COMMODITY Volatility Surface

From the Calypso Navigator, navigate to Market Data > Volatilities > Volatility Surface (menu action marketdata.VolatilitySurface3DWindow).

This page describes setting up:

| • | The COMMODITY volatility surface from offsets using this CommoditySimple generator |

| • | The derived COMMODITY volatility surface using the Moneyness and CommodityDelta generator |

| • | Pricer configuration |

See also Volatility Surface Overview.

See also Volatility Surface Overview.

1. Generating a COMMODITY Volatility Surface from Offsets

|

COMMODITY Volatility Surface from Offsets Quick Reference Configuration Requirements

Surface Generation 1. Click New to start a new surface. 2. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 3. Definition Panel — Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, volatility quote type, “Derived” should not be selected so that you can create the surface from offsets, CommoditySimple generator. 4. Offsets Panel — Select the tenor and expirations. Enter the strikes or relative moneyness. 5. Points Panel — Click Generate to generate the points. Enter the market volatilities. 6. Click Save, enter a name for the surface, and click OK. Pricer Configuration A COMMODITY volatility surface is associated with a pricing environment under the Surfaces panel of the pricer configuration for the volatility type Commodity and the usage VOL. |

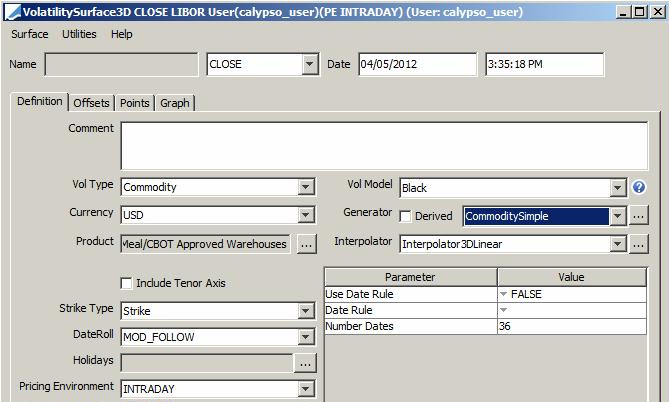

1.1 Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, “Derived” should not be selected so that you can create the surface from offsets, select the CommoditySimple generator.

| » | You can set the following CommoditySimple generator parameters. |

| Parameter | Description |

|---|---|

|

Use Date Rule |

Set to "TRUE" to use a date rule to generate the dates, instead of selecting tenors in the Offset panel. |

|

Date Rule |

Select a date rule to generate the tenors. Create date rules using Configuration > Definitions > Date Rule Definitions from the Calypso Navigator. |

|

Number Dates |

Enter the number of dates you want to generate in the Number Dates parameter. |

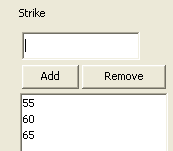

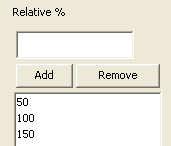

| » | Select the strike type: Strike or Relative %. |

| Surface Type | Definition |

|---|---|

|

Strike |

In the Offset panel, enter absolute strikes.

|

|

Relative % |

In the Offset panel, enter relative moneyness. - 100% means the strike is equal to forward projected price - 50% means the strike is 50% of the forward projected price - 150% means the strike is 150% of the forward projected price

|

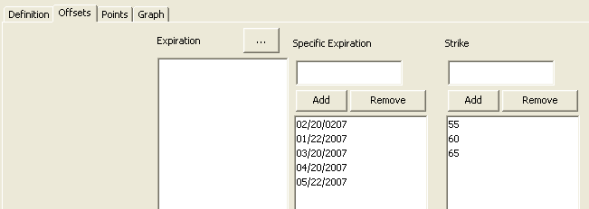

1.2 Offsets Panel

Select the Offsets panel.

| » | Select the expirations. Click ... to select the expirations by tenor. Alternatively, enter the specific dates for the expirations and click Add to add the dates to the panel below. |

