Capturing FX Trades

To capture an FX trade in the Pricing Sheet, select the FX strategy and set the properties as needed.

Ⓘ [NOTE: Strategy templates are not currently implemented for FX strategies]

The following categories of properties are common to all types of strategies:

| • | Trade properties |

| • | Product Amount properties |

| • | Market Data properties |

| • | Solver properties |

| • | Dealt Data properties |

| • | Keyword properties |

| • | Pricer properties |

See Strategy Properties for details.

See Strategy Properties for details.

Properties specific to FX trades are described below.

Contents

1. FX Spot Trade

The Pricing Sheet allows for non-standard settlement of spot trades. You may select the product type manually,

regardless of the Settlement Date. A validation is applied based on the setting in the Currency Defaults window,

Currency Pairs panel Max Spot Days column.

Properties

Ccy Pair - Notional - Ccy1 Amount - Ccy2 Amount - Delivery Date = "Spot Date" (default) - Settle Type = "Physical"

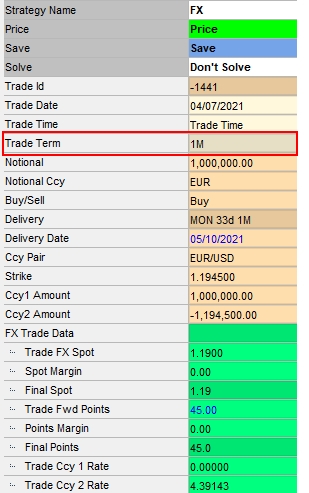

Sample FX Spot trade

"Product: Style" Properties

| Properties | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

||||||||||||

|

Constants |

Displays any value used in solving that is entered manually like Strike, etc. |

||||||||||||

|

Ccy Pair |

Displays the default currency pair if any. The default currency pair is set in Configuration > User Preferences. You can select another currency pair as needed. If a split currency is defined for the selected currency pair (through a triangulation rule), you can right-click and select Supplemental to enter the split rates as needed. You can also view the Routing information.

|

||||||||||||

|

Notional Ccy |

Select the currency of the notional. |

||||||||||||

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

||||||||||||

| Settle Type |

Select the Settle Type:

|

||||||||||||

| Location |

Select the location for commodities. |

||||||||||||

| Allocated |

Displays "Allocated" if the trade has been allocated using the Allocation process, or "Unallocated" otherwise. |

"Product: Rate" Properties

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

| Strike |

Enter the spot rate. Rounding Any system generated strike (solver, shortcut entry) will respect the currency pair rounding settings. If the user manually enters a strike, it will only be rounded based on the constraints of the currency rounding of the amounts that the strike generates. Example: Ccy1 amount is 10,000.00 and a strike is entered as 1.234567.

|

"Date" Properties

| Properties | Description |

|---|---|

| Trade FX Date |

Displays the trade date adjusted by the 5pm rule if set. |

| Trade Date |

Displays the valuation date set in the Pricing window of the pricing sheet by default. You can modify as needed.

|

| Trade Time |

Displays the valuation time set in the Pricing window of the pricing sheet. You can modify as needed.

|

|

Delivery Date |

Enter the delivery date. You can enter a relative term for the delivery, for example, “1m” for one month. The Trade Term property will be updated accordingly. |

|

Delivery |

Displays details on the delivery date. |

| Trade Term |

Displays the delivery date as a tenor. |

"Price" Properties

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Pricing Model |

Select the pricer used to price the trade. It defaults to the pricer set in the pricer configuration. You can also specify pricing parameters associated with the selected pricing model.

|

||||||

| Pricer Override |

The Pricer Override allows overriding the default pricer coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new pricer. You can select a pricer-override key provided you have created override keys in the Pricer Configuration. |

||||||

| Market Data Item Override |

The Market Data Item Override allows overriding the default market data coming from the pricer configuration in a persistent fashion. This trade will always be priced using the new market data. You can select a market data-override key provided you have created override keys in the Pricer Configuration. |

||||||

| Model Price |

Displays the theoretical price computed by the pricer. |

||||||

| Trader Price |

Displays the theoretical price computed by the pricer. You can modify its value. |

||||||

| Customer Price |

Displays the customer price such that:

