Margin Call Contract Mapping

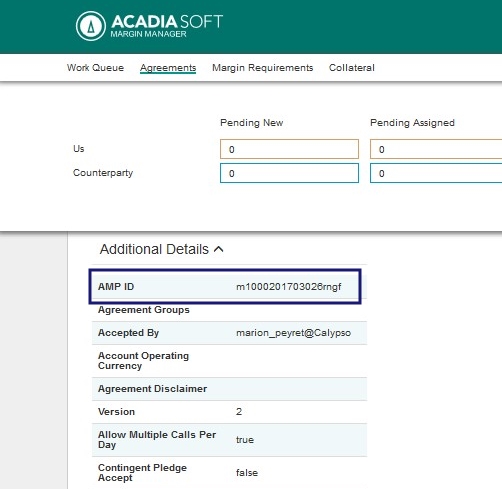

A Margin Call Contract and an AcadiaSoft agreement are mapped to each other using the agreement reference (identifier in Calypso, which maps to the message field short name). If there is no identifier, the contract AmpId (see below for more details) is used. If there is more than one contract or one exposure group with the same AmpId, the system looks at a combination of AmpId, call type, roll, etc...to map.

The AmpId is a unique identifier that MarginSphere assigns to an object in the system (agreement, margin call, etc...). An agreement is assigned an AmpId when it is created in MarginSphere.

In other words, the Create message requires that either the agreement AmpId or the agreement reference (which must be unique) be provided to identify the correct agreement. MarginSphere knows who the parties are based on the agreement cited.

1. Example of Bilateral Process

1.1 PRICED_RECEIVE

In the case the PO is expecting to receive collateral, the Margin Call Entry will be in PRICED_RECEIVE status. The PO will then send the message using the CREATE action, which will move the entry to CREATED and generate a CreateMarginCall message.

The PO will then wait for the CP's response, which can be one of the following:

| • | AGREE_EXPOSURE- This moves the entry to AGREED_REC. The PO then waits for the CP's pledge. |

| • | PLEDGE - This moves the entry to PLEDGED_REC. The PO can then choose from the following actions: |

| – | Accept the pledge with the actions PLEDGE_ACCEPT or PLEDGE_CHECK_AND_ACCEPT, which moves the entry to PLEDGE_ACCEPTED (sending a PledgeAcceptMarginCall message back to the CP). The action EXECUTE can then be applied to save the Margin Call trades. |

| – | Reject the pledge (action PLEDGE_REJECT). In this case, a pop up message appears and the PO must provide rejection reasons, which are used to populate the message. This moves the entry to PLEDGE_REJECTED (sending a PledgeRejectMarginCall message to the CP). The CP can amend their pledge, in which case the PO receives a PledgeAmendMarginCall message. |

| • | DISPUTE - In case of a full dispute, moving the entry to DISPUTED |

| • | PARTIAL_AGREE - In the case of a partial dispute, moving the entry to PARTIAL_REC. This updates the Agreed Amount field to the CP amount. Moving to the next status depends on the CP action, which can be: |

| – | CANCEL_DISPUTE if the CP cancels the dispute, moving the entry to CREATE |

| – | PLEDGE, moving the entry to PLEDGED_REC |

1.2 PRICED_PAY

In the case the PO is expecting to be called, the margin call entry will be in PRICED_PAY status and waiting to receive a message from the CP. Once the message is received, the action RECEIVE will be applied automatically and the entry will be moved to RECEIVED.

From there the PO can:

| • | AGREE_EXPOSURE, moving the entry to AGREED. The PO will then: |

| – | PLEDGE (see PLEDGE description above) |

| – | CANCEL_AGREE , moving the entry to CANCEL_AGREED. Then proceed to disputing it (partial or full). |

| • | PLEDGE - The PO manually selects a pledge via the Allocation window. Upon receiving this pledge, the CP can accept or reject the pledge. The action applied on the entry depends on the message sent by the CP: |

| – | If the CP accepts the pledge, PLEDGE_ACCEPT is applied and the entry moves to PLEDGE_ACC. The PO can then execute the entry to save the Margin Call trades. |

| – | If the CP rejects the pledge, PLEDGE_REJECT will be applied and the entry moves to PLEDGE_REJ. The PO will then amend their pledge (a PledgeAmendMarginCall message will be sent). |

| • | DISPUTE - Note that before the action DISPUTE is applied, the user needs to set the Agreed Amount. This can be done by either manually updating the Agreed Amount field and selecting the Dispute Option Select Other (in Collateral Manager > Dispute drop-down), or by selecting the Dispute Option Select PO amount. The DISPUTE action can then be applied. At this point, a pop up window appears for a dispute reason to be selected and a dispute comment to be entered. This information populates fields in the DisputeMarginCall message which is sent once the entry is in DISPUTED status. The dispute can be: |

| – | Partial dispute, in which case the PO pledges based on the agreed amount. |

| – | Full dispute, in which case it remains in DISPUTED status unless the PO cancels the dispute with the CANCEL_DISPUTE action. |

2. Acadia Attributes in Margin Call Contract

2.1 Acadia Details

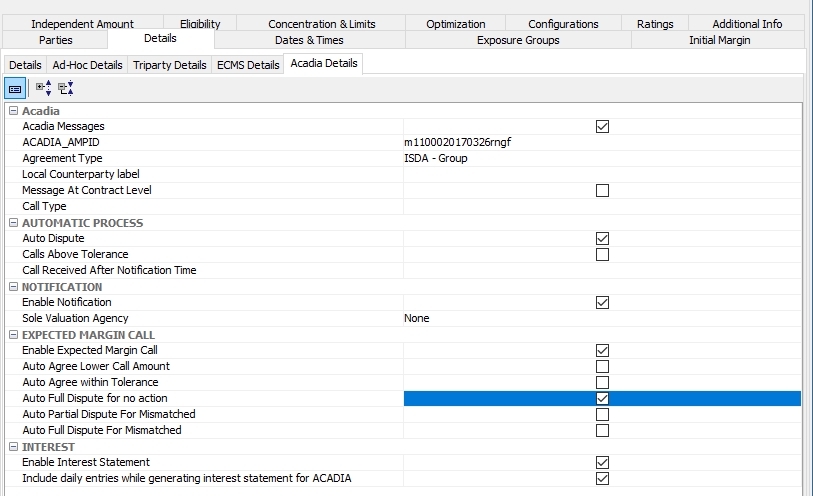

The Acadia Details panel, within the Details panel in the Margin Call contract in the Collateral module, contains information related to generating AcadiaSoft messages.

From Calypso Navigator, select Configuration > Fees, Haircuts & Margin Calls > Margin Call.

In the Details >Acadia Details tab, the following Acadia details are displayed. Click the Acadia Messages checkbox to indicate that Acadia messages are going to be sent and received.

Ⓘ NOTE: Automatic Process, Notification and Expected Margin Call are available at contract level only. They are not on the Acadia Details panel for Exposure Groups. Only one of these options can be chosen.

|

Fields |

Description |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Acadia |

|||||||||||||||||||||||||

|

Acadia Messages |

Click the Acadia Messages checkbox to indicate that Acadia messages are going to be sent and received. |

||||||||||||||||||||||||

|

ACADIA_AMPID |

In the ACADIA_AMPID, input the incoming response Id to a Margin Call when using AcadiaSoft.

|

||||||||||||||||||||||||

|

Agreement Type |

Select a value for the Agreement Type, which also comes from the Acadia configuration. The options are:

The options available for selection come from the Collateral.AcadiaAgreementType domain value. |

||||||||||||||||||||||||

|

Local Counterparty label |

When populated with a value, it will populate the same value in the Create Margin Call message |

||||||||||||||||||||||||

|

Message At Contract Level |

When selected, messages are sent at contract level. This should only ONLY be selected if there are no Exposure Groups on the contract. |

||||||||||||||||||||||||

|

Sole Valuation Agency |

Options of PO or none, if PO is selected, a notification is automatically sent to the counterparty if the Global Required Margin is less than 0. |

||||||||||||||||||||||||

|

Call Type |

Specifies the type of margin call, defining whether the call is netted or segregated (variation or initial) |

||||||||||||||||||||||||

|

Automatic Process |

|||||||||||||||||||||||||

|

Auto dispute |

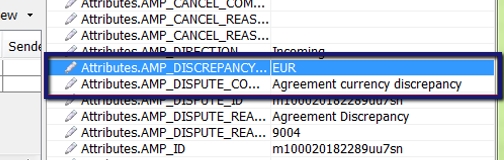

The Auto Dispute process automatically initiates a dispute when a designated dispute tolerance is exceeded. Configuration for this feature is as follows:

This feature is also used when an incorrect margin call currency is received from Acadia. When Auto Dispute is selected, the margin call will be auto disputed if the incoming call currency is not the same as the agreement currency. The comments for the AMP_DISCREPANCY_CURRENCY attribute will reflect the incorrect currency and the AMP_DISPUTE_COMMENTS will read "Agreement currency discrepancy."

Dispute margin call messages received on non-business day will get mapped to the fully disputed entry and will get auto disputed. Once margin call is disputed, the system will send dispute code as 9999 and comment as “Non business day”. In Collateral Context, Workflow Subtype should be set to “From Contract and Entry” in order to use the “valuation” workflow on a non-business day. |

||||||||||||||||||||||||

|

Calls Above Tolerance |

If checked, an incoming call above the tolerance will automatically be disputed. If unchecked, no dispute will be performed based on the call amount. |

||||||||||||||||||||||||

|

Call Received After Notification Time |

The STP process can be stopped if the call is received from the counterparty after the notification time on the agreement. The possible values are: Ignore Notification Time, Stop STP and Auto Dispute. This attribute checks the Collateral Manager > Result > Time to Notification column. If it is >0, the notification has not been reached yet and the call will not be disputed on this basis. If it is <0, the notification has passed, and the call can be disputed depending on the configuration of this attribute. |

||||||||||||||||||||||||

|

Notification |

|||||||||||||||||||||||||

|

Enable Notification |

Select if a Notification needs to be generated on the contract. A Notification is visible to both the party sending the Notification to the HUB and the Counterparty. |

||||||||||||||||||||||||

|

Sole Valuation Agency |

If Processing Org, a Notification is automatically sent to the Counterparty if the Global Required Margin is < 0.

|

||||||||||||||||||||||||

|

Expected Margin Call |

|||||||||||||||||||||||||

|

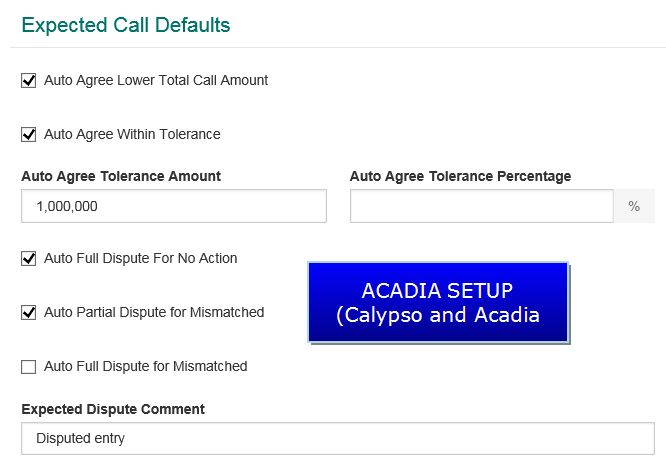

Enable Expected Margin Call |

Select if an Expected Margin Call message needs to be generated on the contract. In the case of a Pay Margin Call entry, an expected margin call message is generated which will be sent to the Acadia HUB, it is not visible to the counterparty. Depending on the following options selected, once the call has been sent to the counterparty, the message can automatically move through the workflow. |

||||||||||||||||||||||||

|

Auto Agree Lower Call Amount |

An Agree message will be automatically generated by Acadia if the Counterparty calls for less than the Processing Org expected. |

||||||||||||||||||||||||

|

Auto Agree within Tolerance |

An Agree message will be automatically generated by Acadia if the Counterparty calls with tolerance. |

||||||||||||||||||||||||

|

Tolerance Amount |

This option is available if Auto Agree within Tolerance is selected. An amount or a percentage must be defined. |

||||||||||||||||||||||||

|

Tolerance Percentage |

This option is available if Auto Agree within Tolerance is selected. An amount or a percentage must be defined. |

||||||||||||||||||||||||

|

Auto Full Dispute for no action |

Dispute in case 'no action' is true. |

||||||||||||||||||||||||

|

Auto Partial Dispute for Mismatched |

Partial dispute message is automatically generated by Acadia if the Counterparty calls for more than expected. |

||||||||||||||||||||||||

|

Auto Full Dispute for Mismatched |

Full dispute with Agreed Amount = 0 is generated if the Counterparty calls for more than is expected. |

||||||||||||||||||||||||

|

Interest - See Acadia Interest Manager for more information. |

|||||||||||||||||||||||||

|

Enable Interest Statement |

If selected, Acadia interest statements are generated for the interest bearing trades linked to the Margin Call Contract. If it is not selected, the potential interest bearing trades linked to this Margin Call Contract will not generate interest statements. |

||||||||||||||||||||||||

|

Include daily entries while generating interest statement for ACADIA |

If selected, Acadia interest statements will include daily entries. |

||||||||||||||||||||||||

NOTE: The setup in Calypso and Acadia must match.

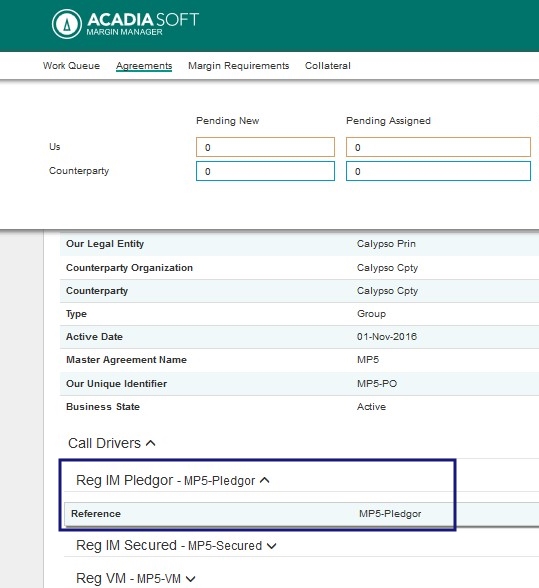

| » | For ISDA-Group at Master level, the following configuration is needed: |

| – | Configure ACADIA_AMPID, Agreement Type = ISDA-Group and select Acadia Messages |

| – | Configure ACADIA_MASTER_IDENTIFIER = Acadia Reference for each agreement type in the Additional Info panel of the Margin Call contract |

| – | Configure ACADIA_MASTER TYPE in the Additional Info panel of the Margin Call contract, choosing from the values in the drop-down. Values are Legacy Initial, Legacy Variation, Regulatory VM, Regulatory IM Pledgor and Regulator IM Secured |

| » | The workflow is the same for the ISDA-Group contract either at the Master level or the Exposure Group level |

| » | On the Acadia side, the call driver reference must be set at the lowest level of the group in case of VM Gross |

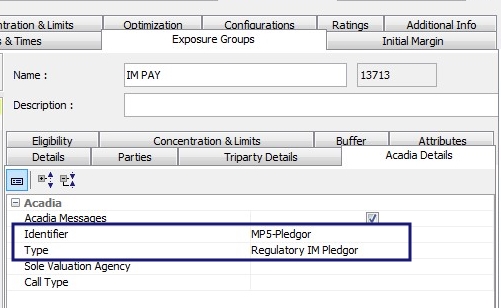

Acadia Details are also available in the Exposure Group configuration, though the selection options are different from the Details panel.

The Type field is only mandatory if the master Acadia Agreement Type is ISDA -Group.

Select the Acadia Messages checkbox to indicate that messages are going to be sent/received from the Exposure Group level.

Enter an Identifier which corresponds to the Identifier added in Acadia as well as a Type. The values possible for the Type field are:

| • | Legacy Initial (for non-regulatory IM) |

| • | Legacy Variation (for non-regulatory VM) |

| • | Regulatory IM Pledgor |

| • | Regulatory IM Secured |

| • | Regulatory IM |

These values are stored in the Collateral.AcadiaMarginCallType domain value.

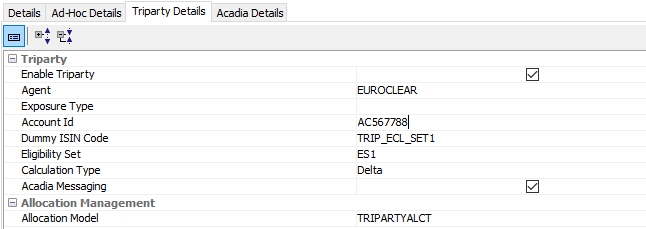

2.2 Triparty Details

Refer to the Triparty Services Guide for information on Triparty setup. Some fields of this panel are described below.

|

Field |

Description |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Calculation Type |

Net Exposure: Previous default behavior Delta: Default behavior. When Delta is chosen, the Global Required Margin shows a delta amount rather than the net exposure for Triparty/Non-Acadia contracts. When this is chosen, the following calculations apply:

If Acadia Messaging is True, the only option for Calculation Type is Delta. |

||||||||||||||||||||||||||||||||||||

|

Allocation Model |

The selection of the Allocation Model has an impact on the remaining margin calculation and changes based on whether Acadia Messaging is true or false. When Enable Triparty is selected, the Allocation Management section will become visible. The options when Acadia Messaging is set to False are:

If Acadia Messaging is set to True, the options for Allocation Model are:

The following workflow transition should be used: XXX – CANCELTRIPARTY – TRIPARTY_TRANSATION_CANCELED. When applying this transition, the following will happen:

The status TRIPARTY_TRANSATION_CANCELED is defined to trigger a cancel message in the Collateral.TripartyCancelationStatus domain. Message setup is described in the Triparty Services documentation.

For Triparty IM Calls, the following options are available to send dummy pledge messages:

|

2.3 Triparty MTA and Rounding

MTA and rounding are supported for Triparty contracts. Calculation type must be set to Delta.

MTA Calculation:

For MTA calculation, if Constituted Margin is below the MTA, Global Required Margin is 0. If Constituted Margin is above the MTA, Global Required Margin is equal to the Constituted Margin. If the margin call needs to be paid, the PO’s side MTA applies. If the margin call needs to be received, the counterparty’s side MTA applies.

Rounding:

For Rounding, the margin call is a New Margin, the Global Required Margin is rounded using the delivery methodology specified on the margin call contract. If the margin call is a Return Margin, the Global Required Margin is rounded using the return methodology specified on the margin call contract.

If the margin call needs to be paid, the PO’s side rounding methodology applies. If the margin call needs to be received, the counterparty’s side rounding methodology applies.

New Margin Above MTA Example:

MTA = 200,000

Delivery Rounding Method: Rounding UP - 1,000

Return Rounding Method: Rounding DOWN - 1,000

Margin Required = $2,854,873.00

Previous RQV = $2,155.000.00

New Margin = $2,854,873.00 - $2,155,000.00 = $699,873.00

New Margin (Rounding) = $700,000.00, which is above the MTA (200,000.00)

Global Required Margin = $700,000.00

Required Value = $2,855,000.00 (which is $700,000.00 + $2,155,000.00)

New Margin Below MTA Example:

MTA = 200,000

Delivery Rounding Method: Rounding UP - 1,000

Return Rounding Method: Rounding DOWN - 1,000

Margin Required = $2,254,873.00

Previous RQV = $2,155,000.00

New Margin = $2,454,873.00 - $2,155,00.00 = $99,873.00

New Margin (Rounding) = $100,000, which is above the MTA (200,000.00)

Global Required Margin =0.00

Required Value = Previous RQV = $2,155,000.00

Return Above MTA Example:

MTA = 200,000

Delivery Rounding Method: Rounding UP - 1,000

Return Rounding Method: Rounding DOWN - 5,000

Margin Required = $1,854,873.00

Previous RQV = $2,155.000.00

Return Margin = $1,854,873.00 - $2,155,000.00 = $300,127.00

Return Margin (Rounding) = $300,000.00, which is above the MTA (200,000.00)

Global Required Margin = -$300,000.00

Required Value = $1,855,000.00 (which is -$300,000.00 + $2,155,000.00)

Return Below MTA Example:

MTA = 200,000

Delivery Rounding Method: Rounding UP - 1,000

Return Rounding Method: Rounding DOWN - 5,000

Margin Required = $2,054,873.00

Previous RQV = $2,155,000.00

New Margin = $2,054,873.00 - $2,155,00.00 = $100,027.00

New Margin (Rounding) = $100,000, which is above the MTA (200,000.00)

Global Required Margin =0.00

Required Value = Previous RQV = $2,155,000.00

2.4 Auto Send Dummy ISIN TRIPARTYALCT Messages

If this setup is not done, you can use one of the other options to send these messages:

| • | Manual pledge message sent by PO |

| • | Auto pledge functionality of Acadia |

If this setup is done, these messages are automatically sent.

Setup for Allocation Model TRIPARTYALCT

Workflow Rule

For the TRIPARTYALCT allocation model, you need to add workflow rule AutoPledgeTriparty on PLEDGE actions:

DISPUTED - PLEDGE - PLEDGED

AGREED - PLEDGE - PLEDGED

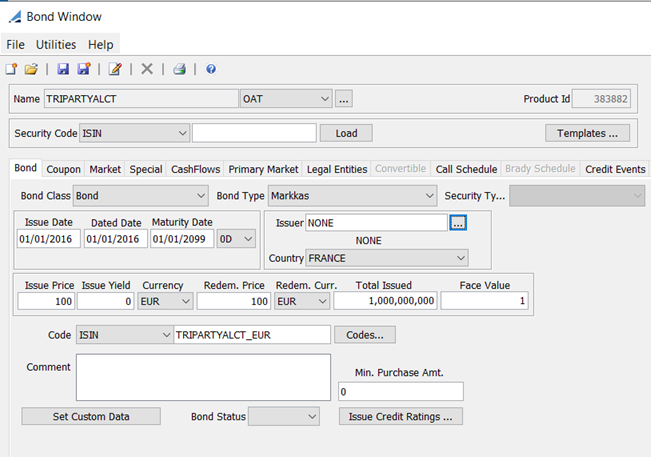

Dummy ISIN

As allocations need to be created in Calypso for the TRIPARTYALCT allocation model, you need to define a dummy bond for each currency with ISIN = TRIPARTYALCT_<currency>, and this bond needs to be priced as 1.

Example for EUR:

Setup for Allocation Model MT569

For allocation model MT569, no allocations are created in Calypso hence it is not necessary to set up a dummy bond.

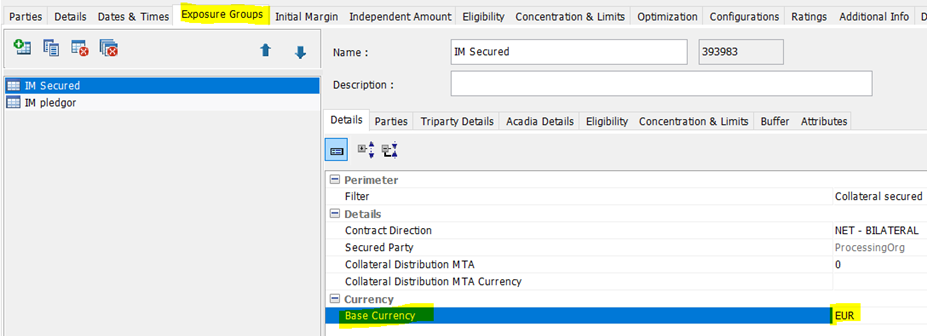

To decide the currency for allocation, the system will first check the currency which is set on exposure groups.

Example:

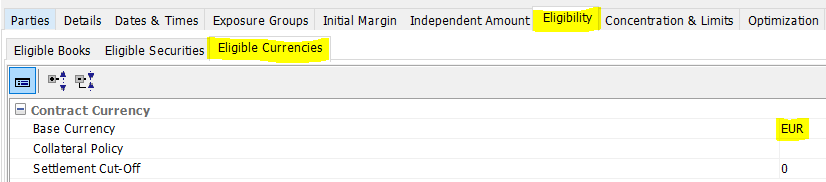

If there are no exposure groups in the contract and separate contracts are created for IM Secured and IM Pledgor, the system will check the currency which is set under eligible currencies.

For allocation model MT569, the allocation message needs to be sent without creating allocations in Calypso and hence it is not necessary to add the workflow rule AutoPledgeTriparty.

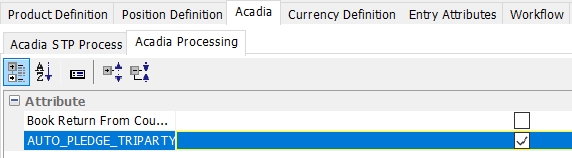

Instead, you need to check the collateral context attribute AUTO_PLEDGE_TRIPARTY under the Acadia panel.

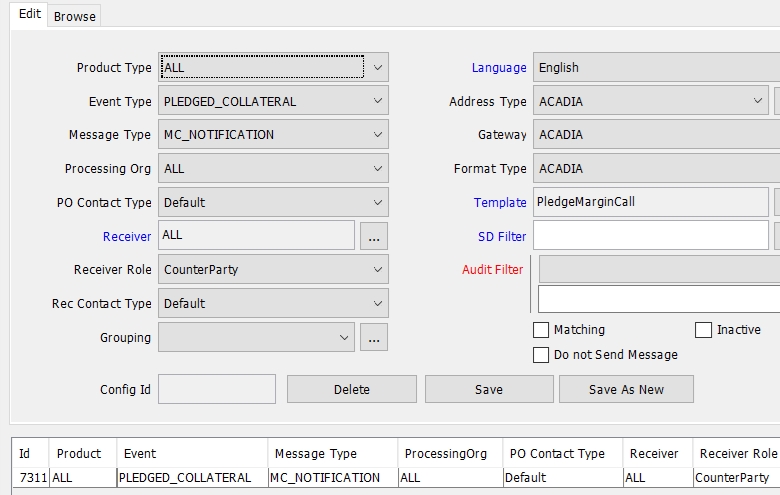

Message Setup

A message of type MC_NOTIFICATION needs to be configured on PLEDGED_COLLATERAL events.

When the PLEDGE action is applied, the message will be generated.

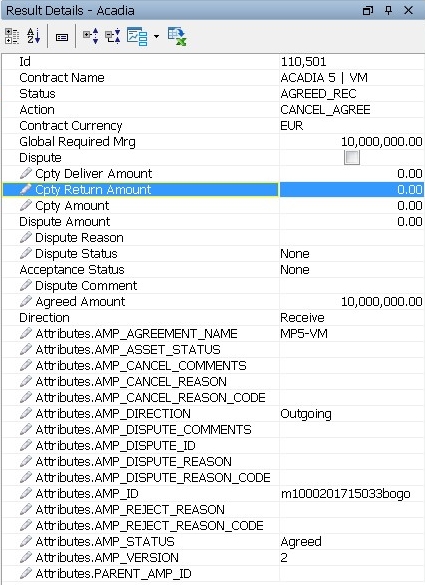

3. Acadia Attributes in Collateral Manager

Required Value and Previous RQV, found in the Collateral Manager > Results panel show Acadia / Triparty information.

|

|

Triparty Non-Acadia |

Triparty Acadia |

Bilateral |

|---|---|---|---|

|

Previous RQV |

RQV from D – 1 |

RQV from D – 1 |

Empty |

|

Required Value |

Global Required Margin |

Prev RQV if below the MTA; otherwise Required Margin (post dispute) This is sent in MT527 (tag :19A::TRAA//) and therefore pushes to the margin call trade in the Exposure Amount field via the Exposure Adjustment lifecycle action when the margin call entry reaches the TRIPARTY_INSTRUCTED status. |

Empty |

|

Triparty Allocation Value |

N/A |

Triparty agent valuation of collateral provided in MT569; Sum of Norm. Transaction Value in the sec finance collateral report. Populated after MT569 integration via the MT569MessageProcesser (if possible). |

Empty |

|

Triparty Margin Amount |

N/A |

Populated after MT569 integration. Required Value minus Triparty Allocation Value. |

Empty |

|

Other Columns |

Regular Triparty calculations |

Constituted Margin = Margin Required – Previous RQV Global Required Margin if there is a dispute: Agreed Amount. If there is no dispute: Constituted Margin Remaining Margin = RQV – Daily Margin |

Regular bilateral calculation |

NOTE: For clients sending and receiving messages from external systems, the RQVMatched workflow rule can be used in a workflow transition to add the RQV of the margin call as the matched RQV in the entry attributes, which will be looked for when calculating Previous RQV. This workflow rule needs to be added to the workflowRuleCollateral domain.

The attribute MatchedRQV is propagated from the margin call entry each time the margin call contract is priced. Therefore, the last matched RQV is stored on a daily basis on each margin call entry and it is possible to archive the older margin call entries without issue.

Margin Flow Approach

There are two fields in related to the Margin Flow Approach, Schedule Amount and SIMM. These fields are used to provide IM information on the CreateMarginCall and ExpectedMarginCall messages.

Also, there are two pricing measures, PM_SIMM and PM_SCHEDULE which map to the Schedule Amount and SIMM. These are editable if you do not break them down automatically when you import your exposures.

Details on the Margin Flow Approach can be found in the Collateral documentation in the Margin Call Contract > Independent Amount section.

4. Acadia Attributes in Collateral Context

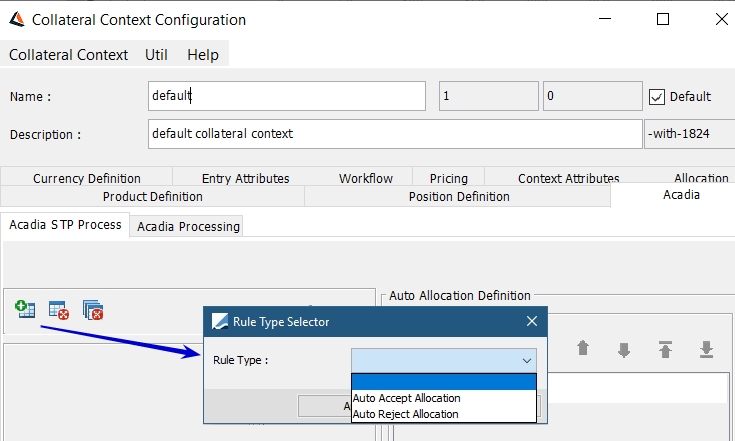

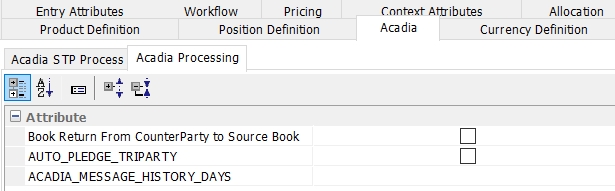

4.1 Acadia STP Process

It is possible to automate the acceptance or rejection of pledges received by the Counterparty via Acadia using pre-defined criteria in the Collateral Context. The rule configuration in the Acadia STP Process panel defines the criteria that must be met for an Auto Accept or an Auto Reject to be possible.

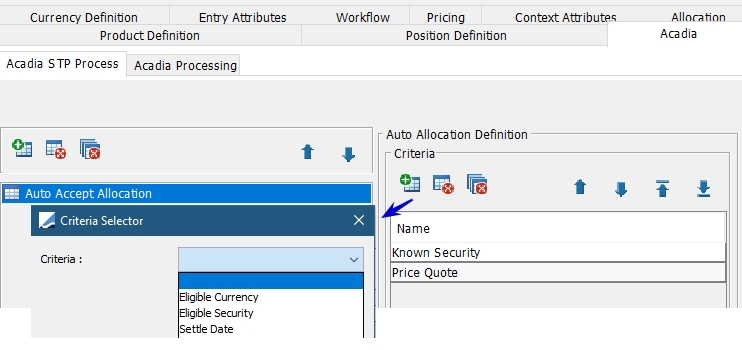

When Auto Accept Allocation is chosen, the Auto Allocation Definition populates automatically with the validation criteria Known Security and Price Quote.

Additional validation criteria may be chosen in the Auto Allocation Criteria Definition area.

The following validation criteria are available:

|

Criteria |

Description |

|---|---|

|

Bond Minimum Purchase Amount |

In the case of a security allocation, this check validates that the Minimum Purchase Amount of the bond is respected. The Minimum Purchase Amount is defined on the Bond Definition window. |

|

Bond Increment Lot Size |

In the case of a security allocation, the nominal of each security allocation is compared with the incremental value. If it is a multiple of the lot size, the validation passes. If it is not a multiple of the lot size, the validation is breached. Increment Lot Size is specified in Bond product code "Lot Size" by default. |

|

Bond Total Issued |

In the case of a security allocation, the validation checks if the amount of the allocation does not exceed the total amount issued. Total Issued amount is set on the Bond Definition window. |

|

Concentration Limit |

The validation checks concentration limits. Please note that concentration limit check is not performed on full return cases when exposure changes are in the PO's advantage. |

|

Eligible Currency |

The validation checks if the currency is eligible, as defined in the Margin Call Contract. |

|

Eligible Security |

The validation checks if the security is eligible, as defined in the Margin Call Contract. |

|

Fully Allocated |

If an allocation suggested by the counterparty does not meet the call amount, Auto Accept can be stopped. If Check collateralization tolerance is checked, incoming pledges must within the Collateralization Tolerance or above (designated in the Collateral Context - Allocation - Collateralization Tolerance tab). If unchecked, the pledges must mach perfectly with the amount calculated by Calypso. |

|

Known Security |

In the case of a security allocation, the product must exist in the system. This auto accept criteria is mandatory. |

|

Price Quote |

In the case of a security allocation, the product must have a price. This auto accept criteria is mandatory. |

|

Settle Date |

The allocation suggested by the counterparty (whether cash or security), has a settle date which matches what is defined in the margin call contract, less than or equal to. |

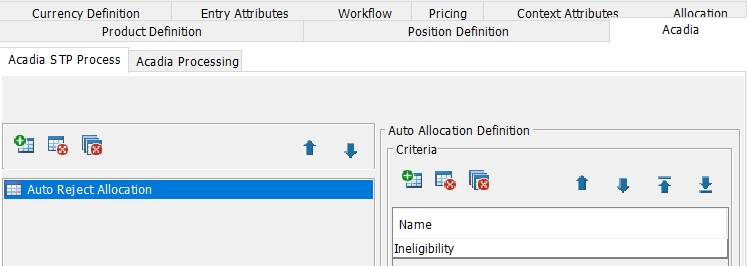

Auto Reject Allocation

When Auto Reject Allocation is chosen, you can select the following criteria:

Ineligibility, which is set by default - Allocation is rejected if pledge security is not eligible.

Settle Date - Allocation is rejected if pledge settle date is not correct based on offset and holidays defined in Margin Call Contract.

Fully Allocated - Allocation is rejected if pledge is under collateralized and not within collateralization tolerance (designated in the Collateral Context - Allocation - Collateralization Tolerance tab), regardless of Check collateralization tolerance.

Ⓘ [NOTE: If you select Settle Date and Fully Allocated as auto-reject criteria, you need to select them as auto-accept criteria as well - Also, the values FullAllocationValidator and SettleDateValidator must be added to the domain "ACADIAAllocationValidators" for consistency]

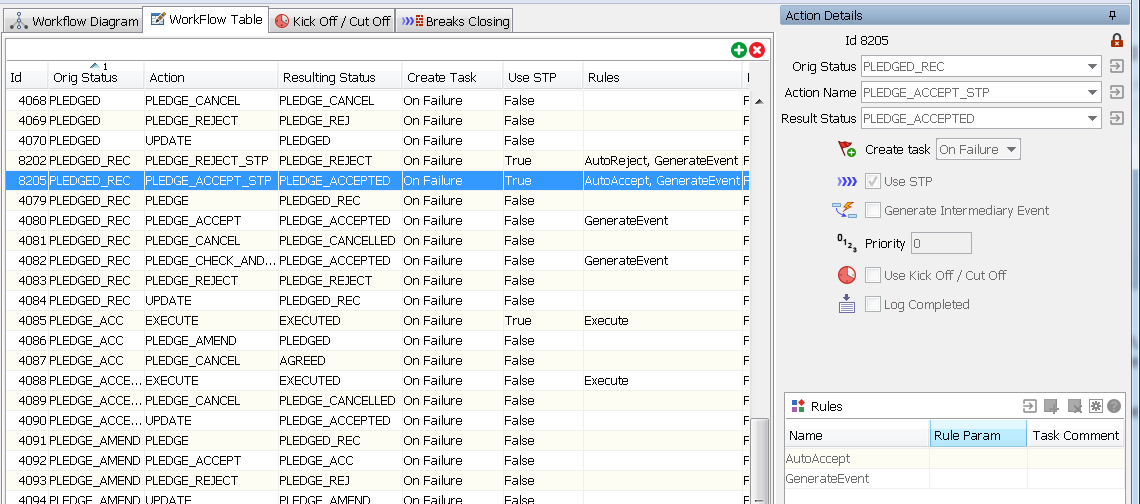

Workflow Rules

There are two workflow rules associated with Auto Accept / Auto Reject functionality which are AutoAccept and AutoReject.

The workflow transitions in STP are:

| • | PLEDGED_REC – PLEDGE_REJECT_STP – PLEDGE_REJECT (with AutoReject and GenerateEvent as workflow rules) |

| • | PLEDGED_REC – PLEDGE_ACCEPT_STP – PLEDGE_ACCEPTED (with AutoAccept and GenerateEvent as workflow rules) |

Non-STP transitions are kept in order to process allocations that cannot be auto accepted or auto rejected:

| • | PLEDGED_REC – PLEDGE_ACCEPT – PLEDGE_ACCEPTED |

| • | PLEDGED_REC – PLEDGE_CANCEL – PLEGED_CANCELLED |

| • | PLEDGED_REC – PLEDGE_CHECK_AND_ACCEPT – PLEDGE_ACCEPTED |

| • | PLEDGED_REC – PLEDGE_REJECT – PLEDGE_REJECT |

Example 1:

If the counterparty pledges the following:

- Cash EUR with settle date = T+1, is auto accepted as it respects all the rules of the Auto Accept functionality. The entry will move to PLEDGE_ACCEPTED automatically.

- Bond A is rejected because it is ineligible, which is a criteria which leads to Auto Reject. The entry moves to PLEDGE_REJECTED automatically.

- Cash EUR with settle date = T+3, the margin call entry remains in PLEDGE_REC. It cannot go to PLEDGE_ACCEPTED automatically because it does not respect all of the Auto Accept criteria (because of the settle date). But, because it is eligible collateral, it cannot automatically be rejected.

The user will therefore have to manually review and decide which action to apply to the allocation.

Example 2:

If the counterparty pledges more than one collateral:

- If all the allocations validate the Auto Accept criteria, the entry can move to PLEDGE_ACCEPTED and the corresponding pledge accept message can be sent out.

- If some allocations can be auto accepted but automatic treatment is impossible for others (does not meet Auto Accept nor Auto Reject), the entry remains in PLEDGE_REC and the user will manually have to decide whether to accept or reject the allocation.

- If some allocations can be accepted but other are rejected, the margin entry moves to PLEDGE_REJECTED and a pledge reject message will be sent back to the counterparty.

- If all the allocations validate the Auto Reject criteria, the entry will move to PLEDGE_REJECTED and a pledge message will be sent to the counterparty.

4.2 Acadia Processing

You can set additional attributes in the Acadia Processing panel.

Book Return From Counterparty to Source Book

If set to true (checked), a return from Acadia is done on initial book. This will have a performance impact which depends on total number of netted positions in the system.

If the same collateral type is delivered from two books and if PO receives collateral from counterparty as return, then it will be booked to source book(s), and it will impact books from smallest position to biggest position.

In below example, ISIN FR000004345 is delivered from two books:

Book 1 for 2500

Book 2 for 2530

If PO has sent margin call for EUR 4,000 then

1. If CP returns 1000, then it should impact Book 1

2. If CP returns 4000, then system should book return of 2500 against Book and 1500 against Book 2

If not set (default), the system will select the books mentioned under Eligibility tab in margin call contract.

AUTO_PLEDGE_TRIPARTY

See Auto Send Dummy ISIN TRIPARTYALCT Messages for details.

See Auto Send Dummy ISIN TRIPARTYALCT Messages for details.

ACADIA_MESSAGE_HISTORY_DAYS

Number of business days for which to display stored messages in the Acadia Message Repository panel of the Collateral Manager. Default is 1 for current business day.

See ACADIA_INCOMING Message Workflow for details.

See ACADIA_INCOMING Message Workflow for details.

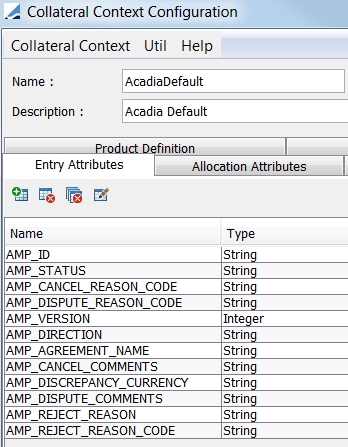

5. Acadia Attributes in Collateral Context Template

From Calypso Navigator, select Processing > Collateral Management > Collateral Manager.

From the Window menu, select Configuration > Collateral Context.

In the Entry Attributes panel, you should see these attributes:

These attributes can be loaded and viewed in the Collateral Manager Results panel.

| • | AMP_AGREEMENT_NAME – from the Margin Call contract Identifier at the Exposure Group level in the Acadia panel |

| • | AMP_ASSET_STATUS – allocation message if there is an issue with the pledged assets, used in case of ineligible collateral |

| • | AMP_CANCEL_COMMENTS – from CancelMarginCall message |

| • | AMP_CANCEL_REASON – from CancelMarginCall message |

| • | AMP_CANCEL_REASON_CODE – from CancelMarginCall message |

| • | AMP_DIRECTION |

| • | AMP_DISCREPANCY_CURRENCY - incorrect call currency received |

| • | AMP_DISPUTE_COMMENTS - from DisputeMarginCall message |

| • | AMP_DISPUTE_ID – from DisputeMarginCall message |

| • | AMP_DISPUTE_REASON – from DisputeMarginCall message |

| • | AMP_DISPUTE_REASON_CODE – from DisputeMarginCall message |

| • | AMP_ID – from Margin Call contract > Details > Acadia Details panel |

| • | AMP_REJECT_REASON – reason for rejecting a pledge (reasons are hard coded), from PledgeRejectMarginCall message |

| • | AMP_REJECT_COMMENTS – free form comments regarding rejected pledge |

| • | AMP_STATUS – corresponds to AMP_STATE when a message is created or received |

| • | AMP_VERSION – version of the Margin Call object on the Acadia side, used to handle history information found on Acadia messages |

| • | PARENT_AMP_ID – Acadia information in case of disputes, where on the Acadia side there are two objects |

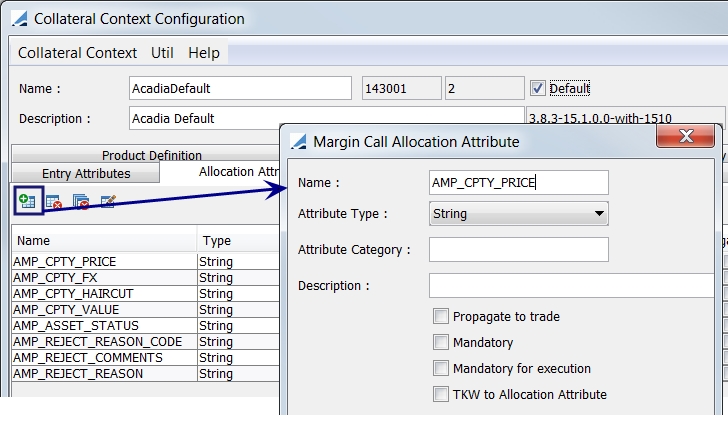

In the Allocation Attributes panel, add the following attributes:

| • | AMP_CPTY_PRICE – the price specified in AcadiaSoft |

| • | AMP_CPTY_FX – FX rate specified in AcadiaSoft |

| • | AMP_CPTY_HAIRCUT – haircut specified in AcadiaSoft |

| • | AMP_CPTY_VALUE – adjusted value based on parameters (price, FX, haircut) of AcadiaSoft |

| • | AMP_ASSET_STATUS – allocation message if there is an issue with the pledged assets, used in case of ineligible collateral |

| • | AMP_REJECT_REASON_CODE – reason code for rejecting a pledge (reason codes are hard coded), from PledgeRejectMarginCall message |

| • | AMP_REJECT_REASON – reason for rejecting a pledge (reasons are hard coded), from PledgeRejectMarginCall message |

| • | AMP_REJECT_COMMENTS – free form comments regarding rejected pledge |

| • | AMP_ID - corresponds to pledge Amp Id |

NOTE: Only the Default Collateral Context can be used for Acadia Messages.