Capturing Bond Forward Trades

Ⓘ [NOTE: Using Bond Forwards requires a specific license agreement. Please contact your Adenza representative for more information]

Bond forwards are OTC derivatives and settlement can be either cash or physical.

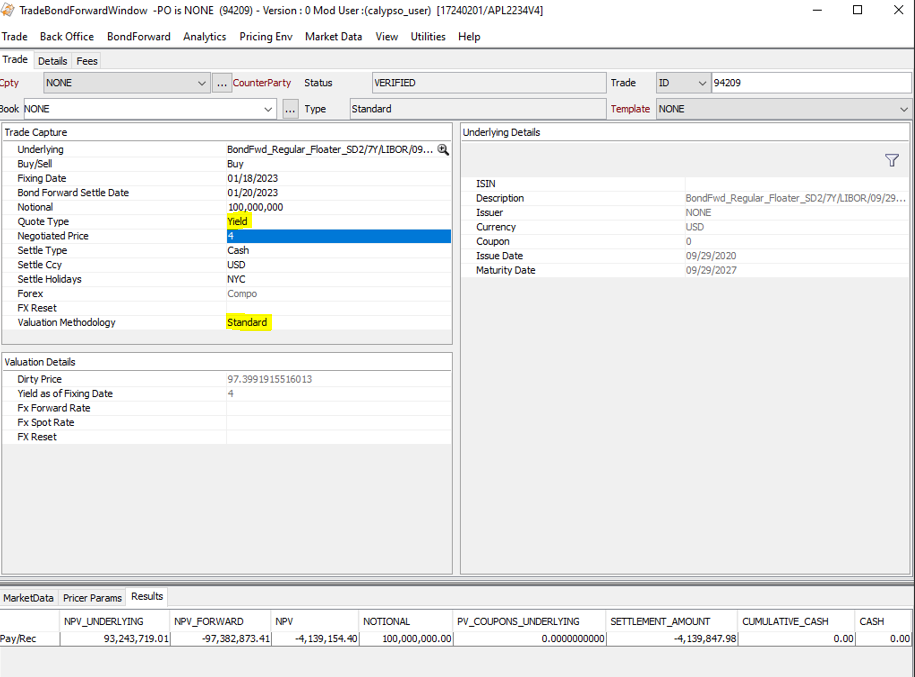

Navigate to Trade > Fixed Income >

Bond Forward (menu action trading.TradeBondForwardWindow) to open the Bond Forward Trade window.

Prior to capturing bond forward trades, you need to specify bond products using Configuration > Fixed Income > Bond Product Definition.

See Defining Bond Products for details.

See Defining Bond Products for details.

Currently, bond forwards support generic fixed rate bonds, for example, Colombian TES bonds, UST, Mexican M-bonds, and UVR (dual currency bonds specific to the Colombian market).

Note that Calypso currently does not support fixed rate bonds with inflation adjustment, flipper type, call schedule, amortization, dual currency, etc, or bonds with coupon type as floating, exotic, etc.

1. Sample Bond Forward Trade

Bond Forward Trade Window

In the Type field, the default value is Standard, unless the underlying is a UVR bond, then the value is Colombian.

Bond Forward now supports to valuation methods :

| • | Colombian, which is a legacy method that was initially introduced for Colombian market. |

| • | Standard, which is the new standard way of pricing a bond forward. |

In the new Standard methodology, following new features have been added :

| • | Bond Forward trade can be captured using 'Yield, Clean Price and Dirty Price' |

| • | Both fixed rate and floating rate bonds (including compounded and Non-compounded bonds) will be supported |

| • | The calculations used for 'Standard' methodology is different from that of 'Colombian'. |

Other lifecycle methodologies, like Exercise, Rollover, terminate etc. stays the same for both methodologies.

Ⓘ Users already using the Colombian methodology can continue using the same methodology without any disruption (Execute SQL will upgrade the existing trades valuation methodology to 'Colombian'). Only in the DTUP files a new field has to be added specifying the valuation methodology for existing clients.

2. Pricing

Bond forward trade capture is based on Clean Price, while valuation and settlement are based on Dirty Price. BondForward Quote type as 'Yield' can be set and with YIELD pricer measure for bond forward, under the valuation method as ‘Standard’.