[NOTE: If the generation parameter “Use Date Rule” is true, you only need to enter strikes or relative moneyness, the dates are automatically generated using the selected date rule.]

| » | Enter the strikes or relative moneyness and click Add. Repeat for each strike or relative moneyness. |

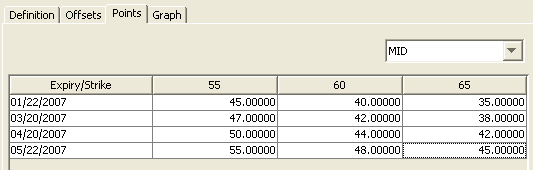

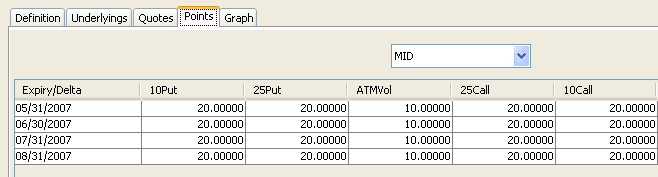

1.3 Points Panel

Select the Points panel.

| » | Click Generate to generate the surface. |

| » | Enter market volatilities. |

1.4 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

2. Derived Commodity Volatility Surface Generator

2.1 Generating a Derived Delta based COMMODITY Volatility Surface

|

Commodity Volatility Surface from Underlying Instruments – CommodityDelta & CommodityVolatilitySpread Generators Quick Reference Configuration Requirements

Surface Underlying Instruments You can use Commodity Option underlying instruments. From the Calypso Navigator, navigate to Configuration > Market Data > Volatility Surface Underlyings, or in the surface application’s Underlyings panel, click New Instrument. Surface Generation 1. Click New to start a new surface. 2. Select the quote instance to use in the surface generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 4. Definition Panel — Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, “Derived” should be selected, select the “Delta” strike type, select the CommodityDelta or CommodityVolatilitySpread generator. 5. Underlyings Panel — Select the underlying instruments. For the CommodityVolatilitySpread generator, the spread underlying has to match that of the underlying surface. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the surface, and click OK. Pricer Configuration

|

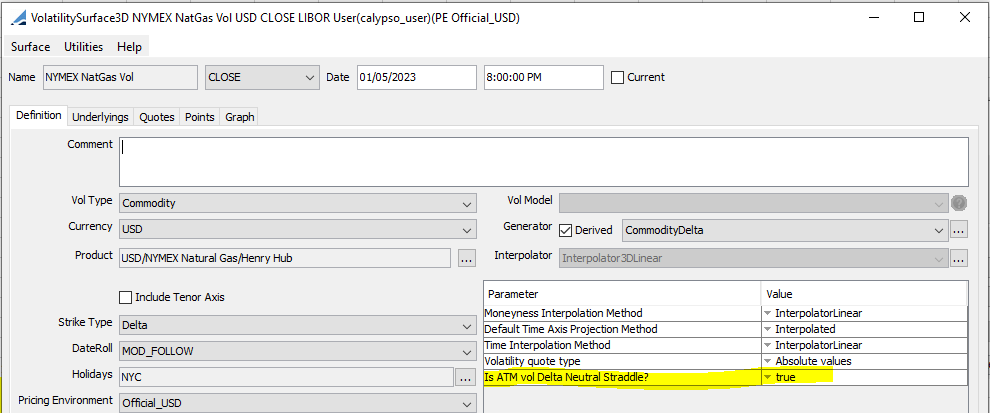

2.1.1 Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, “Derived” should be selected, select the “Delta” surface type, select the CommodityDelta or CommodityVolatilitySpread generator (click ... to add the generator as needed).

