Bond - Curve Underlying

You can create bond underlyings from specific bond products, from benchmarks, or from benchmark indices.

Before you begin

| • | Create bond products using Configuration > Fixed Income > Bond Product Definition from the Calypso Navigator. |

| • | Create benchmarks using Configuration > Fixed Income > Benchmark Management from the Calypso Navigator - You can create bond benchmarks, bond future benchmarks, and CDS index benchmarks. |

Previously created underlyings can be loaded using the Load button. You can use the Currency drop down menu at the bottom of the window to filter results by currency type.

1. Creating a Specific Bond Underlying

You can select a specific bond as the underlying instrument.

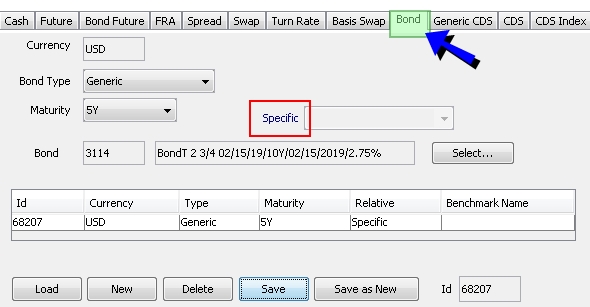

Bond Curve Underlying Window - Specific bond

| » | Click New to create a new underlying. |

Select the bond type and maturity.

Make sure that the Specific label is displayed.

Click Select to select a specific bond.

| » | Click Save to save the underlying. It is given a unique ID by the system, and is displayed in the table. |

The system creates quote names like "Bond.<Bond description>.<Bond maturity date>.<Coupon rate>".

Example "Bond.FHLB 4 3/4 04/08/19.04-08-2019.4.75000".

2. Creating a Benchmark Underlying

You can select a benchmark as the underlying instrument. The benchmark is quoted as a spread over the benchmark product (Bond, Bond Future, or CDS Index).

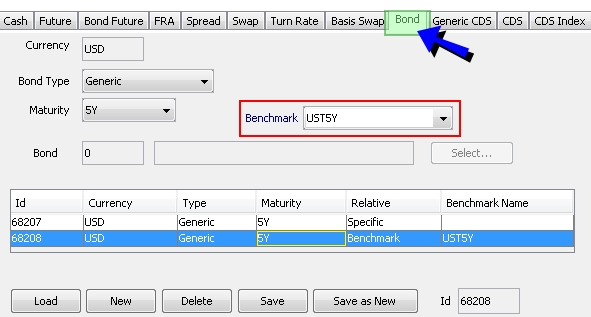

Bond Curve Underlying Window - Benchmark bond

| » | Click New to create a new curve underlying. |

Select the bond type and maturity.

Click the "Specific" label to toggle to "Benchmark", and select a benchmark from the Benchmark field.

| » | Click Save to create the curve underlying. It appears in the table. |

The system creates quote names like "Bond.<Benchmark name>".

Example for the underlying created above "Bond.UST5Y".

3. Creating a Benchmark Index Underlying

You can select a benchmark index as the underlying instrument. The benchmark index is quoted as a yield. It can be retrieved directly from Bloomberg.

This can be used to build real-time par yield curves.

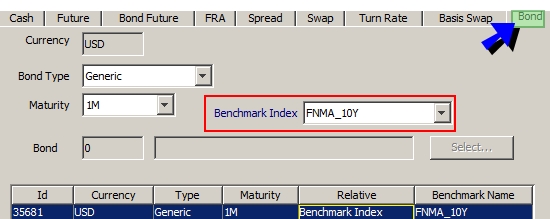

Bond Curve Underlying Window - Benchmark index

| » | Click New to create a new curve underlying. |

Select the bond type and maturity.

Click the "Specific" label to toggle to "Benchmark Index", and select a benchmark index from the Benchmark field.

The benchmark index should be created with no tenor, off a generic bond quoted in Yield.

| » | Click Save to create the curve underlying. It appears in the table. |

Repeat for each maturity and click Save as New.

The system creates quote names like "Bond.<Benchmark name>.<Maturity>".

Example for the underlying created above "Bond.FNMA_10Y.1M".