Now when Quote Type = Yield/Instrument Spread, then Clean Price = Computed Bond’s Dirty Price as of future settlement date – Accrual of the future setting Bond using the cashflows as of Valuation Date.

Resets / Fixings

The following resets / fixings are required:

| • | Non-UVR bond forwards: |

| – | Price of the bond |

| – | FX reset, if settlement currency is different from that of the bond (only needed on exercise date) |

| – | FX spot between bond and bond forward settlement currency |

| • | UVR bond forwards: |

| – | Reset of the price of the bond |

| – | Reset of UVR |

| – | FX reset, if settlement is offshore |

| – | FX spot between UVR and COP |

| – | FX spot between COP and bond forward settlement currency |

| – | FX reset between COP and bond forward settlement currency (only needed on exercise date) |

Exchange Rates

The settlement currency drives the exchange rate if different from the bond currency.

The FX forward rate, or Strike, also needs to be calculated when there is a foreign currency.

Pricer Config

Ensure that PricerBondForward is used for the BondForward product.

The forecast curve is set in the product specific tab for bond currency.

The discount curve is in the bond forward settlement currency.

For bond currency not equal to bond forward currency, the discount curve is needed for both currencies to calculate the FX forward rate.

The underlying bond should also have the necessary discount curves, i.e. the bond should successfully price in a Bond Trade window.

Pricer Measures

The following pricer measures are unique to Bond Forwards.

|

Pricer Measures |

Description |

|---|---|

|

PV_COUPONS_UNDERLYING |

PV of all coupons on the underlying bond during the term of the bond forward. |

|

NPV_FORWARD |

PV of forward. |

|

NPV_UNDERLYING |

PV of underlying. |

|

DIRTY_PRICE_UNDERLYING |

If the value date is less than the fixing date, it is the projected forward dirty price of the underlying, otherwise, it is the spot dirty price of the underlying. |

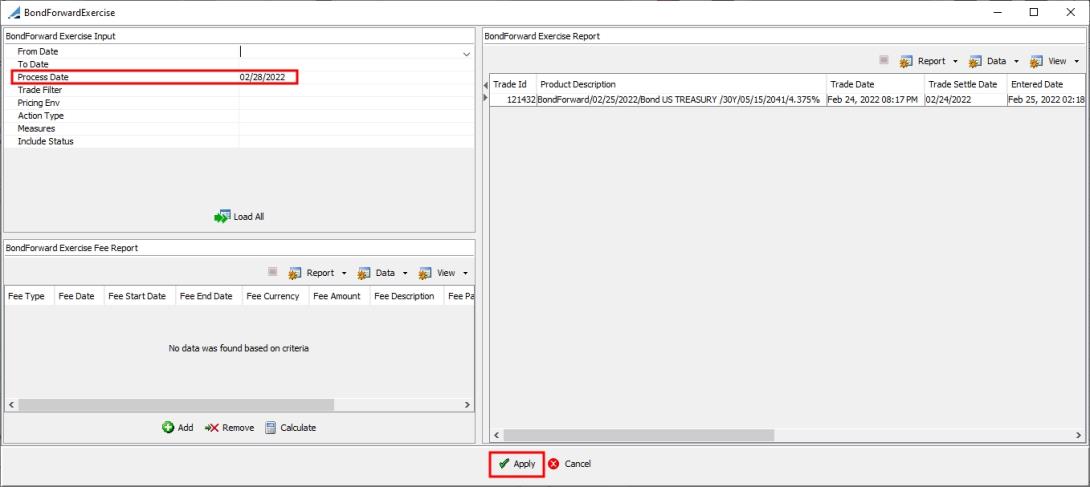

3. Standard Settlement

The Bond Forward Exercise window is used to handle standard settlement of bond forwards, but note that it can only be used to settle the trade on the fixing date.

From the Bond Forward Trade window, select Bond Forward > Exercise to open the Bond Forward Exercise window.

| » | Currently, only the Process Date field and Apply button are used. |

3.1 Cash Settlement

The following fixings are required to calculate the settlement amount:

| • | Price |

| • | FX rate |

| • | FX reset between the bond currency and bond forward settlement currency |

| • | UVR to COP spot (for UVR bonds only) |

The settlement amount and date will be shown once the fixings are set. Once the action is applied and the bond forward trade is moved to EXERCISED status, the fee is generated based on the settlement amount and settlement date.

