Listed Corporate Actions

The process for applying corporate actions to listed products is the following:

| • | You first create / import the corporate action definition on the underlying equity / equity index. |

| • | Then you adjust the contract using CA rules and the CA Adjustment report - This adjusts the contract, and creates an adjustment corporate action (ASSIMILATION) to be applied to the listed trades. |

| • | Finally, you apply the ASSIMILATION corporate action to the listed trades. |

This process is the same for ETO trades (listed equity options), Future Equity trades, Future / Future Option Equity Index trades, and Warrants, and applies to the following types of corporate actions:

| • | DIVIDEND |

| • | MDE (Market Disruption Events) |

| • | SPLIT |

| • | MERGER |

| • | SPINOFF |

By default, the new contract is created with Contract Name = "#<source contract name>".

There is also the option of renaming the old contract instead of the new contract using the domain “ETDClearing.RenameOldETONonSVNContract”.

If “ETDClearing.RenameOldETONonSVNContract” contains Value = true:

| • | Add a prefix '#' on the Contract Name of Source Contract. |

| • | Add CAClearingExchangeTicker attribute on Source Contract. |

| • | Remove ClearingExchangeTicker, GMIProduct attributes from Source Contract. |

| • | Set Source Contract Name attribute on New Contract. |

If “ETDClearing.RenameOldETONonSVNContract” contains Value = false:

| • | Add a prefix '#' on the Contract Name of New Contract. |

Average price is used by default. You can use the domain CAByOpenTrade to use the original price instead of the average price:

Value = <CA model.CA subtype.product type>

Comment = true

Example:

Value = TRANSFORMATION.ASSIMILATION.ETOEquity

Comment = true

For these CAs, the price of the new trade is the original price, not the average price.

1. Listed Equity Options (ETOs) - SPLIT Example

In the case of ETOs, the SPLIT corporate action is applied to the ETO contract through a contract adjustment. The contract adjustment creates an ASSIMILATION corporate action that is then applied to the actual ETO trades.

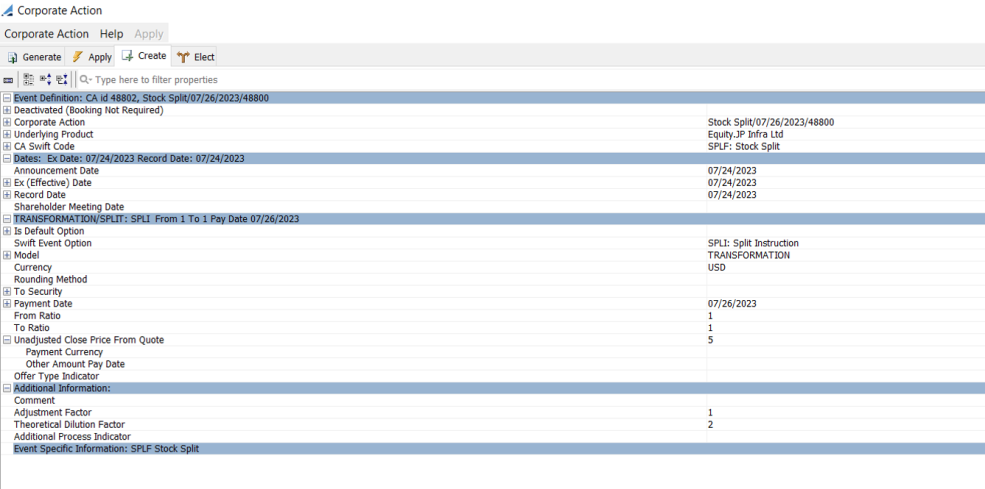

1.1 Creating the SPLIT Corporate Action

Create the corporate action in the Create panel.

| » | Select the underlying equity to which the split applies. |

| » | Select the swift code SPLF or SPLR - The corporate action type is set as follows: |

Model = TRANSFORMATION and Subtype = SPLIT.

| » | Enter the split ratio using From Ratio (old shares) / To Ratio (new shares). |

| » | Enter the “Unadjusted Close Price From Quote” to set the underlying equity price on EX Date, when EX Date quotes are not available. This is only used when the FROM QUOTE operator is selected in Corporate Action Rules window. |

| » | Enter the adjustment factor (manual factor) / theoretical dilution factor as needed. |

