Capturing Security Lending Trades

In a security lending trade, you can lend or borrow securities. Typically the borrower obtains legal custody of the securities. The borrower must re-deliver the securities at a future date. The borrower may have to provide a security equal to the borrowed value, and an interest amount to buffer against the changing price of the lent securities in case of default. The lender receives a fee which the parties negotiate at the time of the transaction.

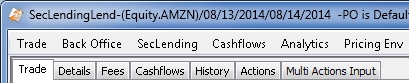

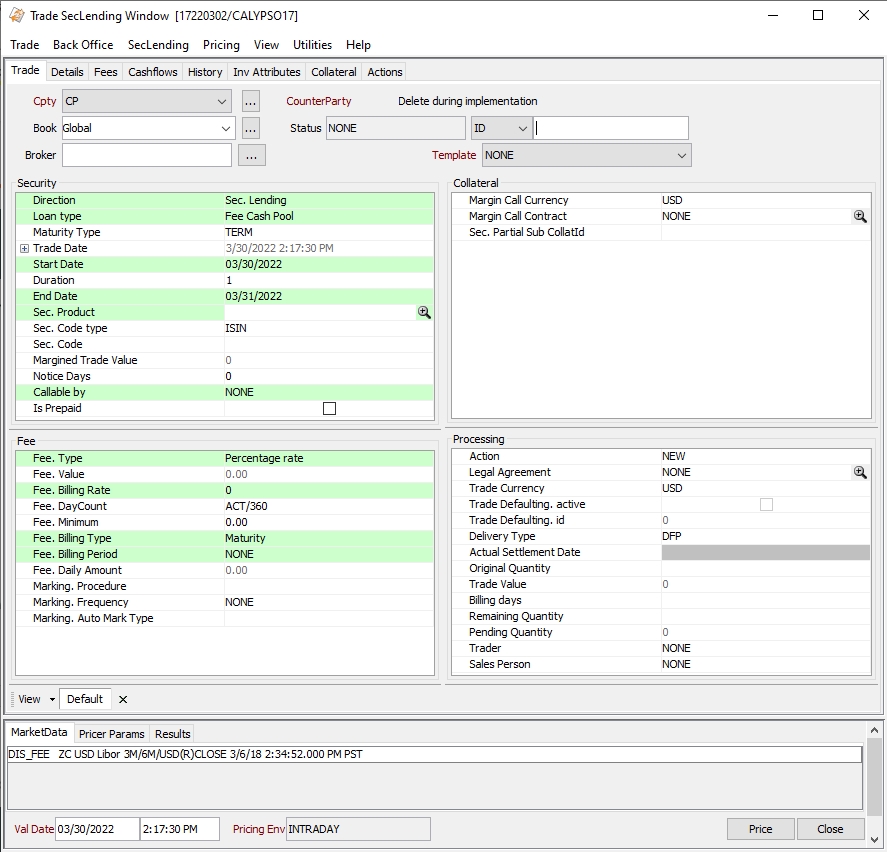

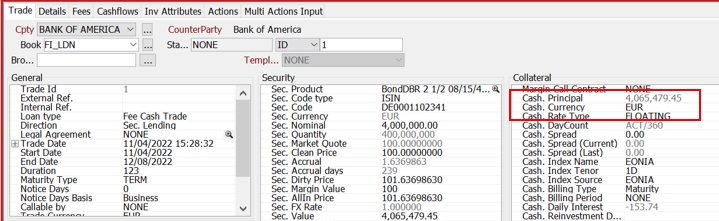

To configure security lending trades, navigate to Trade > Security Finance > Sec Lending (menu action trading.TradeSecLendingWindow).

|

Security Lending Quick Reference

Entering Trade Details

Or you can enter the trade fields directly. They are described below.

Saving a Trade

A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. Ⓘ [NOTE: In a production environment, the Trade > Save As New function (or F3 key) is not recommended for security lending trades] Pricing a Trade

Trade Lifecycle

|

Ⓘ [NOTE: In this document, "Sec Vs <XXX>" is used to refer to all of the Sec Vs Cash, Sec Vs Pledge, and Sec Vs Sec sub-types]

1. Static Data Filter Attributes

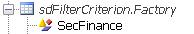

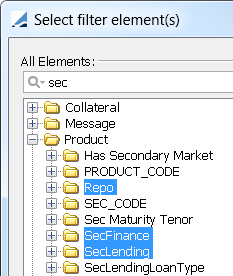

Add "SecFinance" to the domain sdFilterCriterion.Factory to create the Repo, SecFinance, and SecLending product static data filter attributes.

2. Trade Defaulting

Trade default values can be setup in the Security Finance Trade Defaulting window. From the Calypso Navigator, select Configuration > Legal Data > Security Finance Defaulting (menu action refdata.SecurityFinanceDefaultingWindow).

Most editable trade fields can be defaulted, and the defaulting can be driven by counterparty, product, or security and trade currency.

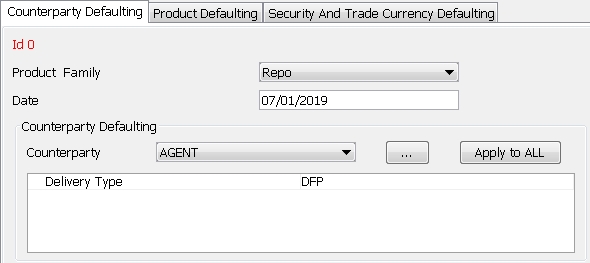

2.1 Counterparty Defaulting

| » | Select the Counterparty Defaulting panel, then click New. |

| » | Select a product family, and enter the effective date of the trade defaulting. |

| » | In the Counterparty Defaulting area, click ... next to the Counterparty field and select the counterparty for whom you want to define default values. It is added to the adjacent drop down. |

Select the counterparty from the drop down, then right-click in the box below and select Configure columns. Select the trade fields to be defaulted for this particular counterparty and click OK. The fields are added to the box.

Enter the default values as needed for this counterparty. They will be used as default values when this counterparty is selected on security lending / repo trades, as defined in the product family.

Repeat as needed, adding more counterparties to the drop down and their corresponding default values to the box below.

You can click Apply to ALL to replicate one counterparty's defaulting configuration to all counterparties.

| » | Then click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry. Note that it will show up in the Authorization window as a legal agreement.

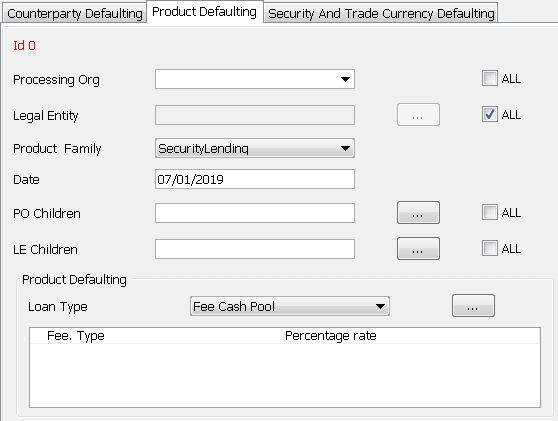

2.2 Product Defaulting

| » | Select the Product Defaulting panel, then click New. |

| » | Enter the common fields as needed. They are described in Trade Defaulting Common Fields below. |

| » | In the Product Defaulting area, click ... next to the Loan Type field and select the loan type for which you want to define default values. It is added to the adjacent drop down. |

Select the loan type from the drop down, then right-click in the box below and select Configure columns. Select the trade fields to be defaulted for this particular loan type and click OK. The fields are added to the box.

Enter the default values as needed for this loan type. They will be used as default values when this loan type is selected on security lending / repo trades, as defined in the product family.

Repeat as needed, adding more loan types to the drop down and their corresponding default values to the box below.

| » | Then click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry. Note that it will show up in the Authorization window as a legal agreement.

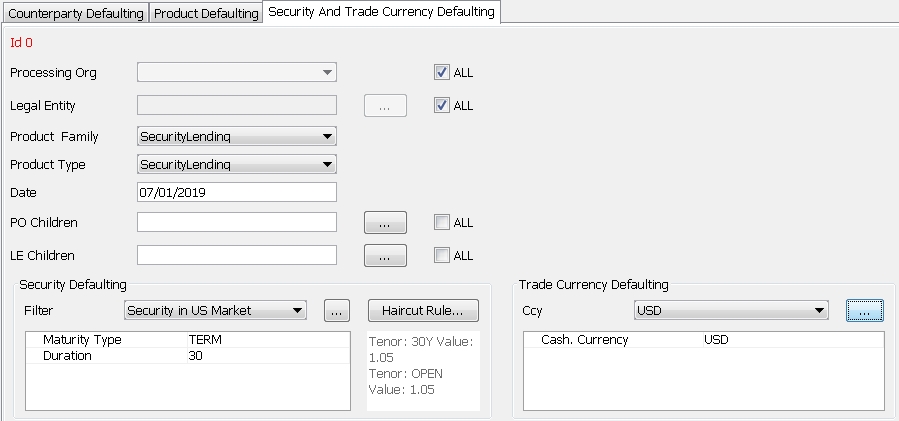

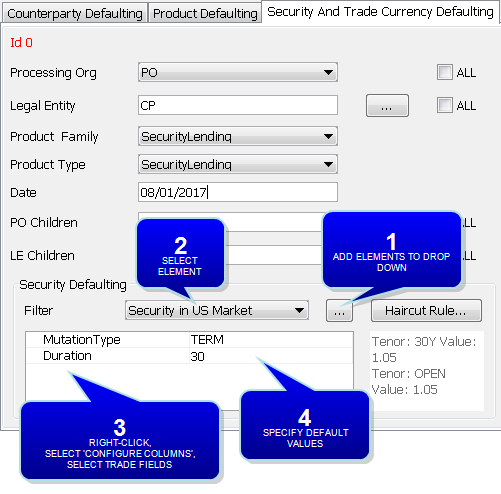

2.3 Security and Trade Currency Defaulting

| » | Select the Security And Trade Currency Defaulting panel, then click New. |

| » | Enter the common fields as needed. They are described in Trade Defaulting Common Fields below. |

| » | In the Security Defaulting area, click ... next to the Filter field and select the haircut rule for which you want to define default values. It is added to the adjacent drop down. |

NOTE: For security defaulting, the static data filters used in haircut rule definitions should contain only securities-related criteria.

Select the haircut rule from the drop down, then right-click in the box below and select Configure columns. Select the trade fields to be defaulted for this particular haircut rule and click OK. The fields are added to the box.