|

||||||

| Sales Price |

Enter the sales price as needed. Default value is Spot Margin + Points Margin. |

"FX Trade Data" Properties

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

| Trade FX Spot |

Enter the Spot Rate of the FX trade. |

||||||

| Spot Margin |

Enter the Spot Margin. This field is disabled if Sales Person is set to NONE. |

||||||

| Final Spot |

Displays the Final Spot such that:

|

||||||

|

Location Spread |

(Precious Metal) The premium over the Loco-London spot price (i.e. Trade FX Spot) of a specific Physical form of precious metal at a particular location. This spread is always quoted in USD/oz and is used to adjust the Loco-London spot rate. You may enter an absolute value or a percentage of the Loco-London Spot for the spread. The base location for each precious metal is designated in the PreciousMetalBaseLocation.currency domain value. For example, PreciousMetalBaseLocation.XAU. You may also designate the base location from the Currency Definition window for the metal. (Configuration > Definitions > Currency Definitions). |

2. FX Forward Trade

Properties

FX Spot properties - Delivery Date = "Forward Date" - Settle Type = "Physical" - Fwd Points - FX Fwd

Sample FX Forward trade

"FX Trade Data" Properties

| Properties | Description | ||||||

|---|---|---|---|---|---|---|---|

| Trade Fwd Points | FX Forward Rate - Spot Rate. | ||||||

| Points Margin | Enter the points to apply on the margin for the trade. This field is disabled if Sales Person is set to NONE. | ||||||

| Final Points |

Displays the Final Points such that:

|

||||||

| Trade Ccy 1 Rate | Calculated from Fwd Rate. Can be manually captured to derive a missing value due to lack of liquidity in the market. | ||||||

| Trade Ccy 2 Rate | Calculated from Fwd Rate. Can be manually captured to derive a missing value due to lack of liquidity in the market. |

"Product: Style" Properties

| Properties | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Settle Type |

Select the Settle Type:

|

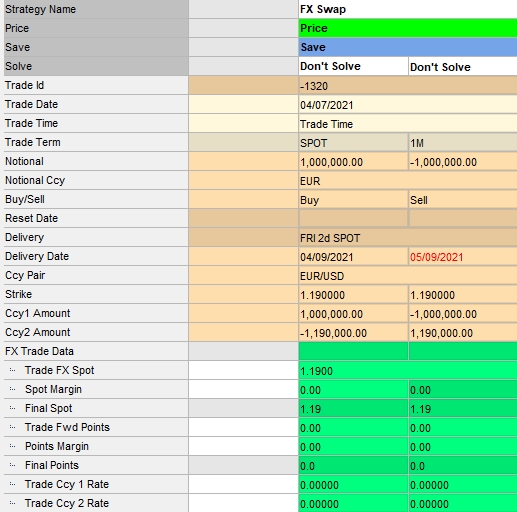

3. FX Swap Trade

Sample FX Swap trade.

"FX Trade Data" Properties

| Properties | Description |

|---|---|

| Fwd/Fwd |

Read-only combined cell for both legs of the Swap describing the forward points calculated following a change to the FX Swap Interest Rate. |

|

Swap IR |

Editable interest rate for swaps for both legs. Impacts the forward points. |

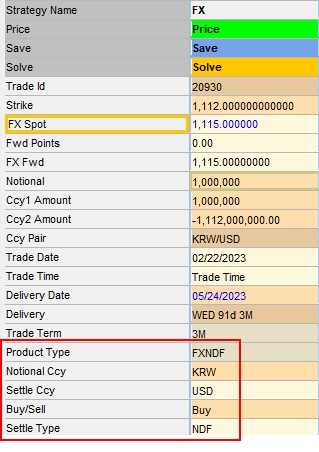

4. FX NDF Trade

Properties

FX Forward properties - Delivery Date = "Forward Date" - Settle Type = "NDF" - Settle Ccy - Settlement Source - Reset Date

Sample FX NDF trade

"Product: Style" Properties

| Properties | Description |

|---|---|

| Settle Ccy | Select the settlement currency. It should be the deliverable currency. |

| Settle Type |

Select NDF. |

"Product: Rate" Properties

| Properties | Description |

|---|---|

| Settlement Source |

Select an FX Rate Definition to fix the FX rates for cash settled trades. FX Rate Definitions are configured from the Calypso Navigator using Configuration > Foreign Exchange > FX Rate Definitions. |

| Reset Date |

Displays "Delivery Date - Number of lag days defined in the FX Rate Definition". It is based on the FX Rate Definition selected in Settlement Source. You can modify as needed. |

Rate Reset Window

To open the Rate Reset window, right click in the FX NDF deal and select "Supplemental".

