Capturing Listed Derivatives Strategies

To capture a listed derivatives trade in the Pricing Sheet, you first need to define listed derivatives contracts and products.

See Listed Derivatives for details.

See Listed Derivatives for details.

Then select a listed derivatives strategy and set the properties as needed.

There are two types of exchange traded strategies (based on the user preference "Default Listed Product Strategy": Specific or Generic.

| • | For Specific, you can capture listed derivatives trades using specific strategies based on the type of the listed derivatives: Future Bond, Future MM, Future Option Bond, etc. |

| • | For Generic, you can capture listed derivatives trades using the strategies Future (for Future trades) or Option (for Future Option and ETO trades). It is mandatory to select Generic for ETD Clearing. |

Ⓘ [NOTE: Strategy templates are not currently implemented for listed strategies]

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Properties specific to listed derivatives strategies are described below.

Contents

- ETO FX, Equity and Equity Index Trades

- Bond, MM, FX, Equity, Equity Index and Commodity Future Trades

- Bond, MM, FX, Equity, Equity Index and Commodity Future Option Trades

- Future Forward Start FX Trades

- Generic Future and Generic Option

1. ETO FX, Equity and Equity Index Trades

Prior to capturing ETO FX trades, you need to specify ETO equity contracts from the Calypso Navigator using Configuration > Listed Derivatives > Option Contracts, and generate the ETO FX, Equity and Equity Index products.

Properties

Exchange - Contract - Contract Date - Strike - Quantity - Buy/Sell - Put/Call

Sample ETO FX trade

An ETO product is uniquely identified by an exchange, a contract, a contract date, and a strike.

| » | Select an exchange, a contract, a contract date, and a strike to select an ETO product. |

Ⓘ [NOTE: So-called "Flex" option products - bespoke products allowed by some exchanges for trading and clearing by the clearinghouse, and which sometimes have multiple expiration dates - are referenced by a day, month, and year in the Contract Date field. To achieve the correct date format used in the quote you can use a combination of the Date Format field and the DateFormat attribute in the Exchange Traded Option Contract Window to populate the correct date in the Contract Date property. See "Exchange Traded Option Contract" in the Calypso Equity Derivatives documentation for details.]

"Product: Style" Properties

| Properties | Description |

|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

| Ccy Pair | Displays the currency pair of the contract. |

|

Notional Ccy |

Select the currency of the notional. |

| Settle Ccy | Select the settlement currency. |

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

| Put/Call |

Enter / displays the option direction for the primary currency. |

| Settle Type |

Displays the settlement type of the contract: Cash or Physical. |

|

Contract ID Type Contract ID |

You can select a security code of the ETO product, and the corresponding value will be displayed in the Contract ID field. |

| Exchange | Select the Exchange where the contract is quoted. |

| Contract Size | Displays the contract size. |

| Quantity | Enter the traded quantity. |

| Contract | Select the contract. |

| Contract Date |

Select the expiration date. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Strike |

Select the strike. |

"Date" Properties

| Properties | Description |

|---|---|

| Trade Date |

Displays the valuation date set in the Pricing window of the pricing sheet by default. You can modify as needed.

|

| Trade Time |

Displays the valuation time set in the Pricing window of the pricing sheet. You can modify as needed.

|

| Expiry Date |

Displays the expiration date. |

| Expiry |

Displays expiration date details. |

|

Delivery Date |

Displays the delivery date. |

|

Delivery |

Displays delivery date details. |

"Price" Properties

| Properties | Description |

|---|---|

| Premium Date |

Displays the premium payment date. The system uses the spot date by default. You can change this to a forward date. If you use a forward date, the application adjusts the premium amount using the discount curve from the selected pricing environment. |

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

|

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

| Model Premium |

Displays the theoretical premium computed by the pricer. |

| Trader Premium |

Displays the theoretical premium computed by the pricer. You can modify its value. |

| Trader Price |

Displays the unit amount of trader premium. |

| Customer Premium |

Displays the premium amount such that Customer Premium = Trader Premium. The premium is the actual fee that will be paid/received. |

| Customer Price |

Displays the unit amount of customer premium. |

| Modified Strike | Displays the strike. |

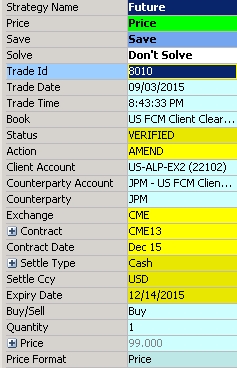

2. Bond, MM, FX, Equity, Equity Index and Commodity Future Trades

Prior to capturing Futures trades, you need to specify Future contracts from the Calypso Navigator using Configuration > Listed Derivatives > Future Contracts, and generate the Future products.

