Capturing Commodities Trades

To capture commodity trades in the Pricing Sheet, you first need to define Commodity products and resets.

See Commodities Trading for details.

See Commodities Trading for details.

Then select a Commodity strategy and set the properties as needed. You can also select a strategy template to populate default values.

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Properties specific to Commodity trades are described below.

- Quantity Schedule for Commodities

- Spread and Strike Schedule for Commodities

Fixing the Price of a Commodity

The price can be fixed in the Price Fixing window.

For details on using the Price Fixing window, see Price Fixing.

For details on using the Price Fixing window, see Price Fixing.

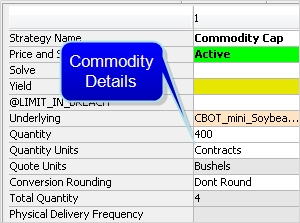

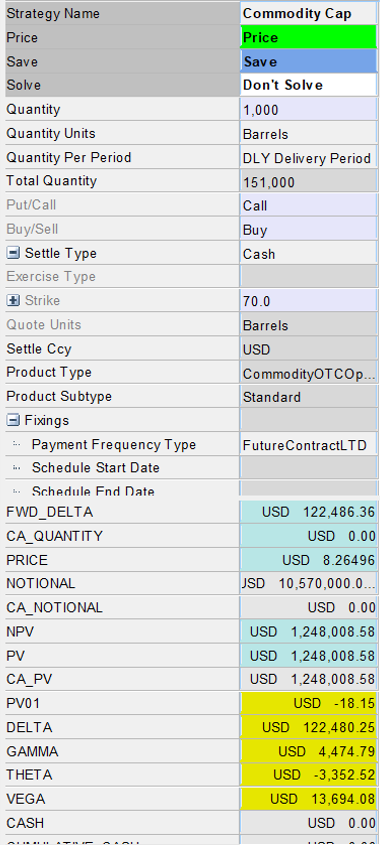

1. Commodity Cap

This strategy is no longer supported for new trade booking. Only existing trades can be opened in this strategy.

Properties

Put/Call - Date - Exercise type - Underlying details

"Product: Style" Properties

| Properties | Description |

|---|---|

|

Buy/Sell |

Select the direction of the trade leg from the book's perspective. |

| Settle Type |

Select the settle type, Cash or Compo. Cash is set by default. When Compo is selected, Settle Ccy and other FX related properties will become editable. |

| Strike | Enter the strike price per unit. The input fields vary depending on the Option Type that you select. |

| Settlement Source |

Select the source to be used as a pricing reference for settlement calculations. |

"Product: Date" Properties

| Properties | Description |

|---|---|

| Trade Date |

Enter the start date and time of the trade. The trade date defaults to the current date. |

| Settle Date | Enter the maturity date for the trade. (For most emissions trades, the settle date is equal to the allowance delivery date.) |

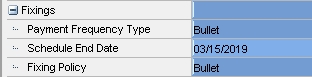

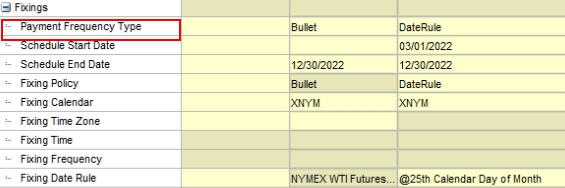

The several properties associated with Fixings in the Pricing Sheet are either editable or non-editable depending on the Payment Frequency Type setting. For example, the Averaging Method and Averaging Rounding Method properties are available for editing with all payment frequency types except for "Bullet," "Daily," and "ThirdWednesday."

| Properties | Description |

|---|---|

| Payment Frequency Type |

Select the payment frequency type. For the DateRule type, set the date rule in the Fixing Date Rule field.

|

| Schedule Start Date | Enter the Schedule start date |

| Schedule End Date | Enter the Schedule end date |

| Fixing Policy |

Select the Fixing Policy.

|

| Fixing Calendar | Select the fixing calendar. |

| Fixing Time Zone | The global time that the commodity reset is expected to be known. This can be, but doesn't have to be, the time zone of the actual exchange or publication. |

| Fixing Time | The global time that the commodity reset is expected to be known. |

|

Fixing Date Rule |

Select the date rule for the DataRule payment frequency type. |

| First Contract |

Only available to payment frequency types FutureContractFND or FutureContractLTD. Displays the first underlying futures contracts that will be used as fixing references. |

| Last Contract |

Only available to payment frequency types FutureContractFND or FutureContractLTD. Displays the last underlying futures contracts that will be used as fixing references. |

| Intraday Policy |

Select the Intraday Policy to be used.

|

| DST Name | Displays the daylight savings. |

| Averaging Method |

Select a method for averaging the rates used in fixing.

|

| Averaging Rounding Method | Select the rounding method. |

"Product: Price" Properties

| Properties | Description |

|---|---|

| Barrier |

Enter the barrier count. |

|

Barrier Type |

Select the type of barrier: 'UI', 'UO', 'DI' or 'DO'. |

| Barrier Duration | Enter Full or NONE. |

| Rebate | The amount of the rebate per commodity unity. The rebate is entered in amount per strike unit. For example, a rebate may be entered as "0.35 per barrel" by entering 0.35 in this field. |

| Rebate Currency | The currency of the rebate. This should always be equal to the settlement currency of the option. |

| Rebate Timing | The payment schedule of the rebate. This can be paid at the original option maturity (At Maturity) or on a date relative to the knock out event (At Instant). |