Scheduled Task AUTOMATIC_EXERCISE_BONDFORWARD is used to auto-exercise Bond Forward trades.

3.2 Physical Settlement

For physical settlement of bond forward trades, a new bond trade is created on the bond forward fixing date and contains the following information:

| • | Notional |

| • | Currency |

| • | ISIN/bond identifier |

| • | Trade price: The bond price on the fixing date |

| • | Trade date: The fixing date of the forward |

| • | Settle date: Trade date + bond settlement lag |

| • | Book: Same book as the bond forward trade |

| • | Bond maturity date |

The settled bond trade id is linked to the original bond forward trade.

The traded price of the new bond is the spot price on the fixing date.

A fee with the settlement amount is set on the bond forward trade. It is calculated as Notional * (Forward Price - Spot Price). The fee currency is in the bond forward settlement currency, and conversions are done accordingly.

The physical bond trade has the keywords BOND_FWD_PRICE_TYPE = CleanPrice and BOND_FWD_PRICE = <clean price value>.

Tax Calculation

For physical settlement of bond forward trades, the resulting bond trade is created with the forward price, and the following pricer measures are calculated if the counterparty requires tax calculation:

COL_TAX_BASIS = (Coupon Rate * Notional * Day Count) / Days + (1 - Clean Price) * Notional / (Days - Accrual Days)

COL_TAX = COL_TAX_BASIS * Tax Rate

The tax rate is set in the PO legal entity attribute BondIncomeTaxRate in the format n%, for example 4%.

The counterparty requires tax calculation if the CP legal entity attribute SelfWithholding.Bond = false.

For information on the associated accounting events, please refer to Calypso Accounting Events documentation.

For information on the associated accounting events, please refer to Calypso Accounting Events documentation.

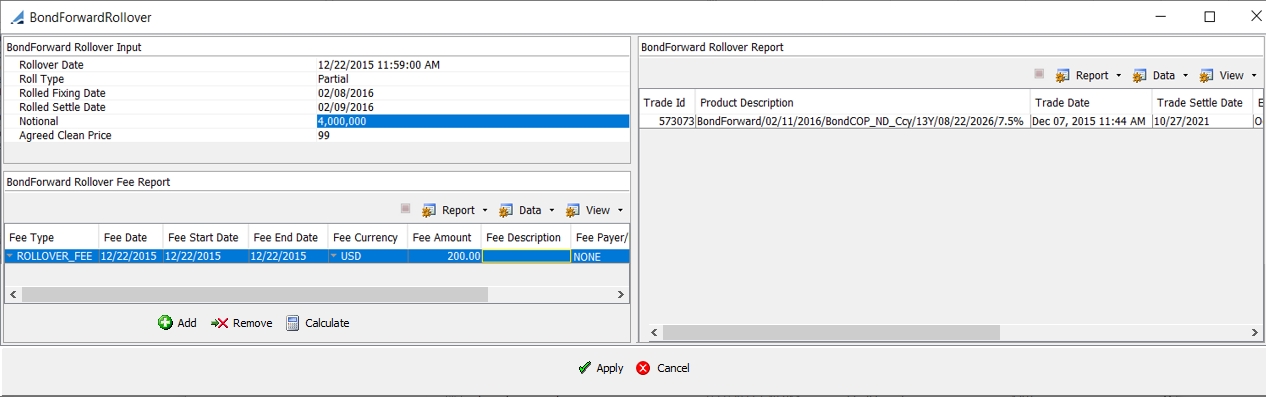

4. Early Settlement

Early settlement, whether full or partial, can be applied to both physical delivery and cash settled bond forwards.

Make sure that the transition VERIFIED - ROLLOVER - ROLLOVERED is configured in the trade workflow with Create Task checked.

