Defining Margin Call & Clearing Contracts

Margin Call Contracts are

defined in the Margin Call Contract window which is accessed via Configuration > Fees, Haircuts, & Margin

Calls > Margin Call (menu action refdata.BOMarginCallConfigWindow).

Clearing Member Contracts are defined through the Cover Distribution Manager by selecting Window > Configuration > Clearing Member Configuration.(menu action refdata.clearing.ClearingMemberConfigWindow).

1. Creating a Margin Call Contract

Select the Edit panel, and click New to create a new margin call contract.

Enter information into the fields of the various panels as applicable. The fields are described below.

| » | The margin call contract is defined between Party A, a processing organization, and Party B, a legal entity. |

| » | Margin calls will be calculated for trades between Party A and Party B that satisfy the criteria defined in the margin call contract. |

| » | At the top of many of the panels, there are toggle buttons for display purposes. They are: |

- Click to toggle the visibility of the Description area in the panel, which gives a brief description of the selected field.

- Click to toggle the visibility of the Description area in the panel, which gives a brief description of the selected field.

- Click either side of this toggle to either expand or collapse the fields in the panel

- Click either side of this toggle to either expand or collapse the fields in the panel

Click Save to save your changes. You can also click Save As New to save the margin call contract as a new margin call contract.

NOTE: If the Authorization mode is enabled, an authorized user must approve your entry.

Defining Margin Call Contract Templates

You can click Templates at the top of the window and save the current margin call contract as a template.

You can then load an existing template to define a new margin call contract.

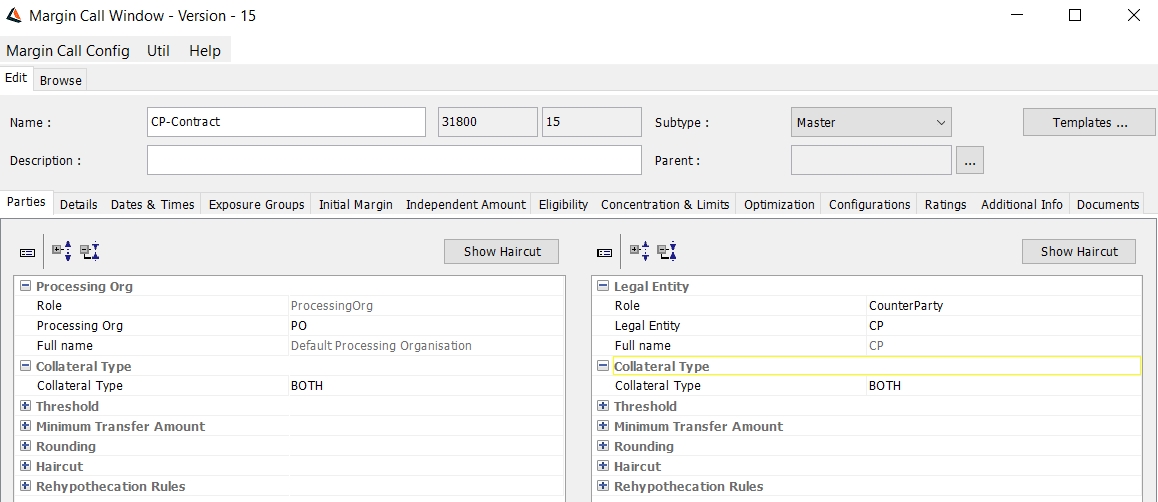

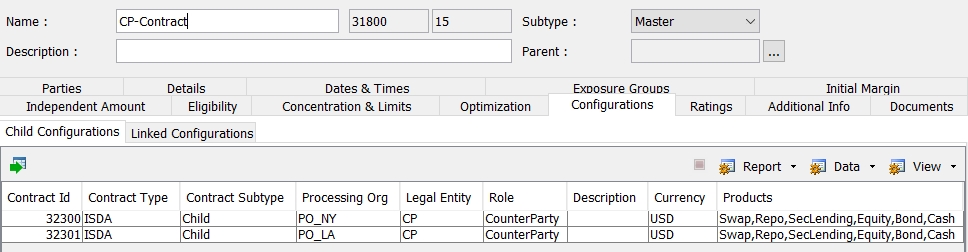

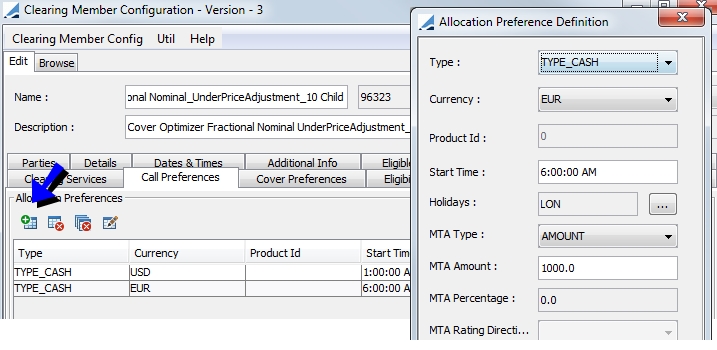

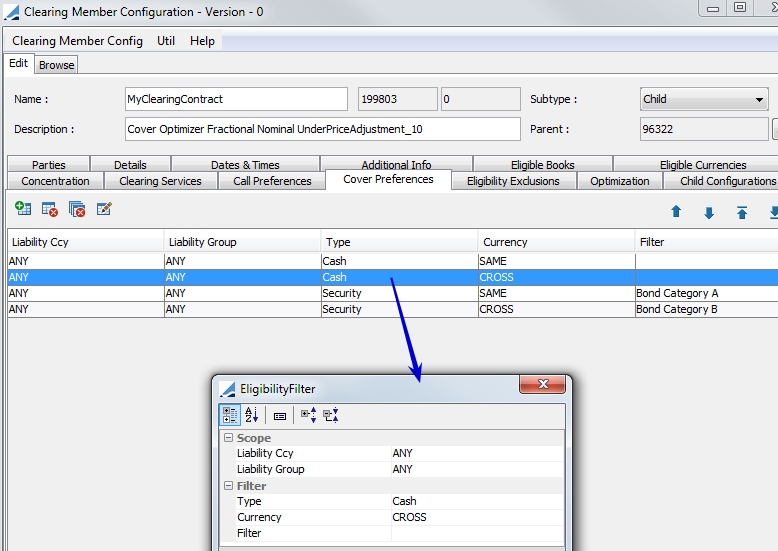

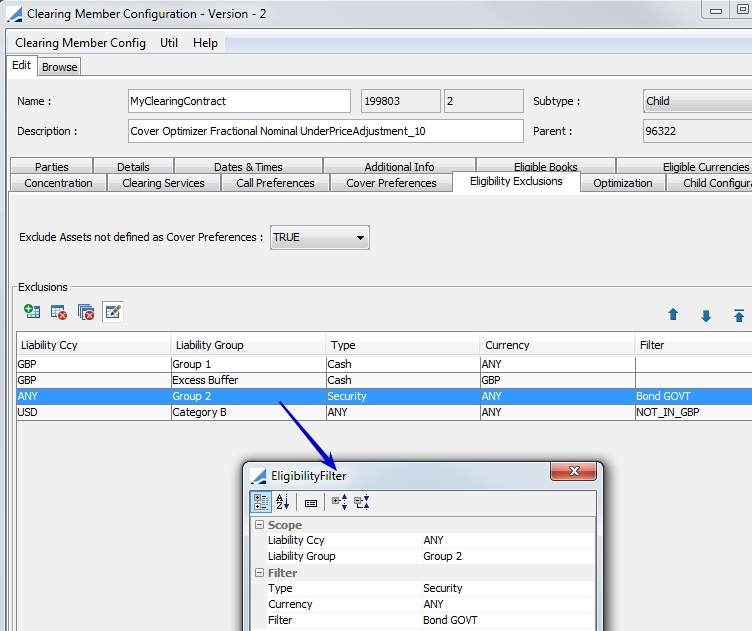

2. Creating a Clearing Member Contract

The Clearing Member contract is used for Cover Distribution.

| » | The clearing member contract is defined between a clearing house and a clearing member. There are at least two contracts involved in a cover distribution, a parent, which is the deposit contract (clearing house) and a child, which is the liability contract (clearing member). |

| » | A deposit contract must be created first and then a child contract can be created and linked to the deposit contract. |

| » | A cover distribution allocates assets from the deposit contract to the liability contract to cover exposures. |

| » | When there isn't enough collateral in the deposit contract to cover the liability, a margin call is generated. |

| » | At the top of many of the panels, there are toggle buttons for display purposes. They are: |

- click this button to toggle the visibility of the Description area in the panel, which gives a brief description of the selected field.

- click this button to toggle the visibility of the Description area in the panel, which gives a brief description of the selected field.

- click either side of this toggle to either expand or collapse the fields in the panel

- click either side of this toggle to either expand or collapse the fields in the panel

Cover Preferences and Eligibility Exclusions are only available for Child contracts

3. Margin Call Window Entry

Below is a description of the panels contained in the Margin Call and Clearing Member Contracts.

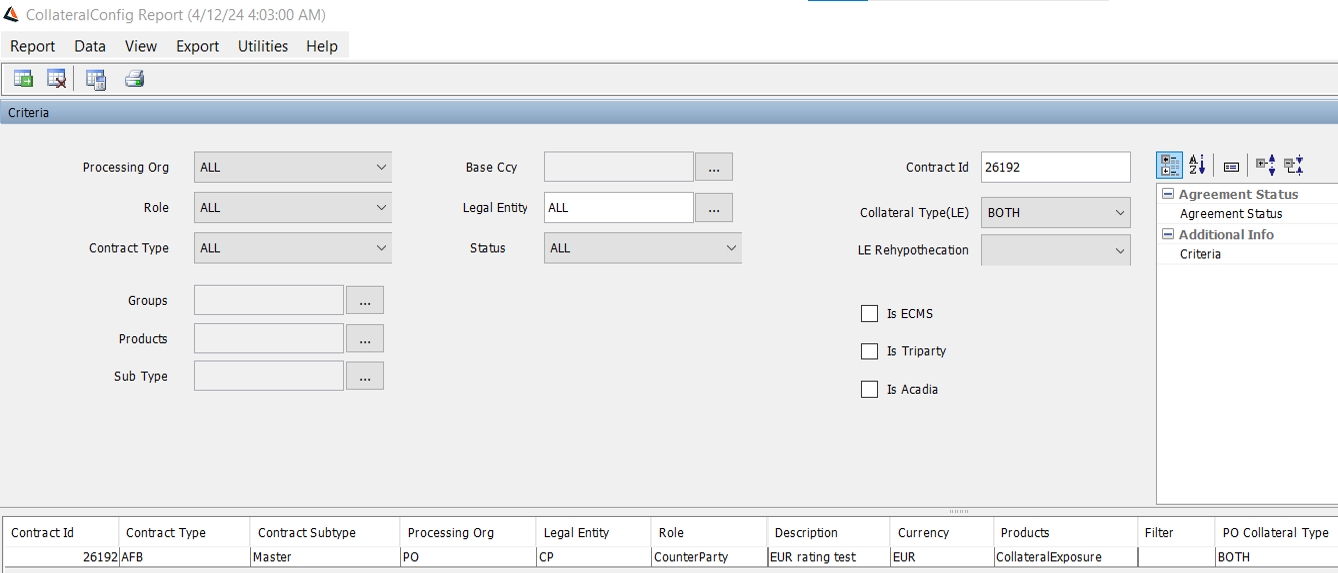

The fields of the Margin Call Contract are available as configurable columns in the Trade Browser when the value CollateralConfig is added to the ExtentionTradeReportStyle domain.