"Underlying Details" Properties

| Properties | Description |

|---|---|

| Underlying |

Select the commodity reset which will drive the forward. When the reset is selected, fields specific to the reset pre-fill with the appropriate information. |

| Quantity | The quantity of the certificate in commodity units. |

| Quantity Units |

Unit of measure that the quantity represents. You can use a different unit type than the unit in the product definition. The quantity unit defaults to the unit defined in the commodity definition. If a unit other than the default unit is chosen, the application requires a conversion definition to correctly convert the units for the cashflows. Commodity positions are always kept in the default unit in the Position Keeper. Define the conversion definition in the Calypso Navigator under Configuration > Commodites > Commodity Conversion. |

| Conversion Rounding |

Round: FX conversions will be rounded. Don't round: FX conversions will not be rounded. |

| Total Quantity | Displays the total quantity units over the life of the trade. |

| Physical Delivery Frequency |

Specify the frequency of the payment. |

| Custom FX Rounding Frequency |

When populated, FX rates will be rounded to a custom number of decimal points; otherwise, default rounding from the currency pair definition will be applied. |

2. Commodity Forward

The commodity forward trade is based on the commodity reset, not the commodity itself. You must define a reset to construct a commodity forward trade.

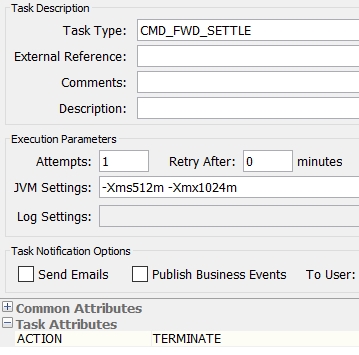

Commodity forward trades without certificates do not update the position by default. You need to run the scheduled task CMD_FWD_SETTLE on the settlement date to terminate the commodity forward trade and create a commodity spot trade. If you want to update positions for commodity forward trades without certificates, you need to set the environment property NEW_CMD_FWD_NO_POSITION = false. See below.

Properties

"Product: Style" Properties- Delivery Properties

"Product: Style" Properties

| Properties | Description |

|---|---|

|

Buy/Sell |

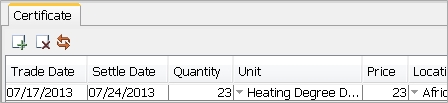

Select the direction of the trade leg from the book's perspective. To buy or sell a Certificate, right click and open the Supplemental panel. Select a certificate (sell trade) or define a certificate (buy trade).

Certificate details can be entered or a template can be used

|

| Settle Type |

Select the settle type, Cash or Compo. Cash is set by default. When Compo is selected, Settle Ccy and other FX related properties will become editable. |

| Strike | Enter the strike price per unit. |

"Price Fixing" Properties

See "Price Fixing" Properties for details.

See "Price Fixing" Properties for details.

"Underlying Details" Properties

| Properties | Description |

|---|---|

| Underlying |

Select the commodity reset which will drive the forward. When the reset is selected, fields specific to the reset pre-fill with the appropriate information. |

| Quantity | The quantity of the certificate in commodity units. |

| Cheapest to Deliver | Enter the cheapest to deliver amount. |

| Quantity Units |

Unit of measure that the quantity represents. You can use a different unit type than the unit in the product definition. The quantity unit defaults to the unit defined in the commodity definition. If a unit other than the default unit is chosen, the application requires a conversion definition to correctly convert the units for the cashflows. Commodity positions are always kept in the default unit in the Position Keeper. Define the conversion definition in the Calypso Navigator under Configuration > Commodites > Commodity Conversion. |

| Quote Units | The commodity unit in which the reference price is quoted, i.e. USD/Barrel. |

| Delivery Location | This is the delivery location for storage based commodities. It is populated from the CommodityLocation domain value. The pricer recognizes the delivery location and prices the forward according to the relevant location differentials. |

| Price Currency | Enter the currency for the price. |

| Physical Delivery Date Roll |

Select the date roll convention to roll the payment dates when they fall on non-business days. The payment calendar is used to determine business days. Date roll conventions are described in the Calypso Navigator under Help > Date Roll Conventions. |

| Physical Delivery Holidays | Click ... to select the calendar(s) the application uses to determine the business days. |

| Physical Delivery Lag | Specify lag days from the end date of the payment period (in business or calendar days) for the actual payment to take place. By default, business days are used to calculate the payment date. To specify calendar days, double-click the Bus label to toggle to Cal. |

| Physical Delivery Day | Number of delivery days. |

Scheduled Task CMD_FWD_SETTLE

This scheduled task terminates commodity forward trades without certificates on the settlement date and creates commodity spot trades.

Select the action to be applied to the forward trade.

Commodity Forwards to Spot Migration

See Commodity Forwards Migration for details.

See Commodity Forwards Migration for details.

