Security Finance Sweeping

Security finance sweeping allows moving security inventory positions of covered books to a sweeping book by using overnight repo / sec lending trades. Applying a rate on these trades will enable users to apply a cost of funding to the covered books, considering the quality of each piece of swept collateral.

Sweeping trades are created either as Repo trades with the sub-type Sweeping, or as SecLending trades with the sub-type Sweeping Fee Unsecured. Repo Sweeping trades are in the Repo direction for long positions and in the Reverse direction for short positions. Sweeping Fee Unsecured trades are in the Sec. Lending direction for long positions and in the Sec. Borrowing direction for short positions. A separate sweeping trade (and its mirror) is generated for each Book/Security position.

1. Sweeping Curve Setup

Sweeping curves are used to determine the fixed rates of generated sweeping trades. The rate derived from the sweeping curve is added to the sweeping spread (specified in the Security Finance Dashboard's "Mid market spread (bp)" field) to give the "Cash. Fixed Rate" amount on the sweeping trade.

Example: If the curve returns a rate of 0.25% on O/N and the sweeping spread is set to 2bps, the fixed rate will be 0.25%+0.02%=0.27%.

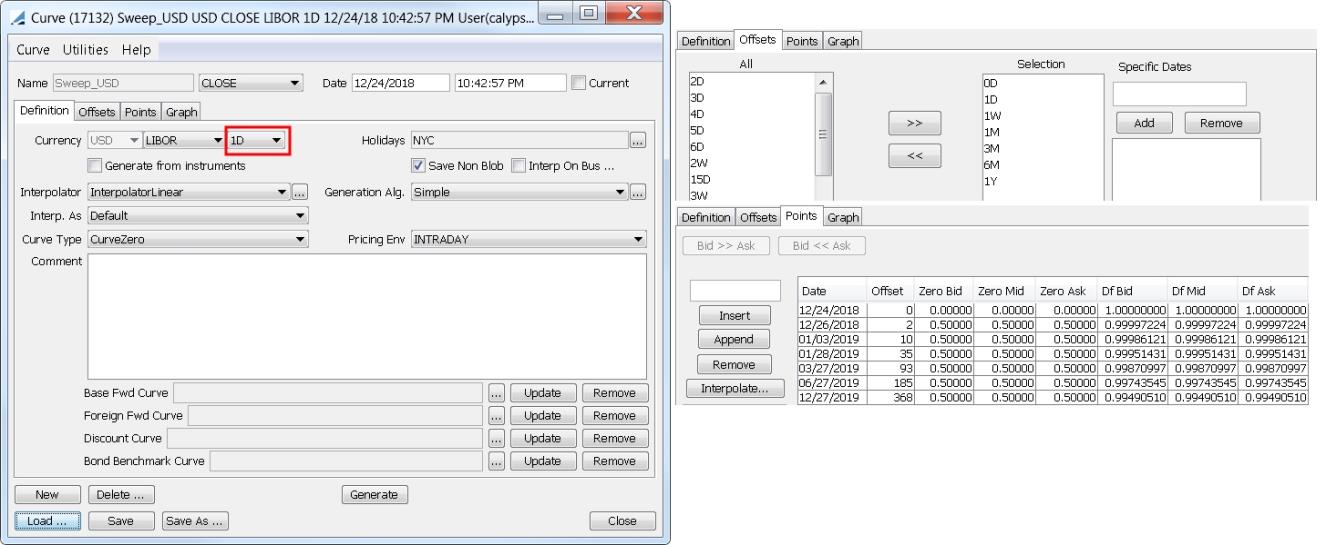

1.1 Zero Curve

The sweeping curve is defined as a zero curve with a 1D tenor from Calypso Navigator > Market Data > Interest Rate Curves > Zero Yield Curve.

Please refer to Calypso Interest Rate Curves documentation for complete details on using zero curves.

Please refer to Calypso Interest Rate Curves documentation for complete details on using zero curves.

