Solving

The pricing sheet offers two types of solving capabilities:

| • | Solving shortcuts |

| • | Advanced solving |

1. Solving Shortcuts

Solving shortcuts are available for the Strike field, to solve for strike in order to obtain at-the-money trades, or a target delta.

A shortcut can be applied to a single trade, to a set of selected trades in a strategy, or to all the trades in a strategy.

1.1 Single Trade Shortcuts

On a single trade, you can enter any of the following in the Strike field, then click ![]() .

.

| • | atm or atmf: To solve for an at the money forward trade. |

| • | atms: To solve for an at the money spot trade. |

| • | #d: To solve for target delta (25d, 10d, 0d, etc.). |

| • | #% itmf: To solve for a percentage of the in-the-money forward (102% itmf). |

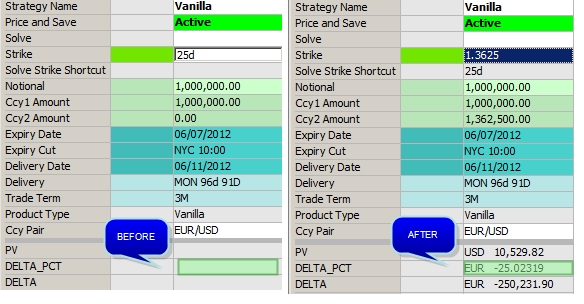

Scenario 1 - Single Trade - Solve for Strike to get 25% Delta

Enter "25d" in the Strike field, then click ![]() .

.

Scenario 1 - Solving Shortcut (Single trade - Solve for strike with target 25% Delta)

The strike shortcut is stored in the property "Solve Strike Shortcut".

1.2 Out-of-the-box Strategies Shortcuts

For out-of-the-box strategies, the following solving shortcuts are predefined. Enter the strike, then click ![]() .

.

| Strategy | Strike | Expected Results | |||

|---|---|---|---|---|---|

|

Straddle |

“0d” or “atm” |

Vanilla Buy PUT S |

Vanilla Buy CALL S |

|

|

|

Strangle |

“25d” or "#d" (# can be any number) |

Vanilla Buy PUT S1 (-25d) |

Vanilla Buy CALL S2 (25d) |

|

|

|

Butterfly |

“25d” or "#d" (# can be any number) |

Vanilla Buy PUT S1 (-25d) |

Vanilla Buy CALL S2 (25d) |

Vanilla Buy PUT S3 (atm) |

Vanilla Buy CALL S3 (atm) |

|

Risk reversal (collar) |

“25d” or "#d" (# can be any number) |

Vanilla Buy PUT S1 (-25d) |

Vanilla Sell CALL S2 (-25d) |

|

|

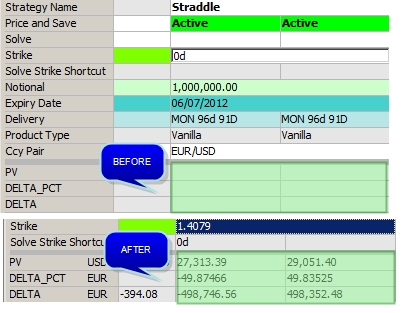

Scenario 2- Out-of-the-box Strategy - Solve for Strike to get 0% Delta over Strategy

Enter "0d" in the Strike field of the first trade, then click ![]() .

.

Scenario 2 - Solving Shortcut (Out-of-the-box Strategy- Solve for strike with target 0% Delta)

DELTA_PCT is null over the strategy.

1.3 Multiple Trades Shortcuts

Now, if you have multiple trades in a strategy, you can still apply a solving shortcut to a single trade, or to a set of selected trades, or to all the trades at once.

To do so, select a set of trades, enter any of the following in the Totals column of the Strike field.

| • | atm or atmf: To solve for an at the money forward trade. |

| • | atms: To solve for an at the money spot trade. |

| • | #d: To solve for delta (25d, 10d, 0d, etc.). |

| • | #% itmf: To solve for a percentage of the in-the-money forward (102% itmf). |

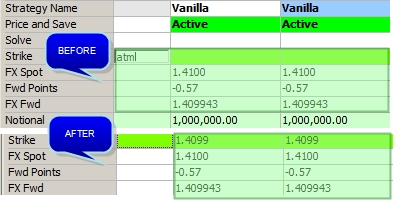

Scenario 3 - Multiple Trades - Solve for at-the-money Forward

Enter "atm" in the Totals column of the Strike field, then click ![]() .