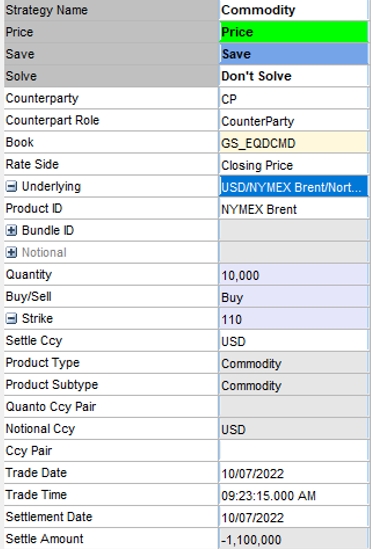

3. Commodity Spot

Select the "Commodity" strategy to enter a commodity spot trade and set the properties as needed.

"Underlying Details" Properties

| Properties | Description |

|---|---|

| Underlying |

Select the commodity. |

| Quantity | Enter the quantity. |

| Strike |

Enter the strike. |

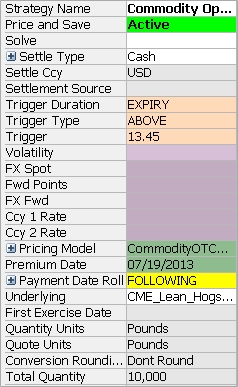

4. Commodity OTC Option

A Commodity OTC Option is a strip of Cash settled Asian or Average Rate Options. The payoff depends on an average of Reference Prices relative to a fixed Strike.

This strategy is no longer supported for new trade booking. Only existing trades can be opened in this strategy.

Select the "Commodity" strategy to enter a Commodity OTC Option trade and set the properties as needed.

Properties

Buy/Sell - Put/Call - Style Properties - Underlying Details - Price Fixing Details - Trigger Details

"Product: Style" Properties

| Properties | Description |

|---|---|

|

Buy/Sell |

Select the direction of the trade leg from the book's perspective. |

| Strike | Enter the strike price per unit. |

| Exercise Type | Select the exercise type. |

"Price Fixing" Properties

See "Price Fixing" Properties for details.

See "Price Fixing" Properties for details.

"Underlying Details" Properties

| Properties | Description |

|---|---|

| Underlying |

Select the commodity reset which will drive the forward. When the reset is selected, fields specific to the reset pre-fill with the appropriate information. |

| Quantity | The quantity of the certificate in commodity units. |

| Total Quantity | Displays the total quantity units over the life of the trade. |

| Quantity Units |

Unit of measure that the quantity represents. You can use a different unit type than the unit in the product definition. The quantity unit defaults to the unit defined in the commodity definition. If a unit other than the default unit is chosen, the application requires a conversion definition to correctly convert the units for the cashflows. Commodity positions are always kept in the default unit in the Position Keeper. Define the conversion definition in the Calypso Navigator under Configuration > Commodites > Commodity Conversion. |

|

Quantity Per Period |

Specify the frequency that the deal quantity is traded. For Pay Frequency – Future Contract LTD/FND, user can select below options for ‘Per Period’: • Future Contract Period - Specified Quantity is applied to each period. • DLY - Specified Quantity is applied to each day in a period. Total Quantity for the period will be Quantity * Number of Days in the period. • DLY Delivery Period - Specified Quantity is applied to each day of Delivery period of Contract. Total Quantity for the period will be Quantity * Number of Days in Delivery period of Future Contract. |

| Conversion Rounding | Set to ‘Round’ to indicate that the reference unit to deal unit conversion of the price should be rounded prior to calculating the amount for the cash flow. The default is ‘Don't Round’, which means the rounding occurs after the amount is calculated. |

Trigger Properties

| Properties | Description |

|---|---|

| Trigger Duration | Select None or EXPIRY. |

| Trigger Type | Select ABOVE or BELOW |

| Trigger | Enter the trigger amount. |

"Product: Payment" Properties

| Properties | Description |

|---|---|

| Payment Date Roll |

Select the date roll convention to roll the payment dates when they fall on business days. The payment calendar is used to determine business days. Date roll conventions are described in the Calypso Navigator under Help > Date Roll Conventions. |

| Payment Holidays | Click ... to select the holiday calendar(s) used to determine the business days when calculating the payment date. |

| Payment Day |

Select to enter payment details. This makes a field available next to the Day label where you can specify which day the payment should take place. For example, enter “5” to specify that the payment date occurs on the 5th of the month following the swap end date. |

| Payment Date Rule | Select a date rule for determining the payment date if required. |