Properties

Exchange - Contract - Contract Date - Strike - Quantity - Buy/Sell

Sample Bond Future trade

A Future product is uniquely identified by an exchange, a contract, and a contract date.

| » | Select an exchange, a contract, and a contract date to select a Future product. |

| » | The trade counterparty must be a clearer, a legal entity of role Clearer. |

"Product: Style" Properties

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

||||||||||||

| Ccy Pair | Displays the currency pair of the contract. | ||||||||||||

|

Notional Ccy |

Select the currency of the notional. |

||||||||||||

| Settle Ccy | Select the settlement currency. | ||||||||||||

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

||||||||||||

| Settle Type |

Displays the settlement type of the contract: Cash or Physical. |

||||||||||||

|

Contract ID Type Contract ID |

You can select a security code of the Future product, and the corresponding value will be displayed in the Contract ID field. |

||||||||||||

| Exchange | Select the Exchange where the contract is quoted. | ||||||||||||

| Contract Size | Displays the contract size. | ||||||||||||

| Quantity | Enter the traded quantity. | ||||||||||||

| Contract | Select the contract. | ||||||||||||

| Contract Date |

Select the expiration date. Once you have entered a trade, you can type the following shortcuts into the Contract Date to duplicate the trade for additional contracts.

|

||||||||||||

| Cheapest to Deliver |

Bond futures only. Displays the cheapest bond to deliver. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Strike |

Enter the traded price. |

"Product: Payment" Properties

| Properties | Description |

|---|---|

| Factor |

Bond futures only. Displays the cheapest to deliver factor. |

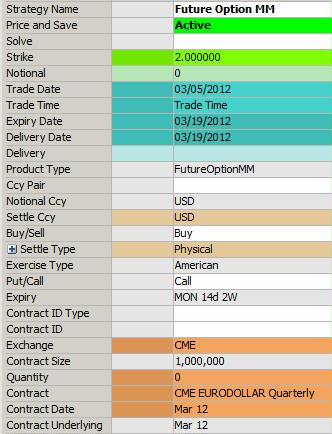

3. Bond, MM, FX, Equity, Equity Index, Commodity Future Option Trades

Prior to capturing Futures Option trades, you need to specify Future Option contracts from the Calypso Navigator using Configuration > Listed Derivatives > Future Option Contracts, and generate the Future Option products.

Ⓘ [NOTE: So-called "Flex" option products - bespoke products allowed by some exchanges for trading and clearing by the clearinghouse, and which sometimes have multiple expiration dates - are referenced by a day, month, and year in the Contract Date field. To achieve the correct date format used in the quote you can use a combination of the Date Format field and the DateFormat attribute in the Future Option Contract Specification Window to populate the correct date in the Contract Date property. See "Defining Future Option Contracts" in the Calypso Futures documentation for details.]

Properties

Exchange - Contract - Contract Date - Strike - Quantity - Buy/Sell - Put/Call

Sample MM Future Option trade

A Future Option product is uniquely identified by an exchange, a contract, a contract date, and a strike.

| » | Select an exchange, a contract, a contract date , and a strike to select a Future Option product. |

| » | The trade counterparty must be a clearer, a legal entity of role Clearer. |

"Product: Style" Properties

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

||||||||||||

| Ccy Pair | Displays the currency pair of the contract. | ||||||||||||

|

Notional Ccy |

Select the currency of the notional. |

||||||||||||

| Settle Ccy | Select the settlement currency. | ||||||||||||

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

||||||||||||

| Put/Call |

Enter / displays the option direction for the primary currency. |

||||||||||||

|

Exercise Type |

Displays the exercise type of the contract. | ||||||||||||

| Settle Type |

Displays the settlement type of the contract: Cash or Physical. |

||||||||||||

|

Contract ID Type Contract ID |

You can select a security code of the Future product, and the corresponding value will be displayed in the Contract ID field. |

||||||||||||

| Exchange | Select the Exchange where the contract is quoted. | ||||||||||||

| Contract Size | Displays the contract size. | ||||||||||||

| Quantity | Enter the traded quantity. | ||||||||||||

| Contract | Select the contract. | ||||||||||||

| Contract Underlying | Displays the expiration date of the underlying future contract. | ||||||||||||

| Contract Date |

Select the expiration date. Once you have entered a trade, you can type the following shortcuts into the Contract Date to duplicate the trade for additional contracts.

|

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Strike | Select the strike. |