.

Scenario 3 - Solving Shortcut (Multiple trades- Solve for at-the-money forward)

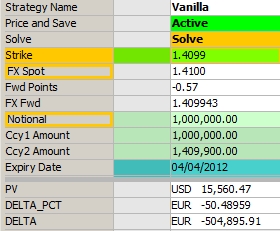

2. Advanced Solving

To enable the advanced solving capability, set the Solve property to "Solve".

Advanced solving can be applied to a single trade, to selected trades in Solve mode in a strategy, or to all trades in Solve mode in a strategy.

All the properties you can solve for are outlined in orange.

Ⓘ [NOTE: In case you have trades with different types of strategies, only the common properties will be available for solving. For example, if you have a Vanilla trade and a Barrier trade, you will not be able to solve for Barrier for the whole strategy, whereas if you only have Barrier trades, you will be able to solve for Barrier]

The pricer measures can be set as targets.

Pricing sheet (Solve mode)

Ⓘ [NOTE: Even though the Customer Premium is not outlined in orange, it is possible to solve for a target customer premium - You can select the Target "Customer Premium" in the Solver window]

| » | Price the trades before getting started. |

2.1 Advanced Solving - Single Trade

Double-click the property you want to solve for, Strike in this example. The background turns orange.

Pricing sheet (Solve mode - Select property to solve for)

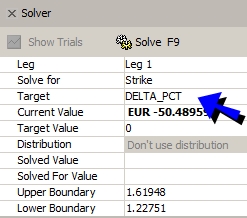

Then double-click the pricer measure that you want to set as target, DELTA_PCT in this example. The solving information is displayed in the Solver window.

Pricing sheet (Solve)

| » | Enter the Target Value, and click Solve. |

You can also enter the target value directly in the pricer measure, and it sets the Target Value in the Solver window.

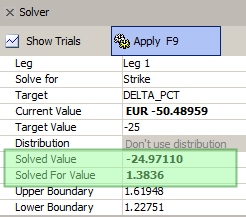

A solution is computed and displayed - The Solver window shows the solved value (Strike in this example), and the new pricer measure computed with the solved value (DELTA_PCT in this example).

At this point, you can:

| – | Try another solution by changing the target value and clicking Solve again. |

| – | Tune the solver parameters: Upper Boundary and Lower Boundary. |

| – | Exit the solver without any change if none of the solutions are satisfying. |

| – | Apply the solution to the trade. |

Pricing sheet (Solving results)

| » | To apply the solution to the trade, click Apply. |

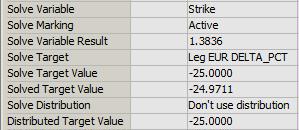

The solved properties are updated accordingly.

Pricing sheet (Apply solving)

Solving details are stored in the solving properties:

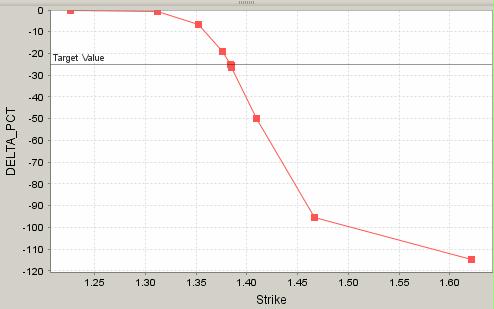

You can also click Show Trials to view the solver trials.

Pricing sheet (Solve - Trials details)

| » | You can right-click the graph and a popup menu appears with a number of options, including the ability to zoom in and out on the various axes. |

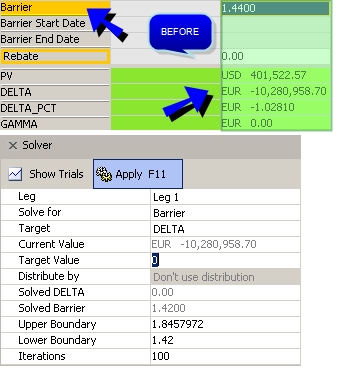

Scenario 4 - Solve for Barrier with Target DELTA

Double-click the Barrier property to solve for barrier, and select the DELTA pricer measure.