|

Payment Frequency Type |

Select FutureContractLTD or FutureContractFND. |

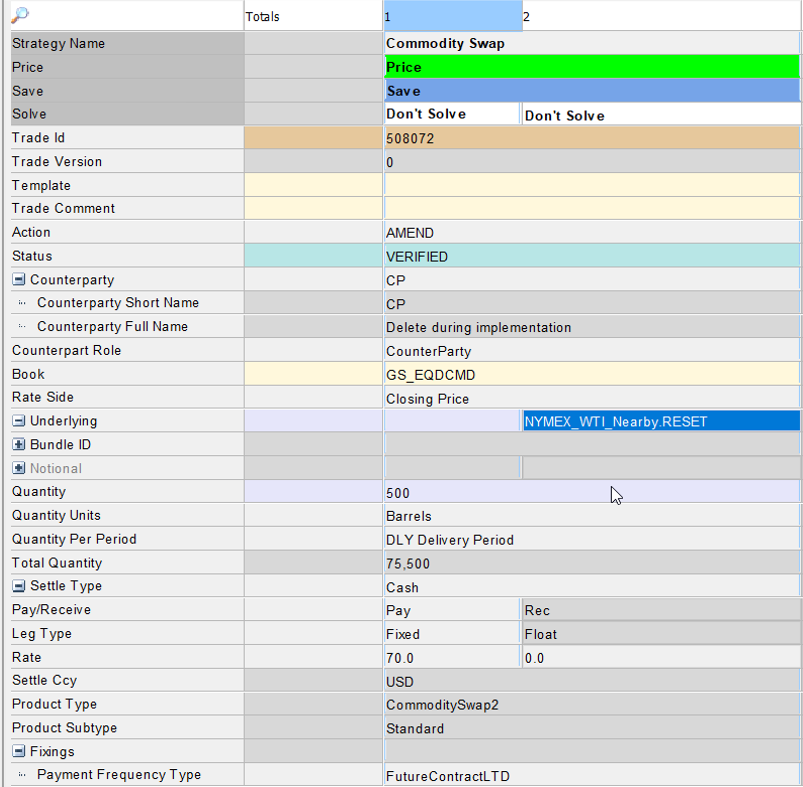

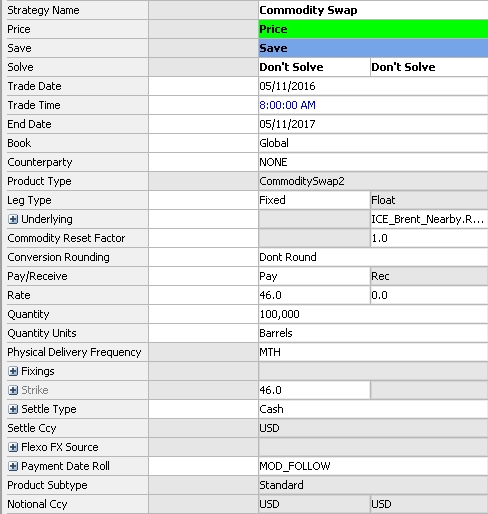

5. Commodity Swap

A Commodity Swap is an exchange of payments between two parties. It uses a Commodity Reset Definition to define values to use for both known and projected commodity amounts. Select the commodity reset during trade capture and define additional fixing details in the trade.

Key Properties

Strike - Leg Type - Settle Type - Pay/Receive - Underlying Details - Fixing Details - Payment Details

|

Basic Steps for Capturing a Commodity Swap

|

"Underlying Details" Properties

| Properties | Description |

|---|---|

| Underlying |

Select the commodity reset which will drive the forward. When the reset is selected, fields specific to the reset auto-populate with the appropriate information. |

| Quantity | The quantity of the certificate in commodity units. |

| Total Quantity | Displays the total quantity units over the life of the trade. |

| Quantity Units |

The unit of measure that the quantity represents. You can use a different unit type than the unit in the product definition. The quantity unit defaults to the unit defined in the commodity definition. If a unit other than the default unit is chosen, the application requires a conversion definition to correctly convert the units for the cashflows. Commodity positions are always kept in the default unit in the Position Keeper. Define the conversion definition in the Calypso Navigator by pointing to Configuration > Commodities > Commodity Conversion. The "Contracts" unit represents the lot size. The conversion factor for each lot, or contract, can be configured in the Commodity Unit Conversion window referred to above. |

|

Quantity Per Period |

Specify the frequency that the deal quantity is traded. For Pay Frequency – Future Contract LTD/FND, user can select below options for ‘Per Period’: • Future Contract Period - Specified Quantity is applied to each period. • DLY - Specified Quantity is applied to each day in a period. Total Quantity for the period will be Quantity * Number of Days in the period. • DLY Delivery Period - Specified Quantity is applied to each day of Delivery period of Contract. Total Quantity for the period will be Quantity * Number of Days in Delivery period of Future Contract. |

| Rate | The Rate on the Fixed leg is auto-populated when you add the Strike. Enter the rate for the floating leg(s) where required. |

| Conversion Rounding | Set to "Round" to indicate that the reference unit to deal unit conversion of the price should be rounded prior to calculating the amount for the cash flow. The default is ‘Don't Round’, which means the rounding occurs after the amount is calculated. |

| Commodity Reset Factor |

The factor is a multiplier representing the value of the actual commodity being used as the underlying compared to the reference commodity defined in the selected Commodity Reset.

|

"Product: Style" Properties

| Properties | Description |

|---|---|

| Strike | Enter the strike price per unit. |

| Settle Type |

Select the settle type, Cash, Compo, Quanto or Flexo. Cash is set by default. When Compo is selected, Settle Ccy and other FX related properties will become editable. The FX rate source can be set in the Flexo FX Source property. |

| Leg Type | Select the leg type: Fixed or Float. The Commodity Swap allows for two floating legs. |

| Pay/Receive | Enter pay or receive for the legs. Selecting one in the first leg populates the other in the second leg. |

| End Date | Enter the trade's End Date. |

| Notional Ccy | Currencies for the legs are populated automatically after selecting the underlying. |

