CREDIT Volatility Surface

From the Calypso Navigator, navigate to Market Data > Volatilities > Volatility Surface (menu action marketdata.VolatilitySurface3DWindow).

CREDIT volatility surfaces can be created from offset points, or derived from underlying instruments.

| • | Surface from offset points |

| • | Surface from underlying instruments |

| • | Pricer configuration |

Interpolation methods and generation algorithms are provided out-of-the-box. Refer to the Credit Derivatives Analytics documentation for details.

See also Volatility Surface Overview.

See also Volatility Surface Overview.

1. Generating a CREDIT Volatility Surface from Offsets

|

CREDIT Volatility Surface from Offsets Quick Reference Configuration Requirements

Surface Generation 1. Click New to start a new surface. 2. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 3. Definition Panel — Select the following to define the surface: currency, issuer / ticker / or basket, volatility type “Credit”, strike type, interpolator, the Derived checkbox should not be selected, generator, date-roll convention, holiday calendars, pricing environment. 4. Offsets Panel — Select the tenor and expirations. Enter the strikes. 5. Points Panel — Click Generate to generate the points. Enter the point values. 6. Click Save, enter a name for the surface, and click OK. Pricer Configuration A CREDIT volatility surface is associated with a pricing environment under the Credit panel of the pricer configuration for the VOL usage. |

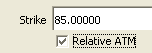

1.1 Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, volatility type “Credit”, issuer / ticker / or basket, strike type, interpolator, the Derived checkbox should not be selected, generator, date-roll convention, holiday calendars, pricing environment.

| » | Select the type of strike: Strike, Relative Spread, Strike Offsets BPs, or Relative % - They are described below. |

| » | Select the generation algorithm: Default, or CreditSimple. You can set the following generator parameters. |

If the spot lag parameter is set to true, the generated exercise dates are rolled using the conventions of the definition screen.

Note that SYNTHETIC_EXPIRY and SYNTHETIC_TENOR are not currently used.

Strike Types Details

| Surface Type | Definition |

|---|---|

|

Strike |

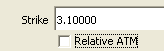

Absolute strike. Offset Points In the Offset panel, enter absolute strikes.

Underlying Instruments The underlying instruments must be specified using an absolute strike.

|

|

Relative Spread |

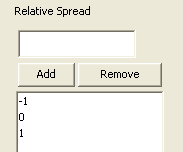

Current strike +/- spread minus ATM strike (in %). Offset Points In the Offset panel, enter relative spreads over the current strike in %. Make sure to add 0.

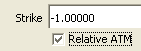

Underlying Instruments The underlying instruments must be specified using a relative strike in %. In this example the relative strike is -1%.

Note that when using a relative strike, one of the underlying instruments must be defined with a strike of 0.

|

|

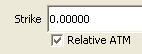

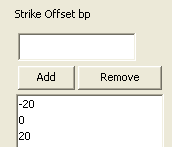

Strike Offset BPs |

Current strike +/- offset minus ATM strike (in bp). Offset Points In the Offset panel, enter relative offset over the current strike in bp Make sure to add 0.

Underlying Instruments The underlying instruments must be specified using a relative strike in bp. In this example the relative strike is +25bp.

Note that when using a relative strike, one of the underlying instruments must be defined with a strike of 0.

|

|

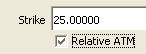

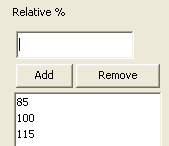

Relative % |

% (current strike) minus ATM strike. Offset Points In the Offset panel, enter a percentage of the current strike.

