Reset Risk

The Reset Risk analysis calculates the total notional value of a portfolio’s at-risk trades on the reset dates of those trades. For interest rates and commodities, it calculates the risk effect of one basis point shift in the rate index at reset date associated with that notional. Support for FX resets on interest rates has also been added.

For FX and Equities, it calculates the change in portfolio Delta across the fixing.

The analysis can be run using the Presentation Server and can therefore be viewed in the Calypso Workstation.

Supported Products

Supported products for interest rates and commodities include the following:

| • | Swap |

| • | Non Deliverable Swap |

| • | Forward Start Notional Swap |

| • | MTM Swap |

| • | Compounding Swap |

| • | SwapCrossCurrency |

| • | Cancellable Swap |

| • | CapFloor |

| • | Swaption (European only) |

| • | FutureMM |

| • | StructuredFlows |

| • | CommoditySwap |

| • | CommodityOTCOption |

Ⓘ [NOTE: You can use this analysis for a Commodity Run Off Report on commodity resets to view how the commodity Delta changes on a specific date or date range due to resets being fixed.]

Supported products for FX include:

| • | FX NDF and FX NDF Swaps |

| • | FXForwardStart |

| • | Forward Start FX Option |

| • | FX NDO |

| • | FX Accruals |

| • | FX Futures |

| • | Average Rate and Average Strike FX Options |

Supported products for Equity include:

| • | Equity Structured Option (pricer: Black1AnalyticVanilla) |

| • | Equity Swap (pricers: Equity Linked Swap, Equity Linked SwapAccrual) |

| • | ScriptableOTCProduct (pricers: BlackNFMonteCarloExotic, LocalVolatilityNFMonteCarloExotic) |

| • | BondExoticNote (pricers: BlackNFMonteCarloExotic, LocalVolNFMonteCarloExotic) |

| • | Equity Forward |

Supported products for LIBOR Fallback Cashflows include:

| • | Equity Forward |

| • | SwapCrossCurrency |

| • | SwapNonDeliverable |

| • | SwapCancellable |

For above products, trades which have IndexCalculator is set to FallbackISDA.

Trades includes:

-

With and without Stubs

-

Standard or Compounding

-

Resetting in advance in the original IBOR trades.

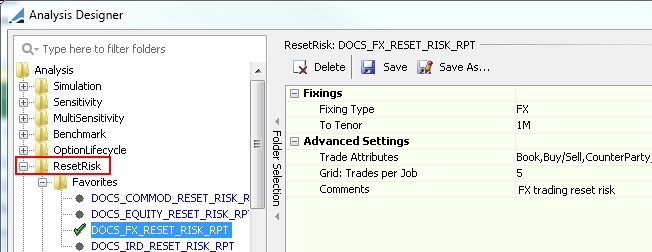

1. Reset Risk Parameters

Reset Risk Parameters are defined in the Analysis Designer window. You can open the Analysis Designer from Calypso Navigator by pointing to Configuration > Reporting & Risk > Analysis Designer.

When configuring report output for Reset Risk, you can also open the Analysis Designer in the following two ways:

| • | From the Calculation Server Setup window: In Calypso Navigator, point to Configuration > Reporting & Risk > Calculation Server. Select "ResetRisk" for Type, then click ... next to the Params field. |

| • | From the Risk Config window: In Calypso Navigator, point to Position & Risk >Risk Config, select "ResetRisk" for the Analysis Type, then click ... next to the Analysis Param Set field. |

Sample Analysis Designer parameters

| » | Open either a Favorites or Others subfolder under ResetRisk in the Folder Selection pane and select an analysis configuration. |

For details on adding analysis configurations, see Analysis Designer Overview.