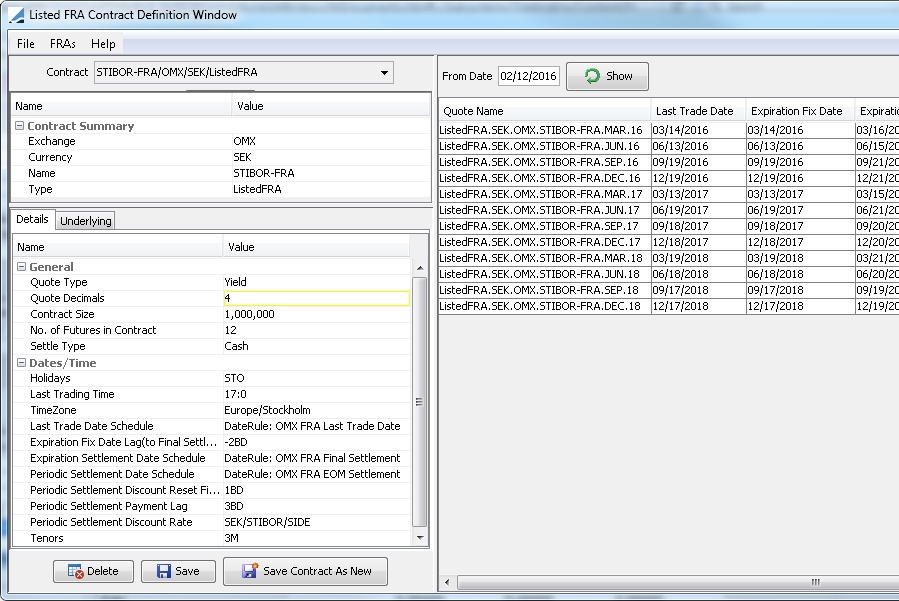

4. Listed FRA Trades

The Listed FRA possesses features of both a future and an OTC trade. As opposed to a plain FRA, the Listed FRA uses a standardized contract to capture the details of the agreement and facilitate clearing of the product by an exchange. The sections that follow describe how to define the contract and then capture the trade in the Pricing Sheet.

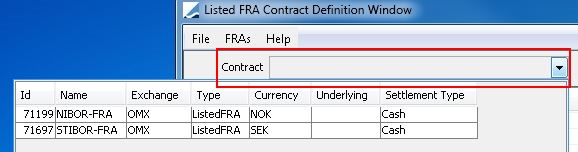

4.1 Defining Listed FRA Contracts

The future contract for the Listed FRA bases the trade on quantity of contracts, where the trade's notional equals quantity times the contract size specified in the contract. To open the contract from Calypso Navigator, point to Configuration > Listed Derivatives > Listed FRA Contracts (menu action refdata.ListedIRContractDefinitionWindow).

| » | To create a new contract, make settings in the Contract Summary, Details and Underlying fields described below and click Save. |

| » | To load an existing contract, select an available contract from the Contract field's drop-down list at the top of the contract window. |

| » | To use an existing contract as the basis for a new one, make preferred changes to the contract and click Save Contract As New. This preserves the existing contract and creates another. |

| » | To delete a contract, select it in the Contract field and click Delete. |

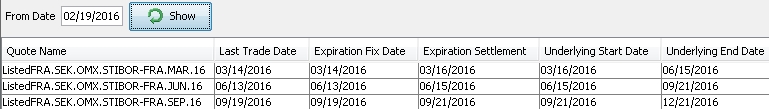

| » | To view the schedule of essential dates and associated quotes to be used for a particular Listed FRA contract, enter a From Date in the top central portion of the contract window and click Show. |

Ⓘ [NOTE: The schedule of dates is a tabular representation of key dates derived from date rule and lag settings defined in the contract. The schedule is provided so that parties to the agreement can verify and validate important dates included in the life of the trade. See Details Tab properties below.]

Contract Summary

| Properties | Description |

|---|---|

| Exchange | Select the exchange where the FRA is listed. |

|

Currency |

Select the currency for the contract. |

| Name | Provide a unique name for the contract. |

| Type | ListedFRA is populated by default. |

Details Tab

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Quote Type | Select Yield for the Listed FRA. | |||||||||

| Quote Decimals | Define the decimal precision at the contract level. The system uses this decimal precision in the Price field in the trade window and in quote rounding when calculating the NPV. | |||||||||

|

Contract Size |

Enter the Contract Size specified by the exchange. | |||||||||

| No. of Futures in Contract | Enter the total number of future products traded in the contract. | |||||||||

| Settle Type | Settlement type for the Listed FRA is "Cash". | |||||||||

| Holidays | Select a holiday calendar. | |||||||||

| Last Trading Time | Enter the time of day that trading will end on the last trading day. Use twenty-four hour time notation (for example 16:30 is four-thirty in the afternoon). | |||||||||

|

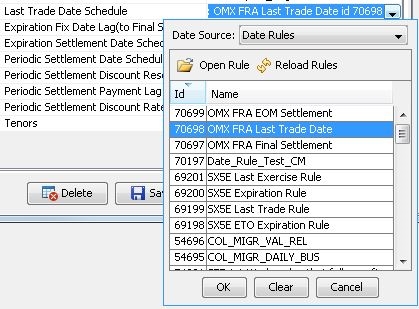

Last Trade Date Schedule Expiration Settlement Date Schedule Periodic Settlement Date Schedule |

Select a date rule to generate the dates for each schedule. Date specifications are provided by the exchange.

