Lookthrough

The main objective of a lookthrough on a portfolio is to decompose it to the lowest level possible.

You can perform a lookthrough of internal funds (fund of funds), external funds, and instruments.

If it is a derivative, the exposure can be measured by the pricer (like the DELTA for options). If the instrument is described as a list of securities (index or basket), then we break down the instrument by each constituent of the list (FutureEquityIndex). Having the various exposures analyzed allows aggregation at the portfolio level. This gives an alternative view of the portfolio that is different from the actual market value.

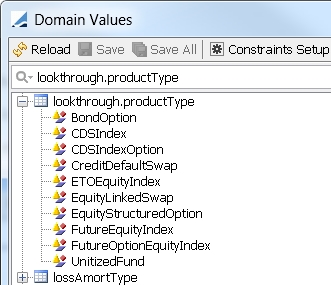

Before You Begin

You first need to add all of the product types you wish to be processed by any lookthrough analysis to the domain lookthrough.productType.

1. Configuring Lookthrough in Analyses

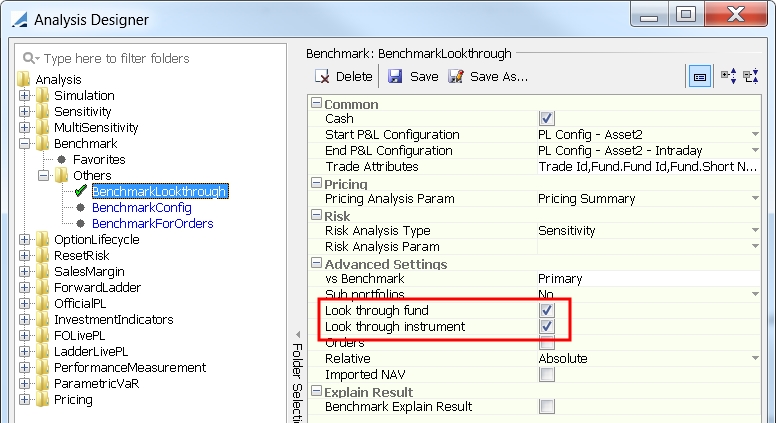

Lookthrough is currently only supported on the Benchmark analysis.

Specifying Lookthrough on the Benchmark Analysis

Lookthrough functionality is enabled on the Benchmark analysis by selecting the "Look through fund" and/or "Look through instrument" checkboxes in the Advanced Settings area. These add the "look through" columns when you reload the columns in the Portfolio Workstation.

| » | Select "Look through fund" to enable lookthrough of internal and external funds. |

| » | Select "Look through instrument" to enable lookthrough of instruments. |

See Benchmark Analysis for complete details on configuring a Benchmark analysis.

See Benchmark Analysis for complete details on configuring a Benchmark analysis.

2. Lookthrough Types

In addition to the common configuration described above, please refer to the sections below for additional information and configuration requirements on the various lookthrough types.

| • | Fund of Funds Lookthrough (Internal Funds) |

| • | External Fund Lookthrough |

| • | Instrument Lookthrough |

2.1 Fund of Funds Lookthrough (Internal Funds)

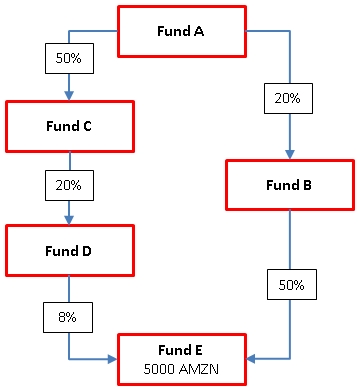

A fund of funds is an alternative way to define a portfolio hierarchy. Instead of investing directly in instruments such as bonds and equities, funds can invest in other funds.

Performing a lookthrough of a parent fund provides a clear view of all holdings retrieved recursively from all child funds, taking into account the weight of the investment in each fund.

In the example above, Fund E has invested in 5000 shares of AMZN. The total number of AMZN shares that results from looking through Fund A is:

Fund A (AMZN) = (50% * 20% * 8% * 5000) + (20% * 50% * 5000) = 540 shares

Configuring Fund of Funds Lookthrough

Step 1 – Define a fund of funds.