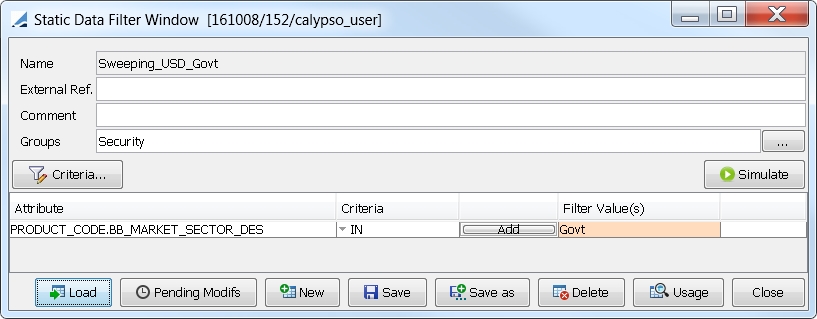

1.2 Static Data Filter

Create one or more static data filters, which will be used to identify the applicable securities, from Calypso Navigator > Filters > Static Data Filter.

| » | Click New. |

| » | Set the Groups to Security. You can set additional Groups as needed. |

| » | Click Criteria and specify the defining criteria. |

| » | Click Save as and name the static data filter. |

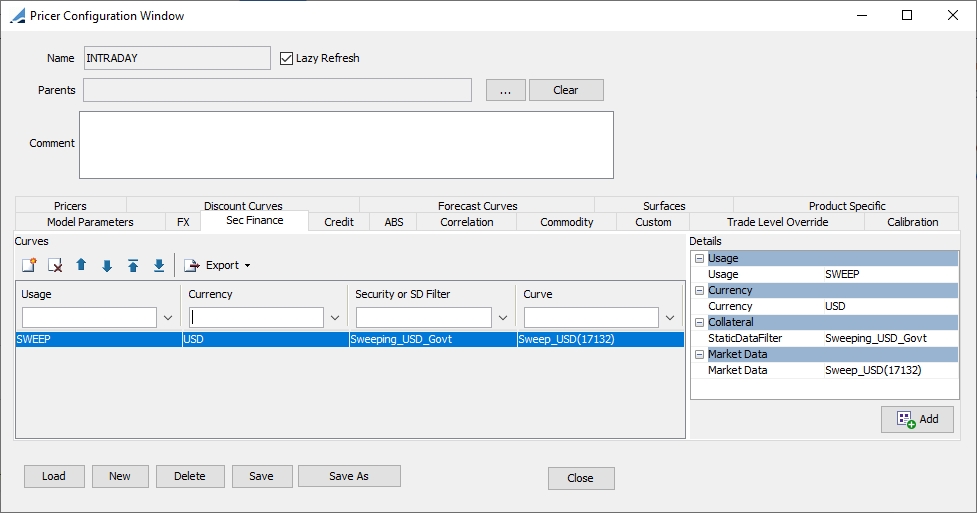

1.3 Pricer Configuration

Populate the sweeping curves in the Pricer Configuration from Calypso Navigator > Market Data > Pricing Environment > Pricer Configuration.

Click Load, select the pricer configuration name, and click OK.

Select the Sec Finance panel.

| » | Click |

| » | Select values in the Details area. |

| – | Select the usage SWEEP. |

| – | Select a currency. |

| – | Select the static data filter for the desired securities. Only static data filters with the "Security" group are available for selection. |

| – | Select the desired curve. |

| » | Click Add to add the curve to the list. |

| » | Click Save to save the pricer configuration. |

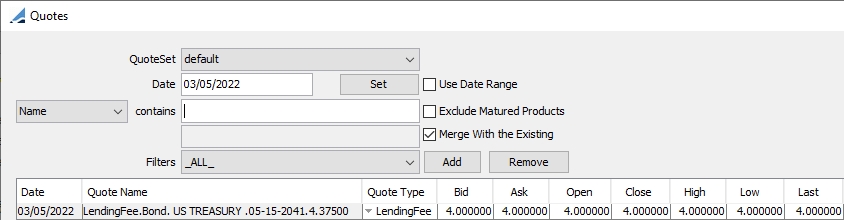

2. Lending Fees

Sweeping Fee Unsecured trades get their remuneration from a fee. This information can be sourced from market data providers, however in the case of overnight sweeping, the rate may be defined by traders.

The lending fees can be assigned automatically, based on quotes from the pricing environment used in the Security Finance Sweeping Dashboard, or used by the SECFINANCE_SWEEPING scheduled task.

A lending fee can also be entered manually in the Security Finance Sweeping Dashboard, either by overriding the spread, or by manually entering it in the Fee Billing Rate field.

If needed, you can amend the lending fee quote and regenerate (or amend) the sweeping trades.

Lending fees are stored as quotes of type LendingFee for a given security. These quotes are created upon clicking Generate Trades in the Security Finance Sweeping Dashboard.