| » | You can set the following generator parameters as desired. |

| Parameter | Description | ||||||

|---|---|---|---|---|---|---|---|

|

Moneyness Interpolation Method |

You can select an interpolation method for the moneyness axis independently of the extrapolation method. |

||||||

|

Default Time Axis Projection Method |

You can select the projection method as Interpolated or Use Commodity Reset. |

||||||

|

Time Interpolation Method |

Can be selected as InterpolatorLinear or InterpolatorPiecewiseConstantRight. InterpolatorLinear interpolates for the trade option expiry from the vol surface expiry dates linearly. When using InterpolatorPiecewiseConstantRight interpolator, if the trade option expiry is greater than “an” expiry pillar of the vol surface, the interpolator will return the next expiry pillar’s volatility. |

||||||

|

Is ATM vol Delta Neutral Straddle |

To control whether the ATM vol corresponds to Moneyness as 1 (false) or to the delta neutral strike (true). Default value is false which keeps backward compatibility. Note: When Parameter is set to TRUE, ATM Vol would represent 50Delta. If FALSE, ATM Vol would represent Moneyness as 1. |

||||||

| Volatility quote type |

Select the quote type for the quotes:

|

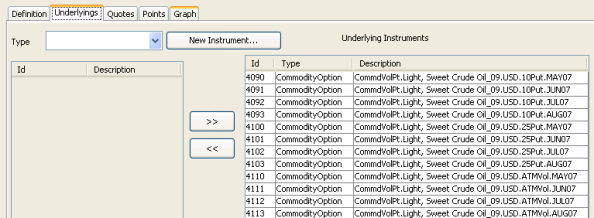

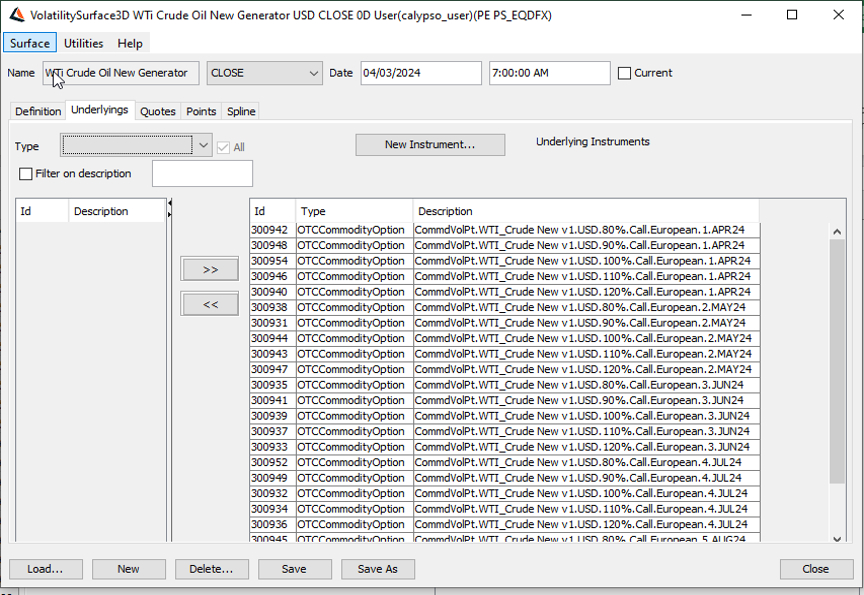

2.1.2 Underlyings Panel

Select the Underlyings panel.

| » | Select the instrument type to display the list of available instruments. The panel is blank if you have not set up any instruments. Click New Instruments to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. |

