Capturing CRD Trades

To capture a Credit trade in the Pricing Sheet, select the Credit strategy and set the properties as needed.

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Credit trades can be opened to the Pricing Sheet from the Credit Market Data window.

See Credit Market Data Window for details.

See Credit Market Data Window for details.

Properties specific to Credit trades are described below.

- CDS SNAC

1. CDS SNAC Trade

To capture CDS SNAC trades, a user enters details for the trade.

You can calculate upfront fees according to ISDA standards if you have the ISDA server configured.

See Capturing CDS Fixed Coupon Trades for more details.

See Capturing CDS Fixed Coupon Trades for more details.

Properties

Pricing Details - Settlement Details - Fee Details

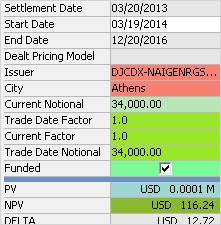

Single Name CDS trade

"Pricing" Properties

| Property | Description |

|---|---|

| Buy/Sell | Enter Buy for buying credit protection or Sell for selling credit protection. |

| Notional | Enter the trade notional. |

"Price" Properties

| Properties | Description | |||

|---|---|---|---|---|

|

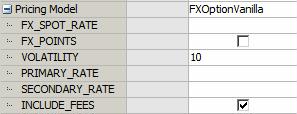

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

Sample pricing parameters

|

|||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

|||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

|||

| Trader Price |

Displays the unit amount of trader premium based on the selected Price Format. |

|||

| Customer Price |

Displays the unit amount of customer premium based on the selected Price Format. |

|||

| Sales Price | Displays the unit amount of sales premium based on the selected Price Format. | |||

|

Sales Premium |

Displays the Sales Fee in premium currency. | |||

| Sales Fee |

This property is only enabled if you have selected a Sales Person. Enter the sales fee.

You can also display:

The MarginFXRate trade keyword stores the rate used in the conversion. |

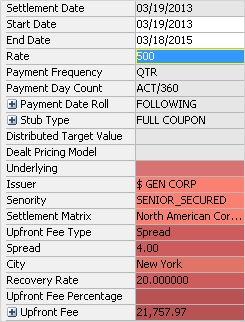

"Settlement" Properties

| Property | Description |

|---|---|

| Issuer | Select an Issuer by clicking the cell and entering a name or by using the search box. |

| Seniority | Select the rating of the reference obligation. |

|

Upfront Fee Type |

Select Spread or Upfront Fee Percentage. If Spread is selected, enter the spread in basis points in the "Spread" cell. If Upfront Fee Percentage is selected, enter a fee as a percentage in the "Upfront Fee Percentage" cell. |

| Underlying | displays any applicable reference obligation on the legal entity. |

| City | The city of the Calc Agent. This is auto populated when selecting the Settlement Matrix. Calculation agent cities are defined in the calcAgentCityCode domain. |

| Recovery Rate | Enter the recovery rate (e.g. "40" for 40%). The recovery rate is the actual recovery which will be applied on the trade. |

"Fee" Properties

| Property | Description |

|---|---|

| Upfront Fee |

Displays the upfront fee based on the spread or percentage entered. Fee information is automatically attached to the trade and can be viewed by right-clicking in the trade and clicking Trade Details > Trade Fees or Alt + F. The ISDA model can be used to calculate the upfront fee if the ISDA module has been configured and a discount curve has been added to the pricer configuration. |

2. CDS Index Trade

To capture CDS Index trades, a user enters details for the trade.

Properties

Pricing Details - Index Details - Fee Details

CDS Index trade

You can set the default RECOVERY_RATE from the Calypso Navigator using Configuration > Credit Derivatives > Standard Recovery for the "CDSIndexDefinition" type.

Pricing Properties

| Property | Description |

|---|---|

| Buy/Sell | Enter Buy for buying credit protection or Sell for selling credit protection. |

| Notional | Enter the trade notional. |

"Product: Info" Properties

| Property | Description |

|---|---|

| Underlying | Displays the product details for the selected index. To select an index, double-click this field and begin typing any portion of the index name to show all available indexes that include the entered text. Click the preferred index from the list to populate the Underlying field. |

Price Details

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

Sample pricing parameters

|

|||||||||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Trader Price |

Displays the unit amount of trader premium based on the selected Price Format. |

|||||||||

| Customer Price |

Displays the unit amount of customer premium based on the selected Price Format. |

|||||||||

| Sales Price | Displays the unit amount of sales premium based on the selected Price Format. | |||||||||

|

Sales Premium |

Displays the Sales Fee in premium currency. | |||||||||

| Sales Fee |

This property is only enabled if you have selected a Sales Person. Enter the sales fee.