Enter the default values as needed for this haircut rule. They will be used as default values when this haircut rule is selected on security lending / repo trades, as defined in the product family / product type.

Repeat as needed, adding more haircut rules to the drop down and their corresponding default values to the box below.

| » | In the Trade Currency Defaulting area, click ... next to the Ccy field and select the currency for which you want to define default values. It is added to the adjacent drop down. |

Select the currency from the drop down, then right-click in the box below and select Configure columns. Select the trade fields to be defaulted for this particular currency and click OK. The fields are added to the box.

Enter the default values as needed for this currency. They will be used as default values when this currency is selected on security lending / repo trades, as defined in the product family / product type.

Repeat as needed, adding more currencies to the drop down and their corresponding default values to the box below.

| » | Then click Save to save your changes. |

Note that if the Authorization mode is enabled, an authorized user must approve your entry. Note that it will show up in the Authorization window as a legal agreement.

2.4 Trade Defaulting Common Fields

|

Fields |

Description |

|

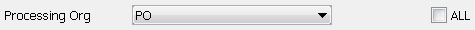

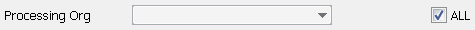

Processing Org ALL |

Select a processing organization for which the trade defaulting applies.

You can also check the "ALL" checkbox next to the Processing Org field to apply the trade defaulting to all processing orgs.

|

|

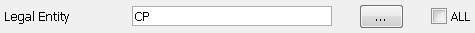

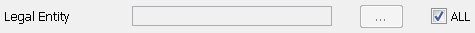

Legal Entity ALL |

Click ... next to the Legal Entity field to select the counterparty for which the trade defaulting applies.

You can also check the "ALL" checkbox next to the Legal Entity field to apply the trade defaulting to all counterparties.

|

|

Product Family |

Select a product family, SecurityLending or Repo. |

|

Product Type |

Only applies to Security and Trade Currency Defaulting. Select a product sub-type, or set this field to match the Product Family field to include all of its sub-types. |

|

Date |

Enter the effective date of the trade defaulting. |

|

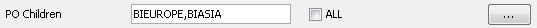

PO Children ALL |

Click ... next to the PO Children field to select the children of the processing org for which the trade defaulting applies.

You can also check the "ALL" checkbox next to the PO Children field to apply the trade defaulting to all the children of the processing org.

|

|

LE Children ALL |

Click ... next to the LE Children field to select the children of the counterparty for which the trade defaulting applies.

You can also check the "ALL" checkbox next to the LE Children field to apply the trade defaulting to all the children of the counterparty.

|

2.5 Sample Trade Defaulting

2.6 Viewing Existing Trade Defaulting Definitions

You can browse trade defaulting definitions using Reports > Cross-Asset Reports > Legal Agreement Report.

Legal agreements are also displayed in this report. Either the 'Trade Defaulting' column or the 'Legal Agreement' column will be checked to indicate which it is.

NOTE: Currently, searching trade defaulting definitions on a counterparty will not return results where the legal entity falls into an "ALL" category.

2.7 Popup Query

If you would prefer to be asked before applying trade defaulting on new trades and when changing counterparties or books, this can be enabled by creating the domain QueryUserBeforeSecFinanceTradeDefaulting with the value "True".

A popup window will ask if you want to apply the trade defaulting, if there is any defined for a given combination of processing org and counterparty. To disable the popup, you can set the value to "False" or null. The default behavior is no popup.

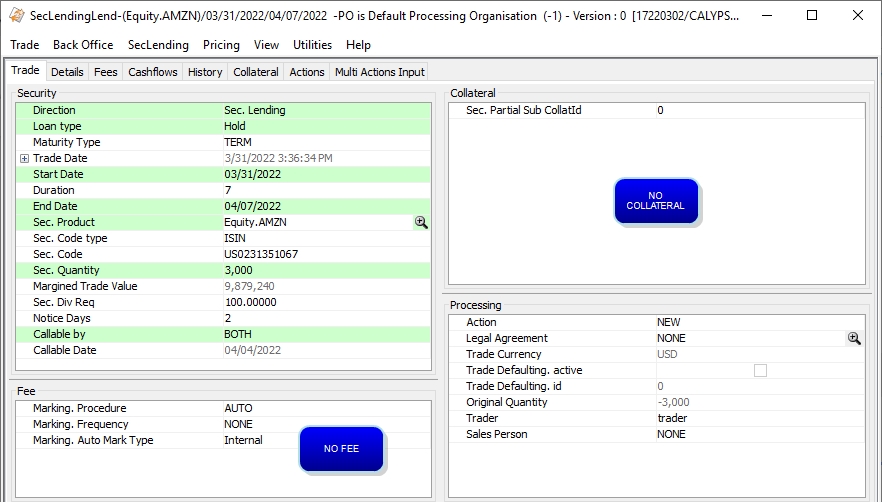

3. Security Lending Trades

Multiple types of loans are supported in this window – Sample trades are shown later in this document.

Security lending allows lending or borrowing of securities and creates a security lending trade with product type = SecLending and product sub-type = Rebate, Fee Cash Trade, Fee Cash Pool, Fee Non Cash Pool, Fee Unsecured, Sweeping Fee Unsecured, Sec Vs Cash, Sec Vs Pledge, Sec Vs Sec, Pay To Hold, or Hold.

Sec Vs Cash and Sec Vs Sec are the only sub-types that support lending multiple securities on the same trade.

The trade screen is split into details sections which each represent a specific attribute of the trade.

For info, when using copy/paste on sec lending trades, lifecycle events are not pasted into the new trade. You can

set the trade keywords that should not be pasted in domain "copyPaste.keywords.toRemove".

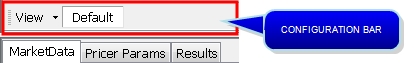

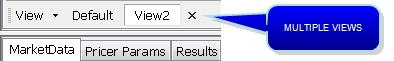

3.1 Security Lending Trade Panel Configuration

The Trade panel of the Repo and SecLending trade windows is highly configurable. You can modify it as desired.

Step 1 – Display the configuration bar.

| » | If it is not already visible, select View > Configuration bar. |

Step 2 – Arrange the panels.

| » | In the configuration bar, select View > Show frame title bar. Title bars are added to each panel. They allow you to "grab" a panel to drag and drop it. |

| » | Arrange the Trade details, Collateral details, and Processing panels by dragging and dropping them to the desired locations. |

| » | You can de-select View > Show frame title bar to remove the title bars once you are done arranging the panels, if desired. |

Step 3 – Add additional panels as desired.

| » | You can select View > Add component > Property panel to create a new details panel. You will be prompted to name the panel. |

The panel is blank when added. Right-click within the panel and choose Select fields, then select the field to add. Repeat as needed until you have added all the desired fields. Some fields are only displayed when certain other criteria is met.

| » | You can select View > Add component > Securities panel to add a securities panel. You will be prompted to name the panel. |

| » | You can select View > Add component > Cashflows panel to add a cashflows panel. You will be prompted to name the panel. |

| » | To delete a panel, enable the title bars (View > Show frame title bar) and click X in the panel to be deleted. |

Step 4 – Add or remove fields, and configure field names and colors as desired.

| » | To add or remove fields, right-click within the desired panel and choose Select fields, then select the field to add or remove. Repeat as needed until you have added and removed all the desired fields. Some fields are only displayed when certain other criteria is met. |

| » | To configure field names and colors, right-click within the desired panel and choose Configure field names and color, then set a display name and/or field color as desired. For SecLending trades, the fields that are colored out-of-the-box indicate those which are necessary when manually entering a trade. |

Step 5 – Save the view.

| » | In the configuration bar, select View > Save to save your current view. |

| » | You can select View > Save As to save an alternative view. You will be prompted to name the view. |

Your saved views are displayed when you enable the configuration bar.

| » | You can delete a view by clicking on the view to delete and selecting View > Delete. You will be prompted to confirm the deletion. |

In the image above, "View2" is selected.

| » | If you do not wish to use multiple views, you can disable the configuration bar by de-selecting View > Configuration bar when you are done configuring the panel. |

3.2 Security Lending Trade Fields Details

The default fields are described below. Note that many fields are contextual and are only displayed when applicable and when certain criteria are met.

The fields that are colored out-of-the-box indicate those which are necessary when manually entering a trade.

Trade Details

|

Fields |

Description |

|---|---|

|

Role / Legal Entity |

The first two fields of the Settlement details identify the trade counterparty. The first field identifies the trade counterparty’s role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field provided you have set up favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also directly enter a Legal Entity short name. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have set up favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status changes over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Broker |

Click ... to select a broker as needed. A broker is a legal entity of role Broker. |

|

Template |

You can select a template from the Template drop down to populate the worksheet with default values. Then modify the fields as applicable. |

Security Details

|

Fields |

Description |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Direction |

Direction of the trade from the book’s perspective. Select Sec. Lending or Sec. Borrowing. |

|||||||||||||||||||||||||||||||||

|

Loan type |

Select the type of security lending. The following values are available:

Security lending loan types are defined in both the SecLending.subtype and SecLending.tradeCaptureSubTypes domains. Samples of each loan type with additional details are shown later in this document. |

|||||||||||||||||||||||||||||||||

|

Maturity Type |

Select the type of termination:

|

|||||||||||||||||||||||||||||||||

|

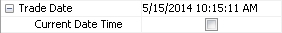

Trade Date Current Date Time |

If "Current Date Time" is checked, the trade date displays the current date and time and cannot be modified. Otherwise, you can modify it as applicable. Double-click +/- next to the Trade Date field to show/hide the Current Date Time field.

|

|||||||||||||||||||||||||||||||||

|

Start Date |

The start date defaults to the spot date (number of spot days specified in the currency defaults are applied to the trade date). You can modify the start date as applicable. |

|||||||||||||||||||||||||||||||||

|

Duration End Date |

Only applies to TERM maturity trades. Enter either the end date for the contract or the duration and the other will be calculated accordingly. The duration is the number of business days the trade will be open. |

|||||||||||||||||||||||||||||||||

|

Sec. Product |

You can select a security in several ways:

If you have specified a quick entry template, the search will look into the products of the quick entry template.

You can view or modify the details of the selected security by clicking |

|||||||||||||||||||||||||||||||||

|

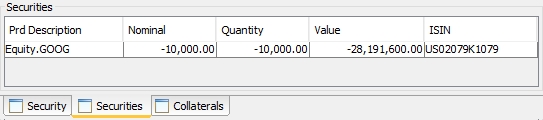

Selected Security |

Only applies to Sec Vs Cash and Sec Vs Sec trades. Double-click +/- next to the Coll. Product field to show/hide the Selected Security field. Displays the security currently selected and its details.