Underlying Instruments The underlying instrument must be specified using a percentage of the current strike. In this example, it is 85% of the current strike.

|

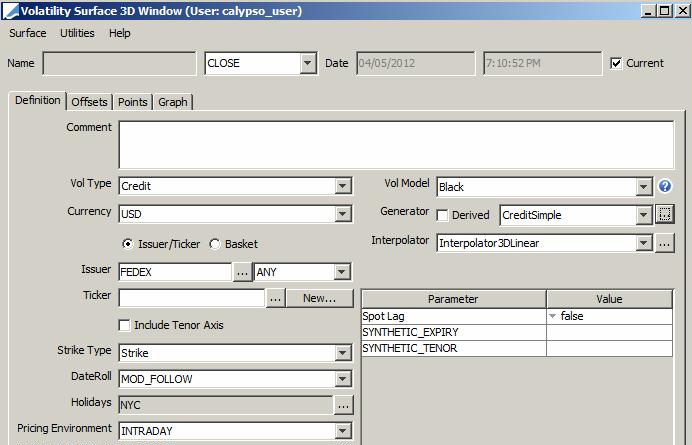

1.2 Offsets Panel

Select the Offsets panel.

| » | Click ... to select expirations. |

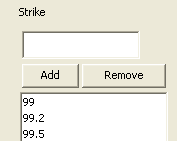

| » | Enter a strike and click Add. Repeat for each strike value. |

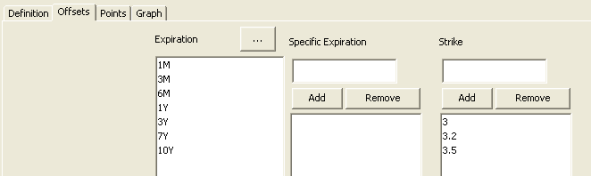

1.3 Points Panel

Select the Points panel, and click Generate to generate the points.

| » | Enter market volatilities for each expiration / strike. |

1.4 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

2. Generating a Derived CREDIT Volatility Surface

|

Derived CREDIT Volatility Surface Quick Reference Configuration Requirements

The upper bound volatility when solving for implied volatility is set to 1 (100%) by default. You can modify the upper bound volatility using the pricing parameter UPPER_BOUND_VOL_SURF. Set to 2 for example for 200%. Surface Underlying Instruments You can use CDS Index Option underlying instruments. From the Calypso Navigator, navigate to Configuration > Market Data > Volatility Surface Underlyings, or in the surface application’s Underlyings panel, click New Instrument. Surface Generation 1. Click New to start a new surface. 2. Select the quote instance to use in the surface generation (CLOSE, LAST, or OPEN). 3. The Current checkbox is selected by default, meaning that when you save the surface, the system timestamps the surface with the current date and time. Clear the Current checkbox to enter a back-dated surface. You can modify the date and time fields. 4. Definition Panel — Select the following to define the surface: currency, issuer / ticker / or basket, volatility type “Credit”, strike type, interpolator, select the Derived checkbox, CDSIndexOption generator, date-roll convention, holiday calendars, pricing environment. 5. Underlyings Panel — Select the underlying instruments. 6. Quotes Panel — Enter quotes manually, use quotes from the quote set, or use real-time quotes. 7. Points Panel — Click Generate to generate the points. 8. Click Save, enter a name for the surface, and click OK. Pricer Configuration A CREDIT volatility surface is associated with a pricing environment under the Credit panel of the pricer configuration for the VOL usage. |

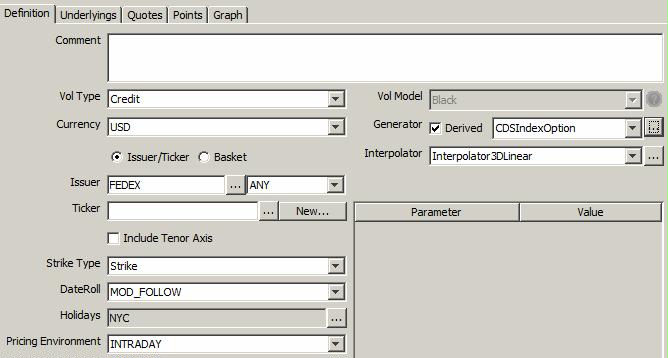

2.1 Definition Panel

Click New to start a new surface.

Select the following to define the surface: currency, issuer / ticker / or basket, volatility type “Credit”, strike type, interpolator, select the Derived checkbox, CDSIndexOption generator, date-roll convention, holiday calendars, pricing environment.

| » | Select the type of strike - They are described below. |

Strike Types Details

| Surface Type | Definition |

|---|---|

|

Strike |

Absolute strike. Offset Points In the Offset panel, enter absolute strikes.