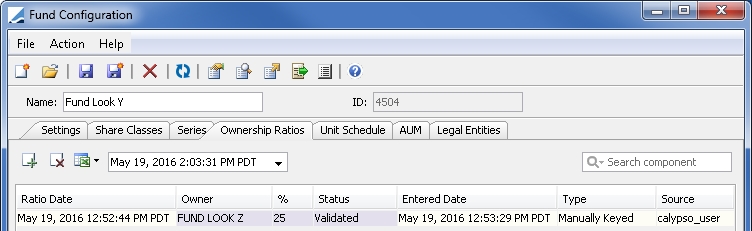

The funds must be internal funds. Ownership is defined on the Ownership Ratios panel, and you can have any number of levels of ownership.

See Defining Funds for details.

See Defining Funds for details.

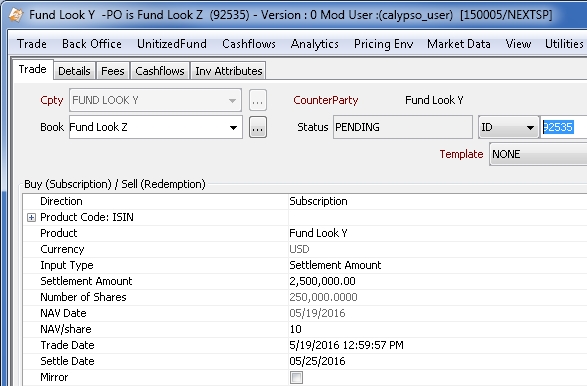

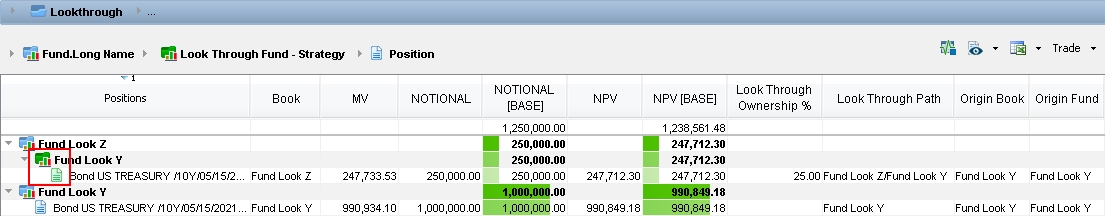

In this example, Fund Look Z owns 25% of Fund Look Y.

Note that in the case of cycling (Fund A > ... > Fund X > Fund A), there is no lookthrough.

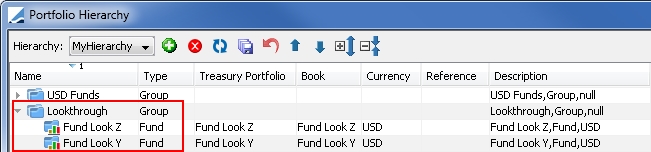

Step 2 – Define a portfolio hierarchy.

See Portfolio Hierarchy for details.

See Portfolio Hierarchy for details.

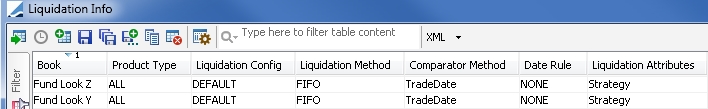

Step 3 – Define a liquidation configuration on the fund books.

See Liquidation Configuration for details.

See Liquidation Configuration for details.

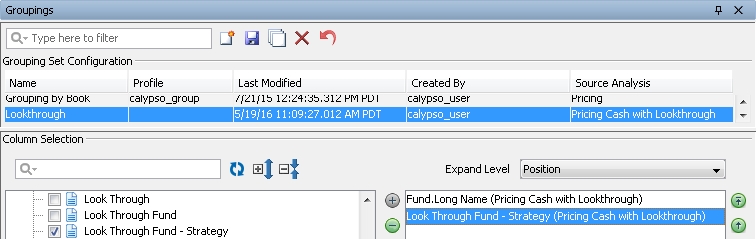

Step 4 – Define a grouping with lookthrough, selecting at least one of the following columns:

| • | Look Through – For lookthrough in flat view. |

| • | Look Through Fund – For lookthrough showing the fund hierarchy (no strategy). |

| • | Look Through Fund - Strategy – For full lookthrough showing all fund hierarchies with their respective strategies. |

See Groupings for details.

