Capturing Fixed Income Trades

To capture a Fixed Income trade in the Pricing Sheet, , you first need t o define Bond products.

See Fixed Income Trading for details.

See Fixed Income Trading for details.

Then select the Bond strategy and set the properties as needed.

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Properties specific to Fixed Income trades are described below.

Contents

1. Bond Trade

Properties

Customer Price - Rate - Settlement Date - Next Coupon - Settlement - Notional - Yield - Spot - Underlying

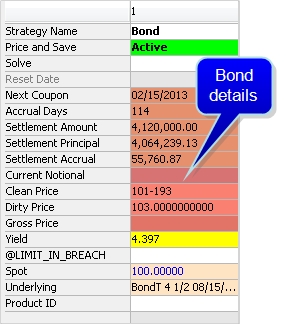

Sample Bond Trade

"Trade" Properties

| Properties | Description |

|---|---|

| Discount |

Displays the discount. |

|

Margin |

For floating rate bonds, displays the DISC_MARGIN pricer measure, which calculates the spread added to current rates to equal the bond yield. You can enter a discounted margin to solve for the clean price. |

|

Cash Rate |

Displays the cash rate. |

|

TM |

Displays the traded margin. |

"Product: Style" Properties

| Properties | Description |

|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

|

Notional |

Enter the Nominal in this field. It will update the Quantity accordingly. |

|

Notional Ccy |

Displays the nominal currency of the selected bond. |

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

| Settle Ccy |

Displays the Proceed currency. |

| Quantity |

Enter the Quantity in this field. It will update the Notional accordingly. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Rate |

Displays the current coupon rate for the selected bond. |

"Date" Properties

| Properties | Description |

|---|---|

| Next Coupon |

Displays the date for the next coupon payment. |

| Settlement Date |

Select the settlement date. Defaults to the Trade Date + the number of Settle Days specified in the Bond Product Definition. The Settlement Date uses the holiday calendar of the bond product to identify business days. If the trade date is changed, user can enter "0D" to update the Settlement Date accordingly. |

"Price" Properties

| Properties | Description |

|---|---|

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model. Click here for a description of all pricing parameters. |

| Trader Price | Enter the clean price for the bond. |

| Customer Price | Enter the clean price for the bond. |

| Sales Price | Displays the unit amount of sales premium based on the selected Price Format. |

| Sales Premium |

Displays the Sales Fee in premium currency. Sales Premium for Bond allows you to enter a flat amount rather than enter the Sales Price. Alternatively, entering the Sales Price will automatically calculate the Sales Premium. |

| Negotiated Price Type | Displays the negotiated price type. |

| Settlement Amount |

Displays the settlement amount in the settlement currency. |

| Settlement Principal |

Displays the settlement principal. |

| Settlement Accrual |

Displays the settlement accrual. |

| Current Notional |

Displays the current nominal. |

| Clean Price |

Enter the clean price (value of bond - accrued interest). |

| Dirty Price |

Enter the dirty price (value of bond + accrued interest). |

| Gross Price | Displays inflation adjusted price. This value is for Inflation Bonds only. |

| Yield | Enter the yield to maturity based on bond inputs. |

| Spot | Displays the market quote for the bond. |

| Underlying | Displays the Bond Product details for the selected bond product. To select a bond product double-click in this field to bring up the Search Bonds window. See below. |

| Product ID |

Enter the bond product identifier. |

| Product ID Type |

Select the product ID type to choose from when entering values in the Product ID field. A default search type can be configured in Configuration > User Preferences under the Defaults tab. Select the default search type form the Default Bond Product ID type drop down. Setting this in the trade leg specifically will override the value set in the defaults. |

2. Treasury Lock

A Treasury Lock is a customized agreement that fixes the yield, clean price, or dirty price of a specific treasury bond on a specific date in the future. On that future date, or lockout date, you can exercise the Treasury Lock by choosing Processing > Exercise, which populates the trade keywords PriceAtLockout, Final DV01/Duration, and Settlement Amount once they are available as properties.

Descriptions of these keywords can be found below.

Key Properties

Product ID - Underlying - Lockout Date - Notional - Negotiated Price Type - Lock Yield - Lock Price - Funding Rate - DV01

