MMFUTURE Volatility Surface

From the Calypso Navigator, navigate to Market Data > Volatilities > Volatility Surface (menu action marketdata.VolatilitySurface3DWindow).

MMFUTURE volatility surfaces can be derived from underlying instruments.

Interpolation methods and generation algorithms are provided out-of-the-box. Refer to the Interest Rate Derivatives Analytics documentation for details.

See also Volatility Surface Overview.

See also Volatility Surface Overview.

|

Derived MMFUTURE Volatility Surface Quick Reference Configuration Requirements

Surface Underlying Instruments You can use FutureOption underlying instruments. From the Calypso Navigator, navigate to Configuration > Market Data > Volatility Surface Underlyings, or in the surface application’s Underlyings panel, click New Instrument. Surface Generation 1. Click New to start a new surface. 2. Select the quote instance to use in the surface generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 4. Definition Panel — Select the following to define the surface: currency, index, and tenor, volatility type “MMFUTURE”, strike type, interpolator, select the Derived checkbox, generator “FutureOption”, date-roll convention, holiday calendars, pricing environment. To price Eurodollar future options with pricer PricerFutureOptionMMBpVol, you need to use the FutureOptionBpVol generator. 5. Underlyings Panel — Select the underlying instruments. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the surface, and click OK. Pricer Configuration A MMFUTURE volatility surface is associated with a pricing environment under the Surfaces panel of the pricer configuration for the MMFUTURE volatility type and VOL usage. |

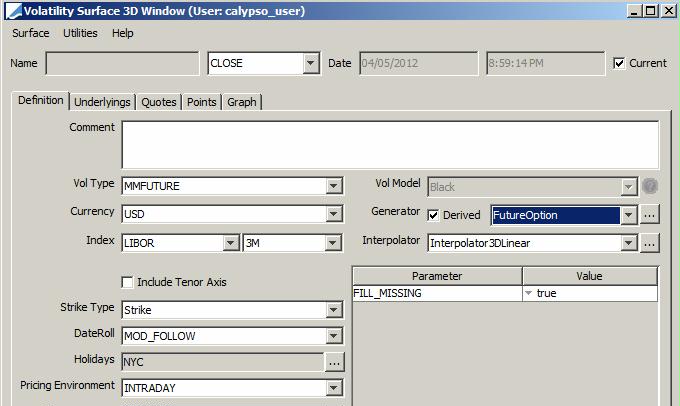

1. Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, index, and tenor, volatility type “MMFUTURE”, strike type, interpolator, select the Derived checkbox, generator “FutureOption”, date-roll convention, holiday calendars, pricing environment.

| » | Select the type of strike: Strike or Strike Offset BPs - They are described below. |

Strike Types Details

| Surface Type | Definition |

|---|---|

|

Strike |

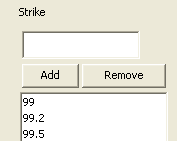

Absolute strike. Offset Points In the Offset panel, enter absolute strikes.

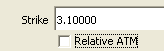

Underlying Instruments The underlying instruments must be specified using an absolute strike.

|

|

Strike Offset BPs |

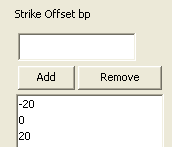

Current strike +/- offset minus ATM strike (in bp). Offset Points In the Offset panel, enter relative offset over the current strike in bp Make sure to add 0.

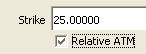

Underlying Instruments The underlying instruments must be specified using a relative strike in bp. In this example the relative strike is +25bp.

Note that when using a relative strike, one of the underlying instruments must be defined with a strike of 0.

|

| » | Select the generation algorithm - It controls the type of underlying instruments that you can select: |

| Generation Algorithm | Description |

|---|---|

|

FutureOption |

Generates and stores volatilities where the underlyings are options on futures. |

|

FutureOptionBpVol |

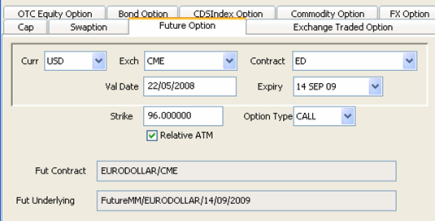

To price Eurodollar future options with pricer PricerFutureOptionMMBpVol. You can set the TRANSFORMATION_METHOD generator parameter in the Definition panel. The default value is EXACT. See below for details. Sample Eurodollar future option underlying.

|

| » | Set the generator parameter as applicable. |

When FILL_MISSING is true (default value) the missing points are filled using linear interpolation in the strike axis, more specifically, InterpolatorLinear is used on all quotes for a particular expiry to fill any missing point. Otherwise, 0 points are generated.