See Groupings for details.

Capturing Trades for a Fund of Funds

A unitized fund position is required to reflect the ownership in the portfolio.

| » | Use unitized fund trades for funds to buy shares of other funds. |

See Capturing Trades for Funds for details.

See Capturing Trades for Funds for details.

| » | Book other investment trades on any of the funds as needed. |

See Capturing Trades for Funds for details.

See Capturing Trades for Funds for details.

Trade Mirroring

You can use the trade mirroring functionality to create a link between a unitized fund trade and a subscription trade. This allows for any changes on the investment to be automatically reflected on the subscription.

| » | On the unitized fund trade, select the "Mirror" checkbox. |

Specify the mirror book, which is the default book for the subscription/redemption trade.

A mirror trade will be saved, injecting cash into the book of the internal fund, and you can view the mirror trade id.

2.2 External Fund Lookthrough

Portfolio managers investing in funds managed by external managers are exposed to risk that is not broken down at position or strategy level.

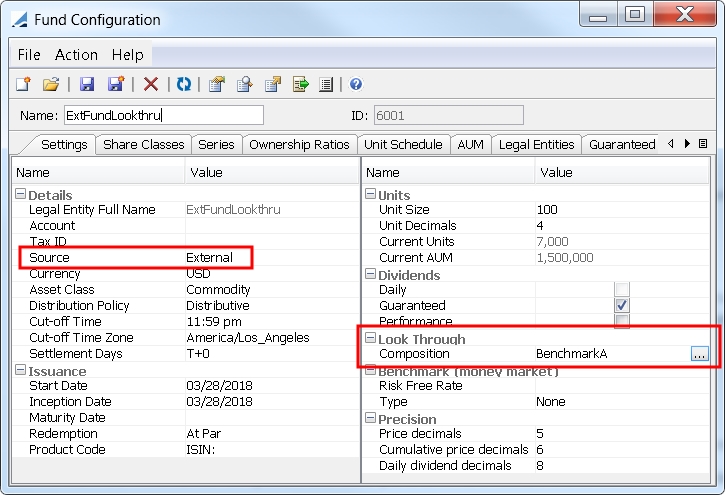

You can perform a lookthrough of external funds in the Portfolio Workstation, provided that the external fund is defined in Calypso with a "constituents" benchmark. In this context, the benchmark is not actually used as a benchmark for relative performance, but rather just to describe the external fund constituents.

The "constituents" benchmark is specified in the Composition field in the Look Through area of the Fund Configuration window. This field is only available for external funds.

See Defining Funds for details on defining funds.

See Defining Funds for details on defining funds.

Typically, an external fund would be modeled in Calypso in one of two ways, either using a bottom up approach or a top down approach.

Bottom Up Approach

A bottom up approach uses transactions and a portfolio hierarchy to model the external fund. In this case the constituents of the benchmark are a portfolio, strategy, weight, or quantity basket, where the underlying constituents fully describe the external fund with "benchmark" positions that can be valued.

See Defining Benchmarks for details on defining benchmarks.

See Defining Benchmarks for details on defining benchmarks.

When a bottom up external fund is decomposed, its constituents' positions are treated as benchmark positions and are scaled to the original market value of the external fund position in the portfolio.

Top Down Approach

A top down approach provides a consolidated view of the constituents, i.e by sector, currency, industry, or issuer, and not the actual transactions. In this case a top-down benchmark is used to describe the external fund's constituents at sector level (or any combination of criteria) and the lookthrough uses the "aggregated" constitution as reference.

See Defining Top-down Benchmarks for details on defining top-down benchmarks.

See Defining Top-down Benchmarks for details on defining top-down benchmarks.

When a top down external fund is decomposed, there is no scaling of metrics as they are defined as records in the benchmark definition, and only top levels are used as, currently, only single level top down description of the external fund (country, currency, sector level1...) is supported.

2.3 Instrument Lookthrough

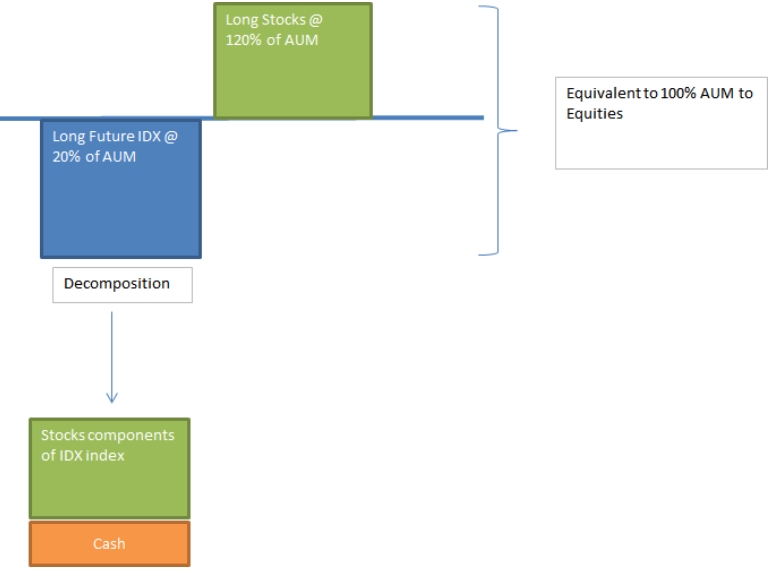

Instrument lookthrough provides decomposition of all instruments described by an index or basket of securities. Currently, only valuation and decomposition of vanilla instruments is supported, and not P&L decomposition or exotic derivatives.

Index level and risk can be decomposed as the sum of its components' value and risk.

For example, on "Long/Short" 120/20 fund, a portfolio manager can expand the exposure to futures to reduce its exposure to stocks being part of the index, since futures on equity index contribute negatively to the exposure. In the diagram below, the future positions on an equity index are decomposed into its constituents plus a residual cash (cost of carry + dividends).

Look Through Instrument Grouping

For instrument lookthrough, you need to include the column Look Through Instrument in your grouping criteria.

See Groupings for details.

See Groupings for details.

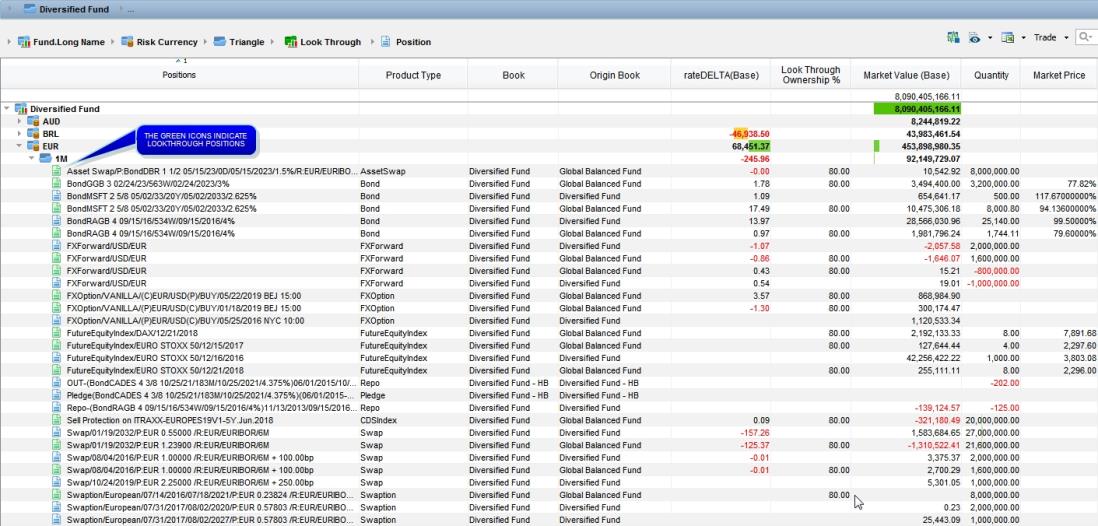

3. Viewing Lookthrough in Analyses

You can view the results of analyses in the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

See Portfolio Workstation for information on running the Portfolio Workstation.

