Analysis Designer Overview

Analysis Designer allows configuring parameters for running risk reports.

Risk reports can be run using the following methods:

| • | Using the scheduled task RISK_ANALYSIS to save results to the database and/or to a file - Saved results can be viewed in the Calypso Workstation using the risk servers. |

| • | In real-time using the risk servers - The results are displayed in the Calypso Workstation. |

| • | On-the-fly in the Trade Blotter and Pricing Sheet using the On Demand analysis function - Refer to Trader Blotter documentation and Pricing Sheet documentation for details. |

From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Analysis Designer to bring up Analysis Designer.

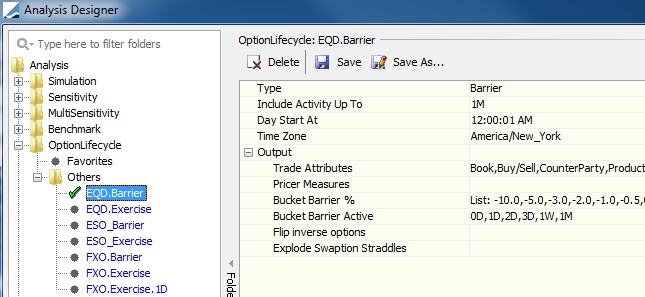

Sample Analysis Designer

| » | You can browse the analyses that are already configured on the left-hand side. There is one folder for each type of analysis. |

| – | Benchmark, Investment Indicators, Investment PL, Performance Measurement, Parametric VaR, Active |

Refer to Calypso Portfolio Workstation documentation for details.

Refer to Calypso Portfolio Workstation documentation for details.

| – | Simulation - Allows simulating how market movements impact the financial institution’s portfolios. |

| – | Sensitivity - Allows showing the discrete sensitivity of a portfolio’s value to changes in the value of the market data used to price the portfolio. |

| – | Multi Sensitivity - Allows running a bundle of existing Sensitivity Analyses and producing a single, aggregated report. |

| – | Option Lifecycle - Allows monitoring exercise and barrier information for options. |

| – | Reset Risk - Allows calculation of the total notional value of a portfolio’s at-risk trades on the reset dates of those trades. |

| – | Sales Margin - Displays sales margins from trade capture. |

| – | Forward Ladder - Allows monitoring product positions and/or cashflows. |

Refer to Calypso Liquidity documentation for details.

Refer to Calypso Liquidity documentation for details.

| – | Official P&L - Allows reporting P&L figures across all asset classes through product positions. |

Refer to Calypso Official P&L documentation for details.

Refer to Calypso Official P&L documentation for details.

| – | FO Live P&L - Used for Taylor methodology P&L in Front Office Workstation. |

Refer to Calypso Front Office Workstation documentation for details.

Refer to Calypso Front Office Workstation documentation for details.

| – | Ladder Live P&L - Used for spot ladder methodology P&L in Front Office Workstation. |

Refer to Calypso Front Office Workstation documentation for details.

Refer to Calypso Front Office Workstation documentation for details.

| – | Pricing - Calculates the values of any set of user selected pricer measures for a given set of trades and positions, as defined by the trade filter selected when the report is run. |

| – | Credit Exposure - Allows monitoring counterparty credit risk and issuer risk. |

Refer to Calypso Compliance documentation for details.

Refer to Calypso Compliance documentation for details.

| – | Order - Allows monitoring orders and their executions. |

Refer to Calypso Orders Management documentation for details.

Refer to Calypso Orders Management documentation for details.

| – | SACCR - Used to create the SA-CCR report. |

Refer to the Regulatory Risk documentation for details.

Refer to the Regulatory Risk documentation for details.

| » | To add a risk report configuration, right-click a folder and choose "New Analysis" from the popup menu. You will be prompted to enter a configuration name. |

You can then set the parameters on the right-hand side.

Click the links below for details on the parameters.

Click the links below for details on the parameters.

| – | Sales Margin |

| – | Sensitivity |

| – | Simulation |

| – | Multi Sensitivity |

| – | Option Lifecycle |

| – | Reset Risk |

| – | Pricing |

Ⓘ [NOTE: Other types of risk reports can be configured through the Risk Config window or the Calculation Server Configuration window]

Custom Pricer Measures

NOTE: Custom Pricer Measures which require market data in addition to what is already managed by the Pricer are not supported (e.g. ACCURAL_BO_BASE, VEGA_BASE). Any “Base” conversions can be configured to occur at report level.

Help

You can right-click the Analysis label and choose "Calypso Online Help" to bring up detailed documentation about Analysis Designer.

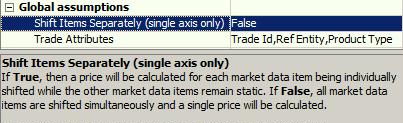

You can right-click the Analysis label and choose "Show Help Area"; so that when you select a given parameter, a Help message is displayed at the bottom of the window as shown below.

Sample Help message