You can also display:

The MarginFXRate trade keyword stores the rate used in the conversion. |

|||||||||

| Trader Premium |

Displays the theoretical premium computed by the pricer. You can modify its value. The Trader Premium can adjust the Sales Premium or the Customer Premium based on the configuration under Configuration > User Preferences. |

|||||||||

| Sale Premium | Displays the Sales Fee in premium currency. | |||||||||

| Customer Premium |

Displays the premium amount such that Customer Premium = Sales Premium + Trader Premium. Displays the customer premium such that:

The customer premium is the actual fee that will be paid/received. |

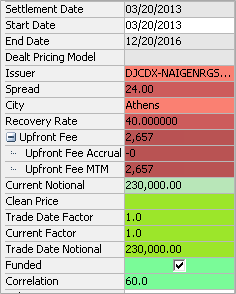

Index Properties

| Property | Description |

|---|---|

| Issuer | Select an Issuer by clicking the cell and entering a name or by using the search box. |

| Seniority | Select the rating of the reference obligation. |

| Settlement Matrix | Displays default settlement instructions. |

|

Upfront Fee Type |

Select Spread or Upfront Fee Percentage. If Spread is selected, enter the spread in basis points in the "Spread" cell. If Upfront Fee Percentage is selected, enter a fee as a percentage in the "Upfront Fee Percentage" cell. |

| City | The city of the Calc Agent. This is auto populated when selecting the Settlement Matrix. Calculation agent cities are defined in the calcAgentCityCode domain. |

| Recovery Rate | Enter the recovery rate (e.g. "40" for 40%). The recovery rate is the actual recovery which will be applied on the trade. |

Fee Details

| Property | Description |

|---|---|

| Upfront Fee |

This is the upfront fee to account for the following (it is computed using the ISDA model): 1. Difference in current spread and inception spread. 2. Accrual. The upfront fee will be calculated for CDS Indices with "Price" as the quote type via Calypso, regardless of ISDA Server set up. Fee information is automatically attached to the trade and can be viewed by right-clicking in the trade and clicking Trade Details > Trade Fees or Alt + F. |

3. CDS Index Option Trade

To capture CDS Index Option trades, a user enters details for the trade.

Properties

Option Details - Settlement Details - Premium Details - Index Details

CDS Index Option trade

Option Properties

| Property | Description |

|---|---|

| Expiry Date | Enter the date for the option to expire. |

| Strike | Enter the spot rate. |

| Volatility | Enter the volatility. |

Price Properties

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

Sample pricing parameters

|

|||||||||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Trader Premium |

Displays the theoretical premium computed by the pricer. You can modify its value. The Trader Premium can adjust the Sales Premium or the Customer Premium based on the configuration under Configuration > User Preferences.

|

|||||||||

| Trader Price |

Displays the unit amount of trader premium based on the selected Price Format. |

|||||||||

| Customer Premium |

Displays the premium amount such that Customer Premium = Sales Premium + Trader Premium. Displays the customer premium such that:

The customer premium is the actual fee that will be paid/received. |

|||||||||

| Customer Price |

Displays the unit amount of customer premium based on the selected Price Format. |

|||||||||

| Sales Price | Displays the unit amount of sales premium based on the selected Price Format. | |||||||||

|

Sales Premium |

Displays the Sales Fee in premium currency. | |||||||||

| Sales Fee |

This property is only enabled if you have selected a Sales Person. Enter the sales fee.

You can also display:

The MarginFXRate trade keyword stores the rate used in the conversion. |

"Product: Info" Properties

| Property | Description |

|---|---|

| Underlying | Displays the product details for the selected index. To select an index, double-click this field and begin typing any portion of the index name to show all available indexes that include the entered text. Click the preferred index from the list to populate the Underlying field. |

Settlement Properties

| Property | Description |

|---|---|

| Settlement | Select Cash or Physical. |

|

Settlement Lag |

Enter the number of days between the delivery date and the expiration date. |

| Expiration Time Zone | Enter the expiration time zone. |

| Expiration Time | Enter the expiration time. |

Premium Properties

| Property | Description |

|---|---|

| Premium Date | Enter the payment date for the option's premium fee. |

| Customer Price |

Displays the customer price such that: - Customer Price = Trader Price + Sales Price (Sell) - Customer Price = Trader Price - Sales Price (Buy) |

| Customer Premium | Enter the customer premium. |

Index Properties

| Property | Description |

|---|---|

| End Date | Displays the maturity date for the index. |

| Issuer |

Select an index name. CDS Indices are defined from the Calypso Navigator using Configuration > Credit Derivatives > CDS Index Definition. |