For details on adding analysis configurations, see Analysis Designer Overview.

| » | Make settings for parameters: |

| – | Fixing Type - Select FX, IR, Commodity, EQUITY, or All |

| – | To Tenor - The selected tenor includes fixings with reset risk that come before or are equal to the tenor's interval of time in the future. |

Ⓘ [NOTE: Since this parameter setting determines how far into the future market data is rolled to measure reset risk, keep in mind that the chances of the tenor having an impact on system performance may increase with the length of the tenor and, therefore, the number of fixings it captures.]

| – | Trade Attributes - Allows you to limit the fixings by trade attributes. |

| – | Grid: Trades per Job - Determines the number of trades in a job. Used only with a calculation grid. |

| » | Click Save to save your changes. You will be prompted to enter a Parameters Set name. |

2. Reset Risk Results

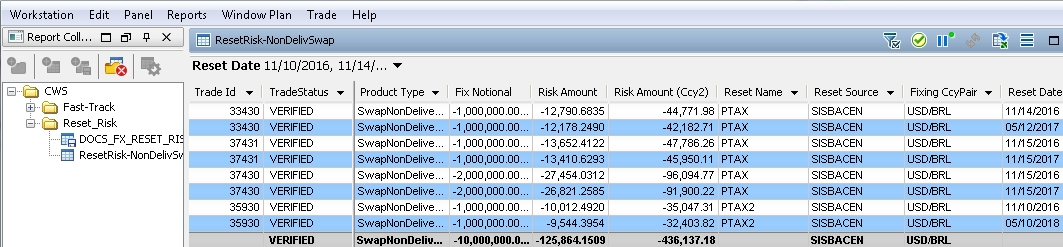

Reset Risk results are displayed in the Calypso Workstation.

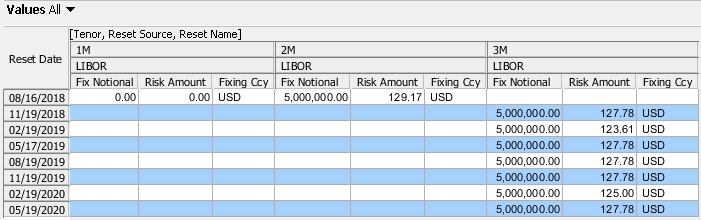

Example Reset Risk report in Calypso Workstation

Risk analysis can be run using the following methods:

| • | On Demand Analysis using either preset reports or ad hoc configurations. |

| • | The end-of-day scheduled task RISK_ANALYSIS to save results to the database and/or to a file - Saved results can be viewed in the Calypso Workstation using Risk Config in conjunction with the risk servers. |

| • | In real-time using the risk servers - "Live" results are displayed in the Calypso Workstation. |

See Calypso Workstation for details.

See Calypso Workstation for details.

The various columns in the report will occasionally serve different purposes for different products. When viewing results, keep the following definitions in mind.

| • | Fix Notional - This is the current notional of the trade fixed on a specific day and shouldn't be mistaken with the original notional. The fix notional is used to accommodate such trades as amortizing swaps and notional adjusting cross currency swaps. |

| • | Fix Risk - This is the risk of a trade fixed on a specific day, whose meaning differs depending on the asset class. For rates products, this is the DV01 of the fixing. For FX and equity products, this is the change in Delta across the fixing. |

| • | Risk Amount - For Interest Rate and Commodity fixings, this is the dollar per basis point value of the fixing. For FX and Equity trades, this is calculated as the difference between the trade's Delta without the fixing and the trade's Delta with the fixing in place and based on the current spot rate. When the fixing is already available in the quote table, the risk on the fixing is zero. |

| • | Risk Amount (Ccy2) - For FX fixings, this is the risk amount converted from the risk currency into Ccy2 at the trade's strike. |

| • | Underlying - Information in the Underlying column varies depending on the fixing type. The elements and format that define the underlying for the four fixing types are as follows: |

| Fixing Type | Format | Example |

|---|---|---|

| FX | Fixing Ccy Pair / Reset Name / Reset Source | USD/BRL/PTAX/SISBACEN |

| IR | Fixing Ccy / Reset Source / Tenor | EUR/EURIBOR/1M |

| Commodity | Fixing Ccy / Reset Source | USD/CBOT.CBOT Soybeans S.2:NOV19 |

| EQUITY | Fixing Ccy / Reset Name | USD/EquityReset.AMZN.NASDAQ |

2.1 Interest Rate Products

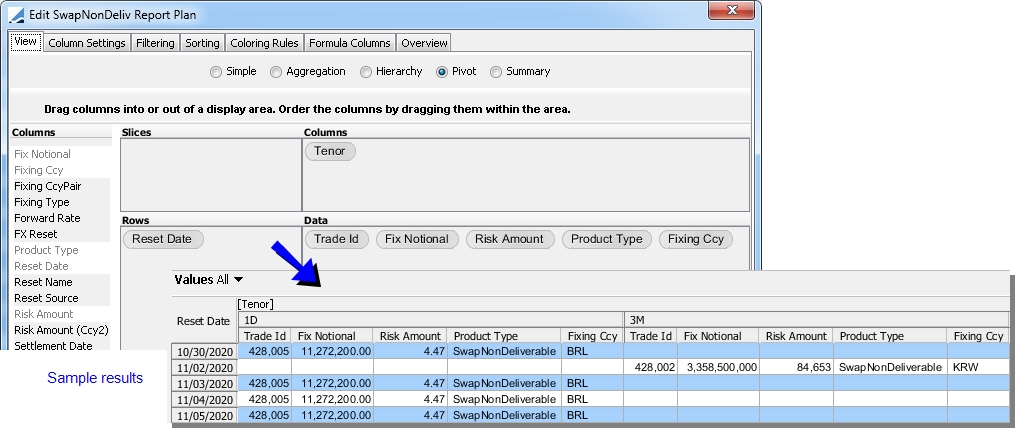

Results can be bucketed by a number of different properties, such as reset date, reset source, tenor, and fixing currency.

Notional at Risk = Notional * (Days in Fwd Period / Basis) * 0.0001

Where:

| • | Days in Fwd Period = Fwd End - Fwd Begin |

| • | Basis = basis set on index (360 or 365). |

| • | Notional = total notional at risk |

| • | 0.0001 = 1 basis point |

For Compounding trades, the formula uses the days in the compounding period:

Notional at Risk = Notional * ((Cmp end - Cmp begin) / Basis) * 0.0001

Ⓘ [NOTE: The Notional at Risk is 0 for a Cap Floor which is out-of-the-money. A Cap Floor is out-of-the-money if fwd rate <= strike for Cap and fwd rate >= strike for Floor.]

Ⓘ [NOTE: All Compounding Swaps should use the compounding notional for reset risk rather than actual notional.]

For a trade with a stub period, the notional at risk is interpolated between the two indexes specified in the trade. In this example, the stub period is interpolated between Libor 1M and Libor 2M.

Swap Non Deliverable

Non Deliverable Cross Currency Interest Rate Swaps display interest rate reset risk as well as FX reset risk in the report. Additionally, on the final fixing date of the trade, Non Deliverable Swaps should display the details and risk associated with any FX resets.

The IR fixing risk measure for Non Deliverable Swap displays interest rate reset risk.

The FX fixing risk measure for Non Deliverable Swap trades appears up to the fixing date of the cashflows of the trade, and the amount should be equal to the discounted value of the cashflow.

Risk Amt= Interest Amt * Pmt Dt df

RiskAmt2= Risk Amt1 * FX Spot

RiskAm1 and RiskAmt2 will be driven by the setup in the currency pair definition.

Forward Start Swap

Forward Start FX trades have fixing risk on the rate-setting date (the date on which the adjusted notional gets fixed). The risk amount displayed is the risk effect of one basis point shift in the forecast FX rate associated with that notional. Once the Rate Reset process is applied, there will be no more FX Reset Risk.

Risk Amt1= (PV – PV +1bp) * Ccy Pair Point Factor

RiskAmt2= Risk Amt1 * FX Spot

PV and PV + 1bp should be computed using the forecast FX rate.

RiskAm1 and RiskAmt2 will be driven by the setup in the currency pair definition.

MTM Swap

MTM Swap trades have FX fixing risk on the date of the fixing of the principal adjustments. (the date on which the principal adjustments become known). The risk amount displayed is the risk effect of one basis point shift in the forecast FX rate associated with that notional adjustment. Only the risk for the principal adjustment is displayed and not the interest payments.

Risk Amt1=(Fix Notional * Proj FX Rate - Fix Notional * Proj FX Rat +1 bp) * Adj Ccy DF * Ccy Pair PointFactor

RiskAmt2= Risk Amt1 * FX Spot

RiskAm1 and RiskAmt2 will be driven by the setup in the currency pair definition.

2.2 FX Products

The table below provides details on specific trades covered under reset risk reporting for FX products.

| Trade | Details | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

FX NDFs and FX NDF Swaps |

|

|||||||||

|

Forward Start FX |

|

|||||||||

|

FX NDOs |

The Risk measure for FX NDOs should appear on the Expiry Date of the trade, and the amount should be equal to the Delta measure of the trade. |

|||||||||

|

Forward Start FX Options |

|

|||||||||

|

FX Accruals |

The Risk measure for FX Accrual products should appear on each Observation Date of the accrual, and the Expiry Date for cash settled FX or Fader type accruals. In each case, the amount should be equal to the change in the Delta of the trade when a fixing is applied to the trade. |

|||||||||

|

FX Futures |

|

|||||||||

| Average Rate and Average Strike FX Options |

|

.

Split Fixings for Trades with FX Resets

Split fixings are cross-currency exposures with two-part fixings (e.g. EURKRW, EURBRL, KRWJPY).

| • | The Reset Risk Report has the ability to select FX fixings created using the FX Reset Pairs function in all fields where FX fixings can be selected. For the Pricing Sheet, this includes Reset Source, Observation Source, and Settlement Source properties. For the Swap trade window, this includes the Intermediate Ccy and Settlement Ccy fields for both legs of a swap trade, and the FX Reset field in the Principal Adjustments feature. |

| • | When a trade uses a split fixing, as configured in the FX Reset Pairs function, the trade generates two lines on the reset risk report – one for each leg of the split fixing. Each fixing will have a separate Risk Amount. |

Ⓘ [NOTE: When a fixing has a rate available in the quote table, the fixing’s Risk Amount will be zero and does not appear in the report. Otherwise, the fixing’s risk amount will be equal to the trade’s Ccy1 notional or Ccy2 notional, converted at the current spot rate.]

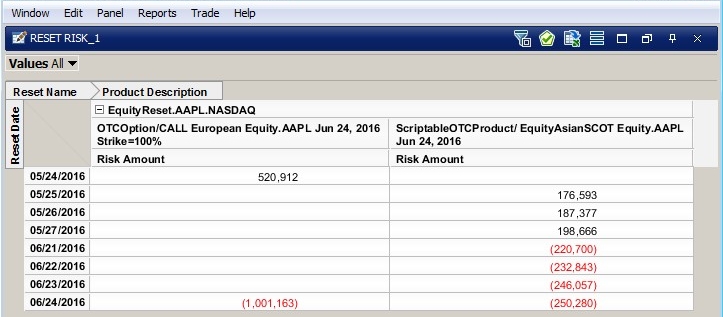

2.3 Equity Products

The Reset Risk Report shows the change in Delta at each reset. For a simple Equity Vanilla, the trade will have two resets: the underlying fixing on the trade date, and the underlying fixing at expiration. Similar results are seen on the left side of the report below.

For options with multiple resets, the report shows the risk across each fixing. Results of this kind are seen on the right side of the report below.

Sample reset risk results for an Equity Vanilla trade and Equity Asian SCOT trade.

2.4 LIBOR Fallback Cashflows

| » | Libor Fallback rate is based on Adjusted SOFR rate, which is an overnight rate. Reset Risk Analysis report for Libor Fallback contains all the reset dates and rate index details which constitute the fallback rate; such that users can see Risk Amount based on Daily RFR Index resets on trades where Fallback is setup. |

| » | Inclusion of Reset date for Libor fallback trades in Reset Risk Analysis Report is based on the below date range criteria: |

| – | Start Date of the report will be from Val Dt, i.e. the report will have the first Reset Date / Sample Date = Val Dt. |

| – | End Date of the Report will be Val Dt + Tenor as set in Reset Risk Analysis Configuration. |

| » | Each Reset / Sample date shows the respective Risk Amount until the reset rate for that Reset / Sample date is known (i.e. the quote is saved in quote set). Once the quote is saved, the Risk Amt for that Reset / Sample date becomes ‘0’. |

| » | Columns under Reset Risk Analysis report such as: Underlying, Reset Source and Tenor are based on Nominal index as configured in Rate Index Attributes of the IBOR index. |

| » | There could be overlapping reset dates (sample dates) between 2 cashflow periods. In such cases the overlapping dates will be repeated. The unique identifiers in such cases would be ‘Settlement dt’ for trades without compounding or ‘Settlement dt + Fix Notional’ for trades with compounding. |

| » | Products in scope include: Swaps, SwapCrossCurrency, SwapNonDeliverable and SwapCancellable trades which have: |

| – | IndexCalculator set to FallbackISDA and |

| – | Reset in advance in the original IBOR trades. |