Corporate Action Apply Trade Simulation Report

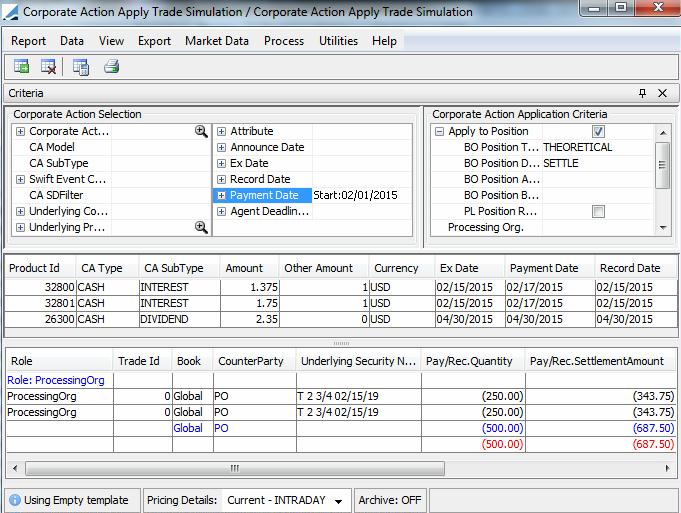

The CA Apply Trade Simulation report allows simulating the application of corporate actions.

It allows loading a set of corporate actions and the corresponding positions / trades, and it simulates the application of the corporate actions in the exact same way as the Apply panel of the Corporate Action window. The only difference is that it does not allow saving the trades.

For information on how the simulated trades and positions are generated, refer to the following topics:

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades.

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades.

Corporate Action for Listed products - Splits, MDEs, and dividends on listed products.

Corporate Action for Listed products - Splits, MDEs, and dividends on listed products.

Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

From the Calypso Navigator, navigate to (menu action reporting.ReportWindow$CAApplyTradeSimulation).

Ⓘ [NOTE: You can configure the columns. Sort columns, subheadings and subtotals have to

be explicitly specified. Choose for details]

|

»

|

You can change the pricing details at the bottom of the window - By default, the pricing environment comes from the User Defaults, and the valuation date is the current date and time. |

|

»

|

You can check / uncheck to display / hide the search criteria. |

|

»

|

Specify search criteria to select corporate actions. |

Specify search criteria to select trades and positions, they are described below.

Then click  to load the corresponding corporate actions, trades and positions.

to load the corresponding corporate actions, trades and positions.

|

»

|

You can select a template, and click  to display the number of objects that will be loaded from the database, before loading the report. to display the number of objects that will be loaded from the database, before loading the report. |

|

»

|

You can click  to print

the report results. to print

the report results. |

Note that for the Pivot view and the Aggregation view, the print icon is disabled.

You can use [Ctrl+P] or [Ctrl+L] to print the report, or you can export the report to Excel and print it from there.

Search Criteria to Select Trades and Positions

|

•

|

Apply to Position - Check to apply the corporate action to positions. Then select the position criteria. |

|

–

|

BO Position Type - Select the position type: ACTUAL (at record date) or THEORETICAL (at ex-dividend date). |

|

–

|

BO Position Date Type - Select the position date: TRADE or SETTLE. |

|

–

|

BO Position Aggregation - Select the position aggregation if any. |

|

–

|

BO Position Balance Type - Select the position balance type. |

|

–

|

PL Position Repoed - Check to trigger the dividend pass-through functionality. |

|

•

|

Processing Org - Select a processing organization as needed. |

|

•

|

Product Type - Select a list of product types as needed. |

|

•

|

Position Filter - Select a trade filter as needed (note that SQL generated Trade Filters are not supported). |

|

•

|

Apply to OTC - Check to apply the corporate action to OTC trades (repo trades, sec lending trades, equity derivatives trades). In that case, the corresponding product types must be selected in the trade filter. |

The "Process Baskets" checkbox is only used in the context of corporate actions on Equity Derivatives with baskets.

|

•

|

Filter Display - Check to filter on CA position type and agent aggregation. |

|

–

|

CA Position Type - Each CA trade is classified in a position type, agent, claim with counterparty, etc… Select as needed. |

|

–

|

Agent Aggregation Only - To display only the CA agent trades against the CA Adjustment book |

|

–

|

Show Log Progress - To show the log progress |

|

•

|

Generate Ca First - Check to simulate the CA products when they do not exist. In that case the simulated CA products have a negative Id and the CA trades have no Trade Ids. |

You need to select underlying bond products in order for the CA products to be simulated.

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades.

Corporate Actions for position-based products - Coupons and redemptions on bonds, corporate actions on equity positions / sec lending trades / repo trades. Corporate Action for Listed products - Splits, MDEs, and dividends on listed products.

Corporate Action for Listed products - Splits, MDEs, and dividends on listed products. Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

Corporate Actions for OTC products - Splits and dividends on OTC equity derivatives.

![]() to load the corresponding corporate actions, trades and positions.

to load the corresponding corporate actions, trades and positions.