Defining Bond Products

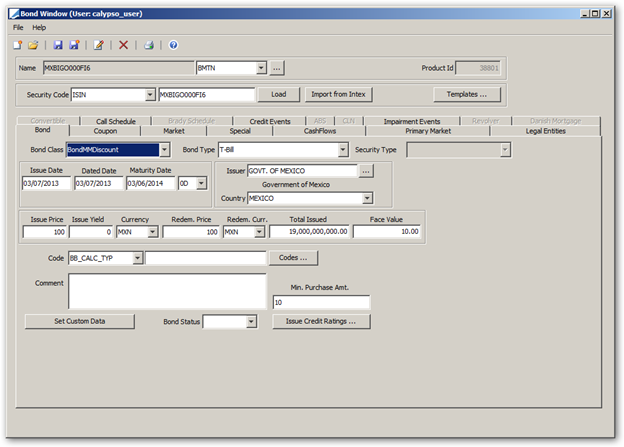

Prior to trading a bond, you need to create the Bond product.

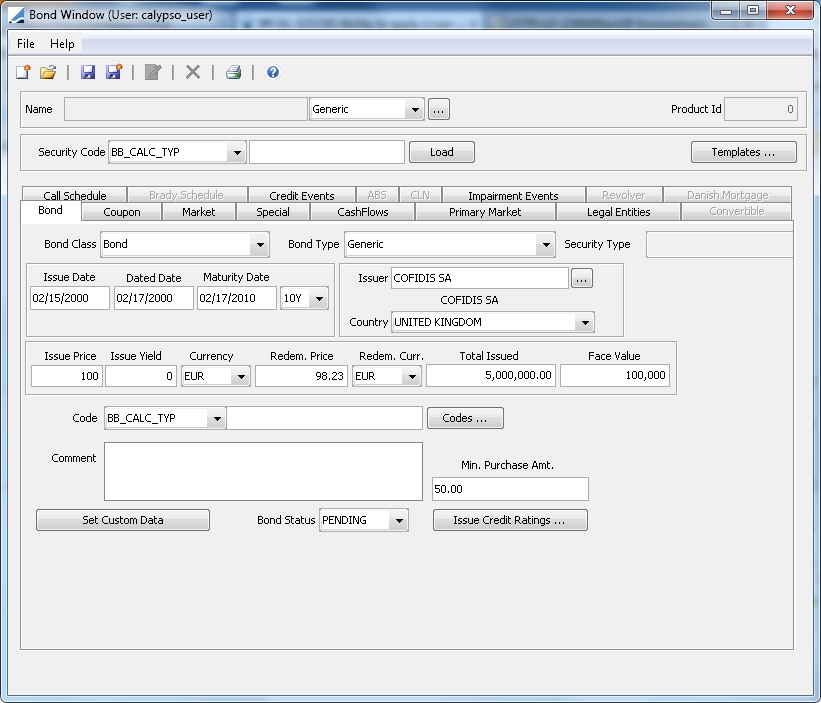

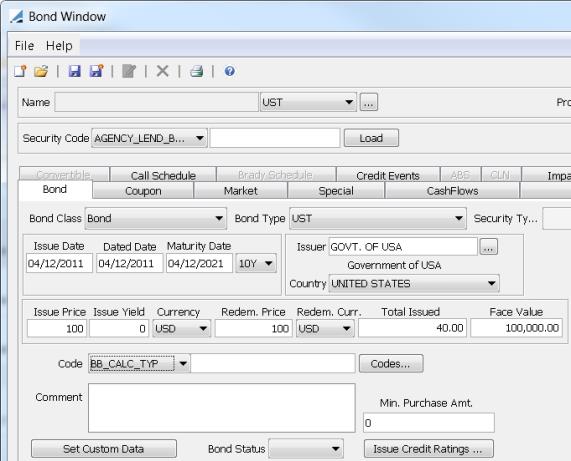

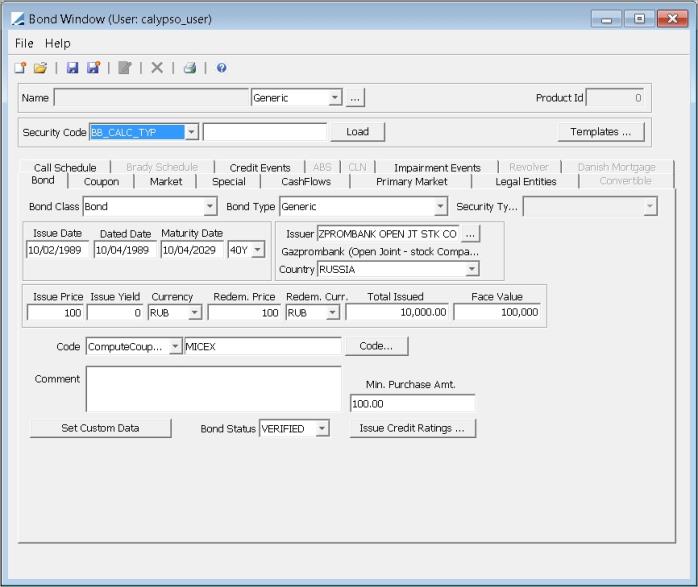

From the Calypso Navigator, navigate to Configuration > Fixed Income > Bond Product Definition to open the Bond window.

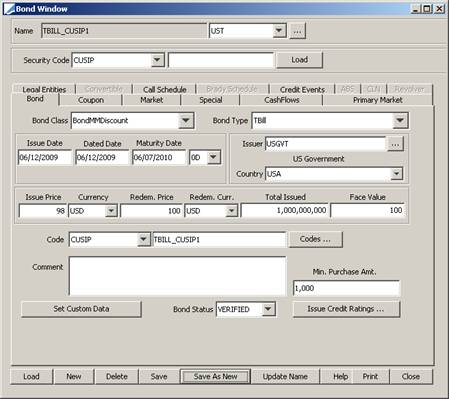

When you open the Bond window, the Bond panel is selected by default.

You can view existing bonds using the Bond Report.

You can view existing bonds using the Bond Report.

|

Contents - Specifying Market Conventions - Specifying Special Characteristics - Specifying Primary Market Information |

Defining Specific Bond and Product Types |

1. Defining a Bond

Select the Bond panel to define a bond.

Bond Product Definition Window

1.1 Loading an Existing Bond

You can load an existing bond into the Bond Product window using one of the following methods:

| » | Select a security code from the Security Code list, and enter the actual code value in the adjacent field. |

Then click Load to load the corresponding bond.

| » | You can also click Load at the bottom of the window to open the Product Chooser window. |

Then enter the fields described below.

1.2 Creating a New Bond

You can create a new bond using one of the following methods.

| » | If you have specified bond defaults, select a bond default next to the Name field. It will populate the corresponding fields in the Bond window. You can click ... to create new bond defaults. |

| » | If you have specified bond templates, click Templates and choose “Load Template”. It will populate the corresponding fields in the Bond window. |

| » | Otherwise, click New and enter the fields in the Bond panel and in the other panels as applicable. The fields are described below. |

1.3 Manipulating Bond Templates

You can save the current bond as a bond template, or load an existing bond template to create a new bond.

| » | Click Templates to manipulate bond templates. |

You can convert all bond defaults to bond templates, load a bond template, remove a bond template, and save the current bond as a bond template.

1.4 Modifying a Bond Name

| » | Click Update Name to modify the bond’s name. You will be prompted to enter a new name. |

1.5 Setting Custom Data

| » | Click Set Custom Data to specify custom data as applicable. It invokes a class named apps.product.BondCustomDataWindow that implements com.calypso.apps.product.CustomDataWindow, provided it is implemented and compiled. Refer to the Calypso Developer’s Guide for details. |

1.6 Saving a Bond

| » | Click Save to save your changes. You will be prompted to enter a bond name. |

| – | When a bond is saved, you can save the quote type. By default the proposed quote type is the one specified in the Market panel. |

| – | You will also be prompted to generate the corporate actions for the bond. You can then apply the corporate actions using Trade Lifecycle > Corporate Action > Corporate Action – Apply panel, or the scheduled task CORPORATE_ACTION. |

| » | You can also click Save As New to save the bond as a new bond. You will be prompted to enter a new bond name. |

1.7 Setting Credit Data

| » | Click Issue Credit Ratings to set credit data at the bond level (they can also be set at the issuer level). The Product Credit Rating report will appear. |

| – | Select an agency, a rating type, a value, and a date range then choose ProductCreditRating > Add New Rating (F5) to add the rating value. |

| – | You can also use this report to display existing rating values. |

Ⓘ [NOTE: Access permissions are needed to add, modify or delete a credit rating in the Product Credit Report Rating window. Functions must be configured in the function domain]

1.8 Printing a Bond Ticket

| » | Click Print to print a bond ticket using the default template. |

| – | The default template can be customized as described under Defining a Bond Ticket Template. |

|

Fields |

Description |

||||||||||||||||||||||||||||||||||||

|

Name |

Name given by the user when the bond is saved. |

||||||||||||||||||||||||||||||||||||

|

Product Id |

Unique id given by the system when the bond is saved. |

||||||||||||||||||||||||||||||||||||

|

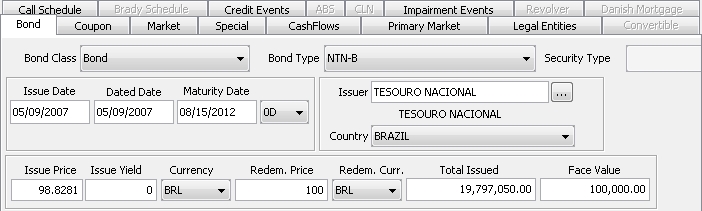

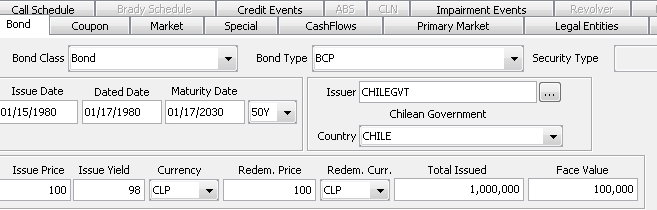

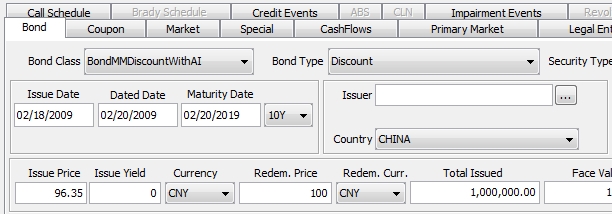

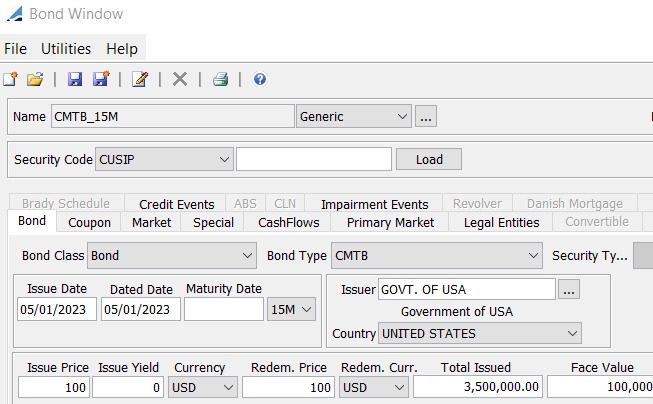

Bond Class |

Select a bond class. The following bond classes are available out-of-the-box:

Ⓘ [NOTE: MBSArm and MBSFixedRate are not currently supported] Bond classes are defined in the productType domain.