Date rules are defined and created in the Date Rules window. To open the window from Calypso Navigator, point to Configuration > Definitions > Date Schedule Definitions > Date Rules - Help is available from that window. |

|||||||||

| Expiration Fix Date Lag (to Final Settlement) | Enter the lag to be used for the expiration fixing date. | |||||||||

| Periodic Settlement Discount Reset Fixing Lag | Enter the lag to be used for periodic settlement discount reset fixing. | |||||||||

| Periodic Settlement Payment Lag | Enter the lag for periodic settlement payment. | |||||||||

| Periodic Settlement Discount Rate | Select the Rate Index to be used as the Discount Rate on the monthly settlement. | |||||||||

| Tenors | Lists the available tenors configured in the system for the Rate Index that is used to determine the Discount Rate. Select the tenors that are valid for use interpolating the correct Discount Rate. |

Underlying Tab

| Properties | Description |

|---|---|

| Start/End Date | Select the date rule that corresponds to the start and end of interest periods specified by the exchange. For example, the start and end dates based on IMM date rules (the third Wednesday of each month ending the quarter) would fall on the third Wednesday of a month ending any given quarter and the third Wednesday of the month ending the next quarter, respectively (e.g., March 16th, 2016 to June 15th, 2016). |

|

Rate Index |

Select the Rate Index to be used as underlying for the trade. |

| DayCount | Select the Daycount convention. |

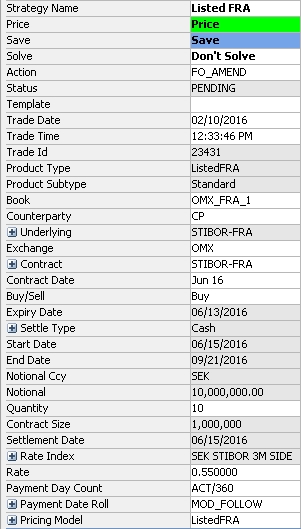

4.2 Capturing a Listed FRA Trade

This section covers the key properties that need to be entered to capture a trade.

|

Basic Steps for Capturing a Listed FRA Trade

|

Key Properties

Exchange - Contract - Contract Date - Buy/Sell - Quantity - Rate

"Product: Style" Properties

| Properties | Description |

|---|---|

| Exchange | The Exchange where the contract is listed. OMX is currently the only exchange used for the Listed FRA product. |

| Contract | Select the contract name. |

| Contract Date |

Select a date from those provided by the Date Rules definitions included in the Listed FRA contract. |

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

| Quantity | Enter the number of Listed FRA contracts to be traded. |

| Product Type |

Displays the product type based on the selected strategy. |

| Trade Date | Determines which contracts can be traded by making available those contracts that are effective on or after the Trade Date. |

| Notional | Calculates a total value that is equal to Quantity multiplied by Contract Size. |

|

Notional Ccy |

Displays the contract currency. |

| Underlying | Displays the contract name and refers to the interest periods, rate index and day count specified by the contract. |

| Settle Type | Settlement type is Cash for the Listed FRA. |

| Contract Size | Displays the size of the contract as defined in the Listed FRA Contract. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Rate | Enter the price of the trade in yield (the strike price as a rate). |

| Rate Index | Displays the rate index defined in the Listed FRA contract. |

"Date" Properties

| Properties | Description |

|---|---|

| Expiry Date | The day on which the contract's final settlement interest is fixed. Defined by Date Rules included in the Listed FRA contract and populated automatically once a contract is chosen in the Pricing Sheet. |

| Start Date | The start of the interest period specified by the exchange. Defined by Date Rules included in the Listed FRA contract and populated automatically once a contract is chosen in the Pricing Sheet. |

| End Date | The end of the interest period specified by the exchange. Defined by Date Rules included in the Listed FRA contract and populated automatically once a contract is chosen in the Pricing Sheet. |

| Settlement Date | Expiration settlement, which coincides with the Start Date. Defined by Date Rules included in the Listed FRA contract and populated automatically once a contract is chosen in the Pricing Sheet. |

Events Panel Columns

Two additional columns are included in the Events Panel for the Listed FRA.

| • | Periodic Settlement: the unadjusted monthly settlement amount based on the EOM ListedFRA fixing. |

| • | Discount Rate: The linearly interpolated Discount Rate based on the relevant rate index tenor quotes for the number of days to final settlement. |

For details on using the Events Panel, see Viewing Trade Cash Flows.

For details on using the Events Panel, see Viewing Trade Cash Flows.

For details on configuring columns for the Events Panel, see Cash Flows Panel.

For details on configuring columns for the Events Panel, see Cash Flows Panel.

5. Future Structured Flows

Future Structured Flows are exotic legs.

