Security Finance Collateral Report

This document describes how to use the Security Finance Collateral report. The Security Finance Collateral report provides an "as of today" view of collateral balances for a selection of repo, security lending and triparty exposure trades, as well as security margin call positions. This allows tracking market collateral value and monitoring repo and security lending trade exposures.

From the Calypso Navigator, navigate to Deal Management > Sec Finance Trade Report > Sec Finance Collateral Report (menu action reporting.SecFinanceCollateralReportWindow$SecFinanceCollateralBalance).

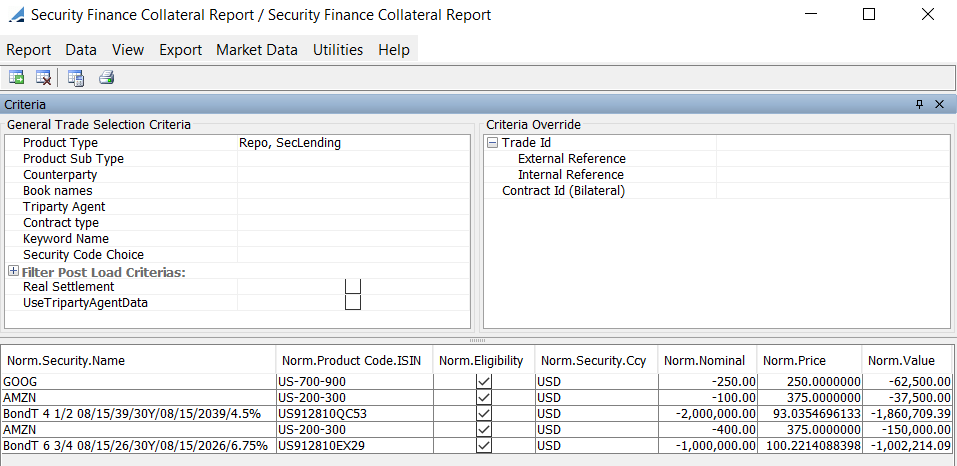

Sample Security Finance Collateral report

Ⓘ [NOTE: The columns of this picture have been configured. Sort columns, subheadings and subtotals have to be explicitly specified using the Data menu]

| » | You can check / uncheck View > Show Frame > Criteria to display / hide the search criteria. |

| » | You can change the pricing details at the bottom of the window - By default, the pricing environment comes from the User Defaults, and the valuation date is the current date and time. |

| » | Specify

the other search criteria as applicable and click |

-

Triparty Agent - This selection criteria can be defined either at Master Margin Call Contract level, Exposure Group level in Triparty Details, and Legal Agreement level for Triparty Repo.

-

Underlying Security Code / Code Value - You can select single code value from the list.

-

Contract Type - This selection criteria can be defined either at Master Margin Call Contract level in Details, and Legal Agreement level in Legal Agreement.

| » | When "Use Triparty Agent data" is checked, 'Pricing.' fields are not calculated, instead 'Norm.' fields are copied into their equivalent 'Pricing.' fields for Triparty Repo and Triparty Exposure trades. |

| » | You can select a template, and click |

| » | You can click |

NOTE: For the Pivot view and the Aggregation view, the print icon is disabled.

You can use [Ctrl+P] or [Ctrl+L] to print the report, or you can export the report to Excel and print it from there.

Security Finance Collateral Report Results

You can click any column heading to sort the results based on that column.

You can right-click any row to invoke the functions of the report menus. See Help > Menu Items for details. In particular, you can apply an action to a trade, and bring up related items like transfers, messages, etc.

Normalized Columns

In Data > Configure Columns, the folder SecfinanceCollateralNormalized and Trade is available. It contains columns which allow displaying in a normalized way any security contributing to the exposure / collateralization of a trade or margin call contract. This provides the ability to explain the margin call calculation by detailing the numbers that contribute to it, and it allows for external margin call reconciliation.

|

Columns |

Description |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Norm.Accrual |

|

|||||||||||||||||||||

|

Norm.Accrual Amount |

The security accrual. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.All In Value |

The security value after the haircut / margin is applied, expressed in security currency. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Clean Price |

The clean price of the security. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Clean Value |

