BOND OPTION Volatility Surface

From the Calypso Navigator, navigate to Market Data > Volatilities > Volatility Surface (menu action marketdata.VolatilitySurface3DWindow).

Bond Option volatility surfaces are created by combining a volatility surface created from underlying instruments, and a volatility surface of coefficients for quadratic adjustments.

Follow the steps below to build the Bond Option volatility surface that will be used for pricing bond options.

See also Volatility Surface Overview.

See also Volatility Surface Overview.

|

Bond Option Volatility Surface Quick Reference Surface Generation

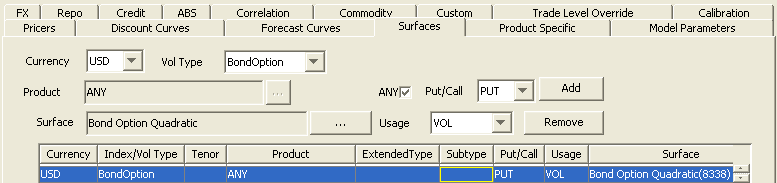

Pricer Configuration A BondOption volatility surface is associated with a pricing environment under the Surfaces panel of the pricer configuration for the BondOption volatility type and VOL usage. |

1. Step 1 - Volatility Surface from Bond Options

Click New to start a new surface.

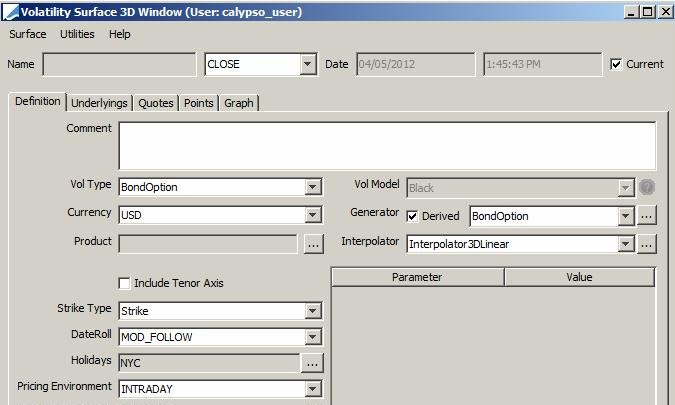

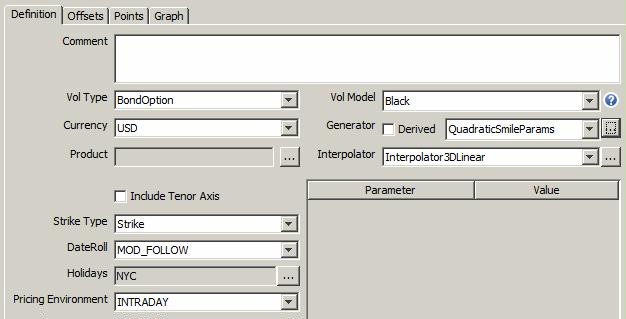

1.1 Definition Panel

Select the following to define the surface: currency, product, volatility type “BondOption”, strike type, interpolator, check the Derived checkbox, generator BondOption, date-roll convention, holiday calendars, pricing environment.

1.2 Underlyings Panel

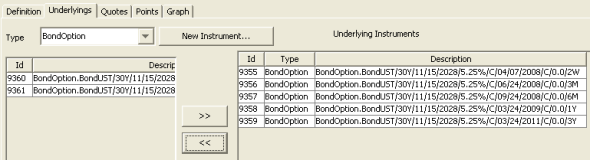

Select the Underlyings panel.

| » | Select BondOption from the Type field and select bond options, then click ... to add them to the list of underlying instruments. |

1.3 Quotes Panel

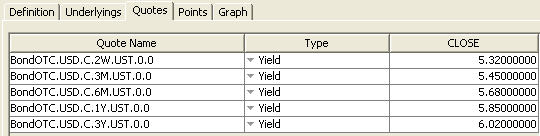

Select the Quotes panel, and enter quotes for the underlying instruments as needed.

| » | You can click Save Quotes to save the quotes. |

1.4 Points Panel

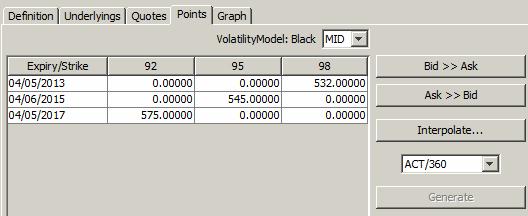

Select the Points panel. Click Generate to generate the points.