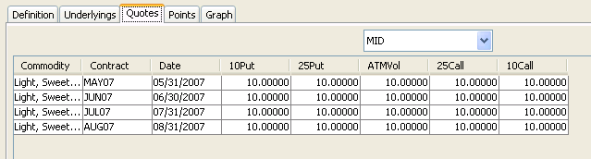

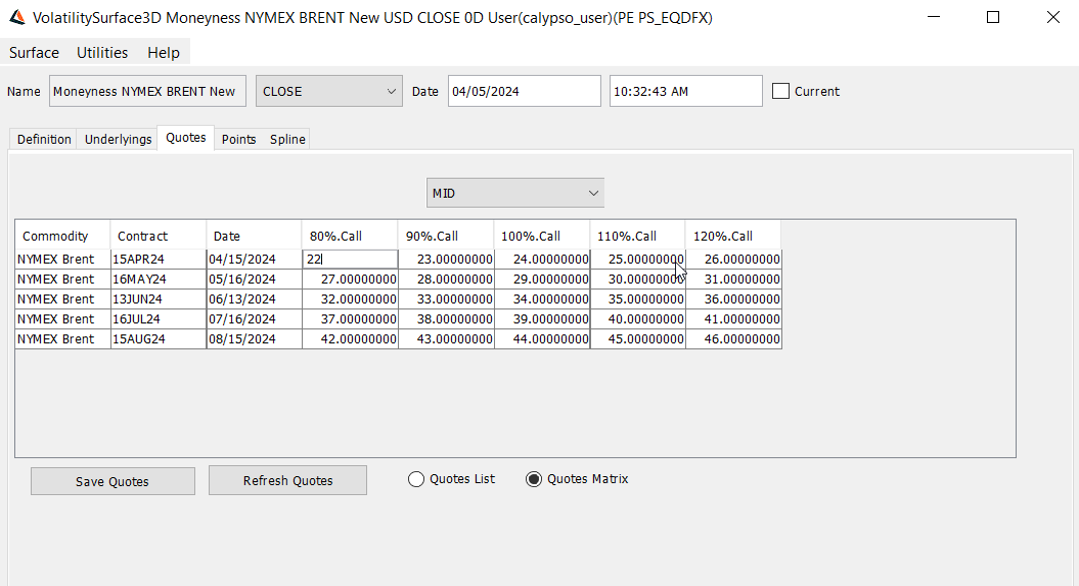

2.1.3 Quotes Panel

Select the Quotes panel. Enter quotes for the underlying instruments; enter the delta quotes as spreads over the ATM volatility or as absolute values depending on the "Volatility quote type" generator parameter. For example, the value entered for the 25 Delta Call is the difference between the volatility for a call with a 25% (forward) delta and the volatility of an ATM (forward) option.

| » | You can click Save Quotes to save the quotes. |

2.1.4 Points Panel

Select the Points panel, and click Generate to generate the points.

Change the drop-down menu value to view Pillar Dates vs. Volatilities or Pillar Dates vs. Moneyness.

2.1.5 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

2.2 Generating a Derived Moneyness based COMMODITY Volatility Surface

|

Commodity Volatility Surface from Underlying Instruments – Commodity & CommodityVolatilitySpread Generators Quick Reference Configuration Requirements

Surface Underlying Instruments You can use OTC Commodity Option underlying instruments. From the Calypso Navigator, navigate to Configuration > Market Data > Volatility Surface Underlyings, or in the surface application’s Underlyings panel, click New Instrument. Surface Generation 1. Click New to start a new surface. 2. Select the quote instance to use in the surface generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 4. Definition Panel — Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, “Derived” should be selected, select the “Relative %” strike type, select the Commodity or CommodityVolatilitySpread generator. 5. Underlyings Panel — Select the underlying instruments. For the CommodityVolatilitySpread generator, the spread underlying has to match that of the underlying surface. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the surface, and click OK. Pricer Configuration

