Option Lifecycle

![]() Download PDF - Option Lifecycle

Download PDF - Option Lifecycle

The Option Lifecycle analysis allows monitoring Barrier and Exercise information for CMD options, FX options, EQD options, Swaptions, and Structured Product with Sub-product Equity Structured Option, and applying actions.

The Option Lifecycle analysis is configured using Configuration > Reporting& Risk > Analysis Designer. It allows monitoring Barrier and Exercise information for CMD options, FX options, EQD options, Swaptions, and Structured Product with Sub-product Equity Structured Option, and applying actions.

Right-click an Option Lifecycle folder in Analysis Designer, and choose "New Analysis" to add a parameter configuration, you will be prompted to enter a configuration name. The parameters are described below. Save your configuration once you are done.

The following types of configurations can be defined: Barrier (monitoring of barriers, triggers, and digitals), and Exercise (monitoring of deals that require a decision in terms of exercise).

Option Lifecycle results can be viewed in the Calypso Workstation.

Refer to Calypso Workstation documentation for setup details.

Refer to Calypso Workstation documentation for setup details.

1. Barrier - FX Options

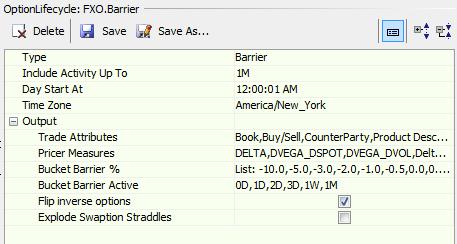

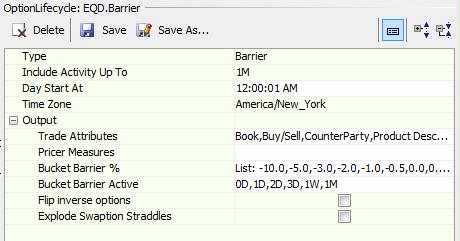

1.1 Sample Configuration

The configuration is very simple, you mostly select what trade attributes you want to display, and what buckets you want to analyze.

| » | Enter the start time and select the timezone of the start time. |

This dictates when the ‘day starts’ for the purpose of tenor buckets. Since barrier monitoring is time dependent, this is important.

| » | Select trade attributes as needed. The number of trade attributes that can be displayed is limited to 30. |

| » | Select Greeks pricer measures as needed. |

| » | Select the "Bucket Barrier %" buckets, and the "Bucket Barrier Active" buckets. These buckets are used to monitor barriers, triggers, and digitals. |

You can enter the individual buckets, or generate buckets on-the-fly.

| » | Specific to FX Options - You can check "Flip inverse options" to display the trades based on the currency pair defined as “Pair Pos Ref” in the Currency Pair Definition. Otherwise they are displayed based on the currency pair selected upon trade capture. |

1.2 Barrier Report Plan in Calypso Workstation

Barrier Risk Report Plan

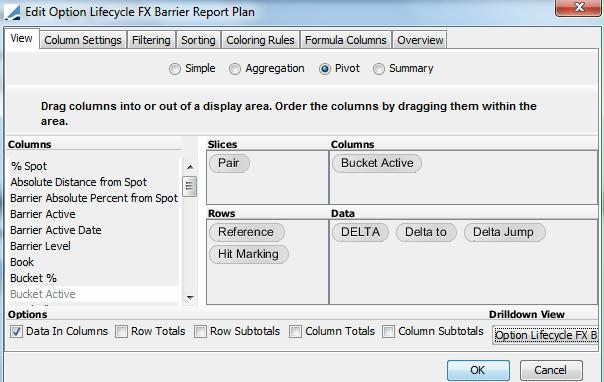

You can see the Delta Risk in the buckets as percentage from forward rate, to and over the barriers.

You can create a Pivot view as shown below.

This view can also be considered as a navigation window to drill down into further details for a particular bucket. For example, you can drill-down into the "Triggered" bucket to see what actual barriers the system considers to be triggered.

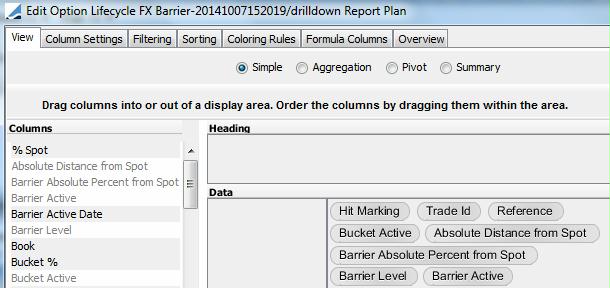

Configure the drilldown report plan as shown below and make sure to associate it with the Pivot view.