You can configure the columns of this panel by right-clicking in the column headings and selecting Configure > Configure Columns. |

|||||||||||||||||||||||||||||||||

|

Sec. Code type Sec. Code |

The code and code format of the underlying security. The code type defaults to the Security Code specified in the User Defaults, but you can change the selection using the drop down. |

|||||||||||||||||||||||||||||||||

|

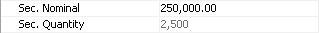

Sec. Nominal Sec. Quantity |

Enter the amount of nominal/quantity that is traded. Field behavior depends on security type and quote type of security. For Nominal, this is the original nominal. The corresponding quantity is displayed.

Ⓘ [NOTE: You can enable the field "Quantity" for all quote types if the domain UseQuantity contains the value true. Setting to true will enable both fields. If UseQuantity is set to false, then Quantity field will be un-editable regardless of quote type] |

|||||||||||||||||||||||||||||||||

|

Sec. Margin Value |

The margin, in percentage, required on the trade, with more collateral required being a value > 100%, and less collateral being a value < 100%. |

|||||||||||||||||||||||||||||||||

|

Sec. Price (Sec. Ccy) |

Only applies to equities. The traded price of the underlying equity. If the trade is cross currency, the field "Sec. Price <trade CCY>" will also be available for input. |

|||||||||||||||||||||||||||||||||

|

Sec. Price Sec. Dirty Price |

Only applies to bonds. Enter the price or the dirty price and the other will be calculated accordingly. The dirty price is clean price + accrual. For bonds quoted using Price32, you can enter the trade’s price with 2, 3, or 4 digits after the dash. The first 2 digits represent the number of thirty-seconds (between 1 and 31). If the price contains 3 digits, the third digit represents the number of eighths of a thirty second (or 1/256, between 1 and 7). A bond price entered as "99-022" will be read as [99 + 2/32 + 2/8(1/32)], or 99.0703125. The third digit can also be +, indicating 4/8 of a thirty second. If the price contains 4 digits, the last 2 digits represent the number of sixteenths of a thirty second (or 1/512, between 1 and 15). Note that the 4-digit logic only applies to bonds with the tick size 512. For securities with tick size other than 100: You can convert clean price to decimal format when dirty price or yield are specified on trade screen. For this, you need to set the security product code SECFINANCE_QUOTE_BASE = 100. Show Clean Price In Decimal The menu item SecLending > Show clean price in decimal gives the ability to compute and display the bond price in decimal format. If this is checked, the clean price is displayed in decimals. Otherwise, it is displayed using the security quote type. You will be prompted to set this option for the current trade, or for all future trades as well. |

|||||||||||||||||||||||||||||||||

|

Sec. AllIn Price |

This field can either be calculated or input. If calculated: Price * Margin Value If the trade is cross currency, the field "Sec. AllIn Price <trade CCY>" will also be available for input. |

|||||||||||||||||||||||||||||||||

|

Sec. Haircut Value |

Enter the haircut percentage, expressed in basis points (enter 0 for no haircut). Haircut rules and defaults can be specified in the Legal Agreement window – See Legal Agreement documentation for details. |

|||||||||||||||||||||||||||||||||

|

Sec. Payment Holidays |

For a Fee Cash Pool trade, you can specify the payment holiday calendar. It comes from the security currency if not set. |

|||||||||||||||||||||||||||||||||

|

Margined Trade Value |

The current value of the trade including the margin. |

|||||||||||||||||||||||||||||||||

|

Div Req |

Enter the percentage of dividend that should be given or received during the life of the trade. Defaults to 100% (full dividend). |

|||||||||||||||||||||||||||||||||

|

Notice Days Callable by Callable Date |

Upon termination, Notice Days is reset to 0 and the original value is stored in the trade keyword OriginalNoticeDays.

Upon termination, Callable By is reset to NONE and the original value is stored in the trade keyword OriginalMaturityType. The Trade Keyword “CheapestToReturn” is automatically populated upon saving based on the type of termination:

|

|||||||||||||||||||||||||||||||||

|

Substitution. substitutable |

Only applies to Sec Vs Sec trades. Check to indicate that the security can be substituted – See Applying Security Lending Actions – Substituting a Security for details on security substitutions. |

|||||||||||||||||||||||||||||||||

|

Is Prepaid |

When checked, the other Prepay fields will appear. Also, the Delivery Type is automatically changed to DFP as prepay means that the collateral will be moved independently of the security. If the trade is already booked and you want to change to a pre-pay, you can amend the trade. On Rebate trades you can set the pre-pay rate to be different from the rate on the collateral. |

|||||||||||||||||||||||||||||||||

|

Prepay. Date Prepay. Days |

Enter either the pre-pay date or days and the other will be calculated accordingly. The pre-pay date must be before the start date. |

Collateral Details

Trades can be linked to the Collateral Management module through the margin call contracts set up by the Collateral Manager. This allows fee trades to be margined in line with market standards, and maintains a link between trade and collateral. Rebate trades inherently have the collateral on the trade.

There are two elements to the collateral where a trade can have two different pools for fee trades. If the fee trade is DFP (Delivery Free of Payment) you can only choose a Variation Margin Pool, and if the trade is DAP (Delivery Against Payment) you can choose a Variation Margin and a Settlement Value Pool.

| • | Variation Margin Pool (Margin Call Contract) – You can set the rate for any variation margin applied during the marking process. |

| • | Settlement Value Pool – You can set the rate for the trade value which will be applied for the duration of the trade. |

|

Fields |

Description |

|||||||||||||||||||||

|

Margin Call Currency |

Only applies to Fee Cash Pool trades. Select the currency of the margin call that is created. |

|||||||||||||||||||||

|

Initial Margin FX Rate Initial Margin Value |

The value of the SV Pool. |

|||||||||||||||||||||

|

Select a margin call contract from the selector window, or select New VM Pool and enter the details of the VM pool in the new fields that appear. Note that New VM Pool details are for informational purposes only. Defaults to the applicable margin call contract if only one is defined for the given combination of processing org and counterparty. You can view the details of the selected margin call contract by clicking |

||||||||||||||||||||||

|

VM Pool. Description |

VM Pool description. |

|||||||||||||||||||||

|

Settlement Value Pool |

Select an SV Pool from the drop down, or select New SV Pool and enter the details of the SV pool in the new fields that appear. Note that New SV Pool details are for informational purposes only. Defaults to the applicable cash account if only one is defined for the given combination of processing org, counterparty, and margin call currency. |

|||||||||||||||||||||

|

Cash. Principal |

Only applies to Sec Vs Cash. Displays the security principal. Click |

|||||||||||||||||||||

|

Cash. Currency |

The currency of the cash rebate. |

|||||||||||||||||||||

|

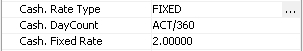

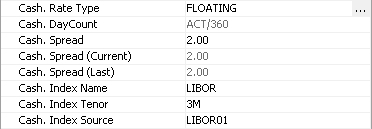

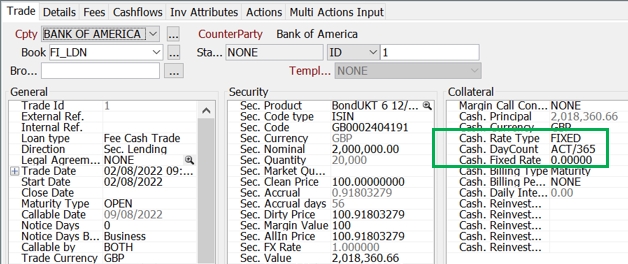

Cash. Rate Type Cash. DayCount Cash. Fixed Rate Cash. Index Name Cash. Spread Cash. Spread (Current) Cash. Index Tenor |

Select FIXED or FLOATING and enter the fields shown below, or you can click ... to open the Security Lending Cash Collateral window and apply the values from there. FIXED

FLOATING

|

|||||||||||||||||||||

|

Cash.Discount Method |

Select the discount method. EXP: This field exponentially discounts the payment/receipt amount from the end date to the start date. |

|||||||||||||||||||||

|

Cash. Zero Flooring |

Check to indicate that the minimum daily rate reset is 0. Only used for Risk Free Rates using DailyCompound2 calculator. |

|||||||||||||||||||||

|

Cash. Compounding Frequency Cash. Compounding Method Cash. Reset Lag Cash. Observation Shift |

These are non-default floating rate fields which can be added to the trade window using the right-click > Select fields functionality.

|

|||||||||||||||||||||

|

Cash. Crystallization Days |

Indicate the number of crystallization days. Only used for Risk Free Rates using DailyCompound2 calculator. |

|||||||||||||||||||||

|

Cash. Billing Period Cash. Billing Type |

Select the billing type:

For Period or PeriodMat, specify the length of the period with a date rule. If they are set in the Statement Config, then the default value appears. |

|||||||||||||||||||||

|

Cash. Daily Interest |

The computed daily cash interest amount. |

|||||||||||||||||||||

|

Coll. Product |

You can select a collateral in several ways:

If you have specified a quick entry template, the search will look into the products of the quick entry template.

You can view or modify the details of the selected collateral by clicking |

|||||||||||||||||||||

|

Selected Collateral |

Only applies to Sec Vs Sec trades. Double-click +/- next to the Coll. Product field to show/hide the Selected Collateral field. Displays the collateral currently selected and its details.

You can configure the columns of this panel by right-clicking in the column headings and selecting Configure > Configure Columns.

|

|||||||||||||||||||||

|

Sec. Partial Sub CollatId |

In the case of a full or partial collateral substitution, indicates the id of the previous collateral. |

|||||||||||||||||||||

|

Coll. Code Coll. Code type |

The code and code format of the underlying collateral. The code type defaults to the Security Code specified in the User Defaults, but you can change the selection using the drop down. |

|||||||||||||||||||||

|

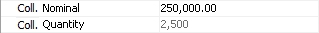

Coll. Nominal Coll. Quantity |

Enter the amount of nominal / quantity that is traded. Field behavior depends on collateral type and quote type of collateral. For Nominal, this is the original nominal. The corresponding quantity is displayed.

