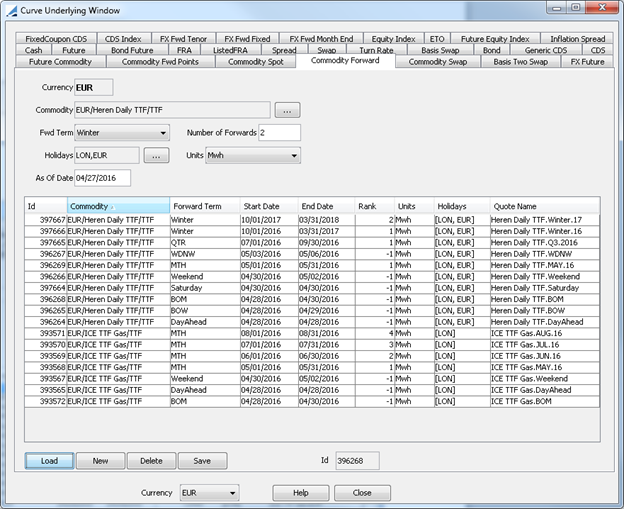

Commodity Forwrd - Curve Underlying

The Commodity Forward curve underlying is used primarily for natural gas markets. In the European natural gas markets, future contract prices are quoted in pence per therm, and EUR per MWh. The flow of natural gas is assumed to be continuous throughout the delivery period, the prices are average prices for the number of days or hours in the delivery period.

For example, if the current month is June and the forward price for next month's delivery is 44 p/therm, then the average of teh prices for each delivery day in July is 44 p/therm. If the forward price for the next quarter delivery is 47 p/therm, it cannot be said that the price for July, August and September are all 47 p/therm because it is known that the July delivery price is 44 p/therm.

The curve underlying allows the user to capture named periods or forward terms. The supported forward terms are:

| WithinDay | Single Day: current day |

Daily Points |

|

DayAhead (DAH) |

Single Day: next business day |

Daily Points |

|

BOW |

Range: DayAhead to last business day of the week into which DayAhead falls |

Daily Points |

|

Saturday |

Single Day: Saturday after the current day |

Daily Points |

|

Sunday |

Single Day: Sunday after the current day |

Daily Points |

|

Weekend (WE) |

Range: Saturday to Sunday |

Daily Points |

|

Week +1 (WDNW) |

Range: Monday after the current day to the Friday of the same week (excluding holidays) |

Daily Points |

|

Balance of Month (BOM) |

Range: DayAhead to last delivery day of the month in which DayAhead falls |

Daily Points |

|

Calendar Month (MTH) |

The first full month after the current day + user specified number of months |

First and last of month |

|

Calendar Quarters (QTR) |

The first full quarter after the current day + user specified number of quarters |

First and last of each month |

|

Calendar Year (YEAR) |

The first full year after the current day + user specified number of years |

First and last of each month |

|

Winter |

The first full winter gas season (October - March) after the current day + user specified number of winter gas seasons |

First and last of each month |

|

Summer |

The first full summer gas season ( April - September) after the current day + user specified number of summer gas seasons |

First and last of each month |

|

Gas Year |

The first full gas year after the current day + user specified number of gas years |

First and last of each month |

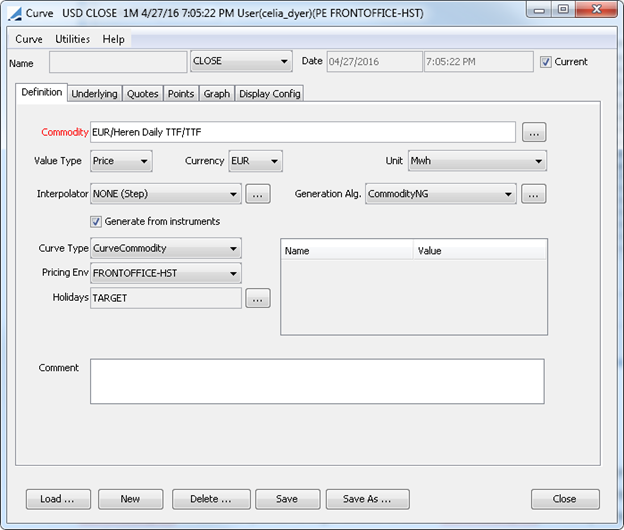

The only curve type that can use the Commodity Forward curve underlying is the Commodity Forward curve. The Commodity forward can only use these curve underlyings when the generator is set to CommodityNG. Additionally, when the generator is set to CommodityNG, the only curve underlyings available are Commodity Forward.

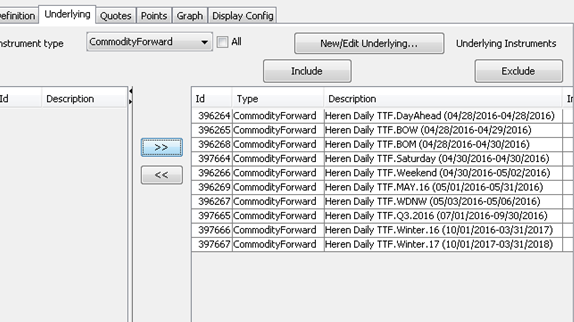

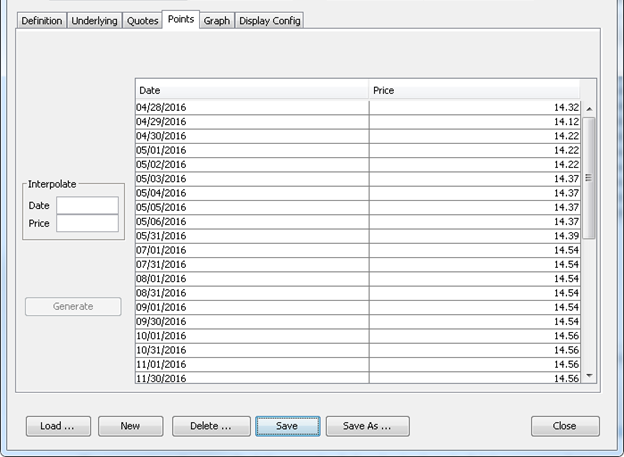

Once the underlyings are selected for the curve, the date range represented by each forward term is displayed relative to the curve date.

| » | For any forward terms indicated as having daily points (as seen above), a point will be generated for each day. Days will not be repeated. |

| » | For any forward terms not having daily points, a point will be generated for the first and last calendar day of each month. Months will not be repeated. |

| » | Once the points are generated, there can be no gaps in the date ranges or else the point prices will not be calculated. |

| » | The price for each day will be calculated by first seeing if the day corresponds to a forward term with a single day. The price of the quote will be used for that day. |

| » | Depending on the curve date, there can be situations where BOW and /or BOM is a single day. In this case, they could also be equal to DayAhead. When this is the case, the market quotes the same price. However, the curve generator will choose to ignore all but one of these prices. |

| » | If a Saturday, Sunday and Weekend price are provided, the weekend price will not be used. If a Weekend price is provided and no Saturday or Sunday prices, then the Weekend p rice is used for both Saturday and Sunday. If a Saturday and Weekend price are provided, but no Sunday, then the Sunday price is calculated as 2 × Weekend price – Saturday price. |

| » | If prices are provided for DayAhead, BOW, Weekend and BOM and the date ranges for these forward terms are all different, the DayAhead and Weekend points can use the provided prices directly. The BOW points will overlap with the DayAhead by one day, so the remaining BOW points will be calculated such that the average of the BOW days will equal the provided BOW price. Then, the BOM point can be calculated by taking into account all the points prices already calculated, and ensuring that the average of the BOM days will equal the provided BOM price. |

| » | The rest of the curve will be calculated in a similar way, except now prices can be considered for an entire month instead of at the daily level. First month prices will be generated, then quarter, then seasons and finally, years. |