Choose ![]() > Create New Drilldown Report Plan.

> Create New Drilldown Report Plan.

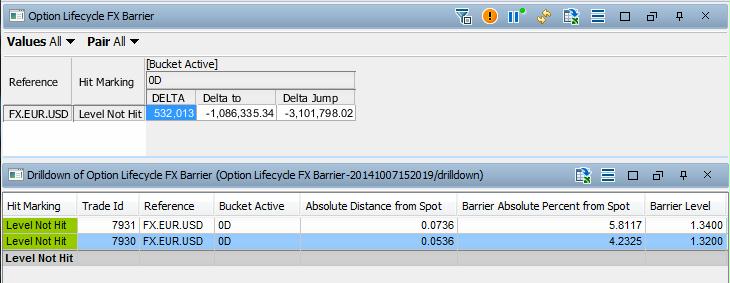

The Barrier Risk report will look as shown below in the Calypso Workstation.

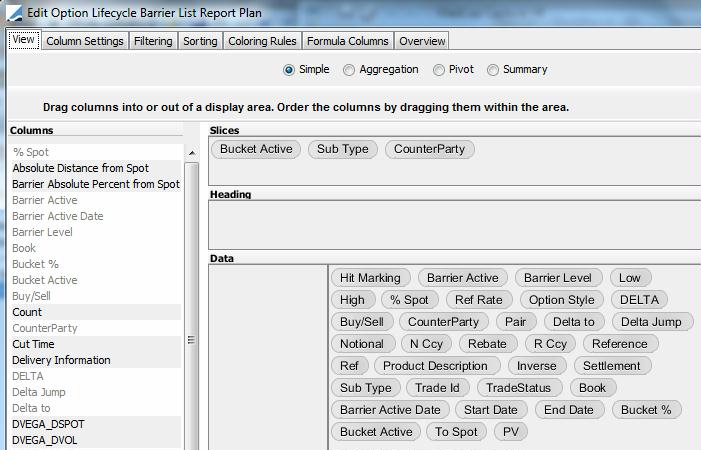

Barrier List Report Plan

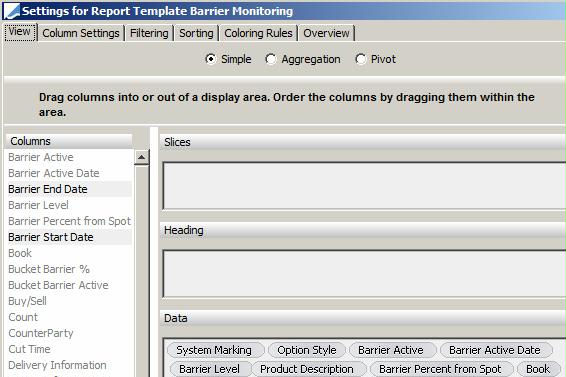

This is a list of barriers. You can setup a Simple view as shown below.

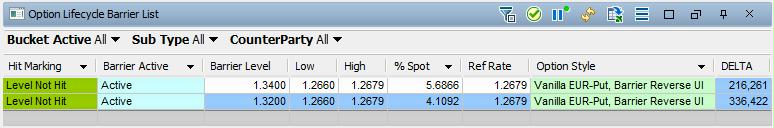

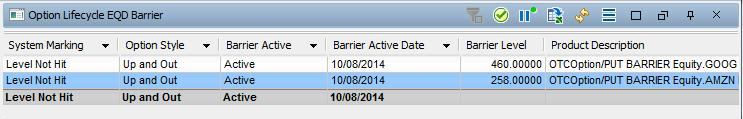

The Barrier List report will look as shown below in the Calypso Workstation.

Applying Actions

From the Barrier list, you can right-click an option and select an action to be applied: Knock-in, Knock-out, Trigger-in, Trigger-out, etc. based on your workflow configuration.

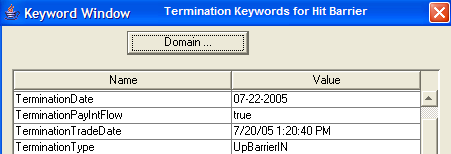

Termination keywords attach to Barrier Options that are hit.

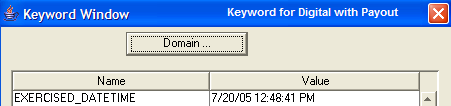

The exercise keyword attaches to triggered Digital Options that payout.

Un-triggered barriers are identified by default by trades in status VERIFIED.

Triggered barriers are identified by default by trades in status EXERCISED, EXPIRED, KNOCKED_IN, or KNOCKED_OUT.

Recommended trade workflow:

| • | VERIFIED - EXERCISE - EXERCISED |

| • | EXERCISED - UNEXERCISE - VERIFIED, workflow rule: UnexerciseOption |

| • | VERIFIED - EXPIRE - EXPIRED |

| • | EXPIRED - UNEXPIRE - VERIFIED, workflow rule: UnexerciseOption |

| • | VERIFIED - KNOCK_IN - KNOCKED_IN |

| • | KNOCKED_IN - UN_KNOCK_IN - VERIFIED, workflow Rule: UnexerciseOption |

| • | VERIFIED - KNOCK_OUT - KNOCKED_OUT |

| • | KNOCKED_OUT - UN_KNOCK_OUT - VERIFIED, workflow Rule: UnexerciseOption |

| • | VERIFIED - TRIGGER_IN - TRIGGERED_IN |

| • | TRIGGERED_IN - UN_TRIGGER_IN - VERIFIED, workflow Rule: UnexerciseOption |

| • | VERIFIED - TRIGGER_OUT - TRIGGERED_OUT |

| • | TRIGGERED_OUT - UN_TRIGGER_OUT - VERIFIED, workflow Rule: UnexerciseOption |

The following table describes the option types and lifecycle actions that can be processed in the Barrier View.

| Option Type | Action | Description |

|---|---|---|

|

Barrier (KI, KIKO) |

Knock In |

Knocking in a barrier whose in barrier has been breached will create a new vanilla option or a KO barrier (if KIKO Type B). This action can be done on any date within the barrier window. |

|

Barrier (KO) |

Knock Out |

Knocking out a barrier whose out barrier has been breached will terminate the option. This action can be done on any date within the barrier window. |

|

Digital (OT, OTNT) |

Trigger In |

Triggering in a digital option whose in trigger has been breached will create a payoff in the form of an exercise fee, or will create a no touch digital (if one touch, no touch Type B). This action can be done on any date within the trigger window. |

|

Digital (NT) |

Trigger Out |

Triggering out a no touch digital option whose out trigger has been breached will terminate the option. This action can be done on any date within the trigger window. |

NOTE: Digital with Barrier follows the same lifecycle action as the Barrier defined on it. Once knocked-in, it follows the same lifecycle action as Digital at Expiry.

2. Exercise - FX Options

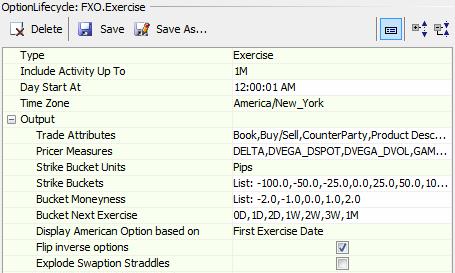

2.1 Sample Configuration

The configuration is similar to which of the barrier - You mostly select what trade attributes you want to display, and what buckets you want to analyze.

| » | Time selection is as in Barrier. Since expiries go on 24 hours you just decide when your day starts so there is no confusion. |

| » | Select trade attributes as needed. The number of trade attributes that can be displayed is limited to 30. |

| » | Select Greeks pricer measures as needed. |

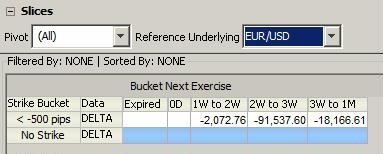

| » | Select the strike bucket unit - percentage, basis points, or pips. |

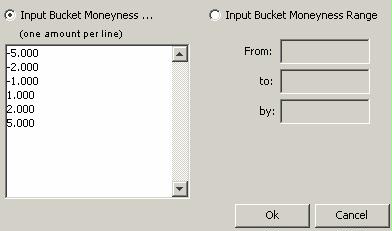

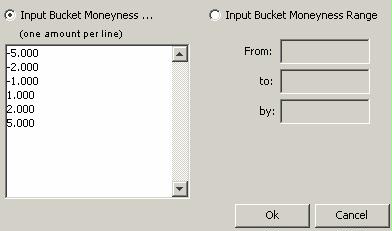

| » | Select the "Strike Buckets", "Bucket Moneyness", and "Bucket Next Exercise" buckets as needed. |

Strike Buckets display trades based on their distance from underlying spot, whether in Pips or % Rel. The Strike-Spot column calculates the distance from strike as Strike – Ref. Rate, regardless of put/call.

The underlying spot is the current spot rate as of report calculation time, for the underlying currency pair of each trade.

You can enter the individual buckets, or generate buckets on-the-fly.

| » | You can choose how to display American options: by First Exercise Date, or by Expiry Date. |

| » | Specific to FX options - You can check "Flip inverse options" to display the trades based on the currency pair defined as “Pair Pos Ref” in the Currency Pair Definition. Otherwise they are displayed based on the currency pair selected upon trade capture. |

| » | Specific to European Swaptions - You can check "Explode Swaption Straddles" to explode only Swaption Straddles into their two underlying Swaptions (RTP, RTR). |

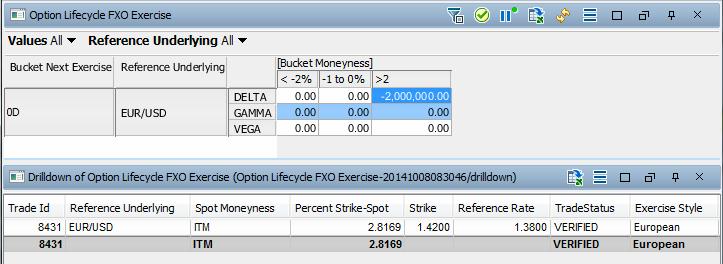

2.2 Exercise View in Calypso Workstation

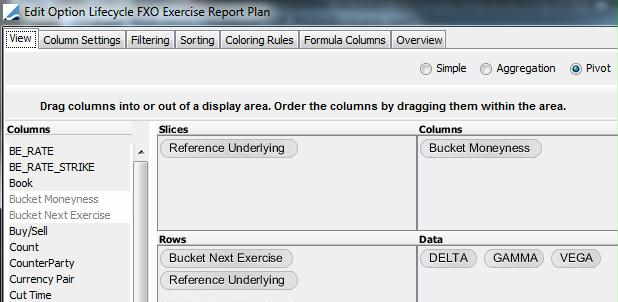

Exercise Pin Risk Report Plan

It is somewhat different as it displays based on moneyness of the option – i.e. % strike from Underling Spot, this is the Percent from Spot column, and is used to build the buckets for that axis as well. This calculation also dictates if the option is flagged as in-the-money (ITM) or out-of-the-money (OTM) in the Moneyness column. This is useful in the trade level drilldown view as a quick indicator.

For options without bucket moneyness, the Bucket Moneyness column will display "Misc.".

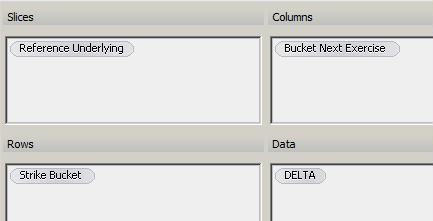

You can create a Pivot View as shown below.

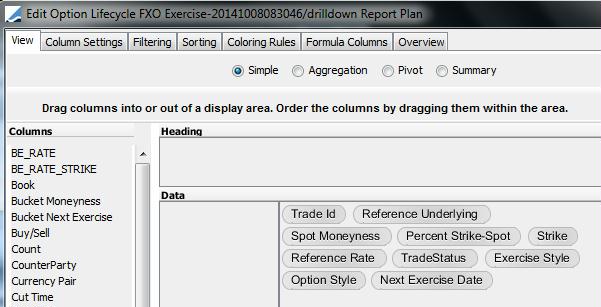

Configure the drilldown view as shown below and make sure to associate it with the Pivot View.

Choose ![]() > Create New Drilldown Report Plan.

> Create New Drilldown Report Plan.

The Exercise Pin Risk report will look as shown below in the Calypso Workstation.

Applying Actions

From the Exercise drilldown view, you can right-click an option and select an action to be applied: Exercise, Expiration, etc. based on your workflow configuration.

For cash settlement exercise, an exercise fee is attached to the option trade, and the trade moves to status EXERCISED.

For physical exercise, a trade is created for the underlying product, and the option trade moves to status EXERCISED.

| • | The ExercisedUnder trade keyword is set on the option trade. It contains the trade id of the trade generated for the underlying product. |

| • | The ExercisedOption trade keyword is set on the trade generated for the underlying product. t contains the trade id of the option trade. |

For expiration, the trade moves to EXPIRED.

Recommended trade workflow configuration:

| • | VERIFIED - EXERCISE - EXERCISED |

| • | EXERCISED - UNEXERCISE - VERIFIED, workflow rule: UnexerciseOption |

| • | VERIFIED - EXPIRE - EXPIRED |

| • | EXPIRED - UNEXPIRE - VERIFIED, workflow rule: UnexerciseOption |

For partial exercise, a trade is created with the residual unexercised amount. If you add the workflow rule CancelRemainderOfPartialExercise on the VERIFIED - EXERCISE - EXERCISED transition, the trade for the residual amount will be in status CANCELED, otherwise it will be in status VERIFIED.

The following table describes the option types and lifecycle actions that can be processed with the Exercise view.

| Option Type | Action | Description |

|---|---|---|

|

Vanilla (American and European |

Exercise |

Exercising a vanilla option will generate the appropriate payoff. European options may only be exercised after the expiration time. American options may be exercised on any date between the first exercise date and the expiration date. |

|

Vanilla (American and European) |

Expire |

Expiring a vanilla option will terminate the option. Vanilla options may only be expired after the expiration time. |

|

Asian |

Exercise |

Exercising an Asian option will generate the appropriate payoff. |

|

Asian |

Expire |

Expiring an Asian option will terminate the option. This action can only be done after expiration time. |

|

Fader |

Exercise |

Exercising a Fader will generate the appropriate payoff. |

|

Fader |

Expire |

Expiring a Fader will terminate the option. This action can only be done after expiration time. |

|

Forward Starting |

Exercise |

Exercising a Forward Starting option will generate the appropriate payoff. |

|

Forward Starting |

Expire |

Expiring a Forward Starting option will terminate the option. This action can only be done after expiration time. |

|

Digital (OT, OTNT & at Expiry), Barrier (KI, KO, KIKO), Digital with Barrier |

Expire |

Expiring an option will terminate the option. This action can only be done after expiration time. |

|

Barrier (KO) |

Exercise |

Exercising a barrier option whose knock-out barrier has not been breached will create the appropriate payoff. This action can be done only after expiration time. Knock In barriers will have been knocked in to a vanilla; therefore KI exercise is not valid. |

|

Digital (at Expiry) |

Exercise |

Exercising a digital at expiry option will create a payoff in the form of an exercise fee. |

|

Lookback |

Exercise |

Exercising a Lookback option will generate the appropriate payoff. |

|

Lookback |

Expire |

Expiring a Lookback option will terminate the option. This action can only be done after expiration time. |

|

Range Accrual |

Exercise |

Exercising a Range Accrual option will generate the appropriate payoff. |

|

Range Accrual |

Expire |

Expiring a Range Accrual option will terminate the option. This action can only be done after expiration time. |

| European Range Binary |

Exercise |

Exercising a European Range Binary option will generate the appropriate payoff. |

|

European Range Binary |

Expire |

Expiring a European Range Binary option will terminate the option. This action can only be done after expiration time. |

|

Volatility Forward |

Exercise |

This is actually a volatility fixing rather than an exercise. “Exercising” a volatility forward will create the appropriate payoff. |

Distance from Spot View

This is a pivot table.

The Distance from Spot report will look as shown below in the Calypso Workstation.

3. Barrier - Equity Derivatives Options

For Equity Derivatives Options, the Option Lifecycle analysis can be used to monitor the barriers. The actual knock-in / knock-out should be done from the Trade Blotter or the Option Exercise window.

3.1 Sample Configuration

The configuration is very simple, you mostly select what trade attributes you want to display, and what buckets you want to analyze.

| » | Enter the start time and select the timezone of the start time. |

This dictates when the ‘day starts’ for the purpose of tenor buckets. Since barrier monitoring is time dependent, this is important.

| » | Select trade attributes as needed. The number of trade attributes that can be displayed is limited to 30. |

| » | Select the "Bucket Barrier %" buckets, and the "Bucket Barrier Active" buckets. These buckets are used to monitor barriers, triggers, and digitals. |

You can enter the individual buckets, or generate buckets on-the-fly.

3.2 Barrier Report Plan in Calypso Workstation

Barrier List Report Plan

This is a list of barriers. You can setup a Simple view as shown below.

The Barrier List report will look as shown below in the Calypso Workstation.

Applying Actions

You can load the trades you want to knock in the Trade Blotter, and apply the actions from there (recommended for bulk processing). Or you can apply the actions from the Option Exercise window.

Refer to Calypso Equity Structured Options documentation for details.

Refer to Calypso Equity Structured Options documentation for details.

4. Exercise - Equity Derivatives Options

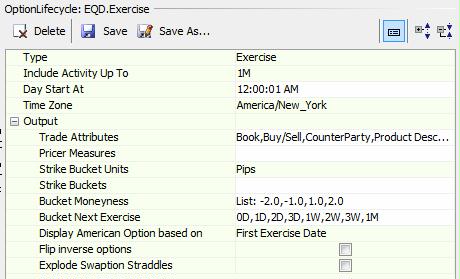

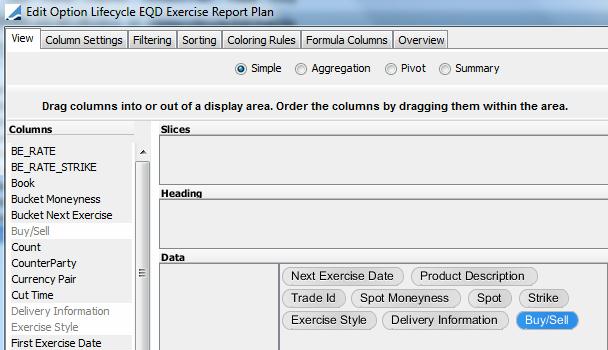

4.1 Sample Configuration

The configuration is similar to which of the barrier - You mostly select what trade attributes you want to display, and what buckets you want to analyze.

| » | Time selection is as in Barrier. Since expiries go on 24 hours you just decide when your day starts so there is no confusion. |

| » | Select trade attributes as needed. The number of trade attributes that can be displayed is limited to 30. |

| » | Select the "Bucket Moneyness" and "Bucket Next Exercise" buckets as needed. |

You can enter the individual buckets, or generate buckets on-the-fly.

| » | You can choose how to display American options: by First Exercise Date, or by Expiry Date. |

4.2 Exercise Report Plan in Calypso Workstation

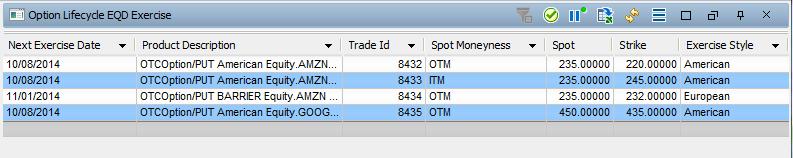

Exercise List Report Plan

This is a list of barriers. You can setup a Simple view as shown below.

The Exercise List View will look as shown below in the Calypso Workstation.

Applying Actions

You can right-click an option and select an action to be applied: Exercise, Expiration, etc. based on your workflow configuration.

For cash settlement exercise, an exercise fee is attached to the option trade, and the trade moves to status EXERCISED.

For physical exercise, a trade is created for the underlying product, and the option trade moves to status EXERCISED.

| • | The ExercisedUnder trade keyword is set on the option trade. It contains the trade id of the trade generated for the underlying product. |

| • | The ExercisedOption trade keyword is set on the trade generated for the underlying product. t contains the trade id of the option trade. |

For expiration, the trade moves to EXPIRED.

Recommended trade workflow configuration:

| • | VERIFIED - EXERCISE - EXERCISED |

| • | EXERCISED - UNEXERCISE - VERIFIED, workflow rule: UnexerciseOption |

| • | VERIFIED - EXPIRE - EXPIRED |

| • | EXPIRED - UNEXPIRE - VERIFIED, workflow rule: UnexerciseOption |