|

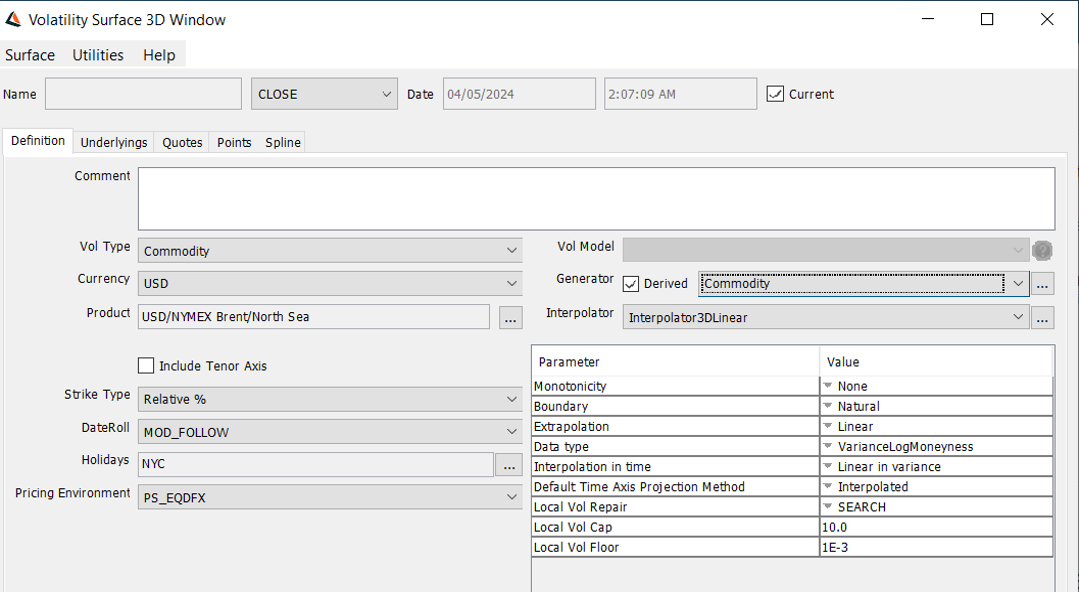

2.2.1 Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, volatility type “Commodity”, click ... to select the commodity product, “Derived” should be selected, select the “Relative%” surface type, select the Commodity or CommodityVolatilitySpread generator (click ... to add the generator as needed).

| » | You can set the following generator parameters as desired. |

| Parameter | Description |

|---|---|

|

Monotonicity |

This parameter offers the possibility to interpolate according to the monotonicity of the data, thereby removing the potential artificial oscillations stemming from cubic splines. |

|

Default Time Axis Projection Method |

You can select the projection method as Interpolated or Use Commodity Reset. |

|

Extrapolation |

This parameter controls the extrapolation in the strike space. Flat will flat extrapolate the volatilities. Linear will extrapolate linearly using the slope of the first and last cubic polynomials so that the slice stays C2 with natural boundary conditions. Note that if the data type is variance, the extrapolation will be linear in variance, which is typical of stochastic volatility models behavior (for example Heston). The extrapolation is floored to machine epsilon to avoid negative variance. In general, we recommend Linear as it will lead to a smooth implied volatility and therefore a smooth local volatility with Natural spline boundaries, around the extrapolation. |

|

Data Type |

This parameters controls which data the spline is applied to. Volatility means that the spline is built from strikes and volatilities, strikes being in the unity defined in the volatility surface (absolute, relative, Delta for SplineSimple). Variance means that the spline is built from strikes and the square of volatilities, strikes being in the unity defined in the volatility surface, and input volatilities being internally converted to variances. This is particularly interesting when combined with a linear extrapolation. VarianceLogMoneyness means that the is spline built from log-moneyness log (K/F) and variances σ², strikes are internally converted to log-moneyness. |

| Interpolation in Time |

By default, the interpolation in time is in linear total variance across the axis (absolute strike, or relative strike or Delta). Through the generator parameter "Interpolation in time", it may be changed to "Linear in volatility", in which case the implied volatilities are interpolated in time across the natural axis of the volatility surface. |

|

Local Vol Repair |

This parameter is used when the generator is used with a Local volatility pricer such as PricerLocalVolatility1FFiniteDifference or PricerLocalVolatilityNFMonteCarloExotic. |

2.2.2 Underlyings Panel

Select the Underlyings panel.

| » | Select the instrument type to display the list of available instruments. The panel is blank if you have not set up any instruments. Click New Instruments to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. |

2.2.3 Quotes Panel

Select the Quotes panel. Enter quotes for the underlying instruments.