Ⓘ [NOTE: You can enable the field "Quantity" for all quote types if the domain UseQuantity contains the value true. Setting to true will enable both fields. If UseQuantity is set to false, then Quantity field will be un-editable regardless of quote type] |

|||||||||||||||||||||

|

Coll. Value |

Calculated based on the nominal / quantity, or vice versa if the value is entered. |

|||||||||||||||||||||

|

Coll. Price <collateral CCY> |

Only applies to equities. The traded price of the underlying equity. If the trade is cross currency, the field "Sec. Price <trade CCY>" will also be available for input. |

|||||||||||||||||||||

|

Coll. Haircut Value |

Enter the haircut percentage, expressed in basis points (enter 0 for no haircut). Haircut rules and defaults can be specified in the Legal Agreement window – See Legal Agreement documentation for details. |

|||||||||||||||||||||

|

Coll. All in money value |

Sec Dirty Price, including haircut, expressed in security currency. |

|||||||||||||||||||||

|

Coll. AllIn Price |

Security All In Price, taking into account the collateral price after haircut. |

|||||||||||||||||||||

|

Coll. Div Req |

Enter the percentage of dividend that should be given or received during the life of the trade. Defaults to 100% (full dividend). |

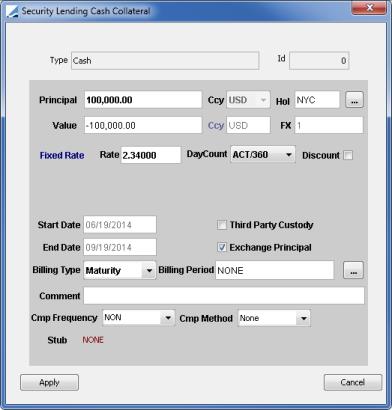

Security Lending Cash Collateral Details

A rebate rate (the rate applied on the cash collateral) is paid to the borrower. The cash collateral can accept a 0 rate.

You can also use it to calculate interest only transfers without actual exchange of cash collateral. This will be an interest paid to the lender.

| » | Enter the fields described below, and click Apply. |

|

Fields |

Description |

|||||||||

|

Type |

Displays Cash, the selected type of collateral. |

|||||||||

|

Id |

Unique Id of the collateral automatically assigned by the system when the loan trade is saved. |

|||||||||

|

Principal |

Enter the amount of cash. |

|||||||||

|

Ccy |

The cash currency. |

|||||||||

|

Hol |

The holiday calendar of the cash currency. You can modify the cash holiday calendar as applicable. |

|||||||||

|

Value |

The principal value. |

|||||||||

|

Ccy |

The trade currency. |

|||||||||

|

FX |

The FX rate. |

|||||||||

|

Fixed Rate / Floating Rate |

Fixed Rate or Floating Rate must be selected in the trade window. Fixed

Floating

|

|||||||||

|

Discount |

Check to pay the interest up front, or at maturity otherwise. |

|||||||||

|

Start Date |

The start date of the trade. |

|||||||||

|

End Date |

The end date of the trade. |

|||||||||

|

Third Party Custody |

Check to indicate that the security is pledged, i.e. held in the custody of a third party. |

|||||||||

|

Exchange Principal |

Not used. |

|||||||||

|

Billing Type Billing Period |

Select the billing type:

If the billing type is Period or PeriodMat, specify the length of the period with a date rule. |

|||||||||

|

Comment |

Enter a free form comment. |

|||||||||

|

Cmp Frequency |

Select the compounding frequency. The compounding frequency must be more frequent than the payment frequency. |

|||||||||

|

Cmp Method |

Select the compounding type if applicable, or None.

|

|||||||||

|

Stub |

Double-click the red label next to the Stub field to open the Cash Detail window for specifying the details of the stub period. |

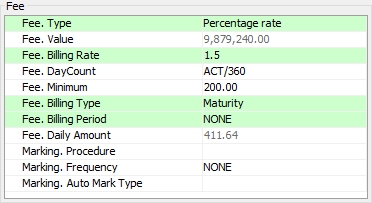

Fee Details

The market standard for fee calculation is the 100% value of the trade * Fee Value / Daycount. This will result in a daily fee amount. The ability to calculate fees off the margined trade value is also available.

Fees appear as a cashflow of type SECLENDING_FEE.

|

Fields |

Description |

||||||||||||

|

Fee. Type |

Select the type of fee to be computed:

|

||||||||||||

|

Fee. Currency |

The currency of the fee. |

||||||||||||

|

Fee. Value |

The value of the trade, to which the Fee Billing Rate is applied for Fee Daily Amount calculation. |

||||||||||||

|

Fee. Billing Rate |

Enter the rate, in percentage, to charge on the Fee Value. |

||||||||||||

|

Fee. DayCount |

Select the fee daycount convention. See Calypso Navigator > Help > Day-Count Conventions for descriptions of the available conventions. |

||||||||||||

|

Fee. Minimum |

The minimum fee amount (specified in the legal agreement, if any). You can modify it as applicable to guarantee a minimum amount of fees. |

||||||||||||

|

Fee. Billing Type Fee. Billing Period |

Select the billing type.

For Period or PeriodMat, specify the length of the period with a date rule. |

||||||||||||

|

Fee. Daily Amount |

The computed daily fee amount. |

||||||||||||

|

Marking. Procedure |

The mark procedure is confirmed with the client when a security lending trade is booked. It indicates whether the security will be marked to market:

|

||||||||||||

|

Marking. Frequency |

The frequency at which the security will be marked to market (specified in the legal agreement, if any). Modify the mark to market frequency as applicable by selecting a date rule. |

||||||||||||

|

Marking. Auto Mark Type |

When the mark procedure is AUTO, you can select the source of the mark. Define values for this list in the SecurityLending.autoMarkType domain using Configuration > System > Domain Values. |

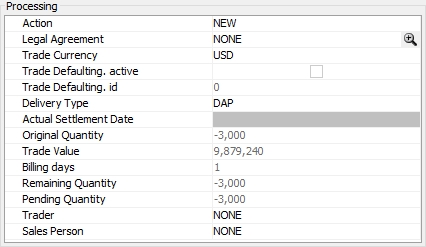

Processing Details

The Processing details section is where you can update the Delivery Type or see the current status of the trade during its lifecycle.

|

Fields |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Action |

Select the Trade workflow action to be applied. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Legal Agreement |

Defaults to the applicable legal agreement if any. However, you can change it as applicable to any available legal agreement. Legal agreements are defined using Configuration > Legal Data > Agreements. Click the down arrow to bring up a selector window.

You can view or modify the details of the selected legal agreement by clicking The legal agreement attribute "CrystalizationDays" can be used to define the number of crystallization days for the EONIA rate index on security finance trades paying interest at maturity. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trade Currency |

The currency of the trade, not the underlying security. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trade Defaulting. active |

If un-checked, trade defaulting will be disabled. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trade Defaulting. id |

The id of the trade defaulting configuration used if any.

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Delivery Type |

DFP (Delivery Free of Payment) or DAP (Delivery Against Payment). DAP is not available for pre-paid trades. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Actual Settlement Date |

The settlement date of the Start Leg Transfer. If there is a partial/split settlement of the Start Leg, this will be set from the settlement of the latest Start Leg Transfer that settles.

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

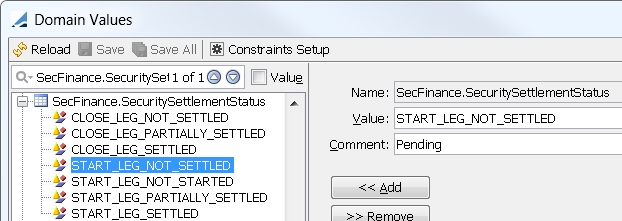

Sec. Settlement Status |

This is a non-default field which can be added to the trade window using the right-click > Select fields functionality. The settlement status of the trade. You can change the display names of the default values using domain values.

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Original Quantity |

The initial quantity of securities the trade was booked for. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trade Value |

The current value of the trade. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Billing days |

If TERM maturity, displays the total amount of days the trade will be accruing for. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Remaining Quantity |

The amount for which a return has not been booked. This shows how much can be returned/recalled. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Pending Quantity |

The settled amount for which the return has not settled. This quantity is what the accrual is based on. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trader |

Select a trader. You can click ... to add new traders. You will be prompted to enter a trader name. Trader names are defined in the trader domain. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

Sales Person |

Select a sales person. You can click ... to add new sales persons. You will be prompted to enter a sales person name. Sales persons are defined in the salesPerson domain. |

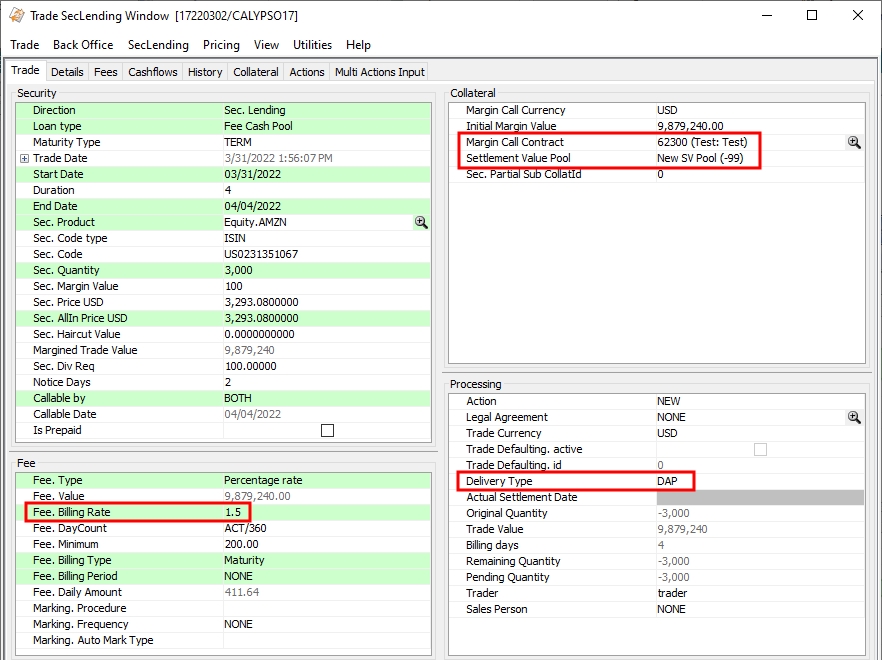

3.3 Sample Fee Cash Pool Trade

In a Fee Cash Pool trade, a pool of cash is designated as collateral, and a fee is paid to the lender of the security.

The cash pool is specified in the Margin Call Contract field of the Collateral panel.