|

||||||||||||||||||||||||||||||||||||

|

Bond Type |

Select a bond type. For each bond class, there is a list of bond types in the <bond class>.subtype domain, for example Bond.subtype. The bond type will be used for pricer / curve selection to compute the Yield-to-Price formula. You can create bond types as applicable for reporting purposes. For the “Azeri” bond type, all frequency tenors will be treated as day-based. E.g. Quarterly will be treated as exact 90D and semi-annual will be treated as exact 180D. Ⓘ [NOTE: Domain names are case-sensitive] |

||||||||||||||||||||||||||||||||||||

|

Security Type |

You can select a security type provided security types are defined in domain <Bond Class>.extendedType, for example Bond.extendedType. The security type can be used for pricer / curve selection, and reporting purposes. Ⓘ [NOTE: Domain names are case-sensitive] |

||||||||||||||||||||||||||||||||||||

|

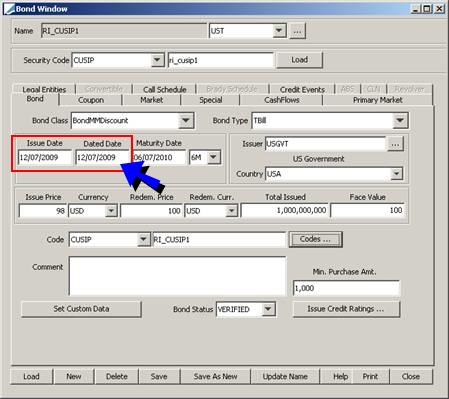

Issue Date |

Enter the issue date. |

||||||||||||||||||||||||||||||||||||

|

Dated Date |

Enter the accrual calculation start date. Bonds with a Dated Date > Issue Date PricerBondGeneric can compute bonds with a Dated Date > Issue Date. For example, on a Spanish Government bond defined with Issue Date = 07/15/2000 and Dated Date 09/01/2002, it is possible to input trades between the issue date and the dated date in order to obtain the settlement amount, i.e. without any accruals calculation. Similarly, a bond with Dated Date < Issue Date may be purchased on its issue date with accrued interest. |

||||||||||||||||||||||||||||||||||||

|

Maturity Date |

You can enter the maturity date, or select a maturity offset. If you select a maturity offset, the maturity date will be calculated as dated date + maturity offset. Date can be left blank for perpetual bonds. You need to set the stub end date however to determine how far to generate the cashflows. Ⓘ [NOTE: The maturity date for a perpetual bond defaults to +60,000 days after the val date. This behavior can be overridden at the API level] |

||||||||||||||||||||||||||||||||||||

|

Issuer |

Click ... to select the issuer. The issuer is a legal entity of role Issuer. |

||||||||||||||||||||||||||||||||||||

|

Country |

Defaults to the country of the issuer. Modify as applicable. |

||||||||||||||||||||||||||||||||||||

|

Issue Price |

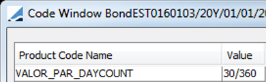

Enter the issue price. Issue Price Base You can specify a different base to use for Issue Price and Redemption Price using the product code "Issue Price Base". If left blank, the default is base 100. Example: Taiwanese bills are entered in base 10,000.

|

||||||||||||||||||||||||||||||||||||

|

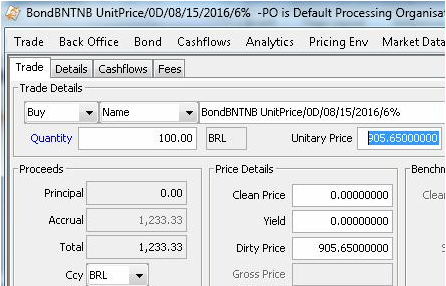

Issue Yield |

Used in defining Chilean Bond products. Enter the Tasa Efectiva Real Anual (TERA) rate for the bond. |

||||||||||||||||||||||||||||||||||||

|

Currency |

Select the issue currency. |

||||||||||||||||||||||||||||||||||||

|

Redem. Price |

Enter the redemption price. Issue Price Base You can specify a different base to use for Issue Price and Redemption Price using the product code "Issue Price Base". If left blank, the default is base 100. Example: Taiwanese bills are entered in base 10,000.

|

||||||||||||||||||||||||||||||||||||

|

Redem. Curr. |

Redemption currency. Defaults to the issue currency. Select another currency as applicable. When the redemption currency differs from the issue currency, you can enter the redemption FX rate in the Market panel.

|

||||||||||||||||||||||||||||||||||||

|

Total issued |

Enter the total face amount of the issue (original par amount used for generating the cashflows). The amount issued does not necessarily need to be correct but an amount greater than the face amount needs to be populated. |

||||||||||||||||||||||||||||||||||||

|

Face Value |

Enter the face value. |

||||||||||||||||||||||||||||||||||||

|

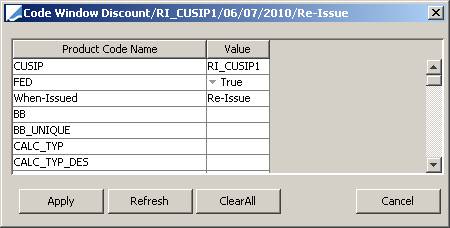

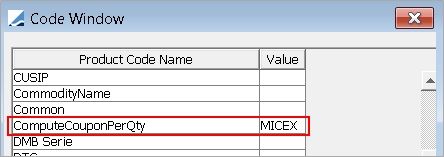

Code |

Displays the default code selected in Configuration > User Access Control > User Defaults, and its associated value in the adjacent field. Click Codes to enter the actual code values.

You can create product codes using Configuration > Product > Code. You can add security codes to the domain securityCode.ReprocessTrades that require checking if trades need to be reprocessed if the security codes are modified. You can update security codes in bulk using the Bond report.

|

||||||||||||||||||||||||||||||||||||

|

Comment |

Enter a free comment as applicable. |

||||||||||||||||||||||||||||||||||||

|

Min. Purchase Amt |

Enter a minimum amount required to trade that bond as needed. |

||||||||||||||||||||||||||||||||||||

|

Bond Status |

Only applies to Bloomberg static data integration. Shows the status of the integration. You can change it as applicable. It is available in the Bond report for filtering bonds and as a column “Bond Status”, and as a static data filter element. |

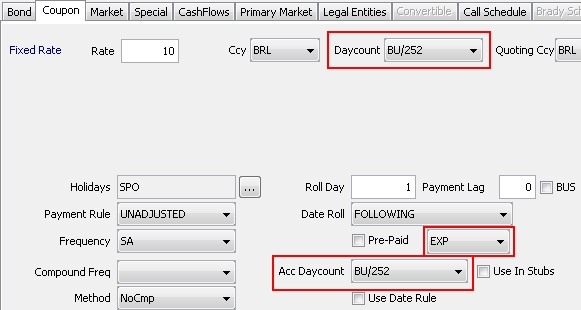

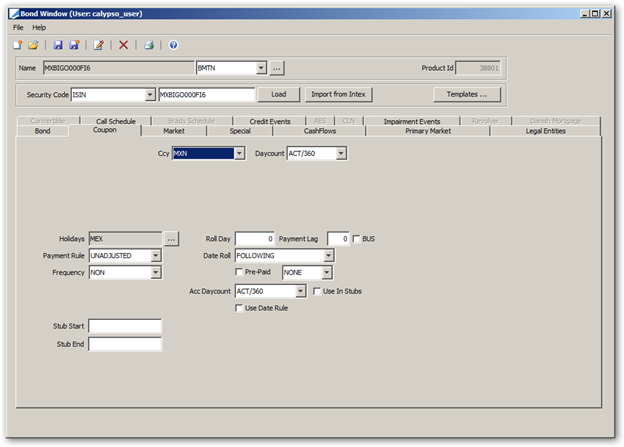

2. Specifying the Coupon

Select the Coupon panel to specify the coupon.

2.1 Specifying a Fixed Rate

The Fixed Rate label is displayed by default.

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|

Rate |

Enter the fixed rate. |

|

Ccy |

Select the coupon currency. |

|

Daycount |

Enter the coupon daycount. Daycount conventions are described under Help > Day-Count Conventions. |

|

Quoting Ccy |

In the case of an All-In Price Quote, set the quoting currency to be the same as the coupon currency. Otherwise, set it to match the bond currency. If you set the quoting currency to match the coupon currency, it assumes the quote includes the FX rate conversion and inflation adjustment. |

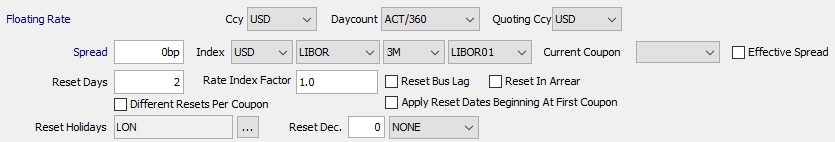

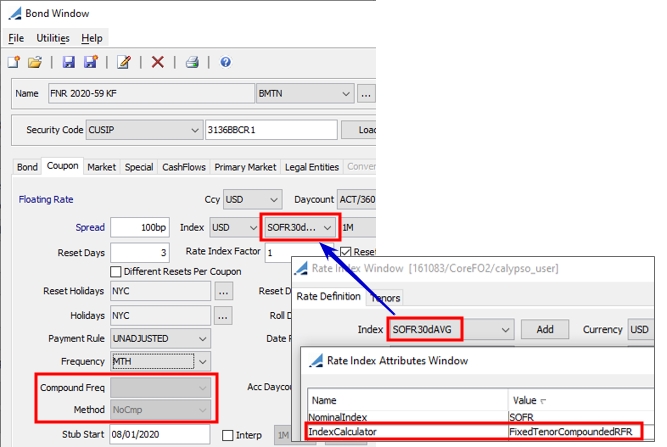

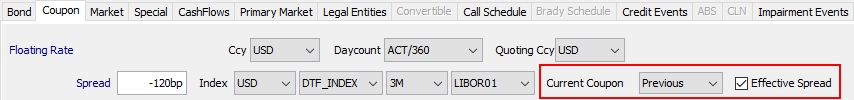

2.2 Specifying a Floating Rate

Double-click the Fixed Rate label to switch to Floating Rate.

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|||||||||||||||

|

Ccy |

Select the coupon currency. |

|||||||||||||||

|

Daycount |

Enter the coupon daycount. Daycount conventions are described under Help > Day-Count Conventions. |

|||||||||||||||

|

Quoting Ccy |

In the case of an All-In Price Quote, set the quoting currency to be the same as the coupon currency. Otherwise, set it to match the bond currency. If you set the quoting currency to match the coupon currency, it assumes the quote includes the FX rate conversion and inflation adjustment. |

|||||||||||||||

|

Spread |

Enter a spread value in basis points over the floating rate. Note that this field can be customized to apply a change in spread to the remaining cashflows, in the case of auctioned bonds for example, where the spread changes on the auction date.