The clean value of the security is same as Norm.Value, but based on clean price instead of dirty price (Norm.Value - Norm.Accrual Value). |

|||||||||||||||||||||

|

Norm.Collateral Flag |

True for the collateral leg, or false for the exposure leg. |

|||||||||||||||||||||

|

Norm.Contract Type |

Displays the Contract Type information in Legal Agreement from Repo (including Triparty) and Securities Lending trades. If these trades have no Legal Agreement, then the information is picked from the Margin Call Contract (if any), else returned blank value. Displays theContract Type information in the Margin Call Contract (or Exposure group) from Triparty Exposure Trade and Margin Call positions. |

|||||||||||||||||||||

|

Norm.Haircut |

The security haircut. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Margin |

|

|||||||||||||||||||||

|

Norm.Message Id |

|

|||||||||||||||||||||

|

Norm.Nominal |

The security nominal. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Pool Factor |

|

|||||||||||||||||||||

|

Norm.Price |

The price used to value the security. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Price(Source) |

|

|||||||||||||||||||||

|

Norm. Product Code. CUSIP |

For cash collateral, it is the CUSIP Product Code or CUSIPIdentifier currency attribute. |

|||||||||||||||||||||

|

Norm. Product Code. ISIN |

For cash collateral, it is the ISIN Product Code or ISINIdentifier currency attribute. |

|||||||||||||||||||||

|

Norm.Quantity |

The security quantity. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Security.Asset Type Name |

For security collateral, it is the Asset Type Name product code or Asset Type Name currency attribute. |

|||||||||||||||||||||

|

Norm.Security.Ccy |

The security currency. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Security.Country |

|

|||||||||||||||||||||

|

Norm.Security.Days to Maturity |

It represents remaining number of days for the ISIN to mature. |

|||||||||||||||||||||

|

Norm.Security.Issuer |

|

|||||||||||||||||||||

|

Norm.Security.Maturity Date |

|

|||||||||||||||||||||

|

Norm.Security.Name |

The name of the security. |

|||||||||||||||||||||

|

Norm.Security.Type |

|

|||||||||||||||||||||

|

Norm.Source |

Internal or External, describing if the security comes from an external allocation or from a negotiated trade.

|

|||||||||||||||||||||

|

Norm.Transaction Ccy |

The currency of the SecFinance trade, or the base currency of the margin call contract. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Transaction FX Rate |

The FX rate between the security currency and the trade currency. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Transaction Type |

The product type of the SecFinance trade: Repo or SecLending. |

|||||||||||||||||||||

|

Norm.Transaction Value |

The security value after the haircut / margin is applied, expressed in transaction currency. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Norm.Transaction Value Before Factor |

The security value before the haircut is applied, expressed in transaction currency, populated from incoming MT569 SWIFT, Tag 19 A::MKTB. |

|||||||||||||||||||||

|

Norm.Triparty Agent |

Displays the Triparty Agent information in Legal Agreement from Triparty Repo trades, and in the Margin Call Contract (or Exposure group) from Triparty Exposure Trade and Margin Call positions. |

|||||||||||||||||||||

|

Norm.Underlying Trade Id |

If the source is External, displays the trade id of the underlying product.

|

|||||||||||||||||||||

|

Norm.Value |

The security value before haircut / margin, expressed in security currency. The value is different depending on the Source Type:

|

|||||||||||||||||||||

|

Pricing.Accrual |

Security unitary accrual as of valuation date. |

|||||||||||||||||||||

|

Pricing.Accrual Amount |

Affected by Real Settlement designation - if Real Settlement is false, Pricing.Nominal = Norm.Nominal. |

|||||||||||||||||||||

|

Pricing.All In Value |

Pricing.Value * [1 - (Pricing.Haircut / 100)] Affected by Real Settlement designation - if Real Settlement is false, Pricing.Nominal = Norm.Nominal. |

|||||||||||||||||||||

|

Pricing.Clean Price |

SEC_FIN_QUOTE_VALUE as of valuation date. |

|||||||||||||||||||||

|

Pricing.Clean Value |

The clean value is same as Pricing.Value, but based on clean price instead of dirty price (Nominal * Market Quote). |

|||||||||||||||||||||

|

Pricing.Eligibility |

|

|||||||||||||||||||||

|

Pricing.Haircut |

SEC_FIN_HAIRCUT_VALUE |

|||||||||||||||||||||

|

Pricing.Haircut (Triparty VF) |

It represents the haircut value as under column Pricing.Haircut when triparty agent is not set up for Inverse margin valuation factor (No attribute setup under LE). This applies conversion formula = [100/(100-Pricing.Haircut)] for haircut value displayed under Pricing.Haircut column when triparty agent is set up for Inverse margin valuation factor (Inverse Margin valuation factor attribute setup under LE). This processing will be triggered only when the triparty agent is updated with the attribute “TRIPARTY_ALLOCATION_VALUATION_FACTOR” added to the Legal Entity attribute with value “INVERSE_MARGIN”. |

