Corporate Actions Overview

![]() Download PDF - Corporate Actions

Download PDF - Corporate Actions

This document describes the corporate actions supported by Calypso, how to define corporate actions, and how to apply corporate actions to trades and positions.

Corporate Actions are defined and applied to trades and positions from Trade Lifecycle > Corporate Action > Corporate Action. They can also be applied using the scheduled task CORPORATE_ACTION.

See Corporate Action Definition Window for complete details on the Create panel in the Corporate Action Window.

See Corporate Action Definition Window for complete details on the Create panel in the Corporate Action Window.

![]() Download PDF - Corporate Action Elections

Download PDF - Corporate Action Elections

See CA Apply Trade Simulation Report for information on simulating the application of corporate actions.

See CA Apply Trade Simulation Report for information on simulating the application of corporate actions.

For information on applying corporate actions see the following topics:

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades.

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades.

Corporate Action for Listed products - Splits, MDEs, and dividends on listed products.

Corporate Action for Listed products - Splits, MDEs, and dividends on listed products.

Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

Corporate Actions for CFD products

Corporate Actions for CFD products

Refer to the Calypso Warrants User Guide for information on creating and applying corporate actions to Warrants.

Refer to the Calypso Warrants User Guide for information on creating and applying corporate actions to Warrants.

The following reports allow monitoring corporate actions:

Corporate Actions Definition

Corporate actions are created from the Create panel of the Corporate Action window.

For bonds, coupons and redemptions can be automatically created in the Generate panel of the Corporate Action window.

See Corporate Actions for position-based products for details.

See Corporate Actions for position-based products for details.

CA events can be imported from external sources using the integration and processing of MT564-MT568 Swift CA events.

For the integration of Swift CA events, see Integrating Swift Corporate Action Events for details.

For the integration of Swift CA events, see Integrating Swift Corporate Action Events for details.

For the integration of Swift CA events from Indeval, see CA Indeval Integration for details.

For the integration of Swift CA events from Indeval, see CA Indeval Integration for details.

1. Supported Corporate Actions

The following corporate actions (CA events) are supported in Calypso. This table also provides the mapping between the CA Swift Code and the Calypso Model and Subtype to be used.

|

SWIFT Code |

CA Event Name |

SWIFT Proc |

Options |

Outcome |

MODEL |

SUBTYPE |

|

ACTV SUSP |

Trading Status active Trading Status suspended |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

BIDS |

Repurchase offer/Issuer bids/Reverse Rights |

REOR |

CASH SECU NOAC |

Closing position against security and/or cash movements |

ACQUISITION ACQUISITION REFERENTIAL |

CASH_OFFER SECU_OFFER REFERENTIAL |

|

BMET |

Bond holder meeting |

CONY PROX CONN NOAC |

CASH REFERENTIAL REFERENTIAL REFERENTIAL |

CAPITALRETURN REFERENTIAL REFERENTIAL REFERENTIAL |

||

|

BONU |

Bonus/capitalization issue |

DISN |

SECU |

Additional securities @ 0 price |

ACCRUAL ACCRUAL |

BONUS STOCK_DIV |

|

BPUT |

Early redemption |

CASH NOAC |

REDEMPTION REFERENTIAL |

REDEMPTION REFERENTIAL |

||

| BRUP |

Bankruptcy |

REOR |

CASH SECU NOAC |

No CA trades generated |

REDEMPTION REDEMPTION REFERENTIAL |

REDEMPTION REDEMPTION REFERENTIAL |

|

CAPD CAPG |

Capital Distribution Capital Gains distribution |

DISN |

CASH SECU |

Cash movement or security movement |

CASH ACCRUAL |

ADJUSTMENT REINVEST |

| CAPI |

Capitalization |

GENL | NOAC | No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

CERT |

Non-US TEFRA D Certification | GENL | NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

CHAN |

Change - Referential |

GENL |

SECU NOAC |

Closing position + New position @ equivalent price |

MERGER REFERENTIAL |

MERGER REFERENTIAL |

|

CLSA |

Class action / Proposed settlement |

REOR |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

CMET MEET OMET XMET |

Court Meeting Meetings Ordinary General Meetings Extraordinary / special meeting |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

| CONV |

Conversion |

DISN |

SECU NOAC |

Change convertible bonds into underlying shares using a pre-stated conversion price/ratio |

TRANSFORMATION REFERENTIAL |

CONVERTIBLE REFERENTIAL |

|

CONS |

Consent |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

COOP |

Company option |

REOR |

SECU SECU SECU CASH NOAC |

Opening Position against cash movement and/or closing position at price = specified price |

MERGER MERGER REDEMPTION REDEMPTION REFERENTIAL |

RIGHTS_CALL MERGER REDEMPTION REDEMPTION REFERENTIAL |

| CREV | Credit event |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

DECR |

Decrease in value |

DISN |

CASH |

Cash movement |

CASH | ADJUSTMENT |

|

DLST |

Trading status delisted |

REOR |

CASH SECU CASH SECU NOAC |

Closing position against cash Closing position against security movement and/or cash movement

