Capturing Trades for Funds

You can capture different types of trades depending on the funds.

Internal Funds

For internal funds, you can capture subscriptions and redemptions into the fund, as well as investment trades for the fund.

External Funds

For external funds, you can only capture subscriptions and redemptions since your organization does not manage the actual fund.

1. Before You Begin

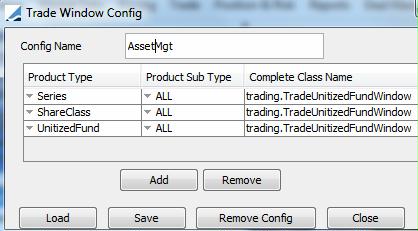

Trade Window Configuration

The trades for all three types of products (ShareClass, Series, and UnitizedFund) are captured from the same window.

In order to allow that, you need to specify the following Trade Window Configuration using Configuration > User Access Control > Trade Window from the Calypso Navigator:

| » | The class name must be set to "trading.TradeUnitizedFundwindow" for the product types Series, ShareClass, and UnitizedFund. |

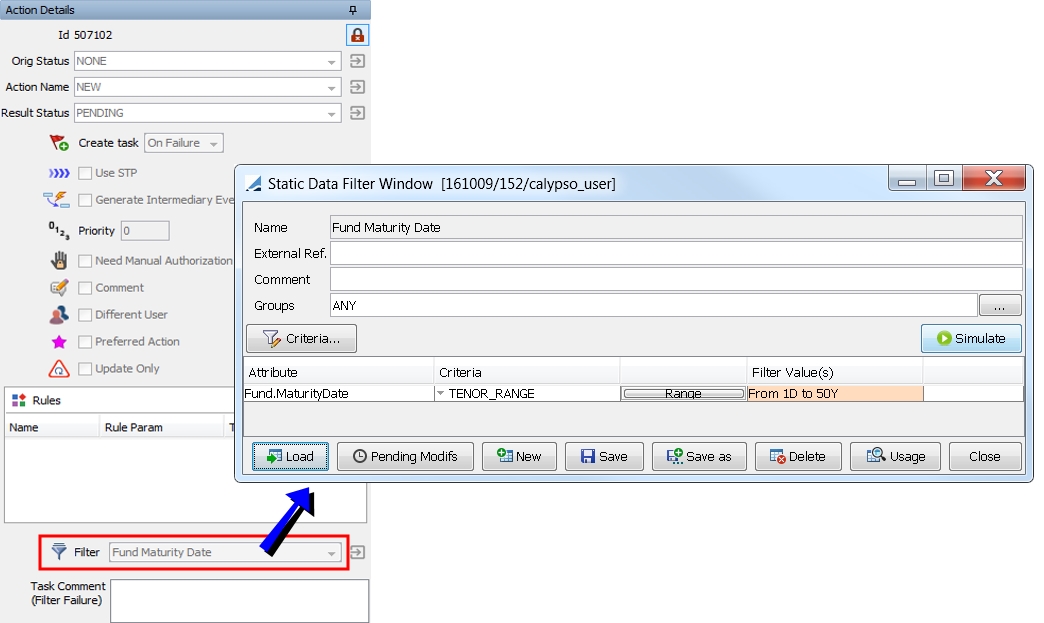

Fund Maturity Workflow Rule

You may wish to set up a workflow rule to prevent saving new trades on funds that have matured. This can be accomplished by setting the following static data filter on the initial transition (typically NONE – NEW – PENDING) of the Trade workflow for the UnitizedFund product. It will ensure that trades are not created on funds whose maturity date is not in the future.

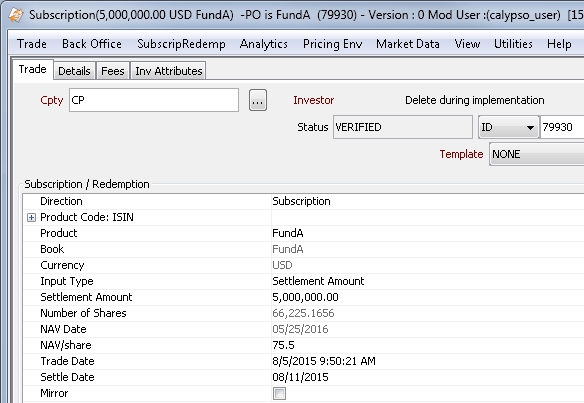

2. Internal Fund - Sample Subscription / Redemption

|

Internal Fund Subscription/Redemption Quick Reference Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. |