|

|||||||||||||||

|

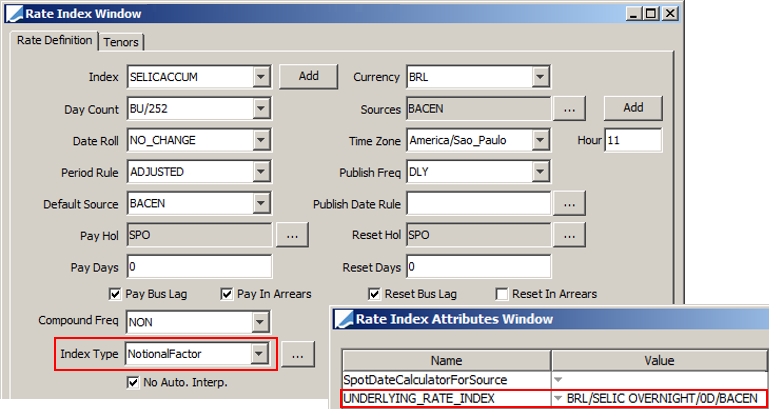

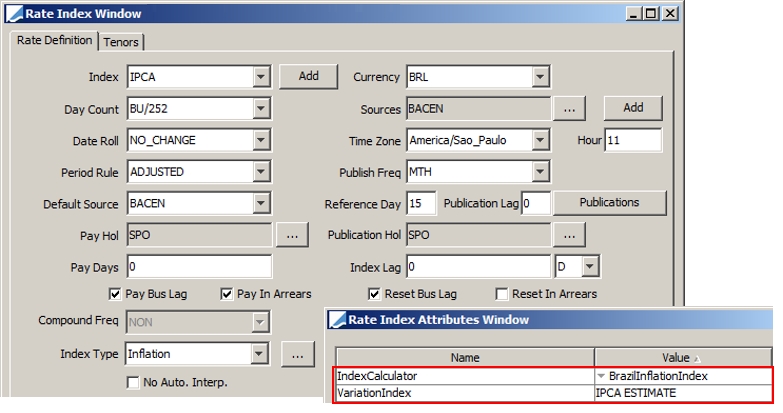

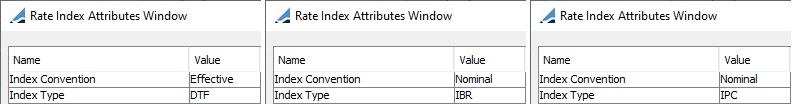

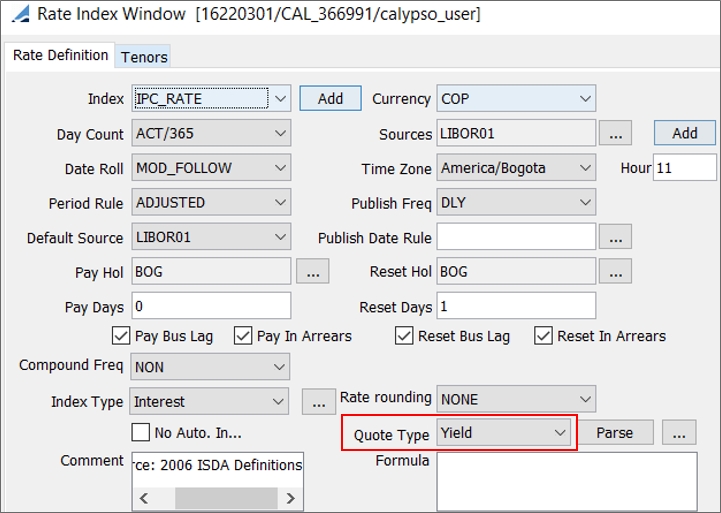

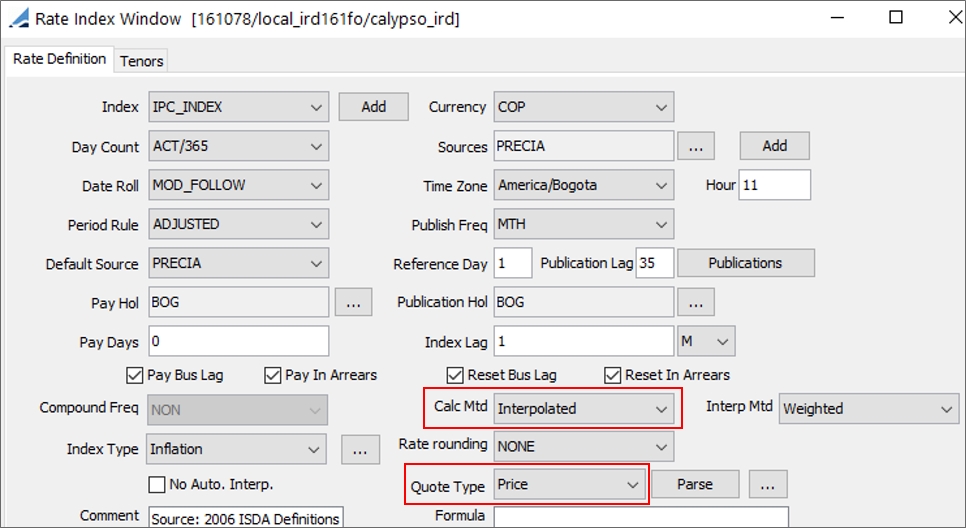

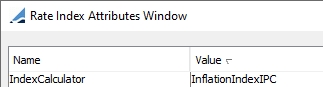

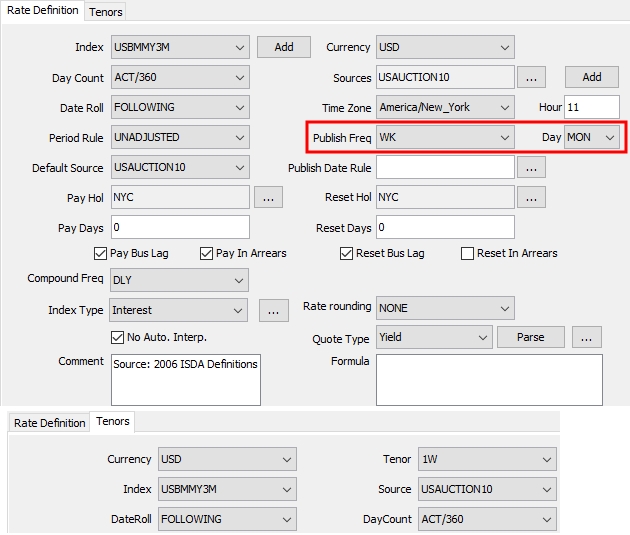

Index |

Select the currency, rate index, tenor and source that identify the floating rate. Rate indices are specified using Configuration > Interest Rates > Rate Index Definitions. Note that you can choose an index with a currency different from the coupon currency, in the case where the security is not yet re-denominated but the index is in EUR for example. |

|||||||||||||||

|

Current Coupon |

Used by Colombian DTF and IBR-linked bonds.

|

|||||||||||||||

|

Effective Spread |

Used by Colombian DTF-linked bonds.

|

|||||||||||||||

|

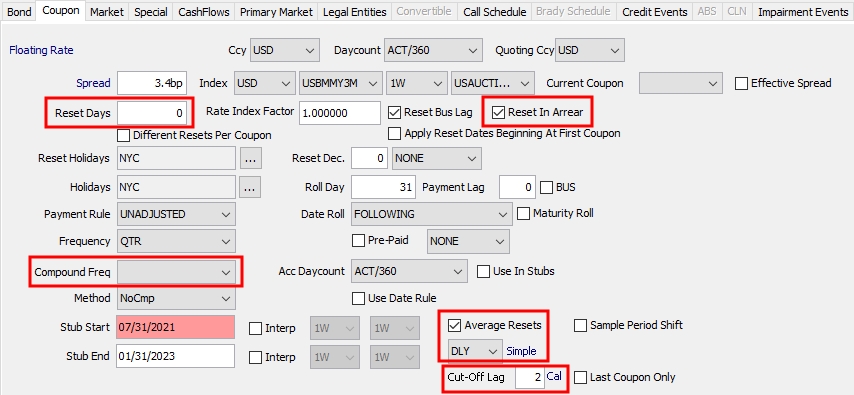

Reset Days |

Defaults to the reset lag specified in the Rate Index definition. Modify as applicable. This is the number of days lag for the floating rate’s fixing. |

|||||||||||||||

|

Rate Index Factor |

Enter a factor to apply to the floating rate as applicable. |

|||||||||||||||

|

Reset Bus Lag |

Check the “Reset Bus Lag” checkbox to specify the reset lag as business days, or as calendar days otherwise. |

|||||||||||||||

|

Reset In Arrear |

Check the “Reset In Arrear” checkbox to indicate that the floating rate is known at the end of the interest period, or clear this box otherwise. |

|||||||||||||||

|

Different Rates Per Coupon |

Check “Different Resets Per Coupon” to generate the reset dates based on the coupon payment frequency, or clear it to generate the reset dates based on the index tenor. |

|||||||||||||||

|

Apply Reset Dates Beginning At First Coupon |

When checked, resets will be produced starting from the issue date. Otherwise resets are produced starting at the maturity date. |

|||||||||||||||

|

Reset Holidays |

Click ... to select reset holiday calendars. |

|||||||||||||||

|

Reset Dec. |

Enter the number of decimal places and select the rounding method from the adjacent field. Used for CCT bonds for example. |

|||||||||||||||

|

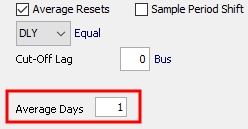

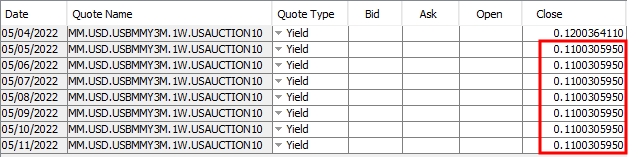

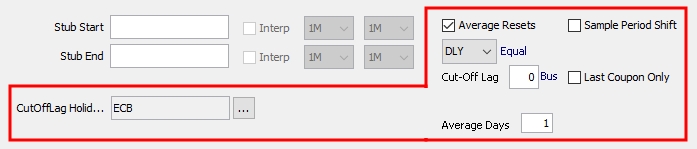

You can check the "Average Resets" checkbox at the bottom of the window to sample resets at a frequency different from the payment frequency. Otherwise, the resets are sampled at the payment frequency.

Select the sampling frequency. For "WK", you can select the day of the week. When the sampling frequency is more frequent than the payment frequency, you can define the weight of the resets by double-clicking the label next to the reset frequency.

|

||||||||||||||||

|

Sample Period Shift |

Only applicable with daily compounding or daily averaging. When checked, the sample weights will be shifted as per the shifted dates of the period. The shifting of observation dates will be visible in the Reset Samples window on the generated cashflows under the "Observation Start Date" and "Observation End Date" columns. |

|||||||||||||||

|

Last Coupon Only |

Only applicable with daily compounding or daily averaging. When checked, the cutoff lag will only be applied to the last interest period. |

|||||||||||||||

|

CutOffLag Holidays |

You can specify an independent holiday calendar for cutoff lag using business days. |

|||||||||||||||

|

Average Days |

Only displayed for Argentine flipper bonds with the "ARS" yield method.

|

2.3 Specifying a Variable Rate

Double-click the Fixed Rate label to switch to Variable.

| » | Click ... to display the Coupon Schedule dialog. |

| – | Select a coupon date rule, or enter a start date, an end date and select a frequency. Then click Generate to generate the corresponding coupon schedule. |

| – | Enter coupon rates (as absolute values) in the coupon schedule as applicable. The coupon rate will apply up to the specified period end date. |

| – | Then click Apply. |

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|

Ccy |

Select the coupon currency. |

|

Daycount |

Enter the coupon daycount. Daycount conventions are described under Help > Day-Count Conventions. |

|

Quoting Ccy |

In the case of an All-In Price Quote, set the quoting currency to be the same as the coupon currency. Otherwise, set it to match the bond currency. If you set the quoting currency to match the coupon currency, it assumes the quote includes the FX rate conversion and inflation adjustment. |

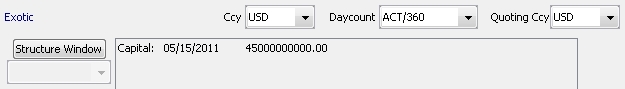

2.4 Specifying an Exotic Rate

Double-click the Fixed Rate label to switch to Exotic.

| » | Click Structure Window to display the Structured Dialog. Help is available from that window. When the formula is applied, it is displayed in the formula area. |

You can also select an exotic structure type if you have defined any. See Configuration > Product > Structure Type Creator for details.

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|

Ccy |

Select the coupon currency. |

|

Daycount |

Enter the coupon daycount. Daycount conventions are described under Help > Day-Count Conventions. |

|

Quoting Ccy |

In the case of an All-In Price Quote, set the quoting currency to be the same as the coupon currency. Otherwise, set it to match the bond currency. If you set the quoting currency to match the coupon currency, it assumes the quote includes the FX rate conversion and inflation adjustment. |

|

Acc Daycount |

Enter the accrual daycount. Daycount conventions are described under Help > Day-Count Conventions. |

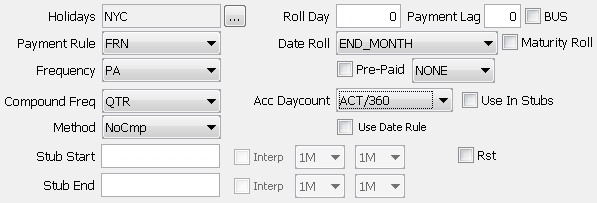

2.5 Specifying Payment Characteristics

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

||||||||||||||||||||||||

|

Holidays |

Click ... to select payment holiday calendars. Note that if you save a bond without a holiday calendar, a warning message will appear. |

||||||||||||||||||||||||

|

Roll Day |

Enter the day of the calendar month to be used as each coupon period’s end date day. If this is set to zero, then the maturity date day of the month will automatically be used by default. So, for example, if the issue date is 7/10/04, the maturity date is 7/20/34, the coupon frequency is SA (semi-annual), and a value of 16 is entered in this field, the coupon payment dates will be 7/16 and 1/16 (there will be ‘stub’ periods at both the beginning and the end). |

||||||||||||||||||||||||

|

Payment Lag BUS |

Enter the number of days lag between the coupon date and the actual payment date, as applicable. Check the "BUS" checkbox to specify the payment lag as business days, or as calendar days otherwise. If the payment lag entered exceeds 30 days, the payment day will be calculated with a lag of 1 month for each 30 days, and then the remaining number of days added to the coupon period end date. Example: A payment lag of 44 for a security with coupon period end date on the 12th day of the month would pay on the 26th of the following month. Example: A payment lag of 54 for a security with coupon period end date on the 12th day of the month would pay on the date which is 24 days after the 12th day of the following month. |

||||||||||||||||||||||||

|

Payment Rule |

Select the payment rule. The following payment rules are available:

|

||||||||||||||||||||||||

|

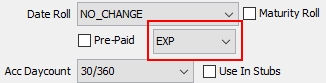

Date Roll |

Payment date roll convention if the coupon period end date is not a business day. Date roll conventions are described under Help > Date Roll Conventions. |

||||||||||||||||||||||||

|

Maturity Roll |

When checked, the maturity principal payment Pmt Dt is used to calculate the price. If not checked, the maturity principal payment Pmt End is used to calculate the price. |

||||||||||||||||||||||||

|

Frequency |

Select the payment frequency. The standard list is: DLY (Daily), WK (Weekly), BIWK(Bi-Weekly), LUN (Lunar), MTH (Monthly), BIM (Bi-Monthly), QTR (Quarterly), SA (Semi-Annually), PA (Annually), ZC (Zero Coupon, End of period). You can check "Use Date Rule" instead to generate the coupon based on a date rule. |

||||||||||||||||||||||||

|

Pre-Paid |

Allows you to specify BondMMInterest products for which the coupon is paid at the beginning of the period. The calculation of the Coupon amount is exactly the same as the classic BondMMInterest except that it is paid by the Issuer at the beginning instead of the end of the period. The FX Reset Date for Dual Currency Bonds will be calculated based on the checkbox selection. When checked, the FX reset date will be calculated using the coupon begin date. If unchecked, the reset date is calculated using the coupon end date.

