Capturing When-Issue and Re-Issue Bond Trades

Prior to capturing a When-Issue or Re-Issue bond trade, you need to define a When-Issue or Re-Issue bond product.

See Defining Bond Products for details.

See Defining Bond Products for details.

During the period between the announcement date and the auction date, Treasury coupon securities are considered to be in "when issued" (WI) status and trading takes place by quoting a bond-equivalent yield.

The calculation of a dollar price (needed to establish the dollar value for the settlement date) from the bond-equivalent yield requires that a coupon value be defined for the security. This is done by using an "assumed" coupon value.

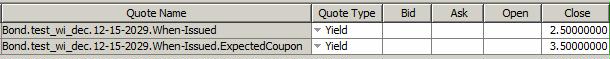

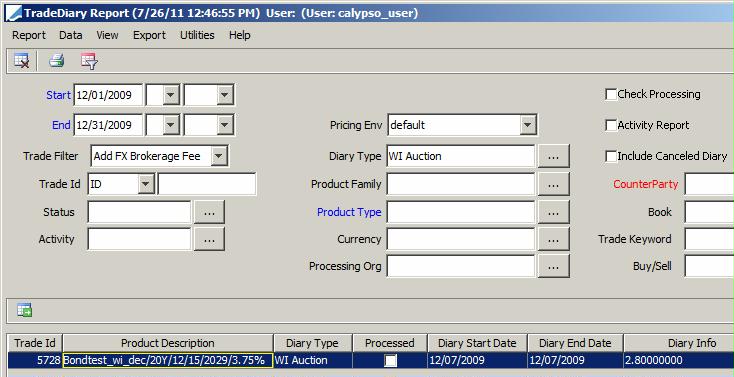

In order to propagate the assumed coupon value over the when-issue period, you can run the PROP_RATE_1BUSDAY scheduled task. It requires a pricing env, holidays, and an attribute called "Quote Name Contains" (similar to the Quotes Window). It will use the valDate and the "Quote Name Contains" to find the quotes to be propagated. You can set the value of "Quote Name Contains" to "When-Issued.ExpectedCoupon".

1. Capturing When-Issue Trades

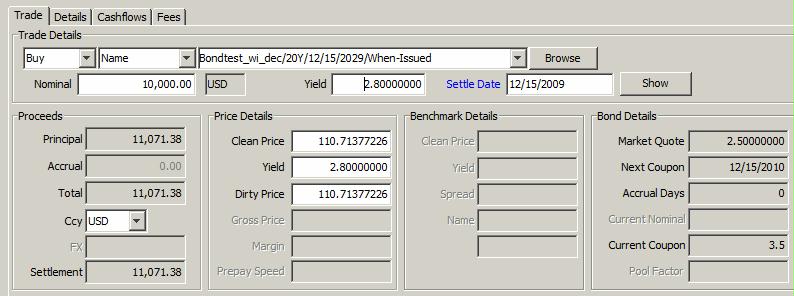

1.1 Sample When-Issue Bond Trade

Navigate to Trade > Fixed Income > Bond to open the Bond Trade window, from the Calypso Navigator or from the Trade Blotter.

The system expects an "assumed coupon rate" to be present, in order to calculate the trade’s price from the entered yield - See "Pricing" below for details.

The settlement date of WI trades is automatically set to the Issue date.

By default, WI trades are NOT eligible for liquidation to generate realized PL. They are marked to market individually. This is true even if a Buy and a Sell for the same WI security exist in the same book.

You can however enable the liquidation of WI trades to generate realized PL using environment property WHENISSUED_LIQUIDATION=true.

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

Pricing

You need the following quotes to price the trade during the When Issue period (between the announcement date and the auction date): The Bond's yield and the expected coupon.

For the expected coupon, you can enter the quote everyday, or you can use the PROP_RATE_1BUSDAY scheduled task to copy the quote to the following day.

1.2 Auction Process

When the coupon rate is announced for the WI security (on the auction date), you should follow the steps below.

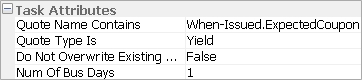

To have the list of upcoming auction dates, you can run the Trade Diary (Reports > Trade Diary) with the Diary Type "WI Auction".