No CA trades generated |

ACQUISITION ACQUISITION REDEMPTION REDEMPTION REFERENTIAL |

CASH_OFFER STOCK_OFFER REDEMPTION REDEMPTION REFERENTIAL |

| DFLT | Bond default |

GRNL |

NOAC CASH |

Cash movement with 0 amount Cash movement |

CASH CASH |

DEFAULT PREMIUM |

|

DRCA |

Cash Distribution From Non-Eligible Securities Sales |

DISN |

SECU CASH NOAC |

Closing position |

REDEMPTION REDEMPTION REFERENTIAL |

REDEMPTION REDEMPTION REFERENTIAL |

|

DRIP DVOP |

Dividend Reinvest Dividend Option |

DISN |

CASH SECU NOAC SECU SECU CASH SECU CASH SECU |

Cash movement Additional securities @ adjusted cash price |

CASH ACCRUAL REFERENTIAL ACCRUAL MERGER ACQUISITION REDEMPTION REDEMPTION ACCRUAL |

DIVIDEND REINVEST REFERENTIAL STOCK_DIV RIGHTS_CALL CASH_OFFER REDEMPTION REDEMPTION EQUITYOFFERING |

|

DSCL |

Disclosure |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

DTCH |

Dutch auction |

REOR |

CASH SECU NOAC |

Closing position against Cash movement |

ACQUISITION ACQUISITION REFERENTIAL |

CASH_OFFER STOCK_OFFER REFERENTIAL |

|

DVCA SHPR |

Cash Dividend Share Premium Dividend |

DISN |

CASH |

Cash movement |

CASH |

DIVIDEND |

|

DVSE DVSC |

Stock Dividend Script Dividend/ Payment |

DISN |

SECU SECU |

Additional securities @ 0 price |

ACCRUAL ACCRUAL |

TAX STOCK_DIV |

|

EXOF MRGR |

Exchange Offer Merger |

REOR |

CASH SECU CASE NOAC |

Closing position against cash Closing position against security Closing positions against cash and security No CA trades generated For equity swaps, the original trade is terminated |

ACQUISITION ACQUISITION ACQUISITION REFERENTIAL |

CASH_OFFER STOCK_OFFER STOCK_OFFER REFERENTIAL |

|

EXRI |

Call on intermediate securities |

REOR |

SECU SECU CASH SECU NOAC |

Closing position + Reopening new position at price of rights |

MERGER REDEMPTION REDEMPTION ACCRUAL REFERENTIAL |

RIGHTS_CALL REDEMPTION REDEMPTION OVER REFERENTIAL |

| EXTM | Maturity extension | REOR |

NOAC SECU |

No CA trades generated Closing position + New position |

REFERENTIAL TRANSFORMATION |

REFERENTIAL ASSIMILATION |

|

EXWA |

Exercise Warrant |

GENL |

SECU SECU |

Closing position |

ACCRUAL EXIPRY |

EXERCISE EXPIRY |

|

INCR |

Increase in Value |

REOR |

CASH |

Cash movement |

CASH |

DIVIDEND |

|

INFO |

Information Only |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

INTR |

Coupon payments on Bonds |

DISN |

CASH |

Corporate action trades for Cash payments and realized P&L |

CASH |

INTEREST INTEREST_SHORTFALL INTEREST_REIMBURSE PRINCIPAL_SHORTFALL PRINCIPAL_REIMBURSE |

|

LIQU |

Liquidation dividend/Payment |

REOR |

CASH SECU CASH SECU NOAC |

Closing position at price = 0 or at a specified price |

ACQUISITION ACQUISITION REDEMPTION REDEMPTION REFERENTIAL |

CASH_OFFER STOCK_OFFER REDEMPTION REDEMPTION REFERENTIAL |

|

MCAL |

Full Call / Early Redemption |

REOR |

SECU CASH |

Corporate action trades for cash and security payments Corporate action trades or buy/sell trades (if environment property BOND_REDEMPTION_TRADE is set to true) for closing original positions |

REDEMPTION REDEMPTION |

CALL_REDEMPTION CALL_REDEMPTION |

| NOOF | Non official offer to repurchase securities |

REOR |

CASH SECY NOAC |

Closing position against security and/or cash movements |

ACQUISITION ACQUISITION REFERENTIAL |

CASH_OFFER STOCK_OFFER REFERENTIAL |

|

ODLT |

Odd lot sale / purchase |

REOR |

CASH NOAC |

Cash movement No CA trades generated |

CASH REFERENTIAL |

ODD_LOT REFERENTIAL |

|

OTHR |

Other |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL CASH |

REFERENTIAL DS_FEE |

|

PARI |

Pari Passu |

REOR |

SECU |

Closing position + New position @ equivalent price |

TRANSFORMATION |

ASSIMILATION |

|

PCAL |

PPRINCIPAL: This is a partial redemption of an Amortizing bond CALL_REDEMPTION: Redemptions of callable bonds based on call schedules provided the “Exercised?” column is set to “Yes” |

REOR |

SECU CASH SECU CASH CASH |

Corporate action trades for cash and security payments Corporate action trades or buy/sell trades (if environment property BOND_REDEMPTION_TRADE is set to true) for closing original positions |

REDEMPTION REDEMPTION REDEMPTION REDEMPTION AMORTIZATION |

CALL_REDEMPTION CALL_REDEMPTION PRINCIPAL PRINCIPAL AMORTIZATION |

|

PINK |

Pay In Kind PIK_INTEREST: Used for Brady bonds to reflect interest amortization (Regular Amortization + PIK Interest) PINK: Used for Danish mortgage bonds to allow redemption of principal without a cash payment to offset the value of negative coupon payments |

DISN | CASH |

Corporate action trades for Cash payments Corporate action trades security movement with no Cash payment |

AMORTIZATION REDEMPTION |

PIK_INTEREST PINK |

|

PLAC |

Place of Incorporation |

GENL |

N/A |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

PPMT |

Installment Call |

DISN |

CASH SECU CASH |

Closing position + reopening existing position reflective of increased avg cost |

REDEMPTION REDEMPTION CASH |

REDEMPTION REDEMPTION INSTALLMENT_CALL |

|

PRED |

AMORTIZATION: Used for sinking bonds to reflect notional amortization PAYDOWN: Used for Asset Backed bonds to reflect pool factor changes |

REOR |

CASH CASH |

Corporate action trades for Cash payments Corporate action trades for Cash payments and realized P&L |