1.2 Adjusting the ETO Contract

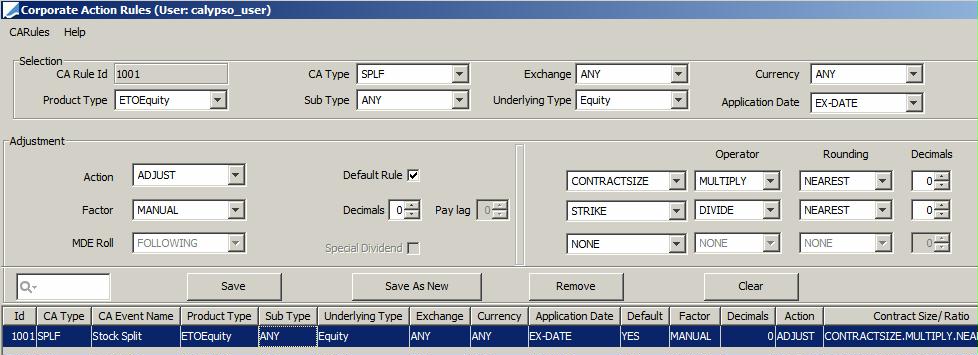

You need to create an adjustment rule for the corporate action using Trade Lifecycle > Corporate Action > CA Rules (menu action reporting.CARulesWindow).

Set the following details for the target adjustments.

| • | Action to be applied. |

| • | Factor: NONE, MANUAL (takes the adjustment factor set in the CA), or THEORETICAL (takes the theoretical dilution factor set in the CA). |

| • | Check "Default Rule". |

| • | Adjustment type - Select one of the following: |

| – | CONTRACTSIZE - To adjust the contract size. |

| – | QUANTITY - To adjust the quantity (position). |

| – | RATIO - In an even split ratio (for example, 1:2, 1:4), the quantity is adjusted. In an odd split ratio (for example, 2:3), the contract size is adjusted. |

| – | STRIKE - To adjust the strike. |

| – | PRICE - To adjust the price. |

| – | BARRIER - To adjust the barrier. |

| • | Operator - Select whether to MULTIPLY, DIVIDE, ADD, FROM QUOTE or SUBTRACT the adjustment factor. When FROM QUOTE is selected, the price is calculated using the Korean Exchange formula which adjusts the contract size with the adjustment factor and requires the underlying equity quote on “EX Date -1” and “EX Date”. If the quote is not available on EX Date, it is taken from “Unadjusted Close Price From Quote”. |

| • | Rounding - Select the rounding method (NEAREST, UP, DOWN) that will be used for the new contract size or quantity. |

Rounding method NEAR8TH is used in US markets and only applies to strike adjustment. It rounds the strike to the nearest 1/8.

| • | Decimals - Set the number of decimal places to use on the new contract size or quantity. |

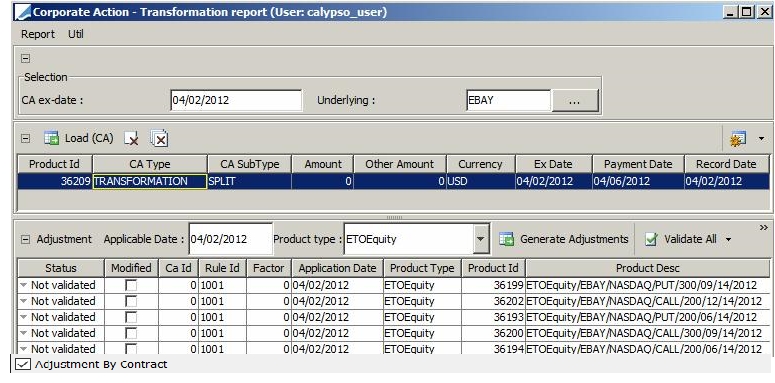

Then you run the CA Adjustment report to adjust the ETO contracts using Trade Lifecycle > Corporate Action > CA Adjustment Report (menu action reporting.CATransformationReportFrame).

| » | Enter the CA date and select the underlying. |

| » | Click Load (CA) to load the applicable corporate actions. |

| » | Select the corporate action you want to apply, and click Generate Adjustments to generate the adjustments. |

| » | Set / adjust the strike / contract size / To Exch clrg ticker / etc. as needed and click Validate All to validate the adjustments. |

You can also select a few rows and choose Validate selected CA Adjustment to validate only the selected adjustments. If "Adjustment By Contract" is checked (default value), you will be prompted to validate all adjustments. Otherwise, only the selected adjustments are validated.

| » | Finally, click Save All to save the adjustments. |

New adjusted contracts and options are created, and the corporate actions to be applied to the actual ETO trades are created.