Step 1 - Update the Bond Product

Go to the Bond Definition window, and update the bond as follows:

| » | Enter the actual coupon rate in the Coupon panel. |

| » | Change the quote type from Yield to CleanPrice in the Market panel, and uncheck the "When Issue bond" checkbox. |

| » | Save the bond. |

After saving the bond, the system will ask you if you want to re-process affected trades. You can reply YES (provided you have completed the workflow setup as described in Step 2), or you can reply NO and process the trades later using the PROCESS_TRADE scheduled task or the Process Trades window.

If asked to reprocess affected Corporate Actions, reply NO.

You will be asked if you want to save the new Quote Type, reply YES.

The product code "When-Issued" is cleared on the Bond definition.

Step 2 - Update the Settlement Amount on the Existing Trades

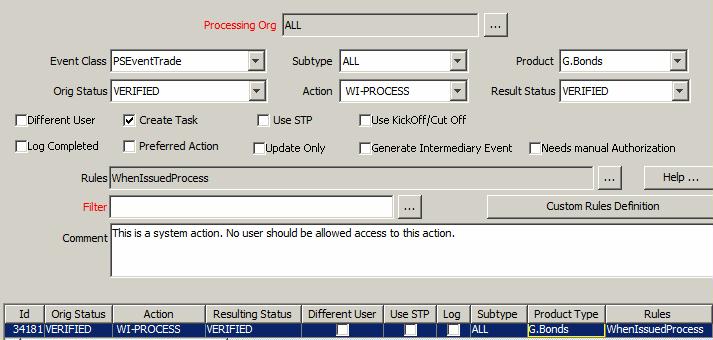

You should first set up a workflow transition with the action: WI-PROCESS and the trade rule WhenIssuedProcess.

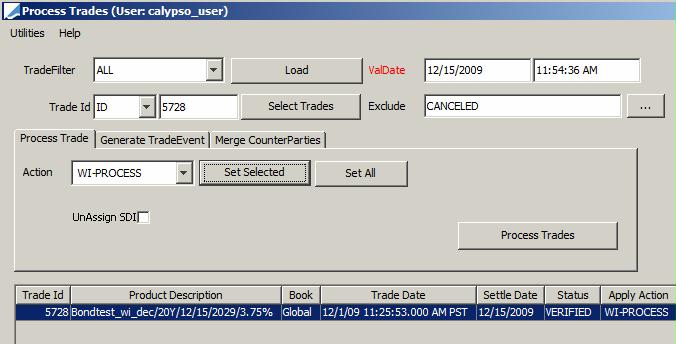

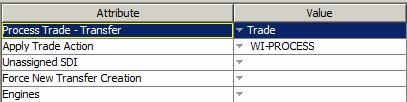

Then run Processing > Process Trades (or the PROCESS_TRADE scheduled task), and apply the action WI-PROCESS.

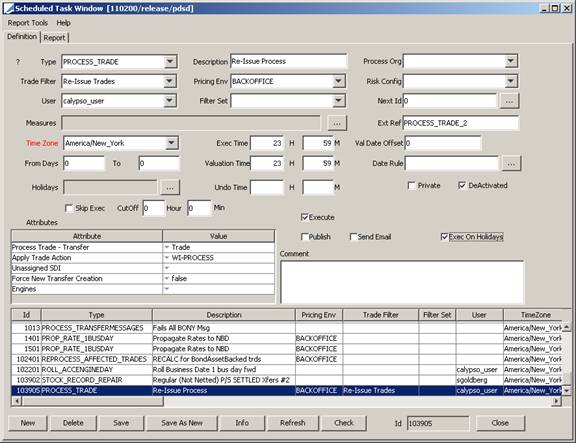

Sample Process Trade Window

Sample PROCESS_TRADE Scheduled Task

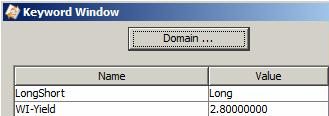

After applying the WI-PROCESS on the trade, the trade keyword "WI-Yield" stores the trade's original yield.

The trade's price is now shown as Clean Price, and the trade is no longer a WI trade.