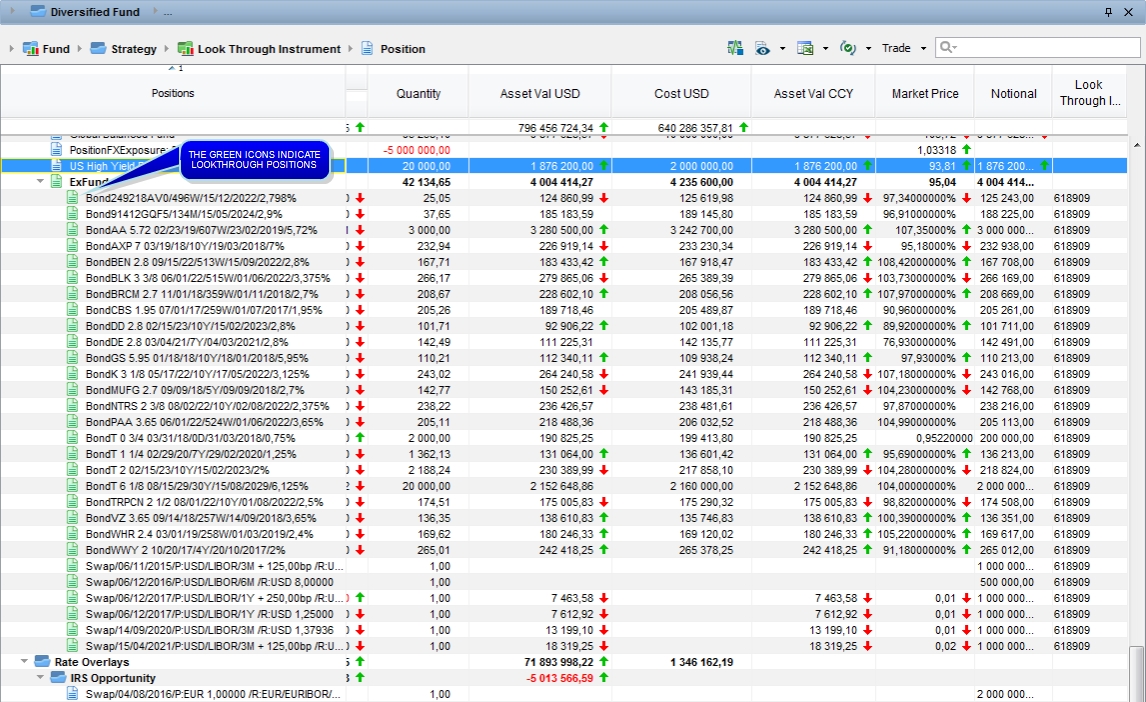

Sample Basic Lookthrough Results

Looking through Fund Look Z to Fund Look Y shows 25% ownership of Fund Look Y, as well as 250,000 (25%) of the 1M bond held by Fund Look Y.

The green icons indicate lookthrough positions.

You can check ![]() > Display Lookthrough Adjustment to display the lookthrough adjustment positions.

> Display Lookthrough Adjustment to display the lookthrough adjustment positions.

The Adjustment rows represent the difference between the value of the fund before lookthrough and the sum of all values for each instrument after lookthrough, as the two are not necessarily equal.

Look Through Ownership % = The ownership ratio computed for the lookthrough position, taking into account all levels, direct or indirect ownership, and the ownership percentage.

Look Through Path = The path leading to the lookthrough position.

Origin Book = The original book of the position without lookthrough.

Origin Fund = The original fund of the position without lookthrough.

Origin Strategy = The original strategy of the position without lookthrough.

Sample Rate Delta Sensitivity (Triangle Shift) Lookthrough Results

Using lookthrough, sensitivity by currency and triangle can be propagated from internal funds. Any other sensitivity of the benchmark works similarly.