"Product: Payment" Properties

| Properties | Description |

|---|---|

|

Payment Frequency Type |

Select FutureContractLTD or FutureContractFND. |

| Payment Date Roll |

Select the date roll convention to roll the payment dates when they fall on business days. The payment calendar is used to determine business days. Date roll conventions are described in the Calypso Navigator under Help > Date Roll Conventions. |

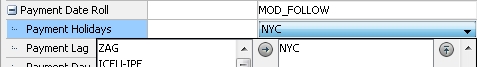

| Payment Holidays |

Double-click in the Payment Holidays field to open the holidays list. Select the holiday calendar(s) used to determine the business days when calculating the payment date.

|

| Payment Lag | Enter the number of business days for lag and press the Enter key to populate the field. Negative numbers are also acceptable. |

| Payment Day | Select to enter payment details. This makes a field available next to the Day label where you can specify which day the payment should take place. For example, enter “5” to specify that the payment date occurs on the 5th of the month following the swap End Date. |

| Payment Date Rule |

Select a date rule for determining the payment date, if required.

|

"Price Fixing" Properties

See "Price Fixing" Properties for details.

See "Price Fixing" Properties for details.

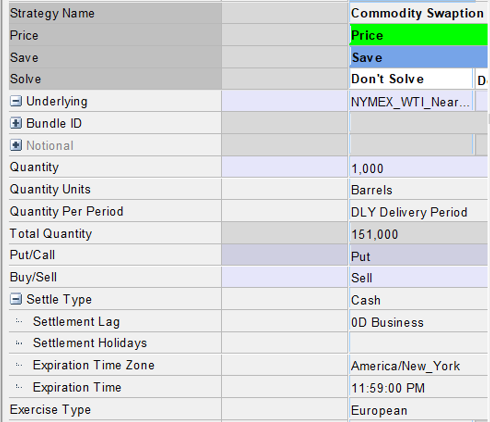

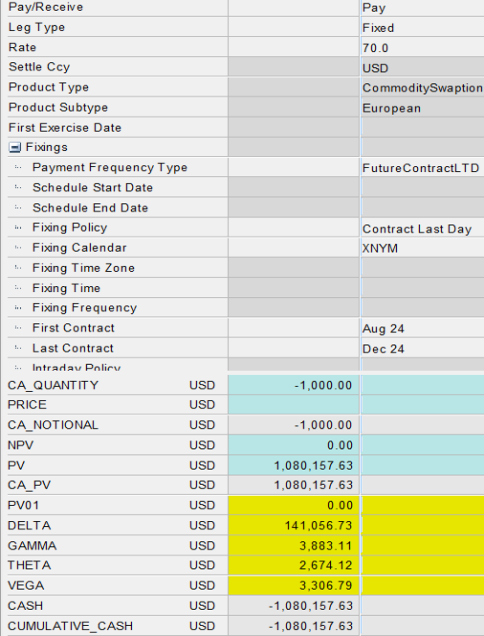

6. Commodity Swaption

A commodity swaption is an option on an underlying commodity swap. The Commodity Swaption is captured from the processing organization's (PO) point of view. Therefore, when the PO buys the option on an underlying swap whose fixed leg is set to Pay, the PO is buying the right to pay the fixed rate. Alternatively, when the PO sells the option on an underlying swap whose fixed leg is set to Pay, the PO is selling the right for the option holder to receive the fixed rate.

Properties

Commodity Swap Properties + Buy/Sell - Put/Call - Settle Type - Exercise Type

|

Basic Steps for Capturing a Commodity Swaption

|

Swaption Properties

| Properties | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Buy/Sell |

Select whether the Processing Organization (PO) is the buyer or seller of the option. |

|||||||||||||||

| Settle Type |

Select Cash, Compo, or Physical. The value of the option on expiry equals the NPV of the underlying swap

|

|||||||||||||||

| Put/Call | This field is auto-populated and not editable. If the underlying swap has the PO paying fixed, then the swaption is a call option. If the underlying swap has the PO receiving fixed, then the swaption is a put option. | |||||||||||||||

| Exercise Type |

Select European, American, or Bermudan.

|

|||||||||||||||

|

Quantity Per Period |

Specify the frequency that the deal quantity is traded. For Pay Frequency – Future Contract LTD/FND, user can select below options for ‘Per Period’: • Future Contract Period - Specified Quantity is applied to each period. • DLY - Specified Quantity is applied to each day in a period. Total Quantity for the period will be Quantity * Number of Days in the period. • DLY Delivery Period - Specified Quantity is applied to each day of Delivery period of Contract. Total Quantity for the period will be Quantity * Number of Days in Delivery period of Future Contract. |

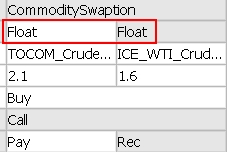

Using Two Commodity Resets

The CommoditySwaption pricer supports the use of two commodity resets so that both legs are floating legs.

| • | The pricer considers two commodity curves and the correlation between them, as well as two volatility surfaces. |

| • | Currently, the pricer only calculates for NPV. |

| • | Greeks are not computed for float/float swap options. |

Commodity Swaption with two floating legs

"Price Fixing" Properties

See "Price Fixing" Properties for details.

See "Price Fixing" Properties for details.

