Commodity Fixing

1. Fixing Policies

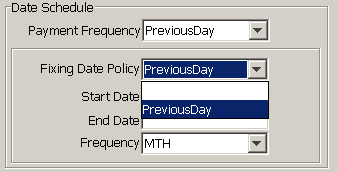

Depending on the payment frequency, you can generally select one of the following types of fixing policies: date fixing or future fixing. You can create new fixing date policies for the FutureContractLTD payment frequency.

The calendar(s) used to determine the business days in the cash flow period are specified in the Swap Leg panel as described above.

After pricing the trade, in the Cashflows you can view the fixing dates for a cash flow period in the Commodity Fixings dialog window. Right-click the cash flow period and choose Show Fixings in the Cash Flow Menu. You can also customize the fixing dates in this dialog window.

Date Fixing

Determines which fixing dates to use during the cash flow period.

| Policy | Description |

|---|---|

|

Whole Period |

There is a fixing date for each business day during the cash flow period. It is also supported for pay frequency FutureContractLTD/FND. |

|

Last Day |

The fixing date occurs on the last day of the cash flow period. |

|

First Day |

The fixing date occurs on the first day of the cash flow period. |

|

Third Wednesday |

This fixing date policy is used with the Periodic payment frequency. The Third Wednesday policy would be very commonly used for strips of LME bullet swaps due to the fact that the Third Wednesday future is the most liquid contract of each month. In order to replicate the physical market which would deliver on the Third Wednesday of each month, the fixing date should be set to the Monday before the Third Wednesday of the month, which would therefore result in the LMECash forward price method projecting the price for the cash date, which would be the Third Wednesday. If the Monday before the third Wednesday is a holiday according to the fixing date calendar, the fixing date should fall on the previous business day according to that same calendar. - No need to consider the FX holidays. - The fixing day is normally the third Monday of the Month, but could be the second Monday if the beginning of the Month is a Tuesday. - Partial month should give you a Warning, and if the end date is too short, an error message box. |

|

Weekday |

When selected, the Fixing Day of Week needs to be entered, which can be any of the seven days of the week. Additionally, Fixing Date Roll specifies what to do if the day of the week is a non-business day on the fixing calendar. This fixing policy is only available when the Payment Frequency is set to Periodic. |

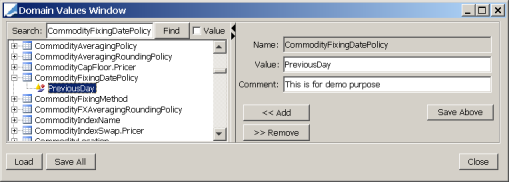

Custom Fixing Policy

You can code a custom fixing date policy class, and register it in the CommodityFixingDatePolicy domain, so that it appears in the Fixing Date Policy drop-down menu.

Step 1 - For the custom Fixing Date Policy, the code should reside in calypsox/tk/product/commodities/schedulegeneration/fixing and be compiled. For reference, please check: calypsox/tk/product/commodities/schedulegeneration/fixing/PreviousDayFixingDatePolicy.java

Step 2 - Add the custom fixing date policy name to the domain CommodityFixingDatePolicy.

Future Fixing

When you select a contract-based payment frequency, you can select the first and last named contract to determine the starting and ending fixing for the swap. There is a cash flow period for each contract between the start and end contract (inclusive). For the fixing date, you can select one of the following policies.

| Policy | Description |

|---|---|

|

Last Four Days |

The fixing dates are the last four business days of the cash flow period. |

|

Last Three Days |

The fixing dates are the last three business days of the cash flow period. |

|

Penultimate |

The fixing date is the business day before the end of the cash flow period. |

|

Contract Last Day |

The fixing date is the last day of the cash flow period. |

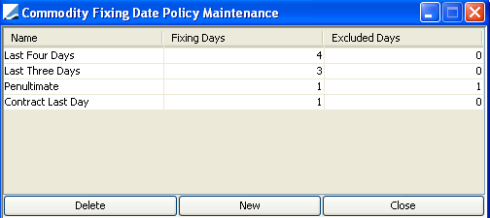

Custom Fixing

You can create new fixing policies for the FutureContractLTD payment frequency in the Commodity Fixing Date Policy Maintenance window. To display this window, from Calypso Navigator, choose Configuration > Commodities > Fixing Date Policy (product.CommodityFixingDatePolicyWindow).

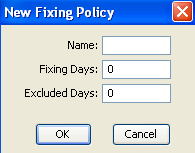

| » | Click New to crate a new fixing policy. |

| » | Define a name. The Fixing Days column represents how many total fixing dates per period you want, and the Excluded Days is the number of days, starting from the future expiration date, to shift those fixing dates backward. |

| » | Click OK to save the policy. The new policy appears in the maintenance window, and in the Fixing Date Policy drop-down menu in the CommoditySwap2 and OTCCommodityOption2 trade worksheets. |

For example, if you wanted to have prices fixed on the last three days of a future contracts listing, INCLUDING the day the future expires, you would set Fixing Days = 3 and Excluded Days = 0.

If you wanted to have fixings on the last four days before a future’s expiration, NOT INCLUDING the expiration date itself, then you would set Fixing Days = 4 and Excluded Days = 1.

2. Fixing Panel

After pricing the trade, in the Cashflows you can view the fixing dates for a cash flow period in the Commodity Fixings dialog window. Right-click the cash flow period and choose Show Fixings in the Cash Flow Menu. You can also customize the fixing dates in this dialog window.

In this window, the Fixing Date, Forward Date, FX Fixing Date, Quote Name, Price, FX Quote and FX Spot Price are displayed.

The FX Fixing Date is the date that is determined by the FX settlement information and used to calculate the forward FX rate. It is populated for future resets only, and only for floating legs.

The Forward Date is the date that is determined by the forward price method (which is selected in the Commodity Reset), and is used to look up the price on the curve. It is populated for future resets only, and only for floating legs. Below is a description of how each Forward Date is calculated based on the Forward Price Method.

|

Forward Price Method |

Forward Date Calculation |

|---|---|

|

Nearby |

Expiry date of the next expiring future contract on or after the fixing date |

|

Fixed |

The date specified on the Commodity Reset |

|

LME3M |

Fixing date plus 3 calendar months rolled to the next business day |

|

NearbyAndSecondNearby |

The expiry date of the second expiring future contract |

| NearbyNonDelivered |

The expiry date of the next expiring future contract on or after the fixing date |

|

LMECash |

Fixing date plus two business days |

|

NearbyThirdWednesday |

The next third Wednesday of the month on or after the fixing date |

|

InterpolatedPrice |

The fixing date |

|

ICENearby |

The expiry date of the next expiring future contract after the fixing date |

|

SecondNearby |

The expiry date of the second expiring future contract on or after the fixing date |