|

||||||||||||||||||||||||

|

Compound Freq |

Select the reset frequency. By default it is the same as the payment frequency. The weekly frequency "WK(R)" works as follows. For a 3M bond paying MONTHLY compounding WEEKLY, this method splits the 90 days into 3 periods of 30 days each, and then splits the 30 day periods into periods of 7 days thus leaving stubs on each coupon period. |

||||||||||||||||||||||||

|

Acc Daycount |

Daycount used for the accrual calculation. By default, it corresponds to the coupon daycount and can be modified. Daycount conventions are described under Help > Day-Count Conventions. |

||||||||||||||||||||||||

|

Use In Stubs |

Check the “Use in Stubs” checkbox to apply the accrual daycount to stub periods. |

||||||||||||||||||||||||

|

Method |

Select the interest calculation method:

On the CashFlow panel, right-click an INTEREST cashflow and choose “Interest History” to see its details. |

||||||||||||||||||||||||

|

Use Date Rule |

Check to select a date rule for the coupon generation rather than the frequency.

|

||||||||||||||||||||||||

|

Cut-Off Lag |

Only appears if Compounding Freq = DLY. The number of days of cutoff lag to be applied every coupon period. You can specify business or calendar days by double-clicking the adjacent label. |

||||||||||||||||||||||||

|

Stub Start Stub End Interp |

Stub Start contains the security’s first coupon period end date. If the security’s first coupon period end date is standard, it is not necessary to enter this date here (although it may still be entered). Stub End contains the security’s penultimate coupon period end date. As with Stub Start, it is not necessary to enter this date if the date is standard. It must be set for perpetual bonds to determine how far out to generate the cashflows. If you have a period shorter or longer than the classic periods, you put either the first coupon’s date or the last coupon’s date. When the bond does not have the same Daycount and Accrual Daycount, and a long stub period is detected, then the Accrual Daycount is set on the Coupon, and a CouponPeriodSchedule is created for this Coupon, with two coupon periods having the following characteristics:

Periods can be seen when you right-click a cashflow in the CashFlow panel of the Bond, and choose "Show Paydown Periods" from the popup menu. Interp checkbox Only applies to floating bonds.

Whenever there is a stub on a floating rate, the system automatically calculates the best index tenor for the stub period (provided “No Auto Interp” is unchecked on the rate index definition). If the length of a stub period matches exactly one of the index tenors, there is no interpolation required. If the length of a stub period is between two index tenors, the system defaults the stub index to interpolate between the two index tenors. You can customize these tenors using the "Interp" checkbox and the adjacent tenor fields. If no interpolation is required, select the same tenor in both boxes. |

||||||||||||||||||||||||

|

Interp Rounding |

The field "Interpolated Rates" is used to determine the rounding, and support rounding for BondFRN Interpolated Rate in Stub. By default, the Interpolated Rates should be set to match the rounding set in the rate index. The drop-down can be set from: Nearest, Up, or Down.

|

||||||||||||||||||||||||

|

|

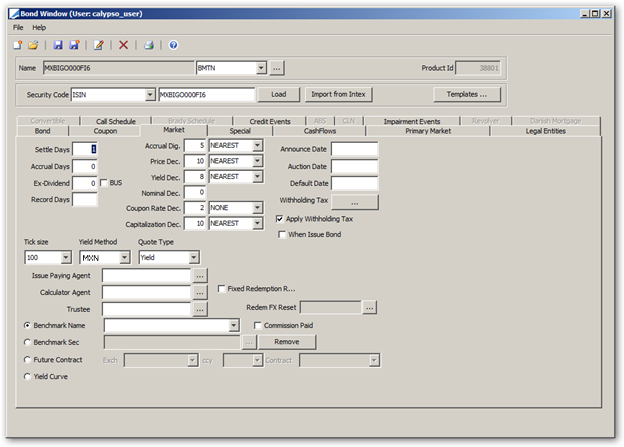

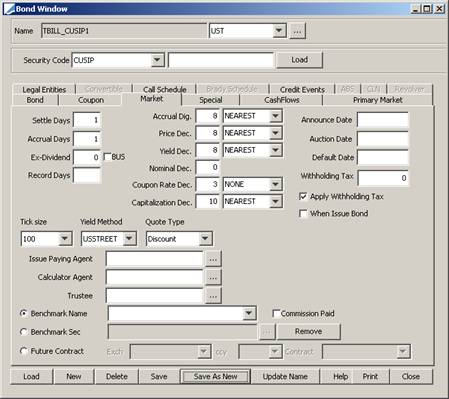

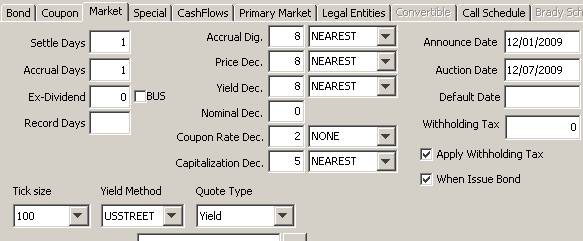

3. Specifying Market Conventions

Select the Market panel to specify market conventions.

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Settle Days |

Number of days between the trade date and the settlement date. This field is used in the trade window to initialize the settlement date. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Accruals Days |

Currently not used. It should be equal to the Settle Days. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

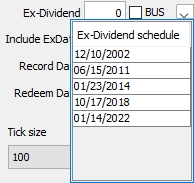

Ex-Dividend BUS |

Number of days used to define the ex-dividend date. The following number of days can be specified:

If the coupon date = end of month then the ex-dividend date will also be set at end of month dates. Otherwise, it will follow the calendar month.

Check the "BUS" checkbox to specify the number of days as business days, or as calendar days otherwise. You can specify an ex-dividend schedule instead which will ignore the ex-dividend days and be used to determine the ex-dividend date.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Include ExDate |

When checked, positive accrual will be computed while valuing on ex-div date and accrual measures will be impacted. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Record Days |

Enter the number of record days prior to the coupon payment date. The record date in the cashflows will be displayed as payment end date - record days. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Redeem Days |

Enter the number of redemption record days as needed. In the cashflows, redemption record date = maturity date - redeem days. If "BUS" is checked, business days will be used to determine the record date, otherwise calendar days will be used. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

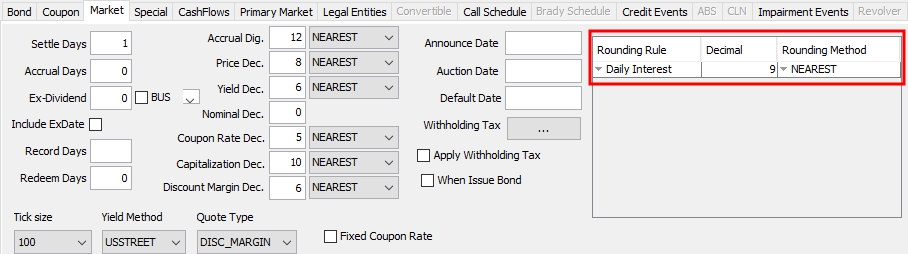

Accrual Dig. |

Number of decimals for the accrual, when expressed in percentage. You can select the rounding method from the adjacent field: NEAREST, DOWN or UP. Rounding methods are described under Help > Rounding Methods. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Price Dec. |

Number of decimal places for the price. If you do not specify the number of decimals, the system will take the value of the environment property BOND_PRICE_DECIMAL. You can select the rounding method from the adjacent field: NEAREST, DOWN or UP. Rounding methods are described under Help > Rounding Methods. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Yield Dec. |

Number of decimal places for the yield. If you do not specify the number of decimals, the system will take the value of the environment property BOND_YIELD_DECIMAL. You can select the rounding method from the adjacent field: NEAREST, DOWN or UP. Rounding methods are described under Help > Rounding Methods. You can specify lower and upper initial yield limits using the MIN_YIELD and MAX_YIELD pricing parameters. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Nominal Dec. |

Number of decimal places for the nominal. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Coupon Rate Dec. |

Number of decimal places for the coupon rate. You can select the rounding method from the adjacent field: NONE, SAME AS ACCRUAL, NEAREST, DOWN or UP.

The other rounding methods are described under Help > Rounding Methods. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Capitalization Dec. |

Number of decimal places for the capitalization factor of PIK (“Payment In Kind”) bonds, such as Brady bonds. You can select the rounding method from the adjacent field: NEAREST, DOWN or UP. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Discount Margin Dec. |

Number of decimal places for the discount margin. You can select the rounding method from the adjacent field: NEAREST, DOWN or UP. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

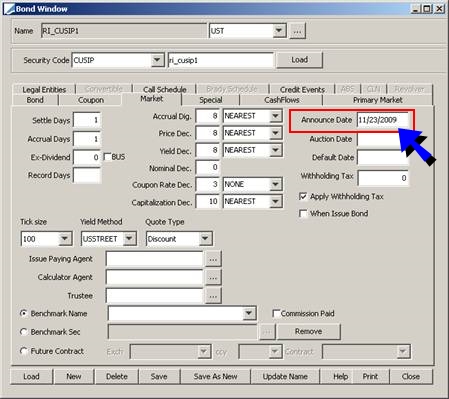

Announce Date |

Date of announcement for a new issue (for Issuance through an issue syndicate, like Corporate Bonds). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Auction Date |

Date of auction for a new issue (for Issuance through an auction, like Government Bonds such as OAT). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Default Date |

Only applies to Brady bonds. Enter the date at which the bond has defaulted. When a bond has defaulted, all cashflows are set to 0, except for the guaranteed cashflows specified in the Brady schedule. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Withholding Tax |

Click ... next to the Withholding Tax field to bring up the Withholding Tax Config window.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Apply Withholding Tax |

Check to apply the withholding tax to the cashflows, or uncheck otherwise. If you set the environment property SEC_WITHHOLDINGTAX=true, the withholding tax will be automatically withdrawn from the coupons, and reclaim fees will be automatically generated.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

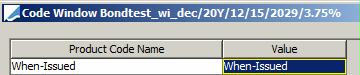

When Issue Bond |

Check to identify a “When-Issue” bond.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

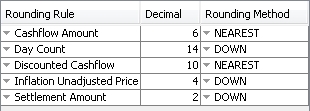

Rounding Rule |

You can add rounding rules as needed.

Note that you will also need to set the security code SETTLEMENT_ROUNDING_CONVENTION to total.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

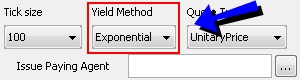

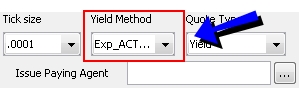

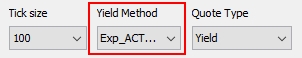

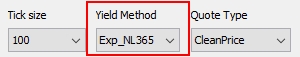

Tick Size |

Tick size of the quote. For Repo trades: For securities with tick size other than 100: You can convert Clean Price to decimal format when Dirty Price or Yield are specified on trade screen. For this, you need to set the security product code SECFINANCE_QUOTE_BASE =100. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Yield Method |

Method applied to convert the price to yield and the yield to price.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Quote Type |

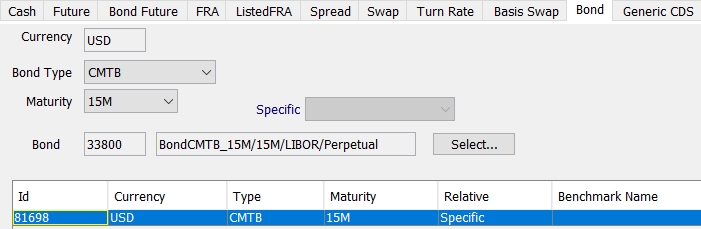

Quote type: AOAS (Agency Option Adjusted Spread – Used for European callable bonds), Clean Price, Dirty Price, Discount, Future, Gross Price, Gross Unitary Price, Price, Price32, Price64, Spread, Unitary Price, Yield, Yield To Best, Yield To Custom, Yield To Maturity, Yield To Next, or Yield To Worst. The quote type is automatically displayed in the trade window. For the Spread quote type, you should select a benchmark. See benchmark fields below. For the Yield To Custom quote type, you must have Effective Call = Custom, and a Call Date set in the Call Schedule panel.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Inflation Protected |

Only applies to Mexican BPA inflation protected bonds (floating rate bond with yield method = MXN). When checked, specify an FX index in the Coupon FX Reset field, and an FX Roll convention.

