Equity Index Product Definition

Prior to trading an equity index, you need to create the Equity Index product.

1. Defining an Equity Index

To define an equity index product, from Calypso Navigator choose Configuration > Equity > Equity Indexes (menu action product.EquityIndexWindow) as shown below.

1.1 Loading an Existing Equity Index

You can load an existing equity index into the Equity Index window using one of the following methods:

| » | Select a security code from the Security Code list, and enter the actual code value in the adjacent field. |

Then click Search to load the corresponding equity index.

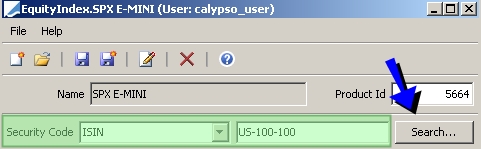

Equity Index window - Loading an equity index by security code

| » | You can also click  near the top of the window to open the Product Chooser window - Help is available from that window. near the top of the window to open the Product Chooser window - Help is available from that window. |

Equity Index window - Loading an equity index

Then modify the fields described below as needed.

1.2 Creating a New Equity Index

| » | Click  and enter the fields described below. and enter the fields described below. |

1.3 Modifying an Equity Index Name

| » | Click  to rename the Equity index. You will be prompted to enter a new name. to rename the Equity index. You will be prompted to enter a new name. |

1.4 Setting Custom Data

Ⓘ [NOTE: The Custom Data button is deprecated and has no function beginning in Release 12.0]

1.5 Saving an Equity Index

| » | Click  to save your changes. You will be prompted to enter an equity index name. to save your changes. You will be prompted to enter an equity index name. |

The system also saves a quote name for the product that is used to enter / retrieve market quotes.

You can also click  to save the equity index as a new product. You will be prompted to enter a new name.

to save the equity index as a new product. You will be prompted to enter a new name.

Definition Fields Details

| Fields | Description | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Name |

This name identifies the equity index throughout the system, and appears in the quote name. When you save the equity index, you will be prompted to enter the name for the index. |

|||||||||||||||

|

Product Id |

Unique ID given by the system when the equity index is saved. |

|||||||||||||||

|

EquityIndex Type |

Select the product subtype. The subtype is for information purposes and can be used for filtering equity indices. |

|||||||||||||||

|

Currency |

Select the currency in which the index is quoted. |

|||||||||||||||

|

BB_CALC_TYP |

Expand this label to view all the security codes defined for equity index products. You can enter a value for each security code as applicable. You can create new security codes using Calypso Navigator > Configuration > Product > Code. |

|||||||||||||||

|

Country |

Select the country for the index. |

|||||||||||||||

|

Exchange |

Click … to select the exchange where the index trades. The market place is a legal entity with the MarketPlace role. You can expand Exchange to enter the Spot Days: default number of business days between the trade date and the settlement date. Business days are determined using the holiday calendar of the market place. |

|||||||||||||||

|

Issuer |

Select the issuer of the index. The issuer is a legal entity role Issuer. You can expand the Issuer to select the IPA (issue paying agent) of the index. The issue paying agent is a legal entity with role IPA. |

|||||||||||||||

|

Provider |

Select the data provider for the Index. The data is used to determine the amount of cash in the index. |

|||||||||||||||

|

Publish |

Expand the Publish label to specify publication details:

For weekly / monthly frequencies, you can enter the day of the week / month in the Day field.

|

|||||||||||||||

|

External Reference |

Enter an external reference as applicable. |

|||||||||||||||

|

Quote Type |

Select the type of quote for the equity: Price, PriceVol, or PriceC (when the price is quoted in the number of cents). Fixing Types The following fixing types are supported in addition to CLOSE, OPEN, HIGH, LOW, and LAST:

|

|||||||||||||||

|

Date Roll |

Select the date roll convention when the publication date falls on a non-business day. Date roll conventions are described under Calypso Navigator > Help > Date Roll Conventions. |

|||||||||||||||

|

Sources |

Select the sources that publish the index if multiple sources apply. Sources are defined in the domain equity_index_source. You can expand the Sources label to select the Default Source. |

|||||||||||||||

|

Comment |

Enter a free-form comment as needed. |

2. Specifying Constituents

Select the Constituents panel to define the content of the index.

Equity Index Window - Constituents panel

Step 1 - Click  to add a set of constituents. You will be prompted to enter an effective date and time.

to add a set of constituents. You will be prompted to enter an effective date and time.

Step 2 - Then click  to add individual constituents and select the weight type of the basket: Quantity or Weight (percentage).

to add individual constituents and select the weight type of the basket: Quantity or Weight (percentage).

| » | Select the asset. If the asset currency is different from the equity index currency, you can define the conversion scheme between the currencies - See Multi-Currency Details below. |

| » | Enter the quantity or weight of the asset. You can also click "Apply equal weights" to apply equal weights to all assets. It is to be noted that, the check to ensure weights of all constituents amounts to 100%, is accurate upto 10 decimal places. |

Repeat as needed.

Click  to save the constituents of the index.

to save the constituents of the index.

Multi-Currency Details

| Fields | Description |

|---|---|

|

FX Pair |

Displays Product currency / Basket currency. |

|

Quanto/Compo |

Select whether the basket level is computed based on a fixed rate (Quanto) or an FX Rate definition (Compo). |

|

FX Reset |

If you have selected Compo, select an FX Rate Definition to convert the product amount into the basket amount. |

|

Quanto Rate |

If you have selected Quanto, enter the FX rate to convert the product amount into the basket amount. |

Importing the Constituents from an Excel Spreadsheet / a Basket

You can export the content of a basket to an excel spreadsheet by clicking  in the Basket window (Calypso Navigator > Configuration > Basket). You can also create an Excel spreadsheet that contains the constituents of the index.

in the Basket window (Calypso Navigator > Configuration > Basket). You can also create an Excel spreadsheet that contains the constituents of the index.

Then in the Excel spreadsheet, select the constituents you want to import and hit [Ctrl-C].

In the Constituents panel of the Equity Index window, click  to paste the constituents into the panel.

to paste the constituents into the panel.

3. Specifying Dividends

Ⓘ [NOTE: The Dividend panel is not supported and must not be used to create dividends. The dividends must be created directly from the Corporate Actions window]

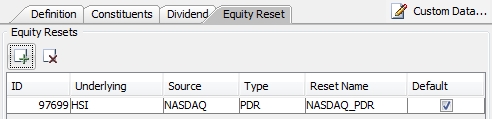

4. Specifying Equity Resets

You can define multiple equity resets using the Equity Reset tab as needed. You can then select the actual equity reset to be used when you capture the trades.

By default, the system adds an equity reset for the Exchange specified in the Equity Index definition.

To add more equity resets, click ![]() and select a source and a type. You can modify the name as needed.

and select a source and a type. You can modify the name as needed.

If no default equity reset is specified, the trades will use the "CLOSE" equity reset which corresponds to the spot quote.

When using equity resets, you can set the fixing quotes for the quote name: "EquityReset.<equity index name>.<reset name>".

For example: "EquityReset.HSI.NASDAQ_PDR".

Make sure to save the Equity Index.