| » | You can click Save Quotes to save the quotes. |

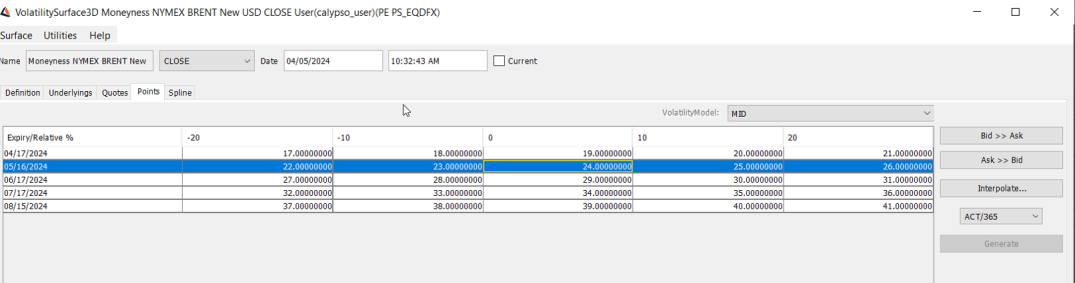

2.2.4 Points Panel

Select the Points panel, and click Generate to generate the points.

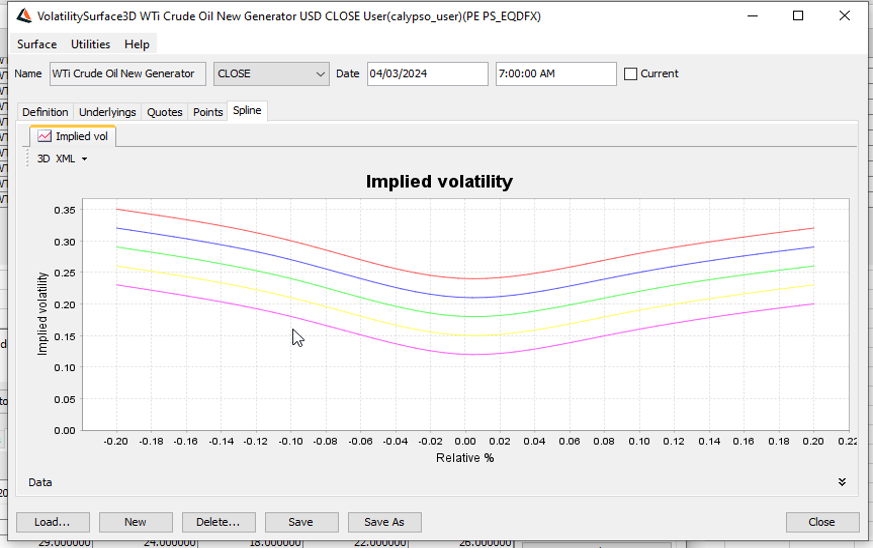

2.2.5 Spline Panel

Select the Spline panel, to generate the implied volatility with respect to relative %.

2.2.6 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

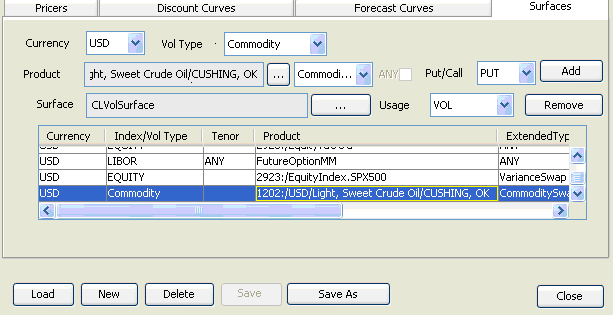

3. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Click Load, and select a pricer configuration.

Click the Surfaces tab.

| » | Click ... to select the volatility surface. |

| » | Select the currency, volatility type, product, type of commodity trade, put/call, and usage. |

| » | Click ... to select the volatility surface. |

| » | Select the surface in the Selection window and click Load to display the surface name in the pricer configuration. |

| » | Click Add to add the surface to the list. |

| » | Click Save to save the pricer configuration. |