The rate will be calculated as: Max(Index Rate, FX Index Rate Change) where FX Index Rate Change = (FX End Period / FX Beginning Period - 1) * 360 / Days in Period |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fixed Coupon Rate Coupon FX Reset |

Only appear if the currency of the coupon is different from the currency of the bond. You can enter a fixed FX rate in the Fixed Coupon Rate field, or select an FX Reset from the Coupon FX Reset field. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

FX Roll |

Only applies to dual currency bonds. When rolled days will be included in interest calculation, select a date roll convention to determine how to roll the dates for the FX. Note that when using FX Roll, the FX reset date will be computed from the unadjusted coupon period. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fixed Redemption Rate Redem FX Reset |

When the redemption currency is different from the issue currency, you can set the FX rate as follows.

FX Rate Definitions are defined under Configuration > Foreign Exchange > FX Rate Definitions. The FX rates are reset using Trade Lifecycle > Reset > FX Rate Reset. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Issue Paying Agent |

Name of the Issue Paying Agent for a new issue. The agent should be previously created as a Legal Entity with the role IPA. The Issue Paying Agent will be used for issuance trades. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Calculator Agent |

Name of the calculator agent for a new issue. The agent should be previously created as a Legal Entity with the role Calculator Agent. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trustee |

Name of the trustee of the issue. The trustee should be previously created as a Legal Entity with the role Trustee. It is used in the Domiciliation process.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Commission Paid |

Automatically checked when the domiciliation commission has been paid.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Benchmark Name |

Click the Benchmark Name radio button, if the bond is quoted in spread over a benchmark bond or bond future that will change over the life of the bond.

Note that the Quote Type should be set to Spread in that case. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Benchmark Sec |

Click the Benchmark Sec radio button, if the bond is quoted in spread over a benchmark bond that will remain the same over the life of the bond.

Note that the Quote Type should be set to Spread in that case. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Future Contract |

Click the Future Contract radio button, if the bond is quoted in spread over a benchmark bond future that will remain the same over the life of the bond.

Note that the future contract will be rolled to the next one for pricing, if the pricing occurs within the number of days specified in the Benchmark panel of the Future contract before the last trading day. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Yield Curve |

Click the Yield Curve radio button, if the bond is quoted in spread using a yield curve. Yield curves are defined using Market Data > Interest Rate Curves > Par Yield Curve from the Calypso Navigator. |

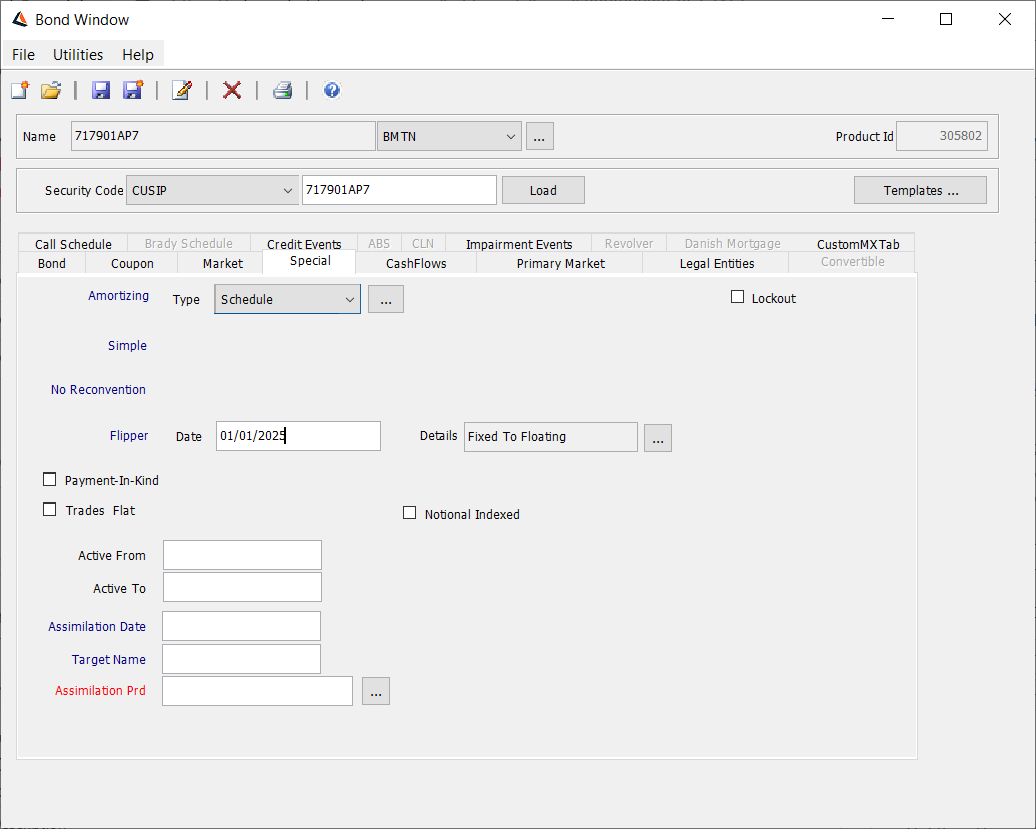

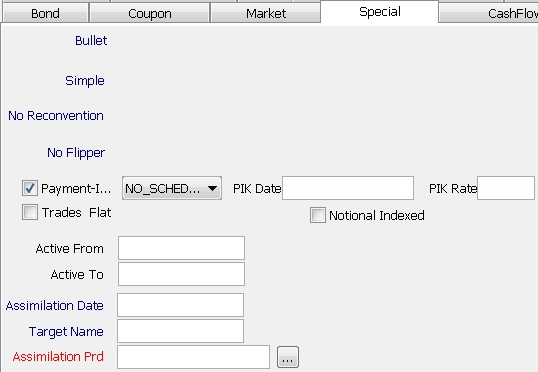

4. Specifying Special Characteristics

Select the Special panel to specify special characteristics.

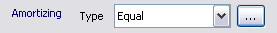

4.1 Specifying Amortization Characteristics

Bullet

The Bullet label is displayed by default. The entire principal is repaid on the security at maturity.

Amortizing

Some of the principal will be repaid prior to the maturity date. A preset schedule defines the exact repayment dates, and the amount to be repaid on each date (for example, if "Equal" is specified for the Amortizing type, then the par amount will be repaid in equal installments, the final installment being on the security maturity date).

Although the par amount is entered as an original par amount (the concept of paydowns does not apply to this type of security), it does reflect the "current" original par amount.

Double-click the Bullet label to switch to Amortizing.

| » | Select the amortization type from the Type field. The following types of amortization are available: |

| – | Annuity: The amount of each payment (interest + principal) remains constant over the life of the bond. The interest payments will be larger at the start and decrease over time, while the principal repayments will be smaller at the start and increase over time. |

| – | Equal: The principal is amortized in equal payments for each interest period. |

| – | Step down: The principal will decrease or increase (as desired) by a specified amount. Enter the step down amount in the Amount field. |

| – | Mortgage: The principal is amortized using the fixed rate and period length of each interest period. You can specify the rounding convention for the constant payment rate in the "Mortgage Payment Rate" rounding rule on the Market panel. The last payment rate is calculated as: |

Amortizationn = Notionaln-1

Paymentn = Amorizationn + Interestn

| – | Schedule: The principal is amortized according to a user-defined schedule. Click ... to define the schedule. In the Principal Schedule window you can select from the drop down whether you want to enter amounts in terms of Quantity, Notional, or Notional Percent, which is the percent remaining of the notional value. |

| – | Custom: The principal is amortized according to the coupon schedule by user-defined amounts specified in the CashFlows panel. |

|

Amortizing Example Take a Security issued on 10/15/94 and maturing on 10/15/24. The Security is set up as "Amortizing", with Amortizing Type "Equal", and payment frequency SA (semi-annual). Total amount issued is 600,000,000. Principal-related cashflows will be: 10/15/94 (600,000,000) 4/15/95 10,000,000 10/15/95 10,000,000 4/15/96 10,000,000 etc., until the maturity date. If a Buy trade is entered for 40,000,000 settling on 11/20/94:

11/20/94 (40,000,000 * price) 4/15/95 666,666.67 10/15/95 666,666.67 4/15/96 666,666.67 etc., until the maturity date (note that there are 60 repayments between the trade settlement date and the security maturity date). If a Buy trade is entered for 40,000,000 settling on 11/20/04:

11/20/04 (40,000,000 * price) 4/15/05 1,000,000.00 10/15/05 1,000,000.00 4/15/06 1,000,000.00 etc., until the maturity date (note that there are 40 repayments between the trade settlement date and the security maturity date). |

Sinking

As with the "Amortizing" Bond, some of the principal will be repaid prior to the maturity date. A preset schedule defines the exact repayment dates and the amount to be repaid on each date (for example, if "Equal" is specified for the Sinking type, then the par amount will be repaid in equal installments, the final installment being on the security maturity date).

The Sinking Bond behaves almost identically to a BondAssetBacked security, in that there is an original par and a current par, and the current par is "paid down". The difference is that the current par is paid down on a BondAssetBacked as a result of a factor being entered, whereas the current par is paid down on a Sinking Bond as a result of a scheduled paydown taking place. Within Calypso, the scheduled paydown is tracked internally at the security level by the automatic creation of an internal factor.

As with a BondAssetBacked, the original par amount is quoted for trades in a Sinking Bond (the current par is determined by using the internal factor).

The price for a Sinking Bond relates to the current par (i.e. the calculation of the principal amount is original par * factor * price).

Unlike BondAssetBacked securities, there is no delay between the paydown effective date and the setting of the paydown amount (caused by the delay in publication of the factor) – This is ALL scheduled in advance for a Sinking Bond.

With a Sinking Bond, the market usually quotes the "original par", so these trades should be entered in Calypso in the same way as for MBS (i.e. enter original par).

With Calypso’s bond trade window, the "Nominal" field on the top left of the screen is the par (original) nominal. For any bonds that have variable notionals (amortizing, sinking, Brady, ABS, MBS, etc.), the "Current Nominal" field shows the current nominal (that is, the current principal bought/sold on the settlement date).

It is not currently possible to enter the "Current Nominal".

Double-click the Bullet label to switch to Sinking.

![]()

| » | Select the sinking type from the Type field. The following types of sinking are available: |

| – | Annuity: The face value will decrease at the fixed rate for each interest period. |

| – | Equal: The face value will decrease in equal amounts for each interest period. |

| – | Step down: The face value will decrease according to a specified amount. Enter the step down amount in the Amount field. |

| – | Mortgage: The face value will decrease at the fixed rate for each interest period. You can specify the rounding convention for the constant payment rate in the "Mortgage Payment Rate" rounding rule on the Market panel. The last payment rate is calculated as: |

Amortizationn = Notionaln-1

Paymentn = Amorizationn + Interestn

| – | Schedule: The face value will decrease according to a user-defined schedule. Click ... to define the schedule. In the Principal Schedule window you can select from the drop down whether you want to enter amounts in terms of Quantity, Notional, or Notional Percent, which is the percent remaining of the notional value. |

| – | Custom: The face value will decrease according to the coupon schedule by user-defined amounts specified in the CashFlows panel. |

|

Sinking Example Take a security issued on 3/15/04 and maturing on 3/15/34, with a Sinking schedule of "equal" payments. The coupon is SA (semi-annual). We buy 10 million par at price of 100 on the issue date. Our principal cashflows will be: 3/15/04 (10,000,000) 9/15/04 166,666.67 3/15/05 166,666.67 9/15/05 166,666.67 etc. until the last principal cashflow: 3/15/34 166,666.67 Original par and current par will be as follows:

|

4.2 Specifying Floater Characteristics

This applies to floating bonds only to set caps and floors on the floating rate.

Simple

The Simple label is displayed by default, indicating that the floating rate is dependent on the floating index rate only.