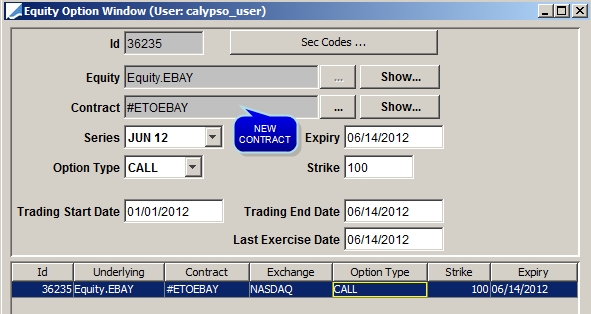

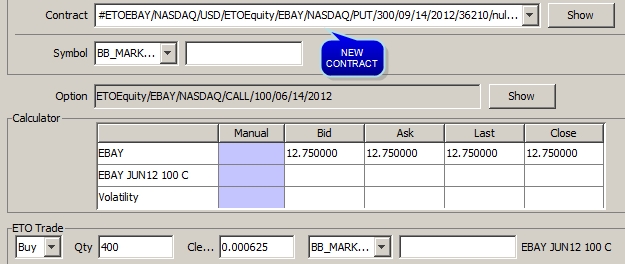

New option on new contract, with adjusted strike:

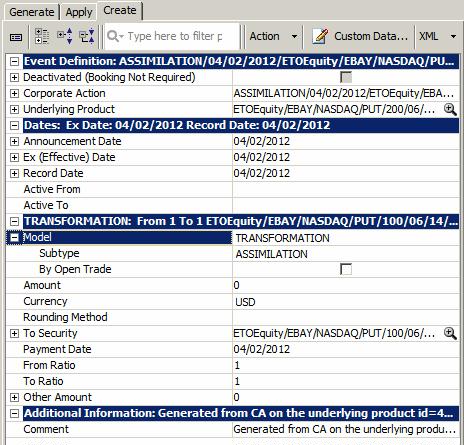

Assimilation corporate action:

If you check "By Open Trade", the close out trade uses the original trade price to close the position.

1.3 Applying the ASSIMILATION Corporate Action

Select the Apply panel of the Corporate Action window to apply the corporate action to the ETO trades.

| » | Enter search criteria to select the corporate action, and click Load (CA). |

You can save a template from the Apply menu to save the criteria currently selected as a template. You can then load a template to populate the criteria as needed.

| » | Click Load (Position) to load the trades / positions impacted by the selected CA and apply the corporate action. |

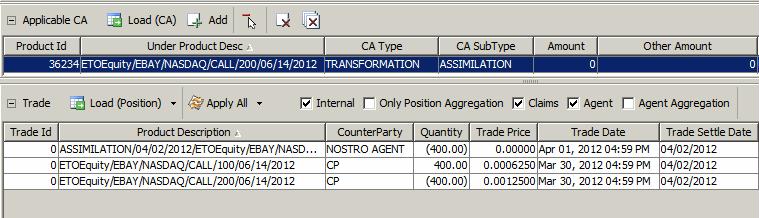

The system creates a trade that will close out the original trade, and a new trade with the new contract.

It also creates a CA trade for the agent position.

| » | Click Apply All to validate the application of the corporate action and save the trades. |

Close out trade:

New trade:

The original trade date is saved in trade keyword CAOriginalTradeDate.