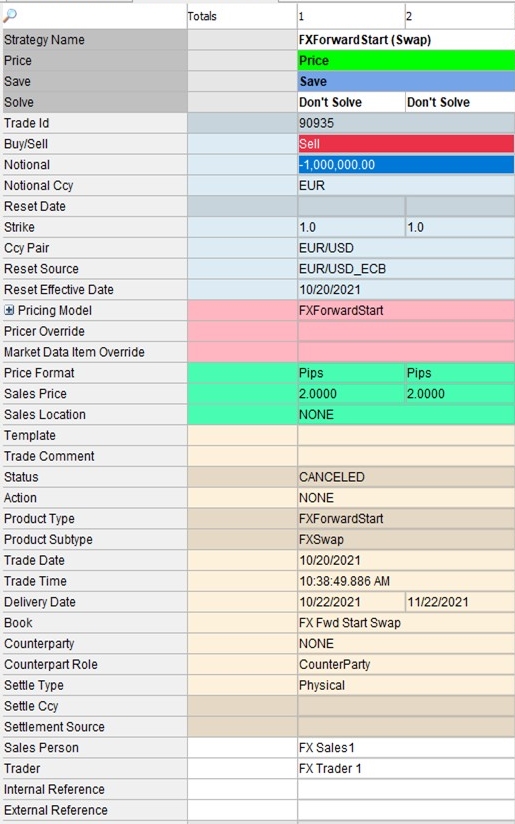

5. FX Forward Start Trade

Properties

Strategy Name is FXForwardStart (Swap) or FXForwardStart (Forward)

Sample FX Forward Start trade

"Product" Properties

| Properties | Description |

|---|---|

| Product Subtype |

The type of underlying trade that the FX Forward Start converts to on the reset date. |

"Date" Properties

| v | Description |

|---|---|

| Reset Effective Date |

The date on which the FX Forward Start trade is converted to the underlying trade type (i.e. Swap or Forward). |