AMORTIZATION PAYDOWN |

AMORTIZATION PAYDOWN |

|

PRIO |

Priority issue |

REOR |

SECU SECU SECU CASH NOAC |

Opening Position against cash movement and/or closing position at price = specified price |

MERGER MERGER REDEMPTION REDEMPTION REFERENTIAL ACCRUAL CASH |

RIGHTS_CALL MERGER REDEMPTION REDEMPTION REFERENTIAL EXERCISE RIGHT_ISSUE |

|

REDM |

Final Maturity |

REOR |

SECU CASH |

Corporate action trades for cash and security payments Corporate action trades or buy/sell trades (if environment property BOND_REDEMPTION_TRADE is set to true) for closing original positions |

REDEMPTION REDEMPTION |

REDEMPTION REDEMPTION |

| REDO | Redenomination | REOR |

NOAC SECU |

No CA trades generated Closing position + New position |

REFERENTIAL TRANSFORMATION |

REFERENTIAL ASSIMILATION |

|

REMK |

Remarking Agreement |

DISN |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

RHDI |

Intermediate securities distribution |

DISN |

SECU |

Additional securities @ 0 price |

ACCRUAL |

RIGHTS_CPN |

|

RHTS |

Rights Issue / Subscription Rights / Rights Offer (as one event) |

REOR |

SECU SECU CASH NOAC SECU SECU SECU CASH SECU |

Opening Position against cash movement and/or closing position at price = specified price |

ACCRUAL ACCRUAL CASH REFERENTIAL ACCRUAL MERGER REDEMPTION REDEMPTION ACCRUAL |

EXERCISE OVER RIGHT_ISSUE REFERENTIAL RIGHTS_CPN RIGHTS_CALL REDEMPTION REDEMPTION EQUITYOFFERING |

|

SMAL |

Smallest Negotiable Unit |

GENL |

NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

SOFF |

Spin Off |

DISN |

CASH SECU |

Cash movement New security position @ price 0, or using adjustment factor and cash movement |

CASH SPINOFF |

ADJUSTMENT SPINOFF |

|

SPLF SPLR |

Stock Split Reverse Stock Split |

DISN REOR |

SECU |

Closing position + New position @ equivalent price |

TRANSFORMATION |

SPLIT |

|

TEND |

Tender acquisition, Takeover, Purchase offer, Buyback |

REOR |

CASH SECU NOAC |

Closing position against security and/or cash movements |

ACQUISITION ACQUISITION REFERENTIAL |

CASH_OFFER STOCK_OFFER REFERENTIAL |

| TREC | Tax Reclaim | DISN |

NOAC CASH |

No CA trades generated Cash movement |

REFERENTIAL REFERENTIAL |

REFERENTIAL CASH |

|

WRTH |

Worthless |

REOR |

CASH SECU |

Closing position at price = 0 or at a specified price |

REDEMPTION REDEMPTION |

REDEMPTION REDEMPTION |

| WTRC | Withholding Tax Relief Certification | GENL | NOAC |

No CA trades generated |

REFERENTIAL |

REFERENTIAL |

|

N/A |

Market disruption events |

N/A |

N/A |

Closing position + New position @ equivalent price |

EXPIRY |

MDE |

|

N/A |

Used for the amortization of Danish Mortgage Bond |

N/A |

N/A |

Corporate action trades for cash and security payments Corporate action trades or buy/sell trades (if environment property BOND_REDEMPTION_TRADE is set to true) for closing original positions For Sec Lending trades, the original Sec Lending trades are reduced with drawing amount (partial return) and cash claims are generated by the CA. |

REDEMPTION |

DRAWING |

|

N/A |

Asset impairment in the context of JGAAP and USGAAP accounting requirements |

N/A |

N/A |

Buy / Sell trades for closing original positions |

TRANSFORMATION |

IMPAIRMENT |

1.1 Defining Corporate Actions

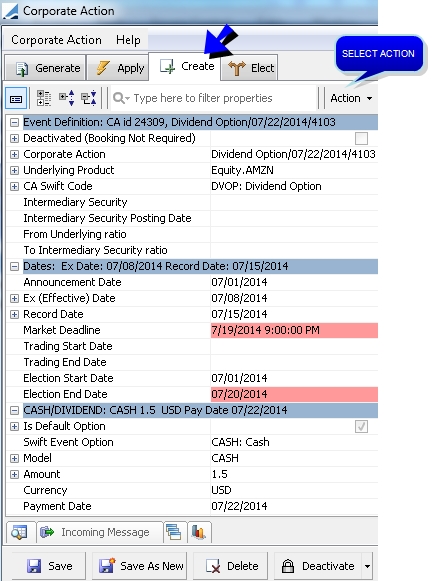

From the Calypso Navigator, navigate to Trade Lifecycle > Corporate Action > Corporate Action, and select the Create panel.

The definition of corporate actions (CA events) depends on the corporate action model and subtype. Combinations of supported models and subtypes are specified in the domain "corporateActionType" as "MODEL.SUBTYPE".

| » | You can click Load to load an existing corporate action, or click New to clear the screen to create a new corporate action. |

Then fill in the fields described below, and click Save to save your changes. You can now apply the corporate action to trades and positions.

You can click Apply to bring up the Apply panel with pre-defined selections.

| » | You can click Deactivate to deactivate a corporate action. |

The Deactivated checkbox will appear checked and the CA will not be processed.

Important Note: Deactivating a CA does not cancel existing trades on the CA. To cancel existing trades, you need to cancel the CA trades using Deactivate > Revert.

