Curve Underlying Overview

Underlying instruments can be used to build curves.

You can set up underlying instruments before creating a curve using Configuration > Market Data > Curve Underlyings from the Calypso Navigator, or while you are creating a curve. When you save an underlying instrument, the system automatically creates a quote name for that instrument so that you can set quotes.

Using Underlying Instruments

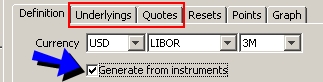

To use underlying instruments for building curves, check “Generate from instruments” in the curve window definition. The curve window then displays the Underlying panel where you can select the underlying instruments, and the Quotes panel where you can set / load quotes for the underlying instruments. This is described in details for each type of curve.

Tenors for Underlying Instruments

Tenors for underlying instruments can be added to the "tenor" domain using Configuration > System > Domain Values from the Calypso Navigator.

Contents

Basis Two Swap - Curve Underlying

Bond Future - Curve Underlying

Cash (Money Market) - Curve Underlying

Commodity Forward - Curve Underlying

Commodity Forward Points - Curve Underlying

Commodity Spot - Curve Underlying

Commodity Swap - Curve Underlying

Equity Index - Curve Underlying

Exchange Traded Option (ETO) - Curve Underlying

Forward Rate Agreement (FRA) - Curve Underlying

MM Future - Structured Flows Future - Curve Underlying

Future Commodity - Curve Underlying

Future Equity Index - Curve Underlying

FX Forward Fixed - Curve Underlying

FX Forward Tenor and Contango - Curve Underlying

Generic CDS - Curve Underlying

Inflation Spread (Instrument Spread) - Curve Underlying