Fields Details

|

Fields |

Description |

|

Name |

Designate a name for the contract |

|

Id / Revision # |

Unique id assigned by the system when the contract is saved. When the contract is saved, the revision number increases by one. |

|

Description |

Enter a description for the contract if desired. |

|

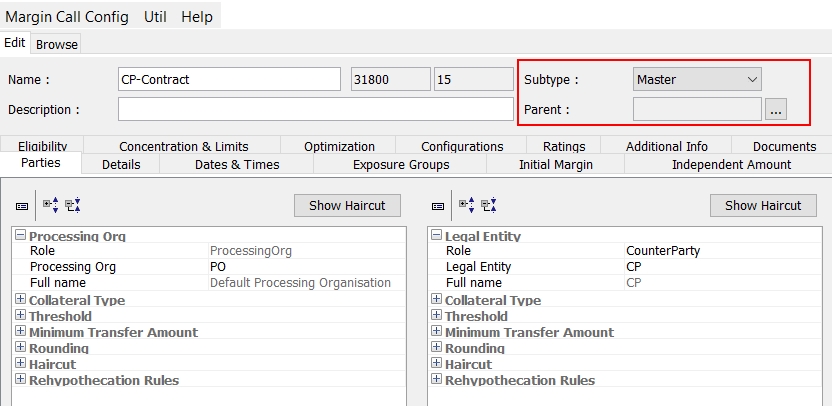

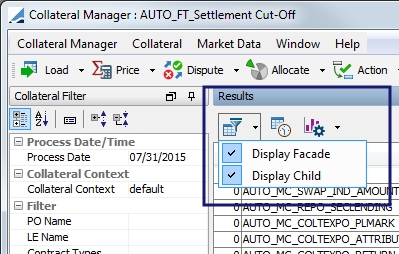

Subtype |

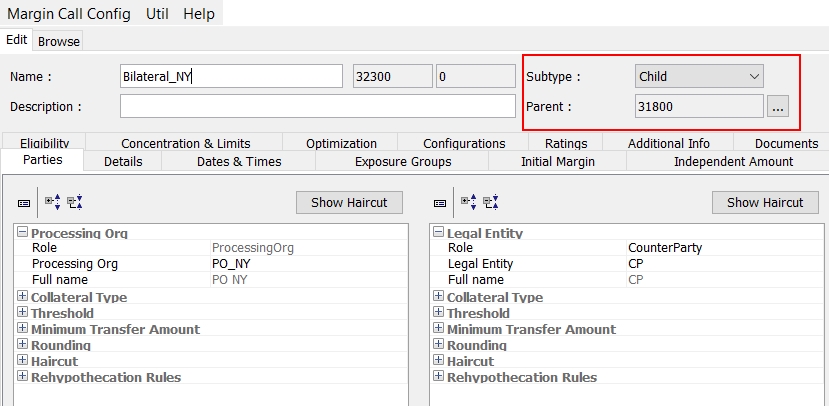

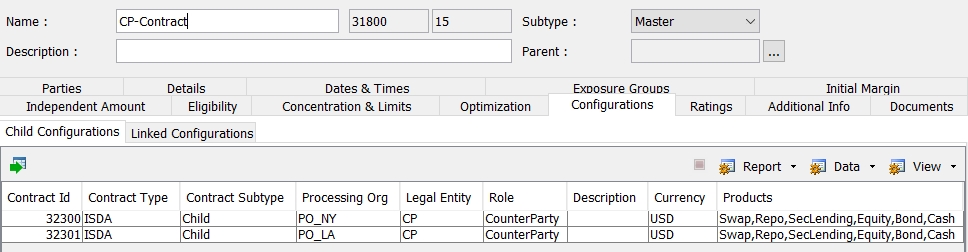

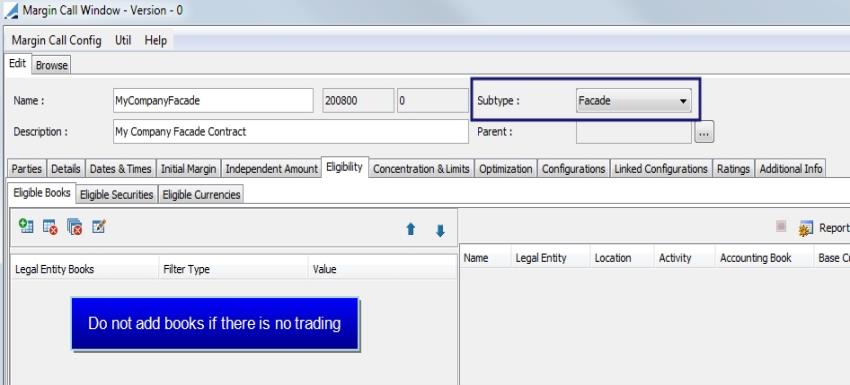

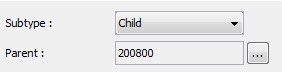

In the Margin Call contract, the subtype options are: Master(or parent), Child and Facade (master/parent contract with no margin call trades or margin call positions). See Facade Setup below for more information on Facades. In the Clearing Member contract (used for Cover Distribution) , designate whether the contract is a Deposit contract or a Child, which is a clearing member. (Subtype options Independent Amount and Initial Margin are used for Clearing only. For details on these options, refer to the Clearing module user guide.) |

|

Parent |

Click ... to select an existing contract. The current contract will inherit all the characteristic of the parent contract. The margin calls are calculated for a given hierarchy, and generated at the root contract level. For example, a root contract is defined between PO1 and CPTY1, and children contracts are defined between children of PO1 and children of CPTY1. The margin calls are calculated for all children and aggregated at the PO1/CPTY1 level. For detailed information on the Parent / Child relationships, refer to Setting up Parent/Child Contracts |

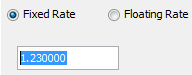

3.1 Parties

|

Fields |

Description |

||||||||||||||||||||||||||||||

|

Processing Org / Legal Entity |

|||||||||||||||||||||||||||||||

|

Role |

The left side of the contract will always be Processing Org and is not editable. On the right side, select the role for the legal entity for the contact. |

||||||||||||||||||||||||||||||

|

Processing Org / Legal Entity |

Select the processing organization or legal entity (counterparty) of the contract. |

||||||||||||||||||||||||||||||

|

Full name |

The full name of the processing org or counterparty |

||||||||||||||||||||||||||||||

|

Collateral Type |

|||||||||||||||||||||||||||||||

|

Collateral Type |

Select the type of collateral that can be used for the margin call: BOTH for cash and security margin calls, CASH for cash only margin call, or SECURITY for security only margin calls. |

||||||||||||||||||||||||||||||

|

Threshold |

|||||||||||||||||||||||||||||||

|

Type |

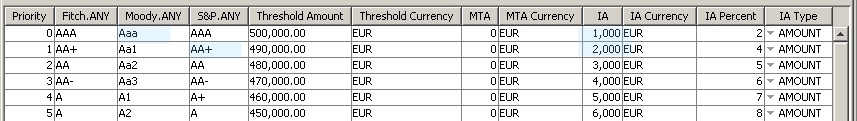

The Threshold is the amount of exposure that a given party is willing to bear before calling collateral margins. When the processing org is receiving the exposure, Legal Entity Threshold applies, and the Counterparty will be paying the margin calls, so Legal Entity MTA and independent amount apply as well. When the processing org is paying the exposure, Processing Org Threshold applies, and the processing org will be paying the margin calls, so Processing Org MTA and independent amount apply as well. Select the type of threshold from the Type field:

To always calculate a margin call, select AMOUNT and enter 0 in the Amount field.

Select Util > View Previous Margin Call Credit Ratings to view the margin Call Credit Rating Threshold report. You are not able to make any changes to this report. It is from this report that you can access the conversion tool to allow you to convert data to the Global Rating Configuration. For details refer to Conversion to Global Rating.

[Note:: You first need to save the contract before you can setup thresholds on credit ratings] Click Ratings at the top of the panel to specify the threshold based on credit ratings. This is done through the Margin Call Credit Rating Configuration window. For details on configuring credit ratings, refer to Margin Call Credit Rating Configuration. Note that the actual credit rating of the legal entities is specified using Configuration > Legal Data > Entities.

Depending on the Type selection, enter either an Amount, Currency, Percentage and /or Rating. |

||||||||||||||||||||||||||||||

|

Amount |

Enter an amount here after having selected Type: AMOUNT |

||||||||||||||||||||||||||||||

|

Base Currency |

When Type: AMOUNT is selected, select the currency of the threshold amount in the Currency field if you wish it to be something other than the base currency which is designated in the Eligible Currencies panel. | ||||||||||||||||||||||||||||||

|

Percentage Basis |

This field must be populated when Type: PERCENTAGE is chosen. The percentage is applied on what is selected in this field.

|

||||||||||||||||||||||||||||||

|

Percentage |

Enter a percentage when Type: PERCENT is selected. You must also select a Percentage Basis. |

||||||||||||||||||||||||||||||

|

Rating |

The selections for Rating are HIGHER or LOWER. This designates whether the higher or lower credit rating will be used in the case where the legal entity is rated differently by one or more of the applicable agencies. | ||||||||||||||||||||||||||||||

|

Value Basis |

This field provides the ability to base the percentage on a net amount or a gross amount. This field is available when either Percentage or BOTH is selected in the Type field. The selection options are Net Value (which is the default) and Gross Value, which is the sum of the absolute value of the margin call value. For example, if there are two trades which have a margin call value of -100 and 300, the MTA/Threshold percentage is multiplied by 400 if Gross Value is selected as the Value Basis. |

||||||||||||||||||||||||||||||

|

Threshold Application |

This field is used with the Margin Flow Approach (which is set up in the Independent Amount panel of the Margin Call contract. It should be set to IA Only for netted VM and IA contracts, and for non-netted IA. It should be set to MTM+IA for IM and non-netted VM contracts. |

||||||||||||||||||||||||||||||

|

Minimum Transfer Amount |

|||||||||||||||||||||||||||||||

|

Minimum Transfer Amount |

The minimum transfer amount (MTA) is the amount that must be reached above the threshold before a margin call can actually take place. When the processing org is receiving the exposure, Legal Entity Threshold applies, and the Counterparty will be paying the margin calls, so Legal Entity MTA and independent amount apply as well. When the processing org is paying the exposure, Processing Org Threshold applies, and the processing org will be paying the margin calls, so Processing Org MTA and independent amount apply as well. Select the type of MTA from the Type field:

To always calculate a margin call, select AMOUNT and enter 0 in the Amount field.

Select Util > View Previous Margin Call Credit Ratings to view the margin Call Credit Rating MTA report. You are not able to make any changes to this report. It is from this report that you can access the conversion tool to allow you to convert data to the Global Rating Configuration. For details refer to Conversion to Global Rating.

[Note:: You first need to save the contract before you can setup MTAs on credit ratings] Click Ratings at the top of the panel to specify the MTA based on credit ratings. This is done through the Margin Call Credit Rating Configuration window. For details on configuring credit ratings, refer to Margin Call Credit Rating Configuration. Note that the actual credit rating of the legal entities is specified using Configuration > Legal Data > Entities.

Depending on the Type selection, enter either an Amount, Currency, Percentage and /or Rating. |

||||||||||||||||||||||||||||||

|

Amount |

Enter an amount here after having selected Type: AMOUNT | ||||||||||||||||||||||||||||||

|

Base Currency |

When Type: AMOUNT is selected, select the currency of the MTA amount in the Currency field if you wish it to be something other than the base currency which is designated in the Eligible Currencies panel. | ||||||||||||||||||||||||||||||

|

Percentage Basis |

This field must be populated when Type: PERCENTAGE is chosen. The percentage is applied on what is selected in this field.

|

||||||||||||||||||||||||||||||

|

Percentage |

Enter a percentage when Type: PERCENT is selected. You must also select a Percentage Basis. | ||||||||||||||||||||||||||||||

|

Rating |

The selections for Rating are HIGHER or LOWER. This designates whether the higher or lower credit rating will be used in the case where the legal entity is rated differently by one or more of the applicable agencies. | ||||||||||||||||||||||||||||||

|

Value Basis |

This field provides the ability to base the percentage on a net amount or a gross amount. This field is available when either Percentage or BOTH is selected in the Type field. The selection options are Net Value (which is the default) and Gross Value, which is the sum of the absolute value of the margin call value. For example, if there are two trades which have a margin call value of -100 and 300, the MTA/Threshold percentage is multiplied by 400 if Gross Value is selected as the Value Basis. |

||||||||||||||||||||||||||||||

|

Rounding |

|||||||||||||||||||||||||||||||

|

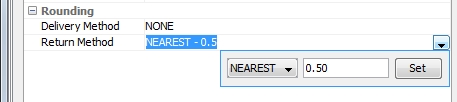

Delivery Method Return Method |

Select the rounding method of the margin call from the Delivery Method / field. The Return Method is used when the PO is the paying party and the Delivery Method is used when the PO is the receive party.

Enter the nearest amount to which you want to round in the field next to the selection.

|

||||||||||||||||||||||||||||||

|

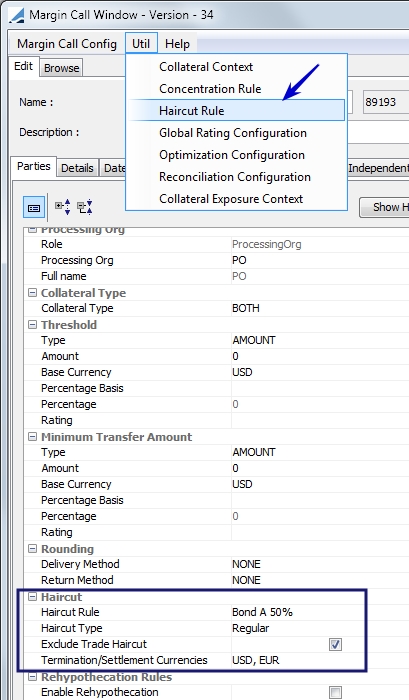

Haircut |

|||||||||||||||||||||||||||||||

|

Haircut Rule |

Select a haircut rule that applies to the margin call calculation for collateral. The collateral value is decreased by the haircut amount. In the Static Data Filter or Static Data Filter Tree used in the Haircut Rule, select a product currency and designate the Product Type as Cash or a security. A haircut rule allows defining haircut percentages based on collateral maturities. To display the Haircut Rule window, select Util > Haircut Rule from the Margin Call window.