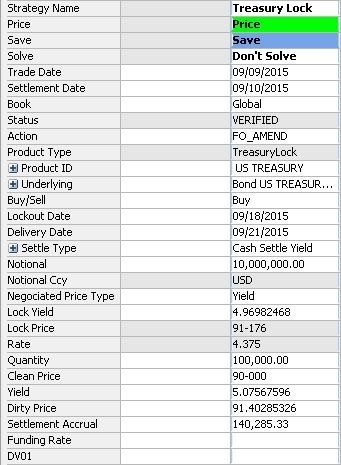

Sample Treasury Lock trade

|

Basic Steps for Capturing a Treasury Lock Trade

|

Properties Description

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

| Settlement Date |

The settlement date defaults to the trade date plus the number of Settle Days specified in the bond product's Bond Window. The settlement date uses the holiday calendar of the bond product to identify business days. If you change the trade date, double-click in the Settlement Date field to update the settlement date accordingly. |

||||||

| Product ID |

Displays the Product ID for the bond underlying the trade. Double-click the field and enter the bond name or security code. Once you begin typing, a list of bonds matching the entered information is populated. Alternatively, you can search for a bond using the Search Bonds window. See the Underlying property below. |

||||||

| Underlying |

Displays the Bond Product details for the selected treasury bond product. To select a bond product, double-click this field to open the Search Bonds window. Ⓘ [NOTE: After selecting a bond, you can open the Bond Window by displaying either Leg Details or Underlying Details in the Tools Panel, and clicking |

||||||

| Buy/Sell | Direction of the trade from the book’s perspective. Double-click the Buy label to change to Sell as applicable. | ||||||

| Lockout Date | Enter a lockout date, which defines the end of the lockout period. | ||||||

| Delivery Date |

The Delivery Date is based on Lockout Date plus Settlement Lag/Holidays. The date is populated automatically once the Lockout Date is entered, although it can be overridden manually in the Delivery Date field. See description of the Settle Type property below. |

||||||

| Settle Type |

The system sets the value to Cash Settle Clean Price, Cash Settle Dirty Price, or Cash Settle Yield, depending on the Negotiated Price Type. The following properties can also be set by clicking the Settle Type label:

Examples: 3D Calendar, 1M Calendar, 1Y Business, etc.

|

||||||

| Notional | Enter the notional amount after the underlying bond is selected. The system autopopulates the quantity, based on quantity being equal to notional divided by face value. | ||||||

| Negotiated Price Type | Select the negotiated price type: Clean Price, Dirty Price, or Yield. This selection determines the Settle Type. | ||||||

| Lock Yield |

The yield for the locked period. Enter a value for Lock Yield when the Negotiated Price Type is set to Yield. If the Negotiated Price Type is CleanPrice or DirtyPrice, the Lock Yield field value is a converted yield. |

||||||

| Lock Price |

The price for the locked period. Enter a value for Lock Price when the Negotiated Price Type is set to either CleanPrice or DirtyPrice. If the Negotiated Price Type is Yield, the Lock Price field value is a converted price. |

||||||

| Rate | Displays the fixed coupon rate of the underlying bond. | ||||||

| Quantity |

The quantity is linked to the Notional value and is calculated by the system once the Notional has been entered. The Quantity equals the Notional divided by the face value of the bond. |

||||||

|

Clean Price Yield Dirty Price |

Clean Price: Clean Price is the underlying bond's clean spot price based on the Settlement Date. Yield: Yield is the underlying bond's spot rate for yield based on the Settlement Date. Dirty Price: Dirty Price is calculated as the underlying bond's dirty spot price based on the Settlement Date.

If the price contains 3 digits, the third digit represents the number of eighths of a thirty second (or 1/256, between 1 and 7). A bond price entered as "99-022" will be read as [99 + 2/32 + 2/8(1/32)], or 99.0703125. The third digit can also be +, indicating 4/8 of a thirty second. If the price contains 4 digits, the last two digits represent the number of sixteenths of a thirty second (or 1/512, between 1 and 15). Note that the four-digit logic only applies to bonds with the tick size 512. |

||||||

| Next Coupon | Displays the date of the next coupon retrieved from the coupon schedule. | ||||||

| Settlement Accrual | Displays the settlement accrual for the underlying bond. | ||||||

| Funding Rate | Funding rate is the repo rate used to compute the forward bond price. It is calculated from the curve, or it can be entered manually (which overrides the repo rate from the curve). | ||||||

| DV01 | The dollar value of a one‐basis point change in the contract forward yield. When left blank, the system uses the DV01 pricer measure for pricing and settlement. | ||||||

| Trader Price |

Displays the trader price: either Yield or Price type based on the selected Negotiated Price Type. |

Related Trade Attributes (Keywords)

| Keyword | Description |

|---|---|

| PriceAtLockout |

Set at the exercise of the trade and captures price or yield on the lockout date. |

| Final DV01/Duration |

Set at the exercise of the trade when Settle Type is Cash Settle Yield and captures DV01 on the lockout date. |

| Settlement Amount |

Set at the exercise of the trade and captures the Settlement Amount. |

3. Inflation Lock

An inflation lock is a customized agreement that fixes the yield or price on a specified inflation bond at a specific date in the future. On the future date, you can exercise the Inflation Lock using Processing > Exercise which also populates the trade keyword "PriceAtLockout".

