Collateral Context

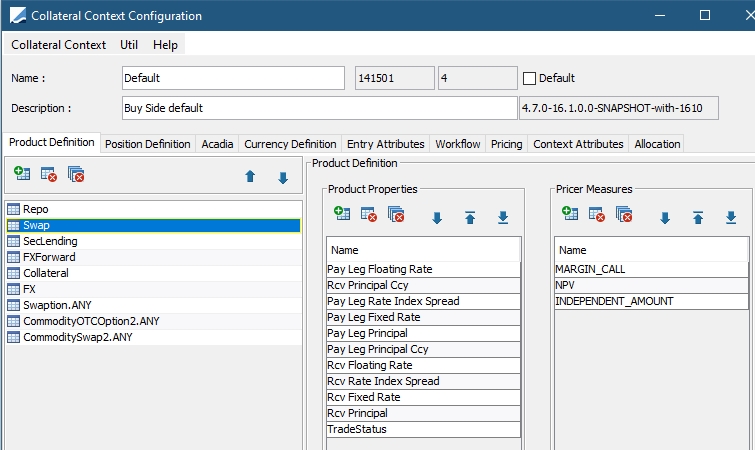

The collateral architecture does not allow the user to add product specific columns directly into the Collateral or Clearing Distribution Manager Underlying panel. By default, the Underlying panel only displays information such as trade date, start date, description, etc... The Collateral Context window takes care of this issue by allowing you to define additional product properties and pricer measures. This context will be common to every contract.

A Collateral Context is chosen in the Collateral Manager window when loading Margin Call Contracts.

The window is accessible through the Margin Call or Clearing Member Contract window by selecting Util > Collateral Context or using the following link: refdata.collateral.CollateralContextWindow.

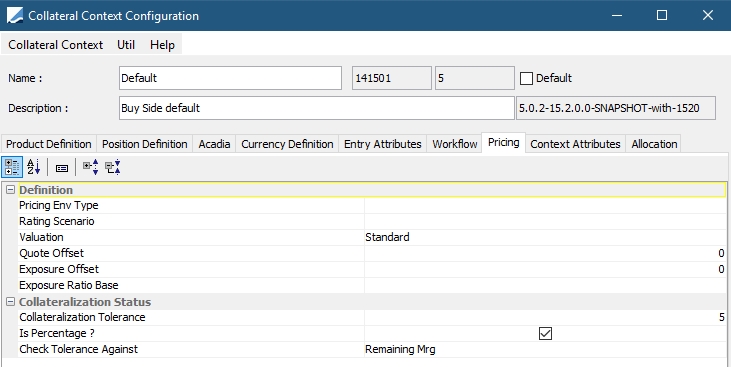

The Collateral Context window looks like that below, with a default set up for Repo trades.

| » | Enter a name and description for the Collateral Context Configuration. |

| » | Select as many product types and sub-types as you would like to include in the configuration. |

| » | You may add or edit the product properties for each product type. |

| » | Add or edit the pricer measures associated with each product type. |

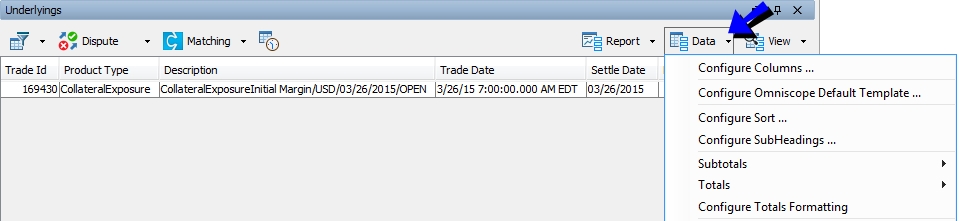

The configurations that are made in the Collateral Context window that apply to column additions are then available for selection in Collateral Manager or Cover Distribution Manager. To add these columns to the view, select Configure Columns from the Data menu from the panel of your choice.

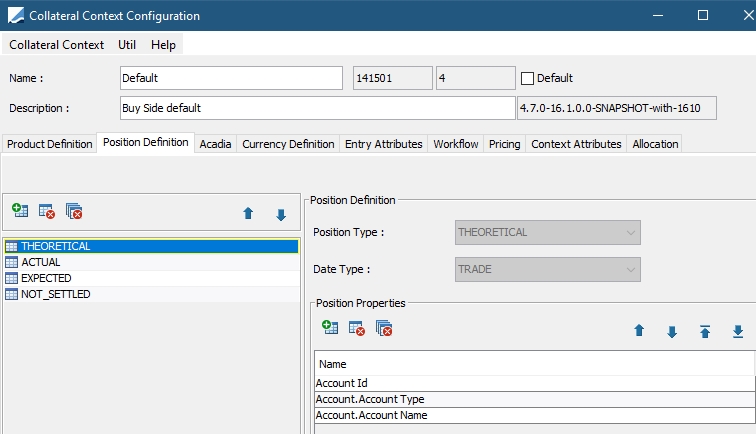

1. Position Definition

The Position Definition panel allows you to add additional positions to Collateral Manager.

Positions are aggregated by position type. All positions defined in the context are loaded and priced by the collateral manager. THEORETICAL and ACTUAL positions are always loaded, even if not present in the collateral context.

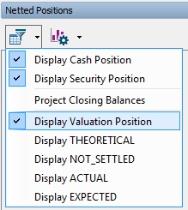

The Collateral Manager Netted Position panel displays every position defined in the context. By default the Valuation Position (the position used to calculate the exposure) is always loaded even if not declared in the Collateral Context).

In the Position Properties area, you may select attributes that will be displayed in the Netted Position panel of Collateral Manager, such as AccountId, AccountName and AccountType.

2. Acadia

This panel is used only for Acadia users.

Refer to Acadia Attributes in Collateral Context for details.

Refer to Acadia Attributes in Collateral Context for details.

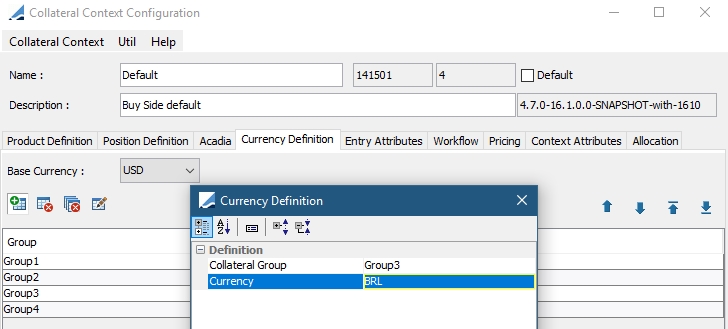

3. Currency Definition

In this panel, you are able to define a group or groups and a corresponding currency linked to that group. The available group names are populated from the Collateral.Config.Group domain value.

You may also define a Base Currency, which is used for the remaining margin (base ccy) and base ccy columns. It enables the comparison of contracts with different contract currencies.

In the Details panel of the margin call contract, you may associate one of these currency definition groups with a contract.

4. Entry Attributes

The Entry Attribute tab functions in the same way as the Allocation > Allocation Attribute tab. To populate attribute types, set up a list of available values using the domain MarginCallEntry.NAME_OF_ATTRIBUTE. You may also click  to add the attribute to the appropriate domain.

to add the attribute to the appropriate domain.

5. Allocation

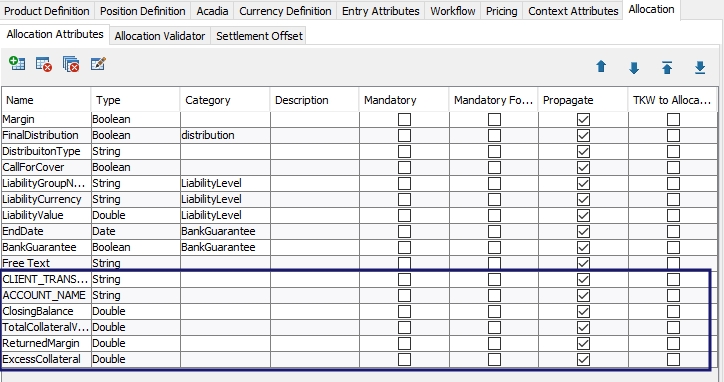

The Allocation panel contains three tabs: Allocation Attributes, Allocation Validator and Settlement Offset.

5.1 Allocation Attributes

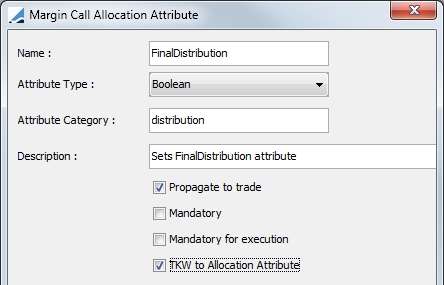

Select the Allocation Attributes tab to define additional attributes for allocation.

For the Attribute Type: Domain, you can set up the list of available values using the domain MarginCallAllocation.NAME_OF_ATTRIBUTE.

Attributes already recognized by Calypso are:

| • | LiabilityGroupName |

| • | LiabilityCurrency |

| • | LiabilityValue |

| • | ContractType |

| • | CoverDistribution |

| • | DistributionType |

| • | CallForCover |

| • | BankGuarantee |

| • | EndDate |

| • | AccomodationChargeId |

| • | TargetAccountId |

The attribute can also be displayed in any allocation report (Collateral Manager or Cover Distribution Manager stand alone report) and the values can be manually edited in the Collateral Allocation window. The attribute is loaded as a standard column from Configure Columns as described below.

For Cover Distribution, two allocation attributes that can be added in the Collateral Context window, Liability Configuration and LiabilityName are propagated to the margin call trades (by selecting Propagate to trade) when "Distribute the call" is selected in the Call Generation section of the Details panel of the contract. The attributes are visible as trade keywords.

When the TKW to Allocation Attribute flag is selected for an attribute, if a trade keyword name matches the allocation attribute, then the keyword value can be displayed in the Allocation panel. Select the keyword/attribute name in Configure Columns.

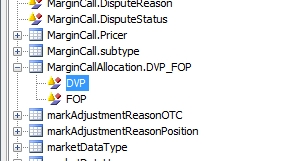

Propagation of Attributes to Margin Call Trade

It is possible to propagate certain attributes to the Margin Call trade. These attributes are:

| • | ExcessCollateral |

| • | NewMargin |

| • | ReturnedMargin |

| • | RemainingMargin |

| • | TotalCollateralValue |

| • | PreviousTotalMargin |

| • | PreviousActualTotalMargin |

| • | ClosingBalance |

Additionally, it is possible to propagate attributes from the Margin Call contract Additional Info panel to the Margin Call trade.

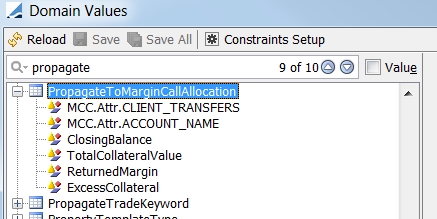

To configure this, first create the domain PropagateToMarginCallAllocation and add the attributes. Attributes from the Additional Info panel must start with MCC.Attr.xxx.

Then, add the fields to Collateral Context > Allocation Attributes and designate the attributes to propagate to the trade.

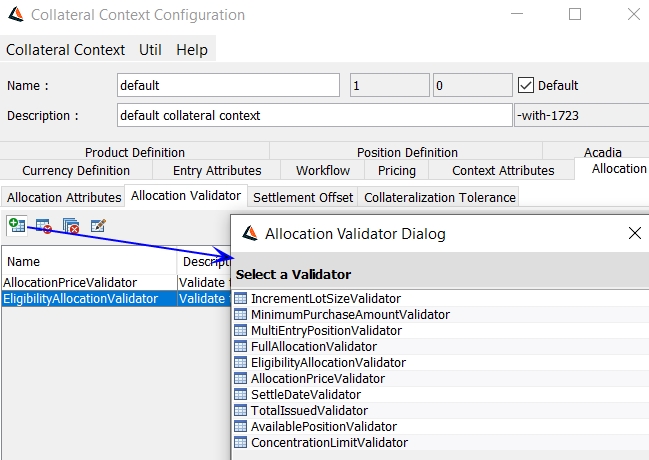

5.2 Allocation Validators

The Allocation Validator panel is used to define validators when allocating and creating margin call trades. The possible validators are:

| • | AllocationPriceValidator |

| • | AvailablePositionValidator |

| • | ConcentrationLimitValidator |

Please note that concentration limit check is not performed on full return cases when exposure changes are in t ooohe PO's advantage.

| • | EligibilityAllocationValidator |

| • | FullAllocationValidator |

| • | IncrementLotSizeValidator |

| • | MinimumPurchaseAmountValidator |

| • | MultiEntryPositionValidator |

| • | SettleDateValidator |

| • | TotalIssuedValidator |

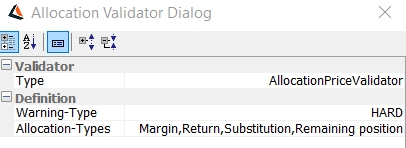

For each validator, it is possible to designate either a hard or soft warning as well as allocation types.

Example:

AvailablePositionValidator

The system compares the allocation nominal against the trading book position nominal coming from the "Allocation_" Inventory Position template defined in the Allocation window. The user can designate Allocation-Types options of Margin, Return, and Substitution.

This feature can only be implemented with an Inventory Report Template using a Book Aggregation. Any other aggregation like Global or Book/Agent/Account will result in a validator failure. The reason why we cannot check at a more granular level of Book/Agent/Account is because we do not have access to the Agent/Account information until after the trade is created and SDI selection has occurred.

FullAllocationValidator

You can check Collateralization_Tolerance to use the tolerance configuration designated in the Collateralization Tolerance tab.

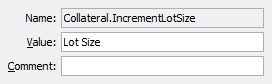

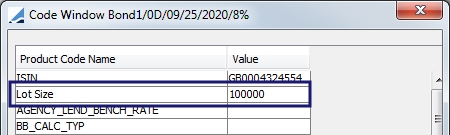

IncrementLotSizeValidator

In the case of a security allocation, the nominal of each security allocation is compared with the incremental value. If it is a multiple of the lot size, the validation passes. If it is not a multiple of the lot size, the system recalculates the allocation based on selected Automatic-Rounding.

Increment Lot Size is specified in Bond product code "Lot Size" by default as defined in domain Collateral.IncrementLotSize.

In the bond's Product Code Window, input the Lot Size Increment amount. Only if this amount is input for the bond will the Increment Lot Size Validator work.

MinimumPurchaseAmountValidator

By default, is set to a hard warning.

MultiEntryPositionValidator

A warning appears if the allocations > previous margin of the processing entry + (daily margin) of all the non-selectec entries. There is also a workflow rule called CheckMultiEntryPosition that performs the same check as this validator.

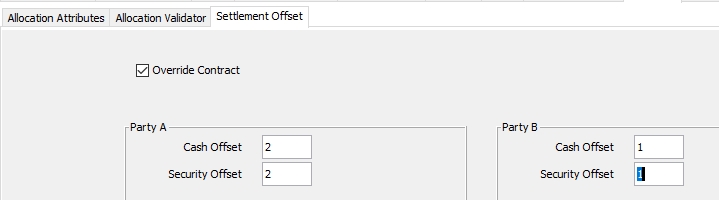

5.3 Settlement Offset

The Settlement Offset panel allows the ability to override, at the Collateral Context level, the settlement lag configuration defined in the Margin Call contract.

When the Override Contract checkbox is enabled, it specifies that the Settlement Offset on the Margin Call contract should be overridden by the values entered in the Party A and Party B boxes.

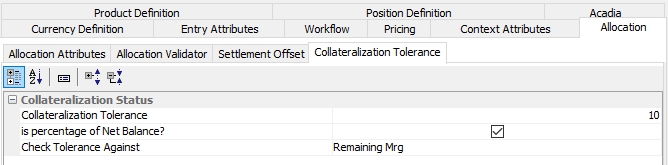

5.4 Collateralization Tolerance

A tolerance can be added for a full allocation validation. Therefore, even if a small percentage of the margin is not allocated or if it is over allocation, the process can continue.

| » | Enter a Collateralization Tolerance amount. |

| » | When Is Percentage of Net Balance is checked, the collateralization tolerance is calculated based on the Net Balance. |

| » | Designate to Check Tolerance Against either the Remaining Margin or the Actual Outstanding Margin. |

Remaining Margin = Netted Position ─ Return ─ Substitution

This feature can be used in conjunction with Acadia Auto Accept Allocation. Refer to the Acadia documentation for details.

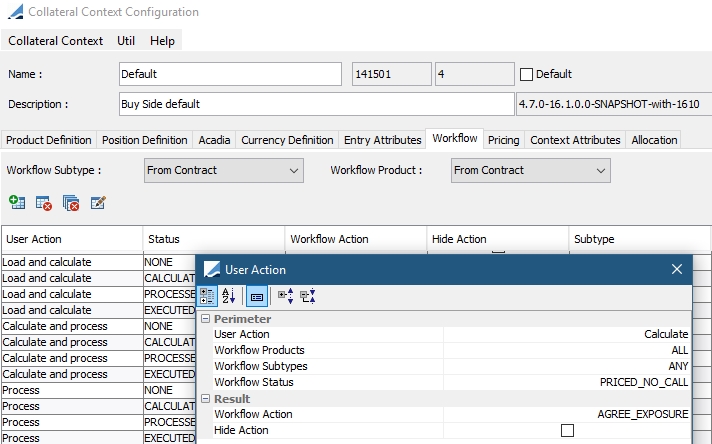

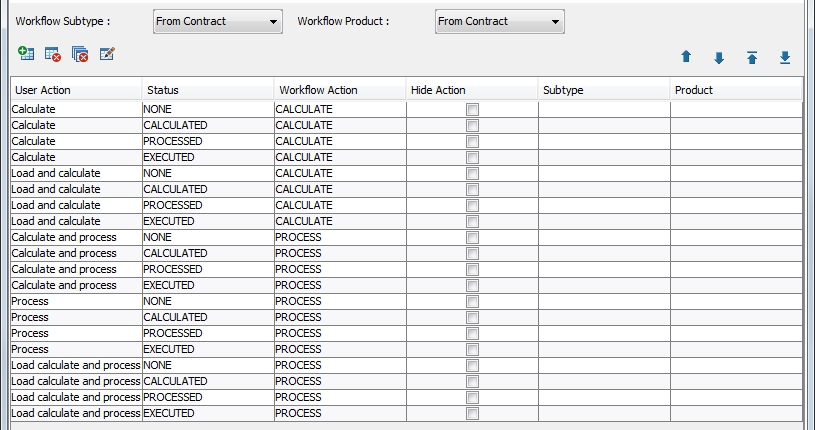

6. Workflow

This panel allows you to link a workflow action directly to the Price and Allocate buttons in Collateral Manager for the selected margin call contract or to the Load and Load & Process buttons in Cover Distribution Manager.

6.1 Workflow for Collateral Manager

In Collateral Manager, by default when you click the Price button, you must then apply the NEW workflow action in order to save the priced contract. You must also perform a save function after an allocation is applied from the ALLOCATE window.

To allow the save action to be performed automatically after a contract is priced or allocation is applied, use this panel to set up which action you would like to be performed when these buttons are clicked and all of the criteria is met.

You may also designate a Workflow Subtype and or Workflow Product. The Workflow Actions available for a specified subtype are displayed based on the actions designated for that subtype in the Collateral Workflow or Cover Distribution Workflow. The Workflow Products and Workflow Subtypes must also be designated in the Details panel of the Margin Call or Clearing Member contract.

NOTE: If you would like to hide an action from the Action button drop-down menu or the right-click Action menu in Collateral Manager, select the Hide Action checkbox.

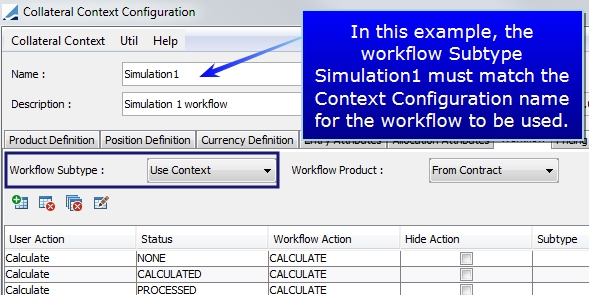

6.2 Workflow Subtype / Workflow Product

The options for Workflow Subtype and Workflow Product are: From Contract, Use Context, From Entry Type and From Contract and Entry.

The Entry Type designations allow the Processing Type selection in Collateral Manager to determine which workflow is used.

When From Entry Type is chosen in the Context, the behavior in Collateral Manager is as follows:

| • | Processing Type Processing uses workflow subtype processing |

| • | Processing Type Substitution uses workflow subtype substitution |

| • | Processing Type Valuation uses workflow subtype valuation |

When From Contract and Entry is chosen, the behavior in Collateral Manager is as follows:

| • | Processing Type Processing uses the workflow from the Margin Call Contract > Details panel > Workflow field |

| • | Processing Type Substitution uses workflow subtype substitution |

| • | Processing Type Valuation uses workflow subtype valuation |

6.3 Workflow for Cover Distribution Manager

In Cover Distribution Manager, by default when the contracts are loaded no action is applied to the contracts. In other words, when you Load, Process or Load & Process, none of the figures are saved to the database unless an action is applied to the contracts. Automatically applying an action upon clicking one of these buttons, is configured in the Workflow tab of the Collateral Context window.

Below is an example of how a Cover Distribution collateral context can be set up detailing the user action (button or menu selection) and the workflow action applied depending on the status of the contract at the time.

NOTE: With the above setup, the same action applied to any contract status will result in the same status. This is useful for the COVER_DISTRIBUTION scheduled task where contracts being processed will most likely be in different statuses (such as NONE, CALCULATED, PROCESSED or EXECUTED).

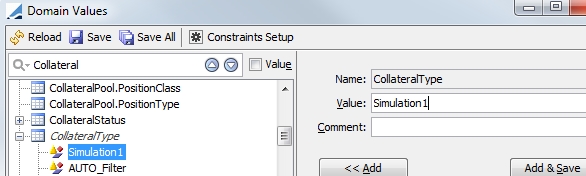

6.4 Context Specific Workflow

In the Workflow panel, you may define a context specific workflow which overrides the workflow specified in the contract for any contracts processed using that context.

An example of when this may be helpful is when a context is being used to calculate the Global Required Margin using simulated credit ratings. In this case, you would not want to use a standard collateral workflow and would instead prefer a simplified workflow which moves the contract to a simulated status when using the simulation context.

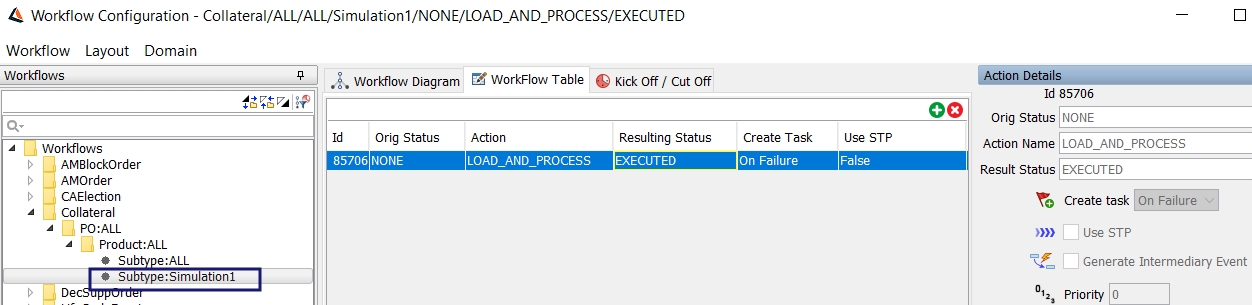

To use this functionality, follow the steps below.

Step 1 - Add the name of the Context Configuration to either one of the following domain values: CollateralType (for Subtype), productGroup or productType (for use with different product types).

Step 2 - In the Workflow window (from Calypso Navigator, Configuration > Workflow), specify the workflow to be used with that context configuration. (If you specified a product type or group, select it from the Product drop-down)

Step 3 - In the Context Configuration window, specify for the Workflow Subtype to use the Context. (If a product type or group was used instead, select Use Context in the Workflow Product drop-down.) Processing Type may also be chosen as the Workflow Subtype or Workflow Product. Processing Types are chosen in the Collateral Manager filter criteria.

7. Pricing

This panel specifies how the collateral data should be priced for the optimization.

7.1 Pricing Environment Type

In this field, designate whether to use end of day (EOD) pricing, intraday (ITD) pricing or credit downgrade simulation (SIM) during optimization. The pricing environments that correspond to these choices are designated in the Details panel of the contract.

7.2 Rating Scenario

The Rating Scenario designation enables simulation of the effects on margin requirements that come from a downgrade in credit rating or a change to counterparty credit ratings. This functionality can be used solely through the Collateral module, or perturbed data may be fed into Collateral from the Liquidity module. Selecting a Rating Scenario in this field indicates that the Collateral module will process data on a scenario basis, rather than a standard one.

The scenario information comes from the CREDIT_RATING_SCENARIO table. If no scenario is selected, the normal CREDIT_RATING table is used to process the collateral information. See Margin Call Credit Rating for more information on standard credit rating processing.

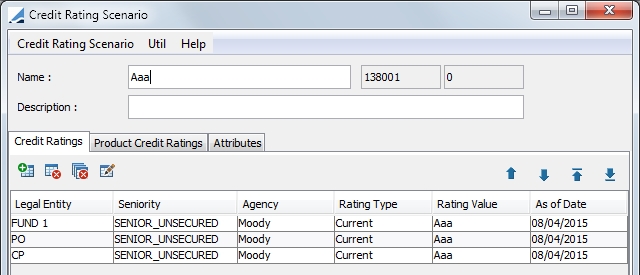

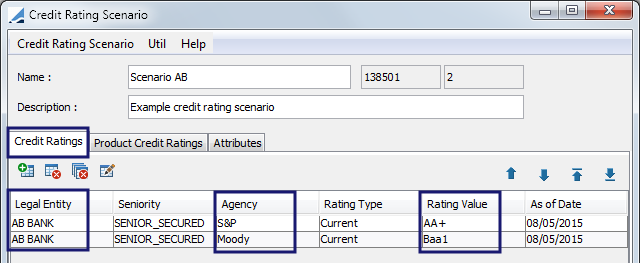

Scenarios are either populated in the CREDIT_RATING_SCENARIO table via the Liquidity module, or the information can be manually entered in the Collateral module from the Credit Rating Scenario window. This window may displayed by selecting Util > Credit Rating Scenario.

You may enter rating information pertaining to legal entity and/or product credit ratings as well as designate credit rating attributes.

NOTE: If the Liquidity module is used to feed credit rating scenario data into the Collateral module, the scenario name in Liquidity must be entered in the Rating Scenario field of the Collateral Context. This enables Collateral to pull the appropriate information from the CREDIT_RATING_SCENARIO table. No additional data is required to be entered in the Credit Rating Scenario window in that case.

Business Case for Credit Rating Scenario

In this example, consider that AB Bank has Senior Secured Debt that is paid first in the event of a default. This debt is secured by collateral to reduce lending risk. The senior secured loan agreement contains covenants tied to anticipate financial metrics of the underlying company. These financial covenants are essentially an option to re-price risk when a covenant default is near or has been reached. If AB Bank projects a certain level of cash flow or leverage (examples of the financial covenants) in the future and they fail to deliver, they can come back and ask to negotiate an amendment to the original agreement, but the new terms often include a re-pricing of risk either in the form of a fee or higher interest rate.

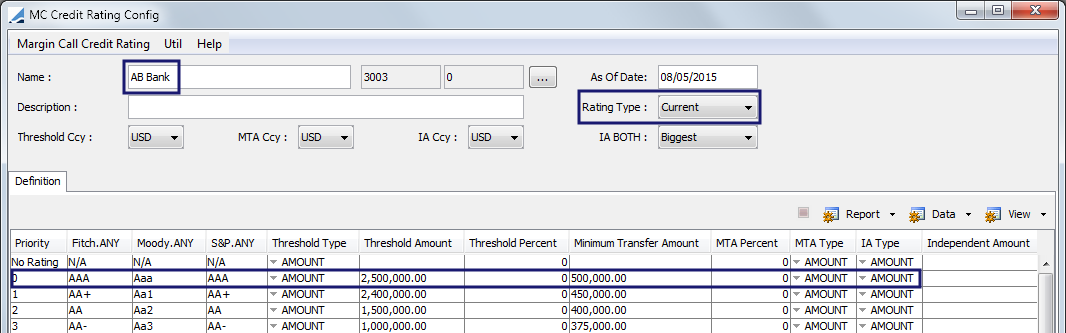

The current Credit Rating provided to AB Bank from S&P and Moody’s is AAA. Our agreement in place for AB Bank was based on the ratings. At this credit rating, the threshold established for AB Bank is $2,500,000 USD. The minimum transfer amount is $500,000 USD. This means in our agreement, we will not initiate a margin call until AB Bank has reached $500,000 USD exposure over the $2,500,000 USD threshold.

For this example, the credit rating has been downgraded for AB Bank by S&P to AA+. This is still considered a low risk. However, the second agency, Moody’s, has downgraded AB Bank to Baa1. This represents Medium Risk by Moody’s. For this agreement, default risk will be managed by using the lowest credit rating (This is set in the Margin Call Contract.) From the two Credit Rating Agency’s ratings, there could be a possibility that one agency has not received the most recent rating assignment to reflect the current creditworthiness of AB Bank.

The exposure in this scenario for AB Bank is now $3,000,000 USD. The new threshold exposure based on the current agreement and previous credit rating by S&P and Moody’s is $1,800,000 USD based on the current threshold of $2,500,000 USD. The new (MTA) minimum transfer amount exposure based the current agreement and previous credit rating by S&P and Moody’s is $375,000 USD.

In this scenario, if AB Bank’s credit rating is Baa1 (Medium Risk), the agreement in place is for a threshold of $700,000 USD and the (MTA) minimum transfer amount exposure is $125,000 USD. The exposure is $825,000 USD based on the downgraded credit rating provided by Moody’s.

7.3 Valuation

This selection designates whether the contracts should be processed for Standard, Ad Hoc or Context Based valuation.

| • | Standard Valuation - The pricing is based on the valuation information specified in the Dates & Times panel and the Minimum Transfer Amount specified in the Parties panel in the contract. |

| • | Ad Hoc Valuation - The pricing is based on the valuation and MTA information specified in the Ad-Hoc Details panel of the contract. |

| • | Context Based Valuation - When this valuation type is selected, the system ignores the Valuation Date rule and the Valuation Time Offset rule defined in the Dates & Times panel of the contract and instead loads every contract (meeting template criteria) on the process date and forces the valuation offset defined on the context. There are also two fields that appear only when this Valuation Type is chose. One to indicate the Valuation Offset and the other to designate Business Calendars to use on the context to respect business days for the offset. |

7.4 Quote Offset & Exposure Offset

These fields are used to utilize initial margin balances to offset against variation margin. The system will look for a date rule set, defined in the Dates & Times panel of the Margin Call Contract, and then calculate the real quote the day after the offset. The exposure value date will be the day after the offset.

Note: Quote Offset exists on the Margin Call contract as well but the setting in the Collateral Context overrides the contract setting.

Total Quote Offset = Contract Quote Offset Days + Context Quote Offset

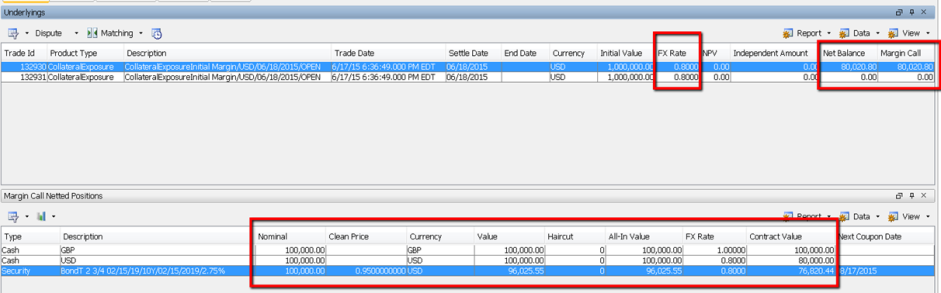

Example 1:

|

Process Date |

|

6/29/2015 |

|

Val Date Offset |

0 | |

|

Contract Quote Offset |

0 | |

| Context Quote Offset |

2 |

6/25/2015 |

|

Total Quote Offset |

2 |

6/25/2015 |

|

Exposure Offset |

1 |

6/26/2015 |

|

Offset Days |

FX.GPB.USD |

Bond T |

PL Mark |

|

|

6/21/2015 |

1.21 | 91 | 100021 | |

| 6/22/2015 | 1.22 | 92 | 100022 | |

| 6/23/2015 | 1.23 | 93 | 100023 | |

| 3 | 6/24/2015 | 1.24 | 94 | 100024 |

| 2 | 6/25/2015 | 1.25 | 95 | 100025 |

| 1 | 6/26/2015 | 1.26 | 96 | 100026 |

| Weekend | 6/27/2015 | 1.27 | 97 | 100027 |

| Weekend | 6/28/2015 | 1.28 | 98 | 100028 |

| 0 | 6/29/2015 | 1.29 | 99 | 100029 |

| 6/30/2015 | 1.3 | 100 | 100030 | |

| 7/1/2015 | 1.31 | 101 |

100031 |

Exposure: 100026/1.25 = 80020.80

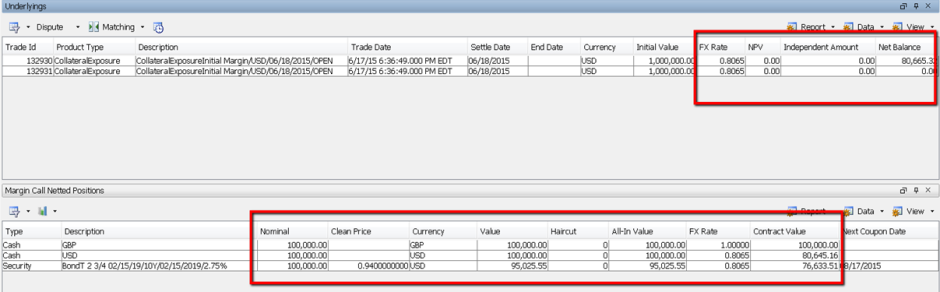

Example 2:

|

Process Date |

|

6/29/2015 |

|

Val Date Offset |

0 | |

|

Contract Quote Offset |

1 | |

| Context Quote Offset |

2 |

|

|

Total Quote Offset |

3 |

6/24/2015 |

|

Exposure Offset |

2 |

6/25/2015 |

|

Offset Days |

FX.GPB.USD |

Bond T |

PL Mark |

|

|

6/21/2015 |

1.21 | 91 | 100021 | |

| 6/22/2015 | 1.22 | 92 | 100022 | |

| 6/23/2015 | 1.23 | 93 | 100023 | |

| 3 | 6/24/2015 | 1.24 | 94 | 100024 |

| 2 | 6/25/2015 | 1.25 | 95 | 100025 |

| 1 | 6/26/2015 | 1.26 | 96 | 100026 |

| Weekend | 6/27/2015 | 1.27 | 97 | 100027 |

| Weekend | 6/28/2015 | 1.28 | 98 | 100028 |

| 0 | 6/29/2015 | 1.29 | 99 | 100029 |

| 6/30/2015 | 1.3 | 100 | 100030 | |

| 7/1/2015 | 1.31 | 101 |

100031 |

FX rate: 1/1.24 = 0.806452

Exposure: 100025/1.24 = 80665.32

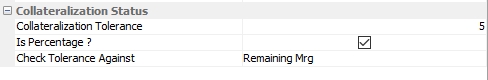

7.5 Collateralization Status

To simplify the end of day controls on Collateral activity, a collateralization tolerance can be defined, either as a fixed amount expressed in contract currency or as a percentage based on the Net Balance. This Tolerance definition is then used in the Collateralization Status in the Collateral Manager Margin Call Entry section.

| • | Collateralization Tolerance - A tolerance number in either percentage or contract currency. Decimal values are permitted. |

| • | Is Percentage? - If false (default), the value provided in Collateralization Tolerance is considered as a fixed amount expressed in base currency. If true, the value in Collateralization Tolerance is a percentage. The formula is Tolerance = Collateralization Tolerance * Net Balance / 100. |

| • | Check Tolerance Against - There are two options for this: |

| – | Remaining Margin - For standard business where margin calls need to be covered on a theoretical basis. When Remaining Margin is chosen, this value is compared against the Tolerance when computing Collateralization Status in Collateral Manager. |

| – | Actual Outstanding Margin - For Sec Finance, where margin calls need to be covered in real settlement (considering the collateral settlement status). |

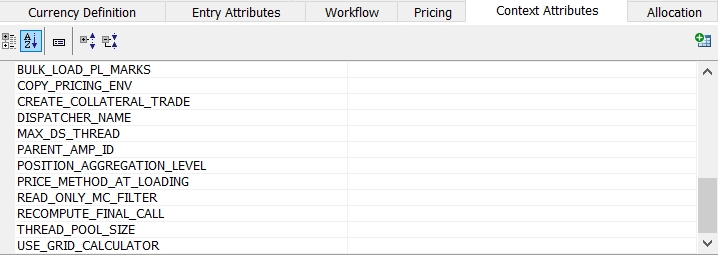

8. Context Attributes

Some of the attributes of the COLLATERAL_MANAGEMENT scheduled task can be also used for Collateral Manager, likewise for the attributes of the COVER_DISTRIBUTION scheduled task and Cover Distribution Manager. Having two separate sets of variables allows for the configuration of scheduled task independently. Some of the attributes are described below.

|

Attribute |

Description |

|---|---|

|

BULK_LOAD_PL_MARKS |

Set to True for bulk loading of PL Marks. Be sure that the Collateral Exposure product is using PricerCollateralExposure in the Pricer Configuration. |

|

CREATE_COLLATERAL_TRADE |

The default of this attribute is true. When set to true, collateral details for repo and sec lending trades are displayed. Set to false to deactivate this display. |

|

DISPATCHER_NAME |

Dispatcher configuration name to use for the grid. |

| MAX_DS_THREAD | Limits the maximum number of threads that can query the data server at the same time in order to avoid too much stress being put on the data server. |

|

POSITION_AGGREGATION_LEVEL |

Position aggregation designation. Book - Margin Call positions are aggregated based on Book Global - Margin Call positions are aggregated at the contract level. If no value is chosen, the default aggregation is by Book. |

|

PRICE_METHOD_AT_LOADING |

This attribute can accept the values PRICE, REPRICE or NONE. The default value is PRICE if you do not define the attribute. This allows the Collateral Manager to automatically price or re-price the entries as part of the loading process. |

|

RECOMPUTE_FINAL_CALL |

If this attribute is not set or set to True (default behavior) then there is no change in final call amount behavior. If it is set to False, then the Final Call Amount is not recomputed when executing the distribution. When the Final Call Amount is reset to 0, the Remaining Margin will always be equal to the Call including the buffer. When the Final Call Amount is not reset, the Remaining Margin = Call including buffer – Final Amount. |

| THREAD_POOL_SIZE |

Total number of threads used by the Collateral module for improved performance |

|

USE_GRID_CALCULATOR |

Set to true if the collateral module should run using the grid calculator |