|

||||||||||||||||||||||||||||||

|

Haircut Type |

Select Regular or Inverse. The signedHaircut domain value determines the behavior of this field. When this value is set to true (default behavior) the behavior is: Regular = amount • (1+ haircut) Inverse = amount / (1 - haircut) When the signedHaircut domain value is set to false, the behavior is: Regular = amount • (1- haircut) Inverse = amount / (1 + haircut) Note: This can be asymmetrical between the PO and LE. |

||||||||||||||||||||||||||||||

|

Apply 100% haircut on ineligible |

When the field is selected, any collateral (cash or security) that is ineligible, will have a haircut of 100% applied to it. To determine eligibility and which haircut rule to apply, the system refers to the party receiving collateral: • If PO receives, PO eligibility and haircut are checked. • If CP receives, PO pays, and CP eligibility and haircut are checked When returning collateral, the initial haircut is always used. This field is asymmetrical, meaning it does not have to be the same for both the PO and CP. The checkbox is available at both the contract and exposure group level. |

||||||||||||||||||||||||||||||

|

Exclude Trade Haircut |

When checked, the haircut is excluded from exposure calculation. It is included otherwise. NOTE: This cannot be asymmetrical. It must be the same on both sides of the contract. |

||||||||||||||||||||||||||||||

|

Termination / Settlement Currencies |

Haircut reference currency for cross currency haircut. A haircut will be applied if the asset being delivered is not in the same currency as one of the designated currencies. This field can hold one or more currencies and is not mandatory. If there is no designation in this field, the Base Currency field is used for the cross currency haircut determination. |

||||||||||||||||||||||||||||||

|

Rehypothecation Rules |

|||||||||||||||||||||||||||||||

|

Enable Rehypothecation |

Select this if securities and cash received as collateral can be rehypothecated. When this checkbox is selected, the Collateral Rehypothecation and Accept Rehypothecated Assets fields are displayed. |

||||||||||||||||||||||||||||||

|

Collateral Rehypothecation |

Select an option in the drop-down to indicate what type of collateral can be reused for this contract. You may select CASH, SECURITY, BOTH (cash and securities) or NONE at all.

|

||||||||||||||||||||||||||||||

|

Accept Rehypothecated Assets |

Select an option in the drop-down to indicate if the contract accepts rehypothecated assets. The contract can accept, CASH, SECURITY, BOTH (cash and securities) or NONE at all.

|

||||||||||||||||||||||||||||||

|

Additional Legal Entities |

|||||||||||||||||||||||||||||||

|

Additional Legal Entities |

In this area you may enter additional legal entities for the Processing Org and/or the Legal Entity |

||||||||||||||||||||||||||||||

3.2 Details Panel

In Bilateral contracts, the Details panel contains four panels within it, Details, Ad-Hoc Details, Triparty Details and Acadia Details.

|

Fields |

Description |

||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Perimeter |

|||||||||||||||||||||||||||||||

|

Perimeter Type |

Select the perimeter type to filter which types of trades are loaded with the contract

If there is a trade without any keyword, it will only be accepted in Default mode. If the trade has a keyword, the trade will go in the margin call contract with the designated Id. If the designated Id is less than zero, the trade will not go into any contract. NOTE: You may run the COLLATERAL_EXPOSURE_INDEXATION scheduled task to link collateral exposure trades to the contract Id if the collateral exposure trades were created without the contract Id configured. (This is used for Cover Distribution only.) |

||||||||||||||||||||||||||||||

|

Products |

Click The product type can be a group of products. See Configuration > Product > Group ( If you are using underlyings that are non-Calypso trades, select the product type Collateral Exposure. Refer to Collateral Exposure for more information. |

||||||||||||||||||||||||||||||

|

Products Filter |

Click Click the Define SD button to display Static Data Filter definition window. |

||||||||||||||||||||||||||||||

|

Books |

Select the book or books to which the contract can be applied. |

||||||||||||||||||||||||||||||

|

Currencies |

Click  to select

the currencies to which this contract can be applied, or ANY. to select

the currencies to which this contract can be applied, or ANY. |

||||||||||||||||||||||||||||||

|

Exposure Type |

Select the underlying products for the margin call here if one of the Products selected is Collateral Exposure. |

||||||||||||||||||||||||||||||

|

Start Date / Time |

Enter the date and time on which the contract is effective. | ||||||||||||||||||||||||||||||

|

End Date / Time |

Enter the date and time on which the contract will no longer be effective (these fields can be left blank if a closing date is not know or does not apply). | ||||||||||||||||||||||||||||||

|

Effective Date |

Ⓘ [NOTE: REAL_SETTLEMENT is available and supported for Sec Finance products]

When this option is chosen, a Settlement Offset field is exposed for entry. The value in this field is used in combination with the calendar defined on the Dates and Times panel to determine which trades have a settlement offset (in business days) greater than or equal to the Settlement Offset field. The trades meeting this criterion will be collateralized and loaded in Collateral Manager. |

||||||||||||||||||||||||||||||

|

Agreement Workflow - Please refer to Calypso Acadia documentation for more information. |

|||||||||||||||||||||||||||||||

|

Agreement Workflow Product |

Product type used for Acadia Agreement Manager workflow. |

||||||||||||||||||||||||||||||

|

Agreement Workflow Subtype |

Subtype used for Acadia Agreement Manager workflow. |

||||||||||||||||||||||||||||||

|

Collateral Agreement Status |

Agreement status for Acadia Margin Agreement. |

||||||||||||||||||||||||||||||

|

Workflow |

|||||||||||||||||||||||||||||||

|

Product |

Select a product type use for collateral workflow selection. |

||||||||||||||||||||||||||||||

|

Subtype |

Subtype used in the collateral workflow. You may select a specific workflow to use for this contract, which is defined in the collateral workflow. This list is populated from the collateralType domain value. For more information, see Collateral Manager Workflow or Cover Distribution Workflow. |

||||||||||||||||||||||||||||||

|

Margin Call Generation Level - See Exposure Groups for details. |

|||||||||||||||||||||||||||||||

|

Generate Margin Calls per Exposure Group |

When designating a contract to use Exposure Groups , it is necessary to have Generate Margin Calls per Exposure Group selected in the Details panel of the contract. This field is selected by default in the margin call contract.

|

||||||||||||||||||||||||||||||

|

Distribute to Exposure Group |

Indicates that Collateral will be distributed to Exposure groups. |

||||||||||||||||||||||||||||||

|

Portfolio Based Distribution |

Indicates that collateral is provided by the Exposure Groups rather than the PO's collateral being distributed to the Exposure Groups. This is used in conjunction with the Targeted-Allocation optimization solver. |

||||||||||||||||||||||||||||||

|

Direction Based Inclusion |

When selected, excludes net exposure of Exposure Group from the distribution process if it is not in the same direction as the master contract. |

||||||||||||||||||||||||||||||

|

Details |

|||||||||||||||||||||||||||||||

|

Status |

When the contract is saved, the status will be set to OPEN. If the contract is closed in the Margin Call report window, the status will become CLOSED. NOTE: Closing a contract is available at the contract level only. A contract cannot be closed at the Exposure Group level. |

||||||||||||||||||||||||||||||

|

Contract Type |

Select the type of legal agreement that applies to the contract. Contract types are user-defined in the legalAgreementType domain. |

||||||||||||||||||||||||||||||

|

Contract group |

Select a currency group, defined in the Collateral Context window Currency Definition panel, to be associated with the contract. |

||||||||||||||||||||||||||||||

|

Contract Direction |

Choose the direction of the contract. The options are:

|

||||||||||||||||||||||||||||||

|

Secured Party |

This available for selection when Unilateral is chosen for Contract Direction. Specify which party will receive collateral. |

||||||||||||||||||||||||||||||

|

End of Day Pricing Environment |

The pricing environment to use for an end of day, intraday and simulation allocation or cover distribution . The Pricing Environment Type (e.g. EOD, ITD or SIM) is chosen in the Collateral Context Pricing tab. The Collateral Context associated with the Collateral Manager template determines which pricing scenario to use. The Collateral Context can also be changed in Collateral Manager. |

||||||||||||||||||||||||||||||

|

Intraday Pricing Environment |

|||||||||||||||||||||||||||||||

|

Simulation Pricing Environment |

|||||||||||||||||||||||||||||||

|

Include End Date Exposure |

Select this box to include end date exposure in the margin calculation. This property is based off of the trade date (not the process date). |

||||||||||||||||||||||||||||||

|

Exclude Delivery Date Accruals |

If true, the Accrual calculated in the Collateral Manager is only computed until the Value Date, rather than Process Date which is the existing behavior. This attribute is false by default. This applies only to Repo and Sec Lending. |

||||||||||||||||||||||||||||||

|

Ignore MTA on Returned Margin |

If selected, the previous collateral will be returned when the Net Exposure changes sign. In this case, the MTA will only be applied to the New Margin. Otherwise, the MTA is applied to the sum of the Returned Margin plus the sum of the New Margin. |

||||||||||||||||||||||||||||||

|

Ignore MTA on Returned Margin below Threshold |

If selected, the previous collateral will be returned when the Net Exposure falls below the Threshold, or when the Net Exposure changes sign. |

||||||||||||||||||||||||||||||

|

Rounding before MTA |

Defines whether the rounding is applied before the check on the Minimum Transfer Amount (MTA) or not. If selected, rounding of the required margin will occur only once before it is compared to the MTA. If rounded margin > MTA, the required margin <>0, if rounded margin < MTA, required margin will be null. In this scenario, it is possible to have a required margin not null even though it was below MTA before rounding If not selected, the Required Margin is first compared with the MTA. If the Required Margin exceeds the MTA, then rounding is performed as per the designated Rounding configuration. Then, that amount is again compared to see if a margin call is needed. |

||||||||||||||||||||||||||||||

|

Position Type |

Selecting ACTUAL bases the margin calculation on the current actual margin. THEORETICAL bases the calculation on retical margin. EXPECTED functions in a way that treats all outgoing margin call transfers as settled and all incoming transfers as not being available until a pre-defined number of days has passed after the value date. This date is set in the xferAvailableDate domain value. |

||||||||||||||||||||||||||||||

|

Position Date |

Select the date when the positions are to be loaded.

|

||||||||||||||||||||||||||||||

|

Novation Date Based Inclusion/Exclusion |

This field facilitates Collateral Policy CSA lookup. When chosen, the logic is as follows:

Two additional fields are exposed when this option is chosen:

NOTE: If the trade date is before the regulatory date and not partially terminated, it is subject to legacy CSA. If the trade date is before the regulatory date, and partially terminated before the regulatory date, it is subject to legacy CSA. If the trade date is before the regulatory date but partially terminated after the regulatory date, it is still subject to legacy CSA. If the trade date is after the regulatory date, it is subject to regulatory CSA regardless of whether it is partially terminated or not. |

||||||||||||||||||||||||||||||

|

Adjustments |

|||||||||||||||||||||||||||||||

|

Minimum Adjustment |

Enter the minimum amount by which the margin call amount can be amended in the Margin Call report. Check the “Is Percentage” checkbox if the amount represents a percentage of the margin call amount. If this designated adjustment amount is breached, a warning is displayed in the Allocation window. The warning is generated by comparing the sum of all allocations (executed and proposed) and the Global Required Margin. To ignore the minimum adjustment amount, enter 0 and check the “Is Percentage” checkbox. |

||||||||||||||||||||||||||||||

|

Maximum Adjustment |

Enter the maximum amount by which the margin call amount can be amended in the Margin Call report. Check the “Is Percentage” checkbox if the amount represents a percentage of the margin call amount. If this designated adjustment amount is breached, a warning is displayed in the Allocation window. The warning is generated by comparing the sum of all allocations (executed and proposed) and the Global Required Margin. To ignore the minimum adjustment amount, enter 100 and check the “Is Percentage” checkbox. |

||||||||||||||||||||||||||||||

|

Trade Level Dispute |

|||||||||||||||||||||||||||||||

|

Dispute Tolerance |

Enter the dispute amount limit. When processing a dispute, if the dispute amount is less than or equal to the dispute tolerance, the dispute will be automatically resolved using the counterparty's amount. Check the "Is Percentage" checkbox if the amount represents a percentage of the margin call amount. |

||||||||||||||||||||||||||||||

|

Contract Level Dispute |

|||||||||||||||||||||||||||||||

|

Dispute Tolerance |

|

||||||||||||||||||||||||||||||

|

Track As Dispute |

Available only when Accept CP Amount in PO's Favor is selected. When selected, the Counterparty’s amount is automatically taken as the Agreed Amount because it is in the PO’s favor. In Collateral Manager the Dispute flag is checked, the Dispute Status is Partially Agreed and the Agreed Amount is the Counterparty Amount. |

||||||||||||||||||||||||||||||

|

Accept Undisputed Amount |

When this option is flagged, if the difference between the Global Required Margin and the Counterparty Amount is less than the Undisputed Tolerance, the following things will automatically happen in Collateral Manager: • The Agreed Amount is set to the undisputed amount (which is the lowest of the two amounts) • The Dispute flag is checked • The Dispute Status is set to Partially Agreed |

||||||||||||||||||||||||||||||

|

Undisputed Tolerance |

Undisputed tolerance amount, used in Accept Undisputed Amount |

||||||||||||||||||||||||||||||

|

Percentage calculation basis |

Choose on which amount the percentage has to be based. |

||||||||||||||||||||||||||||||

|

Accept CP Amount in PO's Favor |

Designates to automatically accept the counterparty amount to resolve a dispute if the amount is in the processing org's favor. |

||||||||||||||||||||||||||||||

|

Method |

You may either select NONE or ARITHMETIC MEAN as a method to calculate a margin call in the case of a dispute. If ARITHMETIC MEAN is selected, the two parties will 'split the difference' between the two amounts when under tolerance. |

||||||||||||||||||||||||||||||

|

Response Time |

Enter the time by which a response must be given to the dispute. (For information purposes only.) |

||||||||||||||||||||||||||||||

|

Response Time Zone |

Select the time zone that applies to the response time. (For information purposes only.) |

||||||||||||||||||||||||||||||

|

Alternative Procedure |

Select the alternative procedure in case of a dispute: NONE, SPLIT THE DIFFERENCE (the difference between Party A and Party B’s calculated amounts is to be split and paid/received to/from each party), or OTHER. This is currently for information purposes only. You can display the dispute alternative procedure in the Margin Call Statement. |

||||||||||||||||||||||||||||||

|

Resolution Time |

Enter the time by which a resolution must be agreed upon. (For information purposes only.) |

||||||||||||||||||||||||||||||

|

Resolution Time Zone |

Select the time zone that applies to the resolution time. (For information purposes only.) |

||||||||||||||||||||||||||||||

|

Dispute Aging Start |

This field defines when dispute aging begins when a margin call is disputed in Collateral Manager. When T+1 is selected, the Dispute Age column displays 0 on the first day of the dispute. When T is selected, the aging begins on the first day of the dispute, the Dispute Age column displays 1 on the first day of the dispute. T+1 is the default setting. |

||||||||||||||||||||||||||||||

|

Mirroring |

|||||||||||||||||||||||||||||||

|

Mirror Contract |

Select a mirror contract to for mirroring of Margin Call trades.

