Spread - Curve Underlying

Spreads are used as underlying instruments for generating interest rate curves.

| » | You can click Load to load any existing underlying. |

| » | Click New to create a new underlying, and select the instrument type: Bond, BondEFP, Swap, FRA, or MoneyMarket. |

Enter a name to identify the spread, and select the reference instrument as described below.

| » | Click Save to save the underlying. It is given a unique ID by the system, and is displayed in the table. |

The system creates quote names like "Spread.<Spread maturity>/<Reference instrument maturity>/<Interpolated instrument maturity>" for bond, and "Spread.<Instrument type>.<Spread name>" for Swap, FRA and MoneyMarket.

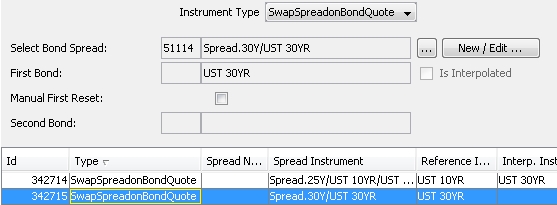

Swap Spread on Bond Quote

The Swap Spread on Bond Quote product references the underlying bond quote.

| » | Select the SwapSpreadonBondQuote product. |

You can create bond spread products using Configuration > Fixed Income > Spread from the Calypso Navigator, or click New/Edit.

If you select a bond spread created from two bonds with an interpolated interest rate, then the curve underlying window displays the bond spread, reference bond, and interpolated bond details.

You can check "Manual First Reset" to apply a first reset manually. The system will request a first reset quote for the rate (a cash quote) in the form "MM.Currency.Rate index.Tenor.Source", for example "MM.USD.LIBOR.3M.LIBOR01".

Sample spread / bond quote name: "Spread.27M/03-15-2012".

Swap Spread on Bond Curve

The Swap Spread on Bond Curve product references the Bond Benchmark Curve to calculate the bond yields. To make this product available for underlyings in the curve window, you first need to add the Bond Benchmark Curve on the Definition panel for either CurveZero or CurveBasis, or the Curve Dependencies tab for the Multicurve Package.

| » | Select the SwapSpreadonBondCurve product. |

You can create bond spread products using Configuration > Fixed Income > Spread from the Calypso Navigator, or click New/Edit.

If you select a bond spread created from two bonds with an interpolated interest rate, then the curve underlying window displays the bond spread, reference bond, and interpolated bond details.

You can check "Manual First Reset" to apply a first reset manually. The system will request a first reset quote for the rate (a cash quote) in the form "MM.Currency.Rate index.Tenor.Source", for example "MM.USD.LIBOR.3M.LIBOR01".

Sample swap spread quote name: "SwapSpread.10Y.USD.LIBOR.3M/UST CT10".

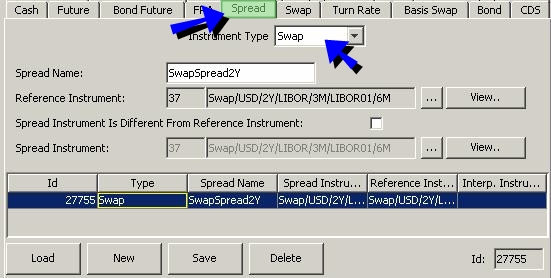

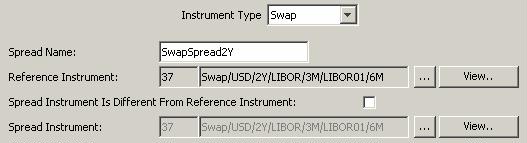

Swap (SpreadOnSwap), FRA (SpreadOnFRA), MoneyMarket (SpreadOnMoneyMarket)

| » | You can select a reference instrument, and the spread will be over that instrument. You can enter a spread over the instrument's quote. |

| » | If you check "Spread Instrument Is Different From Reference Instrument", you can select a spread instrument. The spread is interpolated between the spread instrument and the reference instruments. |

Sample spread / swap quote name "Spread.Swap.SwapSpread2Y".

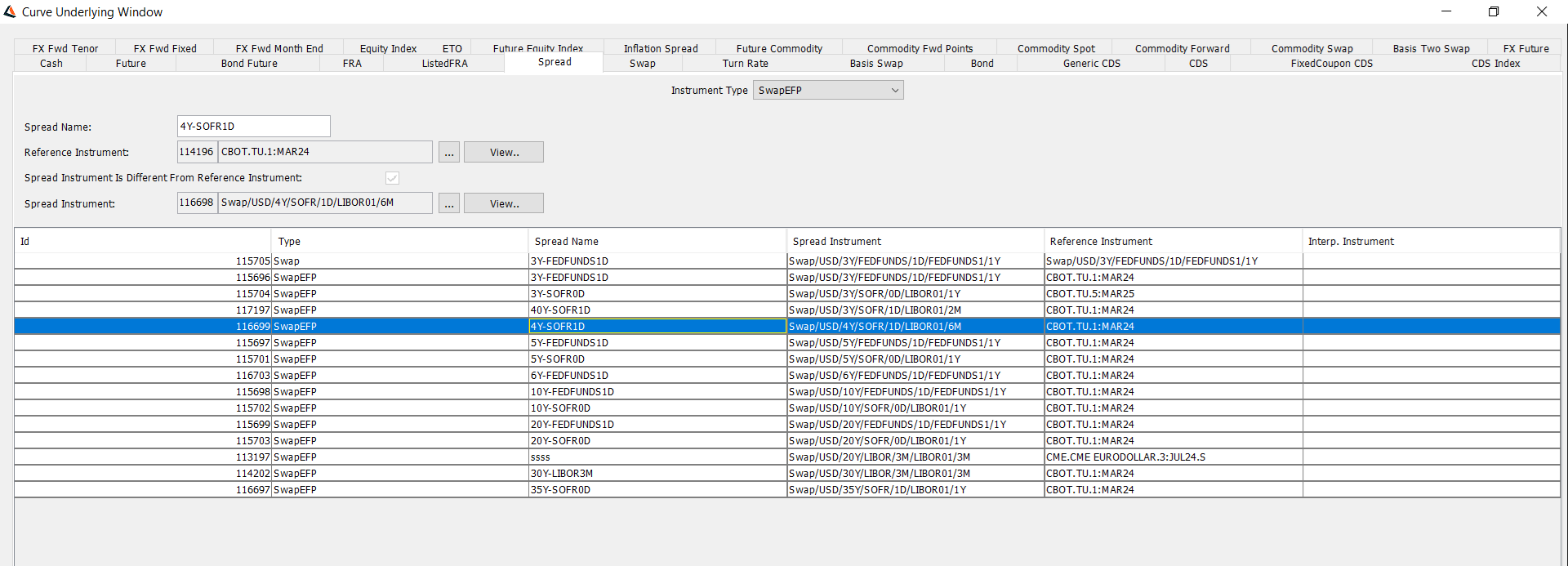

SwapEFP / Bond EFP Curve Underlyings

You can quote swap and bond prices on an EFP (Exchange of Futures for Physical) basis where a swap / bond is quoted as a spread to the relevant future price.

Specification:

Create a new Spread Instrument Type – SwapEFP or BondEFP – on the Spread tab of the Curve Underlying Window.

The new SwapEFP / BondEFP CU will work similarly to the other spread CU’s.

| • | Spread Name: Allow users to input a name for the Spread part of the Quote Name. See below for full Quote Name logic. |

| • | Reference Instrument: Allow users to choose an existing Future Curve Underlying. |

| • | Spread Instrument: Allow users to select an existing Swap / Bond Curve Underlying that represents the Swap / Bond being priced by the bootstrapper based on a spread quote. |

| • | Spread Instrument Is Different From Reference Instrument: This property can be hidden, or set to true and disabled. |

Quote Name Format

The Quote Name for the curve underlying will be as follows:

SwapEFP.[Spread Name].ContractName.[Expiry-same format as Future Product in use]

BondEFP.[Spread Name].ContractName.[Expiry-same format as Future Product in use]

Example:

Spread Name = 1Y-BBSW3M (configured and defined by user)

Reference Future Quote Name = BondFuture.3Y T Bond.03-15-2024

SwapEFP Quote Name = SwapEFP.1Y-BBSW3M.3Y T Bond.03-15-2024