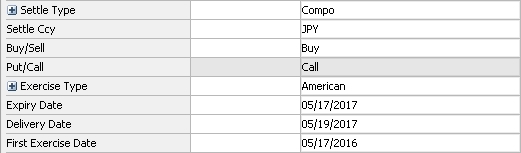

7. Commodity Vanilla

The Commodity Vanilla strategy provides an option on a standard buy/sell commodity trade. Either a commodity reset or future commodity can be used for the underlying.

Key Properties

Underlying - Quantity - Strike - Exercise Type - Settle Type - Schedule Start/End Date

The future commodities used as underlyings for Commodity Vanilla are defined in the Future Contract Specification Window.

For details on creating a future contract, see Defining Future Contracts.

For details on creating a future contract, see Defining Future Contracts.

|

Basic Steps for Capturing a Commodity Vanilla Trade

|

Properties Description

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Underlying |

Select either a commodity reset or future commodity for the underlying. Click the drop-down arrow in the property field to open the Underlying Product Chooser window and then double-click one of the product types. The FutureCommodity or CommodityReset products available as underlyings are displayed in the Underlyings pane. |

|||||||||

| Quantity | Enter a value for the number of units corresponding to the commodity. | |||||||||

| Strike | Enter the strike price per unit. | |||||||||

| Exercise Type |

Select American or European.

|

|||||||||

| First Exercise Date | When Exercise Type is "American" and Settle Type is "Physical," enter a date for the first exercise date. | |||||||||

| Settle Type |

Select Cash, Compo, or Physical.

|

|||||||||

| Fixings |

When Settle Type is "Physical," only "Bullet" is supported for the Payment Frequency Type. Use the Schedule End Date property to set the option expiration.

When Settle Type is either "Cash" or "Compo," all sub-properties for the Fixings property are available.

|

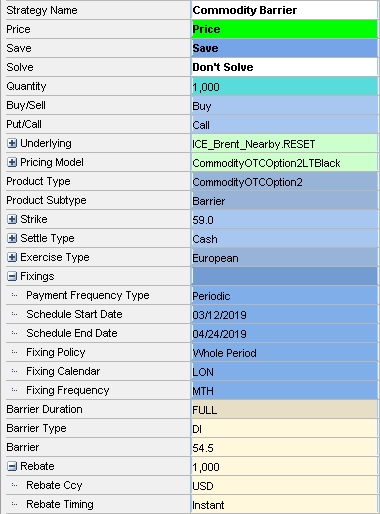

8. Commodity Barrier

The Commodity Barrier strategy allows for trade capture and pricing of a single barrier commodity option with a full duration.

Key Properties

Underlying - Quantity - Strike - Settle Type - Schedule Start/End Date - Barrier Type - Barrier - Rebate - Rebate Timing

The future commodities used as underlyings for Commodity Barrier are defined in the Future Contract Specification Window.

For details on creating a future contract, see Defining Future Contracts.

For details on creating a future contract, see Defining Future Contracts.

|

Basic Steps for Capturing a Commodity Barrier Trade

|

Properties Description

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Underlying |

Select either a commodity reset or future commodity for the underlying. Click the drop-down arrow in the property field to open the Underlying Product Chooser window and then double-click one of the product types. The FutureCommodity or CommodityReset products available as underlyings are displayed in the Underlyings pane. |

||||||||||||

| Quantity | Enter a value for the number of units corresponding to the commodity. | ||||||||||||

| Strike | Enter the strike price per unit. | ||||||||||||

| Exercise Type |

Only European is available for Commodity Barrier. The option is exercised on the expiry date. |

||||||||||||

| Settle Type |

Select Cash or Compo.

|

||||||||||||

| Fixings |

Use the "Fixings" sub-properties to specify trade details related to fixings, such as defining the option maturity using the Schedule End Date property, or setting the Payment Frequency Type.

All Fixings sub-properties are available for the Commodity Barrier strategy.

|

||||||||||||

| Barrier Duration | Automatically set to Full. The barrier is observed throughout the life of the option. | ||||||||||||

| Barrier Type |

Select the type of barrier:

|

||||||||||||

| Barrier | Enter the barrier price used to either knock in or knock out the option. | ||||||||||||

| Rebate / Rebate Ccy / Rebate Timing |

Enter a rebate amount if applicable. You can also set the following properties:

|

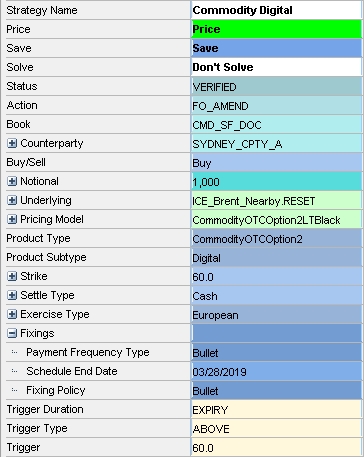

9. Commodity Digital

The Commodity Digital strategy sets a trigger to determine whether the option settles in or out of the money and uses the Notional property to express the payout at expiration. The option is exercised at expiration, which is specified using the Schedule End Date property, and settles in cash or compo.

Key Properties

Underlying - Notional - Settle Type - Schedule End Date - Trigger Type - Trigger

The future commodities used as underlyings for Commodity Digital are defined in the Future Contract Specification Window.

For details on creating a future contract, see Defining Future Contracts.

For details on creating a future contract, see Defining Future Contracts.

|

Basic Steps for Capturing a Commodity Digital Trade

|

Properties Description

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Underlying |

Select the future commodity underlying. (Only future underlyings are supported.) Click the drop-down arrow in the property field to open the Underlying Product Chooser window and then double-click FutureCommodity in the Product Type pane. The FutureCommodity products available as underlyings are displayed in the Underlyings pane. |

|||||||||

| Notional | Enter the settle amount for payout in the case where the option is exercised in the money. | |||||||||

| Strike | Enter the strike for the trade. This will be reflected in the Trigger property. | |||||||||

| Fixings |

Three sub-properties for "Fixings" are valid for the Commodity Digital.

|

|||||||||

| Settle Type |

Select Cash or Compo.

|

|||||||||

| Exercise Type |

Only European is available for Commodity Digital. The option is exercised on the expiry date. |

|||||||||

| Trigger Duration | The Commodity Digital strategy is exercised on the expiration date, and this property is automatically set to EXPIRY. | |||||||||

| Trigger Type |

Select either ABOVE or BELOW to set the criteria for whether the option expires in or out of the money.

|

|||||||||

| Trigger | Enter the trigger to set the threshold for determining whether the option is in or out of the money at expiration. The value for the trigger is reflected in the Strike property. |

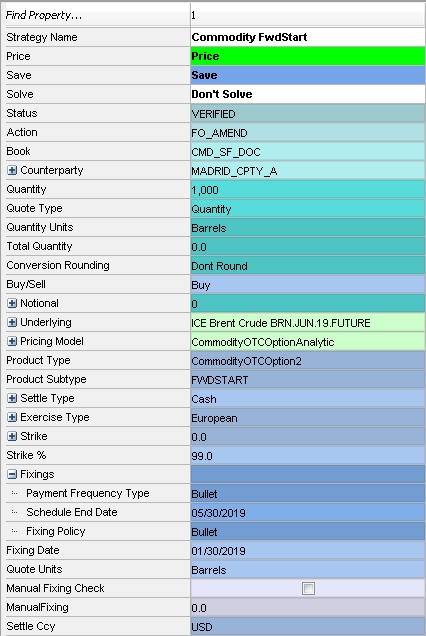

10. Commodity FwdStart

The Commodity FwdStart strategy is a vanilla commodity option that becomes active and fixes the strike price on a specified date in the future. This strategy supports only the exercise type "European" and the settle type "Cash." The Commodity FwdStart also provides a way to manually fix the strike rather than use the quote.

Key Properties

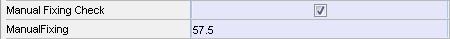

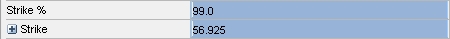

Underlying - Quote Type - Quantity - Notional - Strike % - Fixing Date - Schedule End Date - Manual Fixing Check / ManualFixing

The future commodities used as underlyings for Commodity FwdStart are defined in the Future Contract Specification Window.

For details on creating a future contract, see Defining Future Contracts.

For details on creating a future contract, see Defining Future Contracts.

|

Basic Steps for Capturing a Commodity Forward Start Trade

(the price can be fixed either manually or in the Price Fixing window. See below.)

|

Properties Description

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Underlying |

Select the future commodity underlying. (Only future underlyings are supported.) Click the drop-down arrow in the property field to open the Underlying Product Chooser window and then double-click FutureCommodity in the Product Type pane. The FutureCommodity products available as underlyings are displayed in the Underlyings pane. |

|||||||||

| Quote Type |

Select the Quote Type for the trade, either Notional or Quantity. |

|||||||||

| Notional | When Quote Type is Notional, enter a notional value for the option. See also "Total Quantity" below on conversion to quantity. | |||||||||

| Quantity | When Quote Type is Quantity, enter a value for the number of units corresponding to the commodity. | |||||||||

| Quote Units | This property is used for display only. Displays the commodity unit that corresponds to the underlying once the underlying has been selected. | |||||||||

| Total Quantity | This property is used for display only. For notional quoted options, the notional is converted into quantity on the strike fixing date and Total Quantity is populated based on the Quote Units specification. For quantity quoted options, the Total Quantity is populated as soon as the trade is priced. | |||||||||

| Strike % | Enter a strike percentage that will be used to calculate the strike at the time of the fixing. | |||||||||

| Strike | This property is used for display only. The Strike property is populated after the fixing. The exception is when manual fixing is used. In this case, the strike is populated once a strike is specified for the Manual Fixing property. | |||||||||

| Fixing Date | Enter a date in the future for fixing the strike. | |||||||||

| Fixings |

Three sub-properties for "Fixings" are valid for the Commodity Forward Start.

|

|||||||||

| Settle Type |

Select Cash or Compo.

|

|||||||||

| Exercise Type |

Only European is available for Commodity FwdStart. The option is exercised on the expiry date. |

|||||||||

|

Manual Fixing Check Manual Fixing |

You have the option to select the Manual Fixing Check checkbox to enable manual fixing. You can then specify a strike in the ManualFixing property. This feature is enabled only after the trade has been saved.

