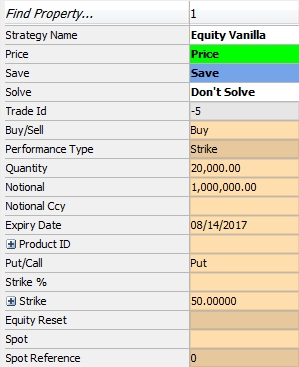

6.1 Equity Vanilla

The Equity Vanilla option forms the basis for other specific options that follow. When capturing the latter, begin configuring the trade as though it were an Equity Vanilla then enter values for properties directly associated with the specific type of trade.

Key Properties

Underlying - Buy/Sell - Put/Call - Notional - Strike% - Strike - Quantity - Trade Date - Effective Date - Expiry Date - Settle Type - Exercise Type

Sample Equity Vanilla trade

|

Basic Steps for Capturing an Equity Vanilla Option

|

Properties Description

| Property | Description | ||||||

|---|---|---|---|---|---|---|---|

| Buy/Sell | Enter buy or sell. | ||||||

| Put/Call |

Enter PUT or CALL.+ |

||||||

| Performance Type |

Automatically switches between Quantity, Notional, or Strike depending on the information entered in the Quantity, Notional, or Strike fields below. Defaults to Quantity. |

||||||

| Quantity |

Enter the quantity. If quantity is entered, then the performance type of the trade is quantity-based. Strike, Price and other dependent properties will display amounts. If notional is entered, then Quantity is calculated as Notional / Spot reference. |

||||||

| Strike |

Enter the strike. If strike is entered, then the performance type of the trade is strike-based, allowing the user to set the strike immediately. If strike is entered, then quantity is calculated as Notional/Strike. |

||||||

| Notional |

Enter the notional. If notional is entered, then the performance type of the trade is notional-based. Strike, Price, and other dependent properties will display % amounts. If quantity is entered, then notional is calculated as Quantity * Spot reference. |

||||||

| Strike % | Enter the strike percentage. If the Strike % is entered, then Strike = Spot Reference * Strike %. | ||||||

| Underlying |

Enter the Equity product for the strategy. To enter a product, define one in the system and click in the cell to bring up the Underlying Product Chooser window.

You can select a basket, and equity or an equity index. If you choose Basket > <create new basket...>, the Basket window will appear. You can define a basket to use. Transient baskets will appear in italics. |

||||||

| Trade Date | The date on which both parties agree on the terms of the trade. | ||||||

| Effective Date | Start date of the trade. | ||||||

| Expiry Date | Enter the expiration date. | ||||||

| Expiry | Displays Day/number of Weeks/Weeks or Years until expiration. | ||||||

| Product Type | Displays the product type. | ||||||

| Notional Ccy | Select the currency of the notional. | ||||||

| Exercise Type | Enter European, American, or Bermudan for the Exercise Type. | ||||||

| Settle Type | Enter the settle type. Choose Cash, Physical, Quanto, Flexo, or Compo from the drop-down list. | ||||||

| Settle Ccy |

Displays the settlement currency. If CASH, then notional currency of underlying is displayed. If PHYSICAL, then blank. If QUANTO or FLEXO, then enter a currency. |

||||||

| Spot | Fixing price. Displays the closing rate of the underlying. | ||||||

| Spot Reference | Uneditable. Displays the fixing price. Spot Rate as effective date. | ||||||

| Price Format |

Displays price in amount or %. If Quantity, then currency (e.g., EUR) is displayed. If Notional, then percent (e.g., EUR%) is displayed. |

||||||

| Delivery Date | Enter the delivery date. | ||||||

| Strike Type |

Enter the strike type. Choose Fixed, Forward Start, Average or Lookback.

|

||||||

| Notional FX Reset | Displays the FX rate reset for the notional. FX rate resets are defined from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. |

6.2 Equity Barrier

To capture an Equity Barrier, select the Equity Barrier strategy and enable the following properties in the Pricing Sheet Profiles window along with the relevant Equity Vanilla properties discussed above.

| Property | Description |

|---|---|

| Barrier Duration | Enter None, FULL, PARTIAL or EXPIRY. |

| Barrier Type | Enter the barrier type: UI, DI, UO, DO, DKI, DKO, KIKO (UI) or KIKO (DI). |

| Barrier | Enter the upper barrier. You can set the barrier levels as a percentage of the spot reference (Barrier %) when Barrier Monitoring = Closing, and Barrier Duration = FULL. |

| Barrier 2 | Enter the lower barrier. You can set the barrier levels as a percentage of the spot reference (Barrier 2 %) when Barrier Monitoring = Closing, and Barrier Duration = FULL. |

| Barrier Monitoring | Enter the barrier monitoring type, Continuous or Closing. When Barrier Monitoring = Closing, and Barrier Duration = FULL, you can define an observation schedule in the Supplemental panel. |

| Barrier Start Date | Displays the start date. |

| Barrier End Date | Displays the end date. |

| Rebate | Displays the rebate amount. |

| Rebate Ccy | Displays the rebate currency type. |

| Rebate Timing | Displays the rebate timing. |

| Performance Type | Automatically switches between Quantity, Notional, or Strike depending on the information entered in the Quantity, Notional, or Strike fields below. Defaults to Quantity. |

6.3 Equity Digital

To capture an Equity Digital, select the Equity Digital strategy and enable the following properties in the Pricing Sheet Profiles window along with the relevant Equity Vanilla properties discussed above.