NOTE: To deactivate a CA adjustment created by the Transformation report, you need to delete it instead of deactivate it.

| » | You can choose Deactivate > Reactivate to reactivate a deactivated corporate action. |

| » | You can choose Deactivate > Revert to cancel existing trades for a corporate action, and restore the original state before the corporate action was applied. This should be performed once you deactivate a corporate action. |

| » | Following fields have been added to the Corporate Action Window: |

New Face Value

Preview Face Value

CA Trade Attributes:

Notional New Face Value

Notional Previous Face Value

These criteria have been added to the CAMatchingConfig for MT564 and MT566 integrations.

These fields only apply to PCAL Corporate Actions.

Ⓘ [NOTE: All functions are also available fAcom the Action menu]

Ⓘ [NOTE: When you select the CA Swift Code, it populates the model and subtype with default values, and drives the selection of the other fields- Some fields only appear for certain types of corporate actions]

Fields Details - Event Definition

The Event Definition is set by the system upon saving.

Fields Details - Deactivated

|

Fields |

Description |

|||||||||

|

Deactivated |

The Deactivated checkbox appears checked when the corporate action has been deactivated using the Deactivate button. The scheduled task CORPORATE_ACTION ignores deactivated corporate actions. |

|||||||||

|

CA Status |

Only appears if the CA Swift Code is not set. Select the CA status as needed - The following status codes are defined out-of-the-box in domain "CA.Status".

If not set, it is APPLICABLE by default. |

|||||||||

|

Function of the Message |

Only appears if the CA Swift Code is set. Displays the function of the SWIFT MT564 message as applicable. |

|||||||||

|

Processing Status |

Only appears if the CA Swift Code is set. Displays the status of the SWIFT MT564 message as applicable. |

|||||||||

|

Preparation Date/Time |

Only appears if the CA Swift Code is set. Displays the Date/Time at which the last update message was prepared. |

Fields Details - Corporate Action

|

Fields |

Description |

|

Corporate Action |

The corporate action name is set by the system upon saving. You can select an existing corporate action as needed. |

|

CA Id |

Unique Id given by the system to the corporate action upon saving. |

|

CA Version |

Version number given by the system upon saving if the corporate action is modified - "0" is the first version. |

|

Sequence |

You can enter the priority of generation when multiple CAs have the same date, as needed - "0" is the highest priority. |

|

Update Related Issuance |

Used for warrants and certificates.

|

|

Liquidation Config |

This field is currently only enabled for the "TRANSFORMATION.IMPAIRMENT" corporate action. It allows defining corporate actions based on the liquidation config for asset impairment in the context of JGAAP and USGAAP accounting requirements.

|

|

Static Data Filter |

You can select a static data filter to restrict the scope of the corporate action. |

|

Product Codes |

You can enter values for the user-defined product codes as needed. You can create product codes using Configuration > Product > Code. |

|

Parent Linked CA |

Certain corporate actions can be linked to a parent corporate action. |

|

Child Linked CA |

Certain corporate actions can be linked to a child corporate action. |

Fields Details - Underlying Product

|

Fields |

Description |

||||||||||||

|

Underlying Product |

Select the product to which the CA applies. If applicable, it displays additional information on the product:

You can click |

Fields Details - CA Swift Code

|

Fields |

Description |

|

CA Swift Code |

Select the CA Swift Code as needed - It populates the model and subtype with default values, and drives the selection of the other fields. The mapping between Swift Codes and corporate action types can be defined using Trade Lifecycle > Corporate Action > CA Swift Event Code.

|

|

Event Choice |

Select how the CA event being processed is mandatory, mandatory with options, or voluntary. When the event choice of a CA is different from MAND (Mandatory), you can add multiple outcomes (options) to the CA.

|

|

Event Process |

Select if the event is a reorganization event or a distribution event. |

|

Type of Change |

Select the type of change from the company. Available for CA Swift Code CHAN. |

|

Renounceable |

Select whether the issued rights can be renounced or not. Available for CA Swift Codes RHTS, RHDI, EXRI, PRIO, and COOP. |

|

Is Taxable |

Check to indicate that the event is deemed taxable by Tax authority. Used to compute the new average price either using the current security average price (not checked) or the market price at ex date (checked). Available for CA Swift Codes MRGR and EXOF. |

|

Offeror |

Enter the name of the company offering stock. Available for CA Swift Codes MRGR, TEND, and EXOF. |

|

Odd lot quantity |

Enter the odd lot quantity. Available for CA Swift code ODLT. |

|

Event Condition Stage |

Select the stage in the CA event lifecycle. Available for CA Swift Code TEND. |

|

Redemption Rate |

Enter the percentage of the principal that is being redeemed. Available for CA Swift Code TEND. |