Properties

Product: Info = Exchange, Contract, Contract Date - Product: Price = Strike, Notional

| » | Select an exchange, a contract, a contract date , and a strike to select a Future Option product. |

"Product: Style" Properties

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Type |

Displays the product type based on the strategy. |

||||||||||||

| Ccy Pair | Displays the currency pair of the contract. | ||||||||||||

| Notional | Displays the notional based on the quantity. | ||||||||||||

|

Notional Ccy |

Select the currency of the notional. |

||||||||||||

| Settle Ccy | Select the settlement currency. | ||||||||||||

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

||||||||||||

| Expiry Date | Displays the expiration date from the future contract | ||||||||||||

| Delivery Date | Displays the delivery date from the future contract. | ||||||||||||

| Settle Type |

Displays the settlement type of the contract: Cash or Physical. |

||||||||||||

| Strike | Enter the strike. | ||||||||||||

|

Contract ID Type Contract ID |

You can select a security code of the Future product, and the corresponding value will be displayed in the Contract ID field. |

||||||||||||

| Exchange | Select the Exchange where the contract is quoted. | ||||||||||||

| Contract Size | Displays the contract size. | ||||||||||||

| Quantity | Enter the traded quantity. | ||||||||||||

| Contract | Select the contract. | ||||||||||||

| Contract Date |

Select the expiration date. Once you have entered a trade, you can type the following shortcuts into the Contract Date to duplicate the trade for additional contracts.

|

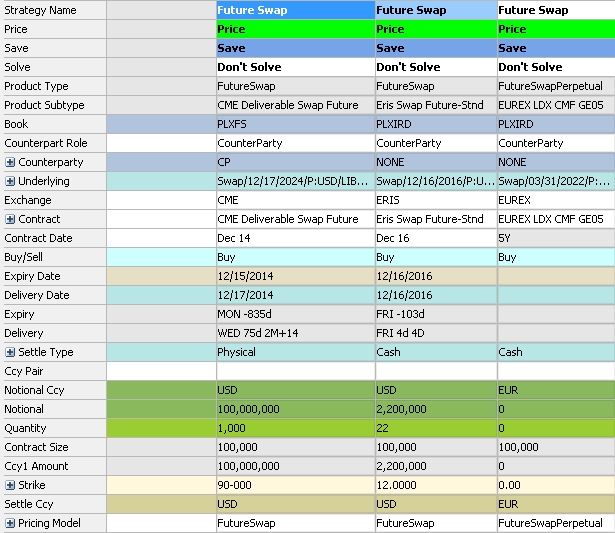

6. Future Swap Trades

Swap Futures combine the economic exposure of an interest rate swap with the benefits of a standardized futures contract. To book and price a trade, the Future Swap strategy requires a futures contract that uses the contract Type Swap or SwapPerpetual.

For details on defining a futures contract, see Defining Future Contracts.

For details on defining a futures contract, see Defining Future Contracts.

|

Basic Steps for Capturing a Future Swap Trade

|

Key Properties

Exchange - Contract - Contract Date

Description of Key Properties

| Properties | Description |

|---|---|

| Exchange | Select the exchange where the contract is listed. |

| Contract | Select the futures contract name. |

| Contract Date |

Select a date from those provided by the Date Rules definitions or enter a manual date schedule. Contract Date is not used for the product FutureSwapPerpetual. |

| Quantity | Enter the number of futures and the Notional will be calculated accordingly. Or enter the Notional and the Quantity will be calculated accordingly. |

| Product Type |

Displays the product type based on the contract. |

| Notional | Calculates a total value that is equal to Quantity multiplied by Contract Size. |

| Underlying | Displays product, maturity, and leg details of the underlying swap. |

| Contract Size | The face value of the underlying product represented by one future. |

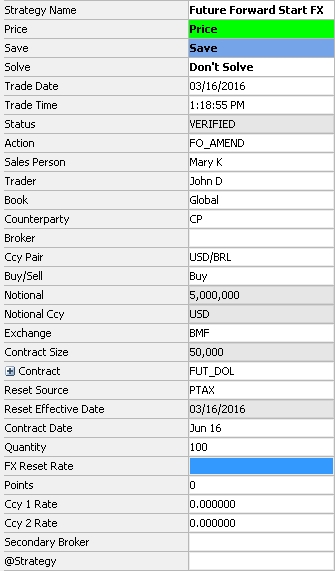

7. Future Forward Start FX Trades

The Future Forward Start FX strategy (Forward Points on US Dollar Futures, or FRP) involves the trading of the first available maturity date of US Dollar Contract (basis month) and adding or subtracting a number of points from the FX spot rate, represented by the Central Bank of Brazil's PTAX rate (the FX rate is released on the same day for settlement in two business days). At the end of a trading session, forward point transactions are transformed into a trade in the US Dollar Futures Contract for the basis month. In the Pricing Sheet this generates a "Child" trade (the underlying DOL Future) and expires the initial "Parent" trade (the FRP product).

