Collateral Exposure

The Collateral Management module allows you to use trades for collateral management purposes which have been created outside of the Calypso system, and are imported into the Calypso system as Collateral Exposure trades. Margin calls can be computed on those trades as on any other native Calypso trade.

This applies, for example, to initial margins imported from the clearing houses in the context of OTC Clearing.

1. Collateral Exposure Context

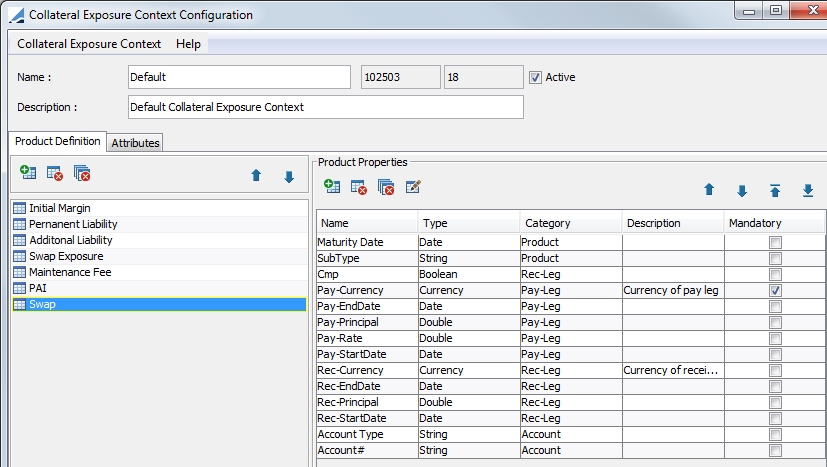

The Collateral Exposure Context window allows you to define the structure of the underlying product of the Collateral Exposure trade. You may save as many contexts was you wish, but only one context may be selected at the default and that context is the one used by the system.

To view this window, select Util > Collateral Exposure Context from the Margin Call Contract window or the Clearing Member Contract window.

| » | Enter a Name and Description for your exposure context. Select the default check box to indicate if you would like the context to be the default and therefore the one the system automatically uses. |

| » | Click  to add a product type or underlying. These are defined in the domain value CollateralExposure.subtype. to add a product type or underlying. These are defined in the domain value CollateralExposure.subtype. |

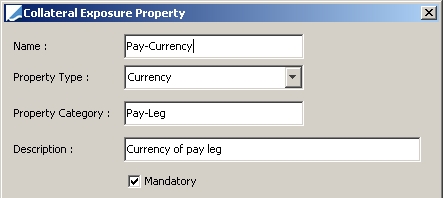

| » | In the Product Properties area, click  to add properties to define your underlying product. When you click this button, the Collateral Exposure Property window displays. to add properties to define your underlying product. When you click this button, the Collateral Exposure Property window displays. |

|

Fields |

Description |

|---|---|

|

Name |

The name of the property |

|

Property Type |

Select the type of data for the property (String, Date, etc...) |

|

Property Category |

Enter a category for the property. This is used to group the properties in the Collateral Exposure Trade window. |

|

Description |

Enter a brief description for the property. |

|

Mandatory |

Check this box if the property is required to save a trade. |

| » | The Description Pattern is used to generate the trade description. The keyword with the format NAME_OF_PROPERTY will be replaced by the value. Below is an example. |

A saved collateral exposure trade with the above description:

| » | The Attributes tab allows you to add additional information to a context. The list of attributes is defined by the domain value CollateralExposureContext. The list of possible values for an attribute is defined with the CollateralExposureContext.NAME_OF_THE_ATTRIBUTE domain value. You may also click  to add the attribute to the domain. to add the attribute to the domain. |

2. Collateral Exposure Trades

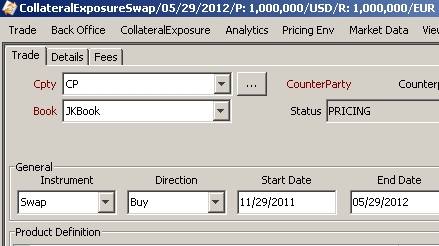

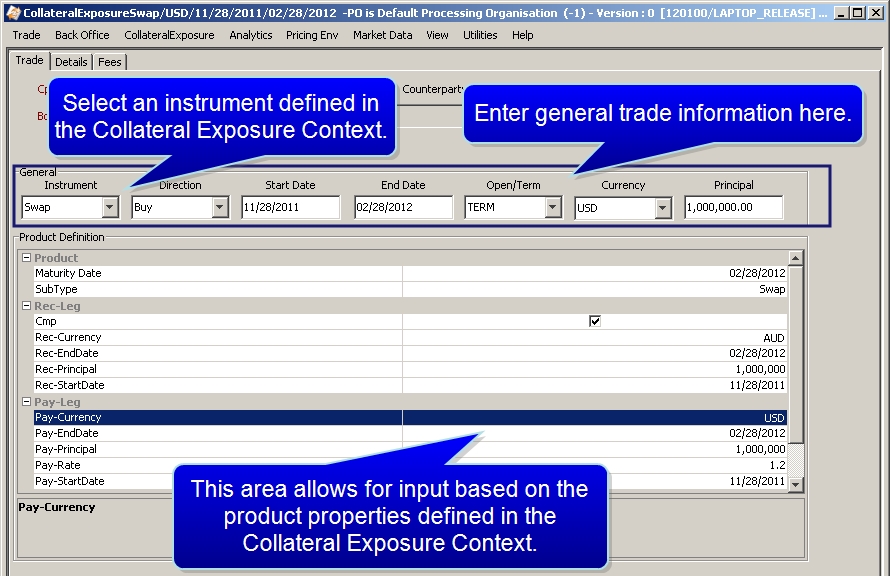

A Collateral Exposure trade displays the trade using basic trade information (such as start date, end date, currency, etc...) but it also contains additional product information defined in the Collateral Exposure Context.

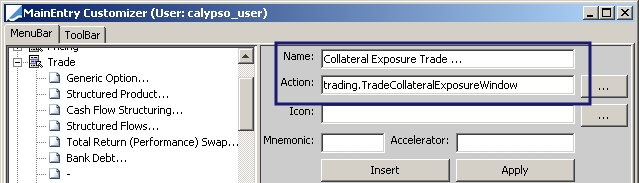

You can add the Collateral Exposure Trade window through the Main Entry Customizer (Utilities > Main Entry Customizer)

Menu action: trading.TradeCollateralExposureWindow

Once opened, the Collateral Exposure Trade window looks like that below.

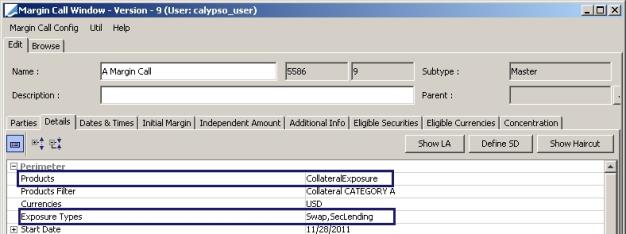

For these types of trades, the product family and type is Collateral Exposure. the product subtype is the underlying type. This is defined in the Contract.

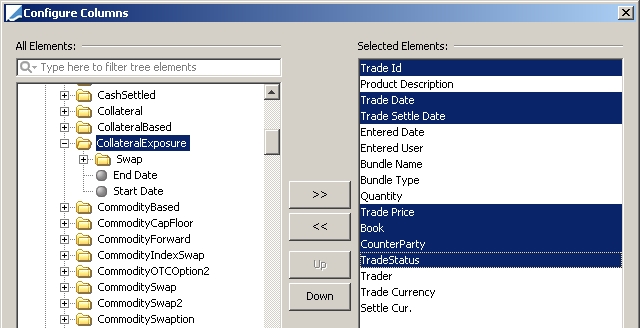

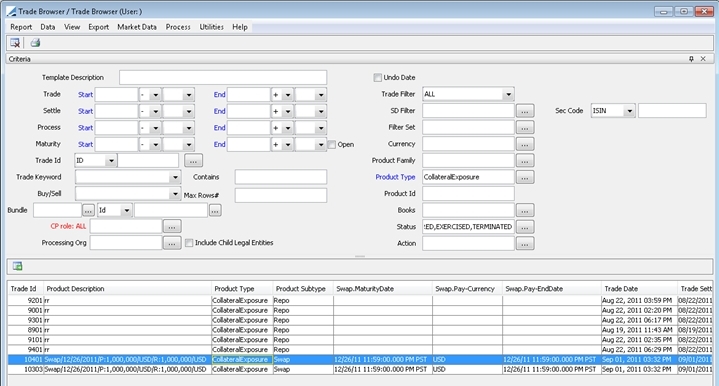

You are able to display the product properties of a Collateral Exposure trade in a trade report like any other product. See the Configure Columns window in the Trade Browser below. (Deal Management > Trade Browser)

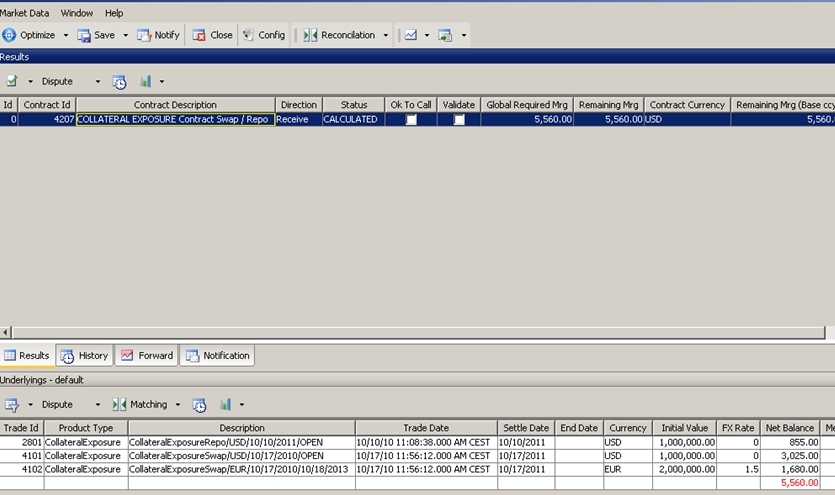

Below is an example of how a Collateral Exposure trade appears in the Collateral Manager.

NOTE: When using a PL Mark currency, you must use the PricerCollateralExposure pricer.