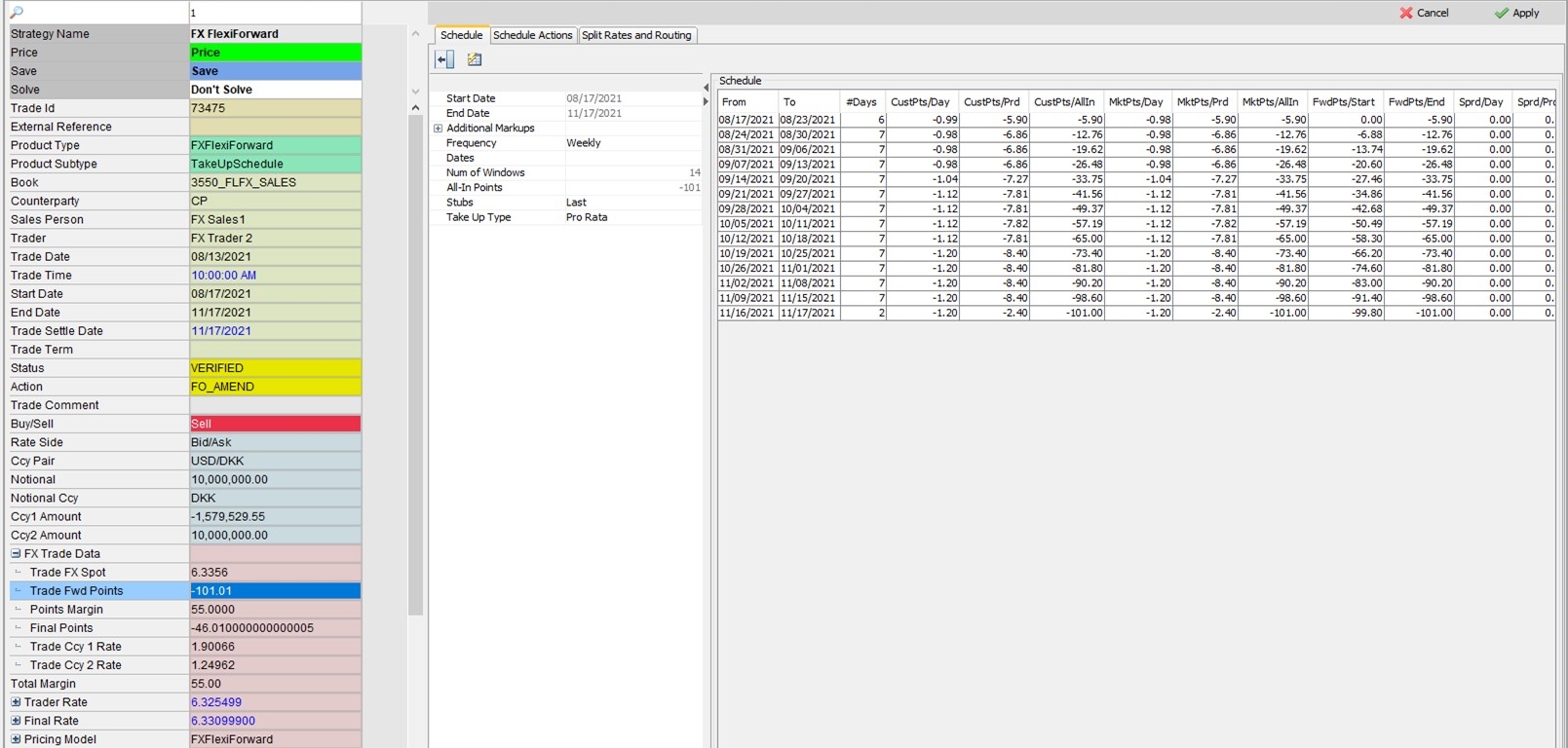

6. FX Flexi Forward Trade

Properties

Flexi Forward Take Up Schedule

To open the Schedule tab, right click in the FX Flexible Forward deal and select "Supplemental".

Double-clicking on the row of a take up opens the FX Forward trade that is generated from the take up.

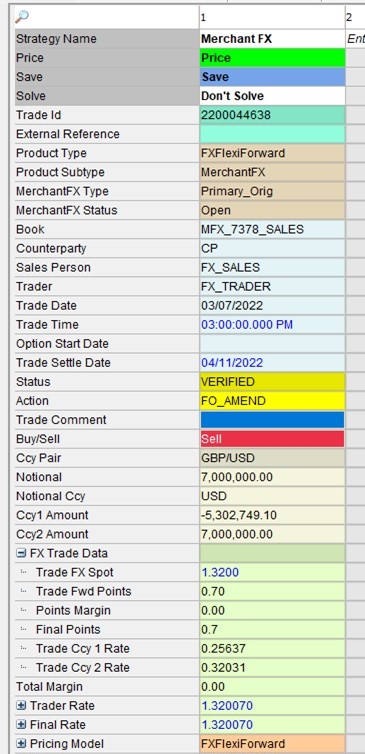

7. Merchant FX Trade

Properties

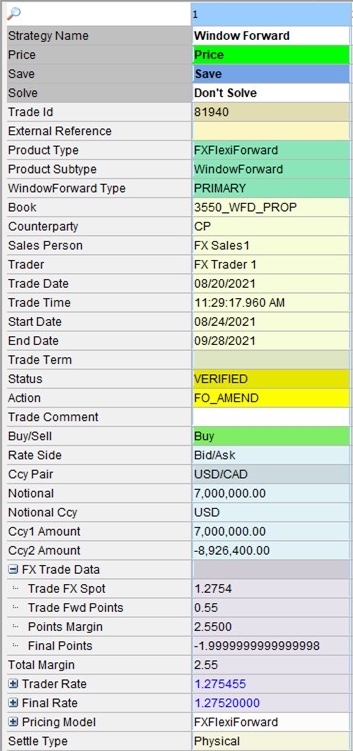

8. FX Window Forward Trade

Properties

Sample Window Forward trade

Window Forward Properties

| Properties | Description |

|---|---|

| Window Forward Type |

PRIMARY, OFFSET, or RISK. Counterparty trades are of type PRIMARY. Backout from the sales book is of type OFFSET. Forward desk trade is of type RISK. |

Right-clicking on the trade, and choosing "Supplemental" will bring up the Window Forward Actions tab (as well as the Split Rates and Routing Tab). From here, the TAKEUP action can be applied to the trade. Right click on a row in the Forward Actions tab to make the UndoTakeUp option appear.