Floater

| » | Double-click the Simple label to change to Floater. |

![]()

Select the type of limit you want to set from the Type field. The following types are available:

| – | Cap: Enter a cap in the Cap field, in percentage. If you enter for example 5%, this means that if the rate on the coupon date is higher than 5%, the coupon rate will be 5% (the value of the cap). If the rate is less than 5% the rate value is used to calculate the coupon amount. |

| – | Floor: Enter a floor in the Floor field, in percentage. If you enter for example 2%, this means that if the rate on the coupon date is less than 2%, the coupon rate will be 2%. If the rate is higher, the rate value is used to calculate the coupon. Negative floor rates are not supported and if set to a negative value, floor=0 will be applied. |

| – | Collar: Enter a cap and floor in the Cap and Floor fields. |

| – | Straddle: Not currently supported. |

| – | Range: Not currently supported. |

4.3 Specifying Reconvention Characteristics

No Reconvention

The “No Reconvention” label is displayed by default, indicating that the daycount convention will apply over the life of the bond.

Reconventioned

| » | Double-click the “No Reconvention” label to switch to Reconventioned so that you can specify a new daycount convention as of a given reconvention date. |

![]()

Enter the reconvention date in the Date field.

Select the new daycount convention from the DayCount field.

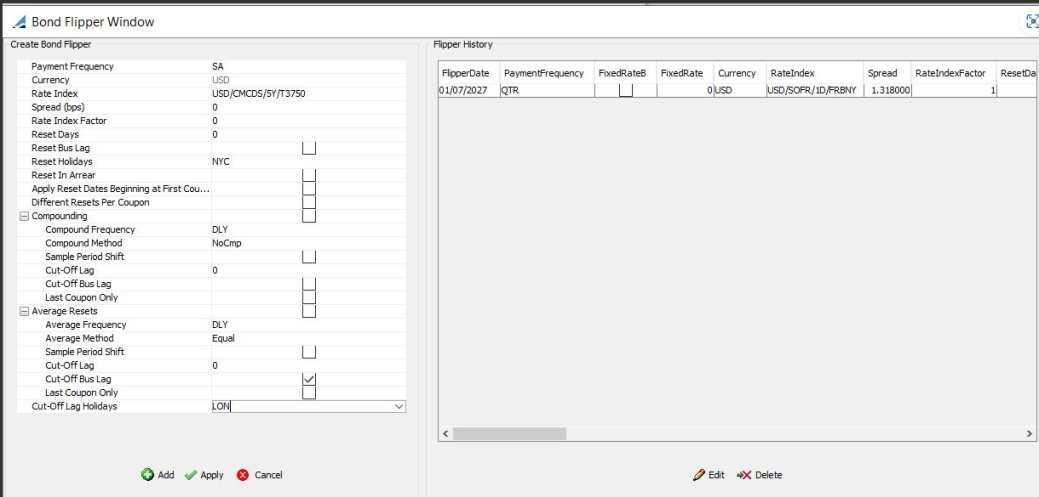

4.4 Specifying Flipper Characteristics

No Flipper

The “No Flipper” label is displayed by default, indicating that the coupon type will apply over the life of the bond. If the bond has a fixed coupon, it will remain fixed, or if the bond has a floating coupon it will remain floating.

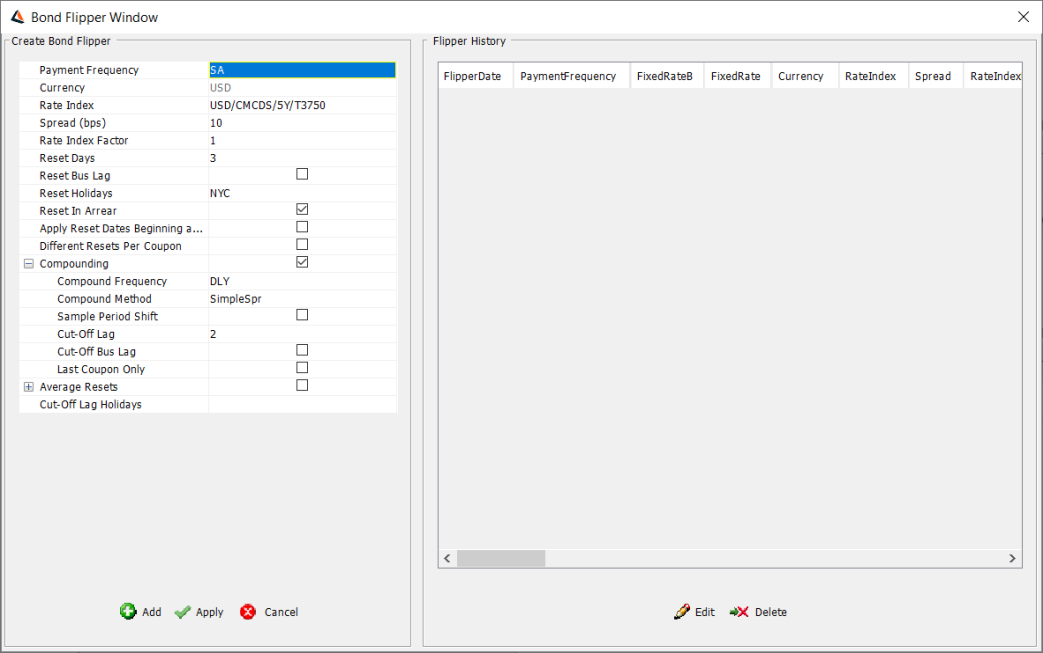

Flipper

| » | Double-click the “No Flipper” label to switch to Flipper. |

| » | Enter the flipper date in the Date field. |

| » | Click ... next to the Details field to specify the new coupon. The coupon will flip to this coupon as of the flipper date. |

| » | Enter the details related to Reset, Compounding and Average Resets while creating a Bond Flipper at the left side of the window. |

| » | Click on the Add button The details will now be displayed in the 'Flipper History' section at the right side of the window. |

| » | Click on the Apply button - the flipper window will close. |

| » | Save the bond. |

| » | Reopen to verify that the details have been added. |

| • | Floating to fixed: Specify the fixed rate and click Apply. You can select a different coupon frequency as applicable, or select NO CHANGE if the coupon frequency does not change. |

| • | Fixed to floating or variable to floating: Specify the floating rate and click Apply. You can select a different coupon frequency as applicable, or select NO CHANGE if the coupon frequency does not change. You can also modify the fields described below as applicable. |

| • | Support has been provided for Flipper bond to RFR rate index for Fixed to Floating and Floating to Floating. You can change the leg type using the Flipper reconvention. A sample flipper reconvention is shown above. |

| • | If the original trade's leg type is Fixed, the Flipper reconvention flips the leg type to Float. You can then specify the parameters for a Float leg. |

| • | The new Flipper related properties are added to Report Framework: |

| – | For Flipper Type [Fixed to Floating | Floating to Floating | Floating to Fixed] |

| – | Flipper Rate Index: if "…to Floating" |

| – | Flipper Rate Index Tenor: if "…to Floating" |

| – | Flipper Rate Index Spread: if "…to Floating" |

| – | Flipper Coupon: if "…to Fixed" |

| • | Currently only the flipper date is available for selection in criteria. |

| • | Users are request to add only 1 line in the Flipper window. |

| • | The system can handle max of 2 lines of flipper details. This is allowed only when the old flipper data is a Non-RFR index and the security has later on changed the flipper details to have an RFR index. |

Ⓘ Note - On Config Workbench, if you export a Flipper Bond prior to upgrading to 17 June MR, you will not be able to import it after upgrade. You first need to upgrade to 17 June MR and export / import Flippers Bonds after upgrade.

|

Fields |

Description |

|

Spread |

Enter a spread value in basis points over the floating rate. |

|

Rate Index |

Select the rate index, tenor and source that identify the floating rate. Rate indices are specified using Configuration > Interest Rates > Rate Index Definitions. |

|

Rate Index Factor |

Enter a factor to apply to the floating rate as applicable. |

|

Apply Reset Dates Beginning At First Coupon |

When checked, the reset dates will be produced starting from the first coupon from the flipper date onward. Otherwise resets are produced started at the maturity date. |

|

Reset Days |

Defaults to the reset lag specified in the Rate Index definition. Modify as applicable. This is the number of days lag for the floating rate’s fixing. |

|

Reset Bus Lag |

Check the “Reset Bus Lag” checkbox to specify the reset lag as business days, or as calendar days otherwise. |

|

Reset In Arrear |

Check the “Reset In Arrear” checkbox to indicate that the floating rate is known at the end of the interest period, or clear this box otherwise. |

|

Reset Holidays |

Click ... to select reset holiday calendars. |

|

Compounding |

This includes Compound Frequency, Compound Method, Sample Period Shift, Cut-Off Lag, Cut-Off Bus Lag, Cut-Off Lag Holidays, Last Coupon Only. |

|

Average Resets |

This includes Averaging Frequency, Averaging Method, Sample Period Shift, Cut-Off Lag, Cut-Off Bus Lag, Last Coupon Only. |

|

Cut-Off Lag Holidays |

Drop-down widget for Holidays. |

4.5 Specifying Additional Characteristics

| » | Enter the fields described below as applicable. |

|

Fields |

Description |

|

Payment-In-Kind |

Check the "Payment-In-Kind" checkbox for specifying payment-in-kind bonds.

|

|

Trades Flat |

Check the “Trade Flat” checkbox for handling distressed bonds. You will be prompted to enter a distress date in the As Of field. The bond does not receive any coupon as of the distress date. |

|

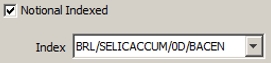

Notional Indexed |

Check the “Notional Indexed” checkbox to specify an inflation bond.

|

|

Active From / Active To |

Range of dates when the product can be used in the system. |

|

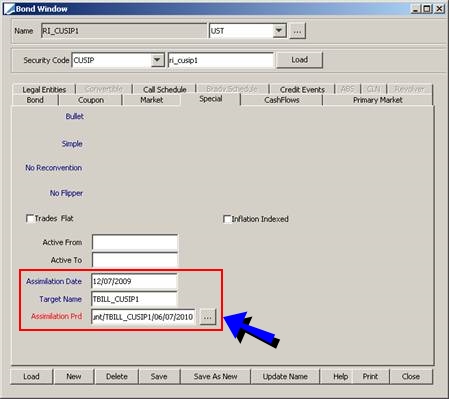

Assimilation Date |

Input the date of the assimilation as applicable (bonds merger, for example process of French Government Bonds, with new issues’ slices). A corporate action can be generated on the assimilation date using the selected assimilation product. See the Assimilation Prd field below. |

|

Target Name |

Double-click the Target Name label to select the ISIN code of the assimilation product. |

|

Assimilation Prd |

Click ... to select the actual assimilation product. Ⓘ [NOTE: In the case of issuance assimilation, the assimilation product is set by the scheduled task ISSUANCE_CONSOLIDATION - See Capturing Bond Trades for details] |

|

Link to Basket |

Only applies to Bond, BondFRN and BondAssetBacked. When checked, the bond is eligible to belong to a basket. You can select the basket from the adjacent field. Note that this is for information purposes only.

You can click Show Basket to view the basket, and New Basket to create a new basket. Help is available from that window. |

|

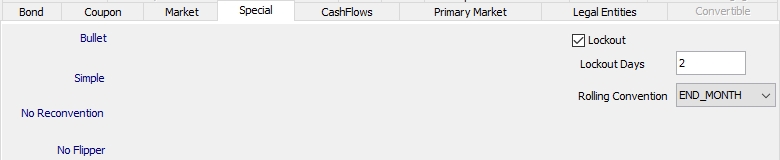

Lockout |

Check the "Lockout" checkbox to specify lockout details for a UST FRN.

|

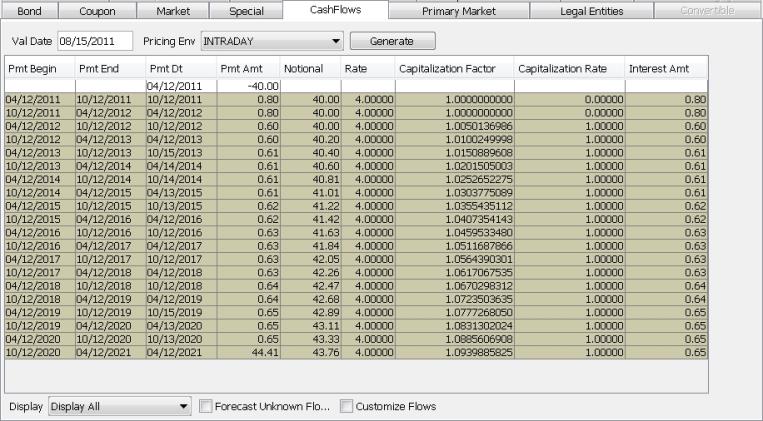

5. Generating the Cashflows

Select the CashFlows panel to generate the cashflows.

