Collateral Pricing

Ⓘ [NOTE: Collateral pricing is currently only supported for Interest Rate Derivatives trades, Equity Derivatives trades, Commodity Swaps, Commodity OTC Options]

Collateral pricing is the ability to select the discount curve based on the collateral agreement's collateral policy instead of the trade currency.

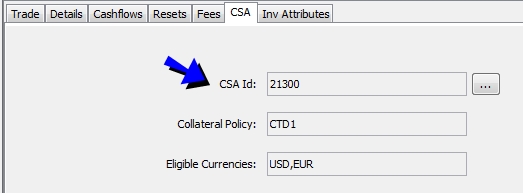

This necessitates the definition of a collateral agreement between the counterparty and the processing organization, and additional settings. The CSA panel in the Trade window will show the collateral agreement if any, and the collateral policy that will be used to select the discount curve.

Ⓘ [NOTE: There can be only one collateral agreement per trade]

Before you Begin

Collateral pricing is enabled if the pricing parameter COLLATERALIZED_PRICING is set to On. You can set the pricing parameter by product type.

For Equity Derivatives, the CSA panel is not displayed by default.

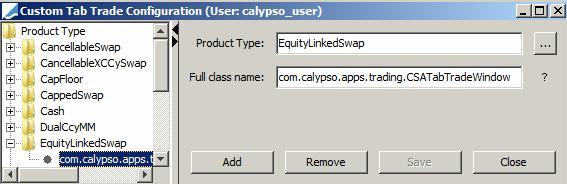

You need to add the CSA panel to the Equity Derivatives trade windows from the Calypso Navigator using Configuration > System > CustomTabWindow.

| » | Select a product type, and set the class name to “com.calypso.apps.trading.CSATabTradeWindow”. |

The margin call contract associated with the trade is saved in trade keyword MARGIN_CALL_CONFIG_ID, provided you add the workflow rule UpdateCSA to the Trade workflow (transition NONE – NEW – PENDING for example).

For existing trades, you need to run Process Trade to update this trade keyword and set the workflow rule on transition VERIFIED – UPDATE – VERIFIED for example.

Contents

- Collateral Agreement Definition

- Collateral Policy Defaults for Swaption Trades

1. Collateral Agreement Definition

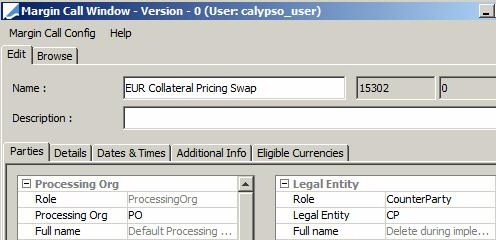

From the Calypso Navigator, navigate to Configuration > Fees, Haircuts, & Margin Calls > Margin Call to define a collateral agreement.

Sample Agreement

The following fields are mandatory.

| • | In the Parties panel, select the processing organization and the counterparty. |

| • | In the Details panel, select the product types to which this agreement applies, and set the start date. |

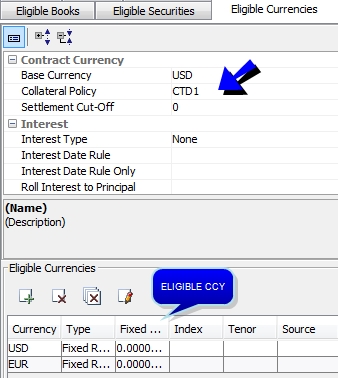

| • | In the Eligible Currencies panel, set the Collateral Policy. It will be used to select the discount curve. Then set at least one eligible currency. |

Collateral policies are defined in the domain "CollateralPolicy".

2. Pricer Configuration

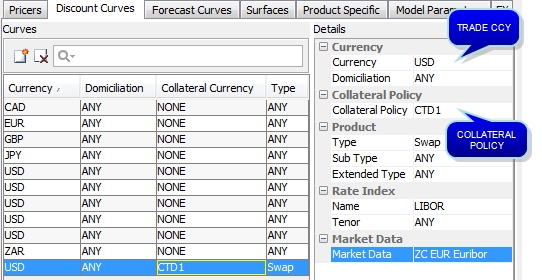

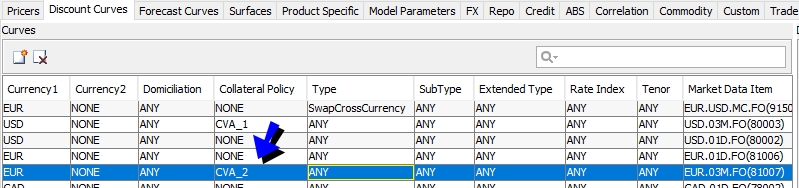

In the Pricer Configuration, you need to indicate which curve to select based on the collateral policy.

Load your pricing environment, and select the Discount Curves panel.

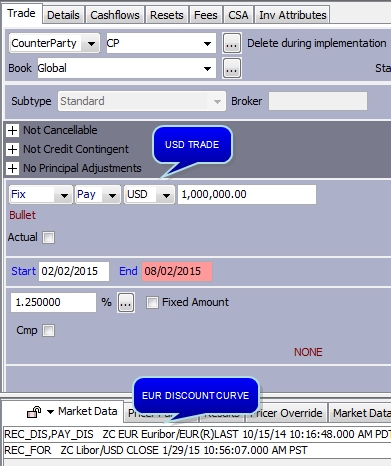

In this example, USD trades with a CTD1 collateral policy use a EUR discount curve.