The basis month is the first US Dollar Futures Contract month, up to the second business day that precedes the expiration date, meaning that the contract is valid and can be traded up to 2 business days prior to the contract expiration date. After that, the basis month will be the second month, which will be the basis month up to the second business day that precedes the expiration date, and so on.

Ⓘ [NOTE: The FRP strategy does not create a new future contract. It is only an alternative way to trade the vanilla US Dollar Futures Contract. All cash transfers will be calculated for the US Dollar Futures Contracts. There is no daily variation margin payment until the contract becomes a US Dollar Future Contract.]

Ⓘ [NOTE: Until the actual PTAX fixing, the spot rate is an estimated rate - the estimated spot rate can also be derived from the Casado.]

7.1 Before You Begin

Certain requirements need to be met, and considerations taken, before you can begin capturing Future Forward Start FX trades in the Pricing Sheet. This section covers these requirements and considerations.

Ⓘ [NOTE: In addition to standard Calypso servers, users need to run the Position Keeping Server and the Liquidation Engine (required for all Futures) before managing these trades.]

Trade Domain Values

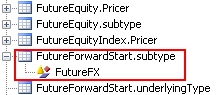

| » | Under the domain "domainName", add the following values: |

| – | FutureForwardStart.subtype |

| – | FutureForwardStart.underlyingType |

| – | FutureForwardStartKeywordsToCopy |

Ⓘ [NOTE: See Parent/Child Trade Keywords below for keyword considerations.

| » | Once the new domain "FutureForwardStart.subtype" has been added, add the value "FutureFX" to it. |

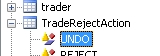

| » | Also, add the domain value "UNDO" to the "TradeRejectAction" domain. |

For details on working with domain data, see "Defining Domain Data" in the Getting Started documentation.

For details on working with domain data, see "Defining Domain Data" in the Getting Started documentation.

Parent/Child Trade Keywords

| • | The linking keyword on the parent Future Forward Start trade is "FutureForwardStartChildTradeId" and is only populated when the underlying child trade (FutureFX) is created. The parent will also include the keyword "FutureForwardStartFixingRate". |

| • | The child trade is created when the forward start reset is fixed. |

| • | The keyword on the child trade that links back to the parent Future Forward Start trade is "FutureForwardStartParentTradeID". The child trade will also have keywords "FutureForwardStartFixingRate" and "FutureForwardStartParentTradeDate". |

| • | The keywords listed under the domain "FutureForwardStartKeywordsToCopy" will be copied over from the parent Future Forward Start trade to the new child underlying trade when the future forward start reset is fixed. |

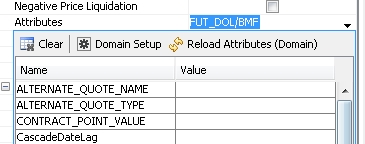

Currency Pair Attributes

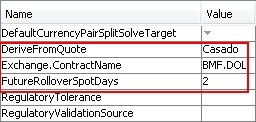

For the currency pair USD/BRL, make the following settings for currency pair attributes.

| • | DeriveFromQuote = Casado (The FX Spot FX.USD.BRL quote is derived from the "Casado" front DOL Future.) |

| • | Exchange.ContractName = BMF.DOL |

| • | FutureRolloverSpotDays = 2 |

Ⓘ [NOTE: The front FX future contract for any valuation date in month N, except the last 2 business days of month N, is the future contract for delivery on the 1st business day of month N+1. The front FX future contract for a valuation date on the last 2 business days of month N, is the future contract for delivery on the 1st business day of month N+2.]

For details on working with default currency pairs, see "Defining Currencies and Currency Pairs" in the Getting Started documentation.

For details on working with default currency pairs, see "Defining Currencies and Currency Pairs" in the Getting Started documentation.

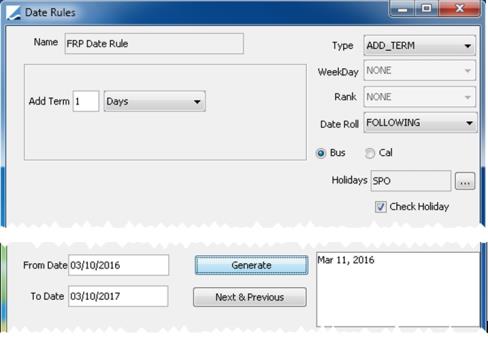

Date Rule Setup for Attributes

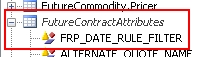

| » | First, add the value FRP_DATE_RULE_FILTER to the "FutureContractAttributes" domain. |

| » | Second, set up a date rule for the attribute added above. In Navigator point to Configuration > Definitions > Date Schedule Definitions > Date Rules to open the Date Rules window. |

For this step, any date rule that adds one business day to the reset date can be used. Also be sure to select a Holiday calendar. The following example illustrates just one way to set up a date rule that meets the requirement.