3. Security Finance Sweeping Dashboard

The Security Finance Sweeping Dashboard allows defining the sweeping perimeter and type, displaying the security positions to be swept, and generating, modifying and saving the sweeping trades.

From the Calypso Navigator, navigate to Deal Management > Sec Finance Trade Report > Sec Finance Sweeping dashboard (menu action trading.secfinance.bulkactions.SecFinanceSweepingWindow).

| » | You can change the pricing details at the bottom of the window – By default, the pricing environment comes from the User Defaults, and the valuation date is the current date and time. |

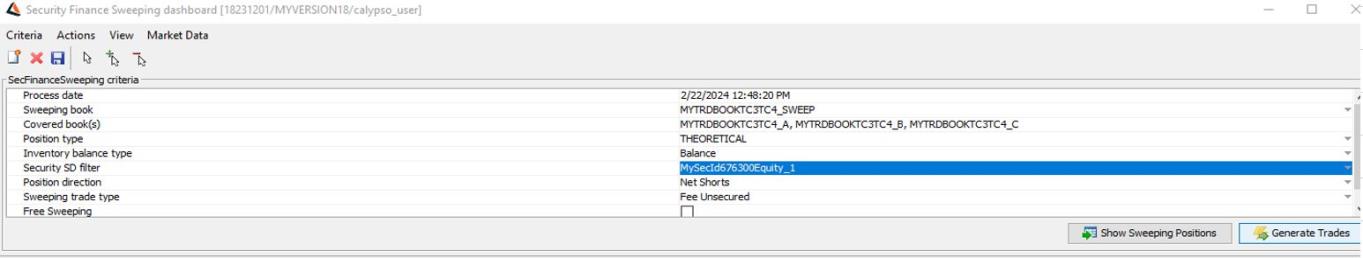

| » | Specify the SecFinance Sweeping criteria fields. |

| – | Process date: You can modify the process date if desired. Otherwise, it defaults to the val date. |

| – | Sweeping book: Select a sweeping book. It is the book to be swept to. |

| – | Covered book(s): Select one or more covered books. These are the books to be swept from. |

| – | Position Type: Select the position type to be swept: Theoretical or Actual. |

| – | Inventory balance type: Balance is the only option. This balance will be used to create on-the-fly the inventory positions from which the overnight sweeping trades will be generated. |

| – | Security SD filter: You can specify a static data filter to reduce the sweeping perimeter to a sub-set of securities, if desired. |

| – | Position direction: Select the positions to be considered: All, Shorts, Longs, or Net Shorts (it will aggregate short positions). |

| – | Sweeping trade type: Select Repo to generate Repo Sweeping trades, or select Fee Unsecured to generate SecLending Sweeping Fee Unsecured trades. |

| – | Free Sweeping: When selected, all sweeping trades are created with a zero fixed interest rate, and the market data check will be limited to security market quotes as sweeping curves are not needed in this case. Lending fee quotes are also not required in the case of Free Sweeping, as a fee of 0 will be applied to the resulting sweeping trade. |

| – | Mid market spread (bp): The sweeping spread. Enter the amount in basis points to be added to / subtracted from the rate derived from the sweeping curve when generating the sweeping trades. |

The spread is also applied to the lending fee, if any, in the Fee Billing Rate field. It is calculated as Fee Billing Rate = LendingFee quote +/- Mid market spread.

It is added in the Repo / Sec. Lending direction and subtracted in the Reverse / Sec. Borrowing direction.

This field is not applicable when "Free Sweeping" is selected.

