Capturing ETF Trades

To capture an ETF trade in the Pricing Sheet, you first need t o define ETF products.

This is described below.

Then select the ETF strategy and set the properties as needed.

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Prerequisite

Make sure that you add ETF to the domains "ProductType" and "PositionBasedProduct".

1. Defining ETF Products

ETF products are created using the ETF window (menu action am.structure.etf.ETFFundWindow).

| » | To view an existing ETF, click |

| » | To create a new ETF, click |

Note that if the Authorization mode is enabled, an authorized user must approve your entry.

Upon saving, the ETF is given a unique id by the system.

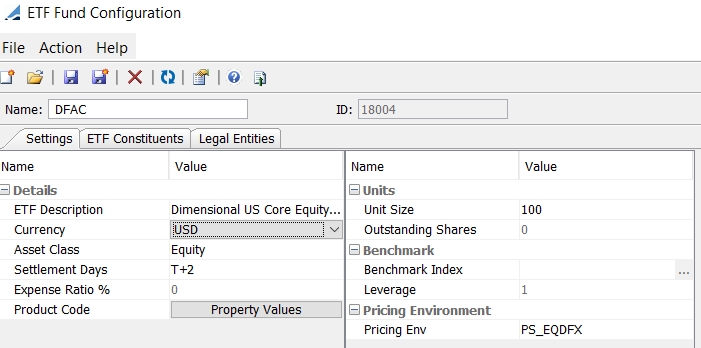

1.1 Settings Panel

Select the Settings panel to enter the ETF's details.

Details

|

Fields |

Description |

|

Name |

Enter a name to identify the ETF throughout the system. |

|

ETF Description |

Enter the ETF description. |

|

Currency |

Select the ETF's currency. |

|

Asset Class |

Select the asset class of the ETF. These values come from the domain UnitizedFund.subtype. |

|

Settlement Days |

Enter the number of days between the trade date and the settlement date in the form T+<number of days>. |

|

Expense Ratio % |

Not currently used. |

Units

|

Fields |

Description |

|

Unit Size |

Enter the unit size or ETF divisor. |

|

Outstanding Shares |

Number of ETF shares as of latest effective date of ETF constituents. |

Benchmark

Benchmark Index and Leverage are not currently used.

Pricing Env

|

Fields |

Description |

|

Pricing Env |

Not currently used. |

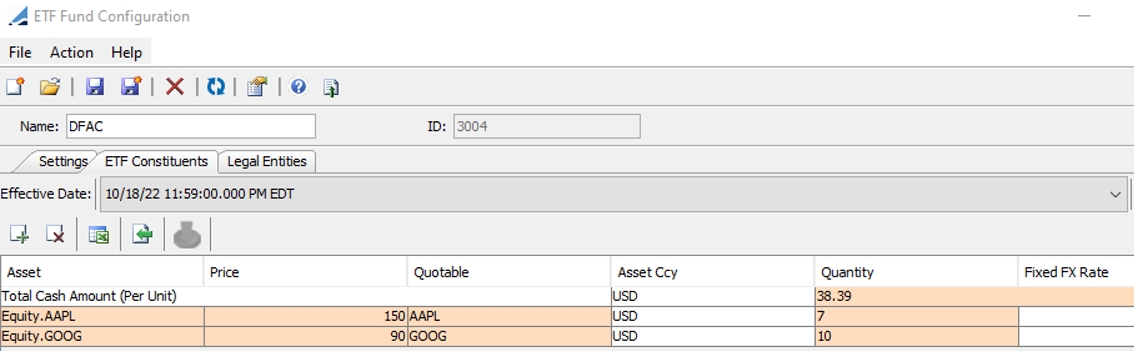

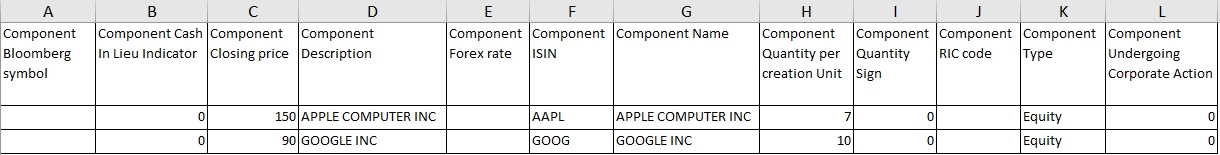

1.2 ETF Constituents Panel

ETF Constituents can be uploaded using a Portfolio Composition File (PCF) or using the Data Uploader, and can also be copy pasted from an Excel Spreadsheet and Clipboard.