Scenario 4 - Solve for Barrier with Target DELTA

| » | Enter the target DELTA in "Target Value", and click Solve. |

The solving results are displayed. You can exit without any change, or apply the results to the trades.

| » | Then click Apply. |

Scenario 4 - Solving results

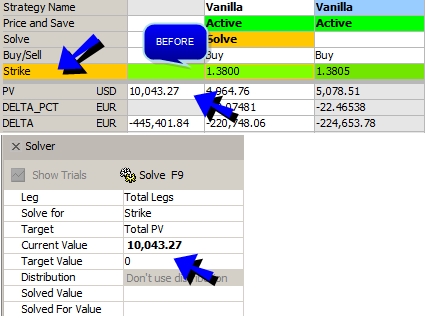

2.2 Advanced Solving - Multiple Trades

You can select a set of trades, or solve all the trades in solving mode. Make sure to price the trades.

Double-click the property you want to solve for, Strike in this example. The background turns orange.

Pricing Sheet (Solve mode - Multiple trades - Select property to solve for)

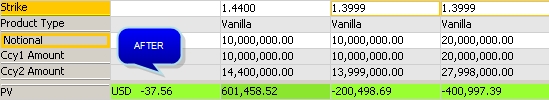

Then, select the Totals column of the pricer measure that you want to set as target, PV in this example.

Pricing Sheet (Solve)

| » | Enter the target value (0 for example), and click Solve. |

A solution is computed and displayed - The Solver dialog shows the solved value (Strike in this example), and the new pricer measure computed with the solved value (PV in this example).

At this point, you can:

| – | Try another solution by changing the target value and clicking Solve again. |

| – | Exit the solver without any change if none of the solutions are satisfying. |

| – | Apply the solution to the trade. |

Pricing sheet (Solving results)

| » | To apply the solution to the trades, click Apply. |

The solved properties are updated accordingly.

Pricing sheet (Apply solving results)

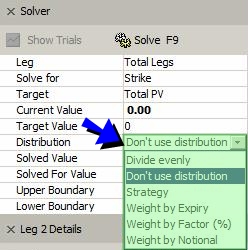

When solving for multiple trades, you can select the distribution method over the trades:

Pricing sheet (Solve - Distribution)

| • | "Don't use Distribution" - Default selection - The solver will find the solution common to all selected trades that gives the target value - The same solved value is applied to all trades. |

| • | For the other distribution methods, the targeted value is split by trade according to the selected method, then the solving process is applied trade by trade to determine the solution that will make the target pricer measure equal to the split amount. |

| – | "Divide evenly" - The target value is divided by the number of selected trades (target value / number of trades). |

| – | "Weight by Notional" - The target value is proportional to the notional of the trade with respect to the total notional amount of the selected trades (target value * trade notional / total notional). |

| – | "Weight by Factor (%)" - You will be prompted to enter a factor for each leg - The target value is proportional to the user-defined factors (target value * factor %). |

| – | "Weight by Expiry" - The target value is proportional to the number of days to expiration of the trade with respect to the total number of days to expiration of the selected trades (target value * trade number of days to expiration / total number of days to expiration). |

| – | "Strategy" - The target value is applied to each selected strategy. For example, you have selected 2 straddles (4 trades) - The target value is applied to each straddle independently. |

Ⓘ [NOTE: It does not make sense to select a distribution method for a null target value]

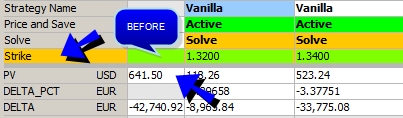

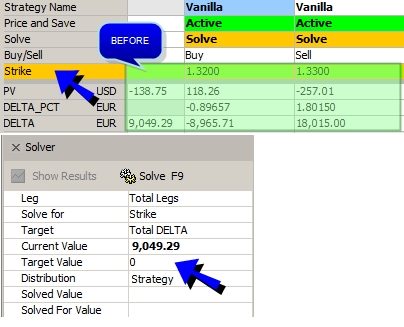

Scenario 5 - Multiple Trades - Solve for Strike to get 0% DELTA

Double-click the Strike property to solve for strike, and select the Totals column for the DELTA pricer measure.