| City | Select the city of the calculation agent. Calculation agent cities are defined in the calcAgentCityCode domain. |

| Current Notional | Displays the current notional value. |

| Clean Price | Displays the clean price. |

| Trade Date Factor |

Displays original factor (the factor on the trade date of the index). |

| Current Factor | Displays current factor (the factor as of Val date of the index). |

| Trade Date Notional | displays the notional on the trade date. |

| Funded |

When funded, there is a notional exchange. If a credit event occurs, we have two flows on the settlement date which offset each other: Seller Pays (1 - Recovery) * Notional, and receives Notional. The net cashflow is Recovery Rate * Notional. If no credit event occurs, the Notional is returned to the Seller of Protection at the maturity of the deal. The settlement is cash only. |

4. CDS Index Tranche Trade

To capture CDS Index Tranche trades, a user enters details for the trade.

Properties

Pricing Details - Issuer Details - Fee Details - Tranche Details

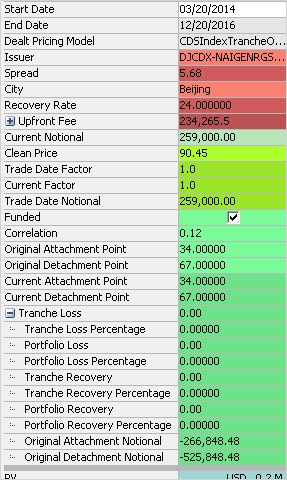

CDS Index Tranche trade

Pricing Properties

| Property | Description |

|---|---|

| Buy/Sell | Direction of the trade from the book’s perspective. |

| Notional |

Enter the notional. The Notional follows the Bond market convention i.e. Buy Index means a positive notional. The factor is displayed in the Current Factor field - the factor is the total number of non-defaulted issuers / total number of original issuers. |

Price Properties

| Properties | Description | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

Sample pricing parameters

|

|||||||||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

|||||||||

| Trader Price |

Displays the unit amount of trader premium based on the selected Price Format. |

|||||||||

| Customer Price |

Displays the unit amount of customer premium based on the selected Price Format. |

|||||||||

| Sales Price | Displays the unit amount of sales premium based on the selected Price Format. | |||||||||

|

Sales Premium |

Displays the Sales Fee in premium currency. | |||||||||

| Sales Fee |

This property is only enabled if you have selected a Sales Person. Enter the sales fee.

You can also display:

The MarginFXRate trade keyword stores the rate used in the conversion. |

"Product: Info" Properties

| Property | Description |

|---|---|

| Underlying | Displays the product details for the selected index. To select an index, double-click this field and begin typing any portion of the index name to show all available indexes that include the entered text. Click the preferred index from the list to populate the Underlying field. |

Issuer Properties

| Property | Description |

|---|---|

| End Date | Displays the maturity date for the index. |

| Issuer |

Select an index tranche. CDS index tranches are defined from the Calypso Navigator using Configuration > Credit Derivatives > CDS Index Definition. |

| Standard Fixed Coupon |

When selected, the "Spread" property becomes a drop-down listing standard SNAC coupon values. These values can be defined using the domain CreditDefaultSwapCoupon.SNAC.

When the checkbox is cleared, the "Spread" property becomes a text field that allows the user to enter any value for the spread. |

| Spread | Enter the spread in basis points. |

| City | Select the city of the calculation agent. Calculation agent cities are defined in the calcAgentCityCode domain. |

| Recovery Rate | Enter the recovery rate. |

Fee Properties

| Property | Description |

|---|---|

| Upfront Fee |

Displays the upfront fee. Fee information is automatically attached to the trade and can be viewed by right-clicking in the trade and clicking Trade Details > Trade Fees or Alt + F. |

| Current Notional | Displays the current notional. |

| Clean Price | Enter the clean price. |

| Trade Date Factor | Displays the current factor on the trade date. |

| Current Factor | Total number of non-defaulted issuers / total number of original issuers. Total number of non-defaulted issuers / total number of original issuers. |

| Trade Date Notional | Displays the notional on the trade date. |

| Funded |

When checked, the subtype of the CDS is FUNDED, otherwise it is UNFUNDED. When a credit event occurs, if the trade is funded, there is no settlement fee but there is a principal reduction for the amount of loss. |

