CDS - Curve Underlying

Before you begin

| • | Create issuers using Configuration > Legal Data > Entities from the Calypso Navigator. |

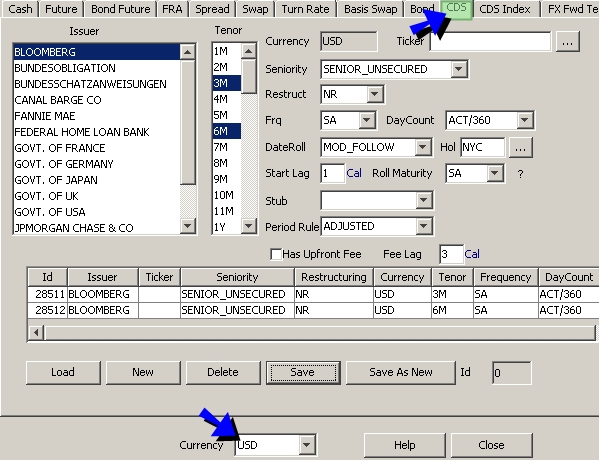

Creating a CDS Underlying

Create an underlying representing a Credit Default Swap for an issuer and different tenors. The quotes are the market spreads for each tenor.

| » | Select a currency at the bottom of the window. |

You can click Load to load any existing underlying.

| » | Click New to create a new underlying. |

Complete the fields described below.

| » | Click Save to save the underlying. It is given a unique ID by the system, and is displayed in the table. |

The system creates quote names like "CDS.<Currency>.<Issue>.<Seniority>/<Tenor>/<Restructuring type>", and if "Has Upfront Fee" is checked additional quote names like "CDS.<Currency>.<Issue>.<Seniority>/<Tenor>/<Restructuring type>/FEE".

Example "CDS.USD.BLOOMBERG.SENIOR_UNSECURED/3M/NR".

Fields Details

| Fields | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Issuer |

Select the issuer. |

||||||||||||||||||||||||

|

Tenor |

Select one or multiple tenors. |

||||||||||||||||||||||||

|

Currency |

Displays the currency selected at the bottom of the window. |

||||||||||||||||||||||||

|

Ticker |

Optional. Click ... to select a ticker. A ticker is a combination of currency, issuer, seniority, and reference obligation used as selection criteria – You can create tickers from the Probability Curve window, or Credit Market Data window. |

||||||||||||||||||||||||

|

Seniority |

Select the seniority. |

||||||||||||||||||||||||

|

Restruct |

Select the restructuring type:

|

||||||||||||||||||||||||

|

Frq |

Select the frequency. |

||||||||||||||||||||||||

|

DayCount |

Select the day count convention. |

||||||||||||||||||||||||

|

DateRoll |

Select the date roll convention. |

||||||||||||||||||||||||

|

Hol |

Select the holiday calendar to define the business days. |

||||||||||||||||||||||||

|

Start Lag |

Define the start offset in business or calendar days. |

||||||||||||||||||||||||

|

Roll Maturity |

Roll the maturity to the 20th of the month, quarterly, or semi-annual months. |

||||||||||||||||||||||||

|

Stub |

Select the rule to apply in case of a stub period:

|

||||||||||||||||||||||||

|

Period Rule |

Select the period rule:

|

||||||||||||||||||||||||

|

Has Upfront Fee |

If you check “Has Upfront Fee,” you can enter two quotes for the curve underlying, the spread plus a fee. The second quote appears when you select the curve underlying in the curve application. Note that the second quote is currently not used by our generator. |

||||||||||||||||||||||||

|

Fee Lag |

You can enter a number of days lag for the upfront fee, and select whether the lag is business days or calendar days. |

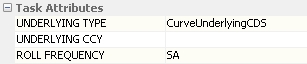

Scheduled Task for Updating Roll Maturity

The scheduled task UPDATE_CURVE_UNDERLYING can be used for bulk updating the roll maturity of CDS curve underlyings and regenerating the curves.

Task Attributes

| • | UNDERLYING TYPE – Select the underlying type: CDS, Generic CDS, or Fixed Coupon CDS. |

| • | UNDERLYING CCY – Select a currency as needed to be updated, or leave blank to update all. |

| • | ROLL FREQUENCY – Select the roll frequency: SA or QTR. |