2. Capturing Re-Issue Trades

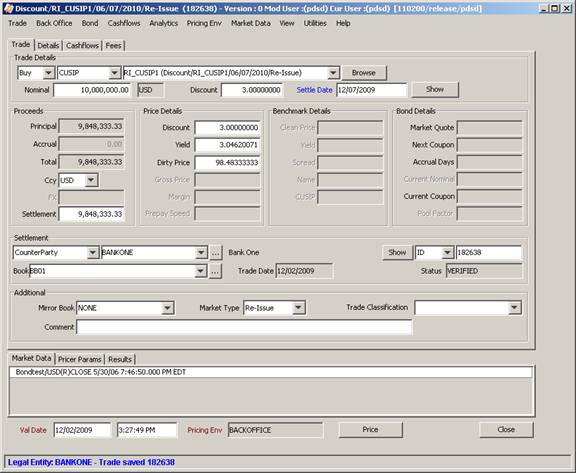

2.1 Sample Re-Issue Bond Trade

Re-Issuance trades are entered to Calypso in exactly the same way as any other trade. Note that the settlement date cannot be prior to the Re-Issuance security’s Issue Date.

Note that:

| • | Market Type shows ‘Re-Issue’ |

| • | The security name shows on the trade screen with ‘Re-Issue appended to it |

As with WI trades, trades in a RI security are not liquidated against each other to generate realized PL. This is true even if a Buy and Sell for the same RI security exist in the same book.

See Capturing Bond Trades for complete details on capturing trades.

See Capturing Bond Trades for complete details on capturing trades.

2.2 Assimilation Process

This is accomplished by using the scheduled task PROCESS_TRADE to convert Re-Issue trades to the assimilation product.

This scheduled task should run during start of day processing (i.e. before the real-time day begins, but after the business date has been rolled forward for the new business day), and the Trade Filter should specify ONLY Re-Issuance trades.

The scheduled task is set up as follows:

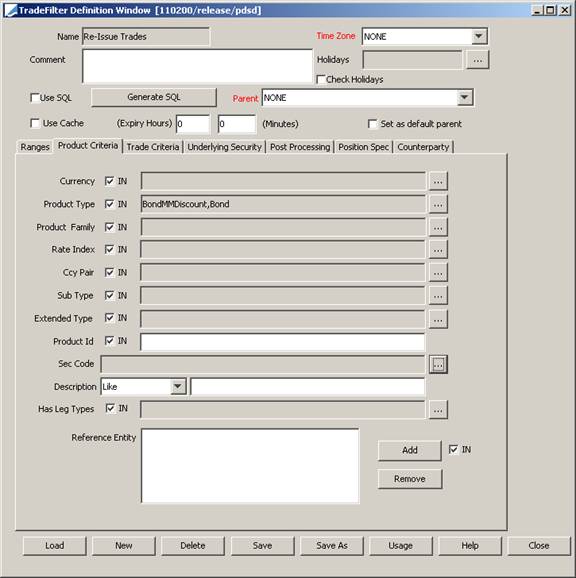

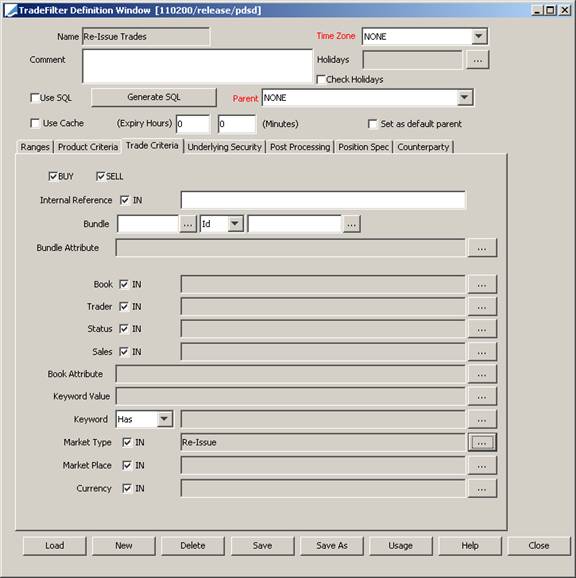

The Trade Filter setup is as follows:

Note that only the Product(s) and the Market Type "Re-Issue" should be specified.

Re-Issue trades will be automatically modified (retaining the original trade id) to specify the original security in place of the re-issuance security. The trade's audit trail information will reflect this change.

Re-Issue trades are assimilated into the original security at start of day on the business day prior to the Re-Issue date.

Please note that the Re-Issue process views "today" to be the date specified in the Legal Entity Attribute "ACC_BUSINESS_DATE" in the Legal Entity Attributes of the Processing Org Legal Entity to which the Re-Issue trade's Book belongs. If the Processing Org does not use "ACC_BUSINESS_DATE", then the Re-Issue process will view today to be the server date.

To have the list of the upcoming Re-Issues, you can launch a Trade Diary with the Diary Type "Re-Issue".