|

Event Restriction |

Check if any restrictions have been declared at the CA Event level. |

| Issuer Agent |

MT564 - TAG95::ISAG |

| Paying Agent |

MT564 - TAG95::PAYA |

| Issuer |

MT564 - TAG95::ISSU |

| Transfer Agent |

MT564 - TAG95::TAGT |

Fields Details - Dates

|

Fields |

Description |

|

Announcement Date |

Enter the date the CA event is announced on the market as applicable. |

|

Propagation Date |

Enter the notification date as applicable. |

|

Ex (Effective) Date |

Enter the effective date of the corporate action. Is Ex-Date Inclusive The eligible position will be the position held at close of business "ex date - 1" if the ex date is non inclusive. If inclusive, it is the position held at close of business ex date (market practice is to be non inclusive). It means that when the system loads the PL position at ex date, it will load any position that is open at ex date end of day (non inclusive). By Trade Date The ex date can be applicable to the trade date position or to the settlement date position otherwise. "By Trade Date" should be checked for equities and portfolio swaps. You also need to add the following values to the domain "generateCA.PortfolioSwap” with Comment = true to generate the corresponding CAs by trade date: CASH.DIVIDEND.setIsByTradeDate TRANSFORMATION.PRICE_CHANGE.setIsByTradeDate Portfolio Swaps You can add the following values to the domain “generateCA.PortfolioSwap” with Comment = true to generate the corresponding CAs with Ex Dividend Date inclusive: CASH.DIVIDEND.setIsExDateInclusive TRANSFORMATION.PRICE_CHANGE.setIsExDateInclusive TRANSFORMATION.SPLIT.setIsExDateInclusive SPINOFF.SPINOFF.setIsExDateInclusive If the trades entered on payment end date are to be considered for reset, then on execution of Price Change CA - 'Ex-Date' Checkbox should be selected and domain 'exDateTradePreviousCF' should be set as 'True'. The default value of 'exDateTradePreviousCF' is 'False'. If the domain is kept as 'False' (or not Set) then on execution of Price Change CA - 'Ex-Date' Checkbox should not be selected. Callable Bonds The ex date for redemption CA will be set to the notification date if the issuer has the attribute Bond_Callable and the value is the issuer's name. On a legal entity whose role is Issuer, you can add the Legal Entity Attribute "Bond_Callable" with the value as the issuer’s name. Then, on the bond definition, if the issuer is set as the same issuer, the ex date on the CA will be equal to the notification date. If the attribute is not set on the legal entity, the ex date will be equal to the redemption date. CA Holidays By default, CA holidays are ignored and a CA trade can be booked on a non-business day if the ex-date falls on a non-business day. To take CA holidays into account, you need to set environment property IGNORE_CA_HOLIDAYS to false. In that case, if the ex-date falls on a non business date, the CA trade date is set to the previous business day. |

|

Record Date |

Enter the date on which the holder of the security are recognized for entitlement. The record date is used by the system to determine whether a buyer or a seller is eligible for benefit, and hence requires a claim to be raised.

Is Record Date Inclusive Check to make the record date inclusive. It is non inclusive otherwise. |

|

Market Deadline |

Enter the Date/Time issuer’s deadline to respond, with an election instruction, to a secondary, to an outstanding offer or privilege. |

| Election to Counterparty Market Deadline |

MT564 - TAG98C::ECPD |

| Election to Counterparty Response Deadline |

MT546 - TAG98A::ECRD |

| Guaranteed Participation Date/Time |

MT564 - TAG98C::GUPA |

|

Shareholder Meeting Date |

Enter the date at which the bondholders or shareholders meeting will take place. |

| Second Meeting Date/Time | MT564 - TAG98C::MET2 |

| Third Meeting Date/Time | MT564 - TAG98C::MET3 |

|

Period Start Date Period End Date |

Enter the dates on which an order starts and expires, or on which a privilege or offer starts and terminates. |

|

Election Start Date Election End Date |

Enter the dates during which elections can be processed. The Election Start Date is set to the Announcement Date by default, and the Election End Date is set to the Ex Date by default.

|

|

Trading Start Date Trading End Date |

Enter the period during which intermediate or outturn securities are tradable in a secondary market. |

|

Protect Date |

Enter the last date a holder can request to defer delivery of securities pursuant to a notice of guaranteed delivery or other required documentation. |

|

Court Meeting Date |

Enter the date upon which the Court meeting will take place. |

|

Active From |

Enter the starting date of validity of the corporate action if applicable. |

|

Active To |

Enter the end date of validity of the corporate action if applicable. |

Fields Details - Corporate Action Type

|

Fields |

Description |

|||||||||||||||||||||||||||

|

Is Default Option Swift Event Option |

This applies to multiple outcomes (options) CAs.

|

|||||||||||||||||||||||||||

|

Model |

Select the type of corporate action, it defines the processing rules attached to the corporate action. All supported models are described above. |

|||||||||||||||||||||||||||

|

Subtype |

Select the corporate action subtype. It depends on the corporate action model. All supported combinations of models and subtypes are described above. |

|||||||||||||||||||||||||||

|

Div Reinvest Type |

Attribute "Div Reinvest Type". |

|||||||||||||||||||||||||||

|

Div Reinvest Price |

Only applies to DRIP CA events. Dividend reinvestment price. You can also specify the following:

|

|||||||||||||||||||||||||||

| Success Percent (Scale Back Ratio) (%) |

Enter the percentage of success. |

|||||||||||||||||||||||||||

|

By Open Trade |

When checked, the Processing Org's PL position is computed using the FIFO method by TOQ instead of whole position on the price of open trades only. This does not impact the Inventory position. This also applies to Redemption CAs for manually liquidated positions. You can check "By Open Trade" when domain "bondPartialRedemption" contains Value = true. |

|||||||||||||||||||||||||||

|

Amount |

Enter the amount applicable for one unit of the corporate action. Total CA Amount Rounding You can define the number of decimals for the total CA amount using the domain “CorporateActionAmount”. Value = MaxRoundingDecimals Comment = <number of decimals> |

|||||||||||||||||||||||||||

|

Payment Gross Rate |

Enter the Gross Dividend Rate Cash dividend amount per equity before deductions or allowances have been made. |

|||||||||||||||||||||||||||

|

Declared Rate |

Amount declared by the issuer. You can also specify the following:

|

|||||||||||||||||||||||||||

|

Tax Free Amount |

Enter the portion of the gross rate that is tax free. |

|||||||||||||||||||||||||||

|

Payment Net Rate |

Enter the Net Dividend Rate Cash dividend amount per equity after deductions or allowances have been made. |

|||||||||||||||||||||||||||

|

Currency |

Select the currency of the corporate action: by default, it is the currency of the selected product. If the corporate action currency is different from the product currency, you can set the FX rate in the "Other Amount" field. |

|||||||||||||||||||||||||||

|

Rounding Method |

The rounding method applies when a ratio / scale back ratio is specified. Select one of the following rounding methods:

You need to enter the unit price of the remaining shares/securities in "Cash In Lieu Rate (FR)". The cash amount is added to the CA trades as a fee. The fee type (for example CA_ADJ_AMOUNT) is taken from the domain “fractionalShareCashPartFeeType”. The value must be defined in the form “<product type>.<fee type>”. For example:

If the domain is not defined, the fee type CA_FEE is used by default. If the sum of the rounded amounts of the P&L CA trades is different from the rounded amount of the Agent CA trades, an adjustment P&L CA trade is created. The adjustment trade is not created if the Agent account has the account attribute ThirdPartyAccount = True.