Example Date Rule for attribute configuration

For details on setting up date rules, see "Defining Date Rules" in the Getting Started documentation.

For details on setting up date rules, see "Defining Date Rules" in the Getting Started documentation.

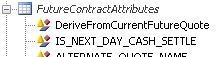

Future Contract Attributes Preconfiguration

| » | Add the following values to the "FutureContractAttributes" domain: |

| – | DeriveFromCurrentFutureQuote |

| – | IS_NEXT_DAY_CASH_SETTLE |

| » | Add the following values to the "domainName" domain: |

| – | FutureContractAttributes.DeriveFromCurrentFutureQuote |

| – | FutureContractAttributes.IS_NEXT_DAY_CASH_SETTLE |

| » | Once these domains are available, add values "Yes" and "No" to them. |

| » | If the attribute "FutureQuoteMultiplier" doesn't already exist under the domain "FutureContractAttributes", add it as a value. |

For details on working with domain data, see "Defining Domain Data" in the Getting Started documentation.

For details on working with domain data, see "Defining Domain Data" in the Getting Started documentation.

Pricing Sheet Preconfiguration

| » | In Pricing Sheet Profiles, add the Future Forward Start FX strategy to the Menu so that it becomes available in the list of leg strategies. |

For details on Configuring Profiles in the Pricing Sheet, see Configuring Profiles.

For details on Configuring Profiles in the Pricing Sheet, see Configuring Profiles.

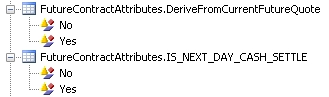

Rate Index Definition

Prior configuration of a rate index for a 1-day interbank deposit rate for currency BRL is required.

Example rate index definition

For details on configuring rate indices, see "Defining Rate Indices" in the Getting Started documentation.

For details on configuring rate indices, see "Defining Rate Indices" in the Getting Started documentation.

Rate Reset Definitions

Following the market conventions for FRP, it is necessary to create two FX Rate Resets. The first (e.g., FRP0) should have the "Reset Days" parameter set as 0 (zero) and the second (e.g., FRP1) should have the parameter set as 1.

For details on configuring FX rate resets, see "Defining FX Rate Fixings" in the Getting Started documentation.

For details on configuring FX rate resets, see "Defining FX Rate Fixings" in the Getting Started documentation.

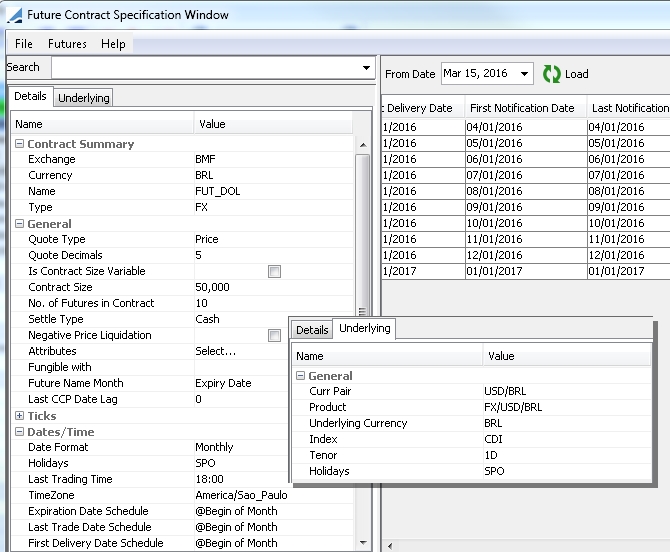

7.2 Defining Future Contracts

Defining the future contract in Calypso creates the US Dollar Future Contract for the Future Forward Start FX strategy. For detailed information needed to define the contract, refer to specifications provided by the exchange.

To open the Future Contract from Calypso Navigator, point to Configuration > Listed Derivatives > Future Contracts.

For further details on defining the future contract, see "Defining Future Contracts" in the Futures and Future Options Trading documentation.

For further details on defining the future contract, see "Defining Future Contracts" in the Futures and Future Options Trading documentation.

Details Tab

| Properties | Description | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exchange | Select the legal entity configured for the exchange. ("BMF" in the example above) | ||||||||||||||||||

| Currency | Select "BRL" for the currency. | ||||||||||||||||||

|

Name |

Enter a unique name for the future contract. | ||||||||||||||||||

| Type | Select "FX". | ||||||||||||||||||

| Quote Type | Select "Price". | ||||||||||||||||||

| Attributes |

Ⓘ [NOTE: You can add new attributes directly from the Attributes window by selecting Domain Setup at the top. However, for those attributes that require lower level values (such as "Yes" or "No"), you will need to add new attributes as described in the Future Contract Attributes Preconfiguration section above.] |