Scenario 5 - Solve for 0% DELTA

| » | Enter the target delta in "Target Value", and click Solve. |

The solving results are displayed. You can exit without any change, or apply the results to the trades.

| » | Then click Apply. |

Scenario 5 - Solving results

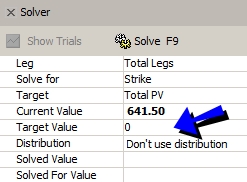

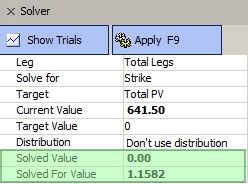

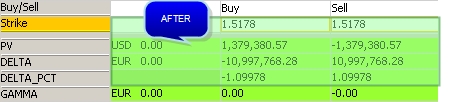

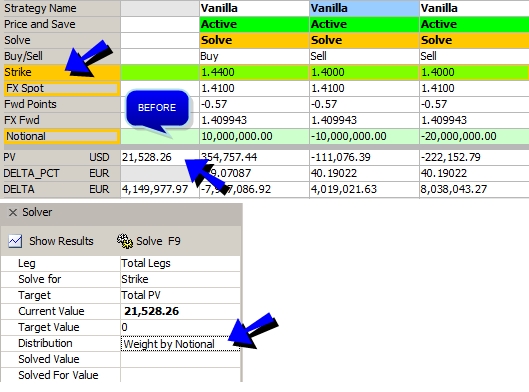

Scenario 6 - Multiple Trades - Solve for Strike to get 0 PV with Notional Distribution

In this scenario, the trader wants to solve for strike to obtain a 0 PV weighted by notional.

Double-click the Strike field to solve for strike, and select the Totals column for the PV pricer measure.

Scenario 6 - Solve for 0 PV

| » | Enter the target PV in "Target Value", and click Solve. |

The solving results are displayed. You can exit without any change, or apply the results to the trades.

| » | Then click Apply. |

Scenario 6 - Solving results

The PV of the trade in Price mode has not changed, and is distributed by notional over the trades in Solve mode.

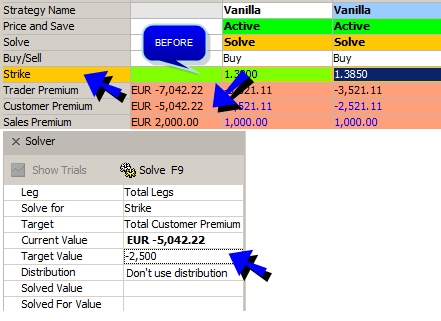

Scenario 7 - Multiple Trades - Solve for Target Customer Premium with Constant Sales Premium

In this scenario, the trader wants to obtain a target customer premium by keeping the sales premium constant.

Double-click the Strike field to solve for strike, and select the target Total Customer Premium in the Solver window.

Scenario 7 - Solve for target premium

| » | Select the distribution method as needed. |

| » | Enter the target premium in "Target Value", and click Solve. |

The solving results are displayed. You can exit without any change, or apply the results to the trades.

| » | Then click Apply. |

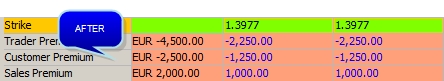

Scenario 7 - Solving results

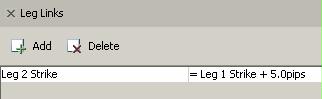

Scenario 8 - Multiple Trades - Solving with Linked Properties

In this example, Strike (second trade) = Strike (first trade) + 5 pips.

Scenario 8 - Linked strikes

Please refer to "Strategy Attributes" in Calypso Building Custom Strategies documentation for details on defining property links.

Please refer to "Strategy Attributes" in Calypso Building Custom Strategies documentation for details on defining property links.

Now, the user want to solve for Strike to get a 0 PV on the whole strategy.

In this case, since the second trade is linked to the first trade, you only need to set the first trade in Solve mode.

Scenario 8 - Solve with Linked Properties

| » | Enter the target PV in "Target Value", and click Solve. |

| » | Then click Apply. |

Scenario 8 - Solving results - Strike (second trade) = Strike (first trade) + 5 pips

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |