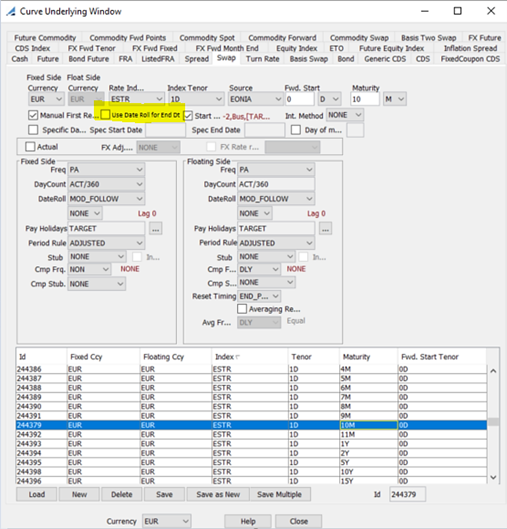

Swap - Curve Underlying

Before you begin

| • | Create rate indices using Configuration > Interest Rates > Rate Index Definitions from the Calypso Navigator. |

Creating a Swap Underlying

The swap underlying has a fixed side and a floating side, and can be cross currency.

| » | Select a currency at the bottom of the window. |

You can click Load to load any existing underlying.

| » | Click New to create a new underlying. |

Complete the fields described below.

| » | Click Save to save the underlying. It is given a unique ID by the system, and is displayed in the table. |

The system creates quote names like: "Swap.<Maturity>.<Currency>.<Rate index>.<Tenor>/<Fixed side frequency>.<Source>".

Example "Swap.2Y.USD.LIBOR.3M/6M.LIBOR01".

Fields Details

|

Fields |

Description |

|---|---|

|

Fixed Side Currency |

Select a currency for the fixed side. |

| Floating side Currency | Currency of the floating side selected at the bottom of the window. |

|

Rate Index |

Select the rate index. |

|

Index Tenor |

Select the index tenor. |

|

Source |

Select the quoting source of the index. |

| Fwd. Start |

Enter a tenor when creating a Forward Start Swap underlying. The selection for Fwd. Start indicates when the Swap starts. The Maturity setting (immediately below) indicates how long after the start the Swap will mature (e.g., Fwd. Start = 5Y; Maturity = 5Y >> Swap starts in five years and ends in 10 years). The quote name for a Forward Start Swap has the prefix "FWDSwap" and includes the Fwd. Start and Maturity tenors. Example: FWDSwap.3Y5Y.USD.LIBOR.3M/6M.LIBOR01 Once Forward Start underlyings are created, they are added in the curve window using "Instrument type" = Swap. |

|

Maturity |

Enter the maturity of the swap: number of Days, Weeks, Months, or Years. |

|

Manual First Reset |

Check to indicate that the first reset is manual. |

|

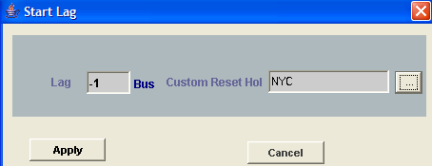

Start Lag |

Swap underlying start date is curve date + reset lag by default. Select Start Lag to enter a custom lag for the starting date of the swap. Click the red lag label to open the Start Lag window. Enter the lag, select business or calendar days (double-click Bus to toggle to Cal, respectively), and click ... to select custom reset holidays if applicable. Click Apply to set the custom lag.

|

| Use Date Roll for End Date |

When this property is unchecked, which is also the expected default behavior, we expect the current behavior to continue. That is, End Date of a Swap curve underlying is rolled using the date roll of the associated Rate Index Tenor configuration. When this property is checked, End Date of a Swap curve underlying is rolled using the Floating side Date Roll of Swap Curve Underlying configuration. |

|

Int. Method |

Select EXP if the swap should have exponential interest, or NONE otherwise. |

|

Specific Dates |

You can check "Specific Dates" to create an underlying with a specific start date and end date. |

|

Day of Month |

When specified, the maturity month is found based on the selected maturity, and the maturity date is set to the selected day of that month. For example, if you set it to "9", and the maturity is in April, it will be set to April 9th. |

|

Actual Exch |

Check to indicate that there is an actual principal exchange. |

| FX Adj. on |

If the fixed currency and the floating currency are different, you can add FX adjustments on either leg: Select NONE, Fixed, or Floating. For Fixed and Floating you can select and FX Rate Reset to set the FX rate. |

Fixed Side

|

Fields |

Description |

|---|---|

|

Freq |

Payment frequency. |

|

DayCount |

Select the daycount convention used for determining the payment periods. |

|

DateRoll |

Select the date roll convention to use when the date falls on a non-business day. |

|

Pay Holidays |

Holiday calendars used in calculating the pay dates. |

|

Period Rule |

Select the accrual period adjustment on non-business days. |

| Stub |

Select the stub period if any. |

| Cmp Frq |

Select the interest compounding frequency as applicable. The "None" label is not active. |

|

Cmp Stub |

Select the stub period on compounding period if any. |

Floating Side

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Freq |

Payment frequency. |

||||||||||||

|

DayCount |

Displays the daycount convention on the rate index. |

||||||||||||

|

DateRoll |

Select the date roll convention to use when the date falls on a non-business day. |

||||||||||||

|

Pay Holidays |

Holiday calendars used in calculating the pay dates. |

||||||||||||

|

Period Rule |

Select the accrual period adjustment on non-business days. |

||||||||||||

| Stub |

Select the stub period if any. |

||||||||||||

|

Cmp Frq |

Select the interest compounding frequency if any. Difference between LUN and LUN(R), BIWK and BIWK(R), WK and WK(R). For a 3M swap paying MONTHLY compounding WEEKLY:

The "None" label is not active. The Compounding Accrual Method is set to "UNADJUSTED", when Rate Index has attribute is7DayRepo = True and a compounding frequency is selected. |

||||||||||||

| Cmp Stub |

Select the stub period on compounding period if any. Only applies to LUN(R), BIWK(R), WK(R) compounding frequencies. |

||||||||||||

| Reset Timing | Select the reset timing: beginning of the period, or end of the period. | ||||||||||||

|

Averaging Reset Avg Frq Day of Sampling |

Check "Averaging Reset" if the rate resets more frequently than the swap. In this case, you need to select the averaging frequency, and day of sampling if needed. You can also select the type of average by toggling the red label:

|