The other rounding methods are not supported. Note that for Merger and Transformation, the system creates just one closing trade and a new trade at the average price of the position. In the Trade Report, the following columns allow viewing fractions handling: New Quantity, Old Quantity, and Fractional Shares. CAAdjustBook On every book, you can set the attribute "CAAdjustBook" with the name of the book where the differences will be stored. The book set in "CAAdjustBook" must also have the attribute "CAAdjustBook" set to itself. You can auto settle all the Agent CA transfers with a CAAdjustBook using the workflow transfer rule "UpdateCAAdjustBookLinkedXfer" on the SETTLE and CANCEL actions. When you apply the SETTLE action on a CA transfer between the Agent and the CAAdjustBook, all the transfers between the Agent and the same CAAdjustBook will be settled as well. Cash and Redemption CAs For CA trades with Agent: When agent attribute CA_Cash_Rounding_Method is set, it is used to determine the rounding method for the CA events. Otherwise, the currency rounding method is used. For CA trades with Counterparty: - When PO is paying and PO agent attribute CA_Cash_Rounding_Method is set, it is used to determine the rounding method for PO transfers on the CA events. - When Counterparty is paying and Counterparty agent attribute CA_Cash_Rounding_Method is set, it is used to determine the rounding method for Counterparty transfers on the CA events. - Otherwise, the currency rounding method is used. |

|||||||||||||||||||||||||||

|

To Security |

Certain types of corporate actions result in the creation of trades on a different product after the corporate action is applied. Select the resulting product of the corporate action as applicable. You can click |

|||||||||||||||||||||||||||

|

Payment Date |

Enter the payment date of the corporate action. |

|||||||||||||||||||||||||||

| Response Deadline Date/Time |

MT564 - TAG98A::RDDT |

|||||||||||||||||||||||||||

| End of Securities Blocking Period |

MT564 - TAG98B:BLOK. The available codes are defined in domain “CAAttribute.blockingPeriod”. |

|||||||||||||||||||||||||||

| Market Deadline Date/Time |

MT564 - TAG98C::MKDT |

|||||||||||||||||||||||||||

| Cover Expiration Deadline Date/Time |

MT564 - TAG98C::CVPR |

|||||||||||||||||||||||||||

| EARD: Early Response Deadline Date/Time |

MT564 – TAG98C::EARD |

|||||||||||||||||||||||||||

|

Available Date/Time For Trading |

Only available for equity related corporate actions. Enter the available date for trading. The trade keyword CASecurityAvailableDate is populated with that date on the equity CA trades. The Available Date is populated with that date as well, when set, for the agent CA transfers. The UPDATE action should be available in the transfer workflow to allow updating the Available Date as needed, without any other changes to the transfers, using the transition SETTLED – UPDATE – SETTLED. |

|||||||||||||||||||||||||||

|

From Ratio To Ratio |

Enter the ratio of the corporate action if applicable. For example From Ratio = 1 / To Ratio = 2 means that 1 unit of "Underlying Product" becomes 2 after the corporate action process (in case of SPLIT for example). If the "To Security" is set (in case of MERGER for example), 1 unit of "Underlying Product" becomes 2 units of "To Security". |

|||||||||||||||||||||||||||

|

Cash In Lieu Rate (FR) Cash In Lieu Currency Cash In Lieu Pay Date |

Used with rounding method "Round Down (Cash In Lieu) (FR)".

|

|||||||||||||||||||||||||||

|

Other Amount |

Enter a fee amount as needed. |

|||||||||||||||||||||||||||

|

Payment Currency |

Enter the fee payment currency. |

|||||||||||||||||||||||||||

|

Other Amount Pay Date |

Enter the fee payment date. |

|||||||||||||||||||||||||||

|

Tax Rate |

Enter the Withholding Tax Rate Percentage of a cash distribution that will be withheld by a tax authority (for SWIFT CA codes DVCA, SHPR) or tax Related Rate Percentage of the gross dividend rate on which tax must be paid (for SWIFT CA code DVOP and DRIP). |

|||||||||||||||||||||||||||

|

ADR Fee |

Enter an ADR fee amount as needed (for SWIFT CA codes DVCA, SHPR). It can be populated from MT564 field :92F::CHAR. This fee is deducted from the net entitlement calculation: Net dividend amount = ((Gross Cash Rate * ((1-WHT)- ADR Fee)) when there is no tax free rate or Net dividend amount = (Taxable Amount) x ((1-WHT%)-ADR fee) + (Entitled Position x Tax Free Amount) when there is a tax free rate |

|||||||||||||||||||||||||||

|

ADR Currency |

Enter the ADR fee currency. |

Fields Details - Additional Information

|

Fields |

Description |

||||||||||||

|

Comment |

Enter a free form comment. |

||||||||||||

|

Adjustment Factor |

Enter the "manual" adjustment factor used by CA rules to adjust the products (strike, contract size, etc.).

|

||||||||||||

|

Theoretical Dilution Factor |

Enter the theoretical dilution factor used by CA rules to adjust the products (strike, contract size, etc.).