Transformation Methods Details

The transformation method allows converting between normal / lognormal vols as needed.

| Name | Transformation |

|---|---|

|

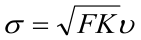

EXACT |

|

|

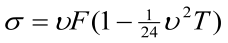

ANDERSON_RATCLIFFE_LN |

|

|

ANDERSON_RATCLIFFE_N |

|

|

HAGAN_APPROX |

|

|

STREET_PROXY1 |

|

|

STREET_PROXY2 |

|

|

STREET_PROXY3 |

|

|

STREET_PROXY4 |

|

|

STREET_PROXY5 |

|

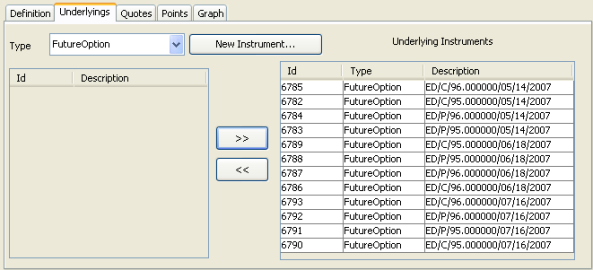

2. Underlyings Panel

Select the Underlyings panel.

| » | Select the instrument type, and the panel below displays the list of available instruments. The panel is blank if you have not set up any instruments. Click New Instrument to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. |

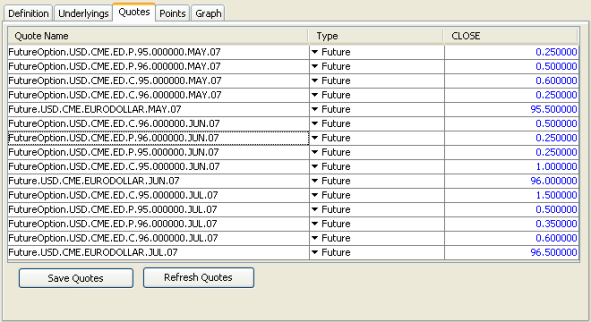

3. Quotes Panel

Select the Quotes panel. Enter quotes for the underlying instruments.

| » | You can click Save Quotes to save the quotes. |

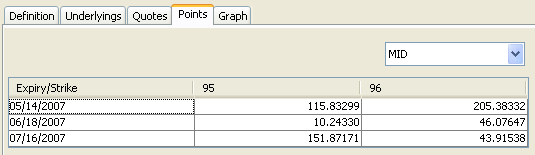

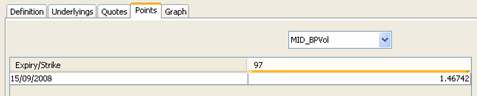

4. Points Panel

Click the Points tab. Click Generate to generate the points.

| » | You can view the points for each combination of expiry and strike (and tenor). |

| » | For the FutureOptionBpVol generator, you can select MID_BPVol, BID_BPVol, or ASK_BPVol to view the bp vol points. |

5. Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

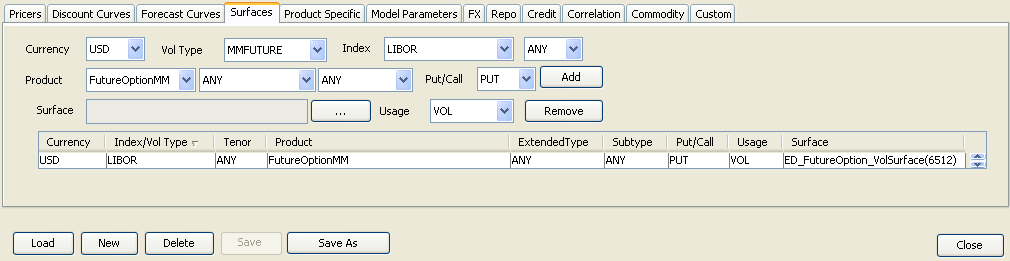

6. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. Load a pricer configuration and select the Surfaces panel.

| » | Select the currency, volatility type, index, and tenor. |

| » | Select the product type, extended type or ANY, subtype or ANY, PUT or CALL. |

| » | Click ... to select the volatility surface. Select the surface in the Selection window and click Load to display the surface name in the pricer configuration. |

| » | Click Add to add the surface to the list. |

| » | Click Save to save the pricer configuration. |