If the Delivery Type is DAP, you can also specify a Settlement Value Pool with a separate rate against the trade value.

The fee charged by the lender is defined in the Fee panel.

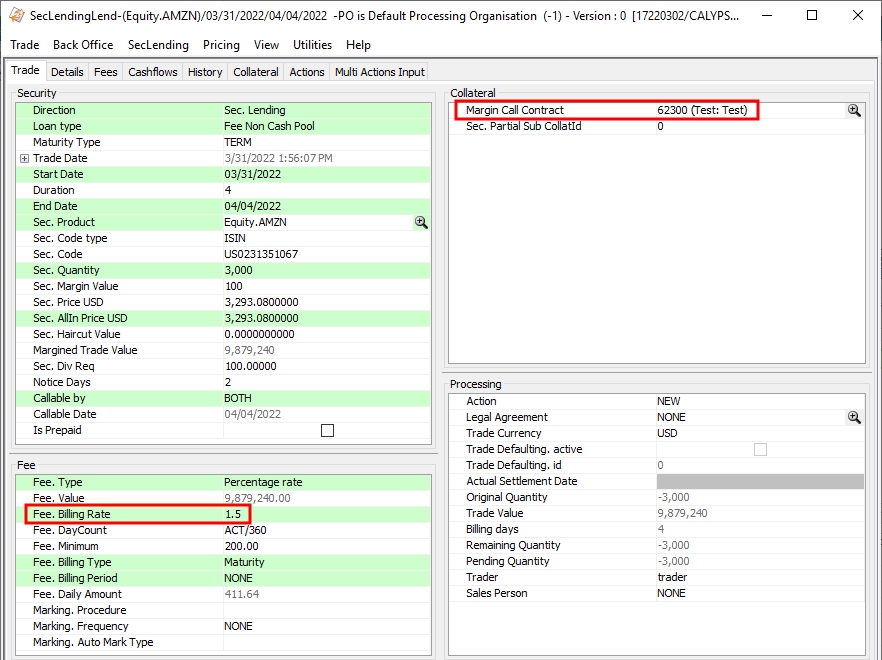

3.4 Sample Fee Non Cash Pool Trade

In a Fee Non Cash Pool trade, a pool of securities is designated as collateral, and a fee is paid to the lender of the security.

The collateral pool is specified in the Margin Call Contract field of the Collateral panel.

The fee charged by the lender is defined in the Fee panel.

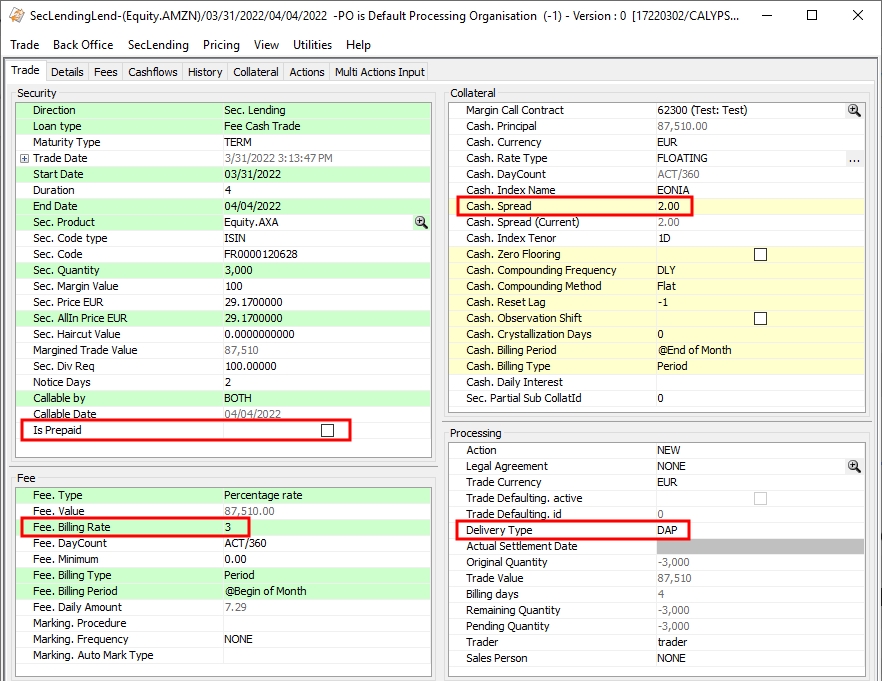

3.5 Sample Fee Cash Trade

A Fee Cash Trade is specific to the Italian and French markets. The contract specifies the loaned or borrowed security, and the negotiated cash rate and fee rate.

The collateral movements (margin calls) are always in cash and in trade currency, and the interest amounts calculated on the cash collateral and the fees are managed at the trade level.

Security settlement is always DAP, so there is no pre-payment.

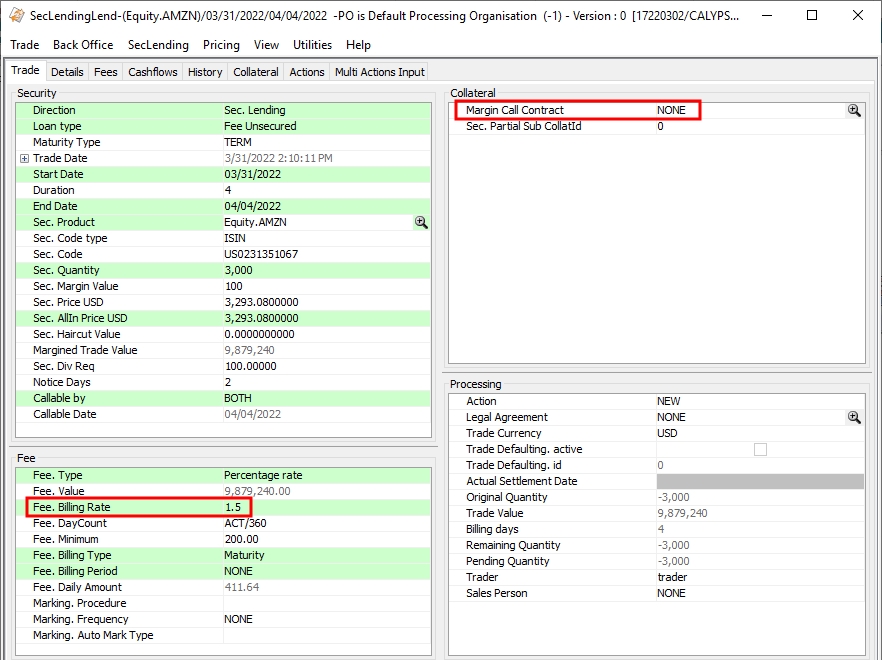

3.6 Sample Fee Unsecured Trade

A Fee Unsecured trade is usually an internal trade, or a trade with a counterparty whose creditworthiness is not a concern. No collateral is required, but a fee is usually paid to the lender of the security.

Nothing is entered into the Collateral panel.

The fee charged by the lender is defined in the Fee panel.

The prepayment option is not available on a Fee Unsecured trade as there no assumption of credit risk.

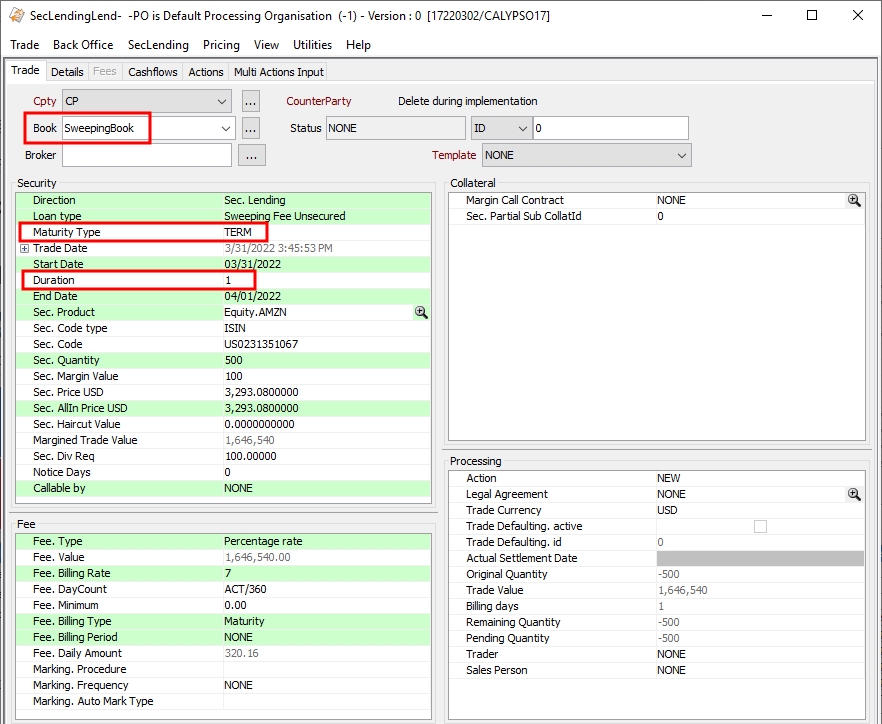

3.7 Sample Sweeping Fee Unsecured Trade

Sweeping Fee Unsecured trades are generated by the Security Finance Sweeping process and would not generally be booked manually by a user.

The book of the sweeping trade is the book that is specified to be swept to in the sweeping process.

Sweeping trades are in the Sec. Lending direction for long positions and in the Sec. Borrowing direction for short positions.

Sweeping trades are always created as overnight trades, so the duration is always 1 day and the maturity type is always TERM.

See Security Finance Sweeping for complete details.

See Security Finance Sweeping for complete details.

