Concentration & Limits

Concentration risk arises when significant amounts of the same securities are taken as collateral with the unintended effect that the institution finds itself relying on that collateral too much. Concentration risk can also arise with sectors, currencies, maturities and even with custodians, if too much collateral is being held in one location.

In order to reduce this risk, Concentration Limits are defined. They are meant to protect against the effect of a collapse in the instrument's price and avoid a prolonged sale of the collateral. Collateral concentration limit is the limit of collateral, in nominal amount and /or percentage, that can be provided according to a set of parameters. Defining concentration limits enables the reduction of risk by limiting the exposure to a particular issuer, for example. Concentration limits can also be applied to currencies, security ratings, countries or other criteria.

Below is a description of what concentration limits are and how they work within the Calypso Collateral Management module.

The following set up requirements are needed to use the concentration limit functionality:

| • | Static Data Filters |

| • | Concentration Rules |

| • | Margin Call / Clearing Member Contract |

1. Static Data Filter Setup

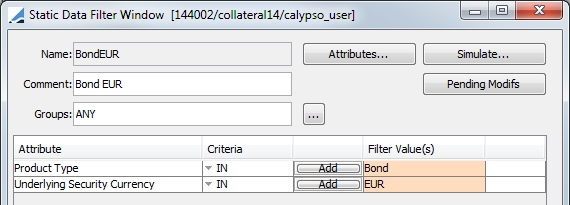

You must define static data filters that cover all of the eligible security collateral. The Static Data Filter window is accessed through Configuration > Filters > Static Data Filter.

The number of filters that are set up vary depending upon your concentration limits. Below is an example of one static data filter used in the examples, a filter that covers all product type bonds with currency type of EUR.

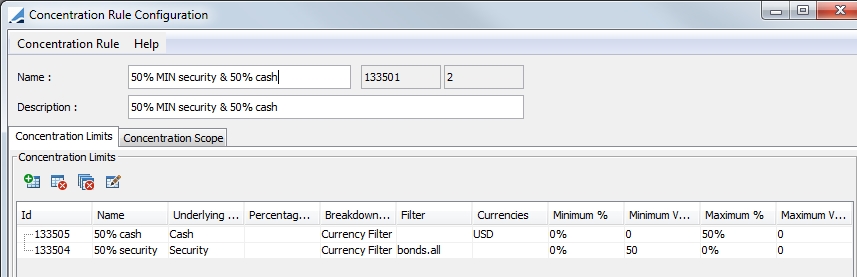

2. Concentration Rules

The Concentration Rule Configuration window is available through Configuration > Fees, Haircut and Margin Calls > Margin Call Concentration. If this window is unavailable in this menu, you may add it through the Main Entry Customizer ( Utilities > Main Entry Customizer) refdata.concentration.ConcentrationRuleWindow

A concentration rule is a group of concentration limits. In Calypso, you can define three types of concentration limit:

| • | Category - defines how much or how little (in percentage or value) of a certain category is allowed in the allocation. The calculation is based on the "Total Collateral" Value. |

Limit % = Category Collateral Value / Total Collateral Value

| • | Issuer - defines how much, in percentages, of the allocation can come from the same issuer. The calculation is based on the Category Collateral Value. |

| • | Issue - defines how much, in percentages, of a same issuance (bond or equity) can be sued for the collateral allocation. The calculation is based on the product definition. |

Each concentration rule has a type (Category, Issue and Issuer). It is not possible to have different types in the same concentration rule.

2.1 Concentration Limits

Click  to add a new limit rule.

to add a new limit rule.

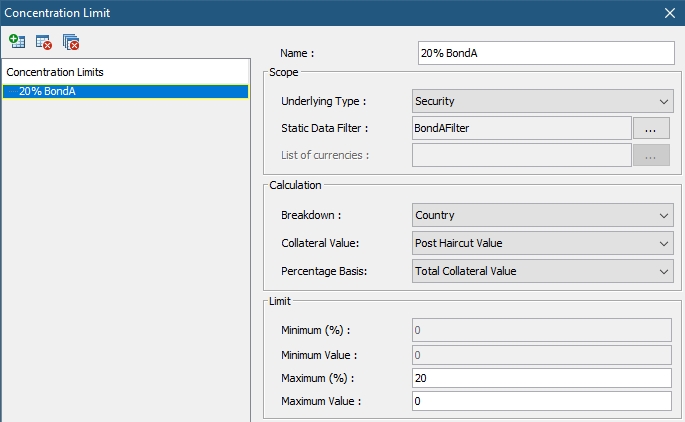

The fields and configuration options of the Concentration Limit Rule window are described below.

|

Fields |

Description |

|---|---|

|

Scope |

|

|

Underlying Type |

The Underlying Type can be either Cash or Security |

|

Static Data Filter |

If Security is selected as the Underlying Type, select the static data filter to be used for the rule |

|

List of currencies |

If Cash is selected as the Underlying Type, select the currencies to be included in the rule |

|

Calculation |

|

|

Breakdown |

Specify how the calculation should be broken down, whether by issuer Country, Issuer, Ultimate Issuer (Issuer Group), Security, Product Code or have no breakdown at all. |

|

Collateral Value |

Option to compute the concentration limit using the pre-haircut or the post-haircut value (in contract currency) of each collateral asset allocated on the contract that is eligible for the concentration limit rule. |

|

Percentage Basis |

Choose from Total Collateral Value, Category Collateral Value, Total Issued, Net Asset Value, Margin Required or Average Daily Trading Volume (available only when Breakdown is Security).

|

|

Limit |

|

|

Minimum (%) |

The minimum for the concentration ratio, percentage under which it will not be accepted. |

|

Minimum (Value) |

The minimum amount the concentration limit can be in value. It is the value under which the limit will not be accepted. This is applicable for the Category rule type only. |

|

Maximum (%) |

The maximum for the concentration ratio. It is the percentage over which it will not be accepted. |

|

Maximum (Value) |

The maximum amount the concentration limit can be in value. It is the value over which the limit will not be accepted. |

To add a concentration limit row, click the  to display the Concentration Limit window.

to display the Concentration Limit window.

Cash concentration limits are considered when using the Allocation-Rule solver with concentration and/or substitution rule set. The Concentration Limit should be set with No Breakdown, Collateral Value = Pre-Haircut Value and Percentage Basis can be either Net Exposure Value or Category Collateral Value with the maximum based on a percentage or fixed value.

2.2 Percentage Basis Calculations

Category Collateral Value

This Percentage Basis is NOT required to meet regulatory requirements.

| • | Breakdown by Issuer - Usage (%) = Collateral Value of asset issued by the same issuer / Category Collateral Value |

Collateral Value of asset issued by the same issuer is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and issued by the same issuer.

Category Collateral Value is the dirty post-haircut value (Contract Value) of all assets eligible for the specified static data filter.

| • | Breakdown by Country - Usage (%) = Collateral Value of collateral asset issued by issuers from the same country / Category Collateral Value |

Collateral Value of asset issued by issuers from the same country is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and issued by issuers from the same country.

Category Collateral Value is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and eligible for the specified static data filter.

The collateral assets must be grouped by Issuers domiciled in the same country and be determined by the Country field in the product definition.

| • | Breakdown by Ultimate Issuer - Usage (%) = Collateral Value of the collateral asset issued by an ultimate issuer / Category Collateral Value |

The ultimate issuer is based on the product code ULTIMATE_ISSUER_ID.

Collateral Value of the collateral asset issued by an ultimate issuer is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and eligible for the specified static data filter.

Category Collateral Value is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and eligible for the specified static data filter.

Total Collateral Value

This Percentage Basis IS required to meet regulatory requirements.

| • | Breakdown by Issuer - Usage (%) = Collateral Value of assets issued by the same issuer / Total Collateral Value |

Collateral Value of assets issued by the same issuer is the dirty post-haircut value (Contract Value) of all assets held on the Margin Call contract and issued by the same issuer.

Total Collateral Value is the dirty post-haircut value (Contract Value) of all assets held on the margin call contract.

| • | Breakdown by Country - Usage (%) = Collateral Value of the collateral assets issued by issuers from the same country / Total Collateral Value |

Collateral Value of the collateral assets issued by issuers from the same country is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and issued by the issuers from the same country.

Total Collateral Value is the dirty post-haircut value (Contract Value) of all assets held on the Margin Call contract.

The collateral assets must be grouped by Issuers domiciled in the same country and be determined by the Country field in the product definition.

| • | Breakdown by Ultimate Issuer - Usage (%) = Collateral Value of collateral assets issued by an ultimate issuer / Total Collateral Value |

The ultimate issuer is based on the product code ULTIMATE_ISSUER_ID.

Collateral Value of the collateral asset issued by an ultimate issuer is the dirty post-haircut value (Contract Value) of all assets held by the Margin Call contract and issued by issuers belonging to the same group.

Total Collateral Value is the dirty post-haircut value (Contract Value) of all assets held on the Margin Call contract.

There are additional columns available in Collateral Manager to clarify the allocation process when the Percentage Basis is Total Collateral Value.

|

Column Name |

Calculation |

Description |

|---|---|---|

|

Total Collateral (Current) |

Total Prev Mrg + Cash Margin + Security Margin |

Total Collateral column at Margin Call Entry level |

|

Total Collateral (Projected) |

Total Prev Mrg + Global Required Margin |

Used as the denominator in the project concentration limit calculation |

|

Max Value (Current) |

Total Collateral (Current) × Maximum % of the concentration limit rule |

Maximum amount of collateral that can be added in the concentration limit bucket without breaching the limit. Concentration limit calculation based on the Total Collateral (Current) |

|

Max Value (Projected) |

Total Collateral (Projected) × Maximum % of the concentration limit rule |

Maximum projected amount of collateral that can be added in the concentration limit bucket without breaching the limit. Concentration limit calculation based on the Total Collateral (Projected) |

|

Usage(%) (Projected) |

Total Allocation ÷ Total Collateral (Projected) |

With current allocations and previous collateral, this column gives the Usage (%) in the concentration bucket, with the assumption that the contract is fully covered (Remaining Margin = 0). Concentration limit calculation based on the Total Collateral (Projected) |

|

Available (Total) (Projected) |

Total Allocation – Max Value (Projected) |

How much collateral can be added to the concentration limit bucket if the contract is fully covered (Remaining Margin = 0) |

|

Status (Projected) |

“In Limit” if Usage (%) (Projected) < Maximum % of the concentration limit rule. “Out of limit” if Usage (%) (Projected) > Maximum % of the concentration limit rule |

Status under the assumption that the contract is fully covered (Remaining Margin = 0). Concentration limit calculation is based on the Total Collateral (Projected) |

Total Issued

Usage(%) = Issue Nominal ÷ Total Issued

where Total Issued is the value stored in the Total Issued field specified in the product definition of the bond or equity.

Net Asset Value

Available for all Breakdown types

Usage(%) = Collateral Value of assets considering the concentration limit Scope and the breakdown / market quote (Fund.<Fund Name linked to the contract legal entity>.NAV * FX.<Fund currency to Contract Currency>)

Average Daily Trading Volume

Available only for Security Breakdown

The ADTV is the market data from the market data providers specific to a given asset. This should be stored in a specific market quote in Calypso <Product Name>.<Bond Name>.ADTV. For example:

Bond.<Bond Quote Name>.ADTV for bonds

Equity.<Equity Quote Name>.ADTV for equities

Usage(%) = quantity of the bond held on the position / Bond.<Bond Quote Name>.ADTV

Usage(%) = quantity of the equity held on the position / Equity.<Equity Quote Name>.ADTV

Total Net Balance

Computes the concentration limits based on the current Total Exposure Amount (Net Balance) of the contract. Available for all breakdowns.

For example:

Contract Total Exposure (Net Balance) = 1,000,000

French Bond allocated = 300,000 in value

Limit = BOND issued by French government should not exceed 40% of Total Exposure Amount

Limit = 300,000 / 1,000,000 = 30%

Status = In Limit

Margin Required

Computes the concentration limits based on the Margin Required of the contract.

Usage(%) = Cash allocated / Margin required

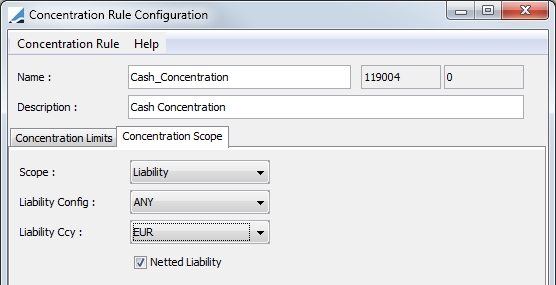

2.3 Concentration Scope

Concentration scope is used to determine what type of concentration rule configuration is used, either Contract or Liability. A Liability configuration is used for Cover Distribution. A Liability concentration can be defined at the liability group (across all liability currencies) or each liability currency within a liability group. The default Concentration Scope is Contract.

|

Fields |

Description |

|---|---|

|

Scope |

Select either Contract or Liability. Contract is the default selection. |

|

Liability Config |

If Liability is selected for the Scope, this field is made available for selection. You may select from any of the configured Liability Groups. The selection defaults to ANY. |

|

Liability Currency |

If Liability is selected for the Scope, this field is made available for selection. You may choose a specific liability currency for the concentration. The selection defaults to ANY. |

|

Netted Liability |

If Liability is selected for the Scope, this field is made available for selection. Selecting this includes liability offsetting which allows the use of positive liabilities to offset negative liabilities. This flag is used solely for concentration purposes. This is not affected by the Liability Offsetting rule in the Liability Group Configuration. |

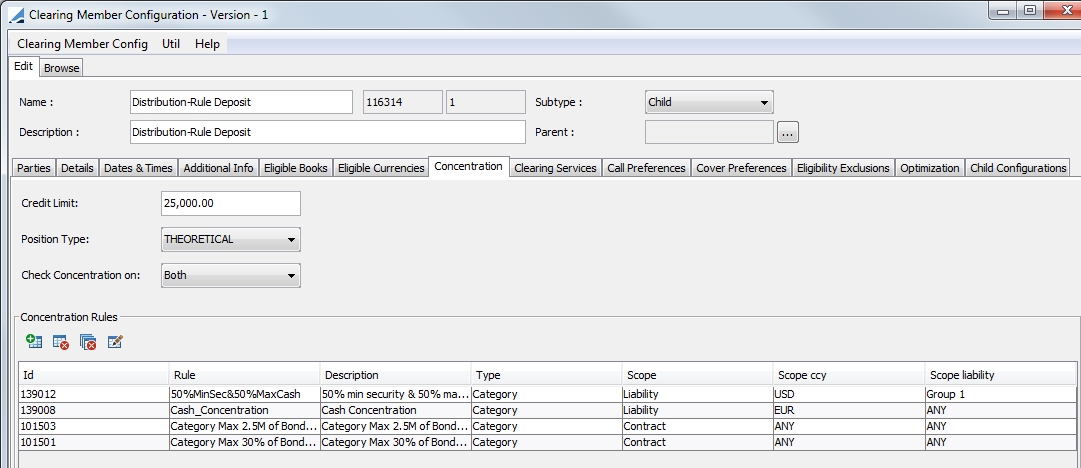

3. Concentration Limits and Margin Call / Clearing Member Contracts

After all of the concentration rules have been created, they can be added to the margin call or clearing member contract.

Once Concentration rules have been created for a contract, they will apply for each allocation on that contract.

|

Fields |

Description |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Credit Limit |

A credit limit may be specified for the counterparty. The credit limit is the amount that a client can borrow against the pledged securities. It is possible for the counterparty to pledge securities with a value above the limit but the value that exceeds the limit is not included in the total collateral value. The amount is in the contract currency and may vary from contract to contract. Additionally, there are certain columns that can be displayed in Collateral Manager pertaining to the Credit Limit. They are:

|

|||||||||||||||||||||||||||||||||

|

Position Type |

Select THEORETICAL or ACTUAL Defines which type of position you would like to use for your 'previous allocation'. |

|||||||||||||||||||||||||||||||||

|

Check Concentration On |

Select either Both, Outgoing or Incoming.

|

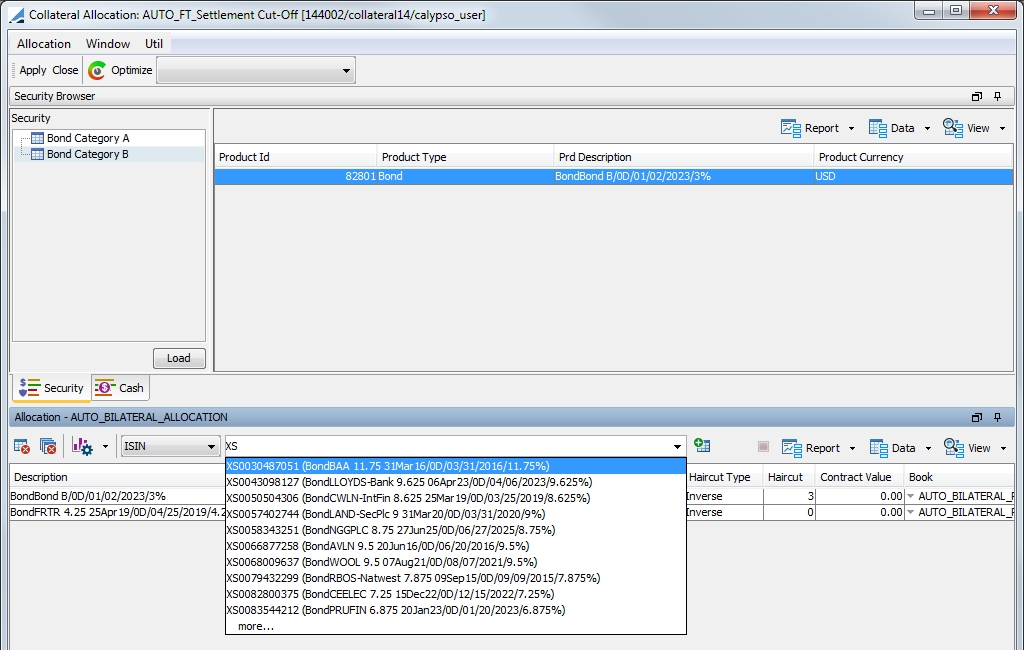

4. Concentration Limit Process

To do a manual allocation once the exposure has been calculated in the Collateral Manager, you can allocate it in the Allocation window.

There are two ways of allocating collateral:

| • | Select the collateral (Cash or Security) in the Security Browser section of the window, then double-click the collateral. It will then appear in the Allocation portion of the window below. |

| • | In the Allocation section of the window, select ISIN from the drop-down list. Either enter a list of ISIN codes of the securities or begin typing the first few letters of the code to view available securities in Calypso. Click  to insert the securities. to insert the securities. |

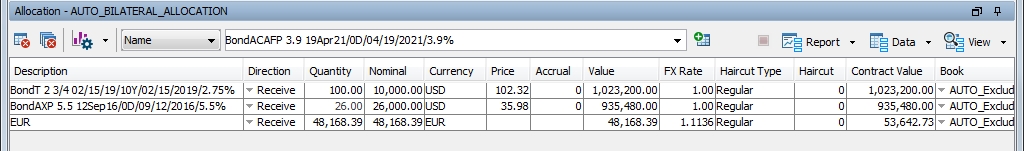

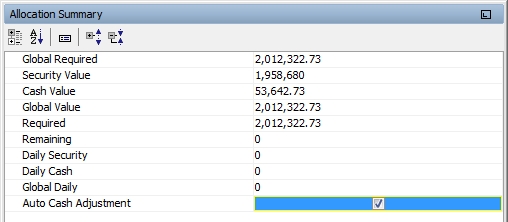

Below is an example of a completed allocation.

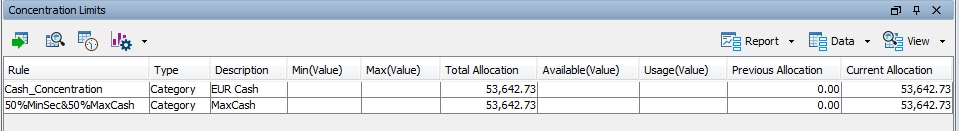

Select the Concentration tab to display the Concentration Limits window.

The default columns in this panel are described below.

|

Column |

Description |

|---|---|

|

Previous Allocation |

Value of previously allocated collateral |

|

Current Allocation |

Value of today's allocated collateral |

|

Total Allocation |

The Previous Allocation + Current Allocation |

|

Min (Value) |

From the contract / concentration definition. The minimum amount the concentration limit can be in value. It is the value under which the limit will not be accepted. This is applicable for the Category rule type only. |

|

Max (Value) |

From the contract / concentration definition. The maximum amount the concentration limit can be in value. It is the value over which the limit will not be accepted. |

|

Available (Value) |

For limit type CATEGORY, equal to Max (Value) - Used (Value) For limit types ISSUE and ISSUER, not applicable. |

|

Usage (Value) |

For limit type CATEGORY, equal to Used (Value) / Max (Value) for limit types ISSUE and ISSUER, not applicable. |

|

Min (%) |

From the contract / concentration definition. The minimum for the concentration ratio. It is the percentage under which it will not be accepted. |

|

Max (%) |

From the contract / concentration definition. The maximum for the concentration ratio. It is the percentage over which it will not be accepted. |

|

Usage (%) |

For limit type CATEGORY, equal to Used (Value) / Global Required Margin For limit type ISSUE, equal to Used (Value) / Total issue amount as defined in the product definition For limit type ISSUER, equal to Used (Value) / Sum of Used (Value) for all bonds of the same category |

|

Available (%) |

For all limit types, equal to Max (%) - Used (%) |

|

Status |

If the Available (Value) or the Available (%) is >, the status indicates 'in limit'. If the Available (Value) or the Available (%) is ≤ 0, the status indicates 'out of limit'. Note: A Concentration Limit column can be added in Collateral Manager Results panel. This field will indicate if the concentration limit is 'out of limit'. |

4.1 Graphics

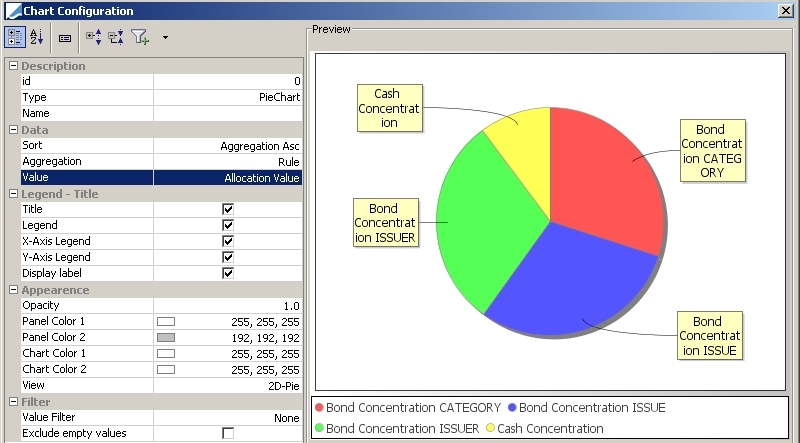

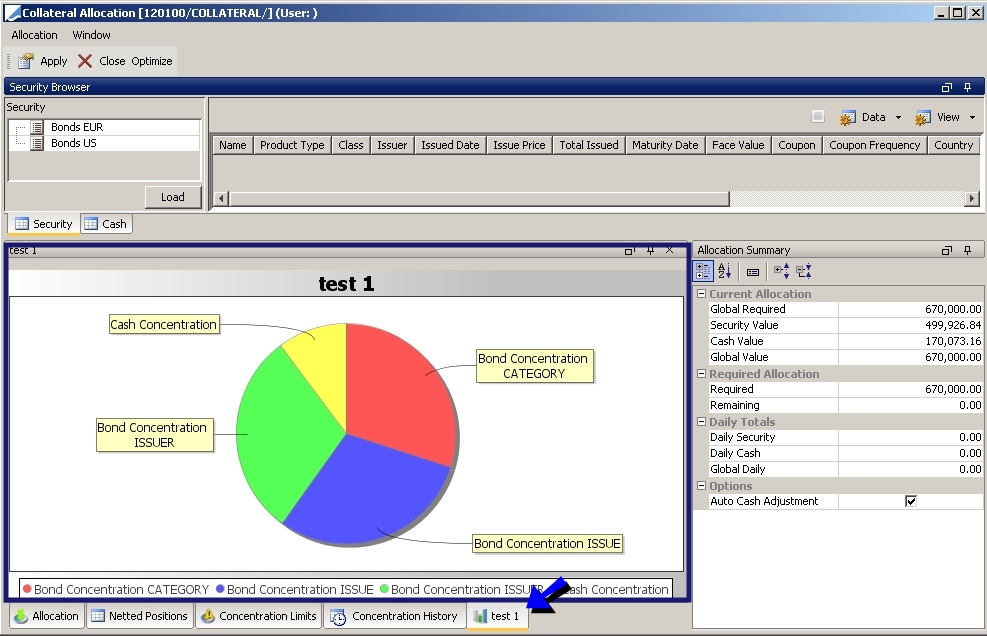

You may add a graph based on the concentration calculations in both the Allocation window and in the Collateral Manager. The steps required to set this up are the same for both.

To view a graphic, select  > Create. You then can select what sort of graph you would like to generate. (In the screen shot below, the allocation value is segregated by concentration rule type.

> Create. You then can select what sort of graph you would like to generate. (In the screen shot below, the allocation value is segregated by concentration rule type.

The graph can be added to the Allocation window as a new panel by choosing  > Add. The list of all the graphs created and saved appears. Choose the graph you would like and click Select. As a result, a new panel appears in the bottom section of the screen.

> Add. The list of all the graphs created and saved appears. Choose the graph you would like and click Select. As a result, a new panel appears in the bottom section of the screen.

4.2 History

You may view the history of your concentration limits from the Concentration History panel.

See

See