Underlying Instruments The underlying instruments must be specified using an absolute strike.

|

|

Relative Spread |

Current strike +/- spread minus ATM strike (in %). Offset Points In the Offset panel, enter relative spreads over the current strike in %. Make sure to add 0.

Underlying Instruments The underlying instruments must be specified using a relative strike in %. In this example the relative strike is -1%.

Note that when using a relative strike, one of the underlying instruments must be defined with a strike of 0.

|

|

Strike Offset BPs |

Current strike +/- offset minus ATM strike (in bp). Offset Points In the Offset panel, enter relative offset over the current strike in bp Make sure to add 0.

Underlying Instruments The underlying instruments must be specified using a relative strike in bp. In this example the relative strike is +25bp.

Note that when using a relative strike, one of the underlying instruments must be defined with a strike of 0.

|

|

Relative % |

% (current strike) minus ATM strike. Offset Points In the Offset panel, enter a percentage of the current strike.

Underlying Instruments The underlying instrument must be specified using a percentage of the current strike. In this example, it is 85% of the current strike.

|

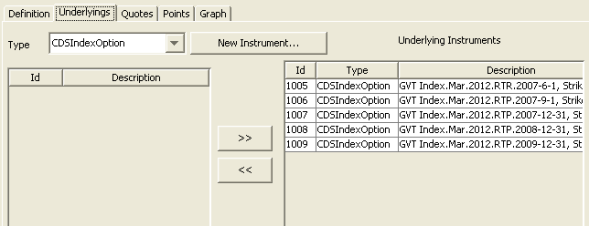

2.2 Underlyings Panel

Select the Underlyings panel.

| » | Select the instrument type to display the list of available instruments. The panel is blank if you have not set up any instruments. Click New Instruments to create new instruments. |

| » | Select instruments and click >> to add them to the instrument list in the right panel. |

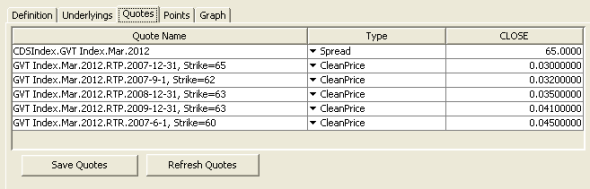

2.3 Quotes Panel

Select the Quotes panel. Enter quotes for the underlying instruments.

| » | You can click Save Quotes to save the quotes. |

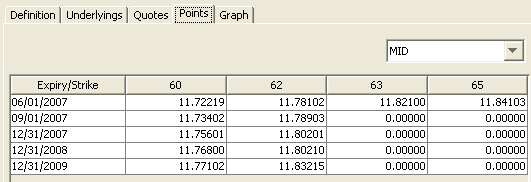

2.4 Points Panel

Select the Points panel, and click Generate to generate the points.

2.5 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

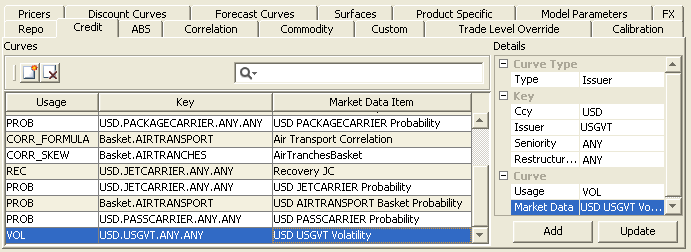

3. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Load a pricer configuration and select the Credit panel.

| » | Click  to add market data. to add market data. |

| » | In the Details area, select the type of association you want to perform: Basket, Issuer, or Ticker. Then select the corresponding key for the selected type. |

For Basket, select a basket or ANY.

For Issuer, select a currency, an issuer, a seniority or ANY, and a restructuring type or ANY.

For Ticker, select a ticker – A ticker is a combination of currency, issuer, seniority and reference obligation – You can create tickers from the Credit Market Data window.

Select the VOL usage, and select a volatility surface from the Market Data field.

| » | Then click Add. |

| » | Click Save to save the changes. |