|

||||||||||||||||||||||||||||||

|

Call Generation (Clearing Member only) |

|||||||||||||||||||||||||||||||

|

Generate a Call |

Selecting this checkbox indicates that the call is generated at the current contract level. If this flag is not selected on either the Deposit or the Child contract, the call is done at the deposit level. |

||||||||||||||||||||||||||||||

|

Distribute the call |

Selecting this checkbox in a child contract will generate a call per uncovered liability if the call preference is eligible for this liability. If not, the liability call amount will be aggregated to the total call amount done at the child contract level. If the call preference is eligible for all uncovered liabilities, the total call amount will be equal to 0 and no allocation will be generated at contract level. |

||||||||||||||||||||||||||||||

|

Excess Buffer Requirement |

The Excess Buffer is an additional amount of collateral that the clearing house requires the member to post. |

||||||||||||||||||||||||||||||

|

Excess Buffer Auto-Call |

If this is selected, a cash call is automatically generated when the excess buffer is breached. If it is not selected, a notification is sent to the member, indicating the amount of the buffer that has been used. |

||||||||||||||||||||||||||||||

|

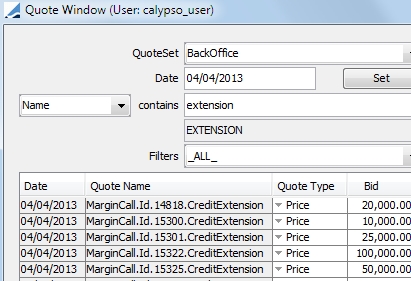

Use Credit Extension |

Credit Extension is an amount of cash value that the Clearing House extends to the Clearing Member to allow them to register trades when they have insufficient available collateral. Selecting this checkbox indicates if a credit extension is permitted. When a Credit Extension is selected and the contract is saved, a new quote for that contract is saved which specifies the daily credit extension amounts.

Credit extensions are ignored during a final distribution. They are only recognized during an intraday distribution. |

||||||||||||||||||||||||||||||

|

Credit Extension Call Percentage |

This is a % of the Credit Extension, once the Clearing Member exceeds this % the Clearing House will call cash collateral from the Clearing Member. The Clearing Member will still be able to clear trades until 100% of the Credit Extension is used. For example, if the clearing member's credit extension is $10,000 with the Credit Extension Call % of 60. If the clearing member uses less than $6,000 of their extension the clearing house makes no call. If the clearing member uses $6,000 then the clearing member will call $6,000, but will still allow trades to be cleared for the remaining $4,000. Credit extensions are only applied for intraday distributions. |

||||||||||||||||||||||||||||||

NOTE: Either a Credit Extension or an Excess Buffer would normally be applied to a contract, but not both at the same time.

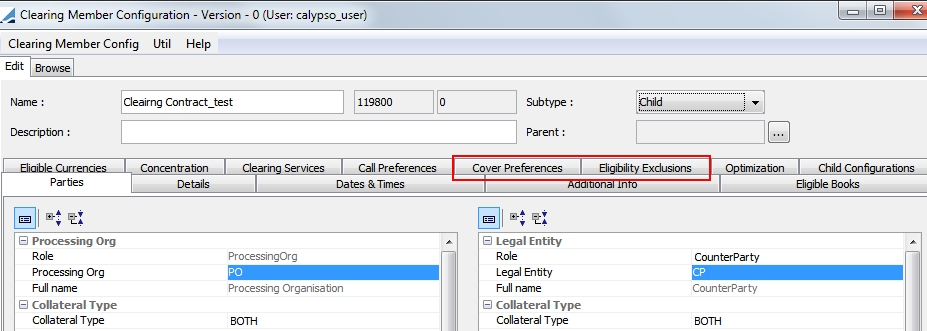

An Ad Hoc margin call is an option which allows contract valuation out of schedule on non-valuation days. Ad Hoc calls may have different Valuation Time Offsets (typically T-2 instead of T-1) and often have a specific Ad Hoc Minimum Transfer Amount to determine whether or not to generate a margin call on an off-schedule day. Any day that is not a Valuation Date is considered an Ad Hoc date.

In the Ad-Hoc Details panel, you may indicate that Ad-Hoc calls are allowed for this contract. This flag is to be used in conjunction with the Ad Hoc Valuation designation in the Collateral Context window.

The fields in this panel function in the same way as the valuation fields in the Dates & Times panel, except they are specific to ad hoc margin calls in bilateral contracts only.

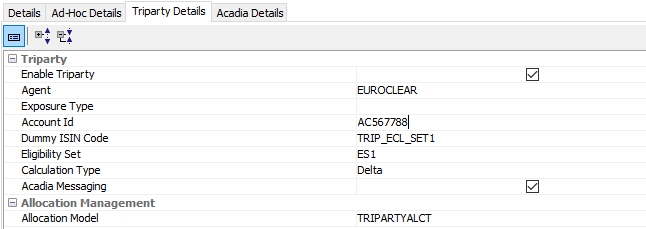

This panel contains information related to triparty activity. Select Enable Triparty to designate that the contract is Triparty. When this is selected, additional fields are available for input.

NOTE: If the Acadia Messaging field is checked at the Exposure Group level, different calculations are applied. A Triparty contract uses Net Exposure calculation; A Triparty Acadia contract uses Delta calculation.

For details related to this panel, please refer to Calypso Traiparty Services documentation and Calypso Acadia documentation.

For details related to this panel, please refer to Calypso Traiparty Services documentation and Calypso Acadia documentation.

Please refer to the ECMS section in the Calypso Collateral Management User Guide for details.

Please refer to the ECMS section in the Calypso Collateral Management User Guide for details.

The Acadia Details panel contains information related to generating AcadiaSoft messages.

For details related to this panel, please refer to Acadia Fields in Collateral Manager in the Acadia documentation.

For details related to this panel, please refer to Acadia Fields in Collateral Manager in the Acadia documentation.

3.3 Dates & Times

|

Fields |

Description |

|---|---|

|

Valuation |

|

|

Valuation Agent Type |

Select PARTY A, PARTY B, BOTH, 3RD PARTY, or NONE. |

|

Valuation Date Frequency |

Click Date rules are defined using Configuration > Definitions > Date Schedule Definitions > Date Rule. You can may display the Valuation Date Frequency in the Margin Call Statement. This is a mandatory field. |

|

Valuation Time Offset |

Click The date rule in this field is typically relative to the Valuation Date Frequency date rule. For example, if the contract has a Valuation Date Frequency of each Monday, then the Valuation Time Offset date rule would be -1 business days relative to the Valuation Date Frequency. For contracts that are processed daily, the Valuation Date Frequency rule should define as type = DAILY and the Valuation Time Offset rule should be -1 day relative to the daily date rule. This is a mandatory field. |

|

Valuation Time |

Enter the time used to determine the date time on the Valuation Time Offset for trade inclusion. You can display the valuation time and time zone in the Margin Call Statement. This is a mandatory field. |

|

Valuation Time Zone |

Select a time zone to be used in conjunction with the Valuation Time field. This is a mandatory field. |

|

Quote Offset Days |

Enter a number of offset days applied to the quote date. |

|

Trade Inclusion (valid only for Effective Date - TRADE DATE) |

|

|

Trade Inclusion Time |

Select the checkbox to enter the Trade Inclusion Time which is the same as the Valuation Time. |

|

Trade Inclusion Time Zone |

This field will be automatically updated based on the data extracted from the Valuation Time Zone field. This field cannot be edited. |

|

Trade Inclusion Time Offset |

This field will be automatically updated based on the date rule saved against the Valuation Time Offset field. This field cannot be edited. |

|

Calendar |

|

|

Holidays |

This is the holiday calendar used to compute the settlement of the margin call trade. The settlement offset of the margin call trade is computed using this calendar and the calendar of the underlying currency of the margin call trade. |

|

Messages |

|

|

Notification Time |

Enter the time by which notification of the margin call must be sent or received. |

|

Time Zone |

Select the appropriate time zone |

|

Collateral Substitution |

|

|

Date Option |

Enter “Next Settlement Date following receipt of the Transferee’s note of consent”, “Settlement Date following the date on which the Transferee receives the new collateral”, or enter the actual number of business days following the receipt of the note of consent or receipt of new collateral. This is currently for information purposes only. You can display the substitution date option in the Margin Call Statement. |

|

Time |

Enter the time by which the substitution must take place. This is currently for information purposes only. You can display the substitution time in the Margin Call Statement. |

|

Substitution Time Zone |

Enter the time zone that applies to the Collateral Substitution Time. |

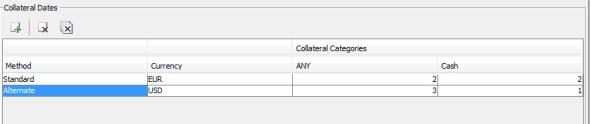

Settlement Offset

If desired, designate an offset for cash and securities for each party. You may also use Collateral Dates for the offsets by selecting the checkbox.

Collateral Dates

In this area, you may define rules to determine the settlement dates of the collateral. Refer to Setting Collateral Dates for information.

3.4 Exposure Groups

Exposure groups can be set up to meet IOSCO regulations including the 2-way movement of Initial Margin and Variation Margin currency silos. Exposure Groups are used for Bilateral functionality as well as Buy Side Fund Distribution. Please refer to Exposure Group Functionality for detailed information.

3.5 Initial Margin

This panel allows you to specify if the Margin Call Contract is associated with initial margin in the context of the Clearing activity. The Initial Margin Buffer panel is also available for Exposure Groups.

Please refer to the Calypso Clearing Member Setup Guide for complete details.

Please refer to the Calypso Clearing Member Setup Guide for complete details.

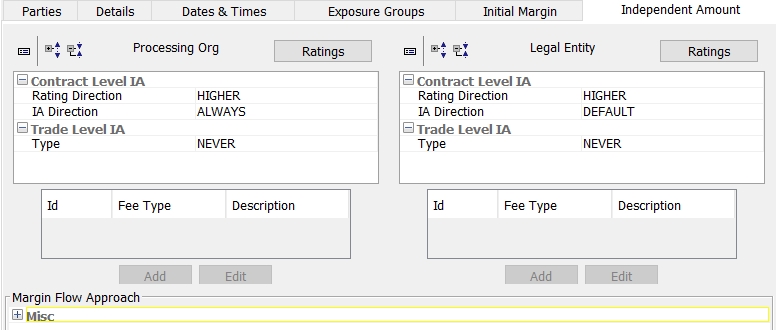

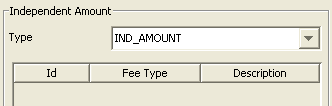

3.6 Independent Amount

The independent amount is handled as a fee. Independent amounts can be either at the contract or trade level.

| • | Contract level Independent Amounts are credit rating based. They can be set up to be either a fixed amount or a percentage. |

| • | Trade level Independent Amounts can be netted with the margin call contract (included in margin call calculations), or non-netted (excluded from margin call calculations). |

NOTE: You first need to save the contract before you can setup the independent amount

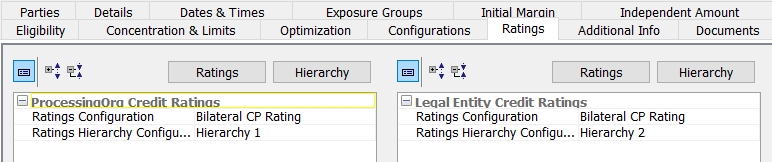

Contract Level Independent Amount

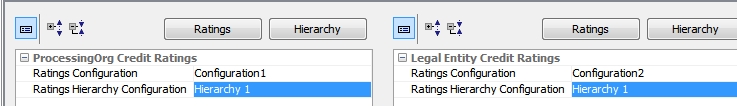

| » | Because a contract level Independent Amount is credit rating based, the following must be defined in the Ratings panel of the Margin Call Contract: |

| – | Credit Rating Configuration for the processing org and/or legal entity |

| – | Ratings Hierarchy Configuration for the processing org and/or legal entity |

| – | Eligible Agencies (The options for this is populated from the ratingAgency domain value.) |