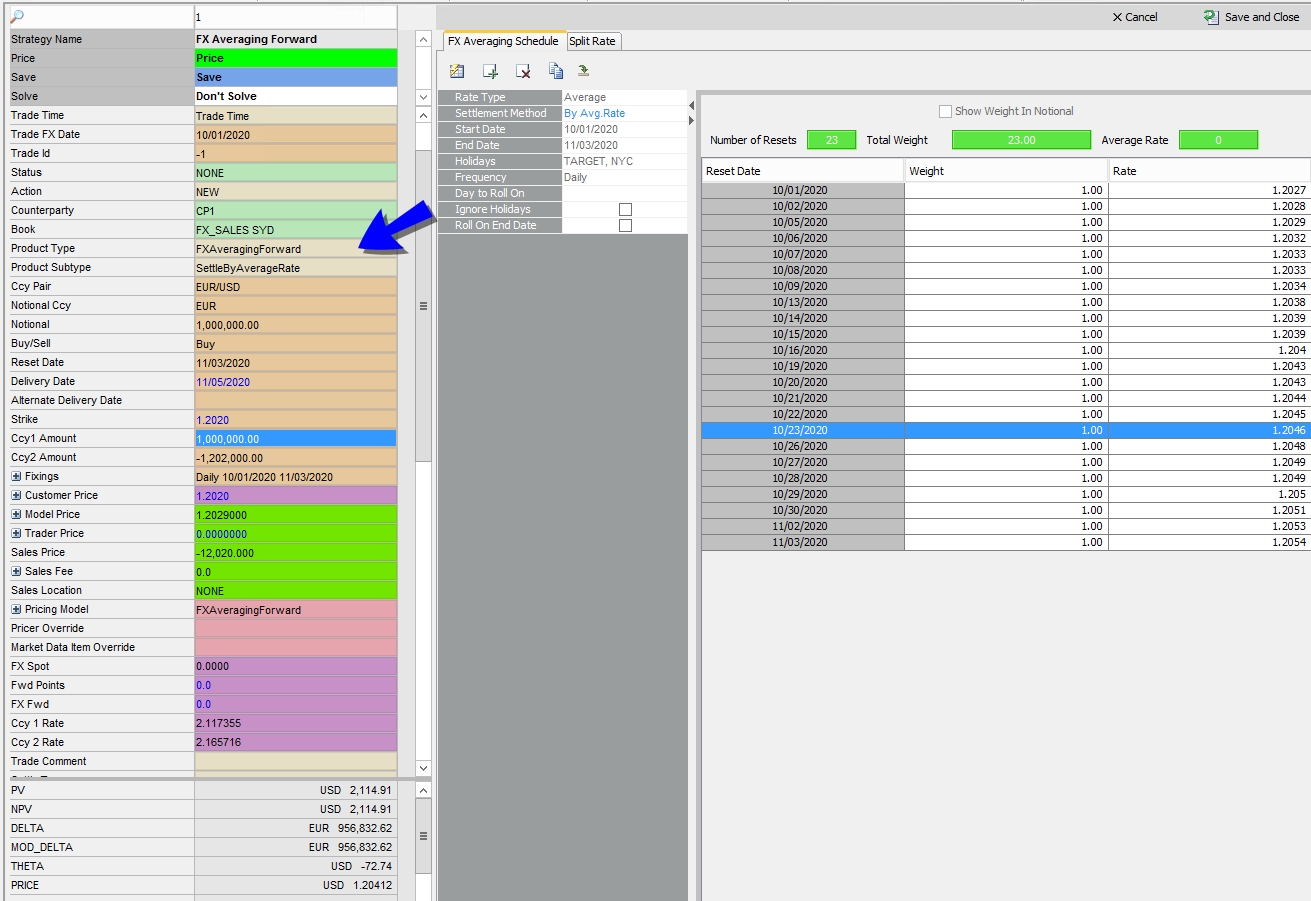

9. FX Averaging Forward Trade

Properties

FX Averaging Forward properties - Settle Type = "Cash" or "Quanto". Fixing Start -Fixing End -Fixing Frequency.