|||||||||||||||||||||

|

Pricing.Margin |

|

|||||||||||||||||||||

|

Pricing.Nominal |

|

|||||||||||||||||||||

|

Pricing.Price |

SEC_FIN_QUOTE_VALUE + Pricing.Accrual |

|||||||||||||||||||||

|

Pricing.Transaction FX Rate |

SEC_FIN_FX_RATE |

|||||||||||||||||||||

|

Pricing.Transaction Value |

SEC_FIN_SECURITY_VALUE Affected by Real Settlement designation - if Real Settlement is false, Pricing.Nominal = Norm.Nominal. For Repo and SecLending: When Collateral asset is ineligible, "Pricing.Transaction Value" must return 0 (valuation at 0 following the same logic than pricing with a parameter MC_EXCLUDED_INELIGIBLE_SEC set to true) When Collateral asset is eligible, "Pricing.Transaction Value" must be computed as normal (following the same logic than pricing with a parameter MC_EXCLUDED_INELIGIBLE_SEC set to false). For Triparty Exposure Trade and Margin Call Cash Position: When collateral asset is ineligible, check the flag "Apply 100% haircut on ineligible" on the contract ("Parties" tab / "Processing Org") side if collateral is received / held and "Legal Entity" side if collateral is delivered /pledged). - If flag "Apply 100% haircut on ineligible" is checked, "Pricing.Transaction Value" must return 0 (valuation at 0) - If flag "Apply 100% haircut on ineligible" is not checked, "Pricing.Transaction Value" must be computed as normal. |

|||||||||||||||||||||

|

Pricing.Transaction Value Before Factor |

(Pricing.Nominal * Pricing.Price) * Pricing.Transaction FX Rate |

|||||||||||||||||||||

|

Pricing.Value |

(Quantity or Nominal) * Pricing.Price Affected by Real Settlement designation - if Real Settlement is false, Pricing.Nominal = Norm.Nominal. |

|||||||||||||||||||||

|

Recon.Accrual |

(Pricing.Accrual - Norm.Accrual) |

|||||||||||||||||||||

|

Recon.Accrual Amount |

(Pricing.Accrual Amount - Norm.Accrual Amount) |

|||||||||||||||||||||

|

Recon.All In Value |

(Pricing.All In Value - Norm.All In Value) |

|||||||||||||||||||||

|

Recon.Clean Price |

(Pricing.Clean Price - Norm.Clean Price) |

|||||||||||||||||||||

|

Recon.Haircut |

For Non Triparty contracts, Recon.Haircut = Norm.Haircut - Pricing.Haircut For Triparty contracts, Recon.Haircut = Norm.Haircut - Pricing.Haircut (Triparty VF) |

|||||||||||||||||||||

|

Recon.Margin |

(Pricing.Margin - Norm.Margin) |

|||||||||||||||||||||

|

Recon.Price |

(Pricing.Price - Norm.Price) |

|||||||||||||||||||||

|

Recon.Transaction FX Rate |

(Pricing.Transaction FX Rate - Norm.Transaction FX Rate) |

|||||||||||||||||||||

|

Recon.Transaction Value |

(Pricing.Transaction Value - Norm.Transaction Value) |

|||||||||||||||||||||

|

Recon.Transaction Value Before Factor |

(Norm.Transaction Value Before Factor - Pricing.Transaction Value Before Factor) |

