Capturing Swaption Trades

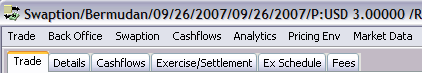

A Swaption is an option to enter into an underlying swap at a future date. The Swaption worksheet allows capturing European, American, and Bermudan swaptions.

Choose Trade > Interest Rates > Swaption to open the Swaption worksheet, from the Calypso Navigator or from the Trade Blotter.

|

Swaptions Quick Reference

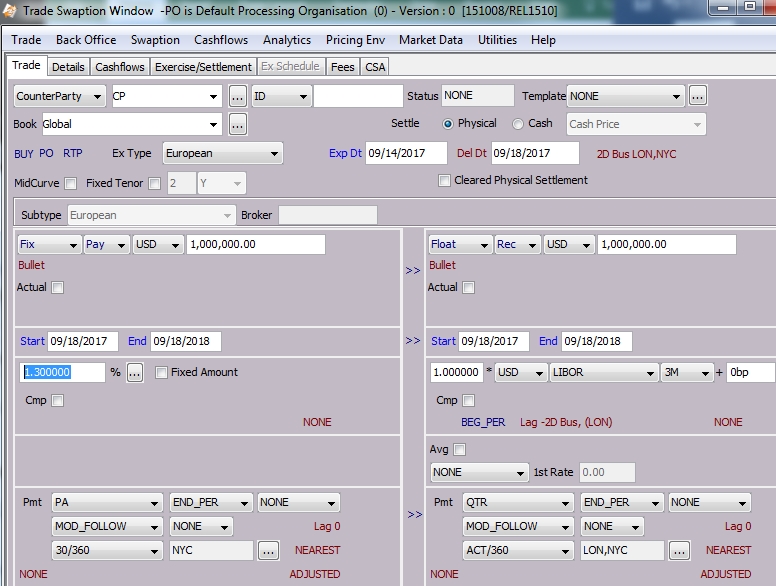

When you open a Swaption worksheet, the Trade panel is selected by default. Entering Trade Details

Or you can enter the trade fields directly. They are described below. Note that the Trade Date is entered in the Details panel.

|

||||||||||||||||||||||||||||||

|

Saving a Trade

You can also hit F3 to save the current trade as a new trade, or choose Trade > Save As New. You can also hit F12 to save the trade using any action available in the workflow, or choose Trade > Save Action. You will be prompted to select an action. A description will appear in the title bar of the trade worksheet, a trade id will be assigned to the trade, and the status of the trade will be modified according to the workflow configuration. |

||||||||||||||||||||||||||||||

|

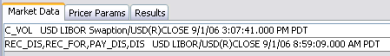

Pricing a Trade

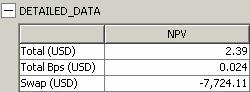

The intrinsic value of the swaption (underlying swap NPV) can be viewed using the pricer measure DETAILED_DATA.

When the premium settles after the exercise date, you can price the swaption on or after the exercise date, by adding PREMIUM to the domain "keepUpFrontFeeType.Swaption", provided the pricing parameter INCLUDE_FEES = Yes. When pricing a Bermudan swaption using PricerSwaptionLGMM1F, you can examine the following data.

When using the BEST_FIT_LM calibration scheme, the pricer will do an additional calculation, and search in a brute force fashion over a range of mean reversion and sigma values, and display the best-fit error function. Note: The calibration scheme BEST_FIT_LM does not use this brute-force method, the brute-force method is simply for the user to get a feel for the error function and double check the BEST_FIT_LM calibration. You can use the pricing parameter LGMM_BEST_FIT_GRAPH_MESH_SIZE to control how fine the mesh used in the brute force search is.

When pricing a swaption using PricerSwaptionSABR, you can compare the SABR Greeks and the Black Greeks using the SABR_GREEKS pricer measure. The SABR Greeks can be compared with the individual pricer measures on PricerSwaptionSABR, whilst the Black Greeks can be checked against PricerSwaption. You can also view details of the model’s parameters using the pricer measure SABR_MODEL. [NOTE: When a user enters a value for the pricing parameters SABRIMPLIEDVOL or VOLATILITY, the model switches to the Black model, so VEGA returns the Black Vega, and IMPLIEDVOLATILITY returns the Black equivalent volatility] When pricing a Bermudan swaption with PricerSwaption, you can view the whole adjusted strike schedule using the EFFECTIVE_STRIKE pricer measure – Note that the pricing parameter ADJUST_FOR_EXERCISE_FEES must be set to true.

When pricing with PricerSwaption, you can solve for VOLATILITY or STRIKE. Select a target pricer measure and enter the target value. Then select the value to solve for (pay rate, receive rate, or FX rate), and click Solve. You can click Apply to set the value to solve for on the trade. Then click Price to obtain the target value. You can modify the solver variables and details as needed. |

||||||||||||||||||||||||||||||

|

Trade Lifecycle

|

1. Sample Vanilla Swaption Trade

See also:

2. Fields Description

The fields of the standard swaption worksheet are defined here.

Trade Details

| Fields | Description |

|---|---|

|

Role/Cpty |

The first two fields of the worksheet identify the trade counterparty. The first field identifies the trade counterparty's role. The default role is specified using Utilities > Set Default Role. However, you can change it as applicable. You can select a legal entity of specified role from the second field provided you have setup favorite counterparties. You can also type in a character to display the favorite counterparties that start with that character. Favorite counterparties are specified using Utilities > Configure Favorite Counterparties. Otherwise, click ... to select a legal entity of specified role from the Legal Entity Chooser. You can also type [Ctrl-F] to invoke the Legal Entity Chooser, or directly enter a Legal Entity short name. |

|

Book |

Trading book to which the trade belongs. Defaults to the book selected in the User Defaults. You can modify as applicable. You can select a book provided you have setup favorite books. Favorite books are specified using Utilities > Configure Favorite Books. Otherwise, click ... to select a book. The owner of the book (a processing organization) identifies your side of the trade. |

|

Id Ext Ref Int Ref |

Unique identification number of the trade. The trade id is automatically assigned by the system when the trade is saved. You can load an existing trade by typing the trade id into this field, and pressing [Enter]. You can also display the internal reference or external reference. The default trade reference to be displayed can be selected in the User Defaults. The internal reference and external reference can be set in the Details panel of the trade worksheet. |

|

Status |

Current status of the trade. The status is automatically assigned by the system based on the workflow configuration. The status will change over the lifetime of the trade according to the workflow configuration and the actions performed on the trade. |

|

Template |

You can select a template from the Template field to populate the worksheet with default values. Then modify the fields as applicable. If you setup favorite templates, only the favorite templates will be available for selection. You can setup favorite templates using Utilities > Configure Favorite Templates. In some trade window, you can click ... to setup favorite templates. |

| Subtype |

The subtype is set by the system based on the type of swaption being captured. Example: American, Bermudan, European, Exotic, FT European, FT American and FT Bermudan (FT stands for Fixed Tenor). You can set pricers and market data by swaption subtype. |

| Broker |

Displays the broker if a broker fee is captured in the Fees panel. |

Option Details

| Fields | Description | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Settle |

Click Physical or Cash to determine the option’s settlement method. If you click Physical, you can check “Cleared Physical Settlement” (ISDA information). If you click Cash, select the calculation method from the adjacent field to compute the settlement amount.

You can define additional parameters in the Exercise/Settlement panel.

[NOTE: If you have defined cash settlement defaults (CSD), it will pick up the settlement method from the CSD defined for the agreement specified in domain CashSettleDefaultsAgreements / rate index / currency - It is ANY by default. For example, ANY is defined in CashSettleDefaultsAgreements, and you have a CSD defined for ANY / LIBOR / USD. If the trade is LIBOR / USD and settles in Cash, then the settlement method from the CSD will be set on the trade by default] Cash Settlement Methods

(a) the amount payable by the Fixed Rate Payer as if the Fixed Rate were the Settlement Rate and (b) the amount payable by the Fixed Rate Payer under the relevant swap transaction. The discount rate will be equal to the Settlement Rate. The Cash Settlement Amount will be adjusted if the Optional Early Termination Date or the Mandatory Early Termination Date does not fall on the Fixed/Floating Rate Payer Payment Date.

|

|||||||||||||||||||||||||||||||||

|

BUY/SELL |

Direction of the trade from the book’s perspective. Double-click the BUY label to switch to SELL as applicable. |

|||||||||||||||||||||||||||||||||

|

RTP/RTR/Straddle |

Direction of the option. Double-click the RTP label to switch to RTR or Straddle as applicable.

|

|||||||||||||||||||||||||||||||||

|

Ex Type |

Select the exercise type: European, Bermudan, or American. See below for details. |

|||||||||||||||||||||||||||||||||

| MidCurve |

|

|||||||||||||||||||||||||||||||||

| Fixed Tenor |

Exercise Type - European

The option can only be exercised on the expiration date.

| » | Enter the expiration date in the Exp Dt field. The background color will change if the date is not a business day. You can double-click the Exp Dt label to roll the date to the previous business day. |

| » | Enter the delivery date of the underlying swap (start date), or enter a number of days after the expiration date (2D for example). |

| » | Double-click the “2D Bus NYC” label to bring up the OptionCalcDialog. See OptionCalcDialog below. |

Exercise Type - Bermudan

The option can be exercised according to a user-defined schedule.

| » | Select the Ex Schedule panel to define the exercise schedule. The Exp Dt and Del Dt fields in the Trade panel are not editable. |

See Defining a Bermudan Exercise Schedule for

details.

See Defining a Bermudan Exercise Schedule for

details.

| » | Double-click the “2D Cal NYC-QTR” label to bring up the OptionCalcDialog. See OptionCalcDialog below. |

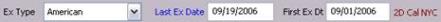

Exercise Type - American

The option can be exercised within a date range.

| » | Enter the last exercise date in the Last Ex Date field, and the first exercise date in the First Ex Dt field. The option can be exercises between those two dates. The background color will change if the date is not a business day. You can double-click the Last Ex Date label to roll the date to the previous business day. |

| » | Double-click the “2D Bus NYC” label to bring up the OptionCalcDialog. See OptionCalcDialog below. |

| » | You can also define an exercise schedule for American swaptions. |

See Defining an American Exercise Schedule for

details.

See Defining an American Exercise Schedule for

details.

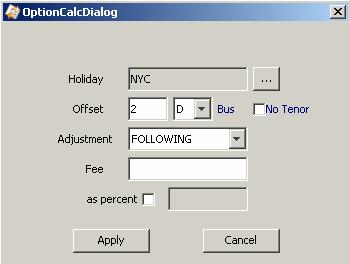

OptionCalcDialog

| » | Select the holiday calendar. |

| » | Enter a number of lag days, months or years in the Offset field. This is the offset between the expiration date and the delivery date. |

Days lag “D” can be business days or calendar days. Double-click the Bus label to switch to Cal as needed.

For months lag “M” and years lag “Y”, the system uses calendar days only.

The “No Tenor” checkbox only applies to days lag, when you enter more than 31 days. If you check the “No Tenor” checkbox, the offset will not be converted to a tenor, as shown below for 35D.

![]()

Otherwise it will be converted to a tenor. Note that the conversion is for display only. The system always stores 35D.

![]()

| » | Select the date roll convention in the Adjustment field. |

| » | For European options only, enter the exercise fee. |

For American and Bermudan options, you can enter the exercise fee in the Ex Schedule panel.

For Bermudan options, select the frequency of the exercise dates.

Swap Details

See Capturing Swap Trades for details.

See Capturing Swap Trades for details.

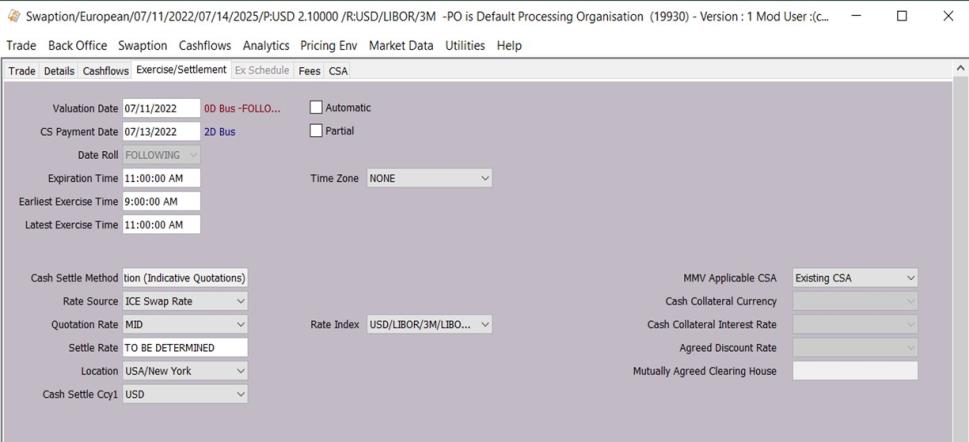

3. Defining Cash Settlement Parameters

For cash settled options, select the Exercise/Settlement panel to define the parameters for computing the settlement amount.

The fields in this window default from Cash Settlement Defaults defined for the agreement specified in domain CashSettleDefaultsAgreements / rate index / currency - It is ANY by default.

See Defining Cash Settlement Defaults for details.

See Defining Cash Settlement Defaults for details.

| » | The valuation date and payment date default to the dates entered in the Trade panel (Expiration Date and Delivery Date) +/- the number of valuations days / payment days defined in Cash Settlement Defaults if any. Double-click the adjacent label to modify the dates as needed. It will bring up the OptionCalDialog previously described. |

| » | The cash settlement method is selected in the Trade panel. |

| » | Enter the fields described below as needed. |

Settlement Details

|

Fields |

Description |

|||

|

Expiration Time |

Enter the time at which the option expires, in the selected timezone. Defaults to Cash Settlement Defaults if any. |

|||

|

Earliest Exercise Time |

Enter the earliest time when the option can be exercised, in the selected timezone. Defaults to Cash Settlement Defaults if any. |

|||

|

Latest Exercise Time |

Enter the latest time when the option can be exercised, in the selected timezone. |

|||

|

Time Zone |

Select the timezone for expiration time, and exercise times. Defaults to Cash Settlement Defaults if any. |

|||

|

Automatic |

Check the Automatic checkbox to allow automatic exercise. Defaults to Cash Settlement Defaults if any. Swaptions can be automatically exercised using the AUTOMATIC_EXERCISE scheduled task, provided they are in-the-money.

Otherwise, choose Back Office > Exercise to exercise the option. Help is provided from that window. NOTE If the Automatic checkbox is checked, you will not be able to save the trade unless a settle rate is entered, or rate index is selected. See Settle Rate and Rate Source below for details. |

|||

|

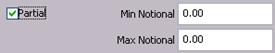

Partial |

Only appears for European options. Check the Partial checkbox to allow partial exercise.

|

|||

|

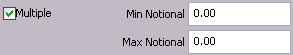

Multiple |

Only appears for American and Bermudan options. Check the Multiple checkbox to allow multiple exercises.

|

|||

|

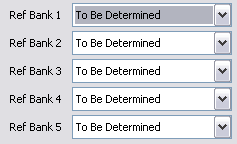

You can select a rate source or none (empty). Rate sources are defined in the RateSource domain. If you select none, you have to select a set of reference banks.

If you select "Other Source", "ISDA Source", "ICE Source", or "Tokyo Swap Reference" you need to select a rate index from the Rate Index field.

|

||||

|

Quotation Rate |

Select the instance of the quotation rate that you want to use: MID, BID, or ASK. Defaults to Cash Settlement Defaults if any. |

|||

|

Displays the settlement rate used to compute the settlement amount for the cash settlement methods “Par Yield Curve - Adj.” and “Par Yield Curve - Unadj.”. In the Option Exercise Window, there is a Settlement Rate field. You can get the value from the pricing environment by clicking Price, or you can enter a value. If you enter a rate, it will be displayed here. |

||||

|

Location |

Select the ISDA location. Defaults to Cash Settlement Defaults if any, or to the location of the selected currency otherwise. |

|||

|

Cash Settle Ccy |

Select the currency of the settlement amount. Defaults to Cash Settlement Defaults if any. |

|||

|

MMV Applicable CSA |

Activated when one of the following settlement types are selected: Mid-market Valuation (Indicative Quotations), Mid-market Valuation (Indicative Quotations) - Alternate Method, or Mid-market Valuation (Calculation Agent Determination). Select No CSA, Existing CSA, or Reference VM CSA. |

|||

|

Cash Collateral Currency |

Activated when MMV Applicable CSA is set to Reference VM CSA. Select a currency from a list defined in Domain Values. |

|||

|

Cash Collateral Interest Rate |

Activated when MMV Applicable CSA is set to Reference VM CSA. Select a Rate Index (Populated via the arte index window from the database). |

|||

|

Agreed Discount Rate |

Activated when one of the following settlement types are selected: Mid-market Valuation (Indicative Quotations), Mid-market Valuation (Indicative Quotations) - Alternate Method, or Mid-market Valuation (Calculation Agent Determination) and MMV Applicable CSA is set to No CSA. Also activated when Cash Settlement Type is set to Collateralized Cash Price. Also activated when Settlement type is set to Cleared Physical Settlement. Select a Rate Index (Populated via the rate index window from the database). |

|||

|

Mutually Agreed Clearing House |

Activated when Cash Settlement type is set to Collateralized Cash Price. Also activated when Settlement type is set to Collateralized Cash Price. Enter text (up to 128 characters). |

4. Defining a Bermudan Exercise Schedule

Select the Ex Schedule panel.

You can generate a schedule from Swap Periods or a Custom Schedule.

Schedule from Swap Periods

| » | Click Swap Periods to generate the exercise schedule based on the cashflows of the underlying swap. |

You can enter the fees for each period in percentage or in amounts.

You can check / uncheck the Include checkbox to include / exclude the corresponding period.

Note that the column Ex Choice is not currently used.

Custom Schedule

| » | Enter From and To dates, select a frequency, a date roll and holiday calendars (for the expiration date and for the delivery date). |

| » | Enter a number of lag days to compute the delivery date based on the actual call date. And select Bus if the lag days are business days, or Cal for calendar days. |

| » | Then click Generate to generate the schedule. |

You can also click Add to add specific dates.

You can enter the fees for each period in percentage or in amounts.

You can check / uncheck the Include checkbox to include / exclude the corresponding period.

Note that the column Ex Choice is not currently used.

You can check “Lock Exercise Periods” to prevent the system from regenerating custom schedules.

5. Defining an American Exercise Schedule

Select the Ex Schedule panel.

| » | Enter the schedule details, and click Generate to define a custom schedule. |

You can enter the exercise fee amount for each period.