|

||||||||||||

|

Special Dividend |

Check for special cash dividend to indicate that the dividend is re-invested. This is currently for information purposes only. |

||||||||||||

|

Dividend Type |

Select the conditions in which a dividend is paid:

|

||||||||||||

|

Fully Franked Rate |

Enter the percentage of dividend that can be reclaimed. Only applicable on Australian equities. |

||||||||||||

|

Arbitrage Book |

Select the book when arbitrage trades are generated.

|

||||||||||||

| Meeting Place |

MT564 - TAG94E::MEET |

||||||||||||

| Meeting Place 2 |

MT564 - TAG94E::MET2 |

||||||||||||

| Meeting Place 3 |

MT564 - TAG94E::MET3 |

||||||||||||

| New Place of Incorporation |

MT564 - TAG94E::NPLI |

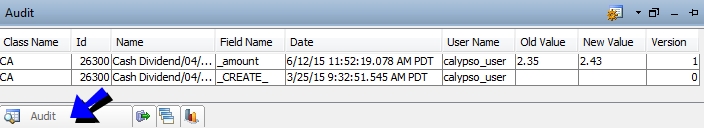

Audit

Click Audit, to view audit information for the CA event - It shows details about all the changes on the CA event.

| » | You can right-click and choose various functions from the popup menu to configure the display, and save the display as a template. |

Incoming Messages

Click Incoming Message to view incoming messages information if any.

| » | You can right-click and choose various functions from the popup menu to configure the display, and save the display as a template. |

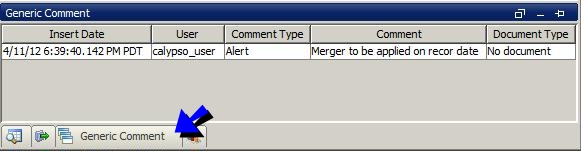

Generic Comments

Click Generic Comment to associate / display generic comments for this corporate action.

| » | You can double-click in the table to bring up the Add Generic Comment window to add generic comments. |

| » | You can right-click and choose various functions from the popup menu to configure the display, and save the display as a template. |

Agent Details

Click Agent Details to add / display agent information related to the CA event - This information is populated when the CA event is imported from MT56X messages.

| » | You can click Add to add an agent, and click Details to set information for that agent - The fields are described below. |

| » | You can right-click and choose various functions from the popup menu to configure the display, and save the display as a template. |

See Integrating Swift Corporate Action Events for details.

See Integrating Swift Corporate Action Events for details.

|

Fields |

Description |

|

Agent |

Agent, SENDER of the message. |

|

CA Reference |

Swift MT564 field CORP – Corporate Action reference; Reference assigned by the account servicer to unambiguously identify a corporate action event. |

|

Message Reference |

Swift MT564 field SEME – Sender’s message reference; Reference assigned by the Sender to unambiguously identify the message. |

|

Safekeeping Account |

Swift Safekeeping account (97A::SAFE). |

|

Custodian |

Swift MT564 Custodian (94F::SAFE//CUST-optional). |

|

Cash Account |

Swift MT564 Cash account (97A::CASH in the sub-sequence E2 CASHMOVE-optional). |

|

Deadline |

Displays the Agent's deadline date time. |

|

Time zone |

Displays the timezone related to the Agent's deadline. |

|

Option 1 |

Displays the option number in the Swift MT564. If the CA event has multiple options, the Option field is repeated for each option. |

1.2 Defining CA for Options

Applies to corporate actions on warrants.

Choose Action > CA Option to define more information related to the delivery of the underlying or the cash following the expiry/exercise of a Warrant.

Refer to Calypso Warrants Documentation for complete details.

Refer to Calypso Warrants Documentation for complete details.

1.3 Defining CA Defaults

You can create corporate action (CA) defaults for stock splits. The CA defaults store default attributes for rounding: rounding conventions and decimal precision. The other fields are not used.

Choose Action > CA Defaults for defining CA defaults - They are only used when applying corporate actions to equity structured options.

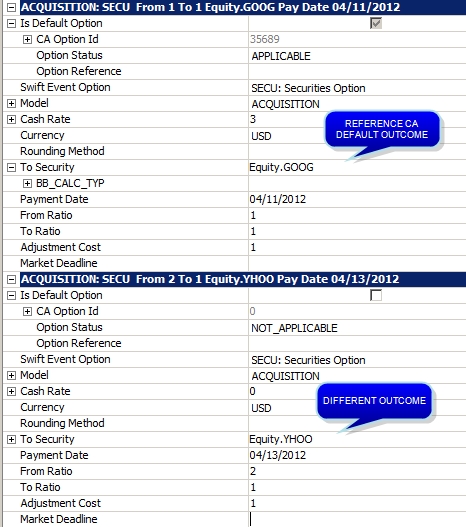

1.4 Defining Multiple Outcomes

When the event choice of a CA is different from MAND (Mandatory), you can add multiple outcomes (options) to the CA.

Choose Action > Multiple Outcome > Add Cash Outcome to add a cash outcome, or Action Multiple Outcome > Add Stock Outcome to add a stock outcome.

It adds a new set of Corporate Action Type attributes to the CA event.