Currently Equity and Equity Index are supported as constituents.

You can also add constituents manually as needed.

NOTE: Theoretical pricing uses constituents with Effective Date <= Value Date.

Sample PCF File

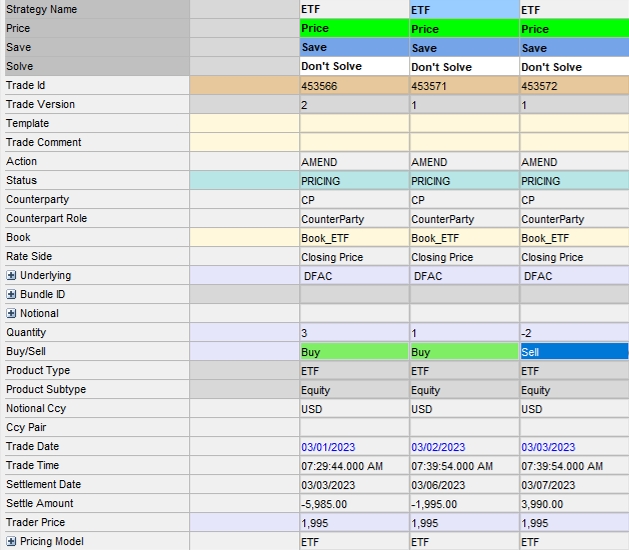

2. ETF Trades

You can capture ETF trades using the Pricing Sheet or using the Data Uploader.

Pricing from Quote

When pricing parameter NPV_FROM_QUOTE=TRUE, price is taken from ETF quote (market price).

Theoretical Pricing

When pricing parameter NPV_FROM_QUOTE=FALSE, price is calculated from constituents quotes (market prices). The theoretical price is the sum of cash component and weighted price (i.e., Price * Quantity) of each component.

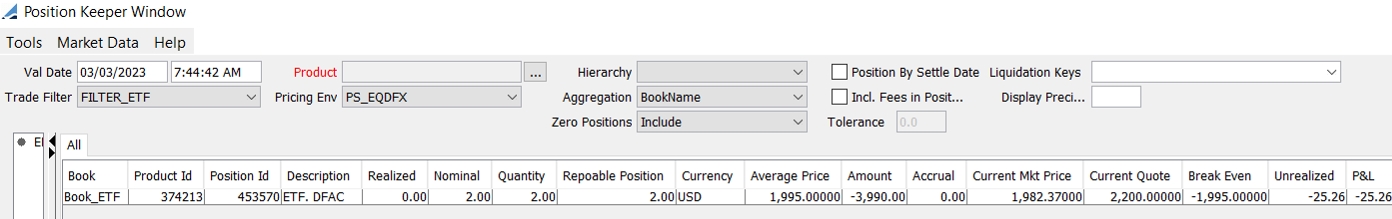

3. Positions

Liquidation methods FIFO and AvgPrice are both supported with comparator method TradeDate.

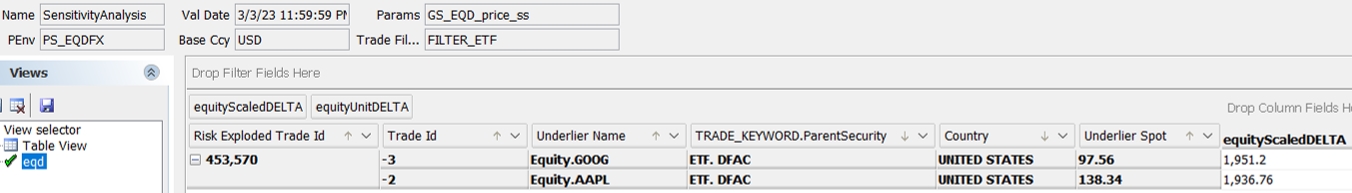

4. Sensitivity Analysis

When Explode Trades is checked, sensitivities are shown at constituent level using "dummy" child trades.

5. Official P&L Report

Official P&L Explain by Greeks is supported.

In Intraday, change in quantity of constituents, is not expected. Hence OPL explain by Greeks is correct.

From T-1 to T, the PnL attribution due to rebalancing will be categorized as Unexplained or Residual.