5.1 Manipulating Cashflows

Generating Cashflows

| » | Select a valuation date from the Val Date field and select a pricing environment from the Pricing Env field. |

Then click Generate. The cashflows are displayed.

Note that if you have customized the cashflows, you should not click Generate if you have not locked the columns that contain modified values, because those columns will be overridden. You should instead right-click any cell and choose 'Recalc' from the popup menu.

See also the “Customize Flows” checkbox below.

| » | Select the type of cashflows you want to display from the Display field: all cashflows, interest cashflows only, or principal cashflows only. |

| » | Check the “Forecast Unknown Flows” checkbox to forecast floating flows. |

For AusCPI bonds, it is possible to display the “p-Factor” and “K-Factor” columns provided “Forecast Unknown Flows” is checked.

Editing Cashflows

| » | Check the “Customize Flows” checkbox to modify the cashflows as applicable. A star will appear next to the label of the CashFlows panel. |

| – | To modify a value, double-click a cell and modify its value as applicable. |

A column that contains modified values will show a star to the right of the column heading.

Note that if you don’t want modified values to be overridden when the cashflows are generated, you need to lock the corresponding columns. Right-click a modified value and choose “Lock Column” or “Lock All Modified Columns” from the popup menu.

A locked column will show a star to the left of the column heading.

| – | The Manual Amt column is automatically checked when the Pmt Amt is manually modified. It indicates that changing parameters that would normally be used in the calculation (fixed rate, interest start and end dates) will have no affect since the payment amount has been manually set. |

| – | Note that when you customize any column of the bond flows, even if the Daycount column has not been customized, the accrual will be computed using the coupon daycount. If the bond flows are not customized, then the coupon amount will be computed via the coupon daycount and the accrual will be computed via the accrual daycount. |

5.2 CashFlow Menu

| » | Right-click any cell in the cashflows to display the Cash Flow Menu. |

| – | The menu items of the Cash Flow menu are described below. |

|

Menu Items |

Description |

||||||||||||||||||||||||||||||

|

Copy Ctl-C Paste Ctl-V |

Allows copying and pasting into values. Select a cell, type Ctrl+C, then select another cell and type Ctrl+V. The content of the first cell will be pasted into the second cell. |

||||||||||||||||||||||||||||||

|

Add |

Right-click a row and choose Add. The selected row will be split between two rows. The first one will be one day long, and the second one will fill the remaining term of the original period. You can edit the periods as applicable. |

||||||||||||||||||||||||||||||

|

Remove |

Right-click a row and choose Remove. The selected row will be removed. |

||||||||||||||||||||||||||||||

|

Scheduler |

Only applies to the Notional, Spread, and Rate columns. Opens the Scheduler dialog. |

||||||||||||||||||||||||||||||

|

Sample Values |

Not applicable to bonds. For averaging and compounding bonds, please use the Bond Trade window instead to verify sample rates as the Bond window uses curves as of the current date, and not as of the valuation date. |

||||||||||||||||||||||||||||||

|

Check Resets |

Checks the reset rates. |

||||||||||||||||||||||||||||||

|

Configure Columns |

Allows selecting and organizing the displayed columns. |

||||||||||||||||||||||||||||||

|

Rename Columns |

Allows customizing the column names. |

||||||||||||||||||||||||||||||

|

Save Configure Columns |

Allows saving the column configuration. |

||||||||||||||||||||||||||||||

|

Lock Column |

Right-click a modified value and choose “Lock Column” so that the value will not be overridden when the cashflows are generated. A locked column will show a star to the left of the column heading. Note that cashflows columns which are locked but not modified will cause the corresponding fields to be outlined in blue in the trade worksheet. |

||||||||||||||||||||||||||||||

|

Lock All Modified Columns |

Allows locking all columns that contain modified values. |

||||||||||||||||||||||||||||||

|

Unlock Column |

Right-click a locked column and choose “Unlock Column” to unlock it. |

||||||||||||||||||||||||||||||

|

Unlock All Columns |

Allows unlocking all locked columns. |

||||||||||||||||||||||||||||||

|

Show Paydown Periods |

Applies to Asset Backed bonds with variable pool factors changes occurring more frequently than coupon payments. Right-click a row and choose “Show Paydown Periods” to show any paydown. This also applies to bonds with long stub periods, when the bond daycount and the accrual daycount are different. |

||||||||||||||||||||||||||||||

|

Interest History |

Applies to floating compounding bonds. Right-click a row and choose “Interest History”. The Interest History window will be displayed. The columns are the following:

|

||||||||||||||||||||||||||||||

|

Show External Flows |

External cashflows are defaulted to Calypso-generated cashflows unless they have been imported from Bloomberg. You can paste cashflows copied from an Excel spreadsheet into the external cashflows. External cashflows are only saved once they have been modified. Right-click any cashflow to invoke a popup menu for additional capabilities. |

||||||||||||||||||||||||||||||

|

Recalc |

When cashflows have been customized, choose Recalc to display the cashflows without overriding unlocked columns. |

||||||||||||||||||||||||||||||

|

Generate |

To generate the cashflows. Note that if you have customized the cashflows, you should not choose Generate if you have not locked the columns that contain modified values, because those columns will be overridden. You should instead choose Recalc. |

||||||||||||||||||||||||||||||

|

Export to Excel |

Allows exporting the cashflows to an Excel spreadsheet. |

||||||||||||||||||||||||||||||

|

Export to HTML |

Allows exporting the cashflows to an HTML page. |

6. Specifying Primary Market Information

Select the Primary Market panel to specify issuance information. Issuance trades can be entered using Trade > Fixed Income > Issuance.

| » | Select a role from the Role field. It should be Lead_Manager or Syndicate_Member. |

| » | Click ... next to the Legal Entity field to select a legal entity for that role. |

| » | Enter a percentage in the % field. This is the percentage of the issue that the selected legal entity should purchase. |

| » | Then click Add. Repeat as needed for other members of the issuance. |

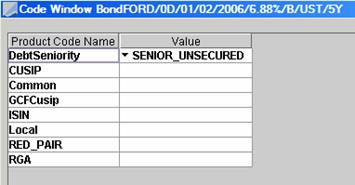

7. Specifying Product Codes by Legal Entity

Select the Legal Entities panel to specify product codes by legal entity.

You can use this panel to specify for example domiciliation codes, or specific product codes by market place.

| » | Click Insert to insert a row. |

| » | Then select a role, a legal entity, a product code, and enter a product code value. Repeat as needed. |

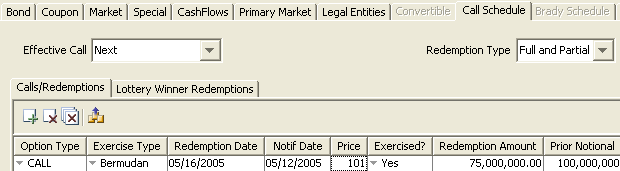

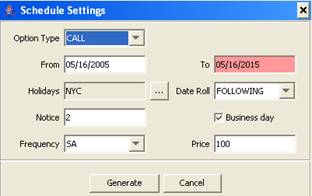

8. Specifying a Call Schedule

Select the Call Schedule – Calls/Redemptions panel to specify a call schedule for callable bonds and perpetual bonds. The schedule is used by the Corporate Action process to perform early redemptions as applicable.

| » | Select the effective call method as applicable. |

All pricer measures are computed based on the effective call.

The system computes the effective call by first looking at the pricing parameter EFFECTIVE_CALL_METHOD to see what the effective method should be (Worst, Best, Next, Maturity, or Custom). If it is not specified in the pricing parameter, it uses the effective call method defined here.

| – | Worst: The call that would occur on the worst option, where worst is defined as the yield to that date. When the val date is past the last call date, the yield is equal to yield-to-maturity. |

| – | Best: The call that would occur on the best option, where best is defined as the yield to that date. When the val date is past the last call date, the yield is equal to yield-to-maturity. |

| – | Next: The call that would occur after the current val date. When the val date is past the last call date, the yield is equal to yield-to-maturity. |

| – | Maturity: The bond is not callable. |

| – | Custom: The call that would occur if you called on the entered call date, but using the redemption price from the call that occurs after that date. If the val date is past the custom date, then the yield behaves as yield-to-worst. |

Note that you must have Effective Call = Custom and a call date set here in order for the Yield To Custom quote type, the YIELD_TO_CUSTOM pricer measure, and the bond trade "Custom" Yield price to work.

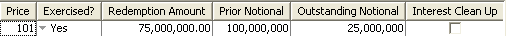

| » | Select the redemption type as applicable: “Full and Partial” or “Full”. |

When you select “Full and Partial”, you can perform partial redemptions. In the redemption row, you can define the amount of redemption, and the outstanding notional amount will be recomputed accordingly. In order for the corporate action process to generate the corresponding corporate action, you need to set the “Exercised?” column to Yes.

You can also check “Interest Clean Up” to perform interest cleanup on the redemption date.

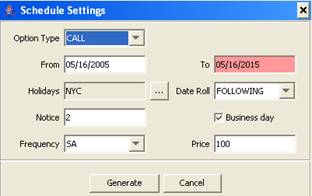

| » | To generate the call schedule, click |

Enter the fields as needed and click Generate. The fields of the call schedule are described below.

The Notice days allow determining the notification date. Check “Business day” if the notice days are business days.

| » | You can also click |

| » | You can right-click a row to bring up the Redemption menu. It allows configuring the columns and saving the column configuration. |

|

Fields |

Description |

|

Option Type |

Choose between CALL and PUT. |

|

Exercise Type |

Select European, American, or Bermudan. For European Callable bonds, you need to set the quote type to AOAS, and the effective call method to Maturity to price using AOAS curves.

|

|

Redemption Date |

Enter the redemption date for European callable bonds. |

|

First Exercise Date |

Enter the first exercise date for American and Bermudan callable bonds. |

|

Notif date |

Enter the redemption notification date. |

|

Price |

Enter the redemption price. |

|

Exercised? |

Choose Yes to allow the generation of corporate actions for partial redemptions. For callable flipper bonds, when flipper date > stub end date and Exercise flag of Bond Call Schedule is checked, the cashflows ignore the flipper date and the stub end date is set to the exercise date. When flipper date > stub end date and Exercise flag is not checked, an error is generated. The Exercise flag must be set manually. |

|

Redemption Amount Prior Notional Outstanding Notional |

Only applies to redemption type “Full and Partial”. Enter the amount of notional that is redeemed. It will re-compute the outstanding notional accordingly. Note that to perform a partial redemption, you need to set the “Exercised?” column to Yes. |

|

Interest Clean Up |

Check to perform interest cleanup on the redemption date. |

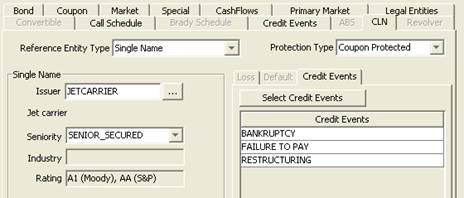

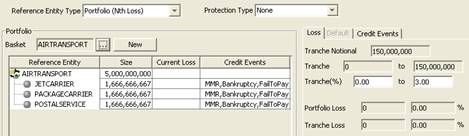

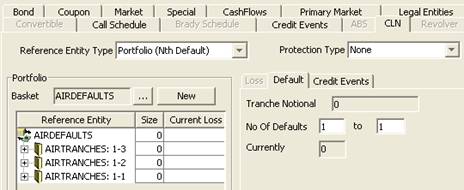

9. Loading Credit Events

Select the Credit Events panel to load credit events that apply to the selected product.

Credit events are created using Trade Lifecycle > Corporate Action > Credit Events.

| » | Click Load to load credit events that apply to the selected bond. |

10. Loading Impairment Events

Select the Impairment Events panel to load impairment events that apply to the selected product.

Impairment events are created using Trade Lifecycle > Corporate Action > Corporate Action in the context of asset impairment for the JGAAP and USGAAP accounting requirements.

A full example is given in the Calypso Positions Management User Guide.

| » | Click Load to load impairment events that apply to the selected bond. |

11. Defining a Bond Ticket Template

You can create a bond ticket template under $CALYPSO_HOME/custom/resources/<custom package>/templates/BondDealTicket.html. If this template is not found, the system will use the default template provided by Calypso.

Refer to the Calypso Developer’s Guide for information on creating custom code and custom packages.

11.1 Ticket Generation Rules

BondDealTicket.html contains rules to fetch the actual HTML templates that you want to use based on any bond criteria.

You can copy resources/calypsox/BondDealTicket.html to $CALYPSO_HOME/custom/resources/<custom package>/templates and edit it as applicable.