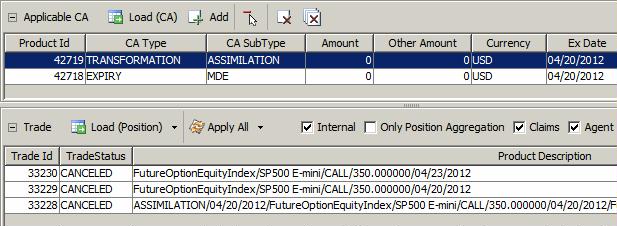

2. Future Option Equity Index - MDE Example

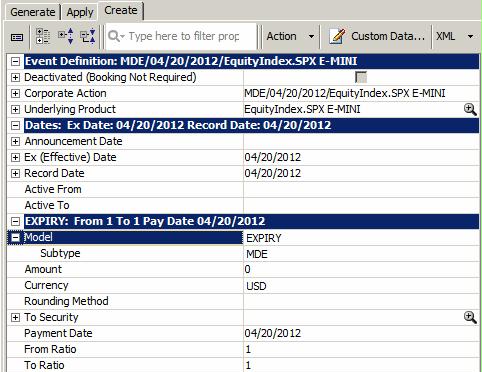

2.1 Creating the MDE Corporate Action

MODEL = EXPIRY

Subtype = MDE

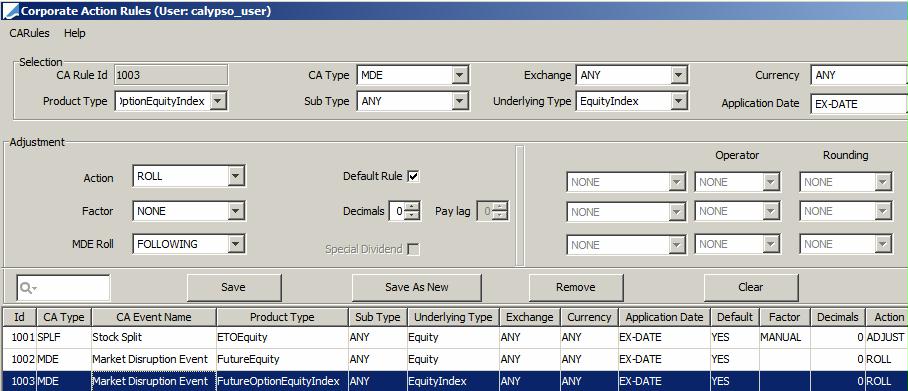

2.2 Adjusting the Future Option

CA Rule

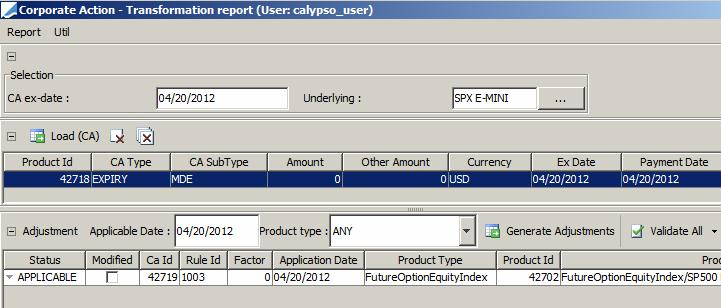

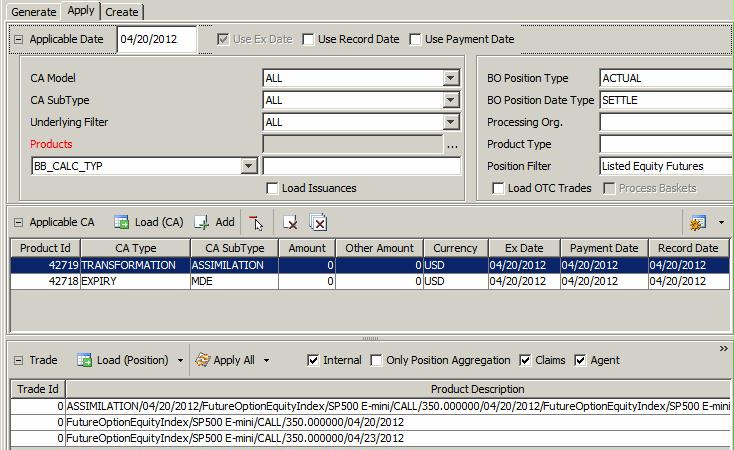

CA Adjustment

| » | Load the CA you want to apply. |

| » | Click Generate Adjustments. |

| » | Check that the information is correct, and click Validate All. |

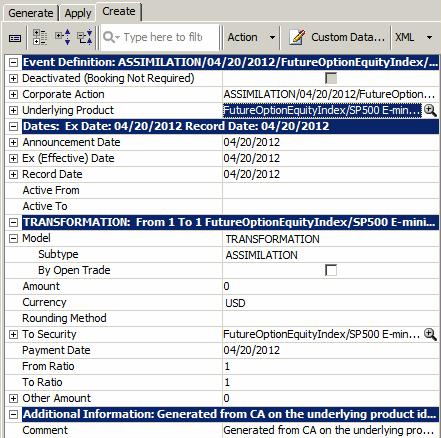

It creates the ASSIMILATION corporate action.

2.3 Applying the ASSIMILATION Corporate Action

3. Modification and Cancellation Process

If you modify / cancel a "parent" corporate action (DIVIDEND, MDE, SPLIT), it does not automatically modify / cancel the adjustment corporate actions. You need to run the scheduled task PROCESS_ADJUSTMENTS to modify / cancel the adjustment corporate actions.

The steps are the following:

| • | Modify or cancel a "parent" corporate action as applicable, by changing its status. |

| • | Run the scheduled task PROCESS_ADJUSTMENTS to cancel / modify the related adjustment corporate actions. |

| • | Apply the cancellation / modification to the actual CA trades using the Apply panel of the Corporate Action window. |

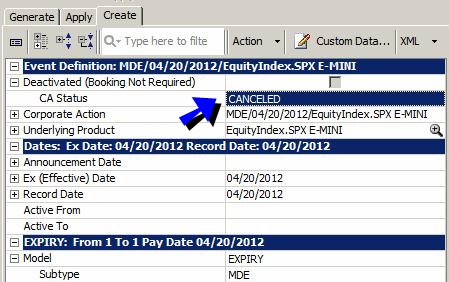

3.1 Modify / Cancel a "Parent" Corporate Action

| » | Modify the corporate action, and change its status as needed - For example: |

| – | Status = CANCELED - To cancel the corporate action. |

| – | Status = VALIDATED - To reflect the modification of the corporate action. |

| » | Save your changes. |

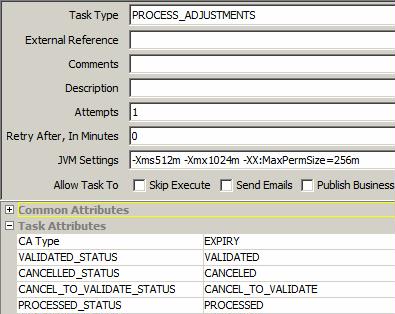

3.2 Run the Scheduled Task PROCESS_ADJUSTMENTS

The corporate action's ex-date must be within the range of the "valuation date - from days", and "valuation date + to days".

The scheduled task loads modified / canceled "parent" corporate actions, and modifies / cancels related adjustment corporate actions. It only modifies / cancels the corporate action definitions, not the actual corporate action trades.

| » | Select the CA type, and select the status codes as follows: |

| – | VALIDATED_STATUS - Status of "parent" modified CAs to be selected - The selected CAs will trigger the modification of the adjustment CAs. |

| – | CANCELLED_STATUS - Status of "parent" canceled CAs to be selected - The selected CAs will trigger the cancellation of the adjustment CAs. |

| – | CANCEL_TO_VALIDATE_STATUS - Resulting status of "canceled" adjustment CA. |

| – | PROCESSED_STATUS - Resulting status of "modified" adjustment CA. |

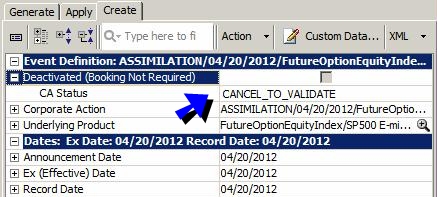

3.3 Apply the Modified / Canceled Adjustment Corporate Actions

Depending on the resulting status that you have selected on the adjustment CAs, you may have to confirm the cancellation / modification.

| » | In this example, change the status to CANCELED to confirm the cancellation. |

Select the Apply panel, and apply the cancellation to the actual corporate actions trades.