| Property | Description |

|---|---|

| Trigger Duration | Enter None, FULL or EXPIRY. |

| Trigger Type | Enter OT Up/Down or Above Below. |

| Payout Type | Displays the digital type. |

| Barrier Monitoring | Enter the barrier monitoring type, Continuous or Closing. When Barrier Monitoring = Closing, and Barrier Duration = FULL, you can define an observation schedule in the Supplemental panel. This applies only to DOT/DNT options. |

| Trigger | Enter the upper trigger. You can set the trigger levels as a percentage of the spot reference (Trigger %) when Barrier Monitoring = Closing, and Barrier Duration = FULL. |

| Trigger 2 |

Enter the lower trigger. You can set the trigger levels as a percentage of the spot reference (Trigger 2 %) when Barrier Monitoring = Closing, and Barrier Duration = FULL. |

| Digital Amount |

Enter the payout quantity. |

6.4 Equity Asian/Lookback

To capture an Equity Asian/Lookback, select the Equity Asian or Equity Lookback strategy and enable the following properties in the Pricing Sheet Profiles window along with the relevant Equity Vanilla properties discussed above.

| Property | Description |

|---|---|

| Function |

Select the averaging function for Asian options. This is done in the Supplemental panel. • Arithmetic — Arithmetic average options where the average is ∑xn, cannot be valued using a closed form solution. There are approximations (Turnbull and Wakeman 1991), that are fairly accurate, or Monte Carlo simulations can be applied. • Geometric — Geometric average options where the average is ((x1…xn)1/n), have a closed form solution, but are far less common in practice than arithmetic averages. |

| Strike % | Enter the strike percentage for strip generation. |

6.5 Equity Cliquet

A Cliquet is a multi-period option with a single payoff at maturity. Select the Equity Cliquet strategy and enable the properties in the table below along with the relevant Equity Vanilla properties discussed above.

Each period has a return that can be floored and/or capped. The Cliquet schedule can be generated and viewed in the Supplemental panel.

| Property | Description |

|---|---|

| Initial Coupon | Enter the Initial Coupon. It is used as a base coupon that period returns are added to. |

| Participation | Enter the percentage of the return to return to the user. |

| Global Cap | The maximum return for the payoff. |

| Global Floor | The minimum return for the payoff. |

| Local Cap | The maximum return for any given reset period. |

| Local Floor | The minimum return for any given reset period. |

6.6 Equity Chooser

The Chooser Payoff allows the holder to choose whether to enter into one of two possible options on the Expiration Date. Each of the possible options has its own Strike, Put/Call and Maturity Date. All options are European. In addition to Equity Vanilla properties shown above, add the following properties to the Equity Chooser strategy.

| Property | Description |

|---|---|

| Compound Settlement Type | Enter Cash or Physical. |

| Compound Put/Call | Enter the Put and Call for each leg. |

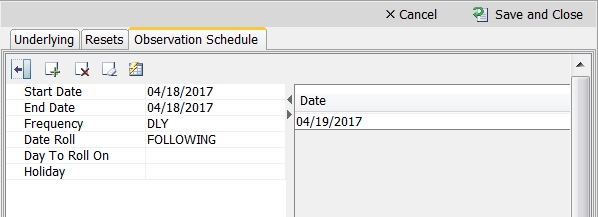

6.7 Defining an Observation Schedule

For Equity Barrier options and Equity Digital options, you can define an observation schedule in the Supplemental panel when Barrier Monitoring = Closing. Right click the strategy and select Supplemental to access the Supplemental panel.

'

'

The start date and end date default to the strategy's details.

Step 1 - Select the frequency, date roll convention, and holidays.

Step 2 - Click Save and Close to generate the schedule.

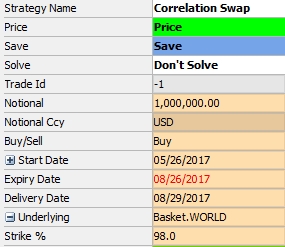

7. Correlation Swap

A Correlation Swap is an OTC transaction between two parties to exchange the difference between a “Strike Correlation” and the “Realized Correlation”.

Key Properties

Notional - Notional Ccy - Buy/Sell - Start Date - Expiry Date - Delivery Date - Underlying - Strike %

Properties Description

| Property | Description | |||

|---|---|---|---|---|

| Notional |

Enter the notional. If notional is entered, then the performance type of the trade is notional-based. Strike, Price, and other dependent properties will display % amounts. If quantity is entered, then notional is calculated as Quantity * Spot reference. |

|||

| Notional Ccy | Select the currency of the notional. | |||

| Buy/Sell | Enter buy or sell. | |||

| Start Date | Enter the start date of the swap. | |||

| Expiry Date | Enter the expiry date of the swap. | |||

| Delivery Date | Enter the delivery date of the swap. | |||

| Underlying |

Enter the Equity product for the strategy. To enter a product, define one in the system and click in the cell to bring up the Underlying Product Chooser window.

A user can search Equity products or ADRs.

|

|||

| Strike % | Enter the strike percentage. If the Strike % is entered, then Strike = Spot Reference * Strike %. |

8. Scriptable OTC Products

In order to capture Scriptable OTC Product trades , you need create custom strategies that use a Pricing Script.

See Building Custom Strategies for details.

See Building Custom Strategies for details.

All the information regarding the pricing script associated with the trade can be found in the Supplemental panel.

You can right-click a SCOT trade in the Pricing sheet and choose:

| • | "Supplemental" - To display the pricing script details in the supplemental panels. |

| • | "Export Script Data" - To export the pricing script details to an HTML file. You can also use the scheduled task EXPORT_SCRIPT_DATA. |

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |