Volatility Surfaces Overview

The following volatility surfaces can be built to support pricing for options:

| • | BOND volatility surface |

| • | BONDFUTURE volatility surface |

| • | BONDOPTION volatility surface |

| • | COMMODITY volatility surface |

| • | Proxy COMMODITY volatility surface |

| • | CREDIT volatility surface |

| • | EQUITY volatility surface |

| • | MMFUTURE volatility surface |

| • | RATE volatility surface |

| • | Volatility surface charts |

Ⓘ [NOTE: Curves and surfaces can be updated in real-time using the Market Data Server]

See Market Data Server Documentation for information on configuring and running the market data server.

See Market Data Server Documentation for information on configuring and running the market data server.

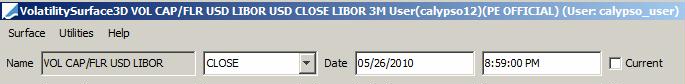

1. General Volatility Surface Information

| • | The name of the volatility surface is set upon saving. It will identify the volatility surface throughout the system. |

| • | The instance of the volatility surface dictates the quote side of the underlying instruments to be used for generating the volatility surface. |

| – | The CLOSE instance uses CLOSE quotes. |

| – | The LAST instance uses BID, MID, and ASK quotes. |

| – | The OPEN instance uses OPEN quotes. |

| • | By default, the volatility surface is saved as of the current date and time. You can clear the Current checkbox and change the volatility surface date as needed. |

Vol Model

The Vol Model allows converting volatilities between Black Vol, Bp Vol and Daily BE Vol (daily break even vol) as follows:

| • | Bp Vol = Daily BE Vol * Sqrt(252) |

| • | Bp Vol = Forward Rate * Black Vol |

Graph Panel

See Volatility surface charts for details.

See Volatility surface charts for details.

Underlying Instruments

See Volatility Surface Underlying Instruments for details.

See Volatility Surface Underlying Instruments for details.

Volatility Surface Update

You can use the scheduled task PROP_RATE_1BUSDAY to roll the quotes which are not liquid.

You can use the scheduled task GENERATE_VOLSURF to regenerate a volatility surface as of the current valuation date.

Interpolator

Note that Interpolator3DLinearExtended is only used for FX Volatility surfaces.

Refer to the Calypso FX and MM Analytics Guide for details.

Refer to the Calypso FX and MM Analytics Guide for details.