For example,

<!--calypso>

if ( |BOND_SUBTYPE| == "UST" )

include "BondDealTicket_Tmpl1.html";

else if ( |BOND_SUBTYPE|== "When-Issued" )

include "BondDealTicket_Tmpl2.html";

else

include "BondDealTicket_Tmpl1.html";

</calypso-->

Then BondDealTicket_Tmpl1.html and BondDealTicket_Tmpl2.html for example contain the actual ticket templates.

So, only BondDealTicket.html is a mandatory file name, then any file name can be used to define the ticket templates. Also BondDealTicket.html is NOT the actual HTML template but just a placeholder to define what ticket templates will be used.

Note that BondDealTicket.html and the ticket templates must be located in the same directory, i.e. $CALYPSO_HOME/custom/resources/<custom package>/templates.

11.2 HTML Ticket Templates

The actual ticket templates are created as standard Calypso message templates using bond-related keywords.

You have two samples under resources/calypsox/BondDealTicket_Tmpl1.html and resources/calypsox/BondDealTicket_Tmpl1.html.

For information on creating HTML templates, see Help > Message Template Keywords. The keywords specific to bond tickets are described in the Bond section.

12. Specifying Argentine Bonds

Argentine floating rate bonds include the following:

| • | BonacS4 |

| • | LedesmaC3 |

| • | TarshopC17 |

12.1 Yield Method

The yield method "ARS" has specific calculations for Argentine bonds.

Refer to the Calypso Bond Analytics Guide for details.

Refer to the Calypso Bond Analytics Guide for details.

12.2 Average Days

The "Average Resets" field "Average Days" is only displayed for Argentine flipper bonds with the "ARS" yield method.

For these bonds, the averaging ignores unknown rates and averages only the known rates.

When Average Days = 1, RateCurrent = rate on Val Date or last known rate before

When Average Days = N where N is an integer > 1, RateCurrent = average of N business days, with the last day of the range being Val Date - 2 business days

See Average Resets for details on using this field.

See Average Resets for details on using this field.

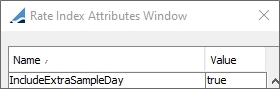

12.3 Sample Days

For Argentine bonds, it is a special case that the samples should go to Coupon End Date. This behavior is controlled by the index attribute IncludeExtraSampleDay.

12.4 Multiple Quote Sources

In Argentina, a bond can be traded in multiple markets, generating different quotes for the same bond.

See Multi Quote Mapping for details.

See Multi Quote Mapping for details.

13. Specifying Asset Backed Bonds

Asset Backed Securities are securities which "pay down" based on a factor.

You can select the ABS (Asset Backed Securities) panel, provided the bond class is BondAssetBacked.

ABS bonds can be imported from Intex – Refer to the Calypso Intex Integration User Guide for details.

| » | Select the bond type as applicable. The following bond types are available: |

| – | ABS: ARM bonds are supported through the Structured Finance module – Refer to the Calypso Structured Finance User Guide for details on ARM bonds. |

| – | AUDMBS: For AUD MBS bonds. It allows saving "<quote name>.TM" quotes required by PricerBondAssetBackedAUD. |

| – | IO (Interest Only): An interest only security is essentially a stream of cashflows that represent interest on outstanding principal. Note that factors need to be captured for these securities, even though no principal paydowns apply. |

| – | PO (Principal Only): PO securities only receive principal repayments. Principal only securities are similar to zero coupon bonds since they are priced at a discount to par, but (unlike zero coupon bonds) they are typically priced with a dollar price (clean price). |

| – | Pass Through: A security which “passes through” payments of interest and principal on the underlying loans to the investor shortly after receipt from borrowers. |

| – | Principal + Interest: A mix of IO and PO. |

| – | Stripped: Stripped paydown ABS securities are created by separating the interest and principal payments from the pool of assets in order to create two new securities: PO securities and IO securities. Some paydown ABS securities may also be partially stripped so that each investor class receives some interest and some principal. |

| » | In the Special panel, you can only choose the Bullet amortization type for an ABS bond. The logic of scheduled payment is built into the pricer. |

| » | Then select the ABS panel to define the details of the ABS. The ABS panel is described below. |

| » | Once the ABS panel is defined, select the CashFlows panel to generate the cashflows. |

13.1 Coupon Panel

By default, the "Compound Freq" and "Method" fields in the Coupon panel are hidden for BondAssetBacked products.

You can enable them by adding the domain BondAssetBacked.showCompounding with the value "true".

When using a floating rate index with the FixedTenorCompoundedRFR index calculator to support fixed tenor deals, for example US 30 Day Average SOFR, the "Compound Freq" and "Method" fields are not available.

13.2 ABS Panel

If the principal percentage on the ABS panel is less than 100, then the system automatically reduces the principal percentage by that amount, regardless of the type. If that rate is set to 100, the system does not reduce the principal percentage.

If the bond is set up as a zero coupon bond (frequency = ZC, rate = 0, and compounding frequency = NON), then no interest payments are made, turning the bond into a principal only bond. Note that factor schedule changes still apply and cause principal paydowns. Also note that you need to set the ABS type to VARIABLE, since there is no schedule of coupons for the fixed or variable schedule to mimic.

If the ABS is set to Interest Only and your principal percentage is not less than 100, a warning is issued. If the ABS is set to Principal Only and the bond is not set up as a zero coupon bond, a warning is issued. These warnings however, do not prevent from saving the bond.

| » | Enter the ABS details as applicable. The fields are described below. |

| » | Click Add/Edit in the Factor Schedule section to add a factor. The Factor Entry dialog will be displayed. |

| – | Enter an effective date: The first date should be the issue date with a factor of 1. |

| – | Enter a factor: The value should be decreasing between 1 and 0. The factor may be > 1. |

An empty factor is an indication that the factor is not yet known, hence it will not be factored into the cashflows.

If the factor has not changed since the security issuance, it should be set to 1 (it should not be empty) so that if there is a coupon change, the coupon change will be applied.

| – | Enter a coupon rate that will be used to calculate the interest of the next period. |

| – | Enter the weighted average coupon, weighted average maturity, and weighted average loan age. |

| – | Enter shortfall and recovery amounts if any, for interest, principal and writedown. |

| » | If you modify past factors, you will be prompted to check the trades that could be impacted (i.e. trades settling in the blackout period). The list of impacted trades will appear in the Process Trades window so that you can re-process the trades to take into account the modified factors. |

ABS Identification

|

Fields |

Description |

|

Series |

Enter the series. |

|

Class |

Enter the class in the series. |

|

Groups |

Enter the group of collaterals supporting the ABS. |

|

Collateral |

Select a collateral type from the Collateral field. You can add collaterals to the BondAssetBacked.collateralType domain. |

Principal Payments

|

Fields |

Description |

|||||||||

|

Schedule Type |

Select the type of factor structure. The following types are available:

Note that for an ABS using the prepayment type PSA or CPR, the schedule type should be either Fixed Schedule or Variable Schedule. |

|||||||||

|

Factor Delay Days |

Enter the number of days between the factor’s effective date and the factor’s known date. |

|||||||||

|

Business Day |

Check the “Business Day” checkbox to indicate that the specified delay corresponds to business days, or calendar days otherwise. |

|||||||||

|

Principal Fraction |

Enter the percentage of principal that will be received at the early redemption date as applicable. |

|||||||||

|

Payment Lag |

Applies to the Variable type of factor only. Enter the number of days between the application of the paydown and its payment. If the payment lag entered exceeds 30 days, the payment day will be calculated with a lag of 1 month for each 30 days, and then the remaining number of days added to the coupon period end date. Example: A payment lag of 44 for a security with coupon period end date on the 12th day of the month would pay on the 26th of the following month. Example: A payment lag of 54 for a security with coupon period end date on the 12th day of the month would pay on the date which is 24 days after the 12th day of the following month. |

|||||||||

|

Business Day |

Applies to the Variable type of factor only. Check the “Business Day” checkbox to indicate that the specified payment lag corresponds to business days, or calendar days otherwise. |

|||||||||

|

Early Redemption Date |

Enter an early redemption date only when known. Entry of a zero factor will automatically set this field to the Effective Date of the zero factor. |

|||||||||

|

Date Roll |

Applies to the Variable type of pool factor only. Select the date roll convention to apply if the payment date falls on a non business day. |

Quotes

|

Fields |

Description |

|

Prepayment Type |

Enter the value for the Bloomberg code MTG_PREPAY_TYP: PSA, CPR, etc. |

|

Speed Assumption |

Displays the quotes of the selected prepayment type. Click Edit to enter the quote. |

|

Weighted Average Life |

Displays the weighted average life of the issue as it is published by external data feed. Click Edit to enter the WAL. This is used for calculating premium accrual, discount accrual and amortization values. A WAL of 4.5 must be interpreted as 4.5 years, not 4 years and 5 months. Double-click the “Weighted Average Life” label to bring up the Quote window showing all of the WAL quotes for the bond between the issue date and today. |

13.3 CashFlows Panel

You can display the pool factor at coupon date. Right-click any cell and choose “Configure Columns” from the popup menu to configure the display columns.

| » | Right-click an Interest cashflow and choose “Show Paydown Periods” to display the details of the paydowns of the period. |

This only applies for variable pool factors changes occurring more frequently than coupon payments.

Also the following columns are specific to asset backed bonds.

|

Columns |

Description |

|

Scheduled Payment |

Value of the Scheduled Payment (Interest + Principal) only populated for PSA bonds. |

|

Scheduled Interest |

Value of the Scheduled Interest (based on the Outstanding Principal). |

|

Scheduled Principal |

Value of the Scheduled Principal Payment (= Scheduled Payment - Scheduled Interest). |

|

CPR |

Prepay annual rate %. |

|

Estimate Principal PrePayment |

Scheduled Principal * CPR. |

|

Estimate Total Payment |

Scheduled Payment + Estimate Principal PrePayment. |

|

Estimate Pool Factor |

Pool Factor included Principal PrePayment Estimation. |

|

Estimate Face Value |

Face Value included Principal PrePayment Estimation. |

Ⓘ [NOTE: For Asset Backed bonds, the Bond Trade window should be used for verifying rates and cashflows]

13.4 External Cashflows

Asset Backed Securities require forecasts to try to predict the future cashflows (principal and interest) based on prepayment models. The external cashflows feature allows importing cashflows from Bloomberg based on a variety of forecast models.

Ⓘ [NOTE: Special license requirements may be required for some models]

To enable external cashflows, follow the steps below.

| » | Add the value “true” to the BondAssetBacked.USE_EXTERNAL_FLOWS_FOR_PRICING domain. |

| » | Add the values “BAM”, “CPY”, “CPJ”, “CPR” and any other desired prepayment model to the ABS.PrepayTypes domain. |

| » | Add the values “BAM”, “CPY”, “CPJ”, “CPR” and any other desired prepayment model to Bloomberg.PrepaymentType domain. |

Once this is enabled, all bond definitions imported from Bloomberg will use the cashflows (forecasted and historical) as specified from Bloomberg based on the chosen prepayment model. Trade cashflows will use the same cashflows defined in the bond definition.

Please refer to the Calypso Bloomberg Data License Integration Guide for more details on importing ABS bonds from Bloomberg.

Please refer to the Calypso Bloomberg Data License Integration Guide for more details on importing ABS bonds from Bloomberg.

13.5 Special Discounting for 30/360 Daycount

For ABS bonds settling on the 31st day of the month and with 30/360 daycount convention, you need to set the domain BondAssetBacked.DC30_360_SpecialDiscountingFor31 with value "true" in order to calculate the yield based on discounting to the 1st of the next month.

13.6 REPROCESS_AFFECTED_TRADES Scheduled Task

The REPROCESS_AFFECTED_TRADES scheduled task checks if there are any pool factor changes to the bonds within 1 business day. If there is, it reprocesses the trades related to the modified bonds (pool factors only).

You need to add REPROCESS_AFFECTED_TRADES to the scheduledTask domain.

You can set a static data filter to filter trades, and select the trade action to be applied. It applies the AMEND action by default.

Whatever workflow action is used should include the workflow rule CheckBondCalculations.

14. Specifying BondMMInterest Products

Instruments with short or mid-term maturities will be entered in the system as BondMMInterest products.

Coupon Panel

| » | If the coupon is paid at the beginning of the period, check the "Pre-Paid" checkbox and select the discounting method from the adjacent field. The default is NONE. |

15. Specifying Brady Bonds

You can select the Brady Schedule panel provided the bond class is BondBrady.

| » | Select the Special panel to specify the amortization type. |

| » | Select the Brady Schedule panel to specify the principal and interest guarantee schedules. |

| » | Then select the CashFlows panel to specify the pay-in-kind rate. |

15.1 Special Panel

Brady Bonds are amortizing or sinking bonds.