Capturing CDS Fixed Coupon Trades

A CDS Fixed Coupon trade is a standard CDS trade with a fixed coupon according to ISDA 2009 conventions.

|

CDS Fixed Coupon Trades Quick Reference Entering a Trade

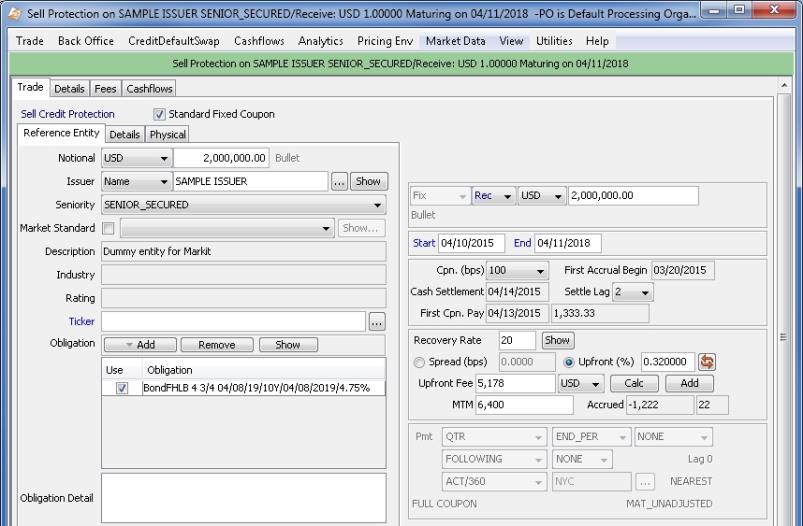

The Reference Entity panel, Details panels, and Physical or Cash panels are the same as for CDS trades - Only the trade details and the Premium panel are different.

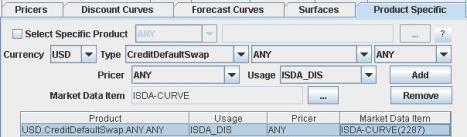

Pricing Requirements Fixed coupon trades require an ISDA curve, running CDS spreads, and upfront fee percentage (the quote value has the form "<cds>.Fee"). The ISDA curve can be obtained from Markit - See Calypso Navigator > Market Data > Utilities > Markit for details - Help is available from that window. The ISDA curve is assigned to the pricer configuration under the Product Specific panel for the product CreditDefaultSwap and usage ISDA_DIS.

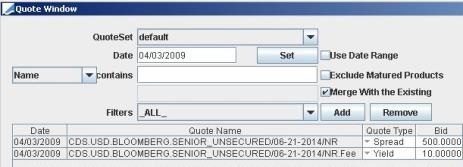

Fixed coupon trade quotes are entered using the Quote window - Choose Pricing Env > Check to view any missing market data.

You can enter a fee and a spread, or just a spread. If a fee is entered, the spread will be used as fixed coupon. Trades can be priced by pure running by leaving the fee to 0. You can use any credit default swap pricer to price fixed coupon trades.

|

1. ISDA Upfront Fee Calculator Setup

You can use the CDS upfront fee calculator provided by ISDA to compute upfront fees. The CDS upfront fee calculator is installed by default when you install Calypso.

In the following section, "<calypso_home>" refers to the directory where Calypso has been installed.

Environment Properties

Ⓘ [NOTE: No longer needed as of version 17 MR May 2023]

You need to set the following environment properties:

| • | CDS_SETTLEMENT_CALCULATOR = ISDA |

| • | ISDA_LIBRARY_PATH = Path to the library "cds.dll" for Windows, or "libcds.so" for Linux and Solaris. |

You can find the libraries at the following locations be default:

| – | For 32-bit Windows using 32-bit JVM, <calypso_home>/lib/win32 |

| – | For 64-bit Windows using 64-bit JVM, <calypso_home>/lib/win64 |

| – | For 32-bit Linux using 32-bit JVM, <calypso_home>/lib/linux32 |

| – | For 64-bit Linux using 64-bit JVM, <calypso_home>/lib/linux64 |

| – | For 32-bit Solaris using 32-bit JVM <calypso_home>/lib/solaris32 |

| – | For 64-bit Solaris using 64-bit JVM <calypso_home>/lib/solaris64 |

| • | ISDA_SERVERHOST = Hostname of the ISDA Server. |

You then need to deploy the Env file to your application servers. Please refer to the Calypso Installation Guide for details.

Domain Value

Domain "CDS_SETTLEMENT_CALCULATOR"

Value = ISDA

ISDA Server

Then start the ISDA Server using "<calypso_home>/startCdsisdamodel.bat" on Windows platforms, or "<calypso_home>/startCdsisdamodel.sh" on *nix platforms.

2. Sample Fixed Coupon Trade

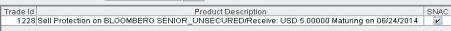

Choose Trade > Credit Derivatives > Credit Default Swap to open the CDS worksheet or from the Trade Blotter. You can also book a CDS SNAC trade in the Pricing Sheet.

CDS Trade Window

| » | Enter the fields described below. |

| » | Then proceed to the other panels - The other panels are the same as for other CDS trades. |

Trade Details

|

Fields |

Description |

|---|---|

|

Standard Fixed Coupon |

Check to capture a fixed coupon trade with ISDA 2009 conventions. The "Standard Fixed Coupon" indicator can be displayed in the trade browser (column located under Trade > Product > Credit Default Swap > SNAC).

|

Premium Details

|

Fields |

Description |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Pay / Rec |

Direction of the premium payments. It is set based on the direction of the trade.

Select the currency from the adjacent field. It defaults to the protection leg currency. Enter the principal amount in the adjacent field. You can use shortcuts, for example enter “10m” for 10,000,000. |

||||||||||||

|

Start End |

Enter the start and end dates of the trade. When saving a trade template, in order for the maturity date to yield the next/nearest IMM date, enter the end date as {n}YC, not {n}Y, example 10YC for 10 years. |

||||||||||||

|

Cpn. (bps) |

Select 100bp for high grade names, or 500bp for high yield names. Values can be added to domain CreditDefaultSwapCoupon.SNAC. |

||||||||||||

|

First Accrual Begin |

Date the coupon starts accruing. |

||||||||||||

|

Cash Settlement |

Cash settlement date = Start date + 3 days. |

||||||||||||

|

Settle Lag |

Enter the cash settlement lag days by choosing the number from the drop down (0, 1, 2, or 3). |

||||||||||||

|

Recovery Rate |

The recovery rate is defaulted based on the standard recovery defined under Calypso Navigator > Configuration > Credit Derivatives > Standard Recovery. If Recovery rate is not specified on the trade, it will be picked up from the Recovery curve / Probability curve. You can click Show to bring up the Standard Recovery Configuration window.

|

||||||||||||

|

First Cpn. Pay |

First coupon date (next quarterly date) and coupon amount. |

||||||||||||

|

Upfront Fee |

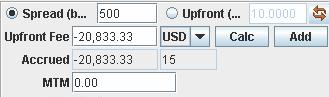

You can enter a spread or a percentage. Spread

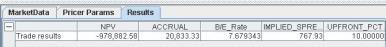

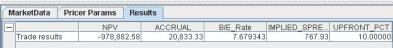

You can click Once your quotes are populated, click Price. Check pricer measures IMPLIED_SPREAD and UPFRONT_PCT.

Percentage

You can click Once your quotes are populated, click Price. Check pricer measures IMPLIED_SPREAD and UPFRONT_PCT.

Pricer Measures Explained

|

See also -

See also -