Margin Call Credit Rating

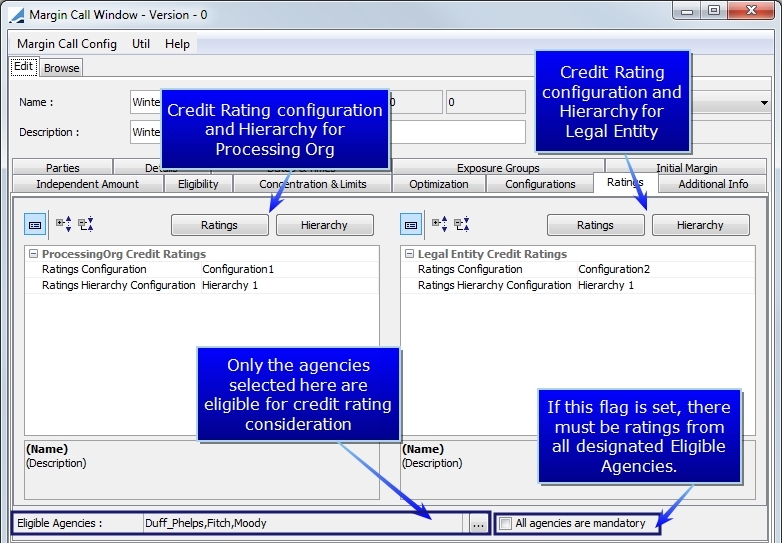

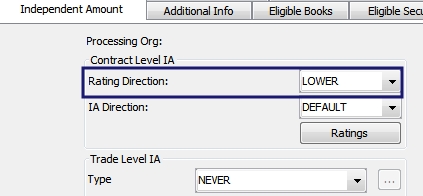

In the Calypso Collateral Management module, it is possible to use the Processing Org and the Counterparty credit rating to determine the Threshold and Minimum Transfer Amount (MTA). The Credit Rating configuration is completed through the Ratings panel in the Margin Call Contract.

In the Ratings panel, you may also define and designate a Hierarchy which is used to order the agencies and in the event that there is a missing rating.

| » | Calypso allows for the Threshold and Minimum Transfer Amounts to be different for the processing org and the legal entity. |

| » | To effectively use credit ratings in Collateral Manager, you must first set up a Global Rating Configuration. This is established to allow for comparisons when a legal entity is rated differently by one or more of the applicable rating agencies. This is used to apply the HIGHER/LOWER Rating selection in the Parties panel of the margin call contract. |

| » | If no agency is specified in the Eligible Agencies field, any agency is valid to be considered in the ratings. If any agency is specified in the Eligible Agencies field, all other credit ratings from any non-eligible agencies are ignored. |

| » | When the All agencies are mandatory field is selected, all of the agencies designated in the Eligible Agencies field must provide ratings for the PO and LE (dependent on pricing direction). The default setting on this field is false (unselected). |

1. Global Rating Configuration

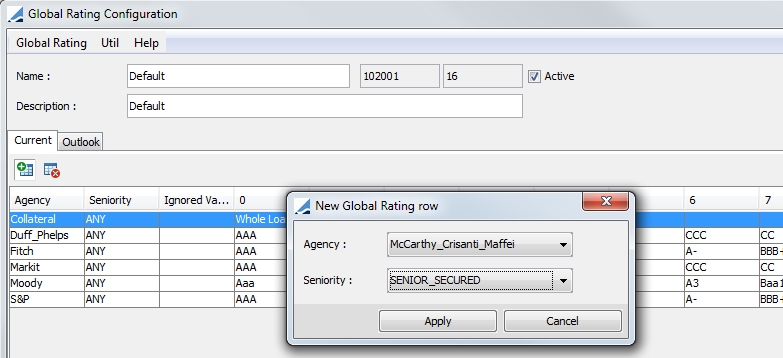

A Global Rating Configuration must be created for comparison purposes between rating agencies. To display this window from the Margin Call contract:

| • | Click the Ratings button which displays the Margin Call Credit Rating Configuration window. From the Util menu in the MC Credit Rating Config window, select Global Rating Configuration. |

| • | In the Margin Call Contract window, select Util > Global Rating Configuration |

In this window, you can enter the appropriate rating information.

| » | Click  to add a new row. Select the Agency name and the Seniority. Then click Apply. to add a new row. Select the Agency name and the Seniority. Then click Apply. |

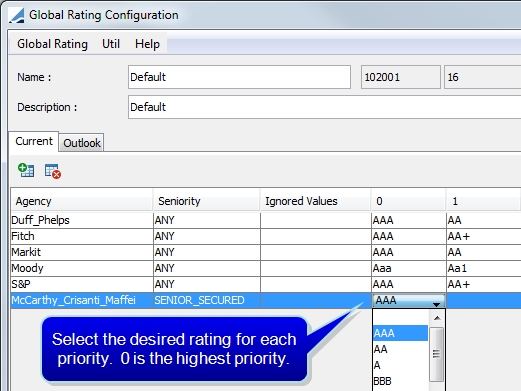

| » | After the row is created, enter the ratings. |

| » | You may have multiple configurations but only one can be Active. Whichever configuration is flagged as Active is the one that will be used. |

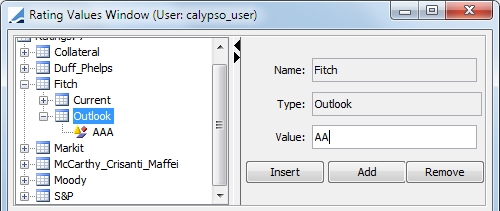

| » | In each panel, Current or Outlook, you are able to set a configuration. The panel names are called Rating Types. Additional Rating Types can be defined in the creditRatingType domain value. |

| » | Once the Rating Type is defined in the domain, select Util > Rating Values to add available values for the rating type if necessary. |

| » | Name the configuration and save it. |

| » | The equivalence table can be different for each rating type depending on the possible credit rating agency/values for that type. |

| » | Double-click in the Ignored Values column to select ratings values to be ignored for a particular Agency. |

2. Conversion to Global Rating

In the Margin Call window, select Util > View Previous Margin Call Credit Ratings to migrate to the Global Credit Rating configuration. If you choose to convert by Rating Value, you must have set up a Global Rating Equivalence in the Global Rating Configuration window.

3. Margin Call Credit Rating Configuration

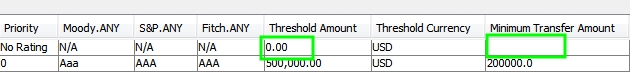

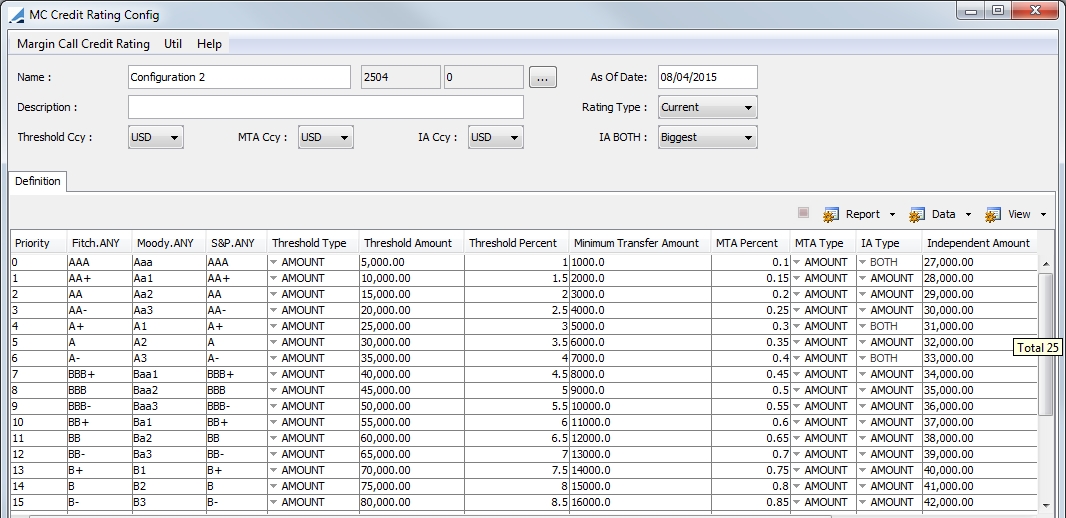

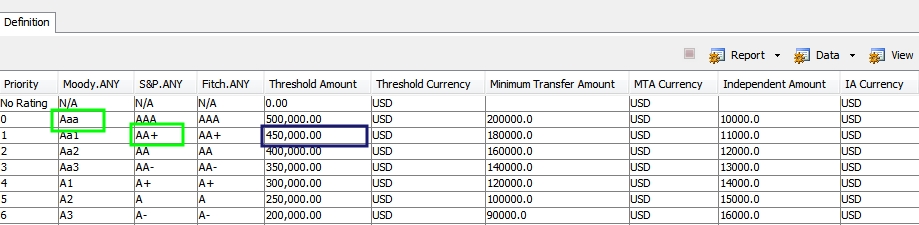

Once you have created and saved a Global Rating Configuration, you are able to enter the desired Threshold and/or Minimum Transfer Amount data.

| » | In this window, you may enter a Threshold Amount and / or Minimum Transfer Amount for each priority. |

| » | Name and save your configuration. You may have multiple Margin Call Rating Configurations, selecting whichever configuration you would like to use for each margin call contract. |

| » | On the Ratings panel in the Margin Call Contract, you must select Eligible Agencies that can be considered for the contract. Only the agencies selected will be used, regardless of whether they are in the margin call rating configuration. |

| » | If you enter an amount of 0 in the No Rating row, if a credit rating is missing, the value of the rating will be set to 0 and the contract will be priced. If this amount is left blank and there are missing ratings, the contract will not be priced and a pricing exception will be generated. |

| » | The IA BOTH field is utilized only when the IA TYPE field for a credit rating is set to BOTH. The options for this field are: |

| – | Smallest: the system chooses the smallest value between the Amount and the Percentage value calculated |

| – | Biggest: the system chooses the largest value between the Amount and the Percentage value calculated |

This field is the same for the entire configuration. It is not possible to have one column set to Biggest and another to Smallest within the same configuration. The default value is Biggest.

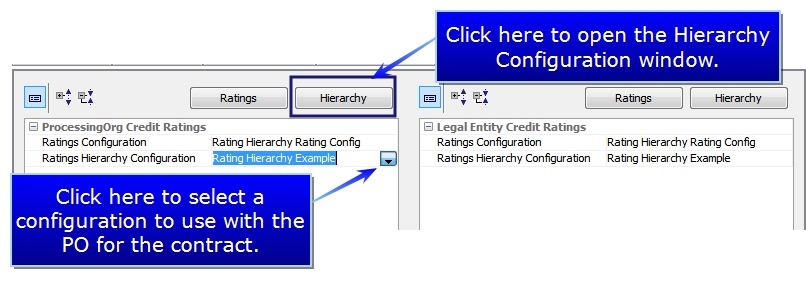

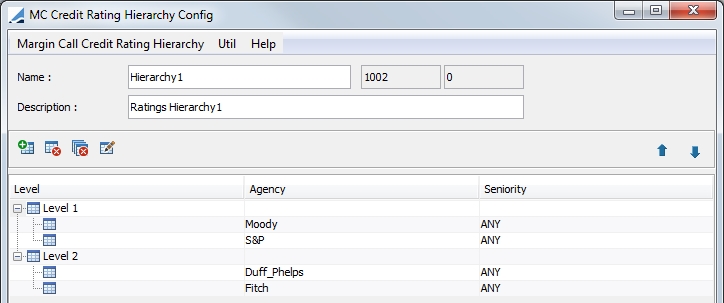

4. Hierarchy

The Ratings Hierarchy window enables the ordering of the Rating Agencies. You may have multiple levels with one or more agency in each level. You may have multiple Hierarchy configurations. In the Ratings panel of the Margin Call Contract, designate which hierarchy you would like to use for the PO and LE.

Based on the rating configuration that is selected for either Threshold or MTA in the Parties panel or in the Independent Amount panel, Calypso looks for the highest or lowest rating of Level 1. If no rating is defined for Level 1, the system moves on to Level 2 and so on....

Using the hierarchy set above, let's say that Moody's rating for the Counterparty is Aaa and S&P's rating is AA+. The Threshold Rating is set to LOWER on the contract. In this case, the S&P rating is used and the Threshold amount is $450,000.

In another example, let's say that Moody's rating is Aaa and S&P has no rating. Because there is a 0 amount in the Threshold Amount column for this configuration, the Moody's rating will be used with a Threshold Amount to 500,000.

If on the other hand, we were referring to a MTA instead of a Threshold, because there is nothing entered in the Minimum Transfer Amount column, Calypso would move on to look at the ratings for the agencies in the next level.