1.5 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

2. Step 2 – Quadratic Adjustments Volatility Surface

Click New to start a new surface.

2.1 Definition Panel

Select the following to define the surface: currency, volatility type “BondOption”, bond product, strike type, interpolator, vol model, the Derived checkbox should not be checked, generator QuadraticSmileParams, date-roll convention, holiday calendars, pricing environment.

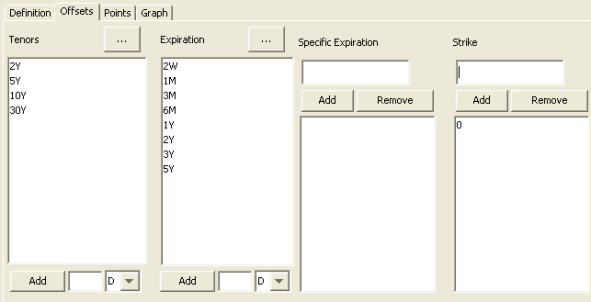

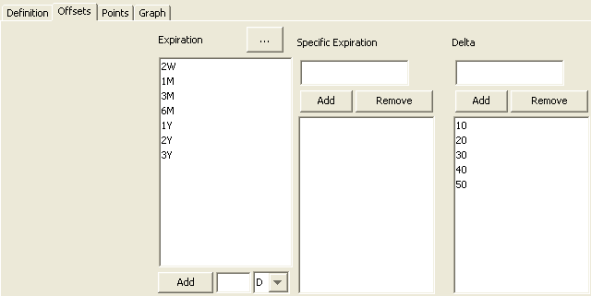

2.2 Offsets Panel

Select the Offsets panel.

| » | Select the tenors and expirations. |

| » | Enter 0 in the Strike field and click Add. |

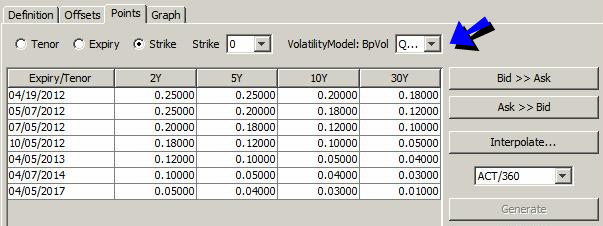

2.3 Points Panel

Select the Points panel, and click Generate to generate the points.

Select QuadAlpha / QuadBeta from the Volatility Model field, and enter the adjustments.

2.4 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

3. Step 3 – Final Bond Option Volatility Surface

Click New to start a new surface.

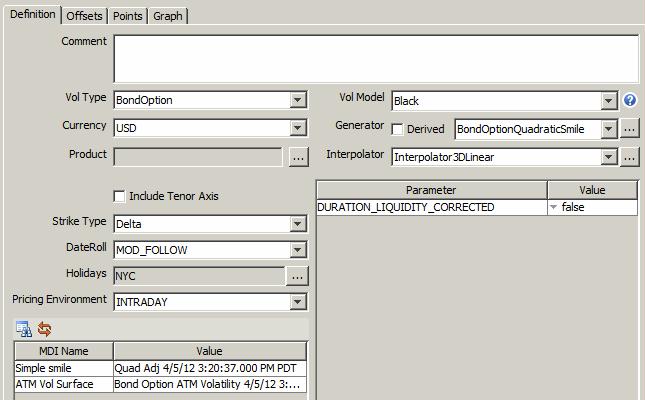

3.1 Definition Panel

Select the following to define the surface: currency, volatility type “BondOption”, bond product, strike type Delta, interpolator, vol model, the Derived checkbox should not be checked, generator BondOptionQuadraticSmile, date-roll convention, holiday calendars, pricing environment.

| » | In the MDI area, select the quadratic adjustments volatility surface, and the ATM volatility surface. |

3.2 Offsets Panel

Select the Offsets panel.

| » | Select the expirations. |

| » | Enter the deltas. |

3.3 Points Panel

Select the Points panel, and click Generate to generate the points.

3.4 Save Surface

Click Save in the bottom of the surface window. Enter a name for the surface, and click OK.

4. Pricer Configuration

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration. Load a pricer configuration and select the Surfaces panel.

| » | Select the currency and BondOption volatility type. |

| » | Select a product or click ANY, and select PUT / CALL / or ANY. |

| » | Select the VOL usage. |

| » | Click ... to select the volatility surface. |

| » | Click Add to add the surface to the list. |

| » | Click Save to save the pricer configuration. |