The manual fixing is reflected in the Strike property.

|

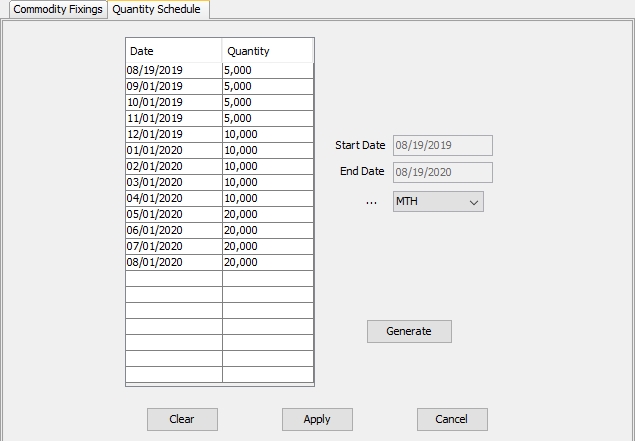

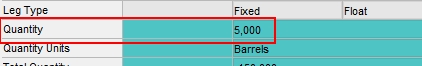

11. Quantity Schedule for Commodities

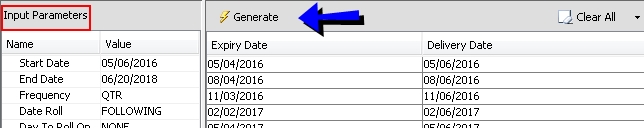

The Quantity Schedule is available for Commodity Swap, Commodity Options and Commodity Swaption strategies. The schedule provides a way to specify the deal quantity to be traded at intervals between the start and end date based on a set frequency, such as daily, monthly, or quarterly.

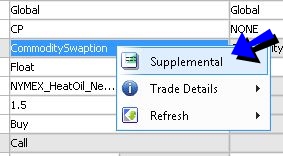

To open the Quantity Schedule, right-click a strategy leg and select "Supplemental" from the menu.

The Supplemental panel opens. Select the Quantity Schedule tab to begin.

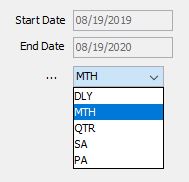

| » | To set the time periods for the schedule, select a frequency from the drop-down list below the Start Date and End Date reference fields. |

| » | Click Generate to generate the dates in the schedule and then enter quantity values in the Quantity field for each interval. |

| » | Click Apply to apply the schedule to the trade, then click Save and Close in the top right corner of the Supplemental panel to see changes to the trade. |

| – | The Quantity property in the strategy changes to reflect the first period in the schedule. |

| – | Details about the deal quantity and the reference quantity can be viewed in the trade's cashflows when those columns are configured in User Preferences. Point to View > Cash Flows to open the Cashflows panel. |

Ⓘ [NOTE: The Payment Frequency Type "Bullet" (found in the "Fixings" sub-properties) is not supported for this feature.]

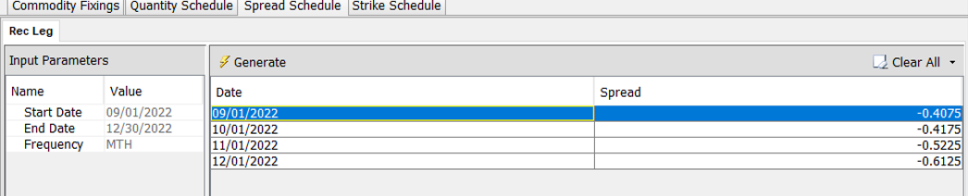

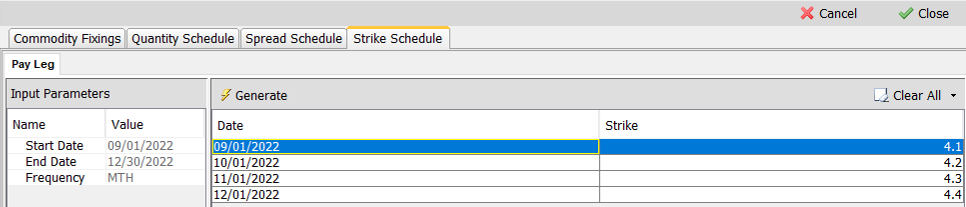

12. Spread and Strike Schedule for Commodities

The Spread and Strike Schedule is available for Commodity Swap, Commodity Options and Commodity Swaption strategies. The schedule provides a way to specify the spread and strike for each time period.

| » | To open the Spread/Strike Schedule, right-click a strategy leg and select "Supplemental" from the menu. |

The Supplemental panel opens. Select the Spread/Strike Schedule tab to begin.

| » | Click Generate to generate the dates in the schedule and then enter Spread/Strike values for each period. |

| » | Click Apply to apply the schedule to the trade, then click Save and Close in the top right corner of the Supplemental panel to see changes to the trade. |

| – | Details about the Spread/Strike can be viewed in the trade's cashflows when those columns are configured in User Preferences. Point to View > Cash Flows to open the Cashflows panel. |

Ⓘ Note: Strike/Spread schedule is supported for Periodic, FutureContractFND, FutureContractLTD, Daily, Daily Rule and Third Wednesday Pay frequency only.

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |