OTC Corporate Actions

This document shows examples of corporate actions applied to OTC Equity Derivatives trades.

Ⓘ [NOTE: Only splits and dividends are supported for OTC Equity Derivatives trades. In addition, accruals and mergers are supported for equity swaps]

1. Equity Structured Options - SPLIT Examples

The guiding principle of adjustment performed on product and trades due to corporate action is that trades are adjusted so that the holder is not affected financially by the corporate action: the market value of the trade or position will not change.

Depending on whether the trade is on a single underlying or a basket, and whether it is defined in quantity or in notional (performance based), different methodologies are used to modify equity derivatives trades after a corporate action is applied.

1.1 Methodology Overview

Single Underlying - Trade Characteristics Adjustment

For single asset options defined in terms of quantity, the number of shares in the option, as well as trade levels will be adjusted in order to reflect the new quotation of the stock in the market after the corporate action has occurred.

By trade levels, we mean all trade information that is defined referring to the price of the underlying stock:

| • | Strike |

| • | Barrier Level |

In addition to the quantity itself, the amounts computed using the quantity will need to be adjusted to avoid unexpected jumps:

| • | Digital amount |

| • | Barrier rebate |

For Corporate Actions inducing a change in the list of the underlying (spin-off, mergers, name change) manual adjustment are performed for single underlying options on the relevant stock through the cancellation and recapture of the trades.

Basket Underlying - Basket Modification

For basket options, the payoff is defined using the basket level when the basket is defined in quantity, in which case the option trade is also defined in quantity.

In this case, a corporate action will result in a modification of the definition of the underlying basket : quantity associated with each component may be modified so that the basket level can be properly calculated by taking the corporate action into account.

Payout Depending on Historical Quotes - Quotes Adjustment

For all types of options where the final payout is defined based on historical quotes, the historical quotes are adjusted so that the payout can be computed appropriately. The rationale behind the adjustment is to correctly revert the drop of the stock price observed on the market when the corporate action becomes effective, in order to calculate the performance of the stock.

This methodology is used in particular for:

| • | Asian and Lookback options. |

| • | Performance based trades, such as Cliquets, Rainbows and generally speaking structures defined using eXSP. |

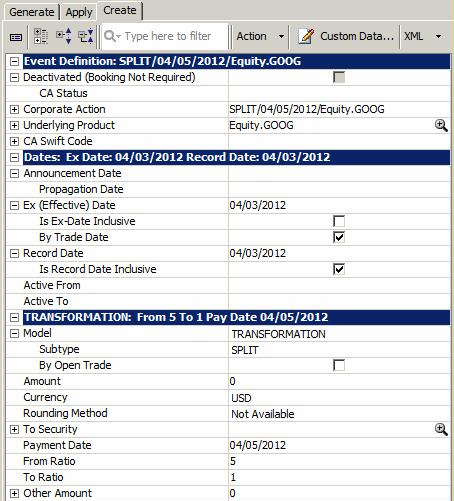

1.2 Stock Split Definition

The corporate action is defined in the Create panel.

| » | Select the underlying equity to which the split applies. |

| » | Select the swift code SPLF or SPLR - The corporate action type is set as follows: |

Model = TRANSFORMATION and Subtype = SPLIT.

| » | Enter the split ratio using From Ratio (old shares) / To Ratio (new shares). |

The corporate action can be applied from the Apply panel, or using the CORPORATE_ACTION scheduled task.

1.3 Applying to a Vanilla OTC Option - Single Underlying

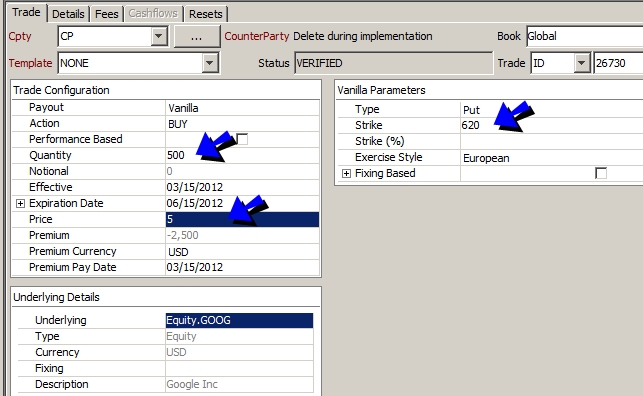

Sample vanilla OTC option trade:

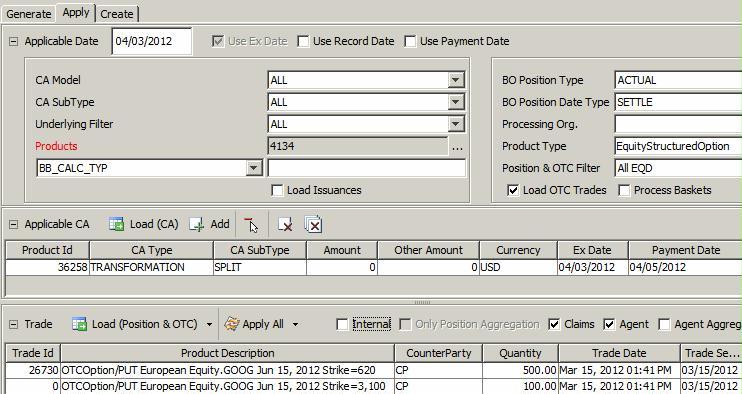

Select the Apply panel to apply the corporate action:

Ⓘ [NOTE: For OTC trades, the Position & OTC Filter must contain the product type of the OTC trades]

| » | Enter search criteria to select the corporate action, and click Load (CA). |

You can save a template from the Apply menu to save the criteria currently selected as a template. You can then load a template to populate the criteria as needed.

| » | Check "Load OTC Trades" and click Load (Position & OTC) to load the trades impacted by the selected CA and apply the corporate action. |

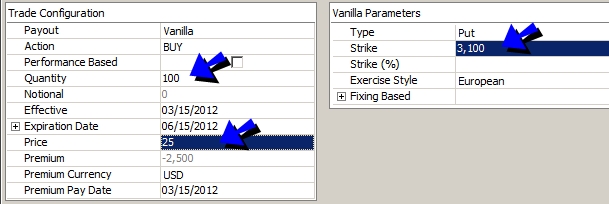

The original trade is terminated and a new trade is created with adjusted characteristics.

| » | Click Apply All to validate the application of the corporate action, and save the trades. |

New Trade: The quantity, premium / price and strike are adjusted according to the split ratio.

1.4 Applying to a Barrier Option - Single Underlying

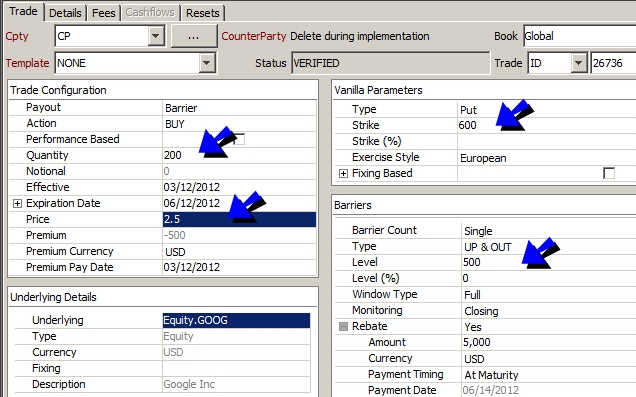

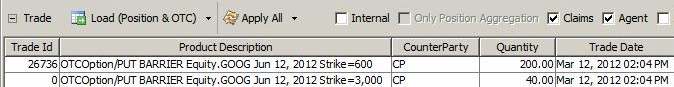

Sample barrier option trade:

Select the Apply panel to apply the corporate action:

New Trade: The quantity, premium / price, strike, and barrier characteristics are adjusted according to the split ratio.

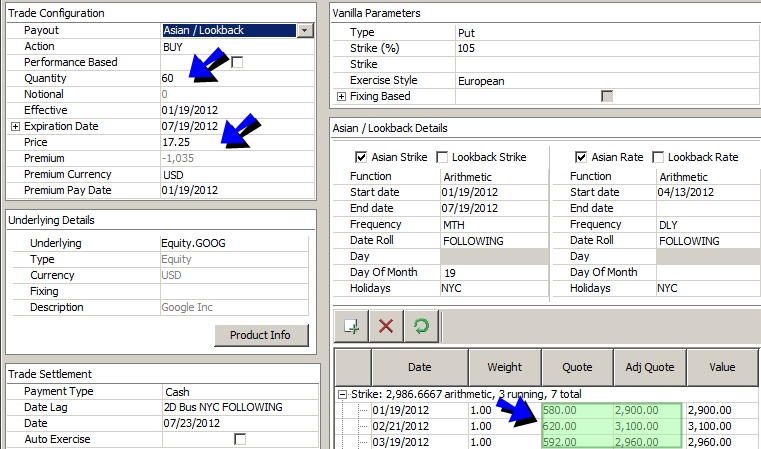

1.5 Applying to an Asian Option - Single Underlying

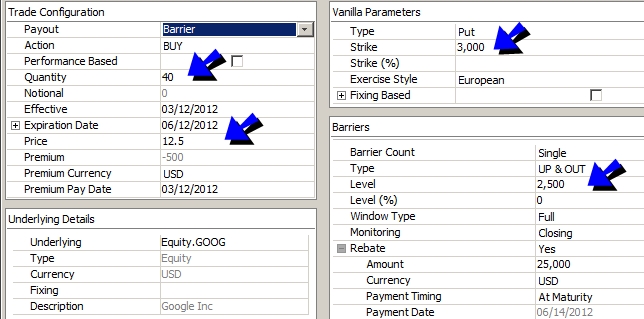

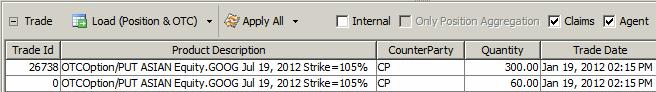

Sample Asian option trade:

Asian schedule: The quotes and adjusted quotes are the same since no split has been applied yet to the corporate action:

Select the Apply panel to apply the corporate action:

Ⓘ [NOTE: For OTC trades, the Position & OTC Filter must contain the product type of the OTC trades]

New Trade: The quantity, premium, and strike are adjusted according to the split ratio.

The Asian schedule shows the adjusted quotes.

1.6 Applying to a Vanilla Option - Quantity Basket Underlying

When a corporate action is applied to a trade with a "quantity" basket underlying, it is first applied to the basket, then to the actual trade.

Applying the corporate action to the basket is done using the CA Basket Generation window.

Then the corporate action is applied to the trades using the Corporate Action window, or the scheduled task CORPORATE_ACTION.

When applying the corporate action to the trades using the scheduled task CORPORATE_ACTION, you must set the attribute "Apply to basket" to True.

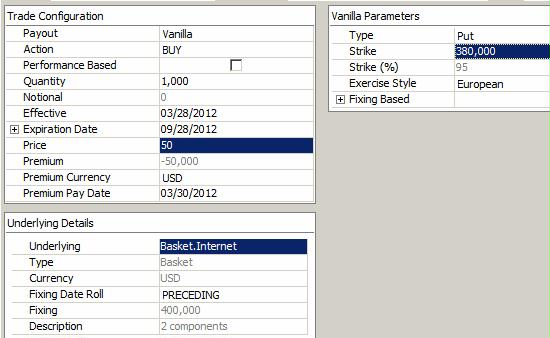

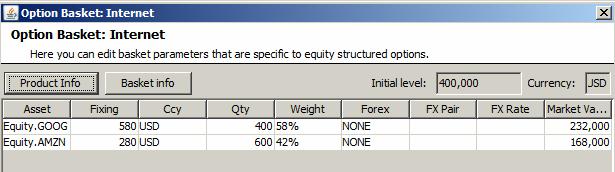

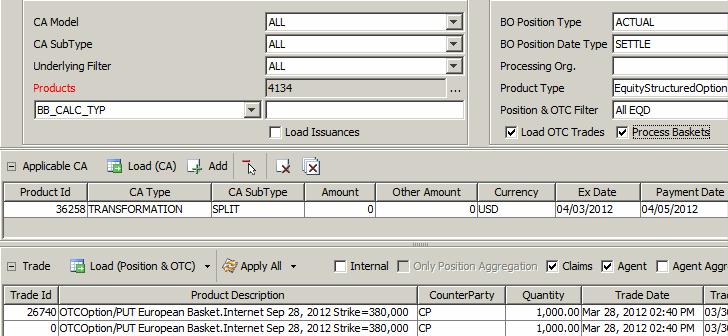

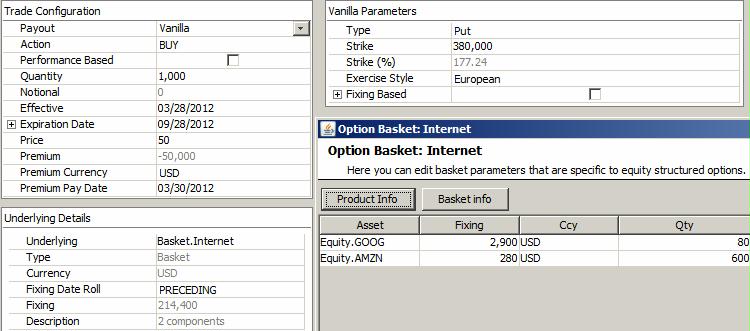

Sample basket:

Sample vanilla option trade:

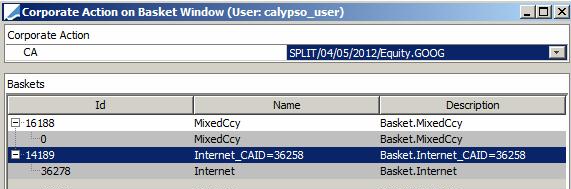

From the Calypso Navigator, navigate to Trade Lifecycle > Corporate Action > CA Basket Generation to apply the corporate action to the basket.

| » | Select the corporate action at the top of the window. |

| » | Click Load Baskets to load the baskets on which the corporate action can be applied. Then select a basket and click Apply Selected to adjust the quantities of the basket. |

Now, the corporate action must be applied to the trade itself. Select the Apply panel in the Corporate Action window.

| » | Check the Process Baskets checkbox. |

The new trade is based on the updated basket.

2. Equity Swap - DIVIDEND Example

2.1 Defining a Dividend

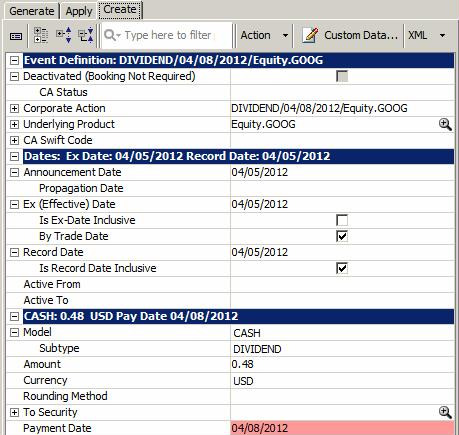

Define the dividend CA in the Create panel of the Corporate Action window: CASH.DIVIDEND.

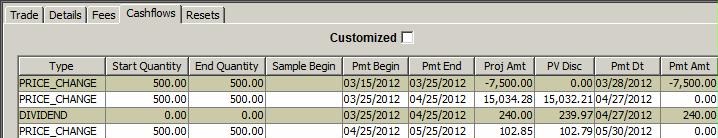

Depending on the Dividend's payment schedule, the newly created dividend corporate action will impact the cashflows of the equity swap.

2.2 Applying to an Equity Swap

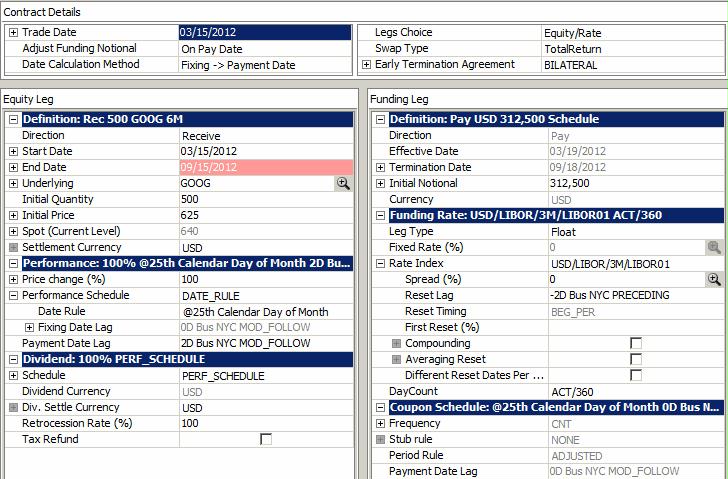

Sample Equity Swap:

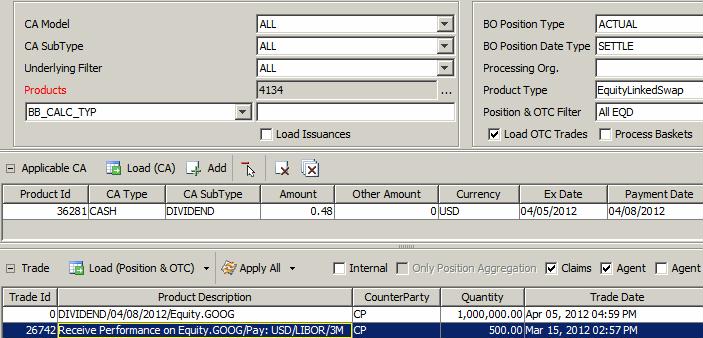

Select the Apply panel in the Corporate Action window.

Ⓘ [NOTE: For OTC trades, the Position & OTC Filter must contain the product type of the OTC trades]

| » | Enter search criteria to select the corporate action, and click Load (CA). You can also click |

| » | Check "Load OTC Trades" and click Load (Position & OTC) to load the trades impacted by the selected CA and apply the corporate action. |

The original trade is modified with the dividend information.

| » | Click Apply All to validate the application of the corporate action, and save the trades. |