Multi Sensitivity

![]() Download PDF - Multi Sensitivity

Download PDF - Multi Sensitivity

This function is currently off-catalog and requires a specific license agreement.

The Multi Sensitivity analysis is designed to run a bundle of existing Sensitivity analyses to produce a single, aggregated report.

Additionally, each underlying Sensitivity analysis can be attached to a Hedge Instrument Set that will be used to produce a hedge recommendation.

See Sensitivity for details on configuring and running a Sensitivity analyses.

See Sensitivity for details on configuring and running a Sensitivity analyses.

See Hedge Recommendation for details on the hedge recommendations.

See Hedge Recommendation for details on the hedge recommendations.

Before you Begin

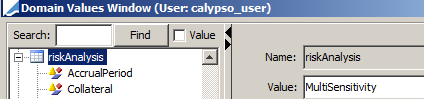

Make sure that the domains "riskAnalysis" and "riskPresenter" contain the value "MultiSensitivity".

"riskAnalysis" domain

1. Supported Sensitivities

The Multi Sensitivity analysis currently supports Sensitivity analyses of the following types:

| • | Commodity [Underlyings Only] |

| • | Credit |

| • | Credit-Recovery |

| • | Equity |

| • | FX Spot |

| • | FX Curve |

| • | Inflation [Underlyings Only] |

| • | Rate [All Subtypes] |

| • | Volatility/Commodity [Underlying Instruments Only] |

| • | Volatility/Credit [Underlying Instruments Only] |

| • | Volatility/Equity [All Subtypes] |

| • | Volatility/FX [All Subtypes] |

| • | Volatility/Rate [All Subtypes] |

2. Configuration

The Multi Sensitivity analysis can be configured from Configuration > Reporting & Risk > Analysis Designer. Right-click a Multi Sensitivity folder in Analysis Designer, and choose "New Analysis" to add a parameter configuration. You will be prompted to enter a configuration name.

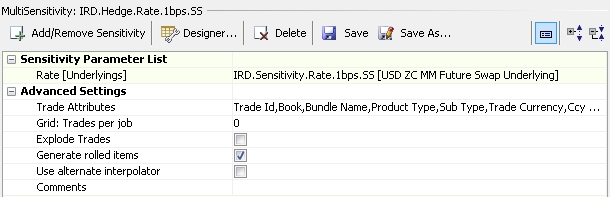

Sample Multi Sensitivity parameters

| » | Complete the parameters details. |

Click Add/Remove Sensitivity to add a sensitivity analysis.

See Sensitivity Parameter List for details.

See Sensitivity Parameter List for details.

| » | Specify the Advanced Settings as needed. |

| – | Trade Attributes - Use this field to add more trade attributes to the output. For example, the trade attribute "CounterParty" allows you to slice by trade counterparty in the output. |

| – | Grid: Trades per job - When using a dispatcher, this input controls how many trades should be included in a single dispatcher’s job. |

The Calypso API allows defining weights for the products in order to assign higher coefficients to some more complex trades. In this case, this input will control the weighted number of trades per job rather than the actual number of trades per job.

Upon execution, the process will assign trades to the current job until the maximum capacity is reached or exceeded. So the final weighted number of trades in a job can be slightly more than what is defined in the configuration.

| – | Explode Trades - Controls whether the trades should be exploded into their underlying components prior to running the report. The explode functions is handled by the <Product>RiskExplode API for each product type. |

| – | Generate Rolled items - Controls whether the market data items that do not exist in the pricing environment at the report's valuation date should be simply rolled (False), or generated again (True). By default, they are simply rolled. |

| – | Use alternate interpolator - If you are using spline interpolators for pricing (MonotoneConvex, Spline, LogSpline) that use the whole curve for interpolation, you can select linear interpolators for the risk computations to use only two consecutive points for interpolation. |

Check “Use alternate interpolator” to use the interpolator defined in domain “riskAlternateCurveInterpolator” for interpolation, typically InterpolatorLinear or InterpolatorLogLinear (default value).

| – | Comments - Free form comment for information purposes. |

| » | Click Save to save the configuration. |

Ⓘ [NOTE: The Advanced Settings set in the Multi Sensitivity parameters override those of the underlying Sensitivity parameters]

2.1 Sensitivity Parameter List

The Sensitivity Parameter List is the list of the underlying Sensitivity analyses and Hedge Instruments Sets. This list should have at least one axis defined, and up to nine axes.

It is the user’s responsibility to ensure that the underlying analyses are properly configured when running a Multi Sensitivity analysis.

Sample "Sensitivity Parameter List"

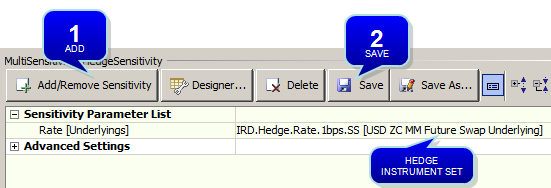

Step 1 - Click Add/Remove Sensitivity to add Sensitivity parameters.

You will be prompted to select Sensitivity parameters.

Ⓘ [NOTE: You can only select Sensitivity parameters which are supported by Multi Sensitivity]

Ⓘ [NOTE: You can only add Inflation Sensitivity parameters if environment property SHOW_PARRATES_IN_MSA=true]

Please see Supported Sensitivities for details.

Please see Supported Sensitivities for details.

If you have selected Sensitivity parameters associated with a hedge instrument set, the hedge instrument set will appear in between brackets, otherwise [None] will appear.

If you want to modify the hedge instrument set associated with the Sensitivity parameters, you can click the hedge instrument set or "[None]", and select a hedge instrument set as needed.

You can click Designer to create hedge instrument sets in the Measure Maker window.

See Hedge Recommendation for details on the hedge recommendations.

See Hedge Recommendation for details on the hedge recommendations.

Step 2 - Click Save to save the Multi Sensitivity parameters.

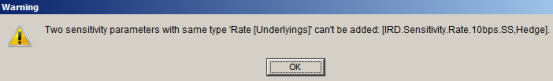

Ⓘ [NOTE: Please note that two axes of the same Sensitivity type/subtype combination cannot be added]

Example

A Multi Sensitivity with the axis Volatility Rate Points and Volatility Rate Tents is not supported.

2.2 Measures

Measures from Underlying Sensitivity

Measures are defined in the underlying Sensitivity configurations. Some measures are not supported in Multi Sensitivity; therefore they will not appear in the Multi Sensitivity Report.

Supported Measures

| Sensitivity Type | Measure Name |

|---|---|

| Credit |

creditDELTA creditGAMMA |

| Credit-Recovery | recoveryDELTA |

| Equity |

equityBetaDELTA equityBetaGAMMA equityDELTA equityGAMMA equityVEGA equityScaledDELTA equityScaledGAMMA equityDaysDELTA equityDiffDelta |

| FX Spot |

fxDELTA fxGAMMA fxDaysDELTA fxDiffDelta |

| FX Curve | fxCurveDELTA |

| Rate |

rateDELTA rateGAMMA rateBucketsDaysDELTA rateBucketsDiffDelta rateForwardDaysDELTA rateForwardDiffDelta rateTrianglesDaysDELTA rateTrianglesDiffDelta |

| Inflation |

InflationDELTA InflationGAMMA |

| Equity Volatility |

Vega Volga equityDaysVEGA equityDiffVega |

| FX Volatility |

Vega Volga fxDaysVEGA fxDiffVega |

| Rate Volatility |

VegaVolga rateDaysVEGA rateDiffVega |

| Volatility Commodity |

Vega Volga |

| Volatility Credit |

Vega Volga |

Underlier Measures

Underlier measures defined in the underlying Sensitivity configurations are not supported in Multi Sensitivity.

Measures not Supported

| Sensitivity Type | Custom Measure Name |

|---|---|

| FX Spot | undFXDelta |

| Rate | undRateDELTA |

| Credit | creditDELTA_H |

| Inflation | undInflationDELTA |

| FX Curve | undfxCurveDELTA |

Ⓘ [NOTE: Custom measures based on unsupported measures are not supported in Multi Sensitivity. Therefore, they will not appear in the Multi Sensitivity report]

See Custom Measures not Supported for details.

See Custom Measures not Supported for details.

Custom measures are defined in the underlying Sensitivity configurations. Some custom measures are not supported in Multi Sensitivity; therefore they will not appear in the Multi Sensitivity Report.

Please find below the custom measures that are supported in Multi Sensitivity.

Supported Custom Measures

| Sensitivity Type | Custom Measure Name |

|---|---|

| Equity | equityUnitDELTA |

| Equity | equityUnitGAMMA |

| Sensitivity Type | Custom Measure Name |

|---|---|

| Rate | rateInstrumentEquivalent |

| FX Spot | fxSpotDelta |

| Credit | creditInstrumentEquivalent |

| Inflation | inflationInstrumentEquivalent |

| FX Curve | fxInstrumentEquivalent |

2.3 Verbose

Verbose mode may be needed when trying to analyze issues or to verify detailed information like shift amounts, shift orders, formulas, etc.

Please contact Calypso Product Support for details.

3. Hedge Recommendation

While Multi Sensitivity Analysis supports the bundling of multiple Sensitivity configurations, each underlying analysis can be linked to a user-defined Hedge Instrument Set and produce a global hedge recommendation.

Note: only the Sensitivity types and subtypes listed below, and certain associated Risk Factors, are considered hedgeable:

| • | Equity |

| • | FX Spot |

| • | Rate [All perturbation types, except ParRates] |

| • | Volatility/Equity [Points and Tents only] |

| • | Volatility/FX [Points and Tents only] |

| • | Volatility/Rate [Points, Adjustments, and Tents] |

See Hedge Recommendation for details.

See Hedge Recommendation for details.

4. Output

4.1 Attributes

Sensitivity Fields

The fields defined in the Advanced Settings of the Sensitivity parameters are available for display in the Multi Sensitivity analysis.

See Sensitivity Advanced Settings for information.

See Sensitivity Advanced Settings for information.

Multi Sensitivity Fields

The following fields have been added to the output to provide more information as described below:

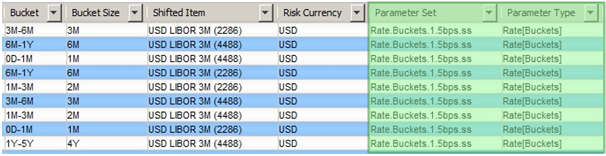

| • | Parameter Set - Displays the name of the Sensitivity Analysis used. |

| • | Parameter Type - Displays the type and subtype of Sensitivity Analysis used. |

Sample table view from Multi Sensitivity - Calypso Workstation

4.2 Measures

Name / Value Measures

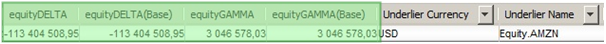

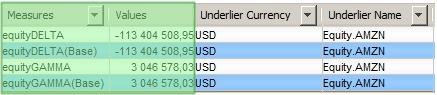

All risk measure names in Multi Sensitivity are aggregated in two columns per risk measure as described below:

| • | Name of risk measure |

| • | Value of the risk measure |

This allows better slicing and dicing capabilities.

Sample table view from Sensitivity – Calypso Workstation

Sample from Multi Sensitivity – Calypso Workstation

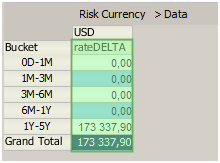

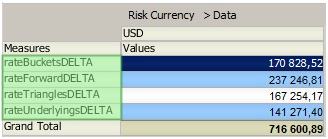

Renaming Rate Measures

All risk measures for rates Delta are renamed in Multi Sensitivity.

| Risk Measure | Name in Sensitivity | Name in Multi Sensitivity |

|---|---|---|

| Rate Buckets | rateDELTA | rateBucketsDELTA |

| Rate Forward | rateDELTA | rateForwardDELTA |

| Rate Triangles | rateDELTA | rateTrianglesDELTA |

| Rate Underlyings | rateDELTA | rateUnderlyingsDELTA |

Sample from Sensitivity – Calypso Workstation

Sample from Multi Sensitivity – Calypso Workstation

Hiding/Viewing Hedge Instruments

By default, only the sensitivities of the portfolio will be seen in Calypso Workstation. The results from hedging instruments are hidden from the output in Calypso Workstation. The sensitivities of the hedging instruments will only serve as inputs for the Hedge Recommendation Window and should not be visible at this stage.

In order to see the hedging trades for debug and or analysis purposes you can set the following environment property:

DISABLE_HIDDEN_FILTERS=true

Ⓘ [NOTE: This is only for testing purposes and MUST NOT BE SET IN PRODUCTION]