You can also use a blended curve created using the curve generator "CTDCollateral". It allows building the cheapest-to-deliver collateral curve by blending up to three collateral discount curves.

Please refer to Calypso Zero Curve documentation for details on creating blended curves.

Please refer to Calypso Zero Curve documentation for details on creating blended curves.

Sample pricer configuration

| » | Select the trade currency and the collateral policy. |

| » | Select an Interest Rate Derivatives or Equity Derivatives product type. |

| » | Then select the curve corresponding to the collateral policy. |

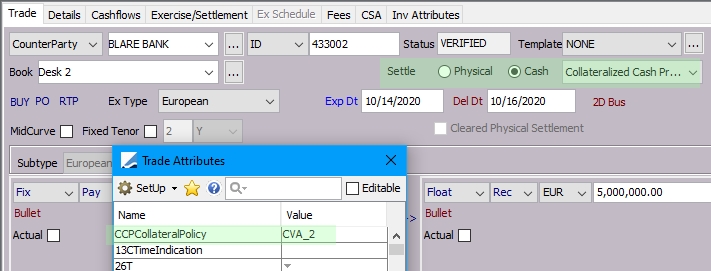

3. CSA Panel

Enter a USD trade between the processing organization and the counterparty for which you have defined the agreement, then select the CSA panel.

It displays the corresponding agreement and collateral policy.

| » | You can click ... to view the agreement details. |

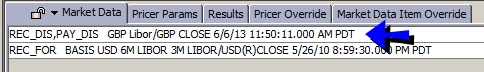

The discount curve is selected based on the collateral currency.

4. Collateral Policy Override

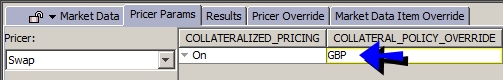

You can override the collateral policy at the trade level using the pricing parameter COLLATERAL_POLICY_OVERRIDE.

| » | You can enter a different collateral policy in the pricing parameter COLLATERAL_POLICY_OVERRIDE. |

| » | When you price the trade, the discount curve will now be selected based on this collateral policy, provided there is a curve defined in the pricer configuration for the trade currency and the selected collateral currency. |

5. Collateral Policy Defaults for Swaption Trades

For Swaptions that settle as "Cleared Physical Settlement" or "Collateralized Cash Price," you can define a single default collateral policy to select the discount curve, or multiple defaults distinguished by currency.

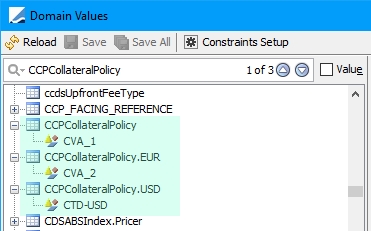

Normally, for Swaptions that settle in one of the above two conditions, the trade attribute CCPCollateralPolicy is populated with the currency code for the underlying Swap. However, you can define domains that override this process and automatically specify a particular collateral policy and associated discount curve configured together in the pricing environment. The following shows the primary domain for specifying a default collateral policy and examples of other domains defined by currency with their sample values.

| • | CCPCollateralPrice - When configured, this domain overrides the CCPCollateralPolicy trade attribute and replaces the default currency code for the underlying Swap with a preferred collateral policy. Example (domain name = domain value): CCPCollateralPolicy = CVA_1 |

| • | CCPCollateralPrice.EUR - When configured, the domain overrides the CCPCollateralPolicy trade attribute with a domain value based on the currency code EUR. Example: CCPCollateralPolicy.EUR = CVA_2 |

| • | CCPCollateralPrice.USD - When configured, the domain overrides the CCPCollateralPolicy trade attribute with a domain value based on the currency code USD. Example: CCPCollateralPolicy.USD = CTD-USD |

Example of domains configured with values

For details on defining domains, see Defining Domain Data.

For details on defining domains, see Defining Domain Data.

The preferred discount curve associated with the collateral policy is configured in the Pricer Configuration Window.

For details on using the Pricer Configuration Window, see Pricing Environment.

For details on using the Pricer Configuration Window, see Pricing Environment.

When the type of settlement for the Swaption is specified as either "Cleared Physical Settlement" or "Collateralized Cash Price," the trade attribute CCPCollateralPolicy is populated with the policy defined by the domain.

The preferred discount curve associated with the collateral policy is then included in the trade's market data.

Hierarchy for Domain Values

When domains are defined and the COLLATERALIZED_PRICING pricing parameter is set to “On,” the system will perform the following flow of events to set the collateral policy.

1. Identify the underlying swap currency (e.g., EUR).

2. Look for a domain that specifies the currency (CCPCollateralPolicy.EUR). If one exists with a value, the trade attribute CCPCollateralPolicy is set with this value. If one doesn’t exist …

3. Look for the primary domain CCPCollateralPolicy. If it exists with a value, the trade attribute CCPCollateralPolicy is set with this value. If one doesn’t exist …

4. Set the trade attribute with the currency identified in step 1.