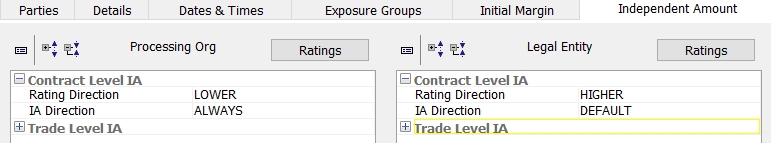

| » | Choose Rating Direction and IA Direction for the processing org and/or the legal entity |

The Rating Directions are:

| • | HIGHER - In the case of conflicting ratings, the highest rating will be used in order to determine the contract level Independent Amount that applies. |

| • | LOWER - In the case of conflicting ratings, the lowest rating will be used in order to determine the contract level Independent Amount that applies. |

| • | NONE - No contract level Independent Amount is applied. If the rating direction is NONE, there is no contract level Independent Amount even if an Independent Amount amount or percent is defined in the Margin Call Credit Rating Configuration. |

The IA Directions allow you to specify if an Independent Amount should always be included or not. The selections are:

| • | DEFAULT - The Independent Amount is included, depending on the sign of the exposure |

| • | ALWAYS - The Independent Amount is always included |

| • | NEVER - The Independent Amount is never included |

NOTES:

| • | If one of either party is set to ALWAYS or NEVER, then the Independent Amount no longer depends on the exposure sign. |

| • | If the IA Direction for both parties is DEFAULT, then this means that the IA is applicable to the party with the negative net exposure. If there are no underlying trades (or if the underlying trades happen to net to 0), then there is no paying party since the net exposure is 0. In this situation no IA value is populated since IA is not being computed for any party. |

| • | If the IA Direction is DEFAULT for the PO, and ALWAYS for the CPTY, and if there are no underlying trades, then the LE IA Amount is populated and the Contract Level Independent Amount is populated with the LE IA Amount. |

| • | If the IA Direction is ALWAYS for the PO, and DEFAULT for the CPTY, and if there are no underlying trades, then the PO IA Amount is populated and the Contract Level Independent Amount is populated with the PO IA Amount. |

| • | If the IA Direction for both parties is ALWAYS, and if there are no underlying trades, then the PO IA Amount and the LE IA Amount are populated, the Contract Level Independent Amount is populated with the difference between PO IA Amount and the LE IA Amount. |

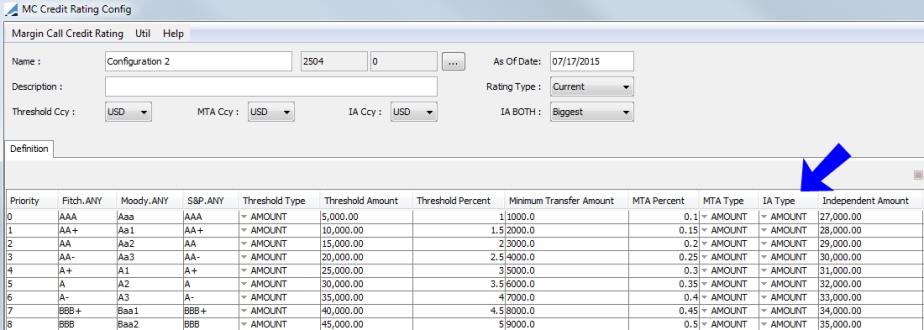

| » | You can click the Ratings button to display the MC Credit Rating Config window. IA Type is one of the columns that can be displayed on this window. |

The IA Type can be:

| • | BOTH - The AMOUNT value is compared with the PERCENT value and the value used is based on the IA BOTH setting. |

| • | AMOUNT |

| • | PERCENT - percent of the notional |

| • | NEVER - no independent amount |

When the selected IA Type is BOTH, the IA BOTH field is utilized. The options for this field are:

| • | Smallest: the system chooses the smallest value between the Amount and the Percentage value calculated |

| • | Biggest: the system chooses the largest value between the Amount and the Percentage value calculated |

This field is the same for the entire configuration. It is not possible to have one column set to Biggest and another to Smallest within the same configuration. The default value is Biggest.

Below are two examples of contract level independent amounts:

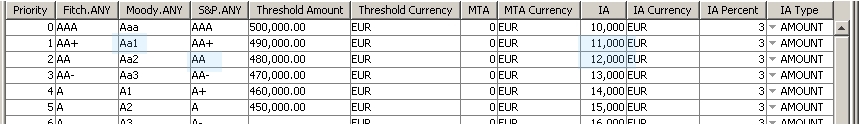

Example 1

Ratings panel

Independent Amount panel

Processing Org Credit Ratings

Counterparty Credit Ratings

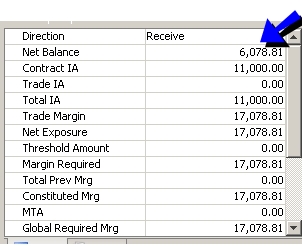

Collateral Manager - Margin Call Entry

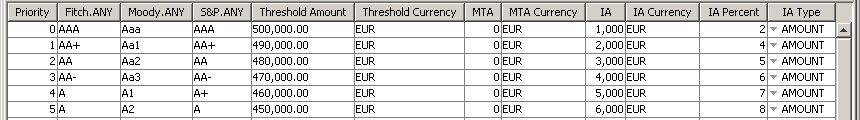

The Net Balance is greater than zero, so the Counterparty credit rating is used.

The Counterparty rating is:

Since the contract rating is HIGHER, 11,000 is used.

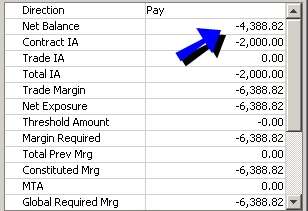

Example 2

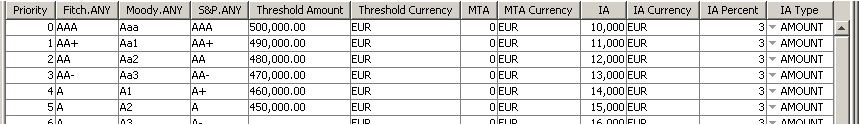

(In this example, there is the same set up as the Example 1.)

Collateral Manager

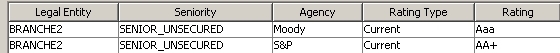

The Net Balance is less than zero so the Processing Organization's Independent Amount is used.

The Processing Organization rating is:

Since the rating direction is LOWER, 2,000 is used.

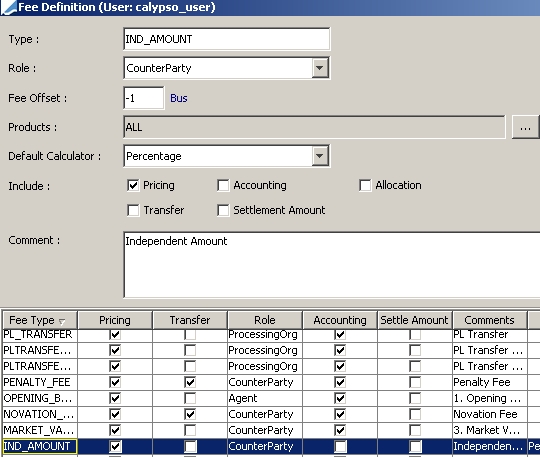

Trade Level Independent Amount - Netted

| » | The pricer measure INDEPENDENT_AMOUNT allows for the retrieval of that fee in reports, and revalues the independent amount for subsequent margin calls. |

| » | Define a fee type “IND_<name>” with or without the FeeGrid calculator, that does not generate transfers using Configuration > Fees, Haircuts, & Margin Calls > Fee Definition. This fee will be taken into account in the margin call calculation. |

Once you have created the fee definition, select the fee from the Type field in the Independent Amount section.

If you do not specify a fee grid, the fee amount will have to be entered manually on the trades.

Trade Level Independent Amount - Non-Netted

| » | Select "NON NETTED" from the Type field, and click .... It creates a sub-contract of the margin call contract with subtype "Independent Amount" - In the sub-contract, define the independent amount as described for "Netted Independent Amount" - It can be manual or computed from a fee grid. The independent amount contract can be subject to Threshold, Minimum Transfer Amount, and Rounding conventions as needed. |

Fee Grid Definition (Optional)

You can click Add to define the Fee Grid with the following attributes:

| • | MARGIN_CALL_CONTRACT_ID = Contract id that uses the fee grid. |

| • | MARGIN_CALL_PAYER_ROLE = Role of the independent amount payer: ProcessingOrg or CounterParty. |

| • | MARGIN_CALL_AUTO_RECALCULATE = True to recalculate the margin call when the fee is modified at the trade level, or false otherwise. |

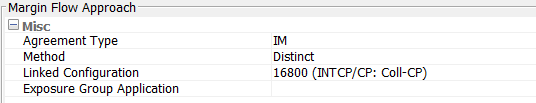

Calypso’s Margin Flow Approach is used for managing Reg IM and IA together. Possible Agreement Types are VM, Netted (VM +IA), IM NR (Non-netted IA) and IM.

There are three methodologies for this: Distinct, Greater and Allocated.

| • | Distinct |

| • | Greater Of: All Agreement Types can be used. If IM is set up as an Exposure Group, select and Exposure Group Application. For VM, no linking is required. |

| • | Allocated: All Agreement Types can be used. For VM, no linking is required |

The Threshold Application field in the Parties panel of the contract is used with the Margin Flow Approach. It should be set to IA Only for netted VM and IA contracts and for non-netted IA. It should be set to MTM + IA for IM and non-netted VM contracts.

Collateral Manager fields

Collateral Manager fields that correspond to these configurations are:

| • | IA Post Threshold - IA–Threshold. |

| • | MFTA - Margin Flow Transfer Amount |

| – | Greater: |

VM&IA or IA contract = greater of the Margin Required and the IMIA offset

IM contract: If Abs(MFTA of IA) > Margin Required of IM contract then = -MFTA of Netted VM&IA contract + Required Margin IM contract; otherwise it is 0

| – | Allocated / VM&IA or IA contract: |

If Margin Required of IM contract < IA post threshold of IA contract, -Margin Required of IM contract

If Margin Required of IM contract > IA post threshold of IA contract, -IA Threshold of IA contract

| • | Revised IA - on VM&IA or IA contracts, this is IA post Threshold + MFTA |

| • | Margin Required Post MFA - on VM&IA or IA contracts = Margin Required + MFTA |

The table below describes this is as well.

|

|

Mcc Type |

IA Post Threshold |

MFTA |

Revised IA |

Margin Required Post MFA |

|---|---|---|---|---|---|

|

Greater |

IA |

IA Threshold |

–IA post Theshold |

IA post Threshold + MFTA |

Margin Required + MFTA |

| IM | N/A |

If abs value of MFTA VM&IA contract > Margin Required of IM contract, then =–MFTA of VM&IA contract + Required Margin IM contract Otherwise, 0 |

N/A | Margin Required + MFTA | |

|

Allocated |

IM |

N/A |

N/A |

N/A |

N/A |

| IA |

IA –Threshold |

If Margin Required of IM contract < IA post threshold of IA contract, then =–Margin Required of IM contract If Margin Required of IM contract > IA post threshold of I A contract, then =– IA Threshold of IA contract |

IA post Threshold + MFTA |

Margin Required + MFTA |

The following additional Collateral Manager fields are not Margin Flow specific but are affected by its implementation:

| • | Trade Margin - IA post Threshold + MTM |

| • | Constituted Margin - refers to new Margin Required (MFA)– Total Previous Margin |

| • | Return / New Margin - To determine the return and new margin and their rounded values, the Margin Required post MFTA is compared with the Previous Margin |

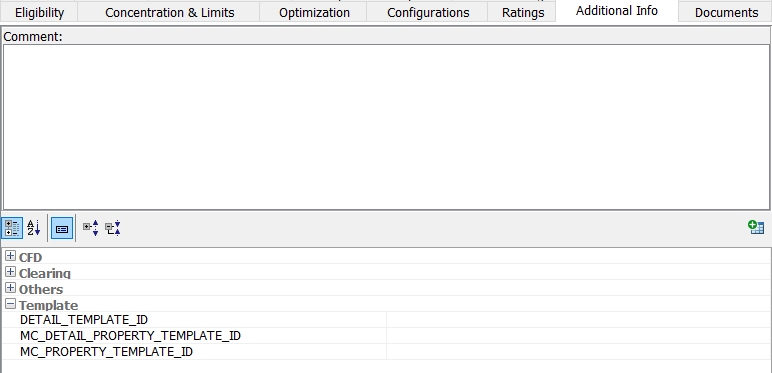

3.7 Additional Info

You can select the Additional Info panel to enter a comment for the contract and to set margin call contract attributes (fields).

Out-of-the-box attributes are described below.

By default the attributes are associated with a category: CFD, Template or Others.

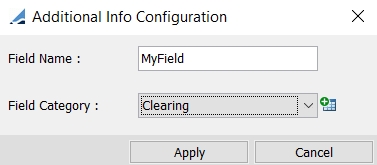

You can create new fields and new categories by clicking  .

.

| » | Enter a field name. |

| » | Click  to add a new category and select the new category. to add a new category and select the new category. |

| » | Click Apply when you are done. |

Fields are added to the domain "mccAdditionalField".

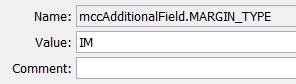

The available values of a given field can be defined in the domain "mccAdditionalField.<field>".

Example: Domain "mccAdditionalField.MARGIN_TYPE" contains available values for the field MARGIN_TYPE.

If such domain does not exist, the field is a free text field.

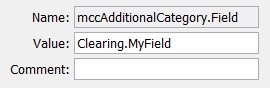

Categories are added to the domain "mccAdditionalCategory".

Mapping between new fields and new categories is added to the domain "mccAdditionalCategory.Field" in the form:

Value = <category>.<field>

Example:

If you want to move an existing field to a different category, you need to add it to the domain "mccAdditionalCategory.Field".

Example:

Value = Clearing.CCP will move the field CCP from the Others category to the Clearing Category.

Out-of-the-box Attributes (Fields)

|

Fields |

Description |

|---|---|

|

CFD |

|

|

BOTH_MARGIN |

For CFD margin call contracts, if this is true with a negative variation margin (VM), NB will be negative. If this is false, with negative VM, NB will only show deposit annex (initial margin) with positive VM, NB will be positive. |

|

NO_MARGIN |

For CFD margin call contracts, if this is true, NB will show only the deposit annex (initial margin). If this is false and the variation margin is negative, NB will show only the deposit annex (initial margin). If the variation margin is positive, NB will be positive. |

|

RST |

For CFD margin call contracts. In this field, define the legal entity (short name) that the provider will pay the dividend to if the provider has a long position. |

|

Template |

|

|

DETAIL_TEMPLATE_ID |

Contains the ID of the default template to load the Margin Call Details report - It is automatically set, when you choose Report > Link Template to Contract in the Margin Call Details report. |

|

MC_DETAIL_PROPERTY_TEMPLATE_ID |

Contains the ID of the default template to load the Margin Call Property template. |

|

MC_PROPERTY_TEMPLATE_ID |

Contains the ID of the default template to load the Margin Call Details Property template. |

|

Others |

|

|

ACCOUNT_NAME |

Account name |

|

ALWAYS_ROUND_RETURN_MARGIN |

This must be set to True to perform rounding on a returned margin call. When this is set, the returned margin will be rounded to UP or DOWN as per the Rounding setup on the contract. |

|

CCP |

These attributes are related to the Clearing module. Refer to the Clearing documentation for more information. |

|

CCP_ORIGIN_CODE |

|

|

CCP_REFERENCE |

|

|

CCP_SEGREGATION_ACCOUNT |

|

|

CLIENT_TRANSFERS |

This setting decides if client transfers will impact the margin call position for that contract. The values can be: • Exclude (client transfers will be excluded from the Margin Call position except for Interest Bearing trades) • Include as Client (client transfers will be included in the Margin Call position as a Client position) • Include as Internal (client transfers will be included in the Margin Call position as an Internal position) The default is Include as Client |

|

CVA_COLLATERAL_POLICY |

This field selects the Collateral Policy used to assign a risky curve for calculation of proxied CVA pricer measure. |

| DISPUTE_COMMENT_MANDATORY |

True if a dispute comment is mandatory when resolving a dispute. Default is false. |

|

EXCLUDE_ACCOUNT_FROM_INTERACOUNTXFER |

Domain name used to exclude a Margin Call contract from the Inter Account Transfer. |

|

EXCLUDE_REPO_INTEREST |

Set this to True to exclude interest on Repo trades from the margin calculation. Set to False if the Repo interest is to be included. Default is False. |

|

EXCLUDE_SECLENDING_INTEREST |

Select true to exclude interest on the SecLending trade from the margin calculation. Select false if you would like the SecLending interest to be included. Default is false. |

|

HAIRCUT_ON_CLEAN_PRICE |

When set to Yes, the haircut will be applied on the clean price instead of the dirty price. The default, or value for no entry is No. |

|

IGNORE_ALLOW_EX_DIVIDEND |

When this is set to True, the ALLOW_EX_DIVIDEND pricing parameter is ignored. This is used when a GILT bond falls under the ex-dividend period. |

|

IM_IMPORT_CURRENCY |

Governs how margin numbers are imported, either in their requirement currency or the native currency. |

|

INCLUDED_VM_FLOWS |

Comma separated list of transfer types explicit to this Margin Call contract. If the list is empty, the contract will accept any transfer not listed on another of this LE's VM Margin Call contract. |

|

INCLUDE_CLIENT_TRANSFERS |

If set to true, Client Transfers will be included in the Margin Call position for the contract. |

|

INTEREST_DAILY_ROUNDING |

When set to true, daily interest amounts are rounded then summed. When not set, un-rounded daily interest is summed and then the total is rounded. This only applies to margin call calculation and not to interest bearing. |

|

INTEREST_DATERULEONLY |

Select true for interest to be computed based only on frequency of the date rule attached to the margin call contract regardless of positive or negative MTM moves. Select false for interest to be computed based on frequency UNLESS there is a switch in the MTM move. |

|

IS_SETTLE_DATE_ACCRUAL_CALC |

When set to true, the accrual of previous positions is not affected (shown in the Netted Positions panel), but the accrual will change in the Allocation panel (in Collateral Manager). Both the bond settle offset days and the contract settle offset will be considered. The calculation is val date + maximum (settle date offset of contract OR settle date offset of bond). The default setting is false or left blank. |

|

MARGIN_TYPE |

|

|

NOTIFY_ON_CLAIM |

|

|

PRODUCT_TYPE |

|

|

RECON_INTEGRATION |

Used to define integration type for reconciliation on margin call entries. This includes reconciliation of bilateral and cleared VM flows. FCM and internally calculated VM flows are shown in Collateral Manager to cross verify the final call amount. The choices for this field are Collateral-Bilaterial-VM, Collateral-Cleared-VM-ETD or Collateral-Cleared-VM-OTC. Based on the selected integration type, the system looks for the Recon.Integration.<integration type> domain to get the mandatory fields. Ⓘ NOTE: The Reconciliation panel is visible after you set Value = true for the domain value "UseCollateralManagerReconciliation" - its default value is set as false.

|

|

Reinvest Coupon |

Used for Corporate Action management. If set to true, then an additional Corporate Action trade counterparty linked to the margin call contract will be created to impact the margin call position. |

|

Reinvest Principal |

This works similarly to Reinvest Coupon except it is for a redemption event in order to reinvest the principal. |

|

RISK_CCY |

If a currency is present in this field, the FX haircut will be based on the static data filter or static data filter tree. The static data filter or static data filter tree can contain cash and securities. |

|

SLM |

Stress Loss Margin When set to True, SLM PL measure (PL type as None) will be considered in calculation. When set to False, SLM PL measure is not considered. Note: The Collateral.Multiplier domain must contain the value of Buffer for the SLM attribute to work properly. |

|

SEND_STATEMENT |

|

|

SEPARATE_VM_SETTLEMENT |

A value of True designates this Margin Call contract as contributing to the Separate Settlements section of the Client statement. Any other value will associate the Margin Call contract with the Financial Summary section. |

|

SET_DEFAULT_BOOK |

|

|

SFTR_REPORTING |

Set to true if the contract is eligible for SFTR reporting. Refer to Calypso SFTR documentation for details on Securities Financing Transaction Regulation. |

|

SLM |

This attribute is used for Stress Loss Margin. The options are:

NOTE: The Collateral.Multiplier domain must contain the value of Buffer for the SLM attribute to work properly. |

|

USE_RECONCILIATION |

Select true if Reconciliation should be used on the contract. |

|

USE_RAW_PRICE |

This attribute allows collateral valuation to be defined using the raw quote price. Set to False by default. |

|

CVD_ROUNDING_DECIMAL |

The amount set in this field is used to round all values in the Cover Distribution calculation. If the field is left blank, the rounding is done based on the Currency definition. |

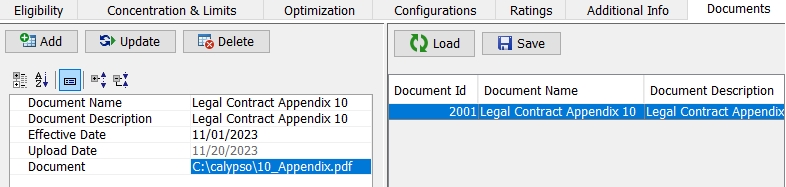

3.8 Documents

You can add documents to the margin call contract from the Documents panel.

Displaying Existing Documents

You can click Load on the right-hand side to load existing documents associated with the margin call contract.

You can double-click the document to open it.

Adding Documents

To add a document to the margin call contract, enter a document name, description and effective date then select the document from the Document field. Then click Add.

The document is added to the right-hand side.

Click Save to save the document. The document is saved to <user home>/AppData/Local/Temp.

You can double-click the document to open it.

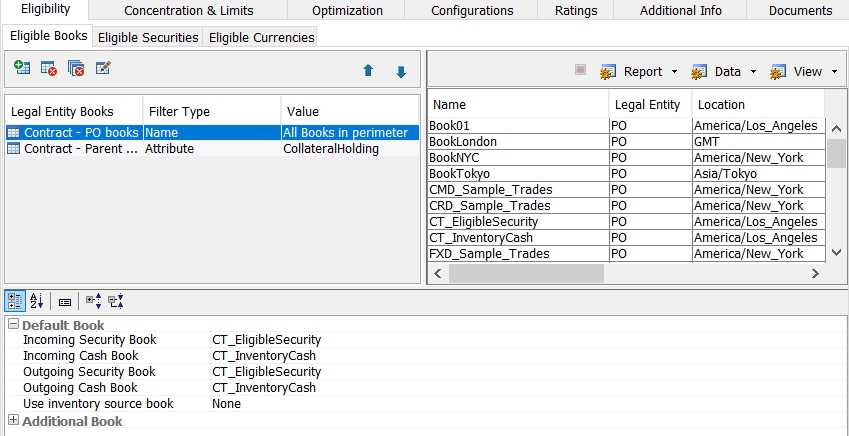

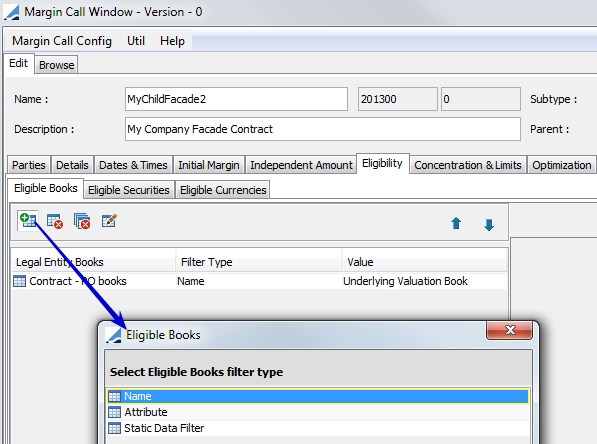

3.9 Eligibility

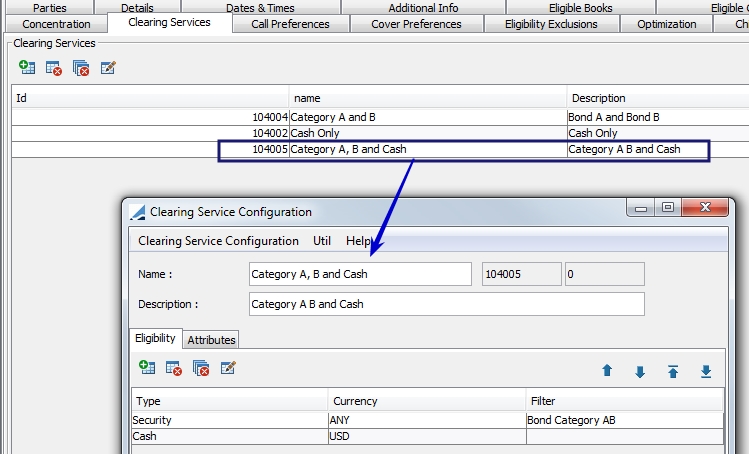

The Eligibility panel contains:

| • | Eligible Books - Select the books eligible for allocation |

| • | Eligible Securities - Select the securities available as collateral |

| • | Eligible Currencies - Mandatory for Cash margins. At least one deliverable currency must be defined |

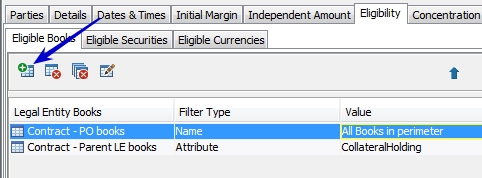

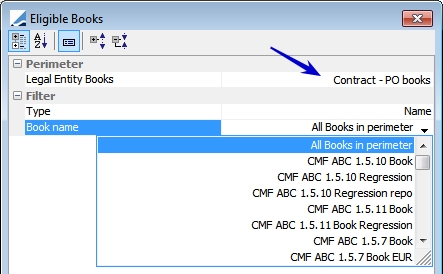

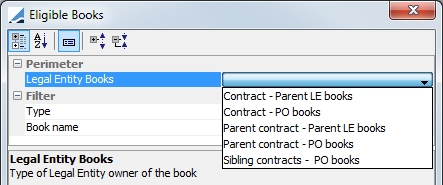

In the Eligible Books panel, the books eligible for allocation are defined. This is also where the default book is defined.

Defining books in this panel is a two step process. The first step requires you to designate which of the following books are eligible for allocation. The selection options are:

| • | Contract - PO books: Books belonging to the PO of the margin call contract |

| • | Contract - Parent LE books: Books belonging to the parent legal entity of the contract |

| • | Parent contract - PO books: Books belonging to the PO of the parent contract |

| • | Parent contract - Parent LE books: Books belonging to the parent legal entity of the parent contract |

| • | Sibling contracts - PO books: Books belonging to the PO of other children margin call contracts |

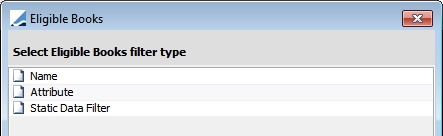

Step 1 - Click  to add Legal Entity Books.

to add Legal Entity Books.

Step 2 - You may filter the eligible books by Name, Attribute or Static Data Filter or Static Data Filter Tree.

Step 3 - Choose the perimeter for the books in the Legal Entity Books field. The various perimeters are detailed above.

For type name, you may select all eligible books in the perimeter.

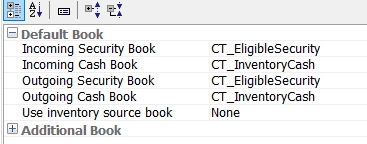

Step 4 - Specify the default book for Incoming Security, Incoming Cash, Outgoing Security and Outgoing Cash. It is also possible to designate that the inventory source book be used for cash, securities, both or not at all. A designation in this field overrides the default book selections.

Only books that belong to the PO (or one of its parents), and have the attribute CollateralHolding set to True, are available for selection.

(LE_HOLDING_BOOK) is not used.

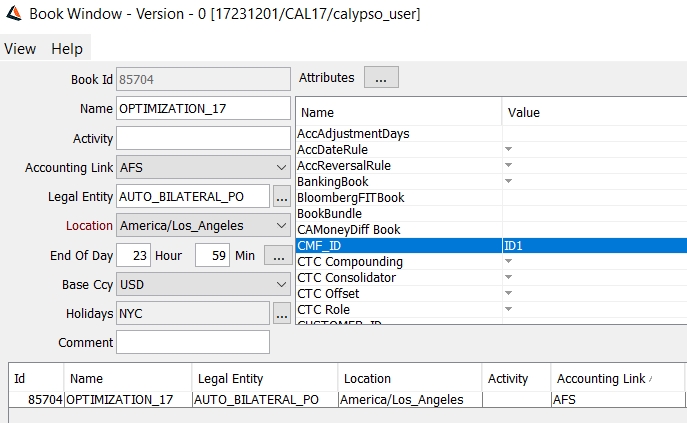

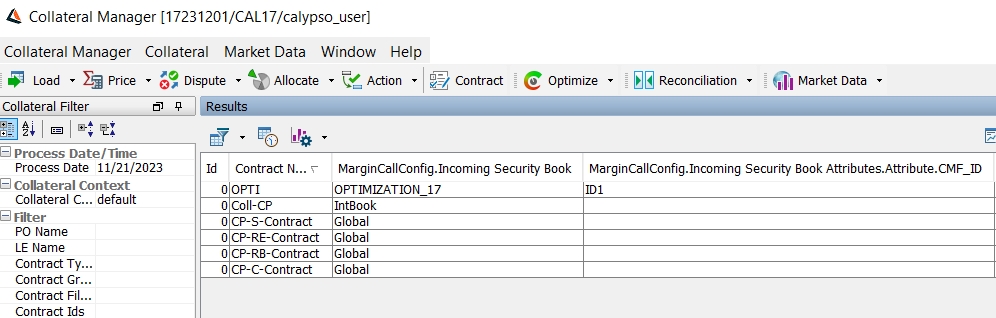

Eligible Book Attributes

Attributes chosen in the Book window of an eligible book can be added as columns in Collateral Manager and Collateral reports and notifications.

Book Attribute setting in Book Window

| • | Eligible Book attribute CMF_ID set as ID1 |

Column display in Collateral Manager Results

| • | Column MarginCallConfig.Incoming Security Book Attributes.Attribute.CMF_ID shows ID1. |

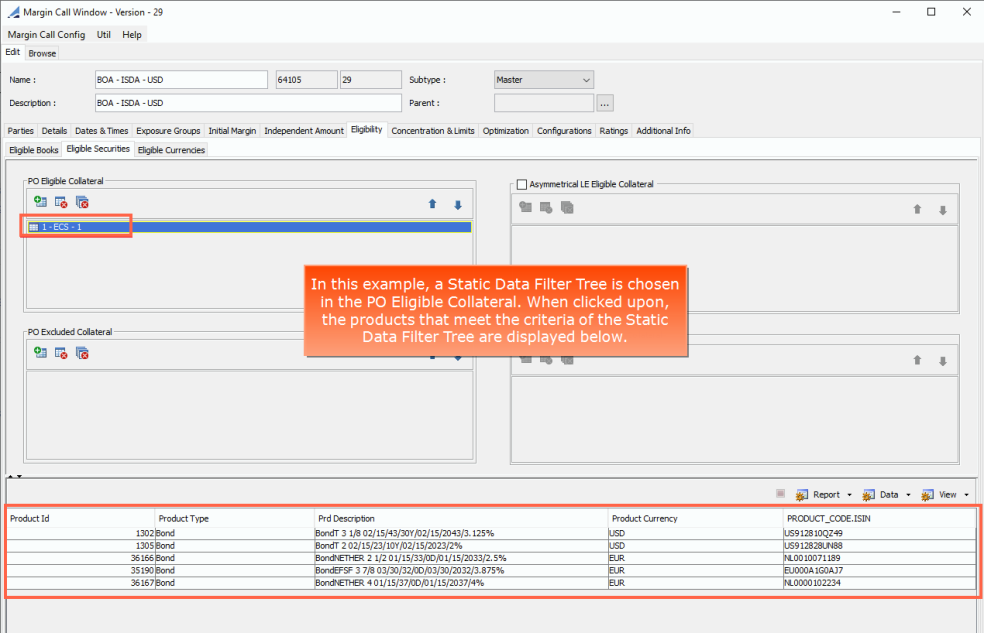

For security margins, select the securities available as collateral.

In order to specify eligible securities to use for collateral, you must have a static data filter or static data filter tree set up that covers all of the eligible securities that you would like to use for collateral. The Static Data Filter window is available through Configurations > Filters > Static Data Filter.

To view the Static Data Filter Tree window, in the Calypso Navigator, add a menu item for the Static Data Filter Tree window (menu action refdata.StaticDataFilterTreeWindow).

The static data filter must have a Product Type defined. If using a static data filter tree, the root static data filter must include Product Type in its criteria.

See Static Data Filter for information on creating Static Data Filters and Static Data Filter Trees.

See Static Data Filter for information on creating Static Data Filters and Static Data Filter Trees.

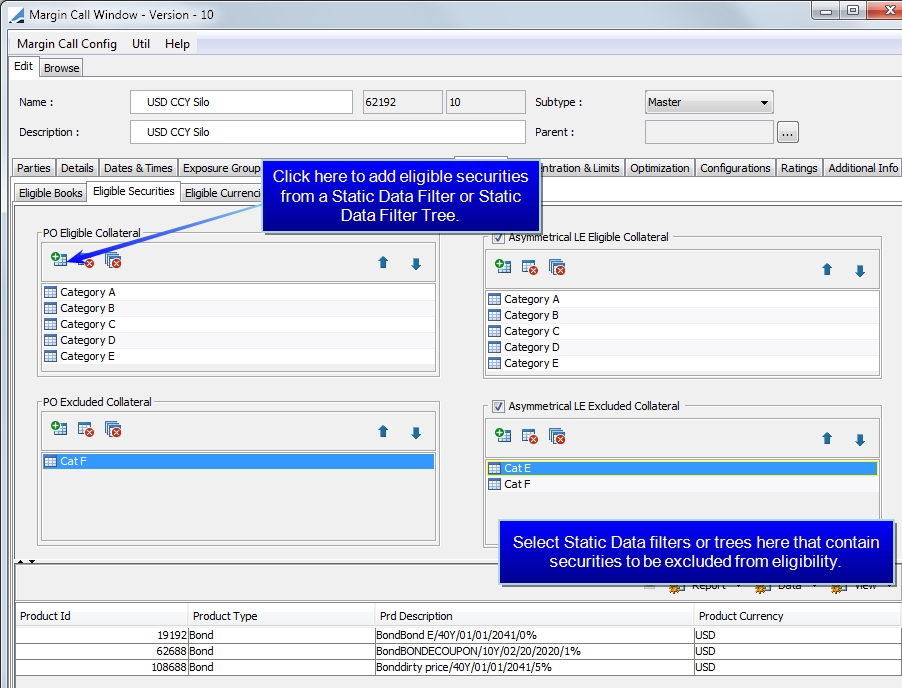

It is possible to flag the PO and LE to share the same Eligible Securities or to enable each to have their own list of Eligible Securities. For the PO and LE to have their own sets of securities, select the Asymmetrical LE Eligible Collateral flag and/or Asymmetrical LE Excluded Collateral flag.

Static Data Filter Tree chosen in PO Eligible Collateral

| » | It is possible to exclude products from eligibility using a static data filter or static data filter tree in the Excluded Collateral section. This exclusion overrides whatever is defined as eligible collateral above. For example, you may have a filter containing government bonds but wish to exclude bonds from certain countries. |

| » | Additionally, an Exclusions column can be added to the Allocation window. A hard warning can be configured for this exclusion functionality using the EnforceCollateralEligibilityHardWarning access permission. |

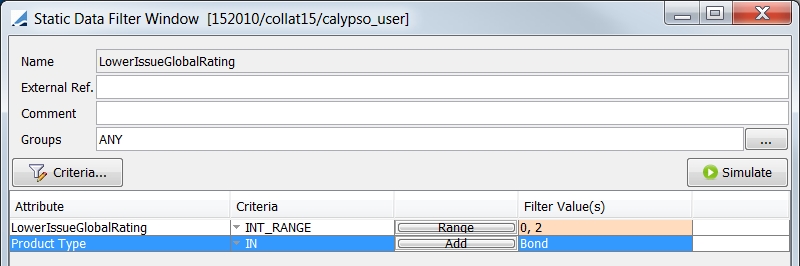

| » | There are three static data filters that can be used to improve filtering based on rating agencies. For the filters to work, the rating acceptance criteria must be the same for all agencies. For example, securities are eligible if rated at least AA- by S&P or Aa3 by Moody’s. These static data filters can then be used in the Margin Call Contract > Eligibility > Eligible Securities definition. The filters are found in the Static Data Filter window under Product > Rating > Global Rating. |

| – | LowerIssueGlobalRating: Ratings must be within the range defined. If both ratings are provided, the lowest rating will be used. If a rating is missing or an ‘ignored value’, the available rating is used. |

| – | LowerIssuerGlobalRating: Ratings must be within the range defined. If both ratings are provided, the lowest rating will be used. If a rating is missing or an ‘ignored value’, the available rating is used. |

| – | LowerIssueThenIssuerGlobalRating: The system first refers to the issue rating. If the issue rating is within the range defined, it is accepted. If both are provided, the system refers to the lower rating. If only one is provided, the available rating is used |

The system only refers to the issuer rating if there is no issue rating or there is an ‘ignored rating’. When referring to the issuer, the rating must be within the range defined for the filter to be accepted. If both are provided, the system refers to the lower rating. If only one is provided, the available rating is used.

In this case, the contract accepts bonds with a Global Rating Valule of 0, 1 or 2 and the system accepts the lowest rating.

Ⓘ NOTE: When selecting a static data filter for a security, the filter should be associated with the group ANY or Margin Call.

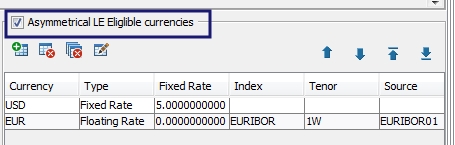

It is possible to flag the PO and LE to share the same Eligible Currencies or to enable each to have their own list of Eligible Currencies. For the PO and LE to have their own sets of currencies, select the Asymmetrical LE Eligible currencies flag.

Ⓘ [NOTE: For cash margins, you MUST define at least one Eligible Currency]

|

Fields |

Description |

|

Contract Currency |

|

|

Base Currency |

Select the default currency for margin calls. |

|

Collateral Policy |

The Collateral Policy is not used in the valuation of margin call contracts. It is used when pricing trades associated with a margin call contract for selecting the appropriate discount curve. Collateral policies are defined in the domain CollateralPolicy. Select a policy as needed. In the Pricer Configuration, curves can be defined by collateral policy. Please refer to Calypso Collateral Pricing documentation for details. |

|

Settlement Cut-Off |

Defines the time frame (when compared to currency Settlement Cut-Off time) within which a warning should appear when the user is saving a margin call trade with that currency. Set time in minutes. To allow for the Trade Date and Settlement date to be the same date, set this to zero. |

|

Minimum Repay Threshold (Cover Distribution) |

This threshold is used in conjunction with the Auto Repayment flag on the Eligible Currency Definition window. This threshold value is expressed in the contract currency and each currency balance is converted to the contract currency and compared against this threshold when determining if Auto Repayment is to be executed. This is used only for final distributions in Cover Distribution. |

|

Interest |

|

|

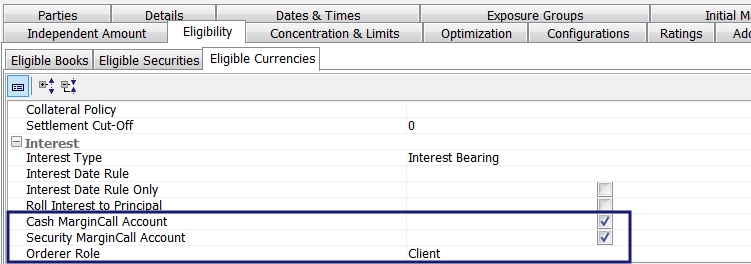

Interest Type |

Define the Interest Payment Type |

|

Interest Date Rule |

If the interest is to be calculated on a regular basis, click ... to select a date rule. Date rules are defined using Configuration > Definitions > Date Rule Definitions. |

|

Interest Date Rule Only |

Select if you want the interest to be compounded only based on the frequency defined above. De-select if you want to compute interest based on frequency , unless there is a switch of sign in the mark to market move. |

| Roll Interest to Principal |

Check to roll the interest into the margin call position. It creates a position of class Margin_Call and type Rolled_Interest for the computed interest. This Rolled_Interest position is added to the computation of the exposure on the following day. Note: To see rolled interest reflected on Netted Positions and Global Required Margin, add the value ROLLED_INTEREST to the flowType domain. |

|

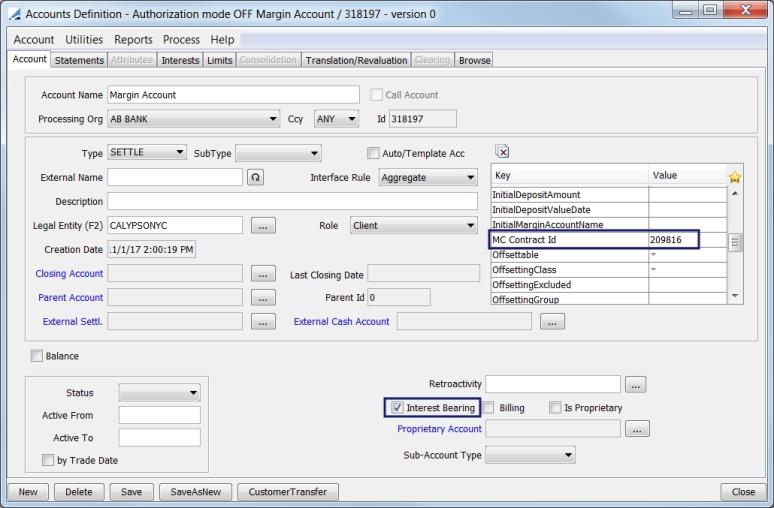

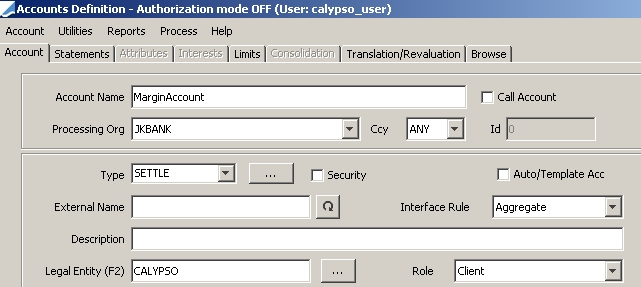

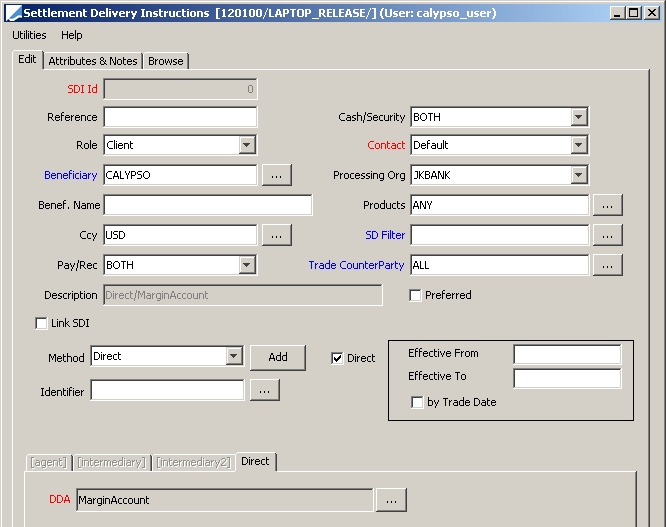

Cash Margin Call Account |

If you select this checkbox and Orderer Role = Client, the Cash margin call will also be generated to a dedicated account, allowing separate interest payments.

|

|

Security Margin Call Account |

If you select Cash Margin Call Account, and Orderer Role = Client, the Security margin call will also be generated to a dedicated account, allowing separate interest payments. This setting should NOT be selected if using MT569 import method to generate margin calls.

|

|

Orderer Role |

This is used to set the role (client or customer) of the legal entity in the case of Cash Margin Call Account and/or Security Margin Call Account is selected. |

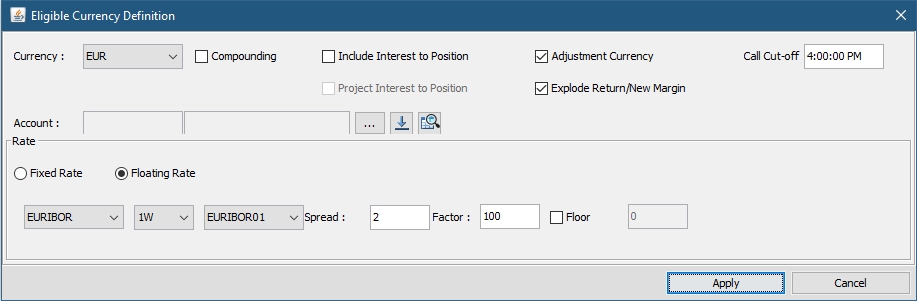

To add a deliverable currency, select  in the Eligible Currencies portion at the bottom of the window to display the Eligible Currency Definition window.

in the Eligible Currencies portion at the bottom of the window to display the Eligible Currency Definition window.

Select the desired information and click Apply. The fields of this window are described below.

Repeat as needed for other deliverable currencies. They will be available for selection when computing margin calls.

NOTE: To modify a deliverable currency, select a currency, and either double-click on the row or click  . Modify the fields appropriately and click Apply.

. Modify the fields appropriately and click Apply.

|

Fields |

Description |

|||||||||

|

Currency |

Select a deliverable currency, and specify how the interest on margin calls in this currency will be calculated. It is mandatory to specify at least one deliverable currency. Note that it is optional to specify how interest on margin calls is computed, in particular if you want to pay the interest separately from the margin calls.

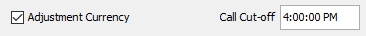

Compounding Check the “Compounding” checkbox to compound the interest. Include Interest to Position Check the “Include Interest to Position” checkbox to include the interest on cash margins in the Margin Call position. Interest is computed on the Actual position. Project Interest to Position This only applies if “Include Interest to Position” is checked. In this case, the interest added to the position is computed on the Theoretical position rather than the Actual position. Adjustment Currency When checked, the margin calls are calculated in the corresponding currency by default. If it is not checked for any currency, the margin calls have to be created manually using Margin Call > Allocation in the Margin Call Manager. When an Adjustment Currency is specified, the Cash Margin column will populate in the Margin Call Manager with the adjusted currency amount. You must also be sure that the AutoAdjust workflow rule is assigned to the appropriate workflow action. Example: PRICED_PAY - AGREE_EXPOSURE - EXPOSURE_AGREED Both the workflow rule and the "Adjustment Currency" checkbox are necessary for the currency amount to be adjusted automatically. Call Cut-off The Call Cut-off field is available only if the Adjustment Currency checkbox is checked. A cutoff time should be entered.

The cutoff is applied to the adjustment currency. Because multiple currencies can be flagged as an Adjustment Currency, the currencies are allocated based on the order in which they are defined in the Eligible Currencies panel and whether the first currency in the list has a holiday. If the first currency in the list has a holiday, a call is generated with the next currency in the list. If only one currency in the list has a holiday, a call is generated with the next currency in the list. If only one currency is an Adjustment Currency and it has a holiday, the margin call is generated on the next business day. If a currency has Adjustment Currency selected but no cutoff time, it is only considered for a holiday scenario. For example: GBP ccy, adjustment ccy - YES, cutoff time 4pm EUR ccy, adjustment ccy - YES, cutoff time 6pm USD ccy, adjustment ccy - YES, cutoff time 5pm JPY ccy, adjusment ccy - YES, cutoff time NULL

If it is before 4pm, GBP is used. If it is after 4pm but before 5pm, USD is used. If it is after 5pm but before 6pm, EUR is used. If it after 6pm, a call is generated in GBP for tomorrow unless tomorrow is a holiday for GBP. If that is the case, it is generated in EUR because it is the second currency in the list. JPY would not be considered at all since it has no time. However, it would be considered if the first 3 currencies were on holiday. Explode Return/New Margin Provides the ability to explode the New Margin and Return Margin into two different allocations. If set to true, the system generates allocations as described below. This checkbox is available only if the Adjustment Currency checkbox is selected. The following behavior is for no dispute, dispute/partially agreed or fully disputed/resolved by PO:

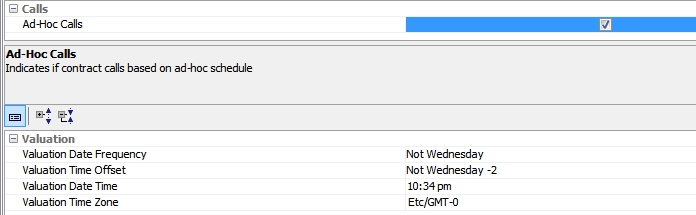

There are three workflows used to accommodate the three auto adjust options. These workflows should use a full STP workflow. When using these workflows rules, there is no need to open the Allocation window. The Margin Call entry goes through the workflow transition anatomically. The workflow rules are: AutoAdjust, AutoReturn and AutoReturnAndAdjust. These rules should be added to a transitions such as: EXPOSURE_AGREED - ALLOCATE - ALLOCATED ALLOCATED - VALIDATE - VALIDATED Ⓘ NOTE: Currently, the Auto Adjustment feature is not available for dispute cases. This functionality will be available in a future release. Auto Repayment This feature is available for Clearing Member Configuration. Select this option to repay excess cash collateral in the deposit contract for any deposit currency which is above the Minimum Repay Threshold. This is applicable for Final Distribution only. Fixed Rate Select the Fixed Rate radio button and enter a rate for the currency that will be used to calculate interest on the margin calls.

Floating Rate

For a Floating Rate, select the radio button and choose the reference index, tenor, and source. Enter the spread and factor if needed. |

3.10 Concentration & Limits

This panel allows you to add Concentration Rules to the Margin Call or Clearing Member Contract.

See Concentration Limits and Margin Call Contracts for detailed information on entering information here.

See Concentration Limits and Margin Call Contracts for detailed information on entering information here.

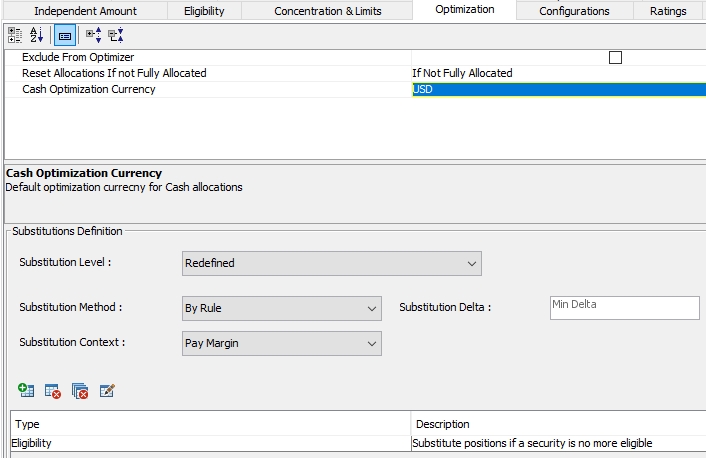

3.11 Optimization

The Optimization panel allows you to designate certain functions related to the optimization of collateral, which is done in the Collateral Manager.

| Fields | Description | ||||||

|---|---|---|---|---|---|---|---|

| Exclude From Optimizer | Select this check box to exclude the contract from optimization. | ||||||

|

Reset Allocations If Not Fully Allocated |

This defines whether the optimizer can partially allocate margin call contracts or not. It affects contracts that accept SECURITY only. This may also be set as an Optimization Constraint. The options are:

|

||||||

|

Cash Optimization Currency |

When gathering a list of eligible assets for a contract, when fetching eligible cash, the system checks whether an optimization currency is defined. If there is, then the optimizer behaves as if this is the only eligible currency so that it will use this currency over another currency with a lower weight in the Target configuration when there is no non-cash collateral available, or as the adjustment currency when filling the remaining margin. The currencies listed are the LE eligible currencies. |

||||||

|

Substitution Level |

Select the level of substitution desired for this contract. You may choose to either inherit the substitution method from the Optimization configuration, or define a method to be used specifically for this contract. |

||||||

|

Substitution Method |

When Redefined is selected as the Substitution Level, this drop-down box is displayed. You may select either Never, By Rule or Always. Refer to optimization substitution for more information. When By Rule is selected, designate the rule or rules in the area at the bottom of the window. | ||||||