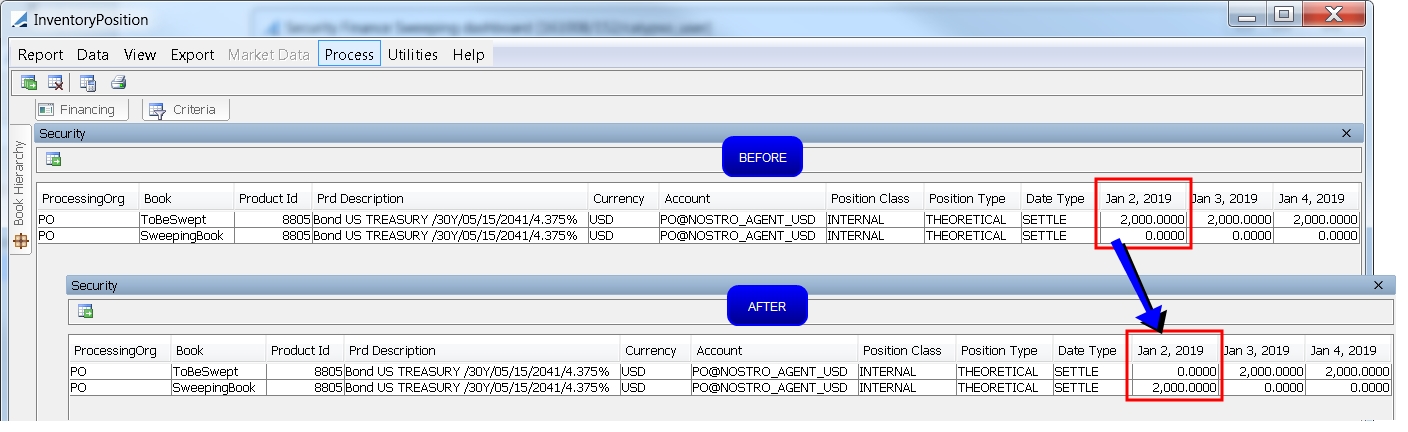

| » | You can click Show Sweeping Positions to review the positions that will be swept, based on the current sweeping criteria. |

| » | Click Generate Trades. The sweeping trades are generated and displayed in the lower portion of the window. |

If market data is missing for any of the sweeping trades, a "Missing Market Data" warning will pop up and those trades with incomplete market data will appear in gray with the "Selected" checkboxes de-selected. Note that this does not block saving the trades - You can simply select the "Selected" checkbox.

| » | Select Market Data > Check at the top of the window to display and set any missing quotes. |

NOTE: If all quotes are set but other market data is missing, such as a sweeping curve, nothing will appear to happen when you select Market Data > Check. You can select Market Data > Quotes to verify that all necessary quotes have been set to confirm that this is the case.

| » | Check/uncheck the "Selected" checkbox to include/exclude trades. You can also use |

| » | You can modify the amounts in the Quantity, Nominal, Fee. Billing Rate, and/or Fixed Rate fields as needed. |

| » | Click Apply & Save to carry out the action. The sweeping trades are saved and the inventory position is updated. |

4. SECFINANCE_SWEEPING Scheduled Task

The same processing that is done in the Security Finance Sweeping Dashboard can also be done via the SECFINANCE_SWEEPING scheduled task. When run, sweeping trades are generated and saved and the inventory position is updated.

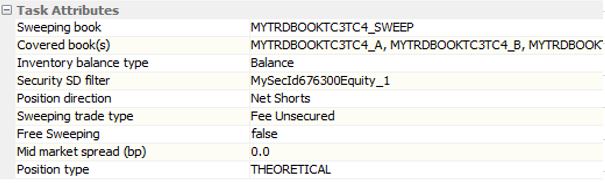

Select a pricing env, and select the task attributes as needed.

Task Attributes

| • | Sweeping book – Select a sweeping book. It is the book to be swept to. |

| • | Covered book(s) – Select one or more covered books. These are the books to be swept from. |

| • | Inventory balance type – Balance is the only option. This balance will be used to create on-the-fly the inventory positions from which the overnight sweeping trades will be generated. |

| • | Security SD filter – You can specify a static data filter to reduce the sweeping perimeter to a sub-set of securities, if desired. |

| • | Position direction – Select the positions to be considered: All, Shorts, or Longs or Net Shorts (it will aggregate short positions). |

| – | Sweeping trade type: Select Repo to generate Repo Sweeping trades, or select Fee Unsecured to generate SecLending Sweeping Fee Unsecured trades. |

| – | Free Sweeping: When selected, all sweeping trades are created with a zero fixed interest rate, and the market data check will be limited to security market quotes as sweeping curves are not needed in this case. Lending fee quotes are also not required in the case of Free Sweeping, as a fee of 0 will be applied to the resulting sweeping trade. |

| – | Mid market spread (bp): The sweeping spread. Enter the amount in basis points to be added to / subtracted from the rate derived from the sweeping curve when generating the sweeping trades. |

The spread is also applied to the lending fee, if any.

It is added in the Repo / Sec. Lending direction and subtracted in the Reverse / Sec. Borrowing direction.

This field is not applicable when "Free Sweeping" is selected.

| • | Position Type: Select the position type to be swept: Theoretical or Actual. |