From the Calypso Navigator, navigate to Processing > Accounting Operations > Subscription/Redemption (menu action trading.TradeSubscripRedempWindow) to open the Subscription/Redemption trade worksheet.

| » | Enter the fields detailed below in the Trade panel as needed. |

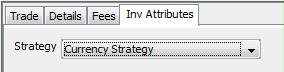

| » | Select the strategy from the Inv Attributes panel. |

| » | Then choose Trade > Save to save the trade. |

Trade Details

|

Fields |

Description |

|

Cpty/Role |

Select the counterparty. The counterparty must have the Investor role specified. |

|

Status |

Displays the current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

ID Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable.

|

Trade Entry Details

|

Fields |

Description |

||||||

|---|---|---|---|---|---|---|---|

|

Direction |

Direction of the trade. Select either Subscription or Redemption. |

||||||

|

Product |

Click ... to select the product. You can select a share class or a series of an internal fund. You can click |

||||||

|

Book |

Displays the book associated with the fund. |

||||||

|

Currency |

Displays the product's currency. |

||||||

|

Input Type |

Select the input type:

|

||||||

|

Settlement Amount |

Enter the settlement amount based on the Input Type. |

||||||

|

Number of Shares |

Enter the number of shares based on the Input Type. |

||||||

|

NAV Date |

Displays the current date. Note that it is not the official date for publication of the NAV. It is not stored and it moves each day. |

||||||

|

NAV/share |

Displays the net asset value per share, if the quote is available. Otherwise, enter the net asset value per share. The scheduled task AM_AMEND_UNITIZED_FUNDS can be used to update the NAV/share on each UnitizedFund trade having a new NAV/share in the quote.

|

||||||

|

Trade Date |

Enter the trade date. |

||||||

|

Settle Date |

Enter the settlement date. |

||||||

|

Mirror Mirror Book Mirror Trade Id |

Select the "Mirror" checkbox if you want to mirror the current trade.

Select a mirror book. A mirror trade will be saved with the current trade to the selected book, and you can view the mirror trade id. |

||||||

|

Cumulative Period accrual |

Only appears for money market products. Displays the cumulative accrual for the period. |

The menu items of the Subscrip / Redemp menu are described below.

|

Menu Items |

Description |

|

Price (F4) |

To price the trade. |

|

Solve (F9) |

The Solve function is not implemented by default. However, you can create a custom Solver.

|

|

Configure Results |

To configure the pricer measures to be displayed in the Results panel. You will be prompted to select pricer measures. Pricer measures are the outputs of the pricing routines. |

|

Save Result Config |

To save the pricer measures configuration. |

|

Re-order Pricing Parameters |

To change the order of the pricing parameters in the Pricer Params panel. |

|

Save Parameters Order |

To save the pricing parameters configuration. |

|

Save As Template |

To save the trade as a template. You will be prompted to enter a template name and specify whether the template is private or public. Other users will not be able to use private templates. |

|

Delete Template |

To delete a template. You will be prompted to select a template. Only the user who created a template (whether it is public or private) can delete it. You can also delete templates using Utilities > Maintenance > Monitoring > Clean-up > Clean-up Database > - Products panel from the Calypso Navigator.

|

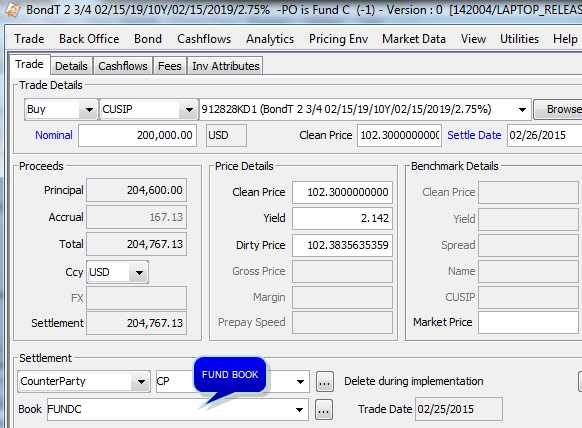

3. Internal Fund - Sample Investment Trade

You can capture any type of trade as an investment trade. You just need to select the book associated with the fund.

Sample Bond Trade

| » | Enter the fields in the Trade panel as needed. |

Select the book associated with the fund.

| » | Select the strategy from the Inv Attributes panel. |

| » | Then choose Trade > Save to save the trade. |

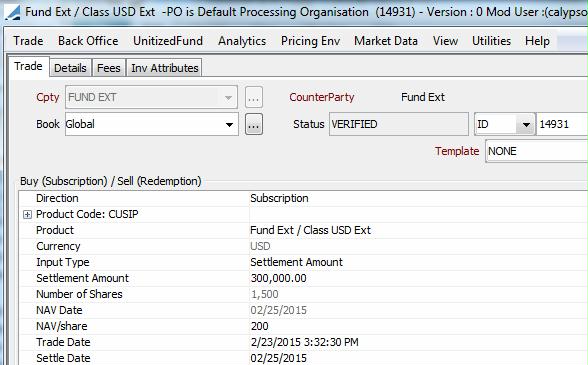

4. External Fund - Sample Subscription / Redemption

Any book in your organization can subscribe / redeem into an external fund.

|

External Fund Subscription/Redemption Quick Reference Configuration

Entering Trade Details

Or you can enter the trade fields directly. They are described below.

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Pricing a Trade

Fund trades are priced using PricerUnitizedFund. |

From the Calypso Navigator, navigate to Trade > Equity > Fund (menu action trading.TradeUnitizedFundWindow) to open the Unitized Fund trade worksheet.

| » | Enter the fields as described for internal subscriptions / redemptions. |

Select an external fund, a share class of an external fund, or a series of an external fund for the product.

| » | Then choose Trade > Save to save the trade. |

The menu items of the UnitizedFund menu are described below.

|

Menu Items |

Description |

|

Price (F4) |

To price the trade. |

|

Solve (F9) |

The Solve function is not implemented by default. However, you can create a custom Solver.

|

|

Configure Results |

To configure the pricer measures to be displayed in the Results panel. You will be prompted to select pricer measures. Pricer measures are the outputs of the pricing routines. |

|

Save Result Config |

To save the pricer measures configuration. |

|

Re-order Pricing Parameters |

To change the order of the pricing parameters in the Pricer Params panel. |

|

Save Parameters Order |

To save the pricing parameters configuration. |

|

Save As Template |

To save the trade as a template. You will be prompted to enter a template name and specify whether the template is private or public. Other users will not be able to use private templates. |

|

Delete Template |

To delete a template. You will be prompted to select a template. Only the user who created a template (whether it is public or private) can delete it. You can also delete templates using Utilities > Maintenance > Monitoring > Clean-up > Clean-up Database > - Products panel from the Calypso Navigator.

|

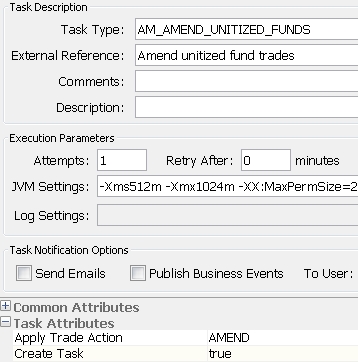

5. AM_AMEND_UNITIZED_FUNDS Scheduled Task

After the NAV of a fund has been published, it is necessary to reprocess all of the fund's Subscription/Redemption trades to compute the number of shares relative to the official NAV/share.

The scheduled task AM_AMEND_UNITIZED_FUNDS is used to update the NAV/share on each UnitizedFund trade having a new NAV/share in the quote.

Common Attributes:

| • | Pricing Environment – The quote type specified in the QuoteUsage pricing parameter for the selected pricing env will be used. The quote type is selected in the following order: |

| – | QuoteUsage for UnitizedFund, if specified |

| – | QuoteUsage for ANY, if specified |

| – | Else CLOSE quotes are used |

Task Attributes:

| • | Apply Trade Action – The trade action to be applied to the trades. |

| • | Create Task – Select true to create a task when an exception occurs (default), or false otherwise. |

See

See