Ⓘ [NOTE: Inflation locks are only supported for the Israeli CPI market]

Properties

Lockout Date - Lock Yield - Lock Price - Duration - Funding Rate

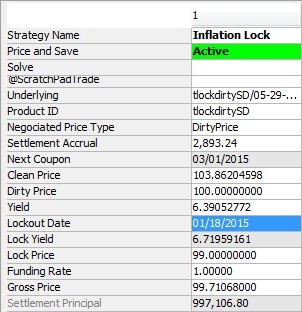

Sample Inflation Lock trade

Properties

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

| Buy/Sell | Direction of the trade from the book’s perspective. Double-click the Buy label to change to Sell as applicable. | ||||||

| Settle Type |

Select the settle type: Cash Settle Price, Cash Settle Yield, or Physical Settle. The following properties can also be set:

Examples: 3D Calendar, 1M Calendar, 1Y Business, etc.

|

||||||

| Lockout Date | Select the lockout date which identifies the end of the lockout period. | ||||||

| Delivery Date |

Enter the delivery date. This date is based on Lockout Date + Settlement Lag/Holidays. |

||||||

| Negotiated Price Type | Select the negotiated price type: Dirty Price or Yield. | ||||||

| Trader Price |

Displays the trader price: either Yield or Price type based on the selected Negotiated Price Type. |

||||||

| Lock Yield |

The yield for the locked period. If the Negotiated Price Type is "Dirty Price", then the Lock Yield will convert to Yield after a dirty price is entered into the Lock Price field. |

||||||

| Lock Price |

Enter the lock price. If the Negotiated Price Type is a "Yield", then the Lock Price will convert to Dirty Price after a yield is entered into the Lock Yield field. |

||||||

| Observation Type |

Displays how the Lockout Rate is calculated, as a Single Yield or Average Yield. In the case of an Average Yield, you can reset the yield using the standard reset process. You can also right-click "Average Yield" and choose "Supplemental" to view the resets. |

||||||

| Fixings |

Displays the number of daily fixings for averaging the yield. The following properties can also be viewed:

|

||||||

| Duration | Displays the duration of the underlying bond. | ||||||

| Funding Rate | Enter the funding rate. | ||||||

| Settlement Date |

The settlement date defaults to the trade date + the number of settle days specified in the bond product. The settlement date uses the holiday calendar of the bond product to identify business days. If you change the trade date, double-click in the Settlement Date field to update the settlement date accordingly. |

||||||

|

Clean Price Yield Dirty Price Gross Price |

Enter the clean price, yield, dirty price, or gross price, and the other fields will be calculated accordingly. The dirty price is clean price + unit accrual. The gross price is the inflation adjusted price. For bonds quoted using Price32, you can enter the trade’s price with two, three, or four digits after the dash. The first two digits represent the number of thirty-seconds (between 1 and 31). If the price contains 3 digits, the third digit represents the number of eighths of a thirty second (or 1/256, between 1 and 7). A bond price entered as "99-022" will be read as [99 + 2/32 + 2/8(1/32)], or 99.0703125. The third digit can also be +, indicating 4/8 of a thirty second. If the price contains 4 digits, the last two digits represent the number of sixteenths of a thirty second (or 1/512, between 1 and 15). Note that the four-digit logic only applies to bonds with the tick size 512. |

||||||

| Settle Ccy | Displays the settlement currency. | ||||||

| FX Rate | Displays the FX rate. | ||||||

| Settlement Accrual | Displays the settlement accrual. | ||||||

| Next Coupon | Displays the date of the next coupon retrieved from the coupon schedule. | ||||||

| Rate | Displays the rate. | ||||||

| Underlying | Displays the Bond Product details for the selected inflation bond product. To select a bond product double-click in this field to bring up the Search Bonds window. See below. | ||||||

| Product Type | Displays the bond class. | ||||||

| Product Subtype | Displays the bond type. |

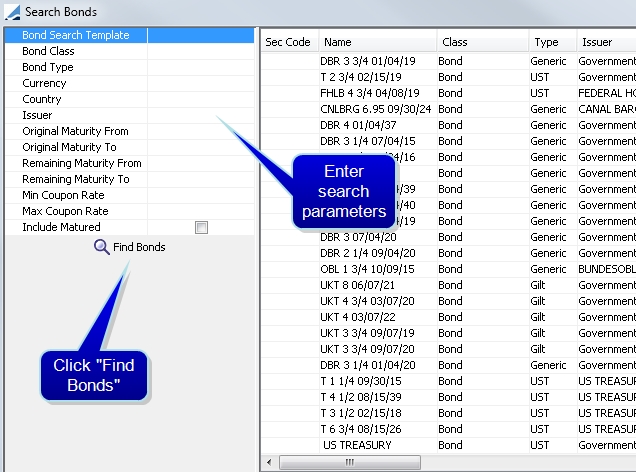

4. Search Bonds Window

The Search Bonds window functions similarly to the Bond Report window. Enter parameters for your search and select a desired bond product.

| » | Enter search parameters. |

| » | Click Find Bonds. |

| » | Double-click the desired bond to load it to the Pricing Sheet. |

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |