Pricing

Calypso pricing and risk calculations are implemented as pricer measures. The Pricing report calculates the values of any set of user selected pricer measures for a given set of trades and positions, as defined by the trade filter selected when the report is run.

The Pricing report is configured in the Analysis Designer, and can be viewed in the Calypso Workstation.

Supported Products

The Pricing report is completely cross asset and can be run on a portfolio containing any mix of product types.

Please refer to individual product documentation for details on applicable pricer measures and trade attributes.

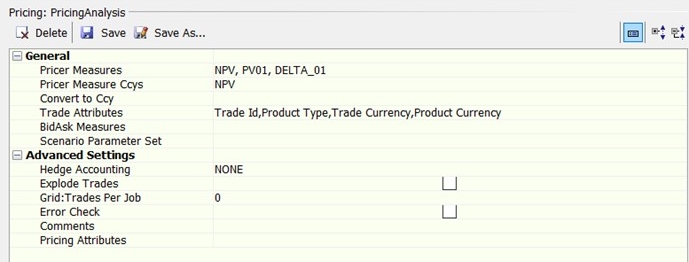

To run a Pricing report, you first need to define the Pricing parameters.

You can define a set of parameters from one of the following windows:

| • | From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Analysis Designer. Right-click a Pricing folder in Analysis Designer, and choose "New Analysis" to add a parameter configuration. You will be prompted to enter a configuration name. |

| • | From the Calypso Navigator, navigate to Configuration > Reporting & Risk > Calculation Server. Select the type Pricing then click ... next to the field "Params". It brings up the Analysis Designer previously described. |

| » | Enter the fields described below as applicable. |

| » | Click Save to save your changes. You will be prompted to enter an Analysis name. |

|

Fields |

Description |

|||||||||

|

Pricer Measures |

Select which pricer measures to calculate. |

|||||||||

|

Pricer Measure Ccys |

Select which Pricer Measures should also display a column with the associated currency. If a PricerMeasure does not display a currency, its implementation should be reviewed. |

|||||||||

|

Convert to Ccy |

Select additional currencies in which to display the results, in addition to the trade currency. Selecting BASE will display the results in the base currency of the Pricing Environment.“Convert to Ccy” is completely independent from “Pricer Measure Ccys” and does not produce additional columns from “Pricer Measure Ccys” selections. |

|||||||||

|

Trade Attributes |

Select which trade attributes to display in the results. |

|||||||||

|

Bid/Ask Measures |

Select Pricer Measures for which bid and ask values will be computed. |

|||||||||

| Scenario Parameter Set |

Select Discrete Scenario Parameter Sets to be included. Please note:

|

|||||||||

| Hedge Accounting |

Select a Participation Classification as needed. It allows grouping of hedging trades and hedged trades in the output. Participation Classifications are set in Hedge Definitions.

|

|||||||||

|

Explode Trades |

Check this box to break down structured trades into their individual components. This feature is also customizable. Refer to the Calypso Developer’s Guide for details. |

|||||||||

|

Grid: Trades Per Job |

Parameter used for dispatching this report for distributed computation.

|

|||||||||

| Error Check |

Check this box to enable the Error Description field in the report output. Two fields in the report are associated with the Error Check feature: the Error Count field and the Error Description field. The Error Description field is used in combination with the Error Count field.

|

|||||||||

| Comments | Enter a comment if desired. | |||||||||

| Pricing Attributes |

Select which pricing attributes to display in the results for FX trades. Please refer to Calypso FX Deal Station documentation for details. |

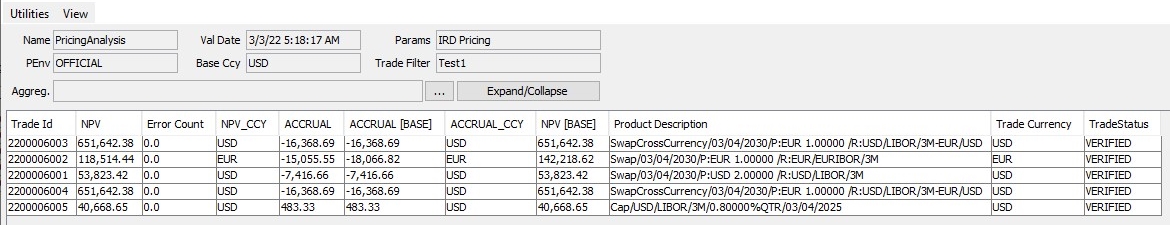

1. Pricing Results

Risk reports can be run using the following methods:

| • | Using the scheduled task RISK_ANALYSIS to save results to the database and/or to a file - Saved results can be viewed in the Calypso Workstation using the risk servers. |

| • | In real-time using the risk servers - The results are displayed in the Calypso Workstation. |

See Calypso Workstation for details.

See Calypso Workstation for details.

Sample Pricing results

Displaying Errors

If you have checked the “Error Check” box in the parameters, the following columns will be displayed:

|

Fields |

Description |

| Error Description | Displays error messages pertaining to the failed pricing of each associated trade. |

| Error Count | Appears as a 1 or 0. 1= one or more errors. 0= no errors. |

Pricer Measures in Base Currency

All conversions happen in a cross-asset fashion, regardless of the pricer or product which produced the measures that are being converted. The pricing parameters and triangulation rules used for the conversion are taken for product type “ANY”: ADJUST_FX_RATE, INSTANCE_TYPE, CURVE_USAGE, QuoteUsage. If not specified for product type “ANY”, the default values are: ADJUST_FX_RATE = false, INSTANCE_TYPE = Last, CURVE_USAGE = MID, QuoteUsage = MID.

The pricing parameter FX_POINTS is always considered false.

Custom Pricer Measures

NOTE: Custom Pricer Measures which require market data in addition to what is already managed by the Pricer are not supported (e.g. ACCURAL_BO_BASE, VEGA_BASE). Any “Base” conversions can be configured to occur at report level.

PricerFromDB and PricerMeasureFromDB

Any measure of type PricerMeasureFromDB, by default, is considered convertible to Base Ccy. Any measures that are not eligible to convert (e.g. Quantity, FX_RATE, PRICE) must be declared as a domain value in the PricerMeasureFomDB_NOCONVERT domain.

When using PricerFromDB or PricerMeasureFromDB, all measures must be returned in the same currency as the trade, else conversion to base currency may fail. It is also acceptable for PricerMeasureFromDB to return measures in the same currency as another standard Pricer Measure defined in the analysis, to ensure proper Market Data is prepared for conversion. Any exception will require custom code.