Sample FX Averaging Forward Trade

"Fixings" Properties

| Properties | Description |

|---|---|

| Fixing Start |

The start date for the rate fixing. |

|

Fixing End |

The end date for the rate fixing. |

|

Fixing Frequency |

The frequency with which rate fixings are calculated: Daily, Weekly, Monthly, Biweekly (BW), Bimonthly (BM), Semi-annually (SM). |

FX Averaging Schedule

To open the FX Averaging Schedule tab, right click in the FX Averaging Forward deal and select "Supplemental".

To change the weight for the rate of any particular reset date, double-click the cell in the weight column corresponding to that date, and enter the weight.

To add additional reset dates for a customized schedule, press ![]() , and enter the date.

, and enter the date.

To remove a reset date from the schedule, select the reset and press ![]() .

.

When you are finished, press ![]() .

.

10. Simple Transfer Trade

Properties

Buy/Sell - Notional - Notional Currency - Settle Type = "Currency"

Sample Simple Transfer trade

"Product: Style" Properties

| Properties | Description |

|---|---|

| Product Type |

Displays the product type based on the selected strategy. |

|

Notional Ccy |

Select the currency of the notional. |

|

Buy/Sell |

Select the direction of the trade: Buy or Sell. |

| Settle Type | Displays "Currency". |

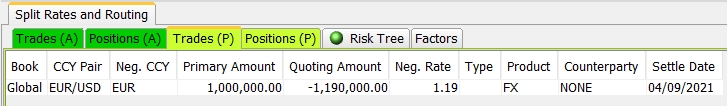

11. Split Rates and Routing

You can right-click an FX trade and choose “Supplemental” to bring up the Split Rates and Routing panel.

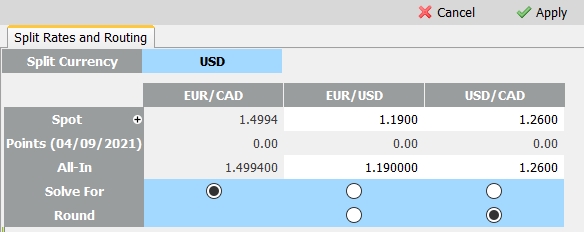

Split Rates for FX Spot, FX Forward, and FX Non-Deliverable Forward

The Split Rates panel only appears if a split currency is defined for the selected currency pair (through a triangulation rule).

Sample Split Currency

| » | Enter the rates and points as needed and click Apply to apply the rates to the trade. |

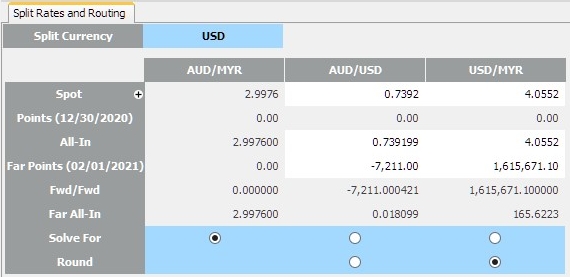

Split Rates for FX Swap, and FX Non-Deliverable Swap

The Split Rates panel only appears if a split currency is defined for the selected currency pair (through a triangulation rule).

Sample Split Currency

| » | Enter the rates and points as needed and click Apply to apply the rates to the trade. |

Routing

Please refer to FX Deal Station documentation for details on the Routing panel.

Please refer to FX Deal Station documentation for details on the Routing panel.

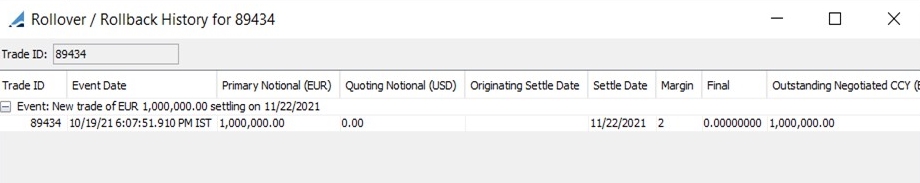

12. Rollover / Rollback History

The rollover and rollback history for any booked FX trade can be viewed by navigating to Processing > Rollover/Rollback History.

See also

| • | Out-of-the-box Strategies |

| • | Using the Pricing Sheet |

| • | Capturing Trades |

| • | Solving Functions |