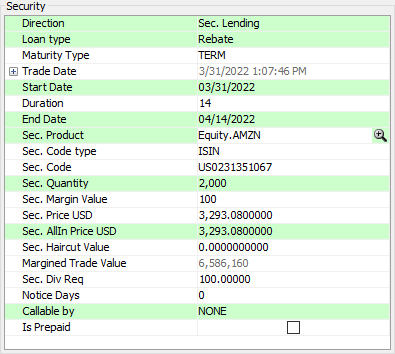

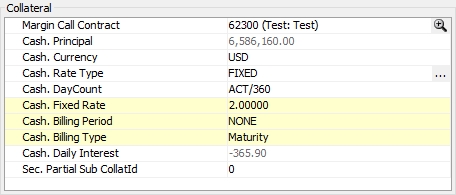

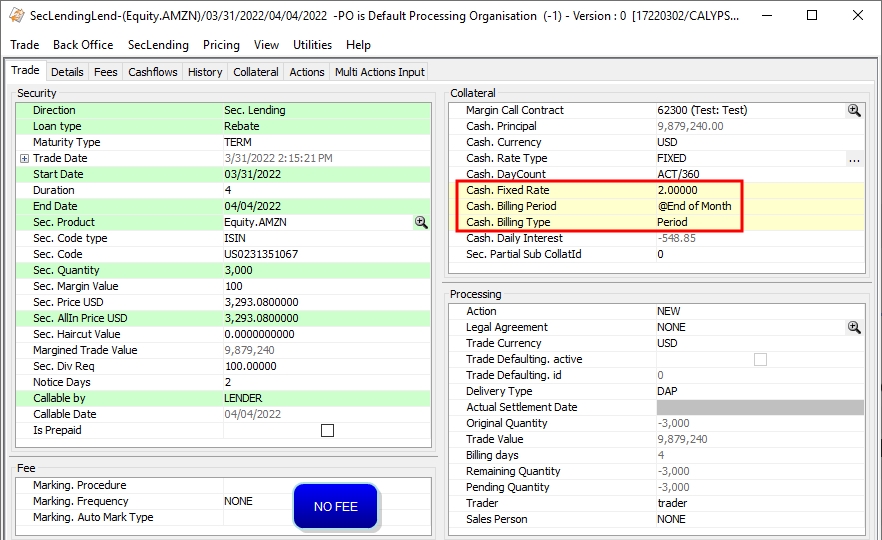

3.8 Sample Rebate Trade

In a Rebate trade, the security is loaned on a one-to-one basis against cash, and the lender of the security pays an interest amount on the cash collateral to the borrower on a periodic basis.

The cash rebate is defined in the Collateral panel.

There is no fee on this type of trade.

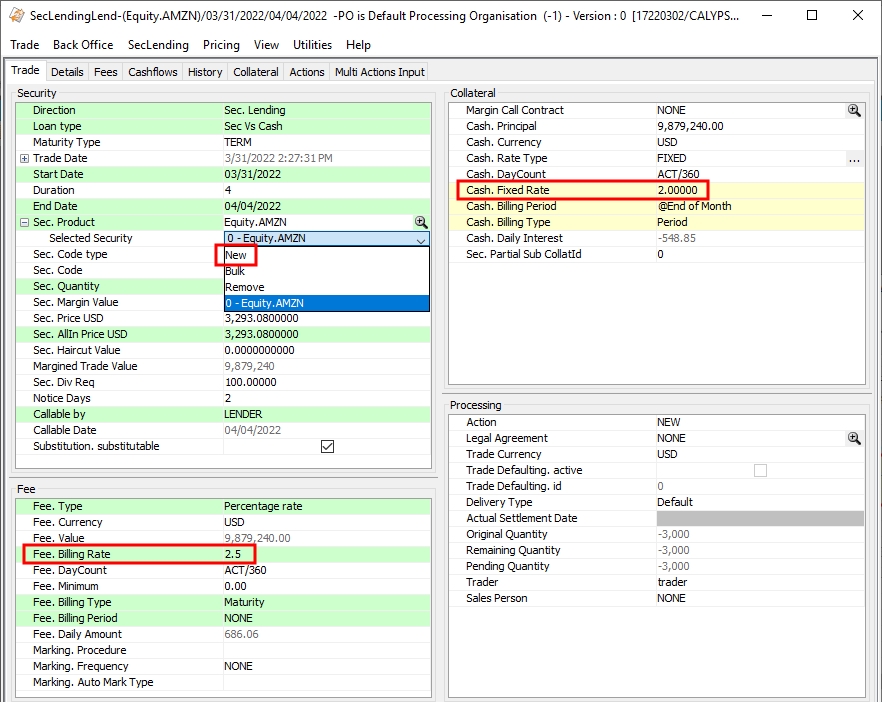

3.9 Sample Sec Vs Cash Trade

In a Sec Vs Cash trade there is a one-to-one relationship between the cash collateral and the securities, and there is also a fee paid to the lender.

Sec Vs Cash and Sec Vs Sec are the only security lending loan types that allow lending multiple securities on a single trade. Additional securities are added by selecting "New" from the Selected Security drop down. A list of securities is shown if you have enabled the Securities panel (from the Configuration Bar, select View > Add component > Securities panel).

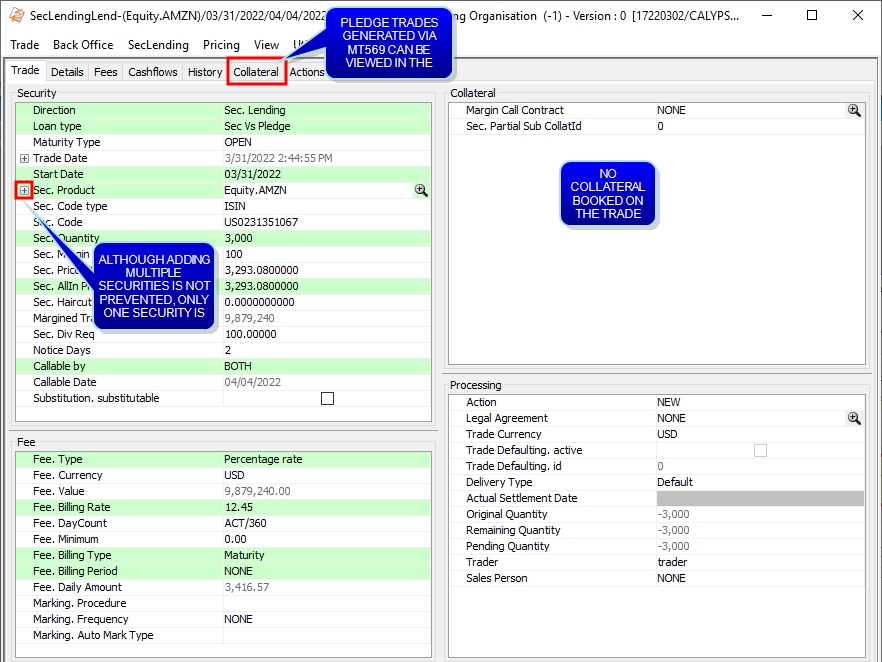

3.10 Sample Sec Vs Pledge Trade

A Sec Vs Pledge trade is security lending versus securities as collateral where the collateral is held on the trade. It allows for single loans against EUREX as a counterparty.

The exposure created by the margined trade value can then be collateralized with securities via MT569 message integration. The collateral is allocated via Pledge trades and can be viewed on the trade itself in the Collateral panel, or in the Triparty Collateral Allocation report.

Although the system does not prevent adding multiple securities on Sec Vs Pledge trades, this is not supported and they must only have a single security.

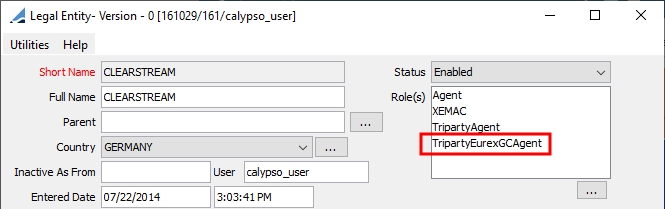

Triparty Processing Configuration

Triparty processing for Sec Vs Pledge trades consists of MT569 message integration with CLEARSTREAM as the agent and EUREX as the counterparty.

Domain Values

Add the following domain values.

| » | Add "TripartyEurexGCAgent" to the role domain. |

| » | Add "TripartyExternalRef" to the tradeKeyword domain. |

| » | Add "TripartyExternalRef" to the TripartyEurexGCPoolingRef domain. |

| » | Add "ERX" to the TripartyEurexGCPoolingRefPrefix domain (optional). |

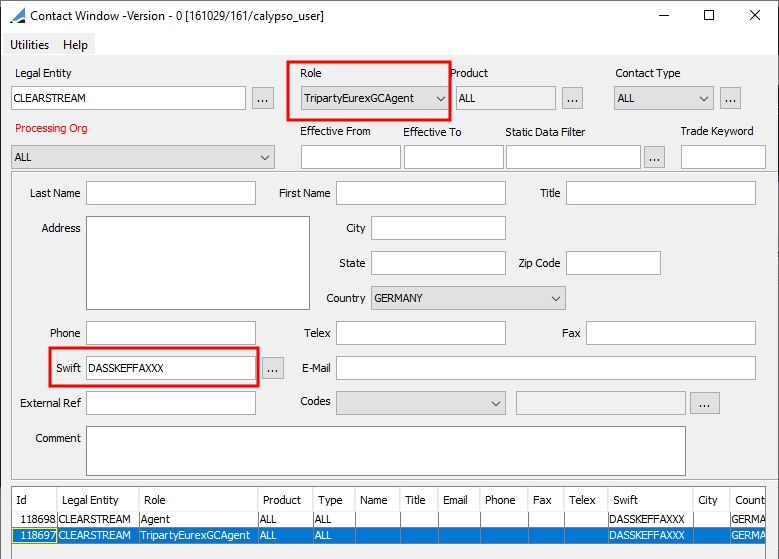

Legal Entity Contact

Create a new contact for the CLEARSTREAM legal entity with the role TripartyEurexGCAgent and SWIFT code equal to the MT569 sender BIC code.

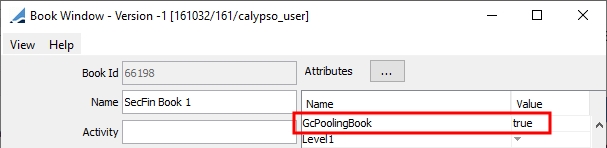

GcPoolingBook Book Attribute

Set the book attribute GcPoolingBook=true on the book to be used for your Sec Vs Pledge trades. This book must be selected on every Sec Vs Pledge trade, as only one book in your environment can have GcPoolingBook=true set and this attribute is required for Sec Vs Pledge trades.

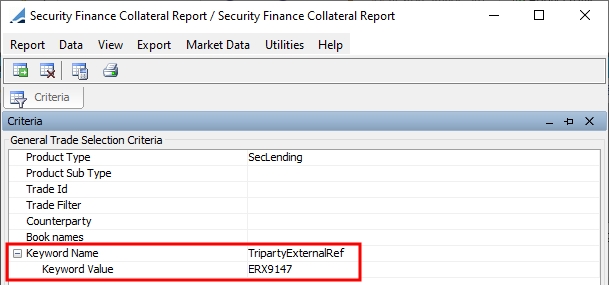

Security Finance Collateral Report

In the Security Finance Collateral Report you can use the TripartyExternalRef trade keyword as a search criterion.

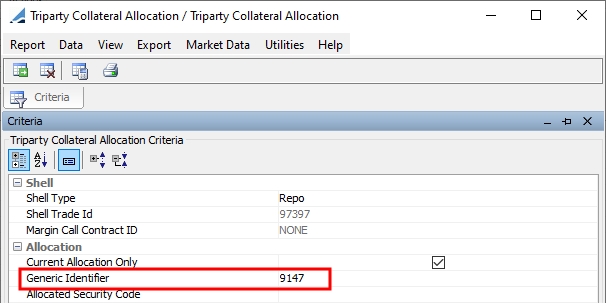

Triparty Collateral Allocation Report

In the Triparty Collateral Allocation Report you can query EUREX allocation using the "Generic Identifier" criterion.

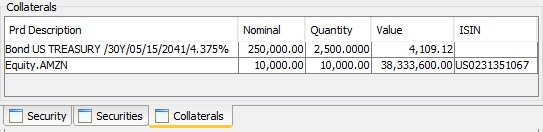

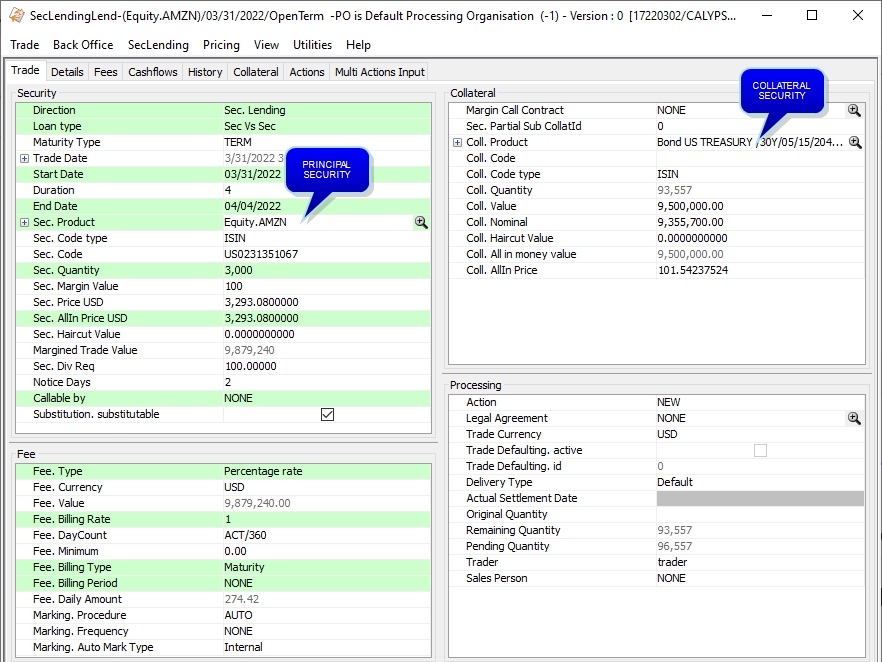

3.11 Sample Sec Vs Sec Trade

6

6

A Sec Vs Sec trade is security lending versus securities as collateral where the collateral is held on the trade. It allows for single or multiple loans against any counterparty.

The exposure created by the margined trade value can then be collateralized with securities in the SecLending trade window. There is no message integration via SWIFT; it is the responsibility of the trader to input and monitor exposure on collateral themselves via the usual pricer measures.

The collateral is represented not as a Pledge, but with the "Balance SecurityLent Collateral" / "Balance SecurityBorrowed Collateral" balance types.

Sec Vs Sec is the only security lending loan type that allows both multiple securities and multiple collaterals on a single trade. Additional securities / collaterals are added by selecting "New" from the Selected Security / Selected Collateral drop down. A list of securities / collaterals is shown if you have enabled the Securities / Collaterals panels (from the Configuration Bar, select View > Add component > Securities panel / Collaterals panel).

The following are not supported on Sec Vs Sec trades:

| • | Collateral bulk entry |

| • | Rollover action |

| • | Close And Reopen action |

| • | "Sec. Settlement Status" field |

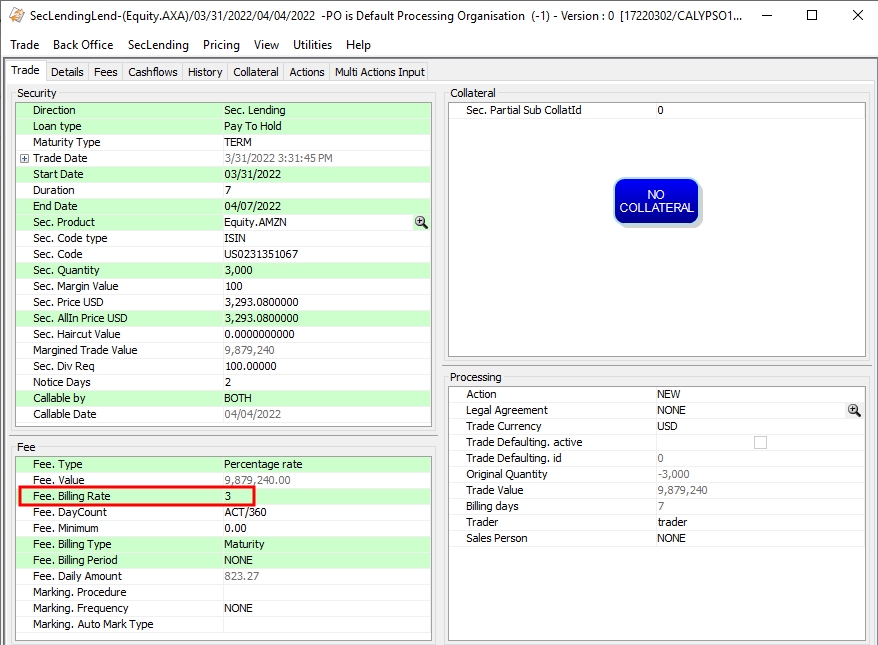

3.12 Sample Pay To Hold Trade

A Pay To Hold trade allows an institution to have a facility from which to borrow a security for selling on a regular basis for a fee, rather than having to pay the collateral on holding a large position of a specific security or being “bought in” because the security is hard to borrow.

The fee charged by the lender is defined in the Fee panel.

There is no collateral on this type of trade.

The prepayment option is not available on a Pay To Hold trade as there no assumption of credit risk.

3.13 Sample Hold Trade

In a Hold trade, a security is held for a particular counterparty without any fee. Usually a Hold is done as an internal trade, or done as a courtesy as no fee is charged.

There is no fee or collateral on this type of trade.

The prepayment option is not available on a Hold trade as there no assumption of credit risk.

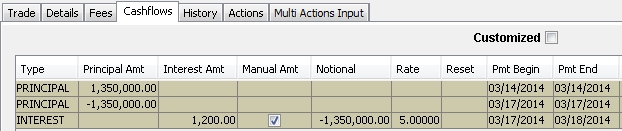

4. Generating the Cashflows

Select the Cashflows panel to view the cashflows associated with the security lending trade.

| » | You can right-click an INTEREST flow and choose Adjust Interest Flow – You will be prompted to enter an interest amount and select an action. Click Apply when you are done. |

The interest amount will be modified, and the "Manual Amt" checkbox will appear checked.

| » | You can right-click a SECLENDING_FEE flow and choose Adjust Fee Flow – You will be prompted to enter a fee amount and select an action. Click Apply when you are done. |

The fee amount (stored in the field Interest Amt) will be modified, and the "Manual Amt" checkbox will appear checked.

| » | The "Customized" checkbox is disabled for security lending trades, except for the Sec Vs <XXX> sub-types. |

You can add Value = true to the domain "SecFinance.HideYellowFlows" to hide CA adjustment flows.

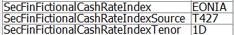

5. Pricing Pool Trades using Fictional Cash

You can price pool trades using fictional cash by setting pricing parameter USE_FICTIONAL_CASH = true.

The pricer simulates the transformation of the Fee Pool trade into a Fee Cash trade.

The Fee Cash Trade has the following properties:

Cash. Billing period = Maturity

Cash. Principal = Fee.Value

Cash Rate type = FIXED by default

You can choose Sec Lending > Display functional cash trade to view the actual cash trade.

Example:

You can also generate the simulated Fee Cash Trade on a floating rate using the following trade keywords to define the rate:

SecFinFictionalCashRateIndex

SecFinFictionalCashRateIndexTenor

SecFinFictionalCashRateIndexSource

Example:

In this case, Cash Rate type = FLOATING

Example:

In addition, you can set pricing parameter FC_IGNORE_FEE_MARK = true to ignore past reprice actions on the Fee Cash Trade to improve pricing performance.

6. Collateral Panel

For Sec Vs <XXX> security lending trades, you can add an additional, optional Collateral panel by choosing View > Collateral Report Tab.

The Collateral panel is divided into two areas: Current and History.

The Current area is based on the Security Finance Collateral report and displays all the existing collateral balances at trade val date.

The History area is based on the Security Finance Collateral Flows report and displays all the past and future trade collateral flows. Future flows are displayed as gray rows.

7. Repo / Sec Lending Curve Allocation

Repo / sec lending curve allocation relies on general collateral categories, and the designation of "special" securities which are not handled as general collateral.

The general process for repo / sec lending curve allocation is the following:

Step 1 – Specify the "special" securities to differentiate them from the general collateral securities.

Step 2 – Group the general collateral (GC) securities into categories.

Step 3 – Define a zero yield curve, per trade currency, for each GC category and for each special security.

Step 4 – Map each GC category and each special security to its dedicated curve.

These steps are further described below.

Ⓘ [NOTE: Sec lending curve allocation is only supported for the following trade sub-types: Fee Cash Trade, Rebate, and Sec Vs Cash]

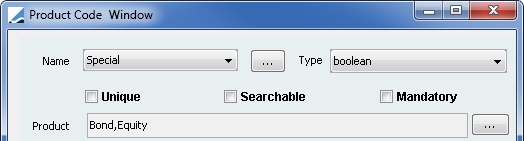

7.1 Specifying Special Securities

"Special" securities, as opposed to general collateral, are specified by setting the product code "Special" to true.

From the Calypso Navigator, navigate to Configuration > Product > Product Code and define the product code "Special".

Please refer to Calypso Getting Started documentation for complete details on defining product codes.

Please refer to Calypso Getting Started documentation for complete details on defining product codes.

Set the product code "Special" to true on each security you wish to designate as "special".

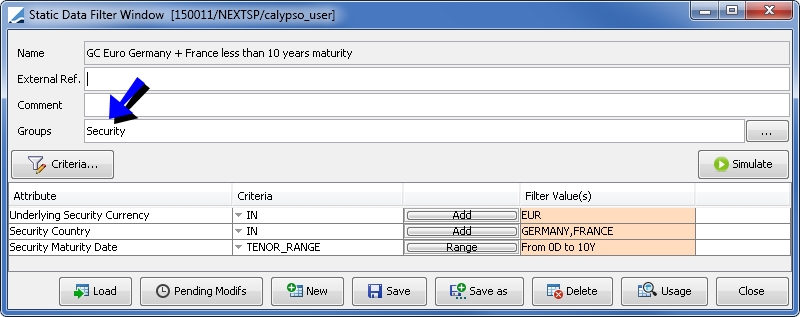

7.2 Creating General Collateral Categories

General collateral (GC) securities should be grouped into categories by defining static data filters that will be used for categorizing the GC repo curves. This will define a GC curve hierarchy per trade currency from the most restrictive static data filter to pure GC. For example:

| • | GC Euro |

| • | GC Euro Germany |

| • | GC Euro Germany + France |

| • | GC Euro Germany + France less than 10 years maturity |

From the Calypso Navigator, navigate to Configuration > Filters > Static Data Filter and define a static data filter for each GC category as needed.

Only static data filters with the "Security" group will be available for selection when mapping the curves, so be sure that this is set.

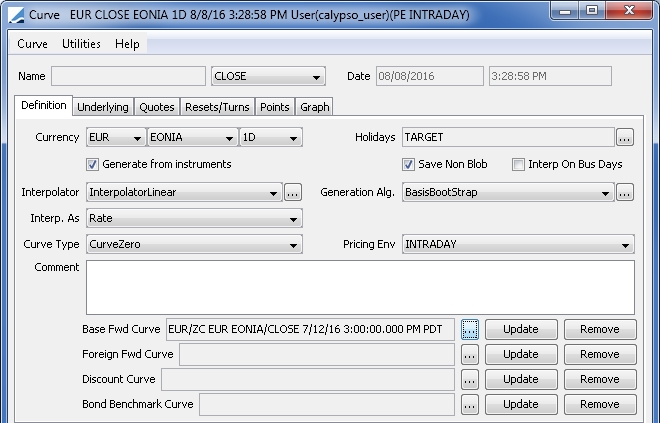

7.3 Defining Zero Yield Curves

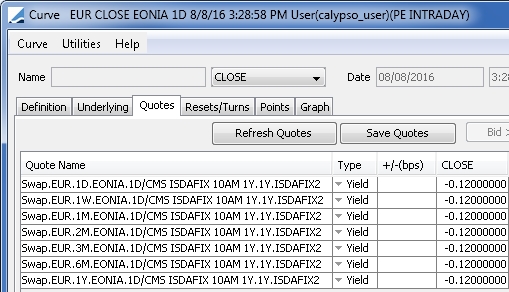

Define a zero yield curve, per trade currency, for each GC category and for each special security. These are in practice basis swap curves relying on OIS curves +/- a repo spread. For example, a repo GC for German bonds dealing with 12 bps spread below EONIA:

Please refer to Calypso Market Data documentation for complete details on defining zero yield curves.

Please refer to Calypso Market Data documentation for complete details on defining zero yield curves.

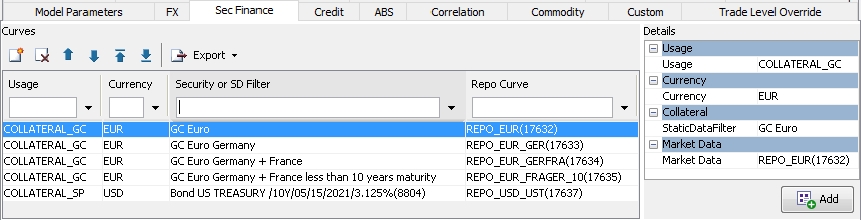

7.4 Mapping Curves

Map each GC category and each special security to its dedicated curve so that each security has at least one curve associated with it.

If the product code “Special” on the security is set to true, the pricer will first look for a discount curve defined with usage COLLATERAL_SP (for repo) / SL_COLLATERAL_SP (for sec lending ) to price the securities. Otherwise, the pricer will look for a discount curve defined with usage COLLATERAL_GC (for repo) / SL_COLLATERAL_GC (for sec lending) to price the securities. If multiple curves are mapped, the most restrictive will be used.

From the Calypso Navigator, navigate to Market Data > Pricing Environment > Pricer Configuration.

Click Load, select the pricer configuration name, and click OK.

Click the Sec Finance tab.

| » | Click |

| » | Select values in the Details area. |

| – | Select the COLLATERAL_GC / SL_COLLATERAL_GC usage for a GC category, or the COLLATERAL_SP / SL_COLLATERAL_SP usage for a special security. |

BOND_PRICING is used for pricing bonds with repo curves, and it is not part of this process.

CLOSING_TRADE is not used.

| – | Select a currency. |

| – | Select a GC category static data filter for the COLLATERAL_GC / SL_COLLATERAL_GC usage, or select a "special" security for the COLLATERAL_SP / SL_COLLATERAL_SP usage. |

Only static data filters with the "Security" group are available for selection.

| – | Select a repo / sec lending curve. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |

8. Late Settlement Fee

The scheduled task SECFINANCE_ACTUAL_FEE_ADJUSTMENT can be used to calculate a "cost of late settlement" adjustment fee based on the unsettled transfers of security lending trades. It should be run on a daily basis.

Attributes

| • | Trade action – The workflow action to be applied when adding the late settlement adjustment fees to the trade. |

| • | Task Exception Type – The exception type to be used by the scheduled task. EX_INFORMATION will be used by default. |

This adjustment fee will be created when there is a late settlement on either the start or end leg, and it will manage partial/split settlement on either leg. The fee is recalculated each time the scheduled task is run to ensure that any backdated amendments are taken into account.

By default the fee type is ADJUSTMENT_FEE, but you can override this by setting the desired fee type(s) in the domain lateSettlementFeeType.

Similarly, by default the minimum adjustment fee is ADJUSTMENT_FEE, and this can be overridden by setting the desired fee type(s) in the domain lateSettlementMinimumFeeType.

The late settlement fee can be added as an adjustment item on the Billing Statement.

See Billing Statement for complete details.

See Billing Statement for complete details.

One Fee per Billing Period

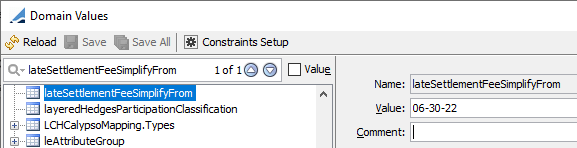

By default, when a security settles late, there is an ADJUSTMENT_FEE for each day the security was expected to settle and failed to do so. This can result in many rows in the Billing Statement which may be cumbersome to reconcile. Alternatively, you can configure having only one late settlement fee per billing period. The late settlement transfer is updated for each day of late settlement for each billing period, and should match the number of SecLending fees.

To enable this behavior, in the domain lateSettlementFeeSimplifyFrom, enter a new date as the value in the format “MM-DD-yy”. This date will be compared to the late settlement fee start date.

9. Collateral and Variation Margin Valuation

IFRS and most of the GAAP fair value oriented requires reclassifying ISIN lent/borrowed or collaterized (in and out) within the balance sheet. The scheduled task SECFINANCE_COLLATERAL_VALUATION is used to publish the fair value of those ISINs per type of holding (collateral, increased/decreased, or lent/borrowed) and rehypothecation.

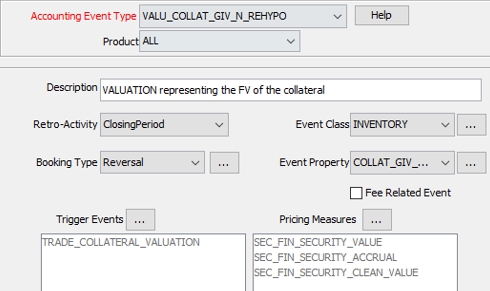

SECFINANCE_COLLATERAL_VALUATION uses a SecFinanceCollateralBalance report template and publishes a PSEventCollateralValuation (TRADE_COLLATERAL_VALUATION) per row of the report in order to generate accounting events of type "VALU_<event property>”.

9.1 Accounting Events

Create the accounting events with TRADE_COLLATERAL_VALUATION trigger event and INVENTORY event class with measures SEC_FIN_SECURITY_VALUE, SEC_FIN_SECURITY_ACCRUAL, and SEC_FIN_SECURITY_CLEAN_VALUE. Only these measures can be used and at least one must be used.

The accounting events must be named "VALU_<event property>”, where <event property> is the concatenation of:

| • | IsSecurity (PRINCIPAL) or IsCollateral (COLLAT) or IsMargin (MC) |

| • | GIVE/REC (GIV/REC) |

| • | With Rehypothecation true/false (REHYPO/N_REHYPO) |

9.2 Engine Configuration

| » | Ensure that the Accounting Engine subscribes to PSEventCollateralValuation. |

| » | Ensure that the Cre Engine subscribes to PSEventCollateralValuation. |

| » | Ensure that the Accounting Engine and the Cre Engine are running before the scheduled task SECFINANCE_COLLATERAL_VALUATION is run. |

9.3 SECFINANCE_COLLATERAL_VALUATION Scheduled Task

Common Attributes

| • | Trade Filter – Note that it is not used by SECFINANCE_COLLATERAL_VALUATION. If you need to apply a trade filter, it must be saved on the report template. |

| • | Pricer Measures – Specify the measures SEC_FIN_SECURITY_VALUE, SEC_FIN_SECURITY_ACCRUAL, and SEC_FIN_SECURITY_CLEAN_VALUE. |

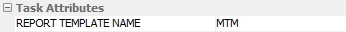

Task Attributes

| • | REPORT TEMPLATE NAME – Enter a SecFinanceCollateralBalance report template name. |

The template must include the columns "Sec. Eligibility", "Added as Margin Call", and "Norm.Collateral Flag", and the pricer measures SEC_FIN_SECURITY_VALUE, SEC_FIN_SECURITY_ACCRUAL, and SEC_FIN_SECURITY_CLEAN_VALUE.