||||||||||||||||||

| Future Name Month | Select "Expiry Date". | ||||||||||||||||||

| Tick Type | Select "Fixed". | ||||||||||||||||||

|

Date Format |

Select "Monthly". | ||||||||||||||||||

| Expiration Date Schedule | Enter "@Begin of Month" for the date rule. | ||||||||||||||||||

| Last Trade Date Schedule | Enter "@Begin of Month" for the date rule. | ||||||||||||||||||

| First Delivery Date Schedule | Enter "@Begin of Month" for the date rule. |

Underlying Tab

| Properties | Description |

|---|---|

| Curr Pair | Select "USD/BRL". |

| Product | Select "FX/USD/BRL" for the product. |

|

Underlying Currency |

Select "BRL". |

| Index | Select the rate index previously configured for a 1-day interbank deposit rate for currency BRL. |

| Tenor | Select "1D" for the tenor. |

| Holidays | Select "SPO" for the holiday schedule. |

7.3 Capturing Future Forward Start FX Trades

This section covers the key properties that need to be entered to capture a trade.

|

Basic Steps for Capturing a Future Forward Start FX Trade

|

Key Properties

Ccy Pair - Exchange - Contract - Contract Date - Buy/Sell - Quantity - Reset Source

"Product: Style" Properties

| Properties | Description |

|---|---|

| Exchange | Select the exchange where the trade is listed. |

| Contract | Select the underlying futures contract. |

| Contract Date |

Select the underlying futures contract date from the list. These are generated from the contract. |

| Ccy Pair | Enter USD/BRL. |

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

| Quantity | Enter the number of future contracts to be traded. |

| Contract Size | Automatically populated and based on information defined in the underlying future contact. |

| Notional | Calculated automatically from contract size and quantity. (contract size * quantity = notional) |

| Notional Ccy | Automatically populated as USD. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Reset Source |

Select the reset source for fixing. You can also configure a custom strategy to have a default reset source populated when opening a new strategy.

|

| FX Reset Rate | Displays the reset rate from the FX Quote window. Typically, this is the last reset value. |

"Date" Properties

| Properties | Description |

|---|---|

| Reset Effective Date | This date is based on the selected reset source and is populated automatically. |

"Market Data" Properties

| Properties | Description |

|---|---|

| Points | Enter the number of points being traded. |

| FX Spot | Automatically populated with the market spot rate from the Market Data panel. It can be manually overridden. |

| FX Fwd | Automatically populated with the calculated outright forward rate based on the spot and interest rates for each currency in the pair. |

|

Ccy 1 Rate Ccy 2 Rate |

Automatically populated with the respective currency's interest rate derived from the specified curve. |

"Keyword" Properties

| Properties | Description |

|---|---|

| @Strategy | Identifies whether the trade is to be used for hedging. |

8. Brazilian FRC Trades

Prior to capturing Brazilian DDI Futures trades, you need to specify Future contracts from the Calypso Navigator using Configuration > Listed Derivatives > Future Contracts and generate the Future products. The DDI Future can be traded as a standard future trade or as an FRC trade.

An FRC future is a future with two legs.

Properties

Product: Info = Exchange, Contract, Contract Date - Product: Price = Strike, Notional

| » | Select an exchange, a contract, a contract date , and a strike to select a Future Option product. |

"Product: Style" Properties

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Type |

Displays the product type based on the FRC strategy. |

||||||||||||

| Ccy Pair | Displays the currency pair of the contract. | ||||||||||||

| Notional | Displays the notional based on the quantity. | ||||||||||||

|

Notional Ccy |

Select the currency of the notional. |

||||||||||||

| Settle Ccy | Select the settlement currency. | ||||||||||||

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

||||||||||||

| Expiry Date | Displays the expiration date from the future contract | ||||||||||||

| Delivery Date | Displays the delivery date from the future contract. | ||||||||||||

| Settle Type |

Displays the settlement type of the contract: Cash or Physical. |

||||||||||||

| Strike | Enter the strike. | ||||||||||||

|

Contract ID Type Contract ID |

You can select a security code of the Future product, and the corresponding value will be displayed in the Contract ID field. |

||||||||||||

| Exchange | Select the Exchange where the contract is quoted. | ||||||||||||

| Contract Size | Displays the contract size. | ||||||||||||

| Quantity | Enter the traded quantity. | ||||||||||||

| Contract | Select the contract. | ||||||||||||

| Contract Date |

Select the expiration date. Once you have entered a trade, you can type the following shortcuts into the Contract Date to duplicate the trade for additional contracts.

|

9. Generic Future and Generic Option

Select the strategy Future or Option for ETD Clearing.

Please refer to the Calypso ETD Clearing Installation and Setup Guide for complete setup details.

Properties

Exchange - Contract - Contract Date - Strike - Quantity - Buy/Sell - Put/Call - Product ID Type - Product ID

| » | Select an exchange, a contract, a contract date , and a strike to select a product. |

| » | You can also select a Product ID Type, and enter a Product ID to select the corresponding product. |

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |