Capturing Mid Curve Swaption Trades

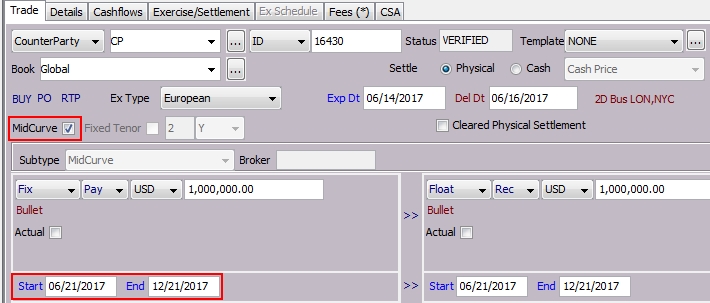

For a mid-curve swaption, the start date of the swap is not the swaption's expiration spot date.

Choose Trade > Interest Rates > Swaption to open the Swaption worksheet, from the Calypso Navigator or from the Trade Blotter.

| » | Check the "MidCurve" checkbox, and enter the swap start and end dates with a lag against the swaption's expiration spot date. The subtype is set to "MidCurve". |

| » | Then enter more trade details as described in Capturing Swaption Trades. |

Pricing

Mid-curve swaption needs to be priced using the pricer PricerSwaptionMidCurve.

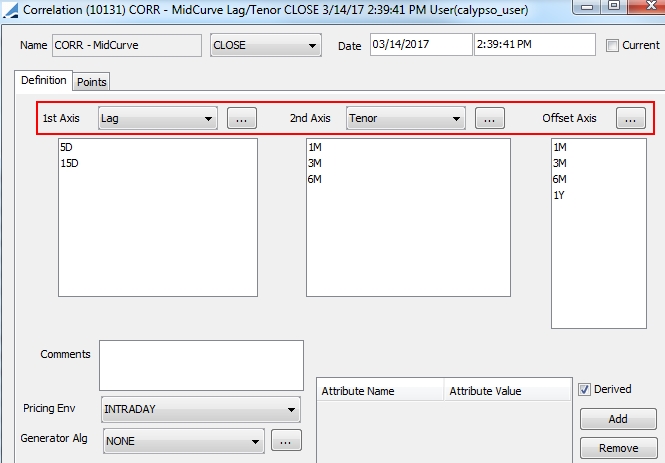

In addition to the volatility surface, discount curve and forecast curve, it requires a correlation matrix between the swaption expiry (Offset Axis), underlying swap start date (1st Axis = Lag) and underlying swap expiry (2nd Axis = Tenor).

Sample Mid-Curve Correlation Matrix

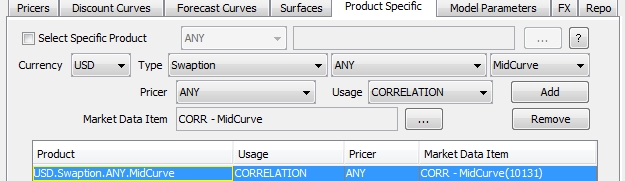

Pricer Configuration

You need to associate the correlation matrix with the Pricer Configuration using the Product Specific panel, for the CORRELATION usage.

You can set the following parameters at trade level:

| • | SWAPTION_MIDCURVE_CALCULATOR |

| – | Normal2Normal - Normal marginals + normal effective distributions. |

| – | Lognormal2Normal - Lognormal marginals + normal effective distributions. |

| – | Lognormal2ShiftedLognormal - Lognormal marginals + shifted-lognormal effective distributions. |

| • | VOLATILITY_LONG_TENOR - Marginal volatility of the long replicating swap. A value of ’1.2’ means 1.2 bp vol for normal marginals, while it is 1.2% for lognormals. Use to numerically calculate corresponding marginal vega. |

| • | VOLATILITY_SHORT_TENOR - Marginal volatility of the short replicating swap. Use to numerically calculate corresponding marginal vega. |

| • | USE_ATM_VOLS - Only True is currently supported. |

| • | CORRELATION - Correlation between the replicating swap rates. The correlation is of the ‘same’ type as the marginals. A value of ‘0.87’ means: 87%. Use to numerically calculate corresponding CORRELATION_01. |

| • | SHIFTEDLOGNORMAL_SHIFT - Shift of the effective shifted-lognormal distribution. If missing, a default value of ‘0.0’ is assumed. Ignored unless VOLATILITY is set as well. Not applicable to Normal2Normal / Lognormal2Normal models. |

| • | VOLATILITY - Effective volatility of the underlying swap. Use to numerically calculate corresponding vega. |

More details can be found in the Calypso Analytics Library documentation.