Only the reference CA will be processed but upon processing, all outcomes will be applied.

| » | Define the corporate action type of the additional outcome as needed. |

| » | Identify the default outcome using the "Is Default Option" parameters - They are described below. |

Fields Details - Is Default Option

This applies to multiple outcomes (options) CAs.

|

Fields |

Description |

|||||||||||||||||||||

|

Is Default Option |

This is checked for the corporate action type of the reference CA by default to identify the default outcome. This is not checked for the other outcomes. Check as needed to identify the default outcome. |

|||||||||||||||||||||

|

CA Option Id |

Displays the CA ID of the reference CA. |

|||||||||||||||||||||

|

CA Option Version |

Displays the version number of the reference CA. |

|||||||||||||||||||||

|

Option Status |

Displays the status of the outcome:

When a default outcome is changed to non default, the status becomes CANCELED in order to let the system cancel any existing CA trades. |

|||||||||||||||||||||

|

Option Reference |

Enter a user-defined reference as needed. |

|||||||||||||||||||||

|

Swift Event Option |

Select the SWIFT code for the outcome:

|

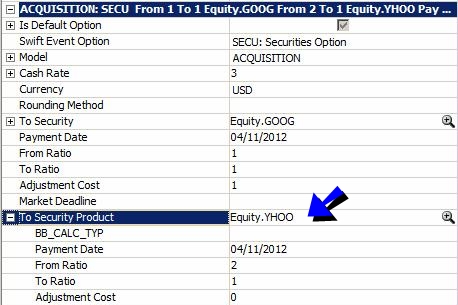

Multiple Products

You can also add products to a given outcome. Choose Action > Add To Product.

It adds a set of "To Security Product" parameters to the CA event.

Upon processing, CA trades will be created for all "to products".

1.5 Adding Custom Fields

The fields that appear for swift codes are defined as CA Attributes in the XML file "CAAttributeDefinition.xml" located under resources/com/calypso/tk/product/corporateaction.

You can add more CA Attributes to this file as needed, or add a new file directly under resources, and set the name of the file in the environment property CA_ATTRIBUTE_DEFINITION.

Ⓘ [NOTE: Changes to resources have to be re-deployed to your application servers. Please refer to the Calypso Installation Guide for details]

For each attribute, you need to specify the following information:

| • | Name |

| • | Type |

| • | Domain name (optional) - Domain name that contains the list of possible values for this attribute |

| • | Sequence number (optional) - Order of display on the screen |

| • | Parent property name - Parent attribute under which you want to display the new attribute |

| • | Display name |

| • | Description (optional) |

| • | CA swift events - Swift code for which this attribute should be displayed |

Example:

<attribute name="PaymentGrossRateType" type="String" domainName="CAAttribute.rateType" sequenceNumber="15" parentPropertyName="Amount">

<displayName>Rate Type</displayName>

<swiftEvent>DVCA</swiftEvent>

<swiftEvent>DVOP</swiftEvent>

</attribute>

1.6 Entitlement Eligibility

When stock / bond units are obtained through a corporate action and do not settle prior to the record date of a subsequent corporate action, those units will not be eligible to participate in the second corporate action.

The same rule applies if there are any long-dated settlement trades that are booked before ex date but do not settle until after record date The holdings resulting from these long-dated trades are not included in the ex date balance.

Example 1

A position holder exercises a rights issue. A cash dividend event quickly follows and the dividend's record date falls before the allotment date for the rights.

This means that the new units from the rights issue will not be settled by the dividend's record date and as a result, those units are not eligible to receive the cash dividend.

Example 2

Similar to Example 1, except the dividend's record date falls after the allotment date for the rights.

This means that the new units from the rights issue will be settled by the dividend's record date and are eligible to receive the cash dividend.

Ex/Cum Processing

The Ex/Cum basis of quotation is the basis upon which a security is traded. Ex-dividend securities generally trade on a "cum" basis, indicating that the securities are entitled to upcoming CA events.

Generally on the ex date of a corporate action, the basis of quotation on the market is "ex" the particular corporate action event. However, in special circumstances, some markets allow shareholders the right to trade the security "cum-entitlement" between the ex date and the record date (inclusive). Trades can be executed with a "cum" basis of quotation after the ex date and are required to be captured in the corporate action entitlement process, as the entitlement has been transferred as part of the trade.

This entitlement eligibility period is also called the CA event active period between the "ex date - 1 EOD" and the "record date EOD".

You can override the default entitlement eligibility using the trade keyword CATradeBasis on the trades.

The available values for CATradeBasis are defined in domain "keyword.CATradeBasis". It contains the Swift ex/cum codes.

The domain name "XferAttributesforMatching" is used to propagate the trade keyword CATradeBasis as a transfer attribute. The transfer attribute CATradeBasis is used in the CA process to adjust the P&L and Agent position in order to include transactions that are traded "cum".

1.7 Withholding Tax on ACQUISITION/CASH_OFFER

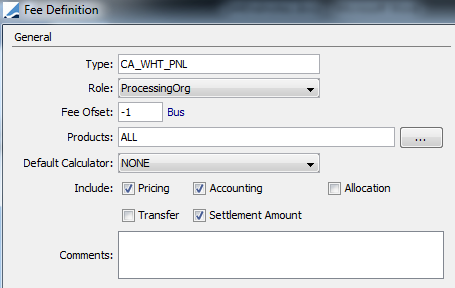

A withholding tax fee of type CA_WHT_PNL can be computed for the CA types EXOF/ACQUISITION/CASH_OFFER, EXOF/ACQUISITION/CASH_OFFER, and SOFF/CASH/ADJUSTMENT, provided a withholding tax configuration exists.

Fee definition

The withholding tax configuration can be defined using Configuration > Fees, Haircuts, & Margin Calls > WithHoldingTax Config.

The system will generate the CA P&L trade with settlement amount = net amount and fee CA_WHT_PNL.

There is no fee generated on the Agent trade.

2. Viewing Corporate Action Definitions

You can display the corporate actions defined in the system using Reports > Securities Reports > Corporate Action Report.

See Corporate Action Report for details.

See Corporate Action Report for details.

3. XML Import Export

Choose XML > XML Export to export the CA event to an XML file.

You can then choose XML > XML Import to import the XML file you have created into another environment, or use the format to import other CA events.