|||||||||||||||||||||

|

Recon.Value |

(Pricing.Value - Norm.Value) |

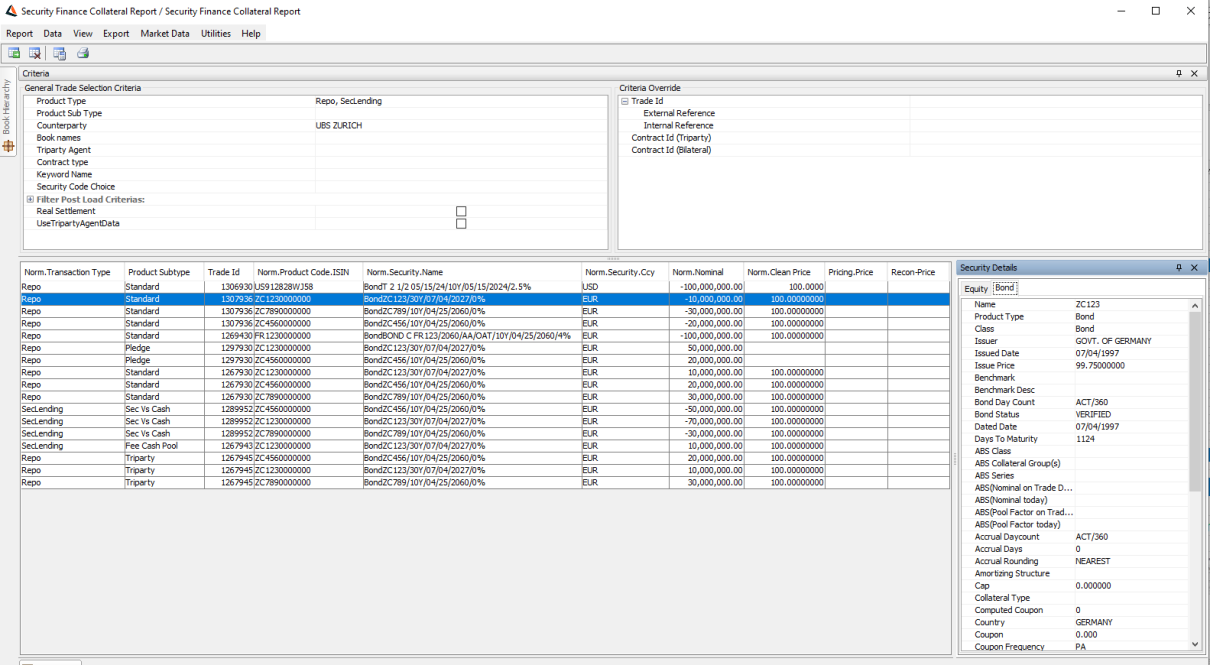

View Details

In order to view product details, you can select any product (Equity / Bond) and click View > Show Frame > Security Details. The Security Details Panel is available.

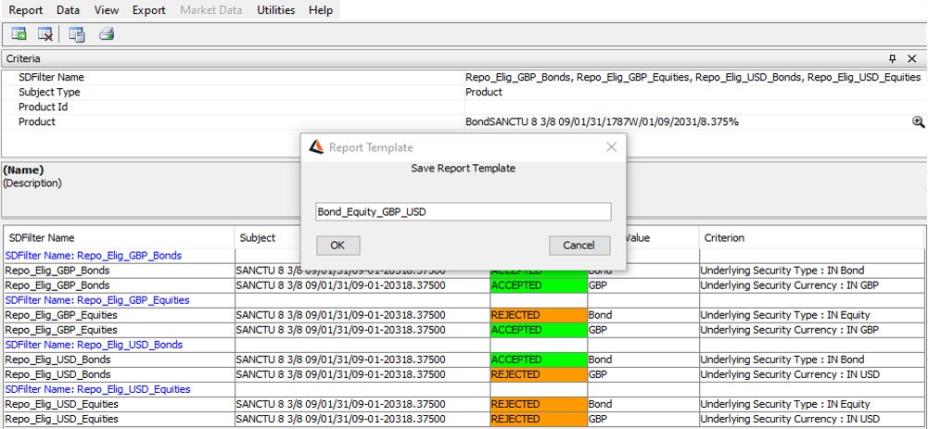

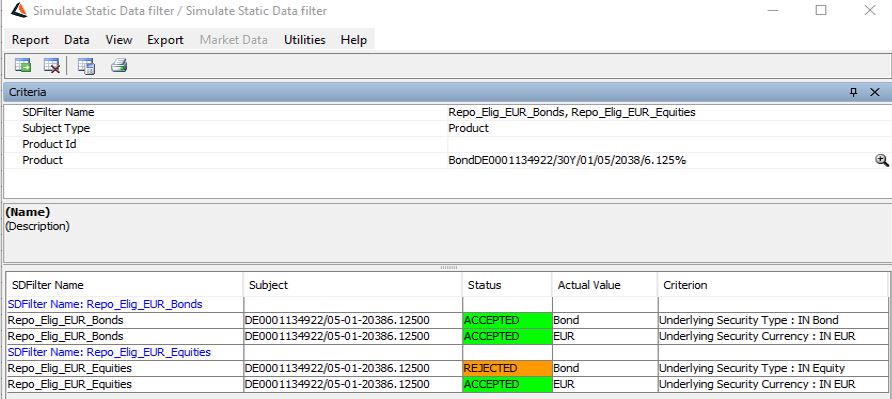

Simulating the Collateral Eligibility

You can right click any collateral and select Simulate > Simulate Eligibility to simulate the eligibility of a collateral based on the eligible securities definition in the Margin Call Contract. It opens the Simulate Static Data Filter window.

The window displays the default Secfinance template when no default template is configured.