Ⓘ [NOTE: You can only rollover a trade in VERIFIED status (out-of-the-box)]

From the Bond Forward Trade window, select Bond Forward > Roll Over to open the Bond Forward Rollover window.

| » | The Rollover Date defaults to the fixing date of the bond forward, but you can modify it as needed. |

| » | Select the Roll Type: Full or Partial. |

| » | Modify the Rolled Fixing Date and/or Rolled Settle Date if needed. |

| » | For partial early settlement, in the Notional field, enter the amount to be early settled. Otherwise, for full settlement, this field is not editable. |

Increasing the notional amount to greater than the original notional is not supported.

| » | Enter the agreed upon new clean price in the Agreed Clean Price field. |

| » | In the Fee Report area, click Add to add a rollover fee if needed. Complete the fee details fields as applicable. |

The Calculate button is not used for rollovers.

| » | Click Apply. |

A new trade is created with the details specified in the Rollover window, including the new price and new fixing date.

For partial early settlement, two new trades are created, one for the notional and agreed clean price for the early partial redemption, and the other for the remaining notional with the original trade terms.

The original trade is changed to status ROLLOVERED. The RolledOverTo keyword on the original trade shows the trade id of the new trade(s).

The RolledOverFrom keyword on the new trade(s) shows the id of the original trade.

Any fee specified is attached to the original trade.

The new trade(s) can then be handled through the Bond Forward Exercise window for standard settlement based on the fixing date(s).

See Standard Settlement for details.

See Standard Settlement for details.

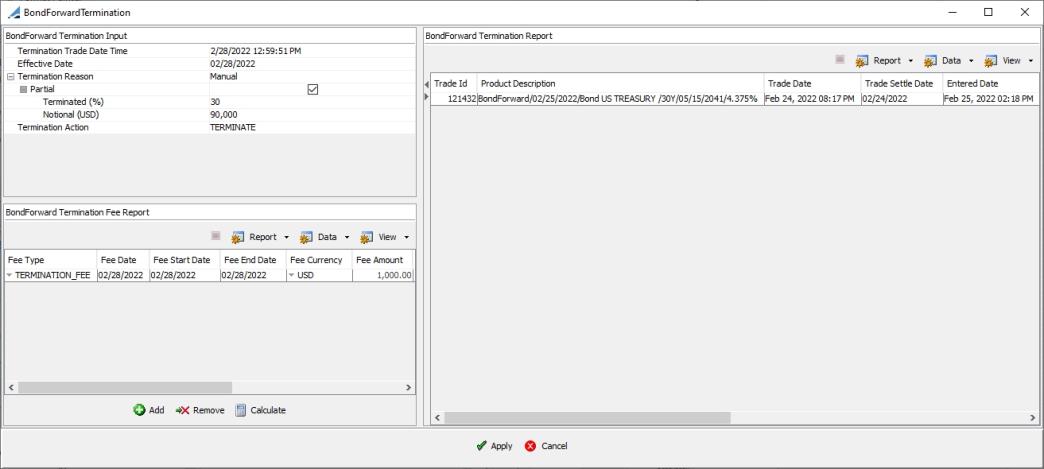

5. Termination

The Bond Forward Termination window is used to handle full or partial termination of bond forwards.

From the Bond Forward Trade window, select Back Office > Terminate to open the Bond Forward Termination window.

| » | Modify the Termination Trade Date Time and/or Effective Date if needed. |

| » | Select the Termination Reason. |

Please refer to Calypso Termination documentation for details on termination reasons.

Please refer to Calypso Termination documentation for details on termination reasons.

| » | For partial termination, select the "Partial" checkbox. Otherwise, leave it unselected for full termination. |

| » | Enter the Termination (%) and the Notional will be calculated, or you can just enter the Notional amount. |

| » | The Termination Action is defaulted to TERMINATE. |

| » | In the Fee Report area, click Calculate to calculate the termination fee as applicable. |

| » | You can click Add to manually add a termination fee if needed. Complete the fee details fields as applicable. |

| » | Click Apply. |

For partial early settlement, a new trade is created for the remaining notional.

The original trade is changed to status TERMINATED. The TransferTo keyword on the original trade shows the trade id of the new trade.

The TransferFrom keyword on the new trade shows the id of the original trade.

Any fee specified is attached to the original trade.

The new trade can then be handled through the Bond Forward Exercise window for standard settlement based on the fixing date.

See Standard Settlement for details.

See Standard Settlement for details.