Tranche Properties

| Property | Description |

|---|---|

| Correlation |

Enter the correlation. If a correlation surface has been configured and mapped, the correlation value will be taken from there. Entering a value will override a previously configured correlation surface. |

| Original Attachment Point | Enter the tranche attachment point at trade inception. |

| Original Detachment Point | Enter the tranche detachment point at trade inception. |

| Trade Date Attachment Point | Displays the effective attachment point as of the entered trade date. |

| Trade Date Detachment Point | Displays the effective detachment point as of the entered trade date. |

| Current Attachment Point | The current attachment point as of the val date. |

| Current Detachment Point | The current detachment point as of the val date. |

| Tranche Loss | Displays the loss amount of the tranche. |

| Tranche Loss Percentage | Displays the percentage loss of the tranche. |

| Portfolio Loss | Displays the loss amount on the portfolio. |

| Portfolio Loss Percentage | Displays the percentage loss on the portfolio. |

| Tranche Recovery | Displays the tranche recovery amount for the trade |

| Tranche Recovery Percentage |

Displays the tranche recovery amount in terms of percentage. |

| Portfolio Recovery | Displays the portfolio recovery amount. |

| Portfolio Recovery Percentage | Displays the portfolio recovery amount in terms of percentage. |

| Original Attachment Notional | Displays the notional at the original attachment point for the trade. |

| Original Detachment Notional | Displays the notional at the original detachment point of the trade. |

5. Asset Swap Trade

To capture Asset Swap trades, a user enters details for the trade.

Properties

Trade Details - Settlement Details - Payment Details - Swap Details - Asset Details - Coupon Details

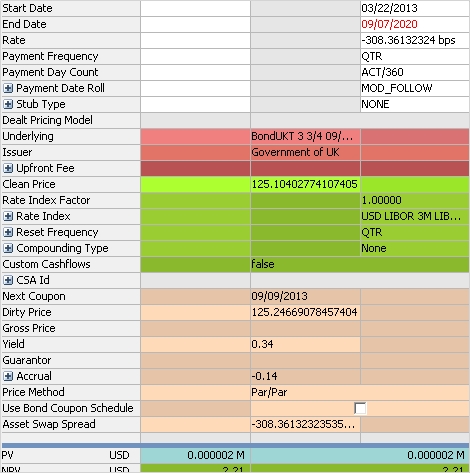

Asset Swap trade

Trade Properties

| Property | Description |

|---|---|

| Notional | Enter the notional amount for the reference leg. |

| Notional Ccy | Enter the notional currency type for the reference leg. |

| Pay/Receive | Enter the pay or receive for each leg in the strategy. |

| Leg Type | Displays the type for each leg in the strategy. |

Swap Properties

| Property | Description | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Start Date | Trade start date. | |||||||||||||||||||||||||||||||||||||||

| End Date | Trade end date. | |||||||||||||||||||||||||||||||||||||||

| Rate | Enter the forward rate. | |||||||||||||||||||||||||||||||||||||||

| Rate Index Factor | Enter the index factor as needed for floating rates to multiply the rate value. | |||||||||||||||||||||||||||||||||||||||

| Rate Index |

Select the rate index for floating rates. You can set additional properties:

|

|||||||||||||||||||||||||||||||||||||||

| Reset Frequency | Select the reset frequency to sample resets at a frequency different from the payment frequency. Otherwise, the resets are sampled at the payment frequency. | |||||||||||||||||||||||||||||||||||||||

| Stub Type |

Select the stub period, if applicable, or none. You can also set the following properties:

Index Based - The DateRoll, the holidays and the daycount are coming from the rate index. Product Payment - The DateRoll, the holidays and the daycount are coming from the coupon panel. |

|||||||||||||||||||||||||||||||||||||||

| Compounding Type |

Select the compounding type, if applicable, or none.

You can also set:

|

Bond Properties

| Property | Description |

|---|---|

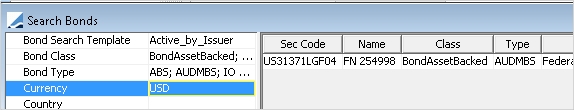

| Underlying |

Select a Bond product. Click the Arrow icon to open a "Search Bonds" window.

You can define a search for current assets. Double click the asset to load it to the Pricing Sheet. |

| Next Coupon | Displays the next coupon date. |

| Clean Price | Enter the clean price. |

| Dirty Price | Enter the dirty price. This includes the accrued interest. |

| Gross Price | Displays Clean Price * Inflation Factor when Inflation Bond is selected. |

| Yield | Enter the yield (rate of return). |

| Guarantor |

If the selected bond is associated with a legal entity of role Guarantor, it will be displayed here. Legal entities can be associated with bonds in the Legal Entities panel of the Bond Product Window. |

| Accrual | Displays the amount of interest accrued as of the settlement date. |

Fee Properties

| Property | Description |

|---|---|

| Upfront Fee |

Displays the Par Adjustment and Accrual fees. Fee information is automatically attached to the trade and can be viewed by right-clicking in the trade and clicking Trade Details > Trade Fees or Alt + F. |

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |