Basis Swap - Curve Underlying

Before you begin

| • | Create rate indices using Configuration > Interest Rates > Rate Index Definitions from the Calypso Navigator. |

Creating a Basis Swap Underlying

The basis swap underlying has two floating sides, and can be cross currency.

| » | Select a currency at the bottom of the window. |

You can click Load to load any existing underlying.

| » | Click New to create a new underlying. |

Complete the fields described below.

| » | Click Save to save the underlying. It is given a unique ID by the system, and is displayed in the table. |

The system creates quote names like: "Swap.<Currency>.<Maturity>.<Base rate index>.<Base tenor>/<Basis rate index>.<Basis tenor>.<Basis source>".

Example "Swap.USD.1Y.LIBOR.3M/LIBOR.6M.LIBOR01".

Fields Details

| Fields | Description |

|---|---|

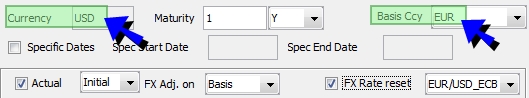

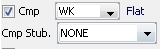

|

Currency |

Base currency selected at the bottom of the window. |

|

Maturity |

Enter the maturity of the swap: number of Days, Weeks, Months, or Years. |

|

Basis Ccy |

Select the basis currency. Modifying this to a different currency will prompt you to enter FX information. |

| Specific Dates |

When checked, you can specify a specific start data and a specific end date in the adjacent fields. |

| Actual |

Check to indicate that there is an actual principal exchange. Then select which principal is exchanged from the adjacent field: Initial, Final, Initial and Final. |

|

FX Adj. on FX Rate reset |

Only used if Basis Ccy is different from default currency.

Select the leg for FX adjustment: "Base" or "Basis". You can select and FX Rate Reset to set the FX rate. |

|

Quote Type Spread / Factor / Inflation Real Rate |

You can choose the quote type: "Spread", "Factor" or "Inflation Real Rate", and the leg to which it applies "Basis" or "Base". If you select Spread, the underlying will be quoted using a spread quote. If you select Factor, the underlying will be using a factor quote. If you select Inflation Real Rate, the underlying will be using the fixed real rate on the inflation leg. For a spread quote, if you select Basis, the spread will be added to the Basis leg, and if you select Base, the spread will be added to the Base leg. It will be multiplicative instead if you check "Multiplicative Spread". For a factor quote, if you select Basis, the factor will multiply the basis leg, and if you select Base, the factor will multiply the base leg. |

Base Side

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Index |

Select the rate index, tenor and source. | ||||||||||||

|

Cmp |

Check for compounding interest.

You can select the compounding frequency and stub method. Double click on the blue text to select 'Flat', 'Spread' (and enter a spread) or 'Simple'. |

||||||||||||

|

Manual 1st Reset |

Check to indicate that the first reset is manual. |

||||||||||||

|

DateRoll |

Select the date roll convention - From the Calypso Navigator, navigate to Help > Date Roll Conventions for details. | ||||||||||||

|

Holidays |

Select the holiday calendars. | ||||||||||||

|

Freq |

Select the payment frequency. | ||||||||||||

| Disc. | Select a discount. | ||||||||||||

|

Rule |

Select the accrual period adjustment rule on non-business days. | ||||||||||||

|

Daycount |

Displays the daycount convention from the rate index definition. | ||||||||||||

| Stub | Select a stub period as needed. | ||||||||||||

| Reset Timing |

Select the reset timing: beginning of the period, or end of the period. |

||||||||||||

|

Averaging Reset Avg Freq. Day of Sampling |

Check "Averaging Reset" if the rate resets more frequently than the swap. In this case, you need to select the averaging frequency, and day of sampling if needed. You can also select the type of average by toggling the red label:

|

Basis Side

| Fields | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Index |

Select the rate index, tenor and source. | ||||||||||||

|

Cmp |

Check for compounding interest.

You can select the compounding frequency and stub method. Double click on the blue text to select 'Flat', 'Spread' (and enter a spread) or 'Simple'. |

||||||||||||

|

Manual 1st Reset |

Check to indicate that the first rest is manual. |

||||||||||||

|

DateRoll |

Select the date roll convention. | ||||||||||||

|

Holidays |

Select the holiday calendars. | ||||||||||||

|

Freq |

Select the payment frequency. | ||||||||||||

| Disc. | Select EXP if the swap should have exponential interest, or NONE otherwise. | ||||||||||||

|

Rule |

Select the accrual period adjustment rule on non-business days. | ||||||||||||

|

Daycount |

Displays the daycount convention from the rate index definition. |

||||||||||||

| Stub | Select a stub period if needed.. | ||||||||||||

| Reset Timing | Select the reset timing: beginning of the period, or end of the period. | ||||||||||||

|

Averaging Reset Avg Freq. Day of Sampling |

Check "Averaging Reset" if the rate resets more frequently than the swap. In this case, you need to select the averaging frequency, and day of sampling if needed. You can also select the type of average by toggling the red label:

|

||||||||||||

| Inflation Indexed |

This only applies when the rate index is an inflation index. It drives the calculation type for applying a change in inflation to the cashflows.

[Final Level / Initial Level]

[(Final Level / Initial Level) - 1] |

Start Lag

| Fields | Description |

|---|---|

|

Start Lag |

You can check Start Lag to define a start lag. Double-click the NONE label to define